B Com Exam > B Com Questions > X commenced business on 1st April2017. He eff...

Start Learning for Free

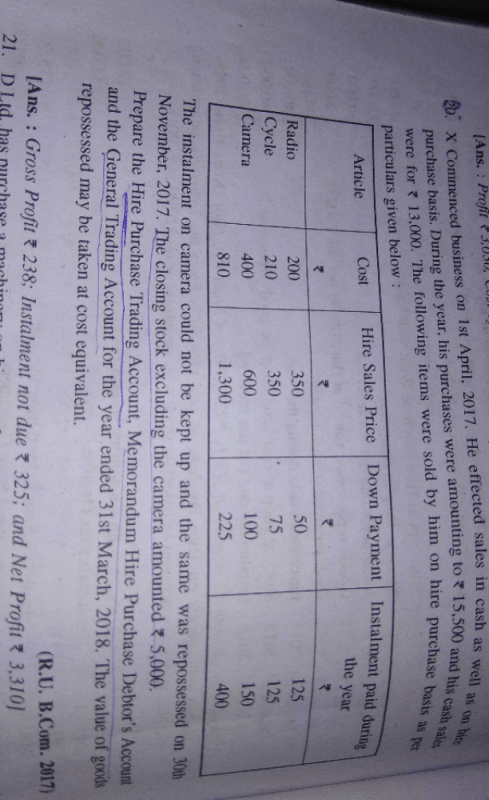

X commenced business on 1st April2017. He effected sales in cash as well as on hire purchase basis. During the year, his purchases were amounting to ₹15500 and his cash sales were ₹13000. The following items were sold by him on hire purchase basis as per particular given below:Articles were RADIO, CYCLE AND CAMERA. THEIR COST WAS:₹200,₹210,₹400 TOTAL WAS=810. HIRE SALES PRICE WERE :₹350,₹350,₹600 TOTAL WAS =₹1300. DOWN PAYMENT OF ARTICLES WAS:, ₹50,₹75,₹100 TOTAL WAS:₹225. INSTALLMENT PAID DURING THE YEAR WAS AS FOLLOWS :₹125,₹125,₹150 TOTAL WAS ₹400. The installment on camera could not be kept up and the same was repossessed on 30th November 2017. The closing stock including the camera amounted ₹5000. Prepare the hire purchase trading account, memorandum hire purchase debtor account and the general trading account for the year ended 31st March 2018. The value of goods repossessed may be taken at cost equivalent.

Most Upvoted Answer

X commenced business on 1st April2017. He effected sales in cash as we...

Hire Purchase Trading Account

• Sales:

Cash Sales: ₹13,000

Hire Sales: ₹1,300

• Cost of Goods Sold:

Purchases: ₹15,500

Cost of Articles Sold on Hire Purchase: ₹810

• Gross Profit:

(Cash Sales + Hire Sales) - (Purchases + Cost of Articles Sold) = ₹2,990

Memorandum Hire Purchase Debtor Account

• Installments Due:

Total Due: ₹1,300

Installments Paid: ₹400

Installments Outstanding: ₹900

• Repossession:

Camera Repossessed: ₹400

General Trading Account

• Opening Stock:

Value: ₹0

• Purchases:

Total: ₹15,500

• Sales:

Total: ₹14,300

• Closing Stock:

Value: ₹5,000

• Gross Profit:

Total Sales - (Opening Stock + Purchases - Closing Stock) = ₹3,800

Community Answer

X commenced business on 1st April2017. He effected sales in cash as we...

|

Explore Courses for B Com exam

|

|

Similar B Com Doubts

X commenced business on 1st April2017. He effected sales in cash as well as on hire purchase basis. During the year, his purchases were amounting to ₹15500 and his cash sales were ₹13000. The following items were sold by him on hire purchase basis as per particular given below:Articles were RADIO, CYCLE AND CAMERA. THEIR COST WAS:₹200,₹210,₹400 TOTAL WAS=810. HIRE SALES PRICE WERE :₹350,₹350,₹600 TOTAL WAS =₹1300. DOWN PAYMENT OF ARTICLES WAS:, ₹50,₹75,₹100 TOTAL WAS:₹225. INSTALLMENT PAID DURING THE YEAR WAS AS FOLLOWS :₹125,₹125,₹150 TOTAL WAS ₹400. The installment on camera could not be kept up and the same was repossessed on 30th November 2017. The closing stock including the camera amounted ₹5000. Prepare the hire purchase trading account, memorandum hire purchase debtor account and the general trading account for the year ended 31st March 2018. The value of goods repossessed may be taken at cost equivalent. Related: Accounting for Hire Purchase - Financial Accounting - B.Com | Karan Arora | Study Khazana

Question Description

X commenced business on 1st April2017. He effected sales in cash as well as on hire purchase basis. During the year, his purchases were amounting to ₹15500 and his cash sales were ₹13000. The following items were sold by him on hire purchase basis as per particular given below:Articles were RADIO, CYCLE AND CAMERA. THEIR COST WAS:₹200,₹210,₹400 TOTAL WAS=810. HIRE SALES PRICE WERE :₹350,₹350,₹600 TOTAL WAS =₹1300. DOWN PAYMENT OF ARTICLES WAS:, ₹50,₹75,₹100 TOTAL WAS:₹225. INSTALLMENT PAID DURING THE YEAR WAS AS FOLLOWS :₹125,₹125,₹150 TOTAL WAS ₹400. The installment on camera could not be kept up and the same was repossessed on 30th November 2017. The closing stock including the camera amounted ₹5000. Prepare the hire purchase trading account, memorandum hire purchase debtor account and the general trading account for the year ended 31st March 2018. The value of goods repossessed may be taken at cost equivalent. Related: Accounting for Hire Purchase - Financial Accounting - B.Com | Karan Arora | Study Khazana for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about X commenced business on 1st April2017. He effected sales in cash as well as on hire purchase basis. During the year, his purchases were amounting to ₹15500 and his cash sales were ₹13000. The following items were sold by him on hire purchase basis as per particular given below:Articles were RADIO, CYCLE AND CAMERA. THEIR COST WAS:₹200,₹210,₹400 TOTAL WAS=810. HIRE SALES PRICE WERE :₹350,₹350,₹600 TOTAL WAS =₹1300. DOWN PAYMENT OF ARTICLES WAS:, ₹50,₹75,₹100 TOTAL WAS:₹225. INSTALLMENT PAID DURING THE YEAR WAS AS FOLLOWS :₹125,₹125,₹150 TOTAL WAS ₹400. The installment on camera could not be kept up and the same was repossessed on 30th November 2017. The closing stock including the camera amounted ₹5000. Prepare the hire purchase trading account, memorandum hire purchase debtor account and the general trading account for the year ended 31st March 2018. The value of goods repossessed may be taken at cost equivalent. Related: Accounting for Hire Purchase - Financial Accounting - B.Com | Karan Arora | Study Khazana covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for X commenced business on 1st April2017. He effected sales in cash as well as on hire purchase basis. During the year, his purchases were amounting to ₹15500 and his cash sales were ₹13000. The following items were sold by him on hire purchase basis as per particular given below:Articles were RADIO, CYCLE AND CAMERA. THEIR COST WAS:₹200,₹210,₹400 TOTAL WAS=810. HIRE SALES PRICE WERE :₹350,₹350,₹600 TOTAL WAS =₹1300. DOWN PAYMENT OF ARTICLES WAS:, ₹50,₹75,₹100 TOTAL WAS:₹225. INSTALLMENT PAID DURING THE YEAR WAS AS FOLLOWS :₹125,₹125,₹150 TOTAL WAS ₹400. The installment on camera could not be kept up and the same was repossessed on 30th November 2017. The closing stock including the camera amounted ₹5000. Prepare the hire purchase trading account, memorandum hire purchase debtor account and the general trading account for the year ended 31st March 2018. The value of goods repossessed may be taken at cost equivalent. Related: Accounting for Hire Purchase - Financial Accounting - B.Com | Karan Arora | Study Khazana.

X commenced business on 1st April2017. He effected sales in cash as well as on hire purchase basis. During the year, his purchases were amounting to ₹15500 and his cash sales were ₹13000. The following items were sold by him on hire purchase basis as per particular given below:Articles were RADIO, CYCLE AND CAMERA. THEIR COST WAS:₹200,₹210,₹400 TOTAL WAS=810. HIRE SALES PRICE WERE :₹350,₹350,₹600 TOTAL WAS =₹1300. DOWN PAYMENT OF ARTICLES WAS:, ₹50,₹75,₹100 TOTAL WAS:₹225. INSTALLMENT PAID DURING THE YEAR WAS AS FOLLOWS :₹125,₹125,₹150 TOTAL WAS ₹400. The installment on camera could not be kept up and the same was repossessed on 30th November 2017. The closing stock including the camera amounted ₹5000. Prepare the hire purchase trading account, memorandum hire purchase debtor account and the general trading account for the year ended 31st March 2018. The value of goods repossessed may be taken at cost equivalent. Related: Accounting for Hire Purchase - Financial Accounting - B.Com | Karan Arora | Study Khazana for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about X commenced business on 1st April2017. He effected sales in cash as well as on hire purchase basis. During the year, his purchases were amounting to ₹15500 and his cash sales were ₹13000. The following items were sold by him on hire purchase basis as per particular given below:Articles were RADIO, CYCLE AND CAMERA. THEIR COST WAS:₹200,₹210,₹400 TOTAL WAS=810. HIRE SALES PRICE WERE :₹350,₹350,₹600 TOTAL WAS =₹1300. DOWN PAYMENT OF ARTICLES WAS:, ₹50,₹75,₹100 TOTAL WAS:₹225. INSTALLMENT PAID DURING THE YEAR WAS AS FOLLOWS :₹125,₹125,₹150 TOTAL WAS ₹400. The installment on camera could not be kept up and the same was repossessed on 30th November 2017. The closing stock including the camera amounted ₹5000. Prepare the hire purchase trading account, memorandum hire purchase debtor account and the general trading account for the year ended 31st March 2018. The value of goods repossessed may be taken at cost equivalent. Related: Accounting for Hire Purchase - Financial Accounting - B.Com | Karan Arora | Study Khazana covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for X commenced business on 1st April2017. He effected sales in cash as well as on hire purchase basis. During the year, his purchases were amounting to ₹15500 and his cash sales were ₹13000. The following items were sold by him on hire purchase basis as per particular given below:Articles were RADIO, CYCLE AND CAMERA. THEIR COST WAS:₹200,₹210,₹400 TOTAL WAS=810. HIRE SALES PRICE WERE :₹350,₹350,₹600 TOTAL WAS =₹1300. DOWN PAYMENT OF ARTICLES WAS:, ₹50,₹75,₹100 TOTAL WAS:₹225. INSTALLMENT PAID DURING THE YEAR WAS AS FOLLOWS :₹125,₹125,₹150 TOTAL WAS ₹400. The installment on camera could not be kept up and the same was repossessed on 30th November 2017. The closing stock including the camera amounted ₹5000. Prepare the hire purchase trading account, memorandum hire purchase debtor account and the general trading account for the year ended 31st March 2018. The value of goods repossessed may be taken at cost equivalent. Related: Accounting for Hire Purchase - Financial Accounting - B.Com | Karan Arora | Study Khazana.

Solutions for X commenced business on 1st April2017. He effected sales in cash as well as on hire purchase basis. During the year, his purchases were amounting to ₹15500 and his cash sales were ₹13000. The following items were sold by him on hire purchase basis as per particular given below:Articles were RADIO, CYCLE AND CAMERA. THEIR COST WAS:₹200,₹210,₹400 TOTAL WAS=810. HIRE SALES PRICE WERE :₹350,₹350,₹600 TOTAL WAS =₹1300. DOWN PAYMENT OF ARTICLES WAS:, ₹50,₹75,₹100 TOTAL WAS:₹225. INSTALLMENT PAID DURING THE YEAR WAS AS FOLLOWS :₹125,₹125,₹150 TOTAL WAS ₹400. The installment on camera could not be kept up and the same was repossessed on 30th November 2017. The closing stock including the camera amounted ₹5000. Prepare the hire purchase trading account, memorandum hire purchase debtor account and the general trading account for the year ended 31st March 2018. The value of goods repossessed may be taken at cost equivalent. Related: Accounting for Hire Purchase - Financial Accounting - B.Com | Karan Arora | Study Khazana in English & in Hindi are available as part of our courses for B Com.

Download more important topics, notes, lectures and mock test series for B Com Exam by signing up for free.

Here you can find the meaning of X commenced business on 1st April2017. He effected sales in cash as well as on hire purchase basis. During the year, his purchases were amounting to ₹15500 and his cash sales were ₹13000. The following items were sold by him on hire purchase basis as per particular given below:Articles were RADIO, CYCLE AND CAMERA. THEIR COST WAS:₹200,₹210,₹400 TOTAL WAS=810. HIRE SALES PRICE WERE :₹350,₹350,₹600 TOTAL WAS =₹1300. DOWN PAYMENT OF ARTICLES WAS:, ₹50,₹75,₹100 TOTAL WAS:₹225. INSTALLMENT PAID DURING THE YEAR WAS AS FOLLOWS :₹125,₹125,₹150 TOTAL WAS ₹400. The installment on camera could not be kept up and the same was repossessed on 30th November 2017. The closing stock including the camera amounted ₹5000. Prepare the hire purchase trading account, memorandum hire purchase debtor account and the general trading account for the year ended 31st March 2018. The value of goods repossessed may be taken at cost equivalent. Related: Accounting for Hire Purchase - Financial Accounting - B.Com | Karan Arora | Study Khazana defined & explained in the simplest way possible. Besides giving the explanation of

X commenced business on 1st April2017. He effected sales in cash as well as on hire purchase basis. During the year, his purchases were amounting to ₹15500 and his cash sales were ₹13000. The following items were sold by him on hire purchase basis as per particular given below:Articles were RADIO, CYCLE AND CAMERA. THEIR COST WAS:₹200,₹210,₹400 TOTAL WAS=810. HIRE SALES PRICE WERE :₹350,₹350,₹600 TOTAL WAS =₹1300. DOWN PAYMENT OF ARTICLES WAS:, ₹50,₹75,₹100 TOTAL WAS:₹225. INSTALLMENT PAID DURING THE YEAR WAS AS FOLLOWS :₹125,₹125,₹150 TOTAL WAS ₹400. The installment on camera could not be kept up and the same was repossessed on 30th November 2017. The closing stock including the camera amounted ₹5000. Prepare the hire purchase trading account, memorandum hire purchase debtor account and the general trading account for the year ended 31st March 2018. The value of goods repossessed may be taken at cost equivalent. Related: Accounting for Hire Purchase - Financial Accounting - B.Com | Karan Arora | Study Khazana, a detailed solution for X commenced business on 1st April2017. He effected sales in cash as well as on hire purchase basis. During the year, his purchases were amounting to ₹15500 and his cash sales were ₹13000. The following items were sold by him on hire purchase basis as per particular given below:Articles were RADIO, CYCLE AND CAMERA. THEIR COST WAS:₹200,₹210,₹400 TOTAL WAS=810. HIRE SALES PRICE WERE :₹350,₹350,₹600 TOTAL WAS =₹1300. DOWN PAYMENT OF ARTICLES WAS:, ₹50,₹75,₹100 TOTAL WAS:₹225. INSTALLMENT PAID DURING THE YEAR WAS AS FOLLOWS :₹125,₹125,₹150 TOTAL WAS ₹400. The installment on camera could not be kept up and the same was repossessed on 30th November 2017. The closing stock including the camera amounted ₹5000. Prepare the hire purchase trading account, memorandum hire purchase debtor account and the general trading account for the year ended 31st March 2018. The value of goods repossessed may be taken at cost equivalent. Related: Accounting for Hire Purchase - Financial Accounting - B.Com | Karan Arora | Study Khazana has been provided alongside types of X commenced business on 1st April2017. He effected sales in cash as well as on hire purchase basis. During the year, his purchases were amounting to ₹15500 and his cash sales were ₹13000. The following items were sold by him on hire purchase basis as per particular given below:Articles were RADIO, CYCLE AND CAMERA. THEIR COST WAS:₹200,₹210,₹400 TOTAL WAS=810. HIRE SALES PRICE WERE :₹350,₹350,₹600 TOTAL WAS =₹1300. DOWN PAYMENT OF ARTICLES WAS:, ₹50,₹75,₹100 TOTAL WAS:₹225. INSTALLMENT PAID DURING THE YEAR WAS AS FOLLOWS :₹125,₹125,₹150 TOTAL WAS ₹400. The installment on camera could not be kept up and the same was repossessed on 30th November 2017. The closing stock including the camera amounted ₹5000. Prepare the hire purchase trading account, memorandum hire purchase debtor account and the general trading account for the year ended 31st March 2018. The value of goods repossessed may be taken at cost equivalent. Related: Accounting for Hire Purchase - Financial Accounting - B.Com | Karan Arora | Study Khazana theory, EduRev gives you an

ample number of questions to practice X commenced business on 1st April2017. He effected sales in cash as well as on hire purchase basis. During the year, his purchases were amounting to ₹15500 and his cash sales were ₹13000. The following items were sold by him on hire purchase basis as per particular given below:Articles were RADIO, CYCLE AND CAMERA. THEIR COST WAS:₹200,₹210,₹400 TOTAL WAS=810. HIRE SALES PRICE WERE :₹350,₹350,₹600 TOTAL WAS =₹1300. DOWN PAYMENT OF ARTICLES WAS:, ₹50,₹75,₹100 TOTAL WAS:₹225. INSTALLMENT PAID DURING THE YEAR WAS AS FOLLOWS :₹125,₹125,₹150 TOTAL WAS ₹400. The installment on camera could not be kept up and the same was repossessed on 30th November 2017. The closing stock including the camera amounted ₹5000. Prepare the hire purchase trading account, memorandum hire purchase debtor account and the general trading account for the year ended 31st March 2018. The value of goods repossessed may be taken at cost equivalent. Related: Accounting for Hire Purchase - Financial Accounting - B.Com | Karan Arora | Study Khazana tests, examples and also practice B Com tests.

|

Explore Courses for B Com exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.