Commerce Exam > Commerce Questions > What is difference between operating activit...

Start Learning for Free

What is difference between operating activities, financing activities and investing activities?

Most Upvoted Answer

What is difference between operating activities, financing activities...

Community Answer

What is difference between operating activities, financing activities...

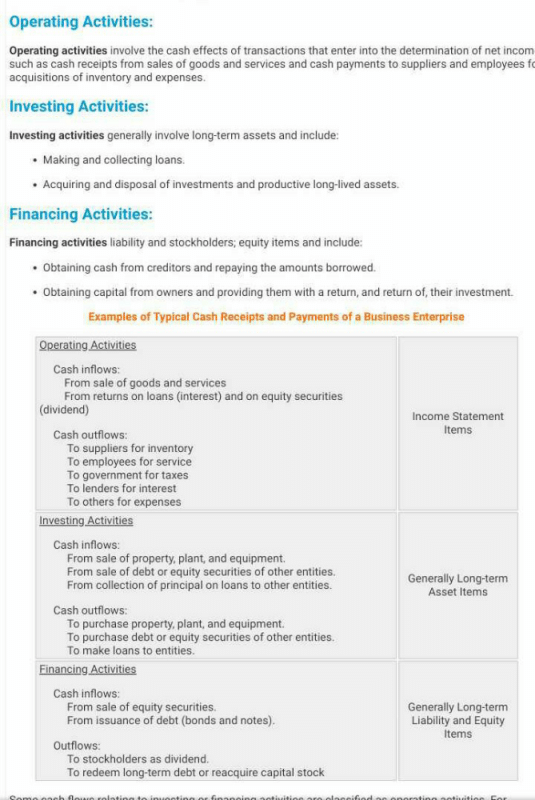

Operating Activities:

Operating activities refer to the day-to-day business operations of a company, which are directly related to generating revenue. These activities involve the production, purchase, and sale of goods or services and the associated cash flows.

Examples of operating activities:

1. Sales revenue: The cash received from customers for the sale of goods or services.

2. Payment to suppliers: The cash paid to suppliers for the purchase of raw materials or inventory.

3. Employee salaries and wages: The cash paid to employees for their services.

4. Rent and utility expenses: The cash paid for renting or leasing business premises and utilities.

5. Interest and dividend income: The cash received from investments or other interest-bearing accounts.

6. Income taxes: The cash paid or received as a result of tax obligations.

Financing Activities:

Financing activities involve the acquisition or repayment of funds to finance the company's operations. These activities primarily deal with the company's capital structure, such as obtaining funds from investors or repaying debts.

Examples of financing activities:

1. Issuing or repurchasing shares: The cash received from issuing new shares or the cash paid to repurchase existing shares.

2. Borrowing or repaying loans: The cash received from borrowing loans or the cash paid to repay the principal amount of loans.

3. Dividend payments: The cash paid to shareholders as a share of the company's profits.

4. Payment of interest: The cash paid to lenders as interest on borrowed funds.

5. Proceeds from debt or equity issuance: The cash received from issuing debt or equity securities.

Investing Activities:

Investing activities involve the acquisition and disposal of long-term assets or investments, which are not directly related to day-to-day operations. These activities are aimed at increasing the company's future earning potential or optimizing its asset base.

Examples of investing activities:

1. Purchase or sale of property, plant, and equipment: The cash paid to acquire or the cash received from selling assets like land, buildings, and machinery.

2. Purchase or sale of investments: The cash paid to acquire or the cash received from selling investments such as stocks, bonds, or other securities.

3. Loans made or collected: The cash provided to borrowers as loans or the cash collected from borrowers as loan repayments.

4. Acquisition or sale of subsidiaries: The cash paid to acquire or the cash received from selling subsidiary companies.

5. Purchase or redemption of treasury stock: The cash paid to repurchase or the cash received from selling the company's own stock.

In conclusion, operating activities involve the core revenue-generating operations of a company, financing activities deal with the company's capital structure and funding sources, and investing activities focus on the acquisition and disposal of long-term assets or investments. These three categories help in understanding the different cash flows within a company and provide insights into its financial performance and strategic decisions.

Operating activities refer to the day-to-day business operations of a company, which are directly related to generating revenue. These activities involve the production, purchase, and sale of goods or services and the associated cash flows.

Examples of operating activities:

1. Sales revenue: The cash received from customers for the sale of goods or services.

2. Payment to suppliers: The cash paid to suppliers for the purchase of raw materials or inventory.

3. Employee salaries and wages: The cash paid to employees for their services.

4. Rent and utility expenses: The cash paid for renting or leasing business premises and utilities.

5. Interest and dividend income: The cash received from investments or other interest-bearing accounts.

6. Income taxes: The cash paid or received as a result of tax obligations.

Financing Activities:

Financing activities involve the acquisition or repayment of funds to finance the company's operations. These activities primarily deal with the company's capital structure, such as obtaining funds from investors or repaying debts.

Examples of financing activities:

1. Issuing or repurchasing shares: The cash received from issuing new shares or the cash paid to repurchase existing shares.

2. Borrowing or repaying loans: The cash received from borrowing loans or the cash paid to repay the principal amount of loans.

3. Dividend payments: The cash paid to shareholders as a share of the company's profits.

4. Payment of interest: The cash paid to lenders as interest on borrowed funds.

5. Proceeds from debt or equity issuance: The cash received from issuing debt or equity securities.

Investing Activities:

Investing activities involve the acquisition and disposal of long-term assets or investments, which are not directly related to day-to-day operations. These activities are aimed at increasing the company's future earning potential or optimizing its asset base.

Examples of investing activities:

1. Purchase or sale of property, plant, and equipment: The cash paid to acquire or the cash received from selling assets like land, buildings, and machinery.

2. Purchase or sale of investments: The cash paid to acquire or the cash received from selling investments such as stocks, bonds, or other securities.

3. Loans made or collected: The cash provided to borrowers as loans or the cash collected from borrowers as loan repayments.

4. Acquisition or sale of subsidiaries: The cash paid to acquire or the cash received from selling subsidiary companies.

5. Purchase or redemption of treasury stock: The cash paid to repurchase or the cash received from selling the company's own stock.

In conclusion, operating activities involve the core revenue-generating operations of a company, financing activities deal with the company's capital structure and funding sources, and investing activities focus on the acquisition and disposal of long-term assets or investments. These three categories help in understanding the different cash flows within a company and provide insights into its financial performance and strategic decisions.

Attention Commerce Students!

To make sure you are not studying endlessly, EduRev has designed Commerce study material, with Structured Courses, Videos, & Test Series. Plus get personalized analysis, doubt solving and improvement plans to achieve a great score in Commerce.

|

Explore Courses for Commerce exam

|

|

Similar Commerce Doubts

What is difference between operating activities, financing activities and investing activities?

Question Description

What is difference between operating activities, financing activities and investing activities? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about What is difference between operating activities, financing activities and investing activities? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for What is difference between operating activities, financing activities and investing activities?.

What is difference between operating activities, financing activities and investing activities? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about What is difference between operating activities, financing activities and investing activities? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for What is difference between operating activities, financing activities and investing activities?.

Solutions for What is difference between operating activities, financing activities and investing activities? in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of What is difference between operating activities, financing activities and investing activities? defined & explained in the simplest way possible. Besides giving the explanation of

What is difference between operating activities, financing activities and investing activities?, a detailed solution for What is difference between operating activities, financing activities and investing activities? has been provided alongside types of What is difference between operating activities, financing activities and investing activities? theory, EduRev gives you an

ample number of questions to practice What is difference between operating activities, financing activities and investing activities? tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.