B Com Exam > B Com Questions > XYZ Ltd. issues 20,000, 8% preference shares ...

Start Learning for Free

XYZ Ltd. issues 20,000, 8% preference shares of Rs. 100 each. Cost of issue is Rs. 2 per

share. Calculate cost of preference share capital if these shares are issued (a) at par, (b) at

a premium of 10% and (c) at a discount of 6%.

?Verified Answer

XYZ Ltd. issues 20,000, 8% preference shares of Rs. 100 each. Cost of ...

Ans.

This question is part of UPSC exam. View all B Com courses

This question is part of UPSC exam. View all B Com courses

Most Upvoted Answer

XYZ Ltd. issues 20,000, 8% preference shares of Rs. 100 each. Cost of ...

Cost of Preference Share Capital

Introduction:

Preference shares are a type of shares that carry a fixed dividend rate and have a higher claim on the company's assets and earnings compared to common shares. The cost of preference share capital refers to the cost incurred by a company to raise funds through the issuance of preference shares.

Cost of Preference Share Capital Calculation:

The cost of preference share capital can be calculated using the formula:

Cost of Preference Share Capital = Dividend Rate / Net Proceeds from Issue of Preference Shares

Where,

Dividend Rate = Annual Dividend per Preference Share / Issue Price per Preference Share

Net Proceeds from Issue of Preference Shares = Issue Price per Preference Share - Cost of Issue

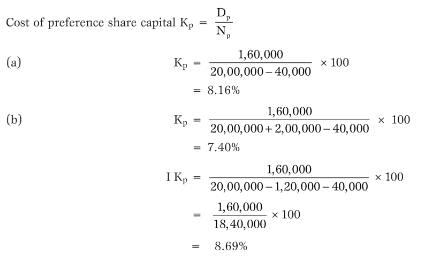

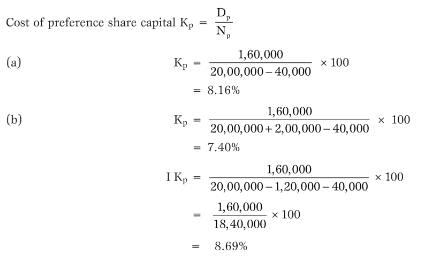

(a) Issued at Par:

When preference shares are issued at par, the issue price is equal to the face value of the shares. In this case, the cost of preference share capital can be calculated as follows:

Dividend Rate = 8% of Rs. 100 = Rs. 8

Cost of Issue = Rs. 2 per share

Net Proceeds from Issue of Preference Shares = Rs. 100 - Rs. 2 = Rs. 98

Cost of Preference Share Capital = Rs. 8 / Rs. 98 = 0.0816 or 8.16%

(b) Issued at a Premium of 10%:

When preference shares are issued at a premium, the issue price is higher than the face value of the shares. In this case, the cost of preference share capital can be calculated as follows:

Issue Price per Preference Share = Face Value + Premium

= Rs. 100 + (10% of Rs. 100) = Rs. 100 + Rs. 10 = Rs. 110

Dividend Rate = 8% of Rs. 100 = Rs. 8

Cost of Issue = Rs. 2 per share

Net Proceeds from Issue of Preference Shares = Rs. 110 - Rs. 2 = Rs. 108

Cost of Preference Share Capital = Rs. 8 / Rs. 108 = 0.0741 or 7.41%

(c) Issued at a Discount of 6%:

When preference shares are issued at a discount, the issue price is lower than the face value of the shares. In this case, the cost of preference share capital can be calculated as follows:

Issue Price per Preference Share = Face Value - Discount

= Rs. 100 - (6% of Rs. 100) = Rs. 100 - Rs. 6 = Rs. 94

Dividend Rate = 8% of Rs. 100 = Rs. 8

Cost of Issue = Rs. 2 per share

Net Proceeds from Issue of Preference Shares = Rs. 94 - Rs. 2 = Rs. 92

Cost of Preference Share Capital = Rs. 8 / Rs. 92 = 0.087 or 8.7%

Conclusion:

The cost of preference share capital can be calculated based on the dividend rate, issue price, and cost of issue. Depending on whether the shares are issued at par, at a premium, or at a discount, the cost of preference share capital will vary. It is important for companies to consider the cost of capital when making

Introduction:

Preference shares are a type of shares that carry a fixed dividend rate and have a higher claim on the company's assets and earnings compared to common shares. The cost of preference share capital refers to the cost incurred by a company to raise funds through the issuance of preference shares.

Cost of Preference Share Capital Calculation:

The cost of preference share capital can be calculated using the formula:

Cost of Preference Share Capital = Dividend Rate / Net Proceeds from Issue of Preference Shares

Where,

Dividend Rate = Annual Dividend per Preference Share / Issue Price per Preference Share

Net Proceeds from Issue of Preference Shares = Issue Price per Preference Share - Cost of Issue

(a) Issued at Par:

When preference shares are issued at par, the issue price is equal to the face value of the shares. In this case, the cost of preference share capital can be calculated as follows:

Dividend Rate = 8% of Rs. 100 = Rs. 8

Cost of Issue = Rs. 2 per share

Net Proceeds from Issue of Preference Shares = Rs. 100 - Rs. 2 = Rs. 98

Cost of Preference Share Capital = Rs. 8 / Rs. 98 = 0.0816 or 8.16%

(b) Issued at a Premium of 10%:

When preference shares are issued at a premium, the issue price is higher than the face value of the shares. In this case, the cost of preference share capital can be calculated as follows:

Issue Price per Preference Share = Face Value + Premium

= Rs. 100 + (10% of Rs. 100) = Rs. 100 + Rs. 10 = Rs. 110

Dividend Rate = 8% of Rs. 100 = Rs. 8

Cost of Issue = Rs. 2 per share

Net Proceeds from Issue of Preference Shares = Rs. 110 - Rs. 2 = Rs. 108

Cost of Preference Share Capital = Rs. 8 / Rs. 108 = 0.0741 or 7.41%

(c) Issued at a Discount of 6%:

When preference shares are issued at a discount, the issue price is lower than the face value of the shares. In this case, the cost of preference share capital can be calculated as follows:

Issue Price per Preference Share = Face Value - Discount

= Rs. 100 - (6% of Rs. 100) = Rs. 100 - Rs. 6 = Rs. 94

Dividend Rate = 8% of Rs. 100 = Rs. 8

Cost of Issue = Rs. 2 per share

Net Proceeds from Issue of Preference Shares = Rs. 94 - Rs. 2 = Rs. 92

Cost of Preference Share Capital = Rs. 8 / Rs. 92 = 0.087 or 8.7%

Conclusion:

The cost of preference share capital can be calculated based on the dividend rate, issue price, and cost of issue. Depending on whether the shares are issued at par, at a premium, or at a discount, the cost of preference share capital will vary. It is important for companies to consider the cost of capital when making

|

Explore Courses for B Com exam

|

|

Similar B Com Doubts

XYZ Ltd. issues 20,000, 8% preference shares of Rs. 100 each. Cost of issue is Rs. 2 per

share. Calculate cost of preference share capital if these shares are issued (a) at par, (b) at

a premium of 10% and (c) at a discount of 6%. Related: Computation Of Cost Of Capital (Part - 2), Accountancy and Financial Management?

Question Description

XYZ Ltd. issues 20,000, 8% preference shares of Rs. 100 each. Cost of issue is Rs. 2 per share. Calculate cost of preference share capital if these shares are issued (a) at par, (b) at a premium of 10% and (c) at a discount of 6%. Related: Computation Of Cost Of Capital (Part - 2), Accountancy and Financial Management? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about XYZ Ltd. issues 20,000, 8% preference shares of Rs. 100 each. Cost of issue is Rs. 2 per share. Calculate cost of preference share capital if these shares are issued (a) at par, (b) at a premium of 10% and (c) at a discount of 6%. Related: Computation Of Cost Of Capital (Part - 2), Accountancy and Financial Management? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for XYZ Ltd. issues 20,000, 8% preference shares of Rs. 100 each. Cost of issue is Rs. 2 per share. Calculate cost of preference share capital if these shares are issued (a) at par, (b) at a premium of 10% and (c) at a discount of 6%. Related: Computation Of Cost Of Capital (Part - 2), Accountancy and Financial Management?.

XYZ Ltd. issues 20,000, 8% preference shares of Rs. 100 each. Cost of issue is Rs. 2 per share. Calculate cost of preference share capital if these shares are issued (a) at par, (b) at a premium of 10% and (c) at a discount of 6%. Related: Computation Of Cost Of Capital (Part - 2), Accountancy and Financial Management? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about XYZ Ltd. issues 20,000, 8% preference shares of Rs. 100 each. Cost of issue is Rs. 2 per share. Calculate cost of preference share capital if these shares are issued (a) at par, (b) at a premium of 10% and (c) at a discount of 6%. Related: Computation Of Cost Of Capital (Part - 2), Accountancy and Financial Management? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for XYZ Ltd. issues 20,000, 8% preference shares of Rs. 100 each. Cost of issue is Rs. 2 per share. Calculate cost of preference share capital if these shares are issued (a) at par, (b) at a premium of 10% and (c) at a discount of 6%. Related: Computation Of Cost Of Capital (Part - 2), Accountancy and Financial Management?.

Solutions for XYZ Ltd. issues 20,000, 8% preference shares of Rs. 100 each. Cost of issue is Rs. 2 per

share. Calculate cost of preference share capital if these shares are issued (a) at par, (b) at

a premium of 10% and (c) at a discount of 6%. Related: Computation Of Cost Of Capital (Part - 2), Accountancy and Financial Management? in English & in Hindi are available as part of our courses for B Com.

Download more important topics, notes, lectures and mock test series for B Com Exam by signing up for free.

Here you can find the meaning of XYZ Ltd. issues 20,000, 8% preference shares of Rs. 100 each. Cost of issue is Rs. 2 per

share. Calculate cost of preference share capital if these shares are issued (a) at par, (b) at

a premium of 10% and (c) at a discount of 6%. Related: Computation Of Cost Of Capital (Part - 2), Accountancy and Financial Management? defined & explained in the simplest way possible. Besides giving the explanation of

XYZ Ltd. issues 20,000, 8% preference shares of Rs. 100 each. Cost of issue is Rs. 2 per

share. Calculate cost of preference share capital if these shares are issued (a) at par, (b) at

a premium of 10% and (c) at a discount of 6%. Related: Computation Of Cost Of Capital (Part - 2), Accountancy and Financial Management?, a detailed solution for XYZ Ltd. issues 20,000, 8% preference shares of Rs. 100 each. Cost of issue is Rs. 2 per

share. Calculate cost of preference share capital if these shares are issued (a) at par, (b) at

a premium of 10% and (c) at a discount of 6%. Related: Computation Of Cost Of Capital (Part - 2), Accountancy and Financial Management? has been provided alongside types of XYZ Ltd. issues 20,000, 8% preference shares of Rs. 100 each. Cost of issue is Rs. 2 per

share. Calculate cost of preference share capital if these shares are issued (a) at par, (b) at

a premium of 10% and (c) at a discount of 6%. Related: Computation Of Cost Of Capital (Part - 2), Accountancy and Financial Management? theory, EduRev gives you an

ample number of questions to practice XYZ Ltd. issues 20,000, 8% preference shares of Rs. 100 each. Cost of issue is Rs. 2 per

share. Calculate cost of preference share capital if these shares are issued (a) at par, (b) at

a premium of 10% and (c) at a discount of 6%. Related: Computation Of Cost Of Capital (Part - 2), Accountancy and Financial Management? tests, examples and also practice B Com tests.

|

Explore Courses for B Com exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.