Commerce Exam > Commerce Questions > scope of financial accountig Related: Financ...

Start Learning for Free

scope of financial accountig

?Most Upvoted Answer

scope of financial accountig Related: Financial Accounting - Chapter ...

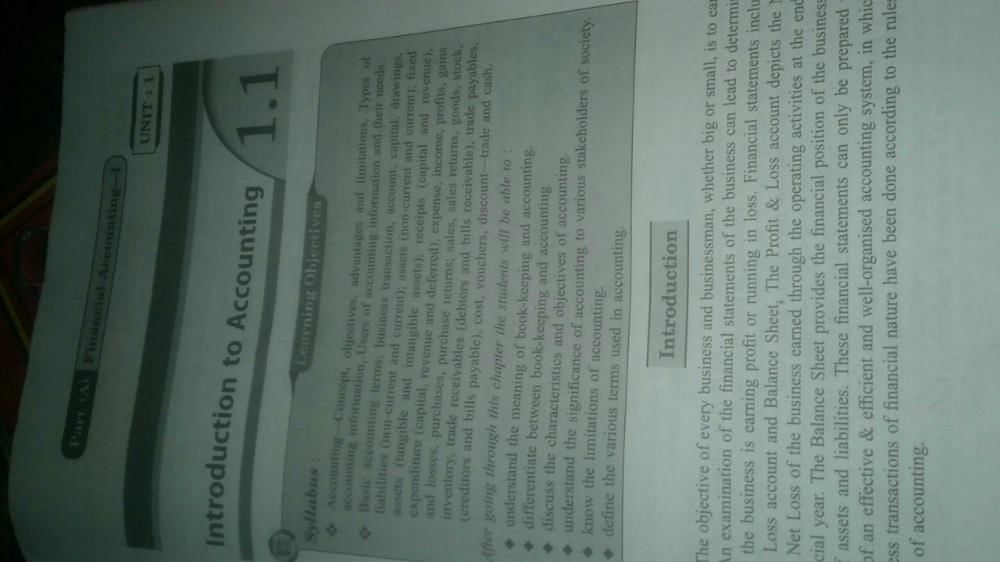

**Scope of Financial Accounting**

Financial accounting is a branch of accounting that focuses on recording, summarizing, and reporting financial transactions and activities of a business. It provides information to external stakeholders such as investors, creditors, and regulatory authorities, enabling them to make informed decisions about the company's financial health and performance. The scope of financial accounting is vast and covers various aspects of a business's financial activities.

**1. Recording Transactions**

Financial accounting involves the systematic recording of all financial transactions of a business. This includes the recording of sales, purchases, expenses, incomes, assets, liabilities, and equity. The transactions are recorded in the general ledger using the double-entry accounting system, which ensures that every transaction has an equal debit and credit entry. This recording process helps in maintaining accurate and reliable financial records.

**2. Summarizing Financial Data**

Once the transactions are recorded, financial accounting involves summarizing the data in various financial statements. The main financial statements include the income statement, balance sheet, and cash flow statement. These statements provide a snapshot of the company's financial performance, financial position, and cash flows. The financial data is presented in a structured manner to facilitate analysis and decision-making.

**3. Reporting to External Stakeholders**

Financial accounting aims to provide relevant and reliable financial information to external stakeholders. These stakeholders include investors, creditors, suppliers, customers, and regulatory authorities. Financial statements are prepared and presented in accordance with generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS). The reports enable stakeholders to assess the company's profitability, liquidity, solvency, and overall financial health.

**4. Compliance with Accounting Standards**

Financial accounting operates within a framework of accounting standards and principles that guide the recording, summarizing, and reporting of financial information. These standards ensure consistency, comparability, and transparency in financial reporting. The most widely recognized accounting standards include the Generally Accepted Accounting Principles (GAAP) in the United States and the International Financial Reporting Standards (IFRS) globally.

**5. Auditing and Assurance**

Financial accounting also encompasses auditing and assurance services. Auditors review financial statements and provide an independent opinion on their accuracy and compliance with accounting standards. Assurance services ensure that financial information is reliable and free from material misstatements or errors. These services enhance the credibility and trustworthiness of financial information.

**Conclusion**

The scope of financial accounting is broad and encompasses various activities such as recording transactions, summarizing financial data, reporting to external stakeholders, compliance with accounting standards, and auditing. Financial accounting plays a crucial role in providing relevant and reliable financial information to assist stakeholders in making informed decisions about a company's financial performance and position.

Financial accounting is a branch of accounting that focuses on recording, summarizing, and reporting financial transactions and activities of a business. It provides information to external stakeholders such as investors, creditors, and regulatory authorities, enabling them to make informed decisions about the company's financial health and performance. The scope of financial accounting is vast and covers various aspects of a business's financial activities.

**1. Recording Transactions**

Financial accounting involves the systematic recording of all financial transactions of a business. This includes the recording of sales, purchases, expenses, incomes, assets, liabilities, and equity. The transactions are recorded in the general ledger using the double-entry accounting system, which ensures that every transaction has an equal debit and credit entry. This recording process helps in maintaining accurate and reliable financial records.

**2. Summarizing Financial Data**

Once the transactions are recorded, financial accounting involves summarizing the data in various financial statements. The main financial statements include the income statement, balance sheet, and cash flow statement. These statements provide a snapshot of the company's financial performance, financial position, and cash flows. The financial data is presented in a structured manner to facilitate analysis and decision-making.

**3. Reporting to External Stakeholders**

Financial accounting aims to provide relevant and reliable financial information to external stakeholders. These stakeholders include investors, creditors, suppliers, customers, and regulatory authorities. Financial statements are prepared and presented in accordance with generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS). The reports enable stakeholders to assess the company's profitability, liquidity, solvency, and overall financial health.

**4. Compliance with Accounting Standards**

Financial accounting operates within a framework of accounting standards and principles that guide the recording, summarizing, and reporting of financial information. These standards ensure consistency, comparability, and transparency in financial reporting. The most widely recognized accounting standards include the Generally Accepted Accounting Principles (GAAP) in the United States and the International Financial Reporting Standards (IFRS) globally.

**5. Auditing and Assurance**

Financial accounting also encompasses auditing and assurance services. Auditors review financial statements and provide an independent opinion on their accuracy and compliance with accounting standards. Assurance services ensure that financial information is reliable and free from material misstatements or errors. These services enhance the credibility and trustworthiness of financial information.

**Conclusion**

The scope of financial accounting is broad and encompasses various activities such as recording transactions, summarizing financial data, reporting to external stakeholders, compliance with accounting standards, and auditing. Financial accounting plays a crucial role in providing relevant and reliable financial information to assist stakeholders in making informed decisions about a company's financial performance and position.

Community Answer

scope of financial accountig Related: Financial Accounting - Chapter ...

Attention Commerce Students!

To make sure you are not studying endlessly, EduRev has designed Commerce study material, with Structured Courses, Videos, & Test Series. Plus get personalized analysis, doubt solving and improvement plans to achieve a great score in Commerce.

|

Explore Courses for Commerce exam

|

|

Similar Commerce Doubts

scope of financial accountig Related: Financial Accounting - Chapter 1: Introduction to accounting.?

Question Description

scope of financial accountig Related: Financial Accounting - Chapter 1: Introduction to accounting.? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about scope of financial accountig Related: Financial Accounting - Chapter 1: Introduction to accounting.? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for scope of financial accountig Related: Financial Accounting - Chapter 1: Introduction to accounting.?.

scope of financial accountig Related: Financial Accounting - Chapter 1: Introduction to accounting.? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about scope of financial accountig Related: Financial Accounting - Chapter 1: Introduction to accounting.? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for scope of financial accountig Related: Financial Accounting - Chapter 1: Introduction to accounting.?.

Solutions for scope of financial accountig Related: Financial Accounting - Chapter 1: Introduction to accounting.? in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of scope of financial accountig Related: Financial Accounting - Chapter 1: Introduction to accounting.? defined & explained in the simplest way possible. Besides giving the explanation of

scope of financial accountig Related: Financial Accounting - Chapter 1: Introduction to accounting.?, a detailed solution for scope of financial accountig Related: Financial Accounting - Chapter 1: Introduction to accounting.? has been provided alongside types of scope of financial accountig Related: Financial Accounting - Chapter 1: Introduction to accounting.? theory, EduRev gives you an

ample number of questions to practice scope of financial accountig Related: Financial Accounting - Chapter 1: Introduction to accounting.? tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.