B Com Exam > B Com Questions > Difference between general insurance and life...

Start Learning for Free

Difference between general insurance and life insurance ?

Most Upvoted Answer

Difference between general insurance and life insurance ?

General Insurance

General insurance is a type of insurance policy that provides financial protection against damages and losses caused by unforeseen events, such as accidents, theft, fire, natural disasters, and other liabilities. The primary objective of general insurance is to protect the policyholder against financial losses arising from unexpected events.

Life Insurance

Life insurance is a type of insurance policy that provides financial protection to the policyholder's family or dependents in the event of the policyholder's death. The primary objective of life insurance is to provide financial security to the policyholder's family or dependents after their death.

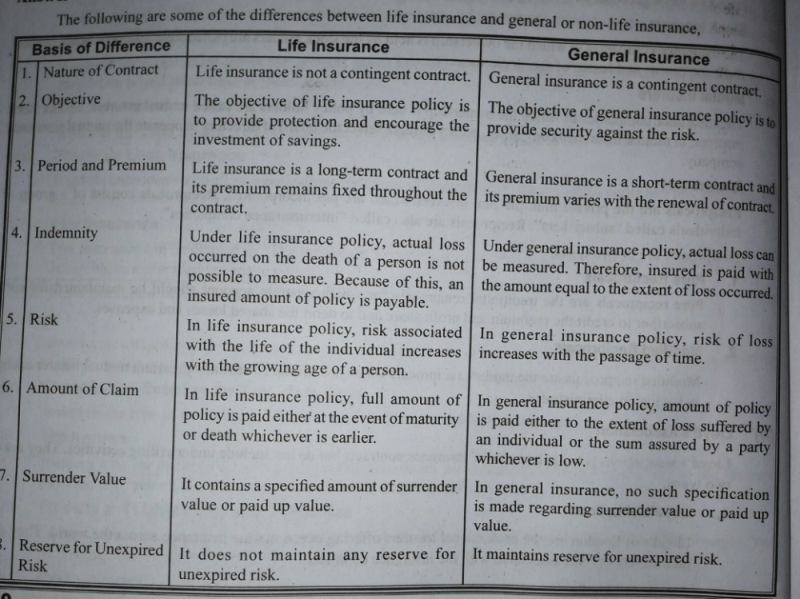

Differences between General Insurance and Life Insurance

1. Coverage: The primary difference between general insurance and life insurance is the type of coverage they offer. General insurance provides coverage against losses caused by unforeseen events, while life insurance provides coverage to the policyholder's family or dependents in the event of the policyholder's death.

2. Purpose: The purpose of general insurance is to protect the policyholder against financial losses caused by unexpected events, while the purpose of life insurance is to provide financial security to the policyholder's family or dependents after their death.

3. Premiums: The premiums for general insurance policies are determined based on the risk associated with the policy, while the premiums for life insurance policies are determined based on the age, health, and lifestyle of the policyholder.

4. Payouts: The payouts for general insurance policies are made when the policyholder suffers a loss or damage due to an unforeseen event, while the payouts for life insurance policies are made when the policyholder dies.

5. Term: General insurance policies are usually short-term policies that provide coverage for a specific period, while life insurance policies are long-term policies that provide coverage for the policyholder's lifetime.

In conclusion, while general insurance provides protection against financial losses caused by unforeseen events, life insurance provides financial security to the policyholder's family or dependents after their death. Both types of insurance policies serve different purposes and offer different types of coverage.

General insurance is a type of insurance policy that provides financial protection against damages and losses caused by unforeseen events, such as accidents, theft, fire, natural disasters, and other liabilities. The primary objective of general insurance is to protect the policyholder against financial losses arising from unexpected events.

Life Insurance

Life insurance is a type of insurance policy that provides financial protection to the policyholder's family or dependents in the event of the policyholder's death. The primary objective of life insurance is to provide financial security to the policyholder's family or dependents after their death.

Differences between General Insurance and Life Insurance

1. Coverage: The primary difference between general insurance and life insurance is the type of coverage they offer. General insurance provides coverage against losses caused by unforeseen events, while life insurance provides coverage to the policyholder's family or dependents in the event of the policyholder's death.

2. Purpose: The purpose of general insurance is to protect the policyholder against financial losses caused by unexpected events, while the purpose of life insurance is to provide financial security to the policyholder's family or dependents after their death.

3. Premiums: The premiums for general insurance policies are determined based on the risk associated with the policy, while the premiums for life insurance policies are determined based on the age, health, and lifestyle of the policyholder.

4. Payouts: The payouts for general insurance policies are made when the policyholder suffers a loss or damage due to an unforeseen event, while the payouts for life insurance policies are made when the policyholder dies.

5. Term: General insurance policies are usually short-term policies that provide coverage for a specific period, while life insurance policies are long-term policies that provide coverage for the policyholder's lifetime.

In conclusion, while general insurance provides protection against financial losses caused by unforeseen events, life insurance provides financial security to the policyholder's family or dependents after their death. Both types of insurance policies serve different purposes and offer different types of coverage.

Community Answer

Difference between general insurance and life insurance ?

|

Explore Courses for B Com exam

|

|

Similar B Com Doubts

Difference between general insurance and life insurance ?

Question Description

Difference between general insurance and life insurance ? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about Difference between general insurance and life insurance ? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Difference between general insurance and life insurance ?.

Difference between general insurance and life insurance ? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about Difference between general insurance and life insurance ? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Difference between general insurance and life insurance ?.

Solutions for Difference between general insurance and life insurance ? in English & in Hindi are available as part of our courses for B Com.

Download more important topics, notes, lectures and mock test series for B Com Exam by signing up for free.

Here you can find the meaning of Difference between general insurance and life insurance ? defined & explained in the simplest way possible. Besides giving the explanation of

Difference between general insurance and life insurance ?, a detailed solution for Difference between general insurance and life insurance ? has been provided alongside types of Difference between general insurance and life insurance ? theory, EduRev gives you an

ample number of questions to practice Difference between general insurance and life insurance ? tests, examples and also practice B Com tests.

|

Explore Courses for B Com exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.