Commerce Exam > Commerce Questions > balance as per cash book as on 31_3_2016 R. 6...

Start Learning for Free

balance as per cash book as on 31_3_2016 R. 6000. interest on overdraft 200 debited in pass book.. cheques issued but not credited yet 2500. cheques deposited but not credited yet 2600.. interest on investment credited by bank 1800 . bills receivable with the bank in Feb.,2016 Dishonored on march 31 and bank had debited 1050 including bank charges ,50. bank column of cash book receipt side overcast by 1000 in march 2016..bank had wrongly debited Mr. Q for 500 on 10 march on account of dishonour of cheque pertaining to Mr. Q. Q had ractfied the said mistake on march 30, 2016

?Most Upvoted Answer

balance as per cash book as on 31_3_2016 R. 6000. interest on overdraf...

Bank Reconciliation Statement

In order to reconcile the balance as per the cash book with the balance as per the pass book, a Bank Reconciliation Statement (BRS) needs to be prepared. The given information can be used to prepare the BRS as follows:

1. Balance as per Cash Book: The balance as per the cash book on March 31, 2016, is Rs. 6000.

2. Interest on Overdraft: The pass book shows an interest of Rs. 200 debited. This means the bank has charged an interest on the overdraft facility provided by them.

3. Cheques Issued but Not Credited: Cheques worth Rs. 2500 have been issued by the company but have not been credited to the bank account yet. These cheques would have been deducted from the balance as per the pass book.

4. Cheques Deposited but Not Credited: Cheques worth Rs. 2600 have been deposited into the bank account but have not been credited yet. These cheques would have been added to the balance as per the pass book.

5. Interest on Investment: The bank has credited an interest of Rs. 1800 on the company's investments. This interest would have been added to the balance as per the pass book.

6. Dishonored Bills Receivable: Bills receivable with the bank in February 2016 were dishonored on March 31, 2016. The bank has debited Rs. 1050, including bank charges of Rs. 50. This amount would have been deducted from the balance as per the pass book.

7. Overcasting of Cash Book: The bank column of the cash book on the receipt side has been overcast by Rs. 1000 in March 2016. This error needs to be rectified by deducting Rs. 1000 from the balance as per the cash book.

8. Wrong Debit: On March 10, 2016, the bank wrongly debited Mr. Q's account for Rs. 500 on account of the dishonored cheque pertaining to Mr. Q. However, Mr. Q rectified this mistake on March 30, 2016. Therefore, this debit entry needs to be adjusted by adding Rs. 500 to the balance as per the pass book.

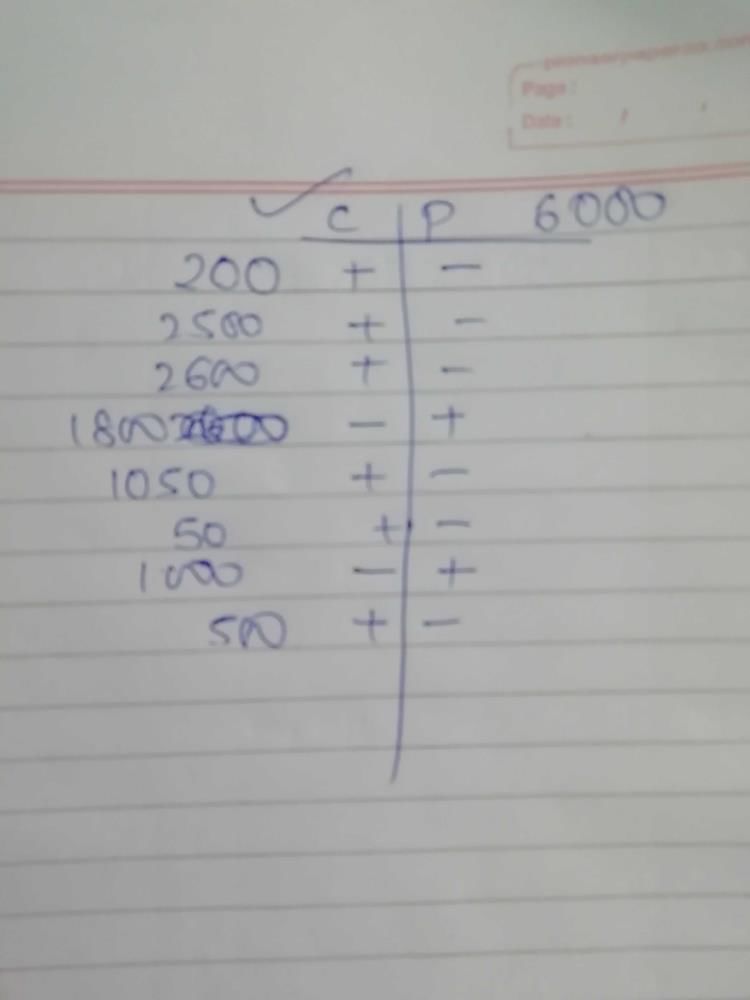

Bank Reconciliation Statement (BRS):

The BRS can be prepared by adjusting the items mentioned above. The adjusted balance as per the pass book can be calculated as follows:

Balance as per Cash Book: Rs. 6000

Add: Cheques issued but not credited: Rs. 2500

Add: Cheques deposited but not credited: Rs. 2600

Add: Interest on Investment: Rs. 1800

Less: Dishonored Bills Receivable: Rs. 1050

Less: Overcasting of Cash Book: Rs. 1000

Add: Wrong Debit: Rs. 500

Adjusted balance as per Pass Book: Rs. (6000 + 2500 + 2600 + 1800 - 1050 - 1000 + 500) = Rs. 11450

Therefore, the adjusted balance as per the pass book

In order to reconcile the balance as per the cash book with the balance as per the pass book, a Bank Reconciliation Statement (BRS) needs to be prepared. The given information can be used to prepare the BRS as follows:

1. Balance as per Cash Book: The balance as per the cash book on March 31, 2016, is Rs. 6000.

2. Interest on Overdraft: The pass book shows an interest of Rs. 200 debited. This means the bank has charged an interest on the overdraft facility provided by them.

3. Cheques Issued but Not Credited: Cheques worth Rs. 2500 have been issued by the company but have not been credited to the bank account yet. These cheques would have been deducted from the balance as per the pass book.

4. Cheques Deposited but Not Credited: Cheques worth Rs. 2600 have been deposited into the bank account but have not been credited yet. These cheques would have been added to the balance as per the pass book.

5. Interest on Investment: The bank has credited an interest of Rs. 1800 on the company's investments. This interest would have been added to the balance as per the pass book.

6. Dishonored Bills Receivable: Bills receivable with the bank in February 2016 were dishonored on March 31, 2016. The bank has debited Rs. 1050, including bank charges of Rs. 50. This amount would have been deducted from the balance as per the pass book.

7. Overcasting of Cash Book: The bank column of the cash book on the receipt side has been overcast by Rs. 1000 in March 2016. This error needs to be rectified by deducting Rs. 1000 from the balance as per the cash book.

8. Wrong Debit: On March 10, 2016, the bank wrongly debited Mr. Q's account for Rs. 500 on account of the dishonored cheque pertaining to Mr. Q. However, Mr. Q rectified this mistake on March 30, 2016. Therefore, this debit entry needs to be adjusted by adding Rs. 500 to the balance as per the pass book.

Bank Reconciliation Statement (BRS):

The BRS can be prepared by adjusting the items mentioned above. The adjusted balance as per the pass book can be calculated as follows:

Balance as per Cash Book: Rs. 6000

Add: Cheques issued but not credited: Rs. 2500

Add: Cheques deposited but not credited: Rs. 2600

Add: Interest on Investment: Rs. 1800

Less: Dishonored Bills Receivable: Rs. 1050

Less: Overcasting of Cash Book: Rs. 1000

Add: Wrong Debit: Rs. 500

Adjusted balance as per Pass Book: Rs. (6000 + 2500 + 2600 + 1800 - 1050 - 1000 + 500) = Rs. 11450

Therefore, the adjusted balance as per the pass book

Community Answer

balance as per cash book as on 31_3_2016 R. 6000. interest on overdraf...

Attention Commerce Students!

To make sure you are not studying endlessly, EduRev has designed Commerce study material, with Structured Courses, Videos, & Test Series. Plus get personalized analysis, doubt solving and improvement plans to achieve a great score in Commerce.

|

Explore Courses for Commerce exam

|

|

Similar Commerce Doubts

balance as per cash book as on 31_3_2016 R. 6000. interest on overdraft 200 debited in pass book.. cheques issued but not credited yet 2500. cheques deposited but not credited yet 2600.. interest on investment credited by bank 1800 . bills receivable with the bank in Feb.,2016 Dishonored on march 31 and bank had debited 1050 including bank charges ,50. bank column of cash book receipt side overcast by 1000 in march 2016..bank had wrongly debited Mr. Q for 500 on 10 march on account of dishonour of cheque pertaining to Mr. Q. Q had ractfied the said mistake on march 30, 2016 Related: Class 11th - Accountancy : Bank Reconciliation Statement (BRS) - Complete?

Question Description

balance as per cash book as on 31_3_2016 R. 6000. interest on overdraft 200 debited in pass book.. cheques issued but not credited yet 2500. cheques deposited but not credited yet 2600.. interest on investment credited by bank 1800 . bills receivable with the bank in Feb.,2016 Dishonored on march 31 and bank had debited 1050 including bank charges ,50. bank column of cash book receipt side overcast by 1000 in march 2016..bank had wrongly debited Mr. Q for 500 on 10 march on account of dishonour of cheque pertaining to Mr. Q. Q had ractfied the said mistake on march 30, 2016 Related: Class 11th - Accountancy : Bank Reconciliation Statement (BRS) - Complete? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about balance as per cash book as on 31_3_2016 R. 6000. interest on overdraft 200 debited in pass book.. cheques issued but not credited yet 2500. cheques deposited but not credited yet 2600.. interest on investment credited by bank 1800 . bills receivable with the bank in Feb.,2016 Dishonored on march 31 and bank had debited 1050 including bank charges ,50. bank column of cash book receipt side overcast by 1000 in march 2016..bank had wrongly debited Mr. Q for 500 on 10 march on account of dishonour of cheque pertaining to Mr. Q. Q had ractfied the said mistake on march 30, 2016 Related: Class 11th - Accountancy : Bank Reconciliation Statement (BRS) - Complete? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for balance as per cash book as on 31_3_2016 R. 6000. interest on overdraft 200 debited in pass book.. cheques issued but not credited yet 2500. cheques deposited but not credited yet 2600.. interest on investment credited by bank 1800 . bills receivable with the bank in Feb.,2016 Dishonored on march 31 and bank had debited 1050 including bank charges ,50. bank column of cash book receipt side overcast by 1000 in march 2016..bank had wrongly debited Mr. Q for 500 on 10 march on account of dishonour of cheque pertaining to Mr. Q. Q had ractfied the said mistake on march 30, 2016 Related: Class 11th - Accountancy : Bank Reconciliation Statement (BRS) - Complete?.

balance as per cash book as on 31_3_2016 R. 6000. interest on overdraft 200 debited in pass book.. cheques issued but not credited yet 2500. cheques deposited but not credited yet 2600.. interest on investment credited by bank 1800 . bills receivable with the bank in Feb.,2016 Dishonored on march 31 and bank had debited 1050 including bank charges ,50. bank column of cash book receipt side overcast by 1000 in march 2016..bank had wrongly debited Mr. Q for 500 on 10 march on account of dishonour of cheque pertaining to Mr. Q. Q had ractfied the said mistake on march 30, 2016 Related: Class 11th - Accountancy : Bank Reconciliation Statement (BRS) - Complete? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about balance as per cash book as on 31_3_2016 R. 6000. interest on overdraft 200 debited in pass book.. cheques issued but not credited yet 2500. cheques deposited but not credited yet 2600.. interest on investment credited by bank 1800 . bills receivable with the bank in Feb.,2016 Dishonored on march 31 and bank had debited 1050 including bank charges ,50. bank column of cash book receipt side overcast by 1000 in march 2016..bank had wrongly debited Mr. Q for 500 on 10 march on account of dishonour of cheque pertaining to Mr. Q. Q had ractfied the said mistake on march 30, 2016 Related: Class 11th - Accountancy : Bank Reconciliation Statement (BRS) - Complete? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for balance as per cash book as on 31_3_2016 R. 6000. interest on overdraft 200 debited in pass book.. cheques issued but not credited yet 2500. cheques deposited but not credited yet 2600.. interest on investment credited by bank 1800 . bills receivable with the bank in Feb.,2016 Dishonored on march 31 and bank had debited 1050 including bank charges ,50. bank column of cash book receipt side overcast by 1000 in march 2016..bank had wrongly debited Mr. Q for 500 on 10 march on account of dishonour of cheque pertaining to Mr. Q. Q had ractfied the said mistake on march 30, 2016 Related: Class 11th - Accountancy : Bank Reconciliation Statement (BRS) - Complete?.

Solutions for balance as per cash book as on 31_3_2016 R. 6000. interest on overdraft 200 debited in pass book.. cheques issued but not credited yet 2500. cheques deposited but not credited yet 2600.. interest on investment credited by bank 1800 . bills receivable with the bank in Feb.,2016 Dishonored on march 31 and bank had debited 1050 including bank charges ,50. bank column of cash book receipt side overcast by 1000 in march 2016..bank had wrongly debited Mr. Q for 500 on 10 march on account of dishonour of cheque pertaining to Mr. Q. Q had ractfied the said mistake on march 30, 2016 Related: Class 11th - Accountancy : Bank Reconciliation Statement (BRS) - Complete? in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of balance as per cash book as on 31_3_2016 R. 6000. interest on overdraft 200 debited in pass book.. cheques issued but not credited yet 2500. cheques deposited but not credited yet 2600.. interest on investment credited by bank 1800 . bills receivable with the bank in Feb.,2016 Dishonored on march 31 and bank had debited 1050 including bank charges ,50. bank column of cash book receipt side overcast by 1000 in march 2016..bank had wrongly debited Mr. Q for 500 on 10 march on account of dishonour of cheque pertaining to Mr. Q. Q had ractfied the said mistake on march 30, 2016 Related: Class 11th - Accountancy : Bank Reconciliation Statement (BRS) - Complete? defined & explained in the simplest way possible. Besides giving the explanation of

balance as per cash book as on 31_3_2016 R. 6000. interest on overdraft 200 debited in pass book.. cheques issued but not credited yet 2500. cheques deposited but not credited yet 2600.. interest on investment credited by bank 1800 . bills receivable with the bank in Feb.,2016 Dishonored on march 31 and bank had debited 1050 including bank charges ,50. bank column of cash book receipt side overcast by 1000 in march 2016..bank had wrongly debited Mr. Q for 500 on 10 march on account of dishonour of cheque pertaining to Mr. Q. Q had ractfied the said mistake on march 30, 2016 Related: Class 11th - Accountancy : Bank Reconciliation Statement (BRS) - Complete?, a detailed solution for balance as per cash book as on 31_3_2016 R. 6000. interest on overdraft 200 debited in pass book.. cheques issued but not credited yet 2500. cheques deposited but not credited yet 2600.. interest on investment credited by bank 1800 . bills receivable with the bank in Feb.,2016 Dishonored on march 31 and bank had debited 1050 including bank charges ,50. bank column of cash book receipt side overcast by 1000 in march 2016..bank had wrongly debited Mr. Q for 500 on 10 march on account of dishonour of cheque pertaining to Mr. Q. Q had ractfied the said mistake on march 30, 2016 Related: Class 11th - Accountancy : Bank Reconciliation Statement (BRS) - Complete? has been provided alongside types of balance as per cash book as on 31_3_2016 R. 6000. interest on overdraft 200 debited in pass book.. cheques issued but not credited yet 2500. cheques deposited but not credited yet 2600.. interest on investment credited by bank 1800 . bills receivable with the bank in Feb.,2016 Dishonored on march 31 and bank had debited 1050 including bank charges ,50. bank column of cash book receipt side overcast by 1000 in march 2016..bank had wrongly debited Mr. Q for 500 on 10 march on account of dishonour of cheque pertaining to Mr. Q. Q had ractfied the said mistake on march 30, 2016 Related: Class 11th - Accountancy : Bank Reconciliation Statement (BRS) - Complete? theory, EduRev gives you an

ample number of questions to practice balance as per cash book as on 31_3_2016 R. 6000. interest on overdraft 200 debited in pass book.. cheques issued but not credited yet 2500. cheques deposited but not credited yet 2600.. interest on investment credited by bank 1800 . bills receivable with the bank in Feb.,2016 Dishonored on march 31 and bank had debited 1050 including bank charges ,50. bank column of cash book receipt side overcast by 1000 in march 2016..bank had wrongly debited Mr. Q for 500 on 10 march on account of dishonour of cheque pertaining to Mr. Q. Q had ractfied the said mistake on march 30, 2016 Related: Class 11th - Accountancy : Bank Reconciliation Statement (BRS) - Complete? tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.