Commerce Exam > Commerce Questions > Exact ltd purchased a running business from M...

Start Learning for Free

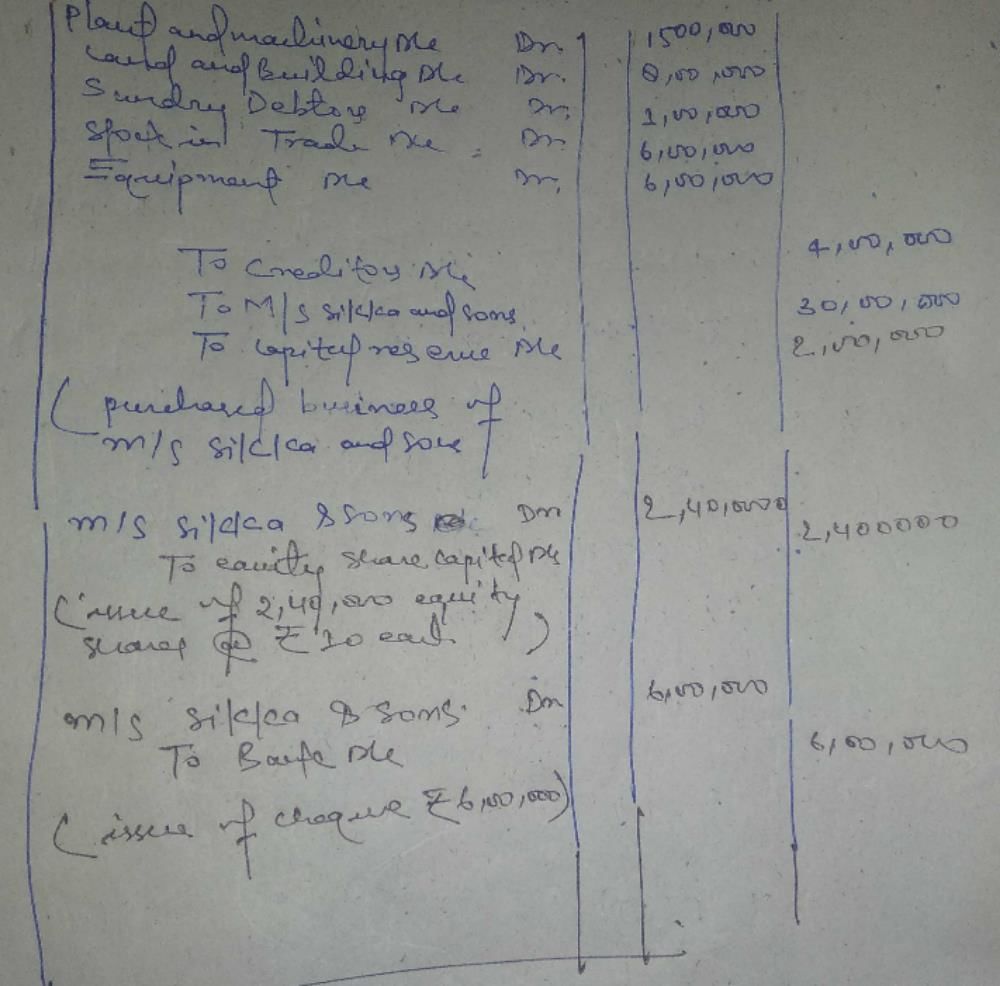

Exact ltd purchased a running business from M/s sikka and sons for a sum of rs 30 lakh payable 24 lakh in fully paid equity shares of rs 10 each and balance through cheque. The assets and liability include Plant and machinery 15 lakh Land and building 8 lakh Sundry debtors. 1 lakh Stock in trade. 6 lakh Equipment. 6 lakh Sundry creditors. 4 lakh Pass journal entries?

Most Upvoted Answer

Exact ltd purchased a running business from M/s sikka and sons for a s...

Journal Entries for the Purchase of Business

1. Purchase of Business Assets:

Debit: Plant and Machinery (15 lakh)

Debit: Land and Building (8 lakh)

Debit: Sundry Debtors (1 lakh)

Debit: Stock in Trade (6 lakh)

Debit: Equipment (6 lakh)

Credit: Cash/Bank (total purchase consideration - 24 lakh)

2. Assumption of Liabilities:

Debit: Sundry Creditors (4 lakh)

Credit: Cash/Bank (4 lakh)

3. Issue of Equity Shares:

Debit: Equity Share Capital (24 lakh)

Credit: Share Application (24 lakh)

4. Payment through Cheque:

Debit: Cash/Bank (balance payable through cheque)

Credit: Cash/Bank (balance payable through cheque)

Explanation:

The purchase of a running business involves the acquisition of its assets and liabilities. In this case, Exact Ltd has purchased a business from M/s Sikka and Sons for a total consideration of Rs 30 lakh. Let's break down the journal entries for each aspect of the transaction.

1. Purchase of Business Assets:

The assets acquired by Exact Ltd include plant and machinery (Rs 15 lakh), land and building (Rs 8 lakh), sundry debtors (Rs 1 lakh), stock in trade (Rs 6 lakh), and equipment (Rs 6 lakh). These assets are recorded on the debit side of the journal entries. The total purchase consideration of Rs 30 lakh is reduced by the value of equity shares issued (Rs 24 lakh) and the remaining amount is paid in cash or through a bank.

2. Assumption of Liabilities:

Exact Ltd also assumes the liabilities of the business, which in this case include sundry creditors (Rs 4 lakh). The liability of Rs 4 lakh is recorded on the debit side, and an equal amount of cash or bank is credited to settle this liability.

3. Issue of Equity Shares:

To pay a part of the purchase consideration, Exact Ltd issues fully paid equity shares of Rs 10 each worth Rs 24 lakh. The equity share capital account is debited for this amount, and an equal amount is credited to the share application account.

4. Payment through Cheque:

The balance amount payable to M/s Sikka and Sons, after considering the equity shares issued, is paid through a cheque. The cash or bank account is debited for this payment, and an equal amount is credited to the cash or bank account.

By recording these journal entries, Exact Ltd properly accounts for the acquisition of the running business from M/s Sikka and Sons, reflecting the purchase of assets, assumption of liabilities, issuance of equity shares, and payment made through cash or bank.

1. Purchase of Business Assets:

Debit: Plant and Machinery (15 lakh)

Debit: Land and Building (8 lakh)

Debit: Sundry Debtors (1 lakh)

Debit: Stock in Trade (6 lakh)

Debit: Equipment (6 lakh)

Credit: Cash/Bank (total purchase consideration - 24 lakh)

2. Assumption of Liabilities:

Debit: Sundry Creditors (4 lakh)

Credit: Cash/Bank (4 lakh)

3. Issue of Equity Shares:

Debit: Equity Share Capital (24 lakh)

Credit: Share Application (24 lakh)

4. Payment through Cheque:

Debit: Cash/Bank (balance payable through cheque)

Credit: Cash/Bank (balance payable through cheque)

Explanation:

The purchase of a running business involves the acquisition of its assets and liabilities. In this case, Exact Ltd has purchased a business from M/s Sikka and Sons for a total consideration of Rs 30 lakh. Let's break down the journal entries for each aspect of the transaction.

1. Purchase of Business Assets:

The assets acquired by Exact Ltd include plant and machinery (Rs 15 lakh), land and building (Rs 8 lakh), sundry debtors (Rs 1 lakh), stock in trade (Rs 6 lakh), and equipment (Rs 6 lakh). These assets are recorded on the debit side of the journal entries. The total purchase consideration of Rs 30 lakh is reduced by the value of equity shares issued (Rs 24 lakh) and the remaining amount is paid in cash or through a bank.

2. Assumption of Liabilities:

Exact Ltd also assumes the liabilities of the business, which in this case include sundry creditors (Rs 4 lakh). The liability of Rs 4 lakh is recorded on the debit side, and an equal amount of cash or bank is credited to settle this liability.

3. Issue of Equity Shares:

To pay a part of the purchase consideration, Exact Ltd issues fully paid equity shares of Rs 10 each worth Rs 24 lakh. The equity share capital account is debited for this amount, and an equal amount is credited to the share application account.

4. Payment through Cheque:

The balance amount payable to M/s Sikka and Sons, after considering the equity shares issued, is paid through a cheque. The cash or bank account is debited for this payment, and an equal amount is credited to the cash or bank account.

By recording these journal entries, Exact Ltd properly accounts for the acquisition of the running business from M/s Sikka and Sons, reflecting the purchase of assets, assumption of liabilities, issuance of equity shares, and payment made through cash or bank.

Community Answer

Exact ltd purchased a running business from M/s sikka and sons for a s...

Attention Commerce Students!

To make sure you are not studying endlessly, EduRev has designed Commerce study material, with Structured Courses, Videos, & Test Series. Plus get personalized analysis, doubt solving and improvement plans to achieve a great score in Commerce.

|

Explore Courses for Commerce exam

|

|

Similar Commerce Doubts

Exact ltd purchased a running business from M/s sikka and sons for a sum of rs 30 lakh payable 24 lakh in fully paid equity shares of rs 10 each and balance through cheque. The assets and liability include Plant and machinery 15 lakh Land and building 8 lakh Sundry debtors. 1 lakh Stock in trade. 6 lakh Equipment. 6 lakh Sundry creditors. 4 lakh Pass journal entries?

Question Description

Exact ltd purchased a running business from M/s sikka and sons for a sum of rs 30 lakh payable 24 lakh in fully paid equity shares of rs 10 each and balance through cheque. The assets and liability include Plant and machinery 15 lakh Land and building 8 lakh Sundry debtors. 1 lakh Stock in trade. 6 lakh Equipment. 6 lakh Sundry creditors. 4 lakh Pass journal entries? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about Exact ltd purchased a running business from M/s sikka and sons for a sum of rs 30 lakh payable 24 lakh in fully paid equity shares of rs 10 each and balance through cheque. The assets and liability include Plant and machinery 15 lakh Land and building 8 lakh Sundry debtors. 1 lakh Stock in trade. 6 lakh Equipment. 6 lakh Sundry creditors. 4 lakh Pass journal entries? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Exact ltd purchased a running business from M/s sikka and sons for a sum of rs 30 lakh payable 24 lakh in fully paid equity shares of rs 10 each and balance through cheque. The assets and liability include Plant and machinery 15 lakh Land and building 8 lakh Sundry debtors. 1 lakh Stock in trade. 6 lakh Equipment. 6 lakh Sundry creditors. 4 lakh Pass journal entries?.

Exact ltd purchased a running business from M/s sikka and sons for a sum of rs 30 lakh payable 24 lakh in fully paid equity shares of rs 10 each and balance through cheque. The assets and liability include Plant and machinery 15 lakh Land and building 8 lakh Sundry debtors. 1 lakh Stock in trade. 6 lakh Equipment. 6 lakh Sundry creditors. 4 lakh Pass journal entries? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about Exact ltd purchased a running business from M/s sikka and sons for a sum of rs 30 lakh payable 24 lakh in fully paid equity shares of rs 10 each and balance through cheque. The assets and liability include Plant and machinery 15 lakh Land and building 8 lakh Sundry debtors. 1 lakh Stock in trade. 6 lakh Equipment. 6 lakh Sundry creditors. 4 lakh Pass journal entries? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Exact ltd purchased a running business from M/s sikka and sons for a sum of rs 30 lakh payable 24 lakh in fully paid equity shares of rs 10 each and balance through cheque. The assets and liability include Plant and machinery 15 lakh Land and building 8 lakh Sundry debtors. 1 lakh Stock in trade. 6 lakh Equipment. 6 lakh Sundry creditors. 4 lakh Pass journal entries?.

Solutions for Exact ltd purchased a running business from M/s sikka and sons for a sum of rs 30 lakh payable 24 lakh in fully paid equity shares of rs 10 each and balance through cheque. The assets and liability include Plant and machinery 15 lakh Land and building 8 lakh Sundry debtors. 1 lakh Stock in trade. 6 lakh Equipment. 6 lakh Sundry creditors. 4 lakh Pass journal entries? in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of Exact ltd purchased a running business from M/s sikka and sons for a sum of rs 30 lakh payable 24 lakh in fully paid equity shares of rs 10 each and balance through cheque. The assets and liability include Plant and machinery 15 lakh Land and building 8 lakh Sundry debtors. 1 lakh Stock in trade. 6 lakh Equipment. 6 lakh Sundry creditors. 4 lakh Pass journal entries? defined & explained in the simplest way possible. Besides giving the explanation of

Exact ltd purchased a running business from M/s sikka and sons for a sum of rs 30 lakh payable 24 lakh in fully paid equity shares of rs 10 each and balance through cheque. The assets and liability include Plant and machinery 15 lakh Land and building 8 lakh Sundry debtors. 1 lakh Stock in trade. 6 lakh Equipment. 6 lakh Sundry creditors. 4 lakh Pass journal entries?, a detailed solution for Exact ltd purchased a running business from M/s sikka and sons for a sum of rs 30 lakh payable 24 lakh in fully paid equity shares of rs 10 each and balance through cheque. The assets and liability include Plant and machinery 15 lakh Land and building 8 lakh Sundry debtors. 1 lakh Stock in trade. 6 lakh Equipment. 6 lakh Sundry creditors. 4 lakh Pass journal entries? has been provided alongside types of Exact ltd purchased a running business from M/s sikka and sons for a sum of rs 30 lakh payable 24 lakh in fully paid equity shares of rs 10 each and balance through cheque. The assets and liability include Plant and machinery 15 lakh Land and building 8 lakh Sundry debtors. 1 lakh Stock in trade. 6 lakh Equipment. 6 lakh Sundry creditors. 4 lakh Pass journal entries? theory, EduRev gives you an

ample number of questions to practice Exact ltd purchased a running business from M/s sikka and sons for a sum of rs 30 lakh payable 24 lakh in fully paid equity shares of rs 10 each and balance through cheque. The assets and liability include Plant and machinery 15 lakh Land and building 8 lakh Sundry debtors. 1 lakh Stock in trade. 6 lakh Equipment. 6 lakh Sundry creditors. 4 lakh Pass journal entries? tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.