Commerce Exam > Commerce Questions > Difference between fixed deposit account and ...

Start Learning for Free

Difference between fixed deposit account and recurring deposit account? class 11 business?

Most Upvoted Answer

Difference between fixed deposit account and recurring deposit account...

Community Answer

Difference between fixed deposit account and recurring deposit account...

**Fixed Deposit Account:**

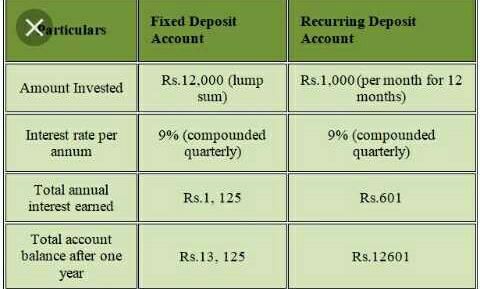

A fixed deposit account is a type of savings account offered by banks and financial institutions where an individual deposits a lump sum amount for a fixed period of time at a predetermined interest rate. The main features and characteristics of a fixed deposit account are as follows:

1. **Deposit Amount:** In a fixed deposit account, the depositor has to make a one-time deposit of a specific amount at the time of opening the account. This amount cannot be withdrawn before the maturity period without incurring penalties.

2. **Maturity Period:** The deposit amount is held for a fixed period known as the maturity period. This period can range from a few months to several years, depending on the terms and conditions set by the bank.

3. **Interest Rate:** Fixed deposit accounts offer a fixed interest rate that is determined at the time of opening the account. This rate remains constant throughout the maturity period, regardless of any changes in the market interest rates.

4. **Interest Payouts:** The interest earned on a fixed deposit account can be paid out to the depositor on a monthly, quarterly, or annual basis, or it can be reinvested in the account itself to earn compound interest.

5. **Withdrawal Restrictions:** Withdrawals from a fixed deposit account before the maturity date are generally not allowed, or they may attract penalties and lower interest rates. However, some banks may offer partial withdrawal facilities or premature closure options with certain restrictions.

**Recurring Deposit Account:**

A recurring deposit account is a type of savings account offered by banks where an individual makes regular monthly deposits for a fixed period of time at a predetermined interest rate. The key features and characteristics of a recurring deposit account are as follows:

1. **Monthly Deposits:** In a recurring deposit account, the depositor has to make regular monthly deposits of a fixed amount for the entire tenure of the account. The amount and duration of the deposits are predetermined at the time of opening the account.

2. **Maturity Period:** The maturity period of a recurring deposit account is also fixed and predetermined. It can range from a few months to several years, depending on the terms and conditions set by the bank.

3. **Interest Rate:** Similar to fixed deposit accounts, recurring deposit accounts offer a fixed interest rate that is determined at the time of opening the account. This rate remains constant throughout the tenure of the account.

4. **Interest Calculation:** The interest earned on a recurring deposit account is usually calculated on a quarterly basis. The interest is compounded and added to the account balance at the end of each quarter.

5. **Withdrawal Restrictions:** Withdrawals from a recurring deposit account before the maturity date are generally not allowed, or they may attract penalties and lower interest rates. However, some banks may offer partial withdrawal facilities or premature closure options with certain restrictions.

A fixed deposit account is a type of savings account offered by banks and financial institutions where an individual deposits a lump sum amount for a fixed period of time at a predetermined interest rate. The main features and characteristics of a fixed deposit account are as follows:

1. **Deposit Amount:** In a fixed deposit account, the depositor has to make a one-time deposit of a specific amount at the time of opening the account. This amount cannot be withdrawn before the maturity period without incurring penalties.

2. **Maturity Period:** The deposit amount is held for a fixed period known as the maturity period. This period can range from a few months to several years, depending on the terms and conditions set by the bank.

3. **Interest Rate:** Fixed deposit accounts offer a fixed interest rate that is determined at the time of opening the account. This rate remains constant throughout the maturity period, regardless of any changes in the market interest rates.

4. **Interest Payouts:** The interest earned on a fixed deposit account can be paid out to the depositor on a monthly, quarterly, or annual basis, or it can be reinvested in the account itself to earn compound interest.

5. **Withdrawal Restrictions:** Withdrawals from a fixed deposit account before the maturity date are generally not allowed, or they may attract penalties and lower interest rates. However, some banks may offer partial withdrawal facilities or premature closure options with certain restrictions.

**Recurring Deposit Account:**

A recurring deposit account is a type of savings account offered by banks where an individual makes regular monthly deposits for a fixed period of time at a predetermined interest rate. The key features and characteristics of a recurring deposit account are as follows:

1. **Monthly Deposits:** In a recurring deposit account, the depositor has to make regular monthly deposits of a fixed amount for the entire tenure of the account. The amount and duration of the deposits are predetermined at the time of opening the account.

2. **Maturity Period:** The maturity period of a recurring deposit account is also fixed and predetermined. It can range from a few months to several years, depending on the terms and conditions set by the bank.

3. **Interest Rate:** Similar to fixed deposit accounts, recurring deposit accounts offer a fixed interest rate that is determined at the time of opening the account. This rate remains constant throughout the tenure of the account.

4. **Interest Calculation:** The interest earned on a recurring deposit account is usually calculated on a quarterly basis. The interest is compounded and added to the account balance at the end of each quarter.

5. **Withdrawal Restrictions:** Withdrawals from a recurring deposit account before the maturity date are generally not allowed, or they may attract penalties and lower interest rates. However, some banks may offer partial withdrawal facilities or premature closure options with certain restrictions.

|

Explore Courses for Commerce exam

|

|

Similar Commerce Doubts

Difference between fixed deposit account and recurring deposit account? class 11 business?

Question Description

Difference between fixed deposit account and recurring deposit account? class 11 business? for Commerce 2025 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about Difference between fixed deposit account and recurring deposit account? class 11 business? covers all topics & solutions for Commerce 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Difference between fixed deposit account and recurring deposit account? class 11 business?.

Difference between fixed deposit account and recurring deposit account? class 11 business? for Commerce 2025 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about Difference between fixed deposit account and recurring deposit account? class 11 business? covers all topics & solutions for Commerce 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Difference between fixed deposit account and recurring deposit account? class 11 business?.

Solutions for Difference between fixed deposit account and recurring deposit account? class 11 business? in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of Difference between fixed deposit account and recurring deposit account? class 11 business? defined & explained in the simplest way possible. Besides giving the explanation of

Difference between fixed deposit account and recurring deposit account? class 11 business?, a detailed solution for Difference between fixed deposit account and recurring deposit account? class 11 business? has been provided alongside types of Difference between fixed deposit account and recurring deposit account? class 11 business? theory, EduRev gives you an

ample number of questions to practice Difference between fixed deposit account and recurring deposit account? class 11 business? tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.