Commerce Exam > Commerce Questions > Ramesh has his account.acccording to his cash...

Start Learning for Free

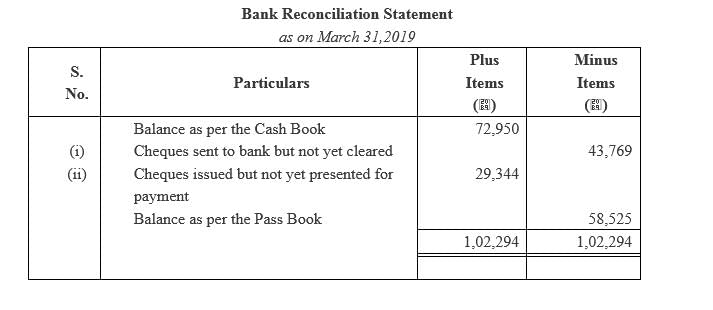

Ramesh has his account.acccording to his cash book,his bank balance on31st March 2019was₹72950.he sent cheque for₹90075 to bank for collection but cheque amount to₹43769 were not collected by that date.out of the cheque issued by him in payment of his debts, cheque for₹29344were not present for payment.prepeir bank reconciliation statement.?

Verified Answer

Ramesh has his account.acccording to his cash book,his bank balance on...

This question is part of UPSC exam. View all Commerce courses

This question is part of UPSC exam. View all Commerce courses

Most Upvoted Answer

Ramesh has his account.acccording to his cash book,his bank balance on...

Bank Reconciliation Statement

A bank reconciliation statement is a statement prepared by a company to reconcile the difference between the balance as per the company's cash book and the balance as per the bank statement. It helps in identifying any discrepancies or errors that may have occurred in the banking transactions.

Steps to Prepare a Bank Reconciliation Statement:

1. Compare the Cash Book and Bank Statement:

- Compare the closing balance as per the cash book with the closing balance as per the bank statement.

- In this case, the closing balance as per the cash book on March 31, 2019, is ₹72,950.

2. Identify Outstanding Cheques:

- Determine the cheques issued by the company but not yet presented for payment by the bank.

- In this case, the cheque for ₹29,344 was not presented for payment.

3. Identify Unpresented Cheques:

- Determine the cheques deposited by the company but not yet cleared by the bank.

- In this case, the cheque for ₹43,769 was not collected by the bank.

4. Adjustments for Outstanding and Unpresented Cheques:

- Deduct the amount of outstanding cheques from the closing balance as per the cash book.

- Add the amount of unpresented cheques to the closing balance as per the cash book.

- In this case, deduct ₹29,344 and add ₹43,769 to the closing balance.

5. Compare Adjusted Cash Book Balance and Bank Statement Balance:

- Compare the adjusted closing balance as per the cash book with the closing balance as per the bank statement.

- In this case, the adjusted closing balance as per the cash book is ₹86,375 (₹72,950 - ₹29,344 + ₹43,769).

6. Identify Other Discrepancies:

- Check for any other discrepancies such as bank charges, interest received, or errors in recording transactions.

- If any discrepancies are found, make the necessary adjustments in the bank reconciliation statement.

7. Prepare the Bank Reconciliation Statement:

- Prepare a statement showing the reconciled balance as per the cash book and the bank statement.

- In this case, the bank reconciliation statement will show the adjusted closing balance as per the cash book (₹86,375) and the closing balance as per the bank statement.

Bank Reconciliation Statement for Ramesh:

Closing balance as per the cash book on March 31, 2019: ₹72,950

Outstanding cheques: ₹29,344

Unpresented cheques: ₹43,769

Adjusted closing balance as per the cash book: ₹86,375

Bank Reconciliation Statement:

Closing balance as per the cash book: ₹86,375

Closing balance as per the bank statement: ₹72,950

Difference: ₹13,425

Explanation: The difference of ₹13,425 represents the discrepancies between the cash book and the bank statement. It could be due to bank charges, interest received, or errors in recording transactions. Further investigation is required to identify and rectify the exact cause of the discrepancy.

Conclusion:

A bank reconciliation statement is an

A bank reconciliation statement is a statement prepared by a company to reconcile the difference between the balance as per the company's cash book and the balance as per the bank statement. It helps in identifying any discrepancies or errors that may have occurred in the banking transactions.

Steps to Prepare a Bank Reconciliation Statement:

1. Compare the Cash Book and Bank Statement:

- Compare the closing balance as per the cash book with the closing balance as per the bank statement.

- In this case, the closing balance as per the cash book on March 31, 2019, is ₹72,950.

2. Identify Outstanding Cheques:

- Determine the cheques issued by the company but not yet presented for payment by the bank.

- In this case, the cheque for ₹29,344 was not presented for payment.

3. Identify Unpresented Cheques:

- Determine the cheques deposited by the company but not yet cleared by the bank.

- In this case, the cheque for ₹43,769 was not collected by the bank.

4. Adjustments for Outstanding and Unpresented Cheques:

- Deduct the amount of outstanding cheques from the closing balance as per the cash book.

- Add the amount of unpresented cheques to the closing balance as per the cash book.

- In this case, deduct ₹29,344 and add ₹43,769 to the closing balance.

5. Compare Adjusted Cash Book Balance and Bank Statement Balance:

- Compare the adjusted closing balance as per the cash book with the closing balance as per the bank statement.

- In this case, the adjusted closing balance as per the cash book is ₹86,375 (₹72,950 - ₹29,344 + ₹43,769).

6. Identify Other Discrepancies:

- Check for any other discrepancies such as bank charges, interest received, or errors in recording transactions.

- If any discrepancies are found, make the necessary adjustments in the bank reconciliation statement.

7. Prepare the Bank Reconciliation Statement:

- Prepare a statement showing the reconciled balance as per the cash book and the bank statement.

- In this case, the bank reconciliation statement will show the adjusted closing balance as per the cash book (₹86,375) and the closing balance as per the bank statement.

Bank Reconciliation Statement for Ramesh:

Closing balance as per the cash book on March 31, 2019: ₹72,950

Outstanding cheques: ₹29,344

Unpresented cheques: ₹43,769

Adjusted closing balance as per the cash book: ₹86,375

Bank Reconciliation Statement:

Closing balance as per the cash book: ₹86,375

Closing balance as per the bank statement: ₹72,950

Difference: ₹13,425

Explanation: The difference of ₹13,425 represents the discrepancies between the cash book and the bank statement. It could be due to bank charges, interest received, or errors in recording transactions. Further investigation is required to identify and rectify the exact cause of the discrepancy.

Conclusion:

A bank reconciliation statement is an

Attention Commerce Students!

To make sure you are not studying endlessly, EduRev has designed Commerce study material, with Structured Courses, Videos, & Test Series. Plus get personalized analysis, doubt solving and improvement plans to achieve a great score in Commerce.

|

Explore Courses for Commerce exam

|

|

Similar Commerce Doubts

Ramesh has his account.acccording to his cash book,his bank balance on31st March 2019was₹72950.he sent cheque for₹90075 to bank for collection but cheque amount to₹43769 were not collected by that date.out of the cheque issued by him in payment of his debts, cheque for₹29344were not present for payment.prepeir bank reconciliation statement.?

Question Description

Ramesh has his account.acccording to his cash book,his bank balance on31st March 2019was₹72950.he sent cheque for₹90075 to bank for collection but cheque amount to₹43769 were not collected by that date.out of the cheque issued by him in payment of his debts, cheque for₹29344were not present for payment.prepeir bank reconciliation statement.? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about Ramesh has his account.acccording to his cash book,his bank balance on31st March 2019was₹72950.he sent cheque for₹90075 to bank for collection but cheque amount to₹43769 were not collected by that date.out of the cheque issued by him in payment of his debts, cheque for₹29344were not present for payment.prepeir bank reconciliation statement.? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Ramesh has his account.acccording to his cash book,his bank balance on31st March 2019was₹72950.he sent cheque for₹90075 to bank for collection but cheque amount to₹43769 were not collected by that date.out of the cheque issued by him in payment of his debts, cheque for₹29344were not present for payment.prepeir bank reconciliation statement.?.

Ramesh has his account.acccording to his cash book,his bank balance on31st March 2019was₹72950.he sent cheque for₹90075 to bank for collection but cheque amount to₹43769 were not collected by that date.out of the cheque issued by him in payment of his debts, cheque for₹29344were not present for payment.prepeir bank reconciliation statement.? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about Ramesh has his account.acccording to his cash book,his bank balance on31st March 2019was₹72950.he sent cheque for₹90075 to bank for collection but cheque amount to₹43769 were not collected by that date.out of the cheque issued by him in payment of his debts, cheque for₹29344were not present for payment.prepeir bank reconciliation statement.? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Ramesh has his account.acccording to his cash book,his bank balance on31st March 2019was₹72950.he sent cheque for₹90075 to bank for collection but cheque amount to₹43769 were not collected by that date.out of the cheque issued by him in payment of his debts, cheque for₹29344were not present for payment.prepeir bank reconciliation statement.?.

Solutions for Ramesh has his account.acccording to his cash book,his bank balance on31st March 2019was₹72950.he sent cheque for₹90075 to bank for collection but cheque amount to₹43769 were not collected by that date.out of the cheque issued by him in payment of his debts, cheque for₹29344were not present for payment.prepeir bank reconciliation statement.? in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of Ramesh has his account.acccording to his cash book,his bank balance on31st March 2019was₹72950.he sent cheque for₹90075 to bank for collection but cheque amount to₹43769 were not collected by that date.out of the cheque issued by him in payment of his debts, cheque for₹29344were not present for payment.prepeir bank reconciliation statement.? defined & explained in the simplest way possible. Besides giving the explanation of

Ramesh has his account.acccording to his cash book,his bank balance on31st March 2019was₹72950.he sent cheque for₹90075 to bank for collection but cheque amount to₹43769 were not collected by that date.out of the cheque issued by him in payment of his debts, cheque for₹29344were not present for payment.prepeir bank reconciliation statement.?, a detailed solution for Ramesh has his account.acccording to his cash book,his bank balance on31st March 2019was₹72950.he sent cheque for₹90075 to bank for collection but cheque amount to₹43769 were not collected by that date.out of the cheque issued by him in payment of his debts, cheque for₹29344were not present for payment.prepeir bank reconciliation statement.? has been provided alongside types of Ramesh has his account.acccording to his cash book,his bank balance on31st March 2019was₹72950.he sent cheque for₹90075 to bank for collection but cheque amount to₹43769 were not collected by that date.out of the cheque issued by him in payment of his debts, cheque for₹29344were not present for payment.prepeir bank reconciliation statement.? theory, EduRev gives you an

ample number of questions to practice Ramesh has his account.acccording to his cash book,his bank balance on31st March 2019was₹72950.he sent cheque for₹90075 to bank for collection but cheque amount to₹43769 were not collected by that date.out of the cheque issued by him in payment of his debts, cheque for₹29344were not present for payment.prepeir bank reconciliation statement.? tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.