B Com Exam > B Com Questions > compute taxable income under the head salary ...

Start Learning for Free

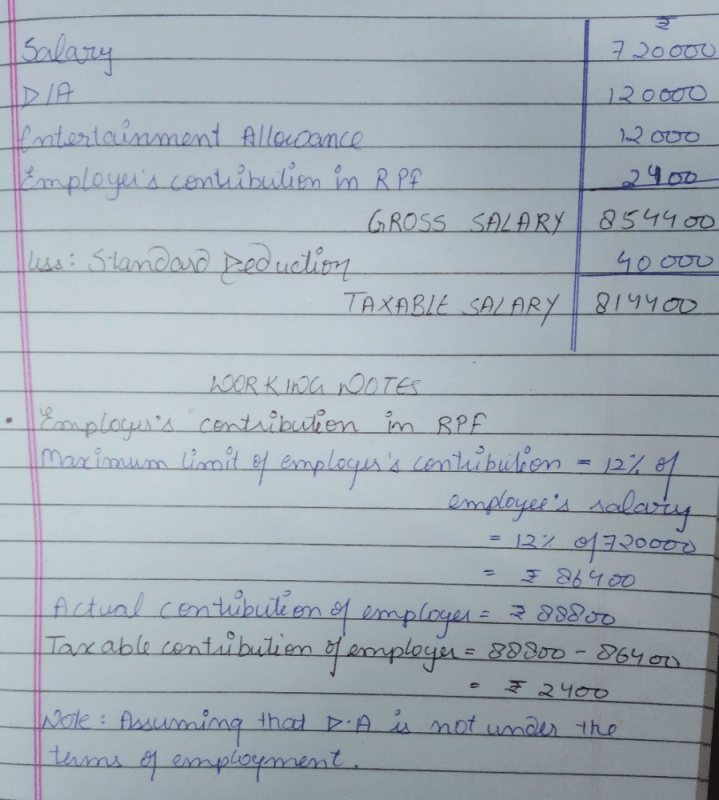

compute taxable income under the head salary of mr.x for the assessment year 19-20 salary 60000pmD.A10, 000pmentertainment allowance 1000pmemployer contribution to recognize provident fund 88800.his own contribution was 88800.

?Most Upvoted Answer

compute taxable income under the head salary of mr.x for the assessmen...

Calculation of Taxable Income under the Head Salary for Mr. X for Assessment Year 2019-2020

1. Salary: Rs. 60,000 per month

2. Dearness Allowance: Rs. 10,000 per month

3. Entertainment Allowance: Rs. 1,000 per month

4. Employer Contribution to Recognized Provident Fund: Rs. 88,800

5. Mr. X's Contribution to Recognized Provident Fund: Rs. 88,800

To calculate the taxable income under the head salary, we need to consider the following components:

1. Basic Salary: Rs. 60,000 per month

2. Dearness Allowance: Rs. 10,000 per month

3. Entertainment Allowance: Rs. 1,000 per month

4. Employer Contribution to Recognized Provident Fund: Rs. 88,800 (exempted up to 12% of basic salary)

5. Total Exempted Provident Fund Contribution: 12% of basic salary + employer contribution = 12% of Rs. 60,000 + Rs. 88,800 = Rs. 95,400

6. Taxable Provident Fund Contribution: Mr. X's contribution to recognized provident fund - exempted provident fund contribution = Rs. 88,800 - Rs. 95,400 = -Rs. 6,600 (negative value means there is no taxable income in this component)

Now, let's calculate the taxable income:

1. Gross Salary: Basic Salary + Dearness Allowance + Entertainment Allowance = Rs. 60,000 + Rs. 10,000 + Rs. 1,000 = Rs. 71,000 per month

2. Exempted Provident Fund Contribution: Rs. 95,400 per year

3. Taxable Income under the Head Salary: Gross Salary - Exempted Provident Fund Contribution = Rs. 71,000 * 12 - Rs. 95,400 = Rs. 7,92,600 per year

Therefore, Mr. X's taxable income under the head salary for assessment year 2019-2020 is Rs. 7,92,600 per year.

Income from Salary - Head of Income, Income Tax Laws

Income from salary is one of the five heads of income under the Income Tax Act, 1961. It includes all the monetary benefits received by an individual for the services rendered by him/her to an employer. These monetary benefits may include basic salary, dearness allowance, entertainment allowance, bonuses, commissions, etc.

The Income Tax Act provides for certain exemptions and deductions for income from salary, which can help in reducing the taxable income. Some of these exemptions and deductions are:

1. Standard Deduction: A standard deduction of Rs. 50,000 is allowed for salaried individuals from the financial year 2019-20 onwards.

2. Leave Travel Allowance: Leave travel allowance (LTA) is exempted twice in a block of four years subject to certain conditions.

3. House Rent Allowance: House rent allowance (HRA) is exempted to the extent of the least of the following: (a) actual HRA received, (b) 50% of basic salary for those living in metro cities or 40% of basic salary for those living in non-metro cities,

1. Salary: Rs. 60,000 per month

2. Dearness Allowance: Rs. 10,000 per month

3. Entertainment Allowance: Rs. 1,000 per month

4. Employer Contribution to Recognized Provident Fund: Rs. 88,800

5. Mr. X's Contribution to Recognized Provident Fund: Rs. 88,800

To calculate the taxable income under the head salary, we need to consider the following components:

1. Basic Salary: Rs. 60,000 per month

2. Dearness Allowance: Rs. 10,000 per month

3. Entertainment Allowance: Rs. 1,000 per month

4. Employer Contribution to Recognized Provident Fund: Rs. 88,800 (exempted up to 12% of basic salary)

5. Total Exempted Provident Fund Contribution: 12% of basic salary + employer contribution = 12% of Rs. 60,000 + Rs. 88,800 = Rs. 95,400

6. Taxable Provident Fund Contribution: Mr. X's contribution to recognized provident fund - exempted provident fund contribution = Rs. 88,800 - Rs. 95,400 = -Rs. 6,600 (negative value means there is no taxable income in this component)

Now, let's calculate the taxable income:

1. Gross Salary: Basic Salary + Dearness Allowance + Entertainment Allowance = Rs. 60,000 + Rs. 10,000 + Rs. 1,000 = Rs. 71,000 per month

2. Exempted Provident Fund Contribution: Rs. 95,400 per year

3. Taxable Income under the Head Salary: Gross Salary - Exempted Provident Fund Contribution = Rs. 71,000 * 12 - Rs. 95,400 = Rs. 7,92,600 per year

Therefore, Mr. X's taxable income under the head salary for assessment year 2019-2020 is Rs. 7,92,600 per year.

Income from Salary - Head of Income, Income Tax Laws

Income from salary is one of the five heads of income under the Income Tax Act, 1961. It includes all the monetary benefits received by an individual for the services rendered by him/her to an employer. These monetary benefits may include basic salary, dearness allowance, entertainment allowance, bonuses, commissions, etc.

The Income Tax Act provides for certain exemptions and deductions for income from salary, which can help in reducing the taxable income. Some of these exemptions and deductions are:

1. Standard Deduction: A standard deduction of Rs. 50,000 is allowed for salaried individuals from the financial year 2019-20 onwards.

2. Leave Travel Allowance: Leave travel allowance (LTA) is exempted twice in a block of four years subject to certain conditions.

3. House Rent Allowance: House rent allowance (HRA) is exempted to the extent of the least of the following: (a) actual HRA received, (b) 50% of basic salary for those living in metro cities or 40% of basic salary for those living in non-metro cities,

Community Answer

compute taxable income under the head salary of mr.x for the assessmen...

|

Explore Courses for B Com exam

|

|

Similar B Com Doubts

compute taxable income under the head salary of mr.x for the assessment year 19-20 salary 60000pmD.A10, 000pmentertainment allowance 1000pmemployer contribution to recognize provident fund 88800.his own contribution was 88800. Related: Income from Salary - Head of Income, Income Tax Laws?

Question Description

compute taxable income under the head salary of mr.x for the assessment year 19-20 salary 60000pmD.A10, 000pmentertainment allowance 1000pmemployer contribution to recognize provident fund 88800.his own contribution was 88800. Related: Income from Salary - Head of Income, Income Tax Laws? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about compute taxable income under the head salary of mr.x for the assessment year 19-20 salary 60000pmD.A10, 000pmentertainment allowance 1000pmemployer contribution to recognize provident fund 88800.his own contribution was 88800. Related: Income from Salary - Head of Income, Income Tax Laws? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for compute taxable income under the head salary of mr.x for the assessment year 19-20 salary 60000pmD.A10, 000pmentertainment allowance 1000pmemployer contribution to recognize provident fund 88800.his own contribution was 88800. Related: Income from Salary - Head of Income, Income Tax Laws?.

compute taxable income under the head salary of mr.x for the assessment year 19-20 salary 60000pmD.A10, 000pmentertainment allowance 1000pmemployer contribution to recognize provident fund 88800.his own contribution was 88800. Related: Income from Salary - Head of Income, Income Tax Laws? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about compute taxable income under the head salary of mr.x for the assessment year 19-20 salary 60000pmD.A10, 000pmentertainment allowance 1000pmemployer contribution to recognize provident fund 88800.his own contribution was 88800. Related: Income from Salary - Head of Income, Income Tax Laws? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for compute taxable income under the head salary of mr.x for the assessment year 19-20 salary 60000pmD.A10, 000pmentertainment allowance 1000pmemployer contribution to recognize provident fund 88800.his own contribution was 88800. Related: Income from Salary - Head of Income, Income Tax Laws?.

Solutions for compute taxable income under the head salary of mr.x for the assessment year 19-20 salary 60000pmD.A10, 000pmentertainment allowance 1000pmemployer contribution to recognize provident fund 88800.his own contribution was 88800. Related: Income from Salary - Head of Income, Income Tax Laws? in English & in Hindi are available as part of our courses for B Com.

Download more important topics, notes, lectures and mock test series for B Com Exam by signing up for free.

Here you can find the meaning of compute taxable income under the head salary of mr.x for the assessment year 19-20 salary 60000pmD.A10, 000pmentertainment allowance 1000pmemployer contribution to recognize provident fund 88800.his own contribution was 88800. Related: Income from Salary - Head of Income, Income Tax Laws? defined & explained in the simplest way possible. Besides giving the explanation of

compute taxable income under the head salary of mr.x for the assessment year 19-20 salary 60000pmD.A10, 000pmentertainment allowance 1000pmemployer contribution to recognize provident fund 88800.his own contribution was 88800. Related: Income from Salary - Head of Income, Income Tax Laws?, a detailed solution for compute taxable income under the head salary of mr.x for the assessment year 19-20 salary 60000pmD.A10, 000pmentertainment allowance 1000pmemployer contribution to recognize provident fund 88800.his own contribution was 88800. Related: Income from Salary - Head of Income, Income Tax Laws? has been provided alongside types of compute taxable income under the head salary of mr.x for the assessment year 19-20 salary 60000pmD.A10, 000pmentertainment allowance 1000pmemployer contribution to recognize provident fund 88800.his own contribution was 88800. Related: Income from Salary - Head of Income, Income Tax Laws? theory, EduRev gives you an

ample number of questions to practice compute taxable income under the head salary of mr.x for the assessment year 19-20 salary 60000pmD.A10, 000pmentertainment allowance 1000pmemployer contribution to recognize provident fund 88800.his own contribution was 88800. Related: Income from Salary - Head of Income, Income Tax Laws? tests, examples and also practice B Com tests.

|

Explore Courses for B Com exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.