Class 12 Exam > Class 12 Questions > current ratio 3:1 working capital 400000 inve...

Start Learning for Free

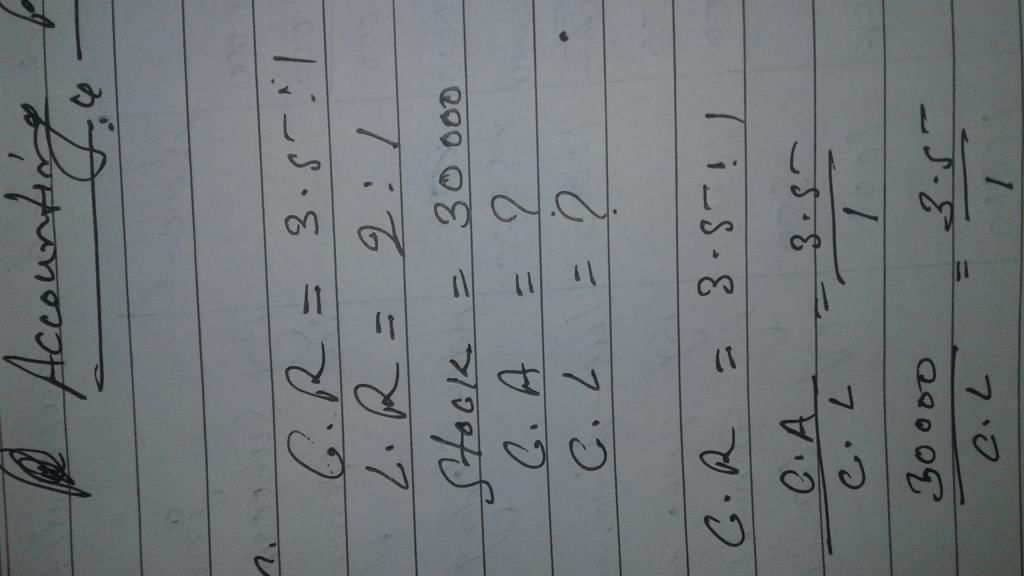

current ratio 3:1 working capital 400000 inventory 250000 calculate current asset current libility quick ratio

Most Upvoted Answer

current ratio 3:1 working capital 400000 inventory 250000 calculate cu...

Financial Ratio Analysis

Current Ratio

The current ratio is a financial ratio that measures a company's ability to pay its short-term liabilities with its short-term assets.

Current Ratio = Current Assets / Current Liabilities

Given the current ratio of 3:1, we can assume that the company has $3 in current assets for every $1 in current liabilities.

Working Capital

Working capital is the difference between a company's current assets and its current liabilities. It represents the funds that a company has available for its day-to-day operations.

Working Capital = Current Assets - Current Liabilities

Given the working capital of $400,000, we can assume that the company has $400,000 in funds available for its daily operations.

Current Assets

Current assets are the assets that a company expects to convert into cash within one year. These assets include cash, accounts receivable, inventory, and prepaid expenses.

Current Assets = Current Ratio * Current Liabilities

Given the current ratio of 3:1 and current liabilities of $X, we can assume that the company has $3X in current assets.

Based on the information given, we can calculate the current assets as follows:

Current Assets = 3 * Current Liabilities

Current Assets = 3 * $X

Current Assets = $3X

Therefore, the company's current assets are $3X.

Current Liabilities

Current liabilities are the company's debts and obligations that are due within one year. These liabilities include accounts payable, short-term loans, and accrued expenses.

Given the current ratio of 3:1, we can assume that the company has $1 in current liabilities for every $3 in current assets.

Current Liabilities = Current Assets / Current Ratio

Current Liabilities = $3X / 3

Current Liabilities = $X

Therefore, the company's current liabilities are $X.

Quick Ratio

The quick ratio is a financial ratio that measures a company's ability to pay its short-term liabilities with its most liquid assets. It is also known as the acid-test ratio.

Quick Ratio = (Current Assets - Inventory) / Current Liabilities

Given the inventory of $250,000, we can calculate the quick ratio as follows:

Quick Ratio = (Current Assets - Inventory) / Current Liabilities

Quick Ratio = ($3X - $250,000) / $X

Quick Ratio = ($3X - $250,000) / $X

Quick Ratio = ($2.75X) / $X

Quick Ratio = 2.75

Therefore, the company's quick ratio is 2.75, which indicates that the company has enough liquid assets to cover its short-term liabilities.

Community Answer

current ratio 3:1 working capital 400000 inventory 250000 calculate cu...

|

Explore Courses for Class 12 exam

|

|

Similar Class 12 Doubts

current ratio 3:1 working capital 400000 inventory 250000 calculate current asset current libility quick ratio

Question Description

current ratio 3:1 working capital 400000 inventory 250000 calculate current asset current libility quick ratio for Class 12 2024 is part of Class 12 preparation. The Question and answers have been prepared according to the Class 12 exam syllabus. Information about current ratio 3:1 working capital 400000 inventory 250000 calculate current asset current libility quick ratio covers all topics & solutions for Class 12 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for current ratio 3:1 working capital 400000 inventory 250000 calculate current asset current libility quick ratio.

current ratio 3:1 working capital 400000 inventory 250000 calculate current asset current libility quick ratio for Class 12 2024 is part of Class 12 preparation. The Question and answers have been prepared according to the Class 12 exam syllabus. Information about current ratio 3:1 working capital 400000 inventory 250000 calculate current asset current libility quick ratio covers all topics & solutions for Class 12 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for current ratio 3:1 working capital 400000 inventory 250000 calculate current asset current libility quick ratio.

Solutions for current ratio 3:1 working capital 400000 inventory 250000 calculate current asset current libility quick ratio in English & in Hindi are available as part of our courses for Class 12.

Download more important topics, notes, lectures and mock test series for Class 12 Exam by signing up for free.

Here you can find the meaning of current ratio 3:1 working capital 400000 inventory 250000 calculate current asset current libility quick ratio defined & explained in the simplest way possible. Besides giving the explanation of

current ratio 3:1 working capital 400000 inventory 250000 calculate current asset current libility quick ratio, a detailed solution for current ratio 3:1 working capital 400000 inventory 250000 calculate current asset current libility quick ratio has been provided alongside types of current ratio 3:1 working capital 400000 inventory 250000 calculate current asset current libility quick ratio theory, EduRev gives you an

ample number of questions to practice current ratio 3:1 working capital 400000 inventory 250000 calculate current asset current libility quick ratio tests, examples and also practice Class 12 tests.

|

Explore Courses for Class 12 exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.