B Com Exam > B Com Questions > what are the essential elements of promissory...

Start Learning for Free

what are the essential elements of promissory note

?Most Upvoted Answer

what are the essential elements of promissory note Related: Presumpti...

Community Answer

what are the essential elements of promissory note Related: Presumpti...

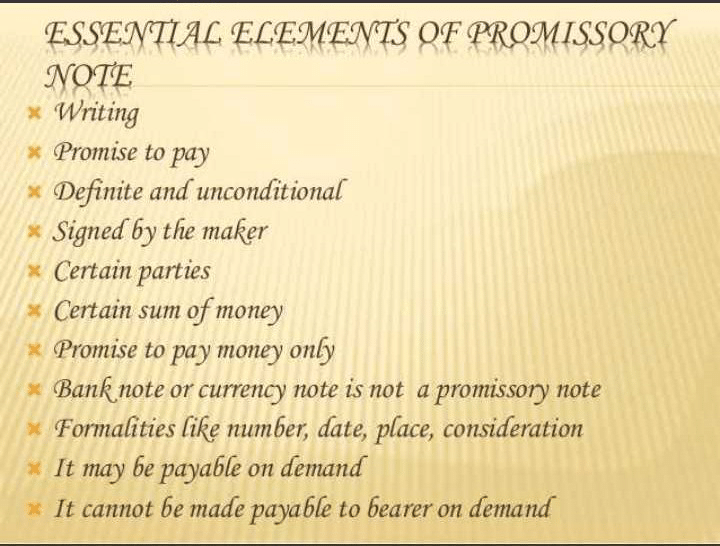

Promissory notes are legal and binding documents that outline a promise to pay a specified amount of money to a designated recipient or lender. These notes are commonly used in business transactions and serve as evidence of a debt owed by one party to another. In order to be valid and enforceable, promissory notes must contain certain essential elements. These elements are as follows:

1. Title: The document should be titled "Promissory Note" to clearly indicate its nature and purpose.

2. Parties: The names and addresses of both the borrower (also known as the maker) and the lender (also known as the payee) must be clearly stated. This ensures that both parties are identified and bound by the terms of the note.

3. Date: The date on which the promissory note is created should be clearly mentioned. This helps establish the timeline for repayment and determines when the note becomes due.

4. Principal Amount: The principal amount, which represents the original sum borrowed, must be clearly stated. It should be written both in words and in numbers to avoid any confusion or disputes.

5. Interest Rate: If applicable, the interest rate charged on the loan must be specified. This ensures that both parties are aware of the cost of borrowing and the terms of repayment.

6. Repayment Terms: The terms of repayment, including the frequency of payments (e.g., monthly, quarterly), the due date(s), and the duration of the loan, should be clearly outlined. This provides clarity on the borrower's obligation to repay the loan and helps prevent misunderstandings.

7. Maturity Date: The maturity date is the date on which the entire loan amount, including any interest, is due. It should be clearly mentioned in the promissory note to indicate the deadline for repayment.

8. Signatures: Both the borrower and the lender must sign the promissory note to indicate their agreement to the terms and conditions outlined therein. This signature serves as evidence of the parties' intention to be bound by the terms of the note.

9. Consideration: A valid promissory note requires consideration, which refers to something of value exchanged between the parties. This consideration may be the loan amount itself or any other form of consideration agreed upon by both parties.

By including these essential elements in a promissory note, the document becomes legally binding and enforceable. It provides a clear record of the debt owed and the terms of repayment, protecting the rights and interests of both the borrower and the lender.

1. Title: The document should be titled "Promissory Note" to clearly indicate its nature and purpose.

2. Parties: The names and addresses of both the borrower (also known as the maker) and the lender (also known as the payee) must be clearly stated. This ensures that both parties are identified and bound by the terms of the note.

3. Date: The date on which the promissory note is created should be clearly mentioned. This helps establish the timeline for repayment and determines when the note becomes due.

4. Principal Amount: The principal amount, which represents the original sum borrowed, must be clearly stated. It should be written both in words and in numbers to avoid any confusion or disputes.

5. Interest Rate: If applicable, the interest rate charged on the loan must be specified. This ensures that both parties are aware of the cost of borrowing and the terms of repayment.

6. Repayment Terms: The terms of repayment, including the frequency of payments (e.g., monthly, quarterly), the due date(s), and the duration of the loan, should be clearly outlined. This provides clarity on the borrower's obligation to repay the loan and helps prevent misunderstandings.

7. Maturity Date: The maturity date is the date on which the entire loan amount, including any interest, is due. It should be clearly mentioned in the promissory note to indicate the deadline for repayment.

8. Signatures: Both the borrower and the lender must sign the promissory note to indicate their agreement to the terms and conditions outlined therein. This signature serves as evidence of the parties' intention to be bound by the terms of the note.

9. Consideration: A valid promissory note requires consideration, which refers to something of value exchanged between the parties. This consideration may be the loan amount itself or any other form of consideration agreed upon by both parties.

By including these essential elements in a promissory note, the document becomes legally binding and enforceable. It provides a clear record of the debt owed and the terms of repayment, protecting the rights and interests of both the borrower and the lender.

|

Explore Courses for B Com exam

|

|

Similar B Com Doubts

what are the essential elements of promissory note Related: Presumptions - Negotiable instruments Act(1881), Business Law?

Question Description

what are the essential elements of promissory note Related: Presumptions - Negotiable instruments Act(1881), Business Law? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about what are the essential elements of promissory note Related: Presumptions - Negotiable instruments Act(1881), Business Law? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for what are the essential elements of promissory note Related: Presumptions - Negotiable instruments Act(1881), Business Law?.

what are the essential elements of promissory note Related: Presumptions - Negotiable instruments Act(1881), Business Law? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about what are the essential elements of promissory note Related: Presumptions - Negotiable instruments Act(1881), Business Law? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for what are the essential elements of promissory note Related: Presumptions - Negotiable instruments Act(1881), Business Law?.

Solutions for what are the essential elements of promissory note Related: Presumptions - Negotiable instruments Act(1881), Business Law? in English & in Hindi are available as part of our courses for B Com.

Download more important topics, notes, lectures and mock test series for B Com Exam by signing up for free.

Here you can find the meaning of what are the essential elements of promissory note Related: Presumptions - Negotiable instruments Act(1881), Business Law? defined & explained in the simplest way possible. Besides giving the explanation of

what are the essential elements of promissory note Related: Presumptions - Negotiable instruments Act(1881), Business Law?, a detailed solution for what are the essential elements of promissory note Related: Presumptions - Negotiable instruments Act(1881), Business Law? has been provided alongside types of what are the essential elements of promissory note Related: Presumptions - Negotiable instruments Act(1881), Business Law? theory, EduRev gives you an

ample number of questions to practice what are the essential elements of promissory note Related: Presumptions - Negotiable instruments Act(1881), Business Law? tests, examples and also practice B Com tests.

|

Explore Courses for B Com exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.