B Com Exam > B Com Questions > Needed a Video for I need numerical based vid...

Start Learning for Free

Needed a Video for I need numerical based videos of topic FIFO and lifo as soon as possible?

Related: Cost Accounting

Most Upvoted Answer

Needed a Video for I need numerical based videos of topic FIFO and lif...

Community Answer

Needed a Video for I need numerical based videos of topic FIFO and lif...

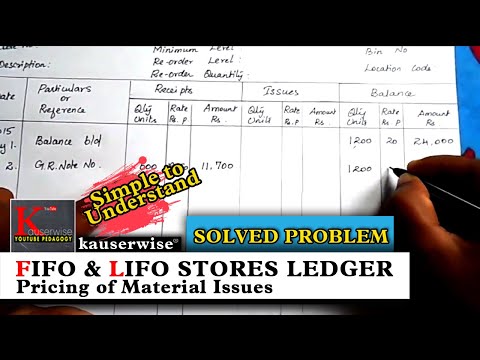

Numerical based videos on FIFO and LIFO for Cost Accounting

FIFO (First-In-First-Out) and LIFO (Last-In-First-Out) are two methods used for inventory management and cost accounting. Here are some numerical based videos that can help you understand these concepts in detail:

1. FIFO Method Video:

This video explains how the FIFO method works and its advantages and disadvantages. It also includes a numerical example that demonstrates how to calculate the cost of goods sold using the FIFO method.

2. LIFO Method Video:

This video explains the LIFO method and how it differs from the FIFO method. It also includes a numerical example that demonstrates how to calculate the cost of goods sold using the LIFO method.

3. Comparison of FIFO and LIFO Video:

This video provides a side-by-side comparison of the FIFO and LIFO methods, including their advantages and disadvantages. It also includes a numerical example that shows how the two methods can produce different results.

4. Practice Problems Video:

This video provides several practice problems related to FIFO and LIFO, including calculating cost of goods sold, ending inventory, and gross profit using both methods.

Cost Accounting

Cost accounting is the process of recording, classifying, analyzing, and allocating costs associated with a product or service. It is used to help businesses make informed decisions about pricing, budgeting, and resource allocation. Here are some key concepts related to cost accounting:

1. Cost Types:

Costs can be classified as direct or indirect, fixed or variable, and product or period costs. Understanding these types of costs is essential for accurate cost accounting.

2. Cost Behavior:

Cost behavior refers to how costs change in relation to changes in production levels or sales. Understanding cost behavior is important for forecasting and budgeting.

3. Cost-Volume-Profit Analysis:

Cost-volume-profit (CVP) analysis is a tool used to determine the break-even point for a product or service. It helps businesses understand how changes in costs and prices will affect their profitability.

4. Standard Costing:

Standard costing is a method of cost accounting that involves setting standard costs for each product or service and comparing actual costs to these standards. This helps businesses identify areas where costs can be reduced and improve overall efficiency.

In conclusion, understanding FIFO and LIFO methods is crucial for cost accounting. These numerical based videos can help you grasp the concepts and apply them in practice. Additionally, being familiar with key concepts related to cost accounting can help you make informed decisions and improve your business's profitability.

FIFO (First-In-First-Out) and LIFO (Last-In-First-Out) are two methods used for inventory management and cost accounting. Here are some numerical based videos that can help you understand these concepts in detail:

1. FIFO Method Video:

This video explains how the FIFO method works and its advantages and disadvantages. It also includes a numerical example that demonstrates how to calculate the cost of goods sold using the FIFO method.

2. LIFO Method Video:

This video explains the LIFO method and how it differs from the FIFO method. It also includes a numerical example that demonstrates how to calculate the cost of goods sold using the LIFO method.

3. Comparison of FIFO and LIFO Video:

This video provides a side-by-side comparison of the FIFO and LIFO methods, including their advantages and disadvantages. It also includes a numerical example that shows how the two methods can produce different results.

4. Practice Problems Video:

This video provides several practice problems related to FIFO and LIFO, including calculating cost of goods sold, ending inventory, and gross profit using both methods.

Cost Accounting

Cost accounting is the process of recording, classifying, analyzing, and allocating costs associated with a product or service. It is used to help businesses make informed decisions about pricing, budgeting, and resource allocation. Here are some key concepts related to cost accounting:

1. Cost Types:

Costs can be classified as direct or indirect, fixed or variable, and product or period costs. Understanding these types of costs is essential for accurate cost accounting.

2. Cost Behavior:

Cost behavior refers to how costs change in relation to changes in production levels or sales. Understanding cost behavior is important for forecasting and budgeting.

3. Cost-Volume-Profit Analysis:

Cost-volume-profit (CVP) analysis is a tool used to determine the break-even point for a product or service. It helps businesses understand how changes in costs and prices will affect their profitability.

4. Standard Costing:

Standard costing is a method of cost accounting that involves setting standard costs for each product or service and comparing actual costs to these standards. This helps businesses identify areas where costs can be reduced and improve overall efficiency.

In conclusion, understanding FIFO and LIFO methods is crucial for cost accounting. These numerical based videos can help you grasp the concepts and apply them in practice. Additionally, being familiar with key concepts related to cost accounting can help you make informed decisions and improve your business's profitability.

|

Explore Courses for B Com exam

|

|

Similar B Com Doubts

Needed a Video for I need numerical based videos of topic FIFO and lifo as soon as possible? Related: Cost Accounting?

Question Description

Needed a Video for I need numerical based videos of topic FIFO and lifo as soon as possible? Related: Cost Accounting? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about Needed a Video for I need numerical based videos of topic FIFO and lifo as soon as possible? Related: Cost Accounting? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Needed a Video for I need numerical based videos of topic FIFO and lifo as soon as possible? Related: Cost Accounting?.

Needed a Video for I need numerical based videos of topic FIFO and lifo as soon as possible? Related: Cost Accounting? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about Needed a Video for I need numerical based videos of topic FIFO and lifo as soon as possible? Related: Cost Accounting? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Needed a Video for I need numerical based videos of topic FIFO and lifo as soon as possible? Related: Cost Accounting?.

Solutions for Needed a Video for I need numerical based videos of topic FIFO and lifo as soon as possible? Related: Cost Accounting? in English & in Hindi are available as part of our courses for B Com.

Download more important topics, notes, lectures and mock test series for B Com Exam by signing up for free.

Here you can find the meaning of Needed a Video for I need numerical based videos of topic FIFO and lifo as soon as possible? Related: Cost Accounting? defined & explained in the simplest way possible. Besides giving the explanation of

Needed a Video for I need numerical based videos of topic FIFO and lifo as soon as possible? Related: Cost Accounting?, a detailed solution for Needed a Video for I need numerical based videos of topic FIFO and lifo as soon as possible? Related: Cost Accounting? has been provided alongside types of Needed a Video for I need numerical based videos of topic FIFO and lifo as soon as possible? Related: Cost Accounting? theory, EduRev gives you an

ample number of questions to practice Needed a Video for I need numerical based videos of topic FIFO and lifo as soon as possible? Related: Cost Accounting? tests, examples and also practice B Com tests.

|

Explore Courses for B Com exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.