B Com Exam > B Com Questions > The Directors of company forfeited 100 equity...

Start Learning for Free

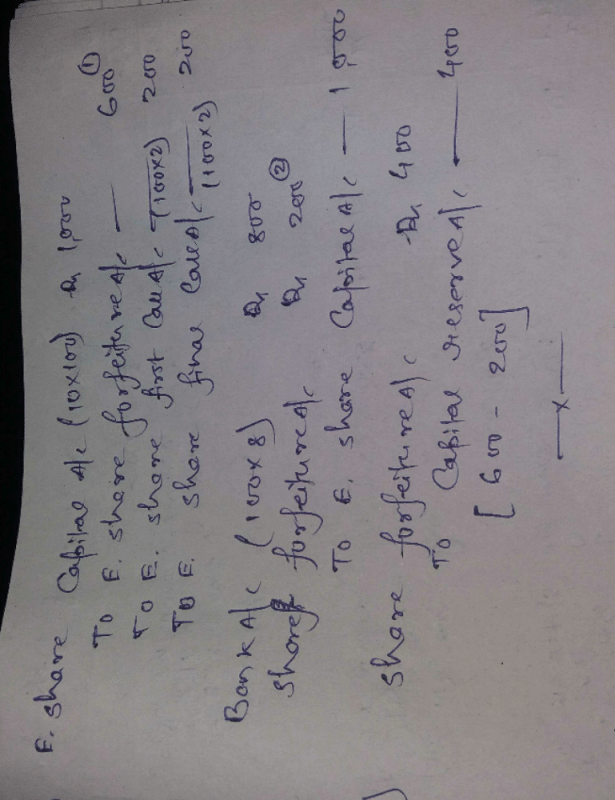

The Directors of company forfeited 100 equity shares of face price Rs. 10 each and issue price of Rs. 15 each for non - payment of the first call of Rs. 2 and final call of Rs. 2. These shares were reissued to one of the directors upon payment of Rs. 8 as Fully paid up. pass journal entries of forfeiture , reissue and settlement of share forfeiture account.

?Most Upvoted Answer

The Directors of company forfeited 100 equity shares of face price Rs....

Journal Entries for Forfeiture, Reissue, and Settlement of Share Forfeiture Account

Forfeiture of Shares

The first step in the process is to record the forfeiture of shares in the company's books. This can be done through the following journal entry:

Debit Share Forfeiture Account (number of shares forfeited x face value)

Credit Share Capital Account (number of shares forfeited x issue price)

Credit Calls in Arrears Account (amount of unpaid calls)

Reissue of Shares

After the shares have been forfeited, they can be reissued to another party. In this case, the shares were reissued to one of the directors upon payment of Rs. 8 as fully paid up. The following journal entry can be used to record the reissue of shares:

Debit Bank Account (amount received for reissued shares)

Credit Share Forfeiture Account (number of shares reissued x face value)

Credit Share Capital Account (number of shares reissued x issue price)

Settlement of Share Forfeiture Account

Finally, the Share Forfeiture Account must be settled. This account is used to track the forfeited shares until they are either reissued or cancelled. In this case, the shares were reissued, so the Share Forfeiture Account must be closed. The following journal entry can be used to settle the Share Forfeiture Account:

Debit Share Forfeiture Account (balance)

Credit Capital Reserve Account (amount transferred to reserve)

Explanation of Share Capital - Alteration of Share Capital

Share Capital refers to the amount of money that a company raises by issuing shares to the public. Companies can alter their share capital in a number of ways, including:

1. Increasing Share Capital: Companies can issue new shares to raise additional capital. This can be done through a rights issue, bonus issue, or public issue.

2. Decreasing Share Capital: Companies can reduce their share capital by cancelling or buying back shares. This can be done through a reduction of capital, share buyback, or redemption of shares.

3. Altering Share Capital: Companies can also alter their share capital by changing the terms of the shares, such as the face value, issue price, or dividend rate.

4. Conversion of Shares: Companies can convert their shares from one class to another, such as converting preference shares to equity shares.

The alteration of share capital must be approved by the company's shareholders and filed with the Registrar of Companies. The process can be complex, and companies should seek professional advice before making any changes to their share capital.

Forfeiture of Shares

The first step in the process is to record the forfeiture of shares in the company's books. This can be done through the following journal entry:

Debit Share Forfeiture Account (number of shares forfeited x face value)

Credit Share Capital Account (number of shares forfeited x issue price)

Credit Calls in Arrears Account (amount of unpaid calls)

Reissue of Shares

After the shares have been forfeited, they can be reissued to another party. In this case, the shares were reissued to one of the directors upon payment of Rs. 8 as fully paid up. The following journal entry can be used to record the reissue of shares:

Debit Bank Account (amount received for reissued shares)

Credit Share Forfeiture Account (number of shares reissued x face value)

Credit Share Capital Account (number of shares reissued x issue price)

Settlement of Share Forfeiture Account

Finally, the Share Forfeiture Account must be settled. This account is used to track the forfeited shares until they are either reissued or cancelled. In this case, the shares were reissued, so the Share Forfeiture Account must be closed. The following journal entry can be used to settle the Share Forfeiture Account:

Debit Share Forfeiture Account (balance)

Credit Capital Reserve Account (amount transferred to reserve)

Explanation of Share Capital - Alteration of Share Capital

Share Capital refers to the amount of money that a company raises by issuing shares to the public. Companies can alter their share capital in a number of ways, including:

1. Increasing Share Capital: Companies can issue new shares to raise additional capital. This can be done through a rights issue, bonus issue, or public issue.

2. Decreasing Share Capital: Companies can reduce their share capital by cancelling or buying back shares. This can be done through a reduction of capital, share buyback, or redemption of shares.

3. Altering Share Capital: Companies can also alter their share capital by changing the terms of the shares, such as the face value, issue price, or dividend rate.

4. Conversion of Shares: Companies can convert their shares from one class to another, such as converting preference shares to equity shares.

The alteration of share capital must be approved by the company's shareholders and filed with the Registrar of Companies. The process can be complex, and companies should seek professional advice before making any changes to their share capital.

Community Answer

The Directors of company forfeited 100 equity shares of face price Rs....

|

Explore Courses for B Com exam

|

|

Similar B Com Doubts

The Directors of company forfeited 100 equity shares of face price Rs. 10 each and issue price of Rs. 15 each for non - payment of the first call of Rs. 2 and final call of Rs. 2. These shares were reissued to one of the directors upon payment of Rs. 8 as Fully paid up. pass journal entries of forfeiture , reissue and settlement of share forfeiture account. Related: Share Capital - Alteration Of Share Capital, Advanced Corporate Accounting?

Question Description

The Directors of company forfeited 100 equity shares of face price Rs. 10 each and issue price of Rs. 15 each for non - payment of the first call of Rs. 2 and final call of Rs. 2. These shares were reissued to one of the directors upon payment of Rs. 8 as Fully paid up. pass journal entries of forfeiture , reissue and settlement of share forfeiture account. Related: Share Capital - Alteration Of Share Capital, Advanced Corporate Accounting? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about The Directors of company forfeited 100 equity shares of face price Rs. 10 each and issue price of Rs. 15 each for non - payment of the first call of Rs. 2 and final call of Rs. 2. These shares were reissued to one of the directors upon payment of Rs. 8 as Fully paid up. pass journal entries of forfeiture , reissue and settlement of share forfeiture account. Related: Share Capital - Alteration Of Share Capital, Advanced Corporate Accounting? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for The Directors of company forfeited 100 equity shares of face price Rs. 10 each and issue price of Rs. 15 each for non - payment of the first call of Rs. 2 and final call of Rs. 2. These shares were reissued to one of the directors upon payment of Rs. 8 as Fully paid up. pass journal entries of forfeiture , reissue and settlement of share forfeiture account. Related: Share Capital - Alteration Of Share Capital, Advanced Corporate Accounting?.

The Directors of company forfeited 100 equity shares of face price Rs. 10 each and issue price of Rs. 15 each for non - payment of the first call of Rs. 2 and final call of Rs. 2. These shares were reissued to one of the directors upon payment of Rs. 8 as Fully paid up. pass journal entries of forfeiture , reissue and settlement of share forfeiture account. Related: Share Capital - Alteration Of Share Capital, Advanced Corporate Accounting? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about The Directors of company forfeited 100 equity shares of face price Rs. 10 each and issue price of Rs. 15 each for non - payment of the first call of Rs. 2 and final call of Rs. 2. These shares were reissued to one of the directors upon payment of Rs. 8 as Fully paid up. pass journal entries of forfeiture , reissue and settlement of share forfeiture account. Related: Share Capital - Alteration Of Share Capital, Advanced Corporate Accounting? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for The Directors of company forfeited 100 equity shares of face price Rs. 10 each and issue price of Rs. 15 each for non - payment of the first call of Rs. 2 and final call of Rs. 2. These shares were reissued to one of the directors upon payment of Rs. 8 as Fully paid up. pass journal entries of forfeiture , reissue and settlement of share forfeiture account. Related: Share Capital - Alteration Of Share Capital, Advanced Corporate Accounting?.

Solutions for The Directors of company forfeited 100 equity shares of face price Rs. 10 each and issue price of Rs. 15 each for non - payment of the first call of Rs. 2 and final call of Rs. 2. These shares were reissued to one of the directors upon payment of Rs. 8 as Fully paid up. pass journal entries of forfeiture , reissue and settlement of share forfeiture account. Related: Share Capital - Alteration Of Share Capital, Advanced Corporate Accounting? in English & in Hindi are available as part of our courses for B Com.

Download more important topics, notes, lectures and mock test series for B Com Exam by signing up for free.

Here you can find the meaning of The Directors of company forfeited 100 equity shares of face price Rs. 10 each and issue price of Rs. 15 each for non - payment of the first call of Rs. 2 and final call of Rs. 2. These shares were reissued to one of the directors upon payment of Rs. 8 as Fully paid up. pass journal entries of forfeiture , reissue and settlement of share forfeiture account. Related: Share Capital - Alteration Of Share Capital, Advanced Corporate Accounting? defined & explained in the simplest way possible. Besides giving the explanation of

The Directors of company forfeited 100 equity shares of face price Rs. 10 each and issue price of Rs. 15 each for non - payment of the first call of Rs. 2 and final call of Rs. 2. These shares were reissued to one of the directors upon payment of Rs. 8 as Fully paid up. pass journal entries of forfeiture , reissue and settlement of share forfeiture account. Related: Share Capital - Alteration Of Share Capital, Advanced Corporate Accounting?, a detailed solution for The Directors of company forfeited 100 equity shares of face price Rs. 10 each and issue price of Rs. 15 each for non - payment of the first call of Rs. 2 and final call of Rs. 2. These shares were reissued to one of the directors upon payment of Rs. 8 as Fully paid up. pass journal entries of forfeiture , reissue and settlement of share forfeiture account. Related: Share Capital - Alteration Of Share Capital, Advanced Corporate Accounting? has been provided alongside types of The Directors of company forfeited 100 equity shares of face price Rs. 10 each and issue price of Rs. 15 each for non - payment of the first call of Rs. 2 and final call of Rs. 2. These shares were reissued to one of the directors upon payment of Rs. 8 as Fully paid up. pass journal entries of forfeiture , reissue and settlement of share forfeiture account. Related: Share Capital - Alteration Of Share Capital, Advanced Corporate Accounting? theory, EduRev gives you an

ample number of questions to practice The Directors of company forfeited 100 equity shares of face price Rs. 10 each and issue price of Rs. 15 each for non - payment of the first call of Rs. 2 and final call of Rs. 2. These shares were reissued to one of the directors upon payment of Rs. 8 as Fully paid up. pass journal entries of forfeiture , reissue and settlement of share forfeiture account. Related: Share Capital - Alteration Of Share Capital, Advanced Corporate Accounting? tests, examples and also practice B Com tests.

|

Explore Courses for B Com exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.