Class 12 Exam > Class 12 Questions > A and B are partners sharing profit in the ra...

Start Learning for Free

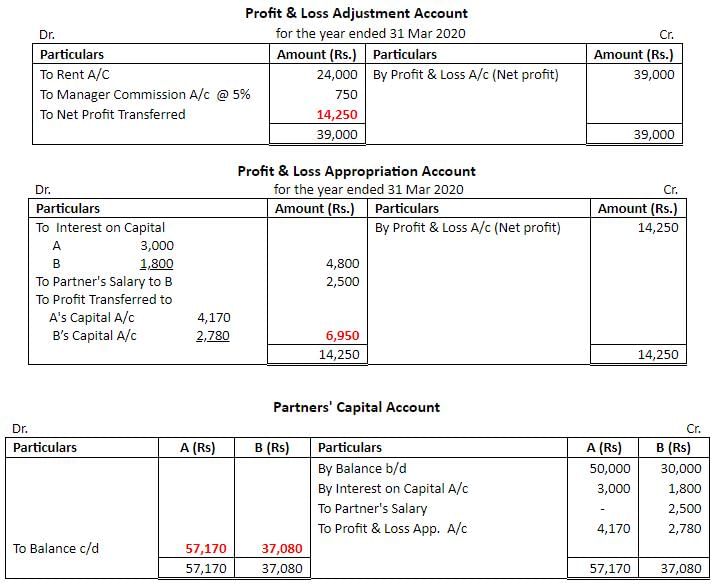

A and B are partners sharing profit in the ratio 3 : 2 with capital of 50000 and 30000 respectively interest on capital is agreed @6% p.a. B is to be allowed an annual salary of 2500 . A provision of 5% of net profit is to be made in respect of manager commission and rent of 24000 is to be accounted being payable to A profit for the year before manager commission and rent to A was 39000 Prepare profit and loss appropriation account and partners capital account.?

Most Upvoted Answer

A and B are partners sharing profit in the ratio 3 : 2 with capital of...

Profit and Loss Appropriation Account:

Net Profit before Manager Commission and Rent: 39000

Less: Manager Commission (5% of Net Profit): 1950

Rent Paid to A: 24000

Salary Paid to B: 2500

Total Appropriation: 28450

Net Profit after Appropriation: 10550

Partner's Capital Account:

A:

Opening Capital: 50000

Add: Interest on Capital (6% of 50000): 3000

Share of Net Profit: 6330 (10550 x 3/5)

Less: Manager Commission (5% of Net Profit): 158

Closing Capital: 56672 (50000 + 3000 + 6330 - 158)

B:

Opening Capital: 30000

Add: Interest on Capital (6% of 30000): 1800

Salary Paid: 2500

Share of Net Profit: 4218 (10550 x 2/5)

Closing Capital: 38518 (30000 + 1800 + 2500 + 4218)

Explanation:

The given information can be used to prepare the Profit and Loss Appropriation Account and the Partner's Capital Account for the year. The Profit and Loss Appropriation Account shows the distribution of the net profit for the year after deducting the manager commission, rent paid to A, and salary paid to B. The remaining amount is the net profit available for distribution among the partners.

The Partner's Capital Account shows the opening capital of each partner, their share of interest on capital, salary paid to B, share of net profit, and the closing capital for the year. A's share of net profit is calculated as 3/5th of the total net profit, while B's share is calculated as 2/5th. A provision of 5% of net profit is made for manager commission, which is deducted from each partner's share of net profit.

A rent of 24000 is paid to A, which is also deducted from A's share of net profit. A and B's opening capital is added to their respective shares of interest on capital, salary paid, and share of net profit, and the total amount is their closing capital for the year.

Overall, the Profit and Loss Appropriation Account and the Partner's Capital Account provide a clear picture of the financial performance of the partnership for the year, and help the partners make informed decisions about the future of the business.

Net Profit before Manager Commission and Rent: 39000

Less: Manager Commission (5% of Net Profit): 1950

Rent Paid to A: 24000

Salary Paid to B: 2500

Total Appropriation: 28450

Net Profit after Appropriation: 10550

Partner's Capital Account:

A:

Opening Capital: 50000

Add: Interest on Capital (6% of 50000): 3000

Share of Net Profit: 6330 (10550 x 3/5)

Less: Manager Commission (5% of Net Profit): 158

Closing Capital: 56672 (50000 + 3000 + 6330 - 158)

B:

Opening Capital: 30000

Add: Interest on Capital (6% of 30000): 1800

Salary Paid: 2500

Share of Net Profit: 4218 (10550 x 2/5)

Closing Capital: 38518 (30000 + 1800 + 2500 + 4218)

Explanation:

The given information can be used to prepare the Profit and Loss Appropriation Account and the Partner's Capital Account for the year. The Profit and Loss Appropriation Account shows the distribution of the net profit for the year after deducting the manager commission, rent paid to A, and salary paid to B. The remaining amount is the net profit available for distribution among the partners.

The Partner's Capital Account shows the opening capital of each partner, their share of interest on capital, salary paid to B, share of net profit, and the closing capital for the year. A's share of net profit is calculated as 3/5th of the total net profit, while B's share is calculated as 2/5th. A provision of 5% of net profit is made for manager commission, which is deducted from each partner's share of net profit.

A rent of 24000 is paid to A, which is also deducted from A's share of net profit. A and B's opening capital is added to their respective shares of interest on capital, salary paid, and share of net profit, and the total amount is their closing capital for the year.

Overall, the Profit and Loss Appropriation Account and the Partner's Capital Account provide a clear picture of the financial performance of the partnership for the year, and help the partners make informed decisions about the future of the business.

Community Answer

A and B are partners sharing profit in the ratio 3 : 2 with capital of...

|

Explore Courses for Class 12 exam

|

|

Similar Class 12 Doubts

A and B are partners sharing profit in the ratio 3 : 2 with capital of 50000 and 30000 respectively interest on capital is agreed @6% p.a. B is to be allowed an annual salary of 2500 . A provision of 5% of net profit is to be made in respect of manager commission and rent of 24000 is to be accounted being payable to A profit for the year before manager commission and rent to A was 39000 Prepare profit and loss appropriation account and partners capital account.?

Question Description

A and B are partners sharing profit in the ratio 3 : 2 with capital of 50000 and 30000 respectively interest on capital is agreed @6% p.a. B is to be allowed an annual salary of 2500 . A provision of 5% of net profit is to be made in respect of manager commission and rent of 24000 is to be accounted being payable to A profit for the year before manager commission and rent to A was 39000 Prepare profit and loss appropriation account and partners capital account.? for Class 12 2024 is part of Class 12 preparation. The Question and answers have been prepared according to the Class 12 exam syllabus. Information about A and B are partners sharing profit in the ratio 3 : 2 with capital of 50000 and 30000 respectively interest on capital is agreed @6% p.a. B is to be allowed an annual salary of 2500 . A provision of 5% of net profit is to be made in respect of manager commission and rent of 24000 is to be accounted being payable to A profit for the year before manager commission and rent to A was 39000 Prepare profit and loss appropriation account and partners capital account.? covers all topics & solutions for Class 12 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for A and B are partners sharing profit in the ratio 3 : 2 with capital of 50000 and 30000 respectively interest on capital is agreed @6% p.a. B is to be allowed an annual salary of 2500 . A provision of 5% of net profit is to be made in respect of manager commission and rent of 24000 is to be accounted being payable to A profit for the year before manager commission and rent to A was 39000 Prepare profit and loss appropriation account and partners capital account.?.

A and B are partners sharing profit in the ratio 3 : 2 with capital of 50000 and 30000 respectively interest on capital is agreed @6% p.a. B is to be allowed an annual salary of 2500 . A provision of 5% of net profit is to be made in respect of manager commission and rent of 24000 is to be accounted being payable to A profit for the year before manager commission and rent to A was 39000 Prepare profit and loss appropriation account and partners capital account.? for Class 12 2024 is part of Class 12 preparation. The Question and answers have been prepared according to the Class 12 exam syllabus. Information about A and B are partners sharing profit in the ratio 3 : 2 with capital of 50000 and 30000 respectively interest on capital is agreed @6% p.a. B is to be allowed an annual salary of 2500 . A provision of 5% of net profit is to be made in respect of manager commission and rent of 24000 is to be accounted being payable to A profit for the year before manager commission and rent to A was 39000 Prepare profit and loss appropriation account and partners capital account.? covers all topics & solutions for Class 12 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for A and B are partners sharing profit in the ratio 3 : 2 with capital of 50000 and 30000 respectively interest on capital is agreed @6% p.a. B is to be allowed an annual salary of 2500 . A provision of 5% of net profit is to be made in respect of manager commission and rent of 24000 is to be accounted being payable to A profit for the year before manager commission and rent to A was 39000 Prepare profit and loss appropriation account and partners capital account.?.

Solutions for A and B are partners sharing profit in the ratio 3 : 2 with capital of 50000 and 30000 respectively interest on capital is agreed @6% p.a. B is to be allowed an annual salary of 2500 . A provision of 5% of net profit is to be made in respect of manager commission and rent of 24000 is to be accounted being payable to A profit for the year before manager commission and rent to A was 39000 Prepare profit and loss appropriation account and partners capital account.? in English & in Hindi are available as part of our courses for Class 12.

Download more important topics, notes, lectures and mock test series for Class 12 Exam by signing up for free.

Here you can find the meaning of A and B are partners sharing profit in the ratio 3 : 2 with capital of 50000 and 30000 respectively interest on capital is agreed @6% p.a. B is to be allowed an annual salary of 2500 . A provision of 5% of net profit is to be made in respect of manager commission and rent of 24000 is to be accounted being payable to A profit for the year before manager commission and rent to A was 39000 Prepare profit and loss appropriation account and partners capital account.? defined & explained in the simplest way possible. Besides giving the explanation of

A and B are partners sharing profit in the ratio 3 : 2 with capital of 50000 and 30000 respectively interest on capital is agreed @6% p.a. B is to be allowed an annual salary of 2500 . A provision of 5% of net profit is to be made in respect of manager commission and rent of 24000 is to be accounted being payable to A profit for the year before manager commission and rent to A was 39000 Prepare profit and loss appropriation account and partners capital account.?, a detailed solution for A and B are partners sharing profit in the ratio 3 : 2 with capital of 50000 and 30000 respectively interest on capital is agreed @6% p.a. B is to be allowed an annual salary of 2500 . A provision of 5% of net profit is to be made in respect of manager commission and rent of 24000 is to be accounted being payable to A profit for the year before manager commission and rent to A was 39000 Prepare profit and loss appropriation account and partners capital account.? has been provided alongside types of A and B are partners sharing profit in the ratio 3 : 2 with capital of 50000 and 30000 respectively interest on capital is agreed @6% p.a. B is to be allowed an annual salary of 2500 . A provision of 5% of net profit is to be made in respect of manager commission and rent of 24000 is to be accounted being payable to A profit for the year before manager commission and rent to A was 39000 Prepare profit and loss appropriation account and partners capital account.? theory, EduRev gives you an

ample number of questions to practice A and B are partners sharing profit in the ratio 3 : 2 with capital of 50000 and 30000 respectively interest on capital is agreed @6% p.a. B is to be allowed an annual salary of 2500 . A provision of 5% of net profit is to be made in respect of manager commission and rent of 24000 is to be accounted being payable to A profit for the year before manager commission and rent to A was 39000 Prepare profit and loss appropriation account and partners capital account.? tests, examples and also practice Class 12 tests.

|

Explore Courses for Class 12 exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.