Commerce Exam > Commerce Questions > FIXED AND fluctuating Capital Account Relate...

Start Learning for Free

FIXED AND fluctuating Capital Account

?Most Upvoted Answer

FIXED AND fluctuating Capital Account Related: Key Notes - Accountin...

Community Answer

FIXED AND fluctuating Capital Account Related: Key Notes - Accountin...

Accounting for Partnership Firms: Fundamentals

Introduction:

Partnership firms are the most common forms of business entities. Accounting for partnership firms is essential for keeping track of the financial transactions and the profits or losses incurred. In this article, we will discuss the fundamentals of accounting for partnership firms.

Fixed and Fluctuating Capital Account Related:

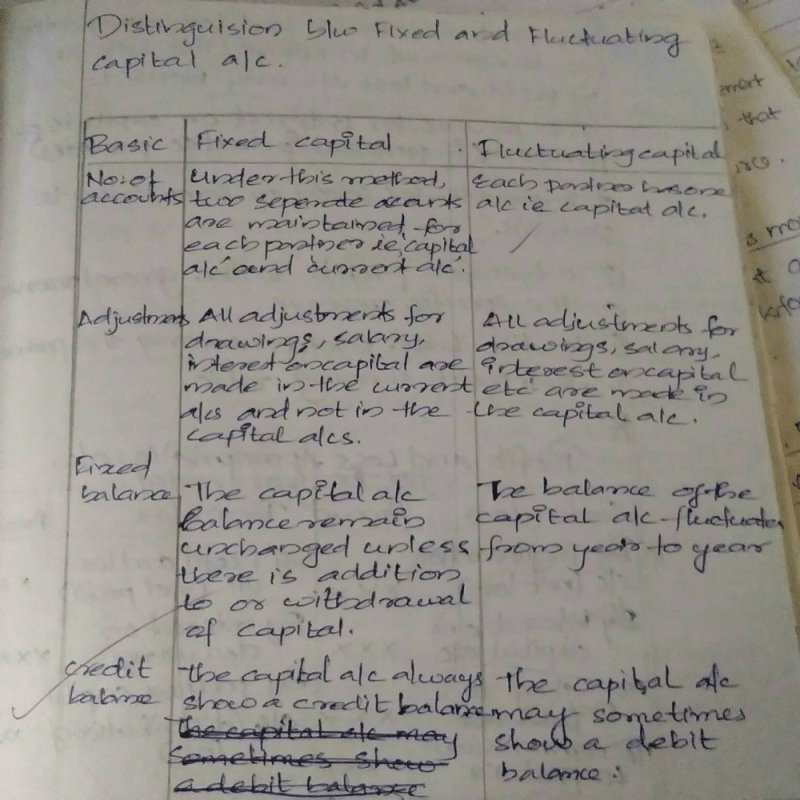

Partnership firms have two types of capital accounts: fixed and fluctuating. Fixed capital accounts refer to the capital invested by the partners at the beginning of the partnership, while fluctuating capital accounts refer to the changes in capital during the course of the partnership.

Accounting Entries:

Accounting entries for partnership firms are prepared based on the transactions that occur during the course of the partnership. Some of the common accounting entries include:

- Recording of capital contributed by each partner in their respective capital accounts.

- Recording of profits or losses incurred by the firm in the profit and loss account.

- Recording of interest on capital contributed by partners in their respective capital accounts.

- Recording of drawings made by partners in their respective capital accounts.

Distribution of Profits and Losses:

The profits or losses incurred by a partnership firm are distributed among the partners based on the agreed profit sharing ratio. The profit sharing ratio is determined at the beginning of the partnership and can be changed by mutual agreement among the partners.

Maintenance of Books of Accounts:

Partnership firms are required to maintain books of accounts as per the provisions of the Partnership Act. The books of accounts include the cash book, ledger, trial balance, profit and loss account, and balance sheet.

Conclusion:

Accounting for partnership firms is essential for keeping track of the financial transactions and the profits or losses incurred. The accounting entries, distribution of profits and losses, and maintenance of books of accounts are some of the fundamentals of accounting for partnership firms.

Introduction:

Partnership firms are the most common forms of business entities. Accounting for partnership firms is essential for keeping track of the financial transactions and the profits or losses incurred. In this article, we will discuss the fundamentals of accounting for partnership firms.

Fixed and Fluctuating Capital Account Related:

Partnership firms have two types of capital accounts: fixed and fluctuating. Fixed capital accounts refer to the capital invested by the partners at the beginning of the partnership, while fluctuating capital accounts refer to the changes in capital during the course of the partnership.

Accounting Entries:

Accounting entries for partnership firms are prepared based on the transactions that occur during the course of the partnership. Some of the common accounting entries include:

- Recording of capital contributed by each partner in their respective capital accounts.

- Recording of profits or losses incurred by the firm in the profit and loss account.

- Recording of interest on capital contributed by partners in their respective capital accounts.

- Recording of drawings made by partners in their respective capital accounts.

Distribution of Profits and Losses:

The profits or losses incurred by a partnership firm are distributed among the partners based on the agreed profit sharing ratio. The profit sharing ratio is determined at the beginning of the partnership and can be changed by mutual agreement among the partners.

Maintenance of Books of Accounts:

Partnership firms are required to maintain books of accounts as per the provisions of the Partnership Act. The books of accounts include the cash book, ledger, trial balance, profit and loss account, and balance sheet.

Conclusion:

Accounting for partnership firms is essential for keeping track of the financial transactions and the profits or losses incurred. The accounting entries, distribution of profits and losses, and maintenance of books of accounts are some of the fundamentals of accounting for partnership firms.

|

Explore Courses for Commerce exam

|

|

Question Description

FIXED AND fluctuating Capital Account Related: Key Notes - Accounting for partnership firms: Fundamentals? for Commerce 2025 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about FIXED AND fluctuating Capital Account Related: Key Notes - Accounting for partnership firms: Fundamentals? covers all topics & solutions for Commerce 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for FIXED AND fluctuating Capital Account Related: Key Notes - Accounting for partnership firms: Fundamentals?.

FIXED AND fluctuating Capital Account Related: Key Notes - Accounting for partnership firms: Fundamentals? for Commerce 2025 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about FIXED AND fluctuating Capital Account Related: Key Notes - Accounting for partnership firms: Fundamentals? covers all topics & solutions for Commerce 2025 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for FIXED AND fluctuating Capital Account Related: Key Notes - Accounting for partnership firms: Fundamentals?.

Solutions for FIXED AND fluctuating Capital Account Related: Key Notes - Accounting for partnership firms: Fundamentals? in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of FIXED AND fluctuating Capital Account Related: Key Notes - Accounting for partnership firms: Fundamentals? defined & explained in the simplest way possible. Besides giving the explanation of

FIXED AND fluctuating Capital Account Related: Key Notes - Accounting for partnership firms: Fundamentals?, a detailed solution for FIXED AND fluctuating Capital Account Related: Key Notes - Accounting for partnership firms: Fundamentals? has been provided alongside types of FIXED AND fluctuating Capital Account Related: Key Notes - Accounting for partnership firms: Fundamentals? theory, EduRev gives you an

ample number of questions to practice FIXED AND fluctuating Capital Account Related: Key Notes - Accounting for partnership firms: Fundamentals? tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.