Commerce Exam > Commerce Questions > X Ltd. invited application for 10,000 shares ...

Start Learning for Free

X Ltd. invited application for 10,000 shares of the value of Rs. 10 each. The amount is payable as Rs. 2 on application and Rs. 5 on allotment and balance on First and Final Call. The whole of the above issue was applied and cash duly received. Give Journal entries for the above transaction.?

Most Upvoted Answer

X Ltd. invited application for 10,000 shares of the value of Rs. 10 ea...

Journal Entries for Share Application, Allotment, and First and Final Call

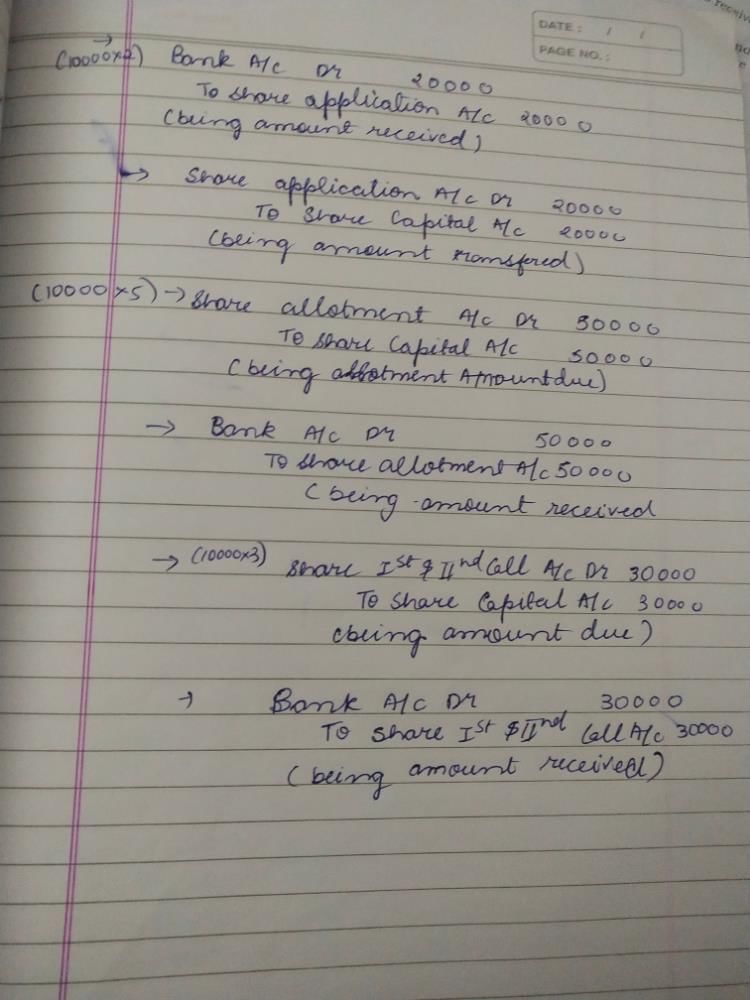

The issuance of shares by a company requires a series of accounting transactions to record the inflow and outflow of cash and to comply with legal requirements. Here are the journal entries for the X Ltd. share issue of 10,000 shares of Rs. 10 each, with Rs. 2 on application, Rs. 5 on allotment, and the balance on First and Final Call:

1. Share Application

When investors apply for shares, the company receives the application money, which is recorded as a liability until the shares are allotted or the application is rejected. The journal entry for share application is:

Bank Account Dr.

To Share Application Account

In this case, the amount received on application is Rs. 2 per share, so the total application money received is Rs. 20,000 (10,000 shares x Rs. 2). The Share Application Account is a current liability account that represents the amount of application money received but not yet allocated to shares.

2. Share Allotment

Once the company decides to allot shares to the applicants, it issues a letter of allotment and receives the allotment money, which is a part of the total share price. The journal entry for share allotment is:

Share Application Account Dr.

To Share Allotment Account

In this case, the allotment money is Rs. 5 per share, so the total allotment money received is Rs. 50,000 (10,000 shares x Rs. 5). The Share Allotment Account is a current liability account that represents the amount of allotment money received but not yet fully paid.

3. First and Final Call

After the shares are allotted, the company may ask the shareholders to pay the balance of the share price in one or more calls, depending on the terms of the issue. The journal entry for the First and Final Call is:

Share Allotment Account Dr.

To First and Final Call Account

In this case, the balance of the share price is Rs. 3 per share, so the total First and Final Call amount is Rs. 30,000 (10,000 shares x Rs. 3). The First and Final Call Account is a current liability account that represents the amount of the final call money received but not yet fully paid.

4. Share Capital

Finally, when the shareholders pay the First and Final Call, the company can record the receipt of the full share price as share capital. The journal entry for share capital is:

Bank Account Dr.

To Share Capital Account

In this case, the total share capital received is Rs. 1,00,000 (10,000 shares x Rs. 10), which is the sum of the application money, allotment money, and First and Final Call money. The Share Capital Account is a permanent equity account that represents the amount of capital invested by the shareholders.

Conclusion

In summary, the issuance of shares by a company involves several journal entries to record the application, allotment, and final call money received, as well as the share capital issued. These entries help the company maintain accurate records of its financial transactions and comply with legal requirements.

The issuance of shares by a company requires a series of accounting transactions to record the inflow and outflow of cash and to comply with legal requirements. Here are the journal entries for the X Ltd. share issue of 10,000 shares of Rs. 10 each, with Rs. 2 on application, Rs. 5 on allotment, and the balance on First and Final Call:

1. Share Application

When investors apply for shares, the company receives the application money, which is recorded as a liability until the shares are allotted or the application is rejected. The journal entry for share application is:

Bank Account Dr.

To Share Application Account

In this case, the amount received on application is Rs. 2 per share, so the total application money received is Rs. 20,000 (10,000 shares x Rs. 2). The Share Application Account is a current liability account that represents the amount of application money received but not yet allocated to shares.

2. Share Allotment

Once the company decides to allot shares to the applicants, it issues a letter of allotment and receives the allotment money, which is a part of the total share price. The journal entry for share allotment is:

Share Application Account Dr.

To Share Allotment Account

In this case, the allotment money is Rs. 5 per share, so the total allotment money received is Rs. 50,000 (10,000 shares x Rs. 5). The Share Allotment Account is a current liability account that represents the amount of allotment money received but not yet fully paid.

3. First and Final Call

After the shares are allotted, the company may ask the shareholders to pay the balance of the share price in one or more calls, depending on the terms of the issue. The journal entry for the First and Final Call is:

Share Allotment Account Dr.

To First and Final Call Account

In this case, the balance of the share price is Rs. 3 per share, so the total First and Final Call amount is Rs. 30,000 (10,000 shares x Rs. 3). The First and Final Call Account is a current liability account that represents the amount of the final call money received but not yet fully paid.

4. Share Capital

Finally, when the shareholders pay the First and Final Call, the company can record the receipt of the full share price as share capital. The journal entry for share capital is:

Bank Account Dr.

To Share Capital Account

In this case, the total share capital received is Rs. 1,00,000 (10,000 shares x Rs. 10), which is the sum of the application money, allotment money, and First and Final Call money. The Share Capital Account is a permanent equity account that represents the amount of capital invested by the shareholders.

Conclusion

In summary, the issuance of shares by a company involves several journal entries to record the application, allotment, and final call money received, as well as the share capital issued. These entries help the company maintain accurate records of its financial transactions and comply with legal requirements.

Community Answer

X Ltd. invited application for 10,000 shares of the value of Rs. 10 ea...

Attention Commerce Students!

To make sure you are not studying endlessly, EduRev has designed Commerce study material, with Structured Courses, Videos, & Test Series. Plus get personalized analysis, doubt solving and improvement plans to achieve a great score in Commerce.

|

Explore Courses for Commerce exam

|

|

Similar Commerce Doubts

X Ltd. invited application for 10,000 shares of the value of Rs. 10 each. The amount is payable as Rs. 2 on application and Rs. 5 on allotment and balance on First and Final Call. The whole of the above issue was applied and cash duly received. Give Journal entries for the above transaction.?

Question Description

X Ltd. invited application for 10,000 shares of the value of Rs. 10 each. The amount is payable as Rs. 2 on application and Rs. 5 on allotment and balance on First and Final Call. The whole of the above issue was applied and cash duly received. Give Journal entries for the above transaction.? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about X Ltd. invited application for 10,000 shares of the value of Rs. 10 each. The amount is payable as Rs. 2 on application and Rs. 5 on allotment and balance on First and Final Call. The whole of the above issue was applied and cash duly received. Give Journal entries for the above transaction.? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for X Ltd. invited application for 10,000 shares of the value of Rs. 10 each. The amount is payable as Rs. 2 on application and Rs. 5 on allotment and balance on First and Final Call. The whole of the above issue was applied and cash duly received. Give Journal entries for the above transaction.?.

X Ltd. invited application for 10,000 shares of the value of Rs. 10 each. The amount is payable as Rs. 2 on application and Rs. 5 on allotment and balance on First and Final Call. The whole of the above issue was applied and cash duly received. Give Journal entries for the above transaction.? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about X Ltd. invited application for 10,000 shares of the value of Rs. 10 each. The amount is payable as Rs. 2 on application and Rs. 5 on allotment and balance on First and Final Call. The whole of the above issue was applied and cash duly received. Give Journal entries for the above transaction.? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for X Ltd. invited application for 10,000 shares of the value of Rs. 10 each. The amount is payable as Rs. 2 on application and Rs. 5 on allotment and balance on First and Final Call. The whole of the above issue was applied and cash duly received. Give Journal entries for the above transaction.?.

Solutions for X Ltd. invited application for 10,000 shares of the value of Rs. 10 each. The amount is payable as Rs. 2 on application and Rs. 5 on allotment and balance on First and Final Call. The whole of the above issue was applied and cash duly received. Give Journal entries for the above transaction.? in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of X Ltd. invited application for 10,000 shares of the value of Rs. 10 each. The amount is payable as Rs. 2 on application and Rs. 5 on allotment and balance on First and Final Call. The whole of the above issue was applied and cash duly received. Give Journal entries for the above transaction.? defined & explained in the simplest way possible. Besides giving the explanation of

X Ltd. invited application for 10,000 shares of the value of Rs. 10 each. The amount is payable as Rs. 2 on application and Rs. 5 on allotment and balance on First and Final Call. The whole of the above issue was applied and cash duly received. Give Journal entries for the above transaction.?, a detailed solution for X Ltd. invited application for 10,000 shares of the value of Rs. 10 each. The amount is payable as Rs. 2 on application and Rs. 5 on allotment and balance on First and Final Call. The whole of the above issue was applied and cash duly received. Give Journal entries for the above transaction.? has been provided alongside types of X Ltd. invited application for 10,000 shares of the value of Rs. 10 each. The amount is payable as Rs. 2 on application and Rs. 5 on allotment and balance on First and Final Call. The whole of the above issue was applied and cash duly received. Give Journal entries for the above transaction.? theory, EduRev gives you an

ample number of questions to practice X Ltd. invited application for 10,000 shares of the value of Rs. 10 each. The amount is payable as Rs. 2 on application and Rs. 5 on allotment and balance on First and Final Call. The whole of the above issue was applied and cash duly received. Give Journal entries for the above transaction.? tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.