B Com Exam > B Com Questions > ) Find out the Indexed cost in following case...

Start Learning for Free

) Find out the Indexed cost in following cases

(separately for each case) for the assessment

year 20 19-2020 :

(i) Cost of plot acquired in 2006-07

for

Rs. 80,000

(ii) Cost of house purchased in 1998-99 for

Rs. 90,000

Fair market value on

1-4-2001 being

Rs. 1,50,000

(iii) Cost of house purchased in

1996-97 for Rs.2,00,000 but

F.M.V. on 1.4.2001

Rs. 4,00,000

[C.I.I. for 2001-02 = 100, for 2006-07 = 122,

and for 2018-19 = 280].

?Most Upvoted Answer

) Find out the Indexed cost in following cases

(separately for each c...

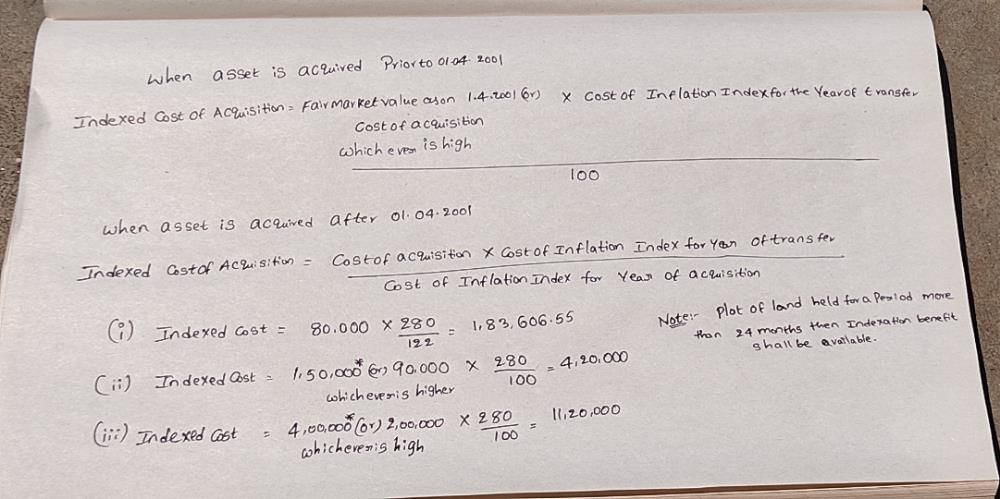

Indexed Cost Calculation for Assessment Year 2019-2020:

(i) Cost of plot acquired in 2006-07 for Rs. 80,000

Indexed Cost = Cost of acquisition x (CII for year of sale or transfer/CII for year of acquisition)

= 80,000 x (280/122)

= Rs. 1,84,262.30

(ii) Cost of house purchased in 1998-99 for Rs. 90,000

Fair market value on 1-4-2001 being Rs. 1,50,000

Indexed Cost = Higher of (cost of acquisition x (CII for year of sale or transfer/CII for year of acquisition)) or (fair market value on 1-4-2001 x (CII for year of sale or transfer/CII for year 2001-02))

= max(90,000 x (280/199), 1,50,000 x (280/100))

= max(1,26,683.42, 6,72,000)

= Rs. 6,72,000

(iii) Cost of house purchased in 1996-97 for Rs. 2,00,000 but F.M.V. on 1.4.2001 Rs. 4,00,000

Indexed Cost = Higher of (cost of acquisition x (CII for year of sale or transfer/CII for year of acquisition)) or (fair market value on 1-4-2001 x (CII for year of sale or transfer/CII for year 2001-02))

= max(2,00,000 x (280/199), 4,00,000 x (280/100))

= max(2,83,919.59, 11,20,000)

= Rs. 11,20,000

Condition applicable to an Individual assessee - Income Tax Laws:

As per the Income Tax Laws, an individual assessee is eligible to be taxed based on their income earned in a particular financial year. However, there are certain conditions applicable to an individual assessee, as follows:

1. The individual should be a resident of India for the relevant financial year.

2. The individual should have earned income that is taxable as per the Income Tax Laws.

3. The individual should file their income tax returns within the due date prescribed by the Income Tax Department.

4. The individual should pay their tax liability on time to avoid penalties and interest.

5. The individual can claim deductions and exemptions as per the Income Tax Laws to reduce their tax liability.

By fulfilling these conditions, an individual assessee can comply with the Income Tax Laws and avoid any legal issues related to taxation.

(i) Cost of plot acquired in 2006-07 for Rs. 80,000

Indexed Cost = Cost of acquisition x (CII for year of sale or transfer/CII for year of acquisition)

= 80,000 x (280/122)

= Rs. 1,84,262.30

(ii) Cost of house purchased in 1998-99 for Rs. 90,000

Fair market value on 1-4-2001 being Rs. 1,50,000

Indexed Cost = Higher of (cost of acquisition x (CII for year of sale or transfer/CII for year of acquisition)) or (fair market value on 1-4-2001 x (CII for year of sale or transfer/CII for year 2001-02))

= max(90,000 x (280/199), 1,50,000 x (280/100))

= max(1,26,683.42, 6,72,000)

= Rs. 6,72,000

(iii) Cost of house purchased in 1996-97 for Rs. 2,00,000 but F.M.V. on 1.4.2001 Rs. 4,00,000

Indexed Cost = Higher of (cost of acquisition x (CII for year of sale or transfer/CII for year of acquisition)) or (fair market value on 1-4-2001 x (CII for year of sale or transfer/CII for year 2001-02))

= max(2,00,000 x (280/199), 4,00,000 x (280/100))

= max(2,83,919.59, 11,20,000)

= Rs. 11,20,000

Condition applicable to an Individual assessee - Income Tax Laws:

As per the Income Tax Laws, an individual assessee is eligible to be taxed based on their income earned in a particular financial year. However, there are certain conditions applicable to an individual assessee, as follows:

1. The individual should be a resident of India for the relevant financial year.

2. The individual should have earned income that is taxable as per the Income Tax Laws.

3. The individual should file their income tax returns within the due date prescribed by the Income Tax Department.

4. The individual should pay their tax liability on time to avoid penalties and interest.

5. The individual can claim deductions and exemptions as per the Income Tax Laws to reduce their tax liability.

By fulfilling these conditions, an individual assessee can comply with the Income Tax Laws and avoid any legal issues related to taxation.

Community Answer

) Find out the Indexed cost in following cases

(separately for each c...

|

Explore Courses for B Com exam

|

|

Similar B Com Doubts

) Find out the Indexed cost in following cases

(separately for each case) for the assessment

year 20 19-2020 :

(i) Cost of plot acquired in 2006-07

for

Rs. 80,000

(ii) Cost of house purchased in 1998-99 for

Rs. 90,000

Fair market value on

1-4-2001 being

Rs. 1,50,000

(iii) Cost of house purchased in

1996-97 for Rs.2,00,000 but

F.M.V. on 1.4.2001

Rs. 4,00,000

[C.I.I. for 2001-02 = 100, for 2006-07 = 122,

and for 2018-19 = 280]. Related: Condition applicable to an Individual assessee - Income Tax Laws?

Question Description

) Find out the Indexed cost in following cases (separately for each case) for the assessment year 20 19-2020 : (i) Cost of plot acquired in 2006-07 for Rs. 80,000 (ii) Cost of house purchased in 1998-99 for Rs. 90,000 Fair market value on 1-4-2001 being Rs. 1,50,000 (iii) Cost of house purchased in 1996-97 for Rs.2,00,000 but F.M.V. on 1.4.2001 Rs. 4,00,000 [C.I.I. for 2001-02 = 100, for 2006-07 = 122, and for 2018-19 = 280]. Related: Condition applicable to an Individual assessee - Income Tax Laws? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about ) Find out the Indexed cost in following cases (separately for each case) for the assessment year 20 19-2020 : (i) Cost of plot acquired in 2006-07 for Rs. 80,000 (ii) Cost of house purchased in 1998-99 for Rs. 90,000 Fair market value on 1-4-2001 being Rs. 1,50,000 (iii) Cost of house purchased in 1996-97 for Rs.2,00,000 but F.M.V. on 1.4.2001 Rs. 4,00,000 [C.I.I. for 2001-02 = 100, for 2006-07 = 122, and for 2018-19 = 280]. Related: Condition applicable to an Individual assessee - Income Tax Laws? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for ) Find out the Indexed cost in following cases (separately for each case) for the assessment year 20 19-2020 : (i) Cost of plot acquired in 2006-07 for Rs. 80,000 (ii) Cost of house purchased in 1998-99 for Rs. 90,000 Fair market value on 1-4-2001 being Rs. 1,50,000 (iii) Cost of house purchased in 1996-97 for Rs.2,00,000 but F.M.V. on 1.4.2001 Rs. 4,00,000 [C.I.I. for 2001-02 = 100, for 2006-07 = 122, and for 2018-19 = 280]. Related: Condition applicable to an Individual assessee - Income Tax Laws?.

) Find out the Indexed cost in following cases (separately for each case) for the assessment year 20 19-2020 : (i) Cost of plot acquired in 2006-07 for Rs. 80,000 (ii) Cost of house purchased in 1998-99 for Rs. 90,000 Fair market value on 1-4-2001 being Rs. 1,50,000 (iii) Cost of house purchased in 1996-97 for Rs.2,00,000 but F.M.V. on 1.4.2001 Rs. 4,00,000 [C.I.I. for 2001-02 = 100, for 2006-07 = 122, and for 2018-19 = 280]. Related: Condition applicable to an Individual assessee - Income Tax Laws? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about ) Find out the Indexed cost in following cases (separately for each case) for the assessment year 20 19-2020 : (i) Cost of plot acquired in 2006-07 for Rs. 80,000 (ii) Cost of house purchased in 1998-99 for Rs. 90,000 Fair market value on 1-4-2001 being Rs. 1,50,000 (iii) Cost of house purchased in 1996-97 for Rs.2,00,000 but F.M.V. on 1.4.2001 Rs. 4,00,000 [C.I.I. for 2001-02 = 100, for 2006-07 = 122, and for 2018-19 = 280]. Related: Condition applicable to an Individual assessee - Income Tax Laws? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for ) Find out the Indexed cost in following cases (separately for each case) for the assessment year 20 19-2020 : (i) Cost of plot acquired in 2006-07 for Rs. 80,000 (ii) Cost of house purchased in 1998-99 for Rs. 90,000 Fair market value on 1-4-2001 being Rs. 1,50,000 (iii) Cost of house purchased in 1996-97 for Rs.2,00,000 but F.M.V. on 1.4.2001 Rs. 4,00,000 [C.I.I. for 2001-02 = 100, for 2006-07 = 122, and for 2018-19 = 280]. Related: Condition applicable to an Individual assessee - Income Tax Laws?.

Solutions for ) Find out the Indexed cost in following cases

(separately for each case) for the assessment

year 20 19-2020 :

(i) Cost of plot acquired in 2006-07

for

Rs. 80,000

(ii) Cost of house purchased in 1998-99 for

Rs. 90,000

Fair market value on

1-4-2001 being

Rs. 1,50,000

(iii) Cost of house purchased in

1996-97 for Rs.2,00,000 but

F.M.V. on 1.4.2001

Rs. 4,00,000

[C.I.I. for 2001-02 = 100, for 2006-07 = 122,

and for 2018-19 = 280]. Related: Condition applicable to an Individual assessee - Income Tax Laws? in English & in Hindi are available as part of our courses for B Com.

Download more important topics, notes, lectures and mock test series for B Com Exam by signing up for free.

Here you can find the meaning of ) Find out the Indexed cost in following cases

(separately for each case) for the assessment

year 20 19-2020 :

(i) Cost of plot acquired in 2006-07

for

Rs. 80,000

(ii) Cost of house purchased in 1998-99 for

Rs. 90,000

Fair market value on

1-4-2001 being

Rs. 1,50,000

(iii) Cost of house purchased in

1996-97 for Rs.2,00,000 but

F.M.V. on 1.4.2001

Rs. 4,00,000

[C.I.I. for 2001-02 = 100, for 2006-07 = 122,

and for 2018-19 = 280]. Related: Condition applicable to an Individual assessee - Income Tax Laws? defined & explained in the simplest way possible. Besides giving the explanation of

) Find out the Indexed cost in following cases

(separately for each case) for the assessment

year 20 19-2020 :

(i) Cost of plot acquired in 2006-07

for

Rs. 80,000

(ii) Cost of house purchased in 1998-99 for

Rs. 90,000

Fair market value on

1-4-2001 being

Rs. 1,50,000

(iii) Cost of house purchased in

1996-97 for Rs.2,00,000 but

F.M.V. on 1.4.2001

Rs. 4,00,000

[C.I.I. for 2001-02 = 100, for 2006-07 = 122,

and for 2018-19 = 280]. Related: Condition applicable to an Individual assessee - Income Tax Laws?, a detailed solution for ) Find out the Indexed cost in following cases

(separately for each case) for the assessment

year 20 19-2020 :

(i) Cost of plot acquired in 2006-07

for

Rs. 80,000

(ii) Cost of house purchased in 1998-99 for

Rs. 90,000

Fair market value on

1-4-2001 being

Rs. 1,50,000

(iii) Cost of house purchased in

1996-97 for Rs.2,00,000 but

F.M.V. on 1.4.2001

Rs. 4,00,000

[C.I.I. for 2001-02 = 100, for 2006-07 = 122,

and for 2018-19 = 280]. Related: Condition applicable to an Individual assessee - Income Tax Laws? has been provided alongside types of ) Find out the Indexed cost in following cases

(separately for each case) for the assessment

year 20 19-2020 :

(i) Cost of plot acquired in 2006-07

for

Rs. 80,000

(ii) Cost of house purchased in 1998-99 for

Rs. 90,000

Fair market value on

1-4-2001 being

Rs. 1,50,000

(iii) Cost of house purchased in

1996-97 for Rs.2,00,000 but

F.M.V. on 1.4.2001

Rs. 4,00,000

[C.I.I. for 2001-02 = 100, for 2006-07 = 122,

and for 2018-19 = 280]. Related: Condition applicable to an Individual assessee - Income Tax Laws? theory, EduRev gives you an

ample number of questions to practice ) Find out the Indexed cost in following cases

(separately for each case) for the assessment

year 20 19-2020 :

(i) Cost of plot acquired in 2006-07

for

Rs. 80,000

(ii) Cost of house purchased in 1998-99 for

Rs. 90,000

Fair market value on

1-4-2001 being

Rs. 1,50,000

(iii) Cost of house purchased in

1996-97 for Rs.2,00,000 but

F.M.V. on 1.4.2001

Rs. 4,00,000

[C.I.I. for 2001-02 = 100, for 2006-07 = 122,

and for 2018-19 = 280]. Related: Condition applicable to an Individual assessee - Income Tax Laws? tests, examples and also practice B Com tests.

|

Explore Courses for B Com exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.