B Com Exam > B Com Questions > Balance sheet as at 31 march 2012 6000 prefer...

Start Learning for Free

Balance sheet as at 31 march 2012 6000 preference share of 100 each. 110000 equity share of 10 each. One 5rs. Equity share to be issued for each 10rs. Preference share dividend in arrar. Dividend on preference share is an arrear from 1 april, 2009 ( Internal Reconstruction)?

Most Upvoted Answer

Balance sheet as at 31 march 2012 6000 preference share of 100 each. 1...

**Balance Sheet as at 31 March 2012**

Preference Share:

- Number of shares: 6,000

- Face value per share: ₹100

Equity Share:

- Number of shares: 1,10,000

- Face value per share: ₹10

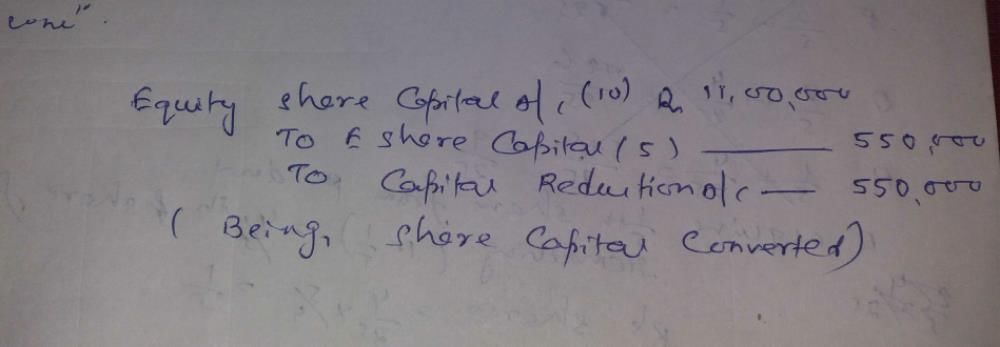

**Issue of Equity Shares**

- For every ₹10 of Preference shares, one ₹5 Equity share will be issued.

- This means that for each Preference share with a face value of ₹100, 10 Equity shares with a face value of ₹5 each will be issued.

**Dividend in Arrear**

- Dividend on Preference shares is in arrear from 1 April 2009.

- This means that the company has not paid the dividend on Preference shares since 1 April 2009.

**Internal Reconstruction**

Internal reconstruction refers to the reorganization of a company's capital structure, usually done to improve its financial position or resolve financial difficulties. It involves altering the rights, liabilities, and capital of the company without winding up or liquidating its operations.

**Explanation**

The given information suggests that the company underwent internal reconstruction, which led to the issuance of new Equity shares and the accumulation of arrears in dividend payments on Preference shares.

When a company undergoes internal reconstruction, it may need to issue new shares to raise additional capital or restructure its existing equity and debt obligations. In this case, the company issued new Equity shares with a face value of ₹5 each for every ₹10 of Preference shares. This suggests that the company was trying to improve its financial position by raising additional funds through the issuance of Equity shares.

Additionally, the fact that the dividend on Preference shares is in arrear from 1 April 2009 indicates that the company has not paid the dividend on these shares since that date. This suggests that the company may have faced financial difficulties or cash flow constraints, leading to the accumulation of dividend arrears.

The Balance Sheet as at 31 March 2012 reflects the company's capital structure after the internal reconstruction, with 6,000 Preference shares and 1,10,000 Equity shares. The exact financial implications of the internal reconstruction and the dividend arrears can be assessed by analyzing the company's financial statements and relevant disclosures.

Overall, the internal reconstruction and dividend arrears indicate that the company underwent significant financial changes and may have faced challenges in meeting its dividend obligations to Preference shareholders.

Preference Share:

- Number of shares: 6,000

- Face value per share: ₹100

Equity Share:

- Number of shares: 1,10,000

- Face value per share: ₹10

**Issue of Equity Shares**

- For every ₹10 of Preference shares, one ₹5 Equity share will be issued.

- This means that for each Preference share with a face value of ₹100, 10 Equity shares with a face value of ₹5 each will be issued.

**Dividend in Arrear**

- Dividend on Preference shares is in arrear from 1 April 2009.

- This means that the company has not paid the dividend on Preference shares since 1 April 2009.

**Internal Reconstruction**

Internal reconstruction refers to the reorganization of a company's capital structure, usually done to improve its financial position or resolve financial difficulties. It involves altering the rights, liabilities, and capital of the company without winding up or liquidating its operations.

**Explanation**

The given information suggests that the company underwent internal reconstruction, which led to the issuance of new Equity shares and the accumulation of arrears in dividend payments on Preference shares.

When a company undergoes internal reconstruction, it may need to issue new shares to raise additional capital or restructure its existing equity and debt obligations. In this case, the company issued new Equity shares with a face value of ₹5 each for every ₹10 of Preference shares. This suggests that the company was trying to improve its financial position by raising additional funds through the issuance of Equity shares.

Additionally, the fact that the dividend on Preference shares is in arrear from 1 April 2009 indicates that the company has not paid the dividend on these shares since that date. This suggests that the company may have faced financial difficulties or cash flow constraints, leading to the accumulation of dividend arrears.

The Balance Sheet as at 31 March 2012 reflects the company's capital structure after the internal reconstruction, with 6,000 Preference shares and 1,10,000 Equity shares. The exact financial implications of the internal reconstruction and the dividend arrears can be assessed by analyzing the company's financial statements and relevant disclosures.

Overall, the internal reconstruction and dividend arrears indicate that the company underwent significant financial changes and may have faced challenges in meeting its dividend obligations to Preference shareholders.

Community Answer

Balance sheet as at 31 march 2012 6000 preference share of 100 each. 1...

|

Explore Courses for B Com exam

|

|

Balance sheet as at 31 march 2012 6000 preference share of 100 each. 110000 equity share of 10 each. One 5rs. Equity share to be issued for each 10rs. Preference share dividend in arrar. Dividend on preference share is an arrear from 1 april, 2009 ( Internal Reconstruction)?

Question Description

Balance sheet as at 31 march 2012 6000 preference share of 100 each. 110000 equity share of 10 each. One 5rs. Equity share to be issued for each 10rs. Preference share dividend in arrar. Dividend on preference share is an arrear from 1 april, 2009 ( Internal Reconstruction)? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about Balance sheet as at 31 march 2012 6000 preference share of 100 each. 110000 equity share of 10 each. One 5rs. Equity share to be issued for each 10rs. Preference share dividend in arrar. Dividend on preference share is an arrear from 1 april, 2009 ( Internal Reconstruction)? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Balance sheet as at 31 march 2012 6000 preference share of 100 each. 110000 equity share of 10 each. One 5rs. Equity share to be issued for each 10rs. Preference share dividend in arrar. Dividend on preference share is an arrear from 1 april, 2009 ( Internal Reconstruction)?.

Balance sheet as at 31 march 2012 6000 preference share of 100 each. 110000 equity share of 10 each. One 5rs. Equity share to be issued for each 10rs. Preference share dividend in arrar. Dividend on preference share is an arrear from 1 april, 2009 ( Internal Reconstruction)? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about Balance sheet as at 31 march 2012 6000 preference share of 100 each. 110000 equity share of 10 each. One 5rs. Equity share to be issued for each 10rs. Preference share dividend in arrar. Dividend on preference share is an arrear from 1 april, 2009 ( Internal Reconstruction)? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Balance sheet as at 31 march 2012 6000 preference share of 100 each. 110000 equity share of 10 each. One 5rs. Equity share to be issued for each 10rs. Preference share dividend in arrar. Dividend on preference share is an arrear from 1 april, 2009 ( Internal Reconstruction)?.

Solutions for Balance sheet as at 31 march 2012 6000 preference share of 100 each. 110000 equity share of 10 each. One 5rs. Equity share to be issued for each 10rs. Preference share dividend in arrar. Dividend on preference share is an arrear from 1 april, 2009 ( Internal Reconstruction)? in English & in Hindi are available as part of our courses for B Com.

Download more important topics, notes, lectures and mock test series for B Com Exam by signing up for free.

Here you can find the meaning of Balance sheet as at 31 march 2012 6000 preference share of 100 each. 110000 equity share of 10 each. One 5rs. Equity share to be issued for each 10rs. Preference share dividend in arrar. Dividend on preference share is an arrear from 1 april, 2009 ( Internal Reconstruction)? defined & explained in the simplest way possible. Besides giving the explanation of

Balance sheet as at 31 march 2012 6000 preference share of 100 each. 110000 equity share of 10 each. One 5rs. Equity share to be issued for each 10rs. Preference share dividend in arrar. Dividend on preference share is an arrear from 1 april, 2009 ( Internal Reconstruction)?, a detailed solution for Balance sheet as at 31 march 2012 6000 preference share of 100 each. 110000 equity share of 10 each. One 5rs. Equity share to be issued for each 10rs. Preference share dividend in arrar. Dividend on preference share is an arrear from 1 april, 2009 ( Internal Reconstruction)? has been provided alongside types of Balance sheet as at 31 march 2012 6000 preference share of 100 each. 110000 equity share of 10 each. One 5rs. Equity share to be issued for each 10rs. Preference share dividend in arrar. Dividend on preference share is an arrear from 1 april, 2009 ( Internal Reconstruction)? theory, EduRev gives you an

ample number of questions to practice Balance sheet as at 31 march 2012 6000 preference share of 100 each. 110000 equity share of 10 each. One 5rs. Equity share to be issued for each 10rs. Preference share dividend in arrar. Dividend on preference share is an arrear from 1 april, 2009 ( Internal Reconstruction)? tests, examples and also practice B Com tests.

|

Explore Courses for B Com exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.