B Com Exam > B Com Questions > Shankar purchased a machine on 1-1-2013 for 3...

Start Learning for Free

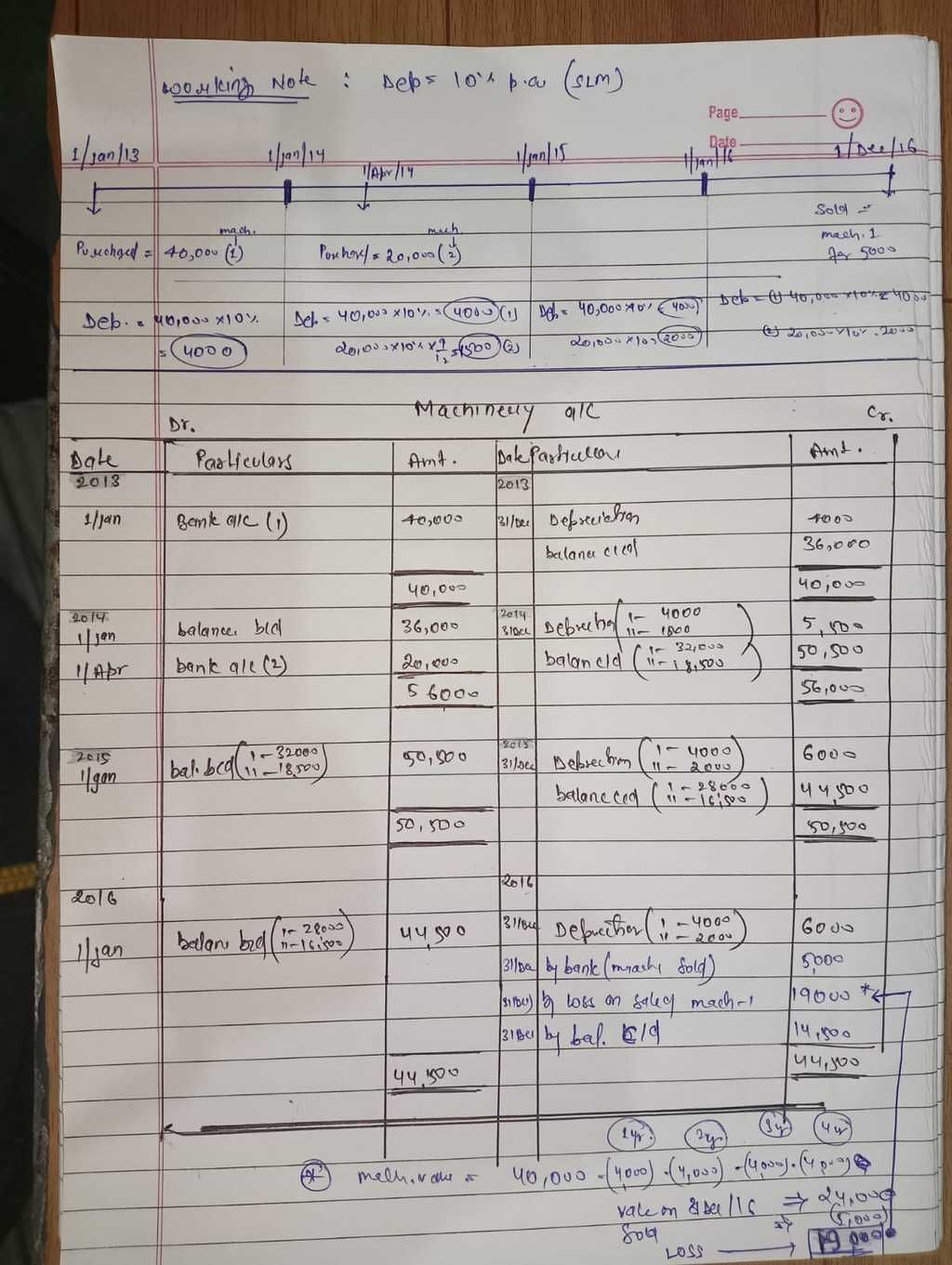

Shankar purchased a machine on 1-1-2013 for 35,000/- and spent 5000/- on its erection on 1-4-2014 he purchased another machine worth 20000/-. On 31-12-2016, machinery purchased on 1-1-2013 become un suitable and sold for 5000/- prepare machinery account under fixed installment method, charging depreciation @ 10% p.a. on all. The machine up to 31-12-2016.?

Most Upvoted Answer

Shankar purchased a machine on 1-1-2013 for 35,000/- and spent 5000/- ...

Solution:

Machinery Account under Fixed Installment Method:

1. Calculation of Depreciation:

- Depreciation = Cost of Machinery * Rate of Depreciation

- Rate of Depreciation = 10% per annum

- For the machinery purchased on 1-1-2013:

- Depreciation for the year 2013 = 35,000 * 10% = 3,500/-

- Depreciation for the year 2014 = (35,000 + 5,000) * 10% = 4,000/-

- Depreciation for the year 2015 = (35,000 + 5,000) * 10% = 4,000/-

- Depreciation for the year 2016 (till 31-12-2016) = (35,000 + 5,000) * 10% = 4,000/-

- For the machinery purchased on 1-4-2014:

- Depreciation for the year 2014 = 20,000 * 10% = 2,000/-

- Depreciation for the year 2015 = 20,000 * 10% = 2,000/-

- Depreciation for the year 2016 (till 31-12-2016) = 20,000 * 10% = 2,000/-

2. Calculation of Annual Installment:

- Annual Installment = (Cost of Machinery - Scrap Value) / Number of Years

- For the machinery purchased on 1-1-2013:

- Annual Installment = (35,000 - 5,000) / 5 = 6,000/-

- For the machinery purchased on 1-4-2014:

- Annual Installment = (20,000 - 0) / 5 = 4,000/-

3. Calculation of Interest:

- Interest = Outstanding Balance * Rate of Interest

- Rate of Interest = 10% per annum

- Outstanding Balance = Cost of Machinery - Total Depreciation

- For the machinery purchased on 1-1-2013:

- Outstanding Balance as on 1-1-2013 = 35,000/-

- Outstanding Balance as on 31-12-2013 = 35,000 - 3,500 = 31,500/-

- Outstanding Balance as on 31-12-2014 = 31,500 - 4,000 = 27,500/-

- Outstanding Balance as on 31-12-2015 = 27,500 - 4,000 = 23,500/-

- Outstanding Balance as on 31-12-2016 = 23,500 - 4,000 = 19,500/-

- For the machinery purchased on 1-4-2014:

- Outstanding Balance as on 1-4-2014 = 20,000/-

- Outstanding Balance as on 31-12-2014 = 20,000 - 2,000 = 18,000/-

- Outstanding Balance as on 31-12-2015 = 18,000 - 2,000 = 16,000/-

- Outstanding Balance

Machinery Account under Fixed Installment Method:

1. Calculation of Depreciation:

- Depreciation = Cost of Machinery * Rate of Depreciation

- Rate of Depreciation = 10% per annum

- For the machinery purchased on 1-1-2013:

- Depreciation for the year 2013 = 35,000 * 10% = 3,500/-

- Depreciation for the year 2014 = (35,000 + 5,000) * 10% = 4,000/-

- Depreciation for the year 2015 = (35,000 + 5,000) * 10% = 4,000/-

- Depreciation for the year 2016 (till 31-12-2016) = (35,000 + 5,000) * 10% = 4,000/-

- For the machinery purchased on 1-4-2014:

- Depreciation for the year 2014 = 20,000 * 10% = 2,000/-

- Depreciation for the year 2015 = 20,000 * 10% = 2,000/-

- Depreciation for the year 2016 (till 31-12-2016) = 20,000 * 10% = 2,000/-

2. Calculation of Annual Installment:

- Annual Installment = (Cost of Machinery - Scrap Value) / Number of Years

- For the machinery purchased on 1-1-2013:

- Annual Installment = (35,000 - 5,000) / 5 = 6,000/-

- For the machinery purchased on 1-4-2014:

- Annual Installment = (20,000 - 0) / 5 = 4,000/-

3. Calculation of Interest:

- Interest = Outstanding Balance * Rate of Interest

- Rate of Interest = 10% per annum

- Outstanding Balance = Cost of Machinery - Total Depreciation

- For the machinery purchased on 1-1-2013:

- Outstanding Balance as on 1-1-2013 = 35,000/-

- Outstanding Balance as on 31-12-2013 = 35,000 - 3,500 = 31,500/-

- Outstanding Balance as on 31-12-2014 = 31,500 - 4,000 = 27,500/-

- Outstanding Balance as on 31-12-2015 = 27,500 - 4,000 = 23,500/-

- Outstanding Balance as on 31-12-2016 = 23,500 - 4,000 = 19,500/-

- For the machinery purchased on 1-4-2014:

- Outstanding Balance as on 1-4-2014 = 20,000/-

- Outstanding Balance as on 31-12-2014 = 20,000 - 2,000 = 18,000/-

- Outstanding Balance as on 31-12-2015 = 18,000 - 2,000 = 16,000/-

- Outstanding Balance

Community Answer

Shankar purchased a machine on 1-1-2013 for 35,000/- and spent 5000/- ...

|

Explore Courses for B Com exam

|

|

Similar B Com Doubts

Shankar purchased a machine on 1-1-2013 for 35,000/- and spent 5000/- on its erection on 1-4-2014 he purchased another machine worth 20000/-. On 31-12-2016, machinery purchased on 1-1-2013 become un suitable and sold for 5000/- prepare machinery account under fixed installment method, charging depreciation @ 10% p.a. on all. The machine up to 31-12-2016.?

Question Description

Shankar purchased a machine on 1-1-2013 for 35,000/- and spent 5000/- on its erection on 1-4-2014 he purchased another machine worth 20000/-. On 31-12-2016, machinery purchased on 1-1-2013 become un suitable and sold for 5000/- prepare machinery account under fixed installment method, charging depreciation @ 10% p.a. on all. The machine up to 31-12-2016.? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about Shankar purchased a machine on 1-1-2013 for 35,000/- and spent 5000/- on its erection on 1-4-2014 he purchased another machine worth 20000/-. On 31-12-2016, machinery purchased on 1-1-2013 become un suitable and sold for 5000/- prepare machinery account under fixed installment method, charging depreciation @ 10% p.a. on all. The machine up to 31-12-2016.? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Shankar purchased a machine on 1-1-2013 for 35,000/- and spent 5000/- on its erection on 1-4-2014 he purchased another machine worth 20000/-. On 31-12-2016, machinery purchased on 1-1-2013 become un suitable and sold for 5000/- prepare machinery account under fixed installment method, charging depreciation @ 10% p.a. on all. The machine up to 31-12-2016.?.

Shankar purchased a machine on 1-1-2013 for 35,000/- and spent 5000/- on its erection on 1-4-2014 he purchased another machine worth 20000/-. On 31-12-2016, machinery purchased on 1-1-2013 become un suitable and sold for 5000/- prepare machinery account under fixed installment method, charging depreciation @ 10% p.a. on all. The machine up to 31-12-2016.? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about Shankar purchased a machine on 1-1-2013 for 35,000/- and spent 5000/- on its erection on 1-4-2014 he purchased another machine worth 20000/-. On 31-12-2016, machinery purchased on 1-1-2013 become un suitable and sold for 5000/- prepare machinery account under fixed installment method, charging depreciation @ 10% p.a. on all. The machine up to 31-12-2016.? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Shankar purchased a machine on 1-1-2013 for 35,000/- and spent 5000/- on its erection on 1-4-2014 he purchased another machine worth 20000/-. On 31-12-2016, machinery purchased on 1-1-2013 become un suitable and sold for 5000/- prepare machinery account under fixed installment method, charging depreciation @ 10% p.a. on all. The machine up to 31-12-2016.?.

Solutions for Shankar purchased a machine on 1-1-2013 for 35,000/- and spent 5000/- on its erection on 1-4-2014 he purchased another machine worth 20000/-. On 31-12-2016, machinery purchased on 1-1-2013 become un suitable and sold for 5000/- prepare machinery account under fixed installment method, charging depreciation @ 10% p.a. on all. The machine up to 31-12-2016.? in English & in Hindi are available as part of our courses for B Com.

Download more important topics, notes, lectures and mock test series for B Com Exam by signing up for free.

Here you can find the meaning of Shankar purchased a machine on 1-1-2013 for 35,000/- and spent 5000/- on its erection on 1-4-2014 he purchased another machine worth 20000/-. On 31-12-2016, machinery purchased on 1-1-2013 become un suitable and sold for 5000/- prepare machinery account under fixed installment method, charging depreciation @ 10% p.a. on all. The machine up to 31-12-2016.? defined & explained in the simplest way possible. Besides giving the explanation of

Shankar purchased a machine on 1-1-2013 for 35,000/- and spent 5000/- on its erection on 1-4-2014 he purchased another machine worth 20000/-. On 31-12-2016, machinery purchased on 1-1-2013 become un suitable and sold for 5000/- prepare machinery account under fixed installment method, charging depreciation @ 10% p.a. on all. The machine up to 31-12-2016.?, a detailed solution for Shankar purchased a machine on 1-1-2013 for 35,000/- and spent 5000/- on its erection on 1-4-2014 he purchased another machine worth 20000/-. On 31-12-2016, machinery purchased on 1-1-2013 become un suitable and sold for 5000/- prepare machinery account under fixed installment method, charging depreciation @ 10% p.a. on all. The machine up to 31-12-2016.? has been provided alongside types of Shankar purchased a machine on 1-1-2013 for 35,000/- and spent 5000/- on its erection on 1-4-2014 he purchased another machine worth 20000/-. On 31-12-2016, machinery purchased on 1-1-2013 become un suitable and sold for 5000/- prepare machinery account under fixed installment method, charging depreciation @ 10% p.a. on all. The machine up to 31-12-2016.? theory, EduRev gives you an

ample number of questions to practice Shankar purchased a machine on 1-1-2013 for 35,000/- and spent 5000/- on its erection on 1-4-2014 he purchased another machine worth 20000/-. On 31-12-2016, machinery purchased on 1-1-2013 become un suitable and sold for 5000/- prepare machinery account under fixed installment method, charging depreciation @ 10% p.a. on all. The machine up to 31-12-2016.? tests, examples and also practice B Com tests.

|

Explore Courses for B Com exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.