Commerce Exam > Commerce Questions > ?What is difference between Preference share ...

Start Learning for Free

What is difference between Preference share and Equity share.?

Verified Answer

?What is difference between Preference share and Equity share.?

Key difference is that while Preference shareholders enjoy the benefit of receiving their dividend distribution first; the equity shareholders enjoy voting rights in major company decisions, including mergers or acquisitions.

A Company can issue two types of shares viz. Equity Shares and Preference Shares. Equity shares are also known as Ordinary Shares. While Preference shareholders enjoy the benefit of receiving their dividend distribution first; the equity shareholders enjoy voting rights in major company decisions, including mergers or acquisitions. Preference shares have the right to receive dividend at a fixed rate before any dividend is paid on the equity shares. Further, when the company is wound up, they have a right to return of the capital before that of equity shares.

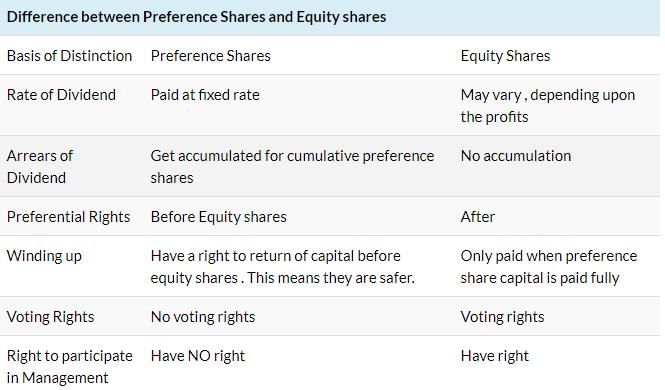

The key differences between preference shares and equity shares are listed in the following table:

This question is part of UPSC exam. View all Commerce courses

This question is part of UPSC exam. View all Commerce courses

Most Upvoted Answer

?What is difference between Preference share and Equity share.?

Difference between PREFERENCE share and EQUITY share.

(1)....They have a right to receive DIVIDEND at a fixed rate before any dividend is paid on the equity shares.

(2)... on the WINDING up of the company they have right to return of capital before anything is paid to equity shareholder.

(3)... While PREFERENCE shares enjoy benefits of being DIVIDEND paid first but at the same time EQUITY shares which are also called as ordinary shares, they enjoy VOTING RIGHTS in major decision making by companies , Mergers and acquisitions including

(1)....They have a right to receive DIVIDEND at a fixed rate before any dividend is paid on the equity shares.

(2)... on the WINDING up of the company they have right to return of capital before anything is paid to equity shareholder.

(3)... While PREFERENCE shares enjoy benefits of being DIVIDEND paid first but at the same time EQUITY shares which are also called as ordinary shares, they enjoy VOTING RIGHTS in major decision making by companies , Mergers and acquisitions including

Community Answer

?What is difference between Preference share and Equity share.?

Difference between Preference Shares and Equity Shares

Introduction:

When it comes to raising capital, companies have different options, including issuing preference shares and equity shares. While both types of shares represent ownership in a company, they have distinct characteristics and rights. This article aims to explain the key differences between preference shares and equity shares.

1. Ownership:

- Preference Shares: Preference shares represent a form of ownership in a company, just like equity shares. However, preference shareholders do not have voting rights in the company's decision-making process.

- Equity Shares: On the other hand, equity shares represent full ownership in a company and entitle the shareholders to voting rights in the company's affairs.

2. Dividends:

- Preference Shares: Preference shareholders are entitled to receive fixed dividends, which are paid out before equity shareholders receive any dividends. These dividends are usually at a predetermined rate and have priority over equity shareholders.

- Equity Shares: Equity shareholders receive dividends after the preference shareholders have been paid. The amount of dividend paid to equity shareholders depends on the company's profitability and the decision of the board of directors.

3. Repayment Priority:

- Preference Shares: In the event of the company's liquidation or winding up, preference shareholders have a higher claim on the company's assets compared to equity shareholders. They are given priority in the repayment of their capital.

- Equity Shares: Equity shareholders have the lowest priority in the repayment of capital during the liquidation process. They are entitled to the residual assets after all other obligations, including preference share repayments, have been fulfilled.

4. Risk and Return:

- Preference Shares: Preference shares are considered less risky compared to equity shares. They offer a fixed rate of return in the form of dividends, which makes them more attractive to risk-averse investors.

- Equity Shares: Equity shares carry a higher level of risk as the returns are not fixed. The dividends paid to equity shareholders depend on the company's profitability and the decision of the board of directors.

Conclusion:

In summary, preference shares and equity shares differ in terms of ownership, dividend rights, repayment priority, and risk and return characteristics. Preference shares provide a fixed rate of return, priority in dividend payments, and repayment during liquidation. On the other hand, equity shares offer voting rights, variable dividends, and residual claim on the company's assets. Understanding these differences will help investors make informed decisions based on their risk appetite and investment objectives.

Introduction:

When it comes to raising capital, companies have different options, including issuing preference shares and equity shares. While both types of shares represent ownership in a company, they have distinct characteristics and rights. This article aims to explain the key differences between preference shares and equity shares.

1. Ownership:

- Preference Shares: Preference shares represent a form of ownership in a company, just like equity shares. However, preference shareholders do not have voting rights in the company's decision-making process.

- Equity Shares: On the other hand, equity shares represent full ownership in a company and entitle the shareholders to voting rights in the company's affairs.

2. Dividends:

- Preference Shares: Preference shareholders are entitled to receive fixed dividends, which are paid out before equity shareholders receive any dividends. These dividends are usually at a predetermined rate and have priority over equity shareholders.

- Equity Shares: Equity shareholders receive dividends after the preference shareholders have been paid. The amount of dividend paid to equity shareholders depends on the company's profitability and the decision of the board of directors.

3. Repayment Priority:

- Preference Shares: In the event of the company's liquidation or winding up, preference shareholders have a higher claim on the company's assets compared to equity shareholders. They are given priority in the repayment of their capital.

- Equity Shares: Equity shareholders have the lowest priority in the repayment of capital during the liquidation process. They are entitled to the residual assets after all other obligations, including preference share repayments, have been fulfilled.

4. Risk and Return:

- Preference Shares: Preference shares are considered less risky compared to equity shares. They offer a fixed rate of return in the form of dividends, which makes them more attractive to risk-averse investors.

- Equity Shares: Equity shares carry a higher level of risk as the returns are not fixed. The dividends paid to equity shareholders depend on the company's profitability and the decision of the board of directors.

Conclusion:

In summary, preference shares and equity shares differ in terms of ownership, dividend rights, repayment priority, and risk and return characteristics. Preference shares provide a fixed rate of return, priority in dividend payments, and repayment during liquidation. On the other hand, equity shares offer voting rights, variable dividends, and residual claim on the company's assets. Understanding these differences will help investors make informed decisions based on their risk appetite and investment objectives.

Attention Commerce Students!

To make sure you are not studying endlessly, EduRev has designed Commerce study material, with Structured Courses, Videos, & Test Series. Plus get personalized analysis, doubt solving and improvement plans to achieve a great score in Commerce.

|

Explore Courses for Commerce exam

|

|

Similar Commerce Doubts

?What is difference between Preference share and Equity share.?

Question Description

?What is difference between Preference share and Equity share.? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about ?What is difference between Preference share and Equity share.? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for ?What is difference between Preference share and Equity share.?.

?What is difference between Preference share and Equity share.? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about ?What is difference between Preference share and Equity share.? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for ?What is difference between Preference share and Equity share.?.

Solutions for ?What is difference between Preference share and Equity share.? in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of ?What is difference between Preference share and Equity share.? defined & explained in the simplest way possible. Besides giving the explanation of

?What is difference between Preference share and Equity share.?, a detailed solution for ?What is difference between Preference share and Equity share.? has been provided alongside types of ?What is difference between Preference share and Equity share.? theory, EduRev gives you an

ample number of questions to practice ?What is difference between Preference share and Equity share.? tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.