Commerce Exam > Commerce Questions > Preliminary expenses area)Revenue receipt.b)D...

Start Learning for Free

Preliminary expenses are

- a)Revenue receipt.

- b)Deferred revenue receipt

- c)Fictitious asset

- d)Deferred capital receipt.

Correct answer is option 'C'. Can you explain this answer?

| FREE This question is part of | Download PDF Attempt this Test |

Most Upvoted Answer

Preliminary expenses area)Revenue receipt.b)Deferred revenue receiptc)...

Free Test

FREE

| Start Free Test |

Community Answer

Preliminary expenses area)Revenue receipt.b)Deferred revenue receiptc)...

Preliminary expenses:

Preliminary expenses refer to the costs incurred by a company before its incorporation or during the early stages of its operations. These expenses are considered as an investment in the establishment of the company and are not directly related to the generation of revenue.

Preliminary expenses can be categorized into different types based on their nature and treatment in the financial statements. The options provided in the question are:

A: Revenue receipt:

- Revenue receipts are the income received by a company from its regular business activities.

- Preliminary expenses do not fall under the category of revenue receipts as they are not generated from the normal business operations.

- Therefore, option A is incorrect.

B: Deferred revenue receipt:

- Deferred revenue receipts are the income received in advance for goods or services that will be provided in the future.

- Preliminary expenses are not deferred revenue receipts as they are not related to the future provision of goods or services.

- Therefore, option B is incorrect.

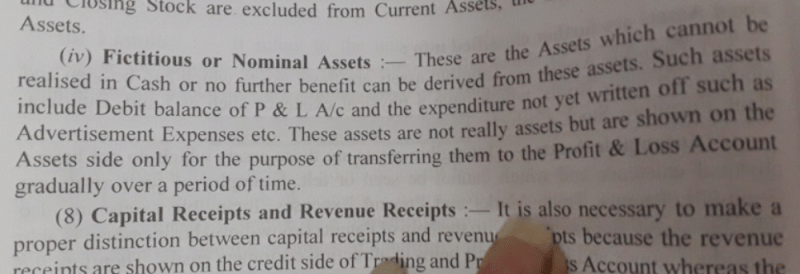

C: Fictitious asset:

- Fictitious assets are those assets that do not have a physical existence but are represented by intangible rights or benefits.

- Preliminary expenses are considered as fictitious assets as they represent the expenditure incurred in the initial stages of the company's formation.

- These expenses are written off over a period of time and are not considered as tangible assets.

- Therefore, option C is correct.

D: Deferred capital receipt:

- Deferred capital receipts are the funds received by a company in advance for the issuance of shares or debentures.

- Preliminary expenses are not deferred capital receipts as they are not directly associated with the capital raised by the company.

- Therefore, option D is incorrect.

In conclusion, the correct answer is option C: Fictitious asset. Preliminary expenses are treated as fictitious assets in the financial statements of a company.

Preliminary expenses refer to the costs incurred by a company before its incorporation or during the early stages of its operations. These expenses are considered as an investment in the establishment of the company and are not directly related to the generation of revenue.

Preliminary expenses can be categorized into different types based on their nature and treatment in the financial statements. The options provided in the question are:

A: Revenue receipt:

- Revenue receipts are the income received by a company from its regular business activities.

- Preliminary expenses do not fall under the category of revenue receipts as they are not generated from the normal business operations.

- Therefore, option A is incorrect.

B: Deferred revenue receipt:

- Deferred revenue receipts are the income received in advance for goods or services that will be provided in the future.

- Preliminary expenses are not deferred revenue receipts as they are not related to the future provision of goods or services.

- Therefore, option B is incorrect.

C: Fictitious asset:

- Fictitious assets are those assets that do not have a physical existence but are represented by intangible rights or benefits.

- Preliminary expenses are considered as fictitious assets as they represent the expenditure incurred in the initial stages of the company's formation.

- These expenses are written off over a period of time and are not considered as tangible assets.

- Therefore, option C is correct.

D: Deferred capital receipt:

- Deferred capital receipts are the funds received by a company in advance for the issuance of shares or debentures.

- Preliminary expenses are not deferred capital receipts as they are not directly associated with the capital raised by the company.

- Therefore, option D is incorrect.

In conclusion, the correct answer is option C: Fictitious asset. Preliminary expenses are treated as fictitious assets in the financial statements of a company.

Attention Commerce Students!

To make sure you are not studying endlessly, EduRev has designed Commerce study material, with Structured Courses, Videos, & Test Series. Plus get personalized analysis, doubt solving and improvement plans to achieve a great score in Commerce.

|

Explore Courses for Commerce exam

|

|

Similar Commerce Doubts

Preliminary expenses area)Revenue receipt.b)Deferred revenue receiptc)Fictitious assetd)Deferred capital receipt.Correct answer is option 'C'. Can you explain this answer?

Question Description

Preliminary expenses area)Revenue receipt.b)Deferred revenue receiptc)Fictitious assetd)Deferred capital receipt.Correct answer is option 'C'. Can you explain this answer? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about Preliminary expenses area)Revenue receipt.b)Deferred revenue receiptc)Fictitious assetd)Deferred capital receipt.Correct answer is option 'C'. Can you explain this answer? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Preliminary expenses area)Revenue receipt.b)Deferred revenue receiptc)Fictitious assetd)Deferred capital receipt.Correct answer is option 'C'. Can you explain this answer?.

Preliminary expenses area)Revenue receipt.b)Deferred revenue receiptc)Fictitious assetd)Deferred capital receipt.Correct answer is option 'C'. Can you explain this answer? for Commerce 2024 is part of Commerce preparation. The Question and answers have been prepared according to the Commerce exam syllabus. Information about Preliminary expenses area)Revenue receipt.b)Deferred revenue receiptc)Fictitious assetd)Deferred capital receipt.Correct answer is option 'C'. Can you explain this answer? covers all topics & solutions for Commerce 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for Preliminary expenses area)Revenue receipt.b)Deferred revenue receiptc)Fictitious assetd)Deferred capital receipt.Correct answer is option 'C'. Can you explain this answer?.

Solutions for Preliminary expenses area)Revenue receipt.b)Deferred revenue receiptc)Fictitious assetd)Deferred capital receipt.Correct answer is option 'C'. Can you explain this answer? in English & in Hindi are available as part of our courses for Commerce.

Download more important topics, notes, lectures and mock test series for Commerce Exam by signing up for free.

Here you can find the meaning of Preliminary expenses area)Revenue receipt.b)Deferred revenue receiptc)Fictitious assetd)Deferred capital receipt.Correct answer is option 'C'. Can you explain this answer? defined & explained in the simplest way possible. Besides giving the explanation of

Preliminary expenses area)Revenue receipt.b)Deferred revenue receiptc)Fictitious assetd)Deferred capital receipt.Correct answer is option 'C'. Can you explain this answer?, a detailed solution for Preliminary expenses area)Revenue receipt.b)Deferred revenue receiptc)Fictitious assetd)Deferred capital receipt.Correct answer is option 'C'. Can you explain this answer? has been provided alongside types of Preliminary expenses area)Revenue receipt.b)Deferred revenue receiptc)Fictitious assetd)Deferred capital receipt.Correct answer is option 'C'. Can you explain this answer? theory, EduRev gives you an

ample number of questions to practice Preliminary expenses area)Revenue receipt.b)Deferred revenue receiptc)Fictitious assetd)Deferred capital receipt.Correct answer is option 'C'. Can you explain this answer? tests, examples and also practice Commerce tests.

|

Explore Courses for Commerce exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.