B Com Exam > B Com Questions > The instrument trade in the financial markets...

Start Learning for Free

The instrument trade in the financial markets?

Verified Answer

The instrument trade in the financial markets?

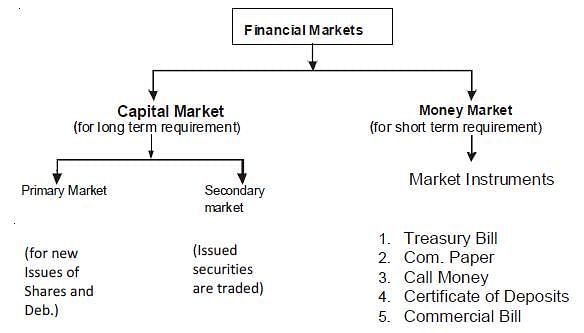

The financial instruments used in capital markets include stocks and bonds, but the instruments used in the money markets include deposits, collateral loans, acceptances and bills of exchange.

This question is part of UPSC exam. View all B Com courses

This question is part of UPSC exam. View all B Com courses

Most Upvoted Answer

The instrument trade in the financial markets?

Community Answer

The instrument trade in the financial markets?

Instrument Trade in Financial Markets

The instrument trade in financial markets involves buying and selling various financial instruments such as stocks, bonds, currencies, commodities, and derivatives. These instruments are traded on various platforms like stock exchanges, forex markets, and over-the-counter markets.

Types of Financial Instruments

- Stocks: Represent ownership in a company and can be bought and sold on stock exchanges.

- Bonds: Represent debt issued by governments or corporations and provide fixed income to investors.

- Currencies: Traded in the forex market where investors speculate on the value of one currency against another.

- Commodities: Include physical goods like gold, oil, and agricultural products that are traded on commodity exchanges.

- Derivatives: Include options, futures, and swaps which derive their value from an underlying asset and are used for hedging or speculation.

Trading Strategies

- Day Trading: Involves buying and selling financial instruments within the same trading day to profit from short-term price movements.

- Swing Trading: Involves holding positions for several days or weeks to capture medium-term trends in the market.

- Long-Term Investing: Involves buying and holding financial instruments for an extended period to benefit from the growth of the underlying asset.

Risks and Rewards

- Risks: Financial markets are volatile and subject to various risks such as market risk, credit risk, and liquidity risk.

- Rewards: Investors can earn profits through capital appreciation, dividends, interest payments, and currency fluctuations.

In conclusion, the instrument trade in financial markets offers opportunities for investors to diversify their portfolios, manage risks, and achieve their financial goals through strategic trading and investment decisions.

The instrument trade in financial markets involves buying and selling various financial instruments such as stocks, bonds, currencies, commodities, and derivatives. These instruments are traded on various platforms like stock exchanges, forex markets, and over-the-counter markets.

Types of Financial Instruments

- Stocks: Represent ownership in a company and can be bought and sold on stock exchanges.

- Bonds: Represent debt issued by governments or corporations and provide fixed income to investors.

- Currencies: Traded in the forex market where investors speculate on the value of one currency against another.

- Commodities: Include physical goods like gold, oil, and agricultural products that are traded on commodity exchanges.

- Derivatives: Include options, futures, and swaps which derive their value from an underlying asset and are used for hedging or speculation.

Trading Strategies

- Day Trading: Involves buying and selling financial instruments within the same trading day to profit from short-term price movements.

- Swing Trading: Involves holding positions for several days or weeks to capture medium-term trends in the market.

- Long-Term Investing: Involves buying and holding financial instruments for an extended period to benefit from the growth of the underlying asset.

Risks and Rewards

- Risks: Financial markets are volatile and subject to various risks such as market risk, credit risk, and liquidity risk.

- Rewards: Investors can earn profits through capital appreciation, dividends, interest payments, and currency fluctuations.

In conclusion, the instrument trade in financial markets offers opportunities for investors to diversify their portfolios, manage risks, and achieve their financial goals through strategic trading and investment decisions.

|

Explore Courses for B Com exam

|

|

The instrument trade in the financial markets?

Question Description

The instrument trade in the financial markets? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about The instrument trade in the financial markets? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for The instrument trade in the financial markets?.

The instrument trade in the financial markets? for B Com 2024 is part of B Com preparation. The Question and answers have been prepared according to the B Com exam syllabus. Information about The instrument trade in the financial markets? covers all topics & solutions for B Com 2024 Exam. Find important definitions, questions, meanings, examples, exercises and tests below for The instrument trade in the financial markets?.

Solutions for The instrument trade in the financial markets? in English & in Hindi are available as part of our courses for B Com.

Download more important topics, notes, lectures and mock test series for B Com Exam by signing up for free.

Here you can find the meaning of The instrument trade in the financial markets? defined & explained in the simplest way possible. Besides giving the explanation of

The instrument trade in the financial markets?, a detailed solution for The instrument trade in the financial markets? has been provided alongside types of The instrument trade in the financial markets? theory, EduRev gives you an

ample number of questions to practice The instrument trade in the financial markets? tests, examples and also practice B Com tests.

|

Explore Courses for B Com exam

|

|

Suggested Free Tests

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.