Accounting for Partnership Firms-Fundamentals (Part - 3) | Accountancy Class 12 - Commerce PDF Download

Page No 2.82:

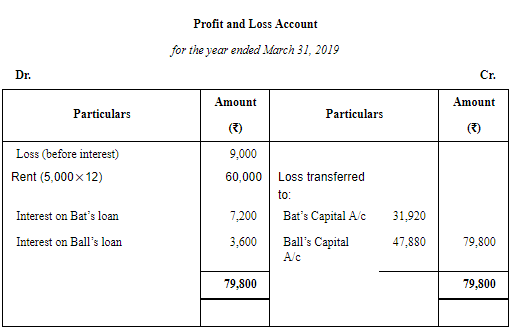

Question 9: Bat and Ball are partners sharing the profits in the ratio of 2 : 3 with capitals of ₹ 1,20,000 and ₹ 60,000 respectively. On 1st October, 2018, Bat and Ball gave loans of ₹ 2,40,000 and ₹ 1,20,000 respectively to the firm. Bat had allowed the firm to use his property for business for a monthly rent of ₹ 5,000. The loss for the year ended 31st March, 2019 before rent and interest amounted to ₹ 9,000. Show distribution of profit/loss.

ANSWER:

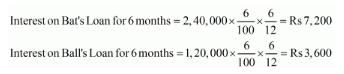

Working Notes:

WN 1 Interest on Partner’s Loan

WN 2 Distribution of Loss to the Partners

Page No 2.82:

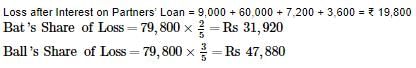

Question 10: A and B are partners. A's Capital is ₹ 1,00,000 and B's Capital is ₹ 60,000. Interest on capital is payable @ 6% p.a. B is entitled to a salary of ₹ 3,000 per month. Profit for the current year before interest and salary to B is ₹ 80,000.

Prepare Profit and Loss Appropriation Account.

ANSWER:

Working Notes:

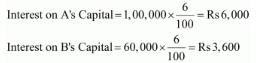

WN1 Calculation of Interest on Capital

WN 2 Calculation of Profit Share of each Partner

Divisible Profit = 80,000 – 9,600 – 36,000 = 34,400

Page No 2.82:

Question 11: X, Y and Z are partners in a firm sharing profits in 2 : 2 : 1 ratio. The fixed capitals of the partners were : X ₹5,00,000; Y ₹ 5,00,000 and Z ₹ 2,50,000 respectively. The Partnership Deed provides that interest on capital is to be allowed @ 10% p.a. Z is to be allowed a salary of ₹ 2,000 per month. The profit of the firm for the year ended 31st March, 2018 after debiting Z's salary was ₹ 4,00,000.

Prepare Profit and Loss Appropriation Account.

ANSWER:

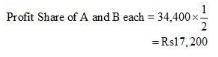

Working Notes:

WN 1 Salary to Z has not been debited to Profit and Loss Appropriation Account. This is because Profit of Rs 4,00,000 is given after adjusting the Z’s salary.

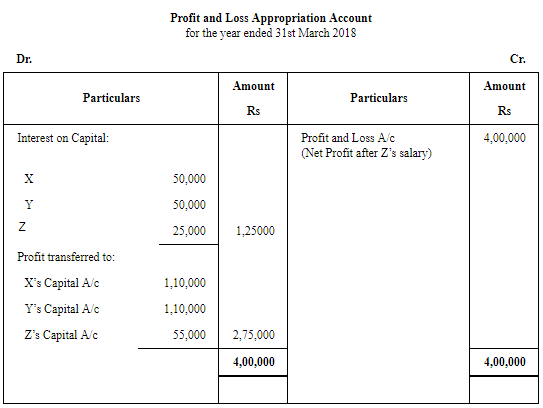

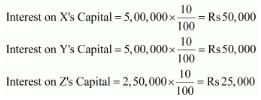

WN 2 Calculation of Interest on Capital

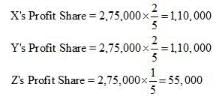

WN 3 Calculation of Profit Share of each Partner

Divisible of Profit after Interest on Capital = Rs 4,00,000 − Rs 1,25,000 = Rs 2,75,000

Profit sharing ratio = 2 : 2 : 1

Page No 2.82:

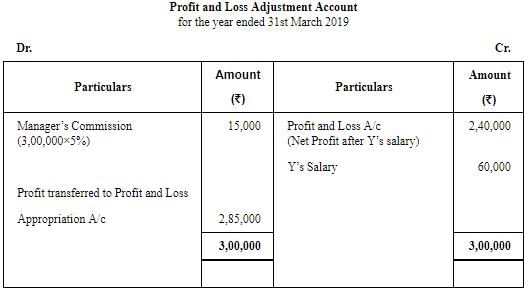

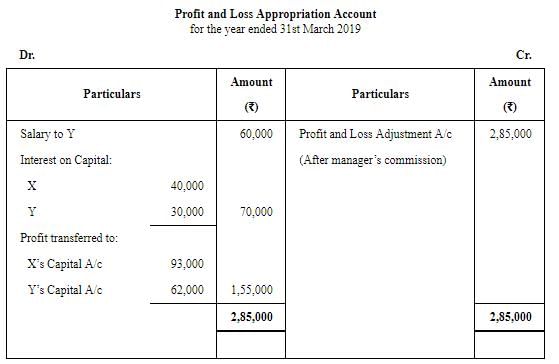

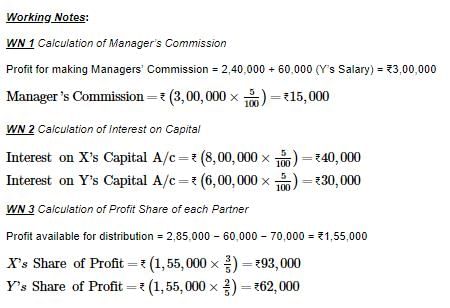

Question 12: X and Y are partners sharing profits in the ratio of 3 : 2 with capitals of ₹ 8,00,000 and ₹ 6,00,000 respectively. Interest on capital is agreed @ 5% p.a. Y is to be allowed an annual salary of ₹ 60,000 which has not been withdrawn. Profit for the year ended 31st March, 2019 before interest on capital but after charging Y's salary amounted to ₹ 2,40,000.

A provision of 5% of the profit is to be made in respect commission to the manager. Prepare an account showing the allocation profits.

ANSWER:

Page No 2.82:

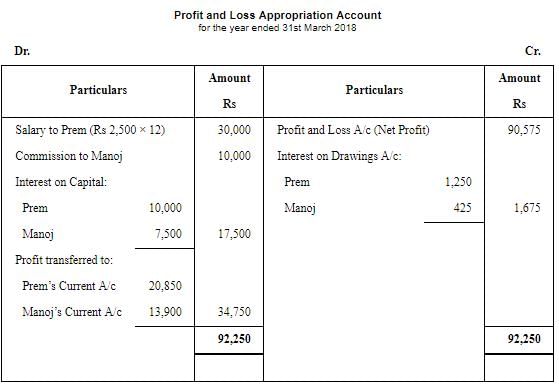

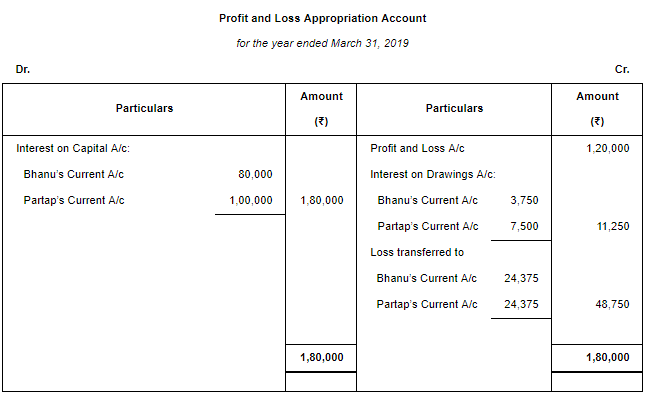

Question 13: Prem and Manoj are partners in a firm sharing profits in the ratio of 3 : 2. The Partnership Deed provided that Prem was to be paid salary of ₹ 2,500 per month and Manoj was to ger a commission of ₹ 10,000 per year. Interest on capital was to be allowed @ 5% p.a. and interest on drawings was to be charged @ 6% p.a. Interest on Prem's drawings was ₹ 1,250 and on Manoj's drawings was ₹ 425. Interest on Capitals of the partners were ₹ 10,000 and ₹ 7,500 respectively. The firm earned a profit of ₹ 90,575 for the year ended 31st March, 2018.

Prepare Profit and Loss Appropriation Account of the firm.

ANSWER:

Page No 2.83:

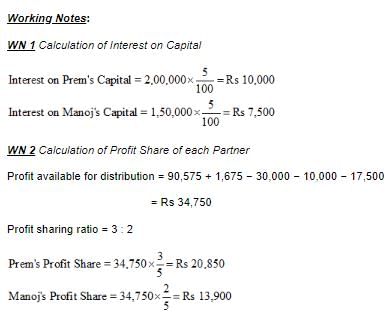

Question 14: Reema and Seema are partners sharing profits equally. The Partnership Deed provides that both Reema and Seema will get monthly salary of Rs 15,000 each, Interest on Capital will be allowed @ 5% p.a. and Interest on Drawings will be charged @ 10% p.a. Their capitals were Rs 5,00,000 each and drawings during the year were Rs 60,000 each.

The firm incurred a loss of Rs 1,00,000 during the year ended 31st March, 2018.

Prepare Profit and Loss Appropriation Account for the year ended 31st March, 2018.

ANSWER:

Note: Since the firm has incurred loss, no interest on capital and salary will be allowed to the partners. However, interest on drawings will be charged from each of them @ 10% p.a. on the amounts withdrawn by them for an average period of six months.

Page No 2.83:

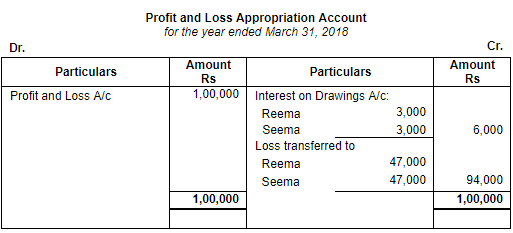

Question 15: Bhanu and Partab are partners sharings profits equally. Their fixed capitals as on 1st April, 2018 are ₹ 8,00,000 and ₹ 10,00,000 respectively. Their drawings during the year were ₹ 50,000 and ₹ 1,00,000 respectively. Interest on Capital is a charge and is to be allowed @ 10% p.a. and interest on drawings is to be charged @ 15% p.a. Net Profit for the year ended 31st March, 2019 was ₹ 1,20,000.

Prepare Profit and Loss Appropriation Account.

ANSWER:

|

42 videos|199 docs|43 tests

|

FAQs on Accounting for Partnership Firms-Fundamentals (Part - 3) - Accountancy Class 12 - Commerce

| 1. What is accounting for partnership firms? |  |

| 2. How are profits and losses distributed in a partnership firm? |  |

| 3. Can a partnership firm have more than one capital account? |  |

| 4. What are the advantages of accounting for partnership firms? |  |

| 5. How are partnership firms taxed? |  |