Amalgamation, Conversion & Sale of Partnership Firms: Notes | Advanced Accounting for CA Intermediate PDF Download

| Table of contents |

|

| Chapter Overview |

|

| Amalgamation of Partnership Firms |

|

| Conversion of Partnership Firm Into a Company |

|

| Partnership-Sale to a Company |

|

Chapter Overview

Amalgamation of Partnership Firms

When two or more partnership firms are amalgamated, the books of the old firm are closed and books of the new firm are opened.

The accounting procedures for the same are:

Closing the books of old firm

(a) Each firm should prepare a Revaluation Account relating to its own assets and liabilities and transfer the balance to the partners’ capital accounts in the profit-sharing ratio.

(b) Entries for raising goodwill should be passed.

(c) Assets and liabilities not taken over by the new firm should be transferred to the capital accounts of partners in the ratio of their capitals.

(d) The new firm should be debited with the difference between the value of assets and liabilities taken over by it; the assets should be credited and liabilities debited.

(e) Partners’ capital accounts should be transferred to the new firm’s account;

Opening the books of the new firm

Debit assets taken out at the agreed values Credit the liabilities taken over, and Credit individual partner’s capital accounts with the closing balances in the erstwhile firm.

When one firm is merged with another existing firm, entries will be in the pattern of winding up in the books of the firm which has ceased to exist. The other firm will record the transaction as that of a business purchase.

Illustration 1:

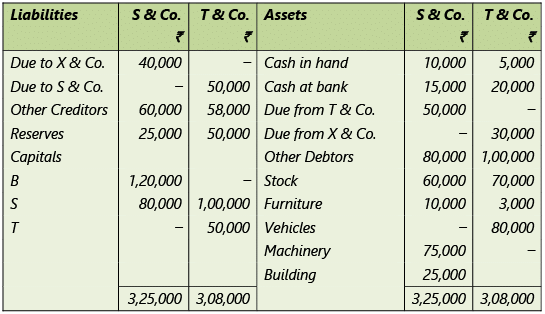

B and S are partners of S & Co. sharing profits and losses in the ratio of 3:1. S and T are partners of T & Co. sharing profits and losses in the ratio of 2:1.

On 31st October, 20X1, they decided to amalgamate and form a new firm M/s. BST & Co. wherein B, S, and T would be partners sharing profits and losses in the ratio of 3:2:1.

Their balance sheets on that date were as under: The amalgamated firm took over the business on the following terms:

The amalgamated firm took over the business on the following terms:

(a) Goodwill of S & Co. was worth ₹ 60,000 and that of T & Co. ₹ 50,000. Goodwill account was not to be opened in the books of the new firm; the adjustments being recorded through capital accounts of the partners.

(b) Building, machinery , and vehicles were taken over at ₹ 50,000, ₹ 90,000 and ₹ 1,00,000 respectively.

(c) Provision for doubtful debts has to be carried forward at ₹ 4,000 in respect of debtors of S & Co. and ₹ 5,000 in respect of debtors of T & Co.

You are required to:

(i) Compute the adjustments necessary for goodwill.

(ii) Pass the journal entries in the books of BST & Co. assuming that excess/deficit capital (taking T’s Capital as base) with reference to share in profits are to be transferred to current accounts.

(i) Adjustment for raising & writing off of goodwill:

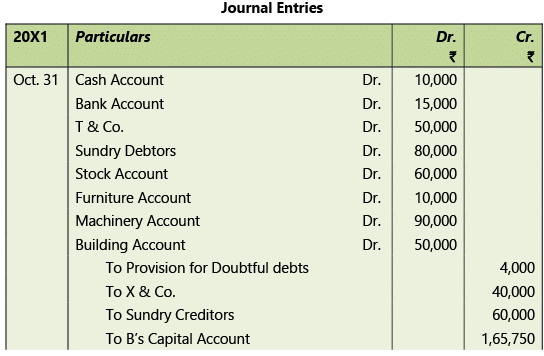

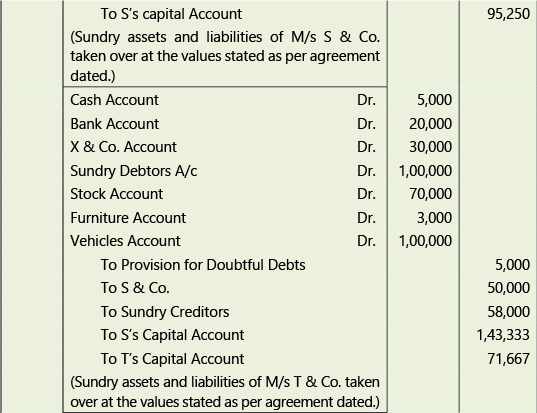

(ii) Books of BST & Co.

Working Notes:

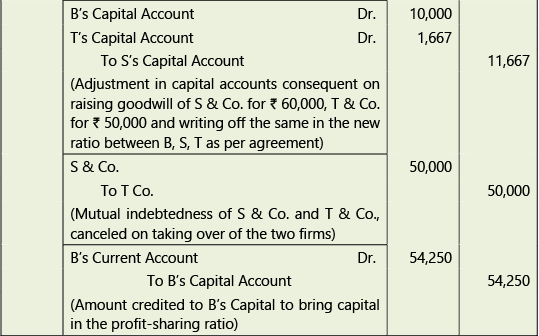

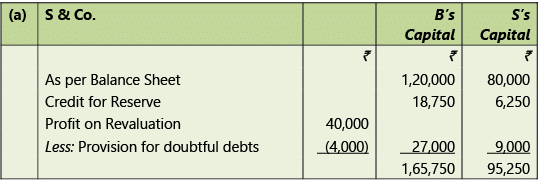

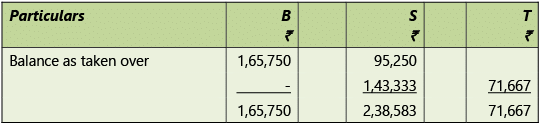

(i) Balance of Capital Accounts on transfer of business to M/s BST & Co.(ii) Capital in the new firm

T’s Capital is ₹ 70,000 and it is 1/6 of total. The total, therefore, is ₹ 4,20,000.

Illustration 2:

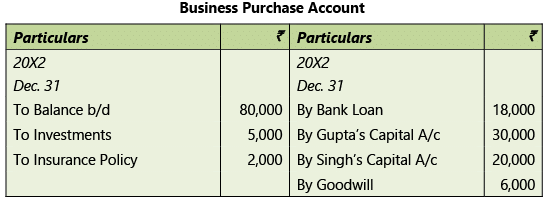

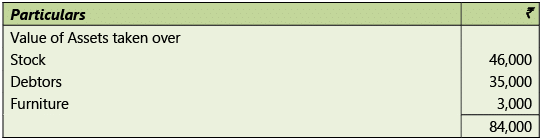

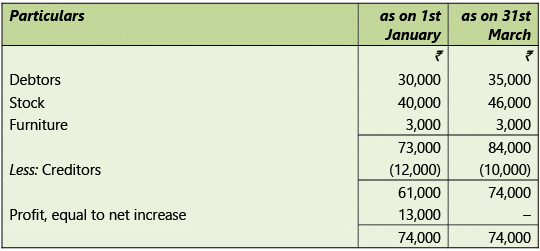

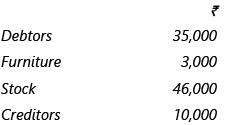

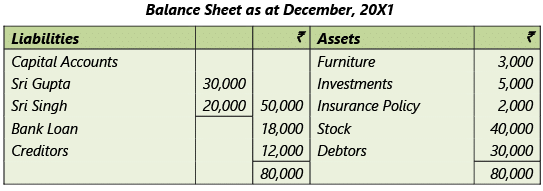

On 31st March 20X2, Sri Raman acquires on payment of ₹ 80,000 the business of M/s Gupta and Singh taking over at book value the following assets and liabilities: There was no change between 1st January, 20X2 and 31st March, 20X2 in the book value of the assets and liabilities not taken over.

There was no change between 1st January, 20X2 and 31st March, 20X2 in the book value of the assets and liabilities not taken over.

The same set of books has been continued after the acquisition and no entries of the acquisition have been passed except for the payment of ₹ 80,000 made by Sri Raman.

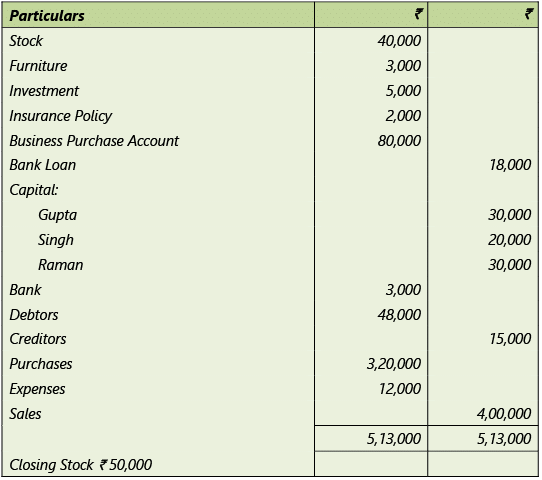

From the following balance sheet and trial balance prepare Business Purchase Account, Profit and Loss Account for the year ended 31st December, 20X2 and Balance Sheet at that date. On 31st December 20X2 the trial balance is:

On 31st December 20X2 the trial balance is:

Profit & Loss Account of Raman for the year ended 31st December, 20X2

Balance Sheet of Raman as on 31st December, 20X2

Working Notes:

(1) Goodwill(2) Increase in net assets upto 31st March 20X2

Illustration 3:

Firm X & Co. consists of partners A and B sharing Profits and Losses in the ratio of 3: 2.

The firm Y & Co. consists of partners B and C sharing Profits and Losses in the ratio of 5: 3.

On 31st March, 20X1 it was decided to amalgamate both the firms and form a new firm XY & Co., wherein A, B, and C would be partners sharing Profits and Losses in the ratio of 4:5:1.

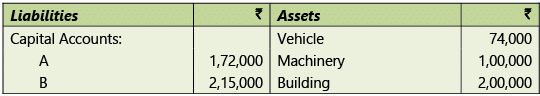

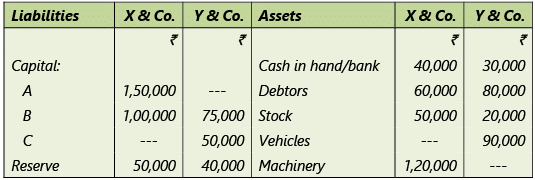

Balance Sheet as at 31.3.20X1

The following were the terms of amalgamation:

(i) Goodwill of X & Co., was valued at ₹ 75,000. Goodwill of Y & Co. was valued at ₹ 40,000. Goodwill account not to be opened in the books of the new firm but adjusted through the Capital accounts of the partners.

(ii) Building, Machinery, and Vehicles are to be taken over at ₹ 2,00,000, ₹ 1,00,000 and ₹ 74,000 respectively.

(iii) Provision for doubtful debts at ₹ 5,000 in respect of X & Co. and ₹ 4,000 in respect of Y & Co. are to be provided.

You are required to:

(i) Show, how the Goodwill value is adjusted amongst the partners.

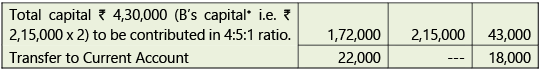

(ii) Prepare the Balance Sheet of XY & Co. as at 31.3.20X 1 by keeping partners’ capital in their profit-sharing ratio by taking capital of ‘B’ as the basis. The excess or deficiency to be kept in the respective Partners’ Current accounts.

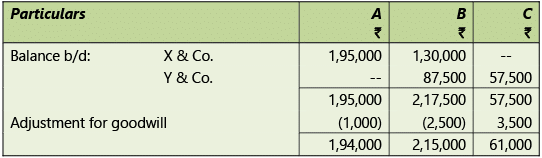

(i) Adjustment for raising and writing off of goodwill

(ii) Balance Sheet of X Y & Co. (New firm) as on 31.3.20X1

Working Notes:

1. Balance of Capital Accounts at the time of amalgamation of firms2. Balance of Capital Accounts in the balance sheet of the new firm as on 31.3.20X1

Conversion of Partnership Firm Into a Company

At times partnerships also are reconstructed like joint-stock companies, with the help of creditors if they are satisfied that if by taking of further risk or forgoing a part of the debt, the chances of recovery of their loan and capital would improve.

It usually entails preparation of Reconstruction Account for determining the past losses which belong to old partners and writing them off to the debit of their capital accounts. If a creditor agrees to join as a partner the whole or only a part of the account standing to the credit of his loan account is transferred to his capital account. For the further development of the business, usually, some fresh capital/loan is required. The amount of loan is placed to the credit of the party contributing the same on such terms and conditions as may have been agreed upon.

When the partnership firm is converted into a company, then the financial statements of the new company will be prepared according to Schedule III to the Companies Act, 2013. The general instructions for preparation of Balance sheet and the Statement of Profit and Loss of the company are given in Schedule III to the Companies Act, 2013.

Illustration 4:

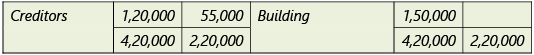

The following is the Balance Sheet of Messers A and B as on 31st March 20X5:

It was agreed that Mr. C is to be admitted for a fifth share in the future profits from 1st April 20X5. He is required to contribute cash towards goodwill and ₹ 10,000 towards capital.

The following further information is furnished:

(i) The partners A and B shared the profits in the ratio 3:2.

(ii) Mr. A was receiving a salary of ₹ 500 p.m. from the very inception of the firm in 20X1 in addition to share of profit.

(iii) The future profit ratio between A, B , and C will be 3:1:1. Mr. A will not get any salary after the admission of Mr. C.

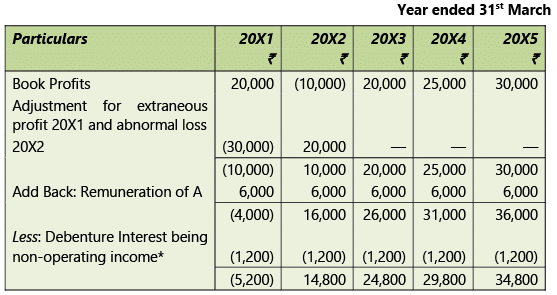

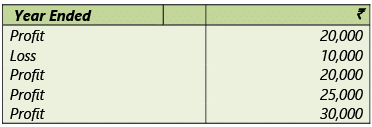

(iv) (a) The goodwill of the firm should be determined on the basis of 2 years’ purchase of the average profits from busi ness of the last 5 years. The particulars of the profits are as under: The above profits and losses are after charging the salary of Mr. A. The profit of the year ended 31st March 20X1 included an extraneous profit of ₹ 30,000 and the loss of the year ended 31st March 20X2 was on account of loss by strike to the extent of ₹ 20,000.

The above profits and losses are after charging the salary of Mr. A. The profit of the year ended 31st March 20X1 included an extraneous profit of ₹ 30,000 and the loss of the year ended 31st March 20X2 was on account of loss by strike to the extent of ₹ 20,000.

(b) It was agreed that the value of the goodwill of the firm should appear in the books of the firm.

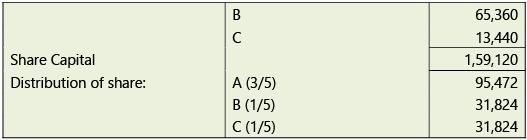

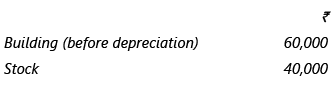

(v) The trading profit for the year ended 31st March, 20X6 was ₹ 40,000 before depreciation.

(vi) The partners had drawn each ₹ 1,000 p.m. as drawings.

(vii) The value of the other assets and liabilities as on 31st March, 20X6 were as under:

(viii) Provide depreciation at 5% on buildings on the closing balance and interest at 6% on A’s loan.

(viii) Provide depreciation at 5% on buildings on the closing balance and interest at 6% on A’s loan.

(ix) They applied for conversion of the firm into a Private Limited Company i.e. ABC Pvt. Ltd. Certificate received on 1-4-20X6. They decided to convert Capital A/cs of the partners into shar e capital in the ratio of 3: 1:1 on the basis of total Capital as on 31-3-20X6. If necessary, partners have to subscribe to fresh capital or withdraw.

Prepare the Statement of Profit and Loss for the year ended 31st March, 20X6 and the Balance Sheet of the company.

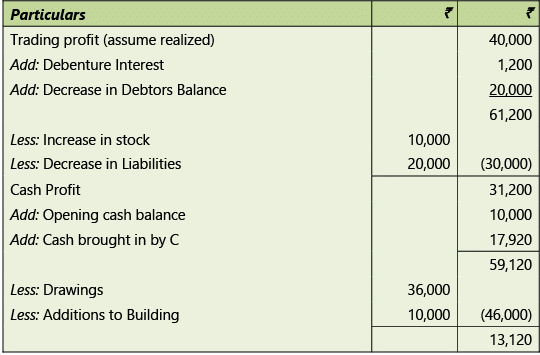

Messers A, B, and C Statement of Profit & Loss for the year ended 31st March, 20X6

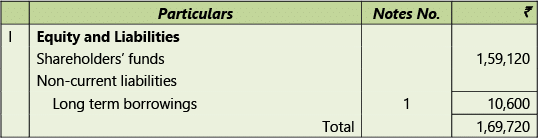

Balance Sheet of the ABC Pvt Ltd. as at 1-4-20X6

Notes to Accounts

Working Notes:

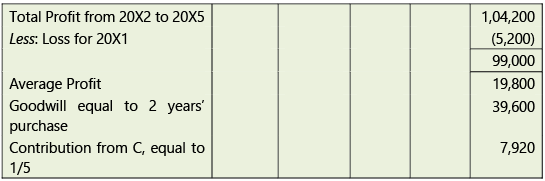

1. Calculation of goodwill:2. Partners’ Capital Accounts as on 31 March 20X6

3. Balance Sheet as on 31st March, 20X6

4. Conversion into Company

A should subscribe shares of ₹ 15,152 (₹ 95,472 – ₹ 80,320) and C should subscribe shares of ₹ 18,384 (₹ 31,824 – ₹ 13,440). B should withdraw ₹ 33,536 (₹ 65,360 – ₹ 31,824) subscribing to shares worth ₹ 31,824.

5. Closing cash balance can be derived as shown below:

Illustration 5:

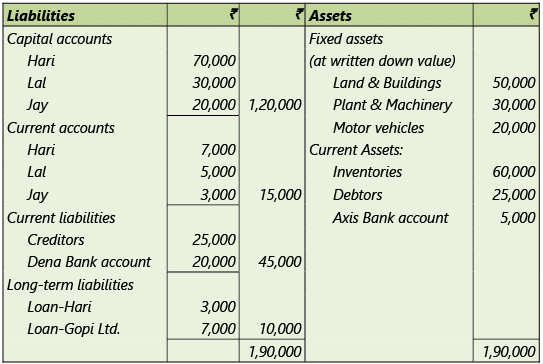

Hari, Lal, and Jay have been in partnership for a number of years, sharing profits/losses in the ratio of 2:2:1 as wholesale stationers trading under the name ‘Hari Brothers’. They decide to convert their partnership into a limited company (with effect from 1st January, 20X2) to be known as Hari Ltd.

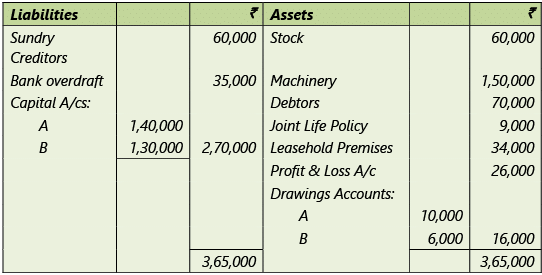

Immediately prior to this conversion , the balance sheet of partnership as on 31st December 20X1 was as follows:

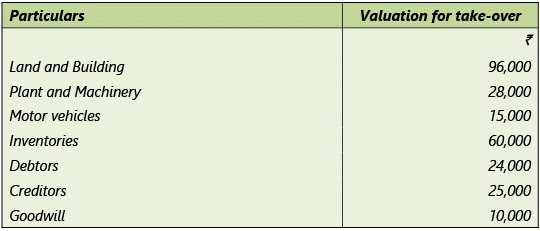

Balance Sheet As on 31st December 20X1 The terms of conversion are that Hari Ltd. is to take over the assets and liabilities of Hari Brothers as follows:

The terms of conversion are that Hari Ltd. is to take over the assets and liabilities of Hari Brothers as follows: The closing balance in Axis Bank account is to be transferred to Dena Bank account before all the other dissolution entries are affected in the partnership ledgers.

The closing balance in Axis Bank account is to be transferred to Dena Bank account before all the other dissolution entries are affected in the partnership ledgers.

Lal took over one of the motor vehicles at an agreed amount of ₹ 2,000. All other liabilities were paid from the Dena Bank account.

The purchase consideration is discharged by an issue at par of ₹ 60,000 10% Debentures (fully paid) to the partners in their capital account proportions as shown in the above balance sheet plus equity shares in Hari Ltd. of ₹ 1 each (fully paid to make up the balance due to each partner).

You are required to

(i) prepare

(a) Realization Account

(b) Partners’ Capital Accounts

(c) Bank account of Axis Bank and Dena Bank in the books of Hari Brothers;

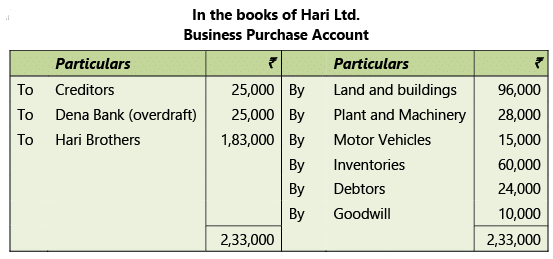

(ii) ‘Business purchase account’ and ‘Hari Brothers’ account in Hari Ltd.'s books.

(i) (a) In the books of Hari Brothers

(b) Partners' Capital Accounts

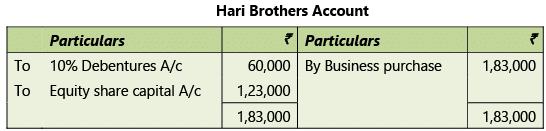

Debentures have been issued in the proportion of capital account balances i.e. in ratio of 7:3:2.

(c) Bank Account(ii)

Partnership-Sale to a Company

The accounting treatment, when a partnership firm is sold to a company, can be explained with the help of the following Illustration.

Illustration 6:

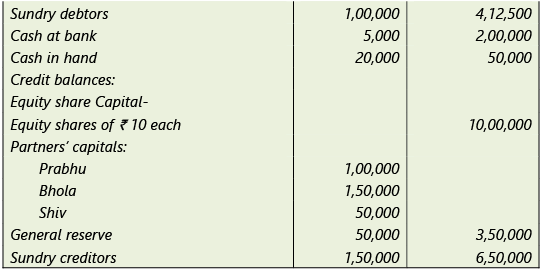

A and B were carrying on business sharing profits and losses equally. The firm’s Balance Sheet as at 31.12.20X1 was: The business was carried on till 30.6.20X2. The partners withdrew in equal amounts half the amount of profits made during the period of six months after charging depreciation at 10% p.a. on machinery and after writing off 5% on leasehold premises. In the half-year, sundry creditors were reduced by ₹ 10,000 and bank overdraft by ₹ 15,000.

The business was carried on till 30.6.20X2. The partners withdrew in equal amounts half the amount of profits made during the period of six months after charging depreciation at 10% p.a. on machinery and after writing off 5% on leasehold premises. In the half-year, sundry creditors were reduced by ₹ 10,000 and bank overdraft by ₹ 15,000.

On 30.6.20X2, stock was valued at ₹ 75,000 and Debtors at ₹ 60,000; the Joint Life Policy had been surrendered for ₹ 9,000 before 30.6.20X2 and other items remained the same as at 31.12.20X1.

On 30.6.20X2, the firm sold the business to a Limited Company. The value of goodwill was fixed at ₹ 1,00,000 and the rest of the assets were valued on the basis of the Balance Sheet as at 30.6.20X2. The company paid the purchase consideration in Equity Shares of ₹ 10 each.

You are required to prepare: (a) Balance Sheet of the firm as on 30.6.20X2; (b) The Realization Account; (c) Partners’ Capital Accounts showing the final settlement between them.

(a) Balance Sheet as on 30.6.20X2

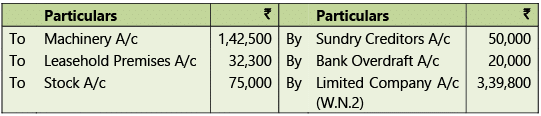

(b) Realization Account

(c) Partners’ Capital Accounts

Working Notes:

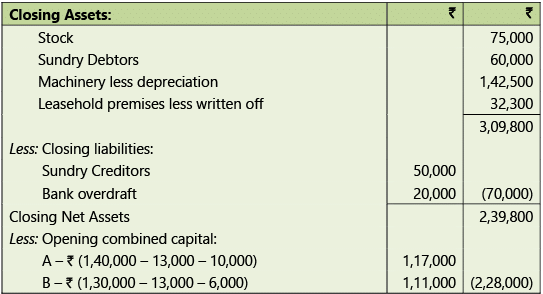

(1) Ascertainment of profit for the 6 months ended 30th June, 20X2(2) Ascertainment of purchase consideration:

Closing net assets (as above) ₹ 2,39,800 + Goodwill ₹ 1,00,000 = ₹ 3,39,800.

Illustration 7:

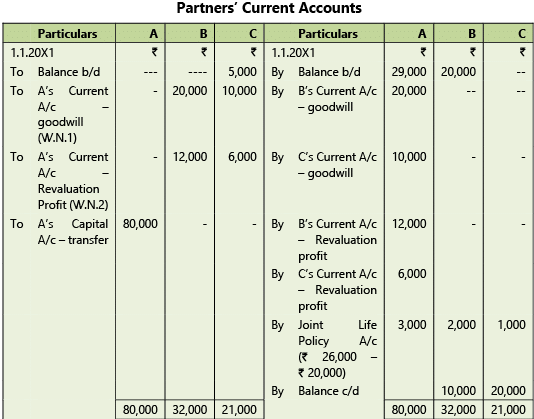

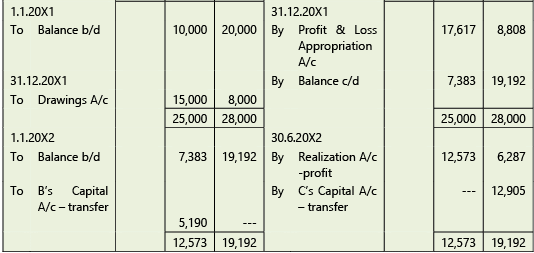

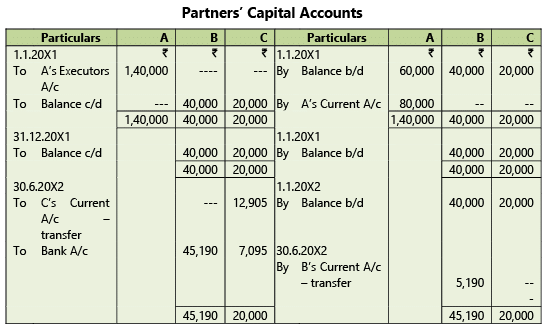

A, B and C were in partnership sharing profits and losses 3:2:1. There was no provision in the agreement for interest on capitals or drawings.

A died on 31.12.20X0 and on that date, the partners’ balance s were as under:

Capital Account: A – ₹ 60,000; B- ₹ 40,000; C- ₹ 20,000

Current Account: A – ₹ 29,000; B – ₹ 20,000; C – ₹ 5,000 (Dr.).

By the partnership agreement, the sum due to A’s estate was required to be paid within a period of 3 years, and minimum insta llment of ₹ 20,000 each were to be paid, the first such installment falling due immediately after death and the subsequent installments at half-yearly intervals. Interest @ 5% p.a. was to be credited half-yearly.

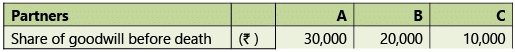

In ascertaining his share, goodwill (not recorded in the books) was to be valued at ₹ 60,000 and the assets, excluding the Joint Endowment Policy (mentioned b elow), were valued at ₹ 36,000 in excess of the book values.

No Goodwill Account was raised and no alteration was made to the book values of fixed assets. The Joint Assurance Policy shown in the books at ₹ 20,000 matured on 1.1.20X1, realizing ₹ 26,000; payments of ₹ 20,000 each were made to A’s Executors on 1.1.20X1, 30.6.20X1 and 31.12.20X1. B and C continued trading on the same terms as previously and the net profit for the year to 31.12.20X1 (before charging the interest due to A’s estate) amounted to ₹ 32,000. During that period, the partners' drawings were: B- ₹ 15,000; and C- ₹ 8,000.

On 1.1.20X2, the partnership was dissolved and an offer to purchase the business as a going concern for ₹ 1,40,000 was accepted on that day. A cheque for that sum was received on 30.6.20X2.

The balance due to A’s estate, including interest, was paid on 30.6.20X2 and on that day, B and C received the sums due to them.

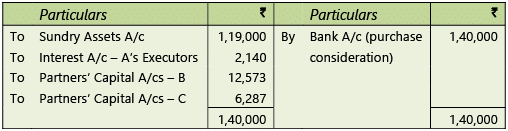

You are required to write-up the Partners’ Capital and Current Accounts from 1.1.20X1 to 30.6.20X2. Show also the account of the executors of A.

Working Notes:

(1) Adjustment in regard to Goodwill(2) Adjustment in regard to revaluation of assets

(3) Ascertainment of Profit for the year ended 31.12.20X1

(4) Balance Sheet as at 31.12.20X1

(5) Realization Account

Apportionment of shares amongst the partners

Sometime an examination problem may require the students to suggest equitable basis for division of shares between the vendors when they are partners, so as to preserve the rights as previously existed between them, that is, to maintain the same profit-sharing ratio and to preserve the priority in regard to repayment of capital.

Suppose A, B and C share profits and losses in the ratio 3: 2: 1 after allowing interest on capital @ 9% p.a. Their capitals on 31st December, 20X1 were: A ₹ 50,000, B ₹ 30,000 and C ₹ 20,000. On 1st January, 20X2 the business was converted into a limited company and was valued at ₹ 1,30,000. A scheme of capitalization, whereby the mutual interest of partners may remain intact as far as possible is suggested below:

The total capital being ₹ 1,00,000 and the value placed on the business being ₹ 1,30,000 there is goodwill of ₹ 30,000 to be shared by the partners in the ratio of 3:2:1 or A ₹ 15,000, B ₹ 10,000 and C ₹ 5,000.

The capital will now be: A ₹ 65,000, B ₹ 40,000, and C ₹ 25,000.

Taking B’s capital as the basis, A’s capital should be ₹ 60,000, i.e. 40,000 × 3/2 and C’s capital should be ₹ 20,000. Both A and C have ₹ 5,000 excess. Since interest on capital is meant to compensate those whose capital is in excess of proportionate limits and since in the case of partners it is an appropriation of profit, it will be proper to give 9% preference shares to A & C for ₹ 5,000 each and the remaining amount of ₹ 1,20,000 can be in the form of equity shares to be divided am ong A, B and C in the ratio of 3: 2: 1. They will then share the company’s profit in the ratio of 3: 2: 1 after allowing preference dividend.

Illustration 8:

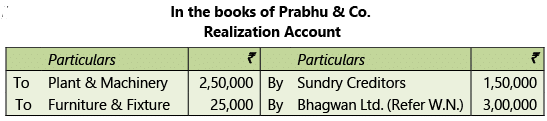

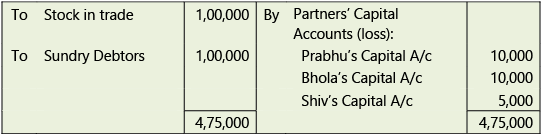

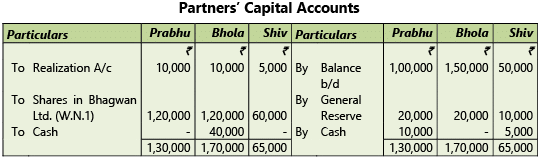

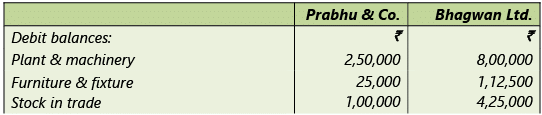

Prabhu & Co. is a partnership firm consisting of Mr. Prabhu, Mr. Bhola and Mr. Shiv who share profits and losses in the ratio of 2:2:1 and Bhagwan Ltd. is a company doing similar business.

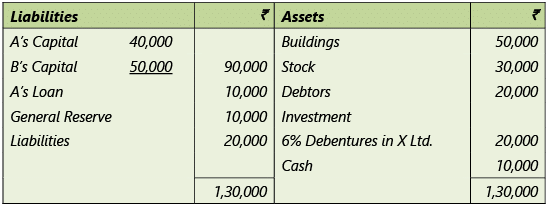

The firm and the company provide the following ledger balances as on 31.3.20X1:

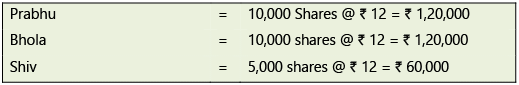

It was decided that the firm Prabhu & Co. be dissolved and all the assets (except cash in hand and cash at bank) and all the liabilities of the firm be taken over by Bhagwan Ltd. by issuing 25,000 shares of ₹ 10 each at a premium of ₹ 2 per share.

It was decided that the firm Prabhu & Co. be dissolved and all the assets (except cash in hand and cash at bank) and all the liabilities of the firm be taken over by Bhagwan Ltd. by issuing 25,000 shares of ₹ 10 each at a premium of ₹ 2 per share.

Partners of Prabhu & Co. agreed to divide the shares issued by Bhagwan Ltd. in the profit-sharing ratio and bring necessary cash for settlement of their capital.

The creditors of Prabhu & Co. includes ₹ 50,000 payable to Bhagwan Ltd. An unrecorded liability of ₹ 12,500 of Prabhu & Co. must also be taken over by Bhagwan Ltd.

Prepare:

(i) Realization account, Partners’ capital accounts and Cash in hand/Bank account in the books of Prabhu & Co.

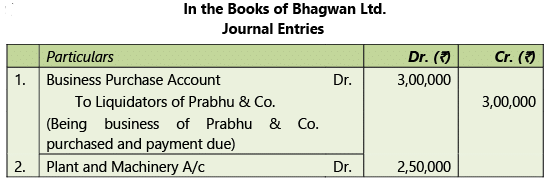

(ii) Pass journal entries in the book s of Bhagwan Ltd. for acquisition of Prabhu & Co.

(i)

(ii)

Working Note:

Computation of purchase consideration:

25,000 Equity shares of ₹ 12 each = ₹ 3,00,000

Equity shares to be given to partners:

Illustration 9:

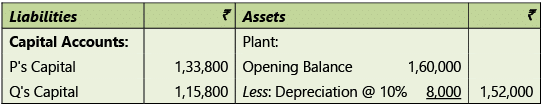

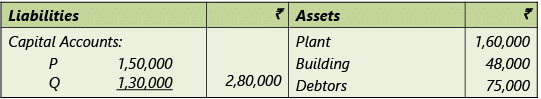

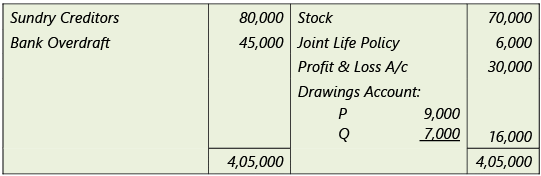

P and Q were carrying on business sharing profits and losses equally. The firm’s Balance Sheet as on 31.12.20X1 was:

The operations of the business were carried on till 30.06.20X2. P and Q both withdrew in equal amount half the amount of profit made during the current period of six months after charging depreciation at 10% per annum on plant and after writing off 5% on building.

The operations of the business were carried on till 30.06.20X2. P and Q both withdrew in equal amount half the amount of profit made during the current period of six months after charging depreciation at 10% per annum on plant and after writing off 5% on building.

During the current period of six months, creditors were reduced by ₹ 20,000 and bank overdraft by ₹ 5,000.

The joint-life policy was surrendered for ₹ 6,000 before 30th June 20X2. Stock was valued at ₹ 84,000 and debtors at ₹ 68,000 on 30th June 20X2. The other items remained the same as at 31.12.20X1.

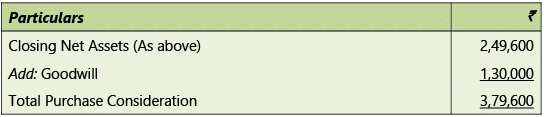

On 30.06.20X2, the firm sold its business to PQ Ltd. The value of goodwill was estimated at ₹ 1,30,000 and the remaining assets were valued on the basis of the balance sheet as on 30.06.20X2.

PQ Ltd. paid the purchase con sideration in equity shares of ₹ 10 each.

You are required to prepare:

(a) Balance sheet of the firm as at 30.06.20X2,

(b) Realization account,

(c) Partners' Capital Accounts showing the final settlement between them.

(a) Balance sheet of the firm as on 30.06.20X2

(b) Realization Account

(c) Partner's Capital Accounts

Working Notes

(1) Ascertainment of profit for the period of 6 Months ended 30.06.20X2(2) Ascertainment of purchase consideration

Summary

- Amalgamation of partnership firms includes

(a) Closing the old books of Amalgamating firms

(b) Opening the new books of Amalgamated firm - When one firm is merged with another existing firm, entries will be in the pattern of winding up in the books of the firm which has ceased to exist. The other firm will record the transaction as that of a business purchase.

- Creditors play an important role in the conversion of a partnership firm into a company.

What you've learned?

- Understand the procedure for amalgamation of partnership firms.

- Learn the accounting treatment when a partnership firm is converted in the form of a company.

- Distribute the shares received as purchase consideration among the partners.

|

53 videos|134 docs|6 tests

|

FAQs on Amalgamation, Conversion & Sale of Partnership Firms: Notes - Advanced Accounting for CA Intermediate

| 1. What is the process of amalgamation of partnership firms? |  |

| 2. How can a partnership firm be converted into a company? |  |

| 3. What is partnership-sale to a company? |  |

| 4. What are some legal requirements for the amalgamation, conversion, or sale of partnership firms? |  |

| 5. What are the key considerations for partners when deciding on amalgamation, conversion, or sale of a partnership firm? |  |