Assessee, Assessment & Previous Year - Definitions and Basic Concepts of Income Tax, Income Tax Laws | Income Tax Laws - B Com PDF Download

| Table of contents |

|

| Meaning of Assessment Year |

|

| Meaning of Previous Year |

|

| Person |

|

| How to Charge Tax on Income |

|

| Meaning of Income |

|

| Gross Total Income |

|

| Income Tax Rates |

|

Meaning of Assessment Year

- The term “Assessment year” refers to the time frame that starts on April 1 and ends on March 31 of the following year.

- For example, the assessment year of 2009-10 begins on April 1, 2009, and concludes on March 31, 2010.

- The income earned by an individual or entity in the previous year is taxed in the subsequent assessment year according to the rates set by the applicable Finance Act.

Meaning of Previous Year

- The income you make in a year is taxed the following year.

- The year in which you earn your income is called the previous year.

- The year when you pay taxes on that income is referred to as the assessment year.

- In simpler terms, the previous year is the financial year that comes right before the assessment year.

Illustration: For the assessment year 2009-10, the immediately preceding financial year (i.e., 2008-09) is the previous year.

Income earned by an individual during the previous year 2008-09 is taxable in the immediately following assessment year 2009-10 at the rates applicable for the assessment year 2009-10.

Similarly, income earned during the previous year 2009-10 by a company will be taxable in the assessment year 2010-11 at the rates applicable for the assessment year 2010-11.

When Income of Previous Year is Not Taxable in the Immediately Following Assessment Year

The rule that the income of the previous year is taxable as the income of the immediately following assessment year has certain exceptions. These are:

(a) Income of non-residents from shipping;

(b) Income of persons leaving India either permanently or for a long period of time;

(c) Income of bodies formed for short duration;

(d) Income of a person trying to alienate his assets with a view to avoiding payment of tax; and

(e) Income of a discontinued business.

In these cases, income of a previous year may be taxed as the income of the assessment year immediately proceeding the normal assessment year. These exceptions have been incorporated in order to ensure smooth collection of income tax from the aforesaid taxpayers who may not be traceable if tax assessment procedure is postponed till the commencement of the normal assessment.

A Financial Year Has a Double Role to Play—it is a Previous Year as Well as an Assessment Year

On the basis of the aforesaid discussion, it can be said that a financial year plays a double role—it is a previous year as well as an assessment year.

Person

The term “person” includes:

(а) an individual;

(b) a Hindu undivided family;

(c) a company;

(d) a firm;

(e) an association of persons or a body of individuals, whether incorporated or not;

(f) a local authority; and

(g) every artificial juridical person not falling within any of the preceding categories.

These are seven categories of persons chargeable to tax under the Act. The aforesaid definition is inclusive and not exhaustive. Therefore, any person, not falling in the above-mentioned seven categories, may still fall in the four corners of the term “person” and accordingly may be liable to tax.

ASSESSEE

“Assessee” means a person by whom income tax or any other sum of money is payable under the Act. It includes every person in respect of whom any proceeding under the Act has been taken for the assessment of his income or loss or the amount of refund due to him. It also includes a person who is assessable in respect of income or loss of another person or who is deemed to be an assessee, or an assessee in default under any provision of the Act.

How to Charge Tax on Income

To know the procedure for charging tax on income, one should be familiar with the following:

- Annual tax—Income-tax is an annual tax on income.

- Tax rate of assessment year—Income of previous year is chargeable to tax in the next following assessment year at the tax rates applicable for the assessment year. This rule is, however, subject to some exceptions.

- Rates fixed by Finance Act—Tax rates are fixed by the annual Finance Act and not by the Income-tax Act. For instance, the Finance Act, 2006, fixes tax rates for the assessment year 2006-07.

- Tax on person—Tax is charged on every person.

- Tax on total income—Tax is levied on the “total income” of every assessee computed in accordance with the provisions of the Act.

Meaning of Income

- The definition of the term “income” in Section 2(24) is broad and includes more than just what is listed in that section.

- This means that “income” covers not only the items specified in Section 2(24) but also other things that the word typically means in everyday language.

- In other words, the term “income” has a general meaning that goes beyond the legal definition.

- Thus, there are additional forms of income that may not be directly mentioned but are still considered as income based on common understanding.

Gross Total Income

As per Section 14, the income of a person is computed under the following five heads:

- Salaries.

- Income from house property.

- Profits and gains of business or profession.

- Capital gains.

- Income from other sources.

The aggregate income under these heads is termed as “gross total income”. In other words, gross total income means total income computed in accordance with the provisions of the Act before making any deduction under sections 80C to 80U.

Income Tax Rates

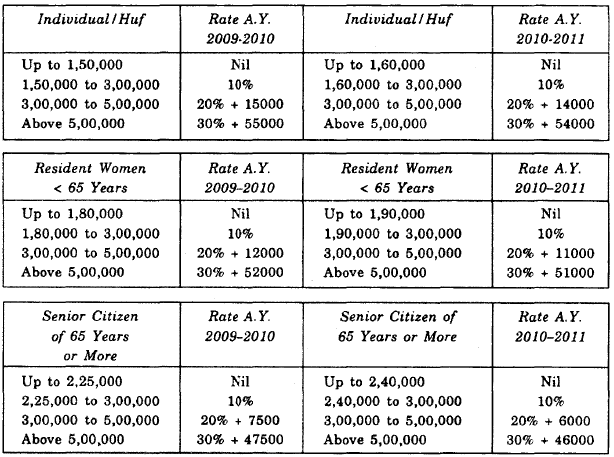

ASSESSMENT YEAR 2009-2010 and 2010-2011

FIRM- 30% of Total Income.

COMPANY- 30% of Total Income.

ADVANCE TAX

Advance tax Limit increased from ? 5,000 to ? 10,000 from financial year 2009-10 onwards.

|

33 videos|41 docs|11 tests

|