Bank Reconciliation Statement ( Part - 2) | Accountancy Class 11 - Commerce PDF Download

Page No 12.44:

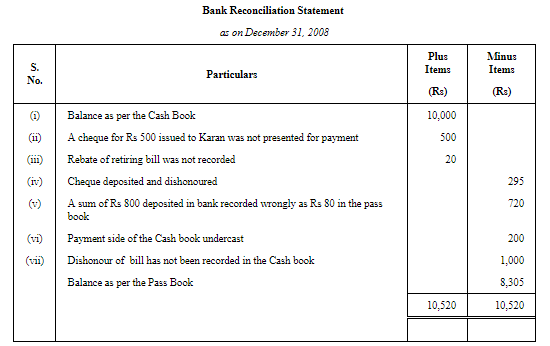

Question 6: From the following particulars, prepare Bank Reconciliation Statement as on 31st December, 2008:

(i) Debit balance as per Cash Book ₹ 10,000.

(ii) A cheque for ₹ 500 issued in favour of Karan has not been presented for

payment.

(iii) A bill for ₹ 700 retired by bank under a rebate of ₹ 20, the full amount of

the bill was credited in the Cash Book.

(iv) A cheque for ₹ 295 deposited in the bank has been dishonoured.

(v) A sum of ₹ 800 deposited in the bank has been credited as ₹ 80 in the Pass Book.

(vi) Payments side of the Cash Book has been undercast by ₹ 200.

(vii) A bill receivable for ₹ 1,000 (discounted with the bank in November 2008) dishonoured on 31st December, 2008.

ANSWER:

Page No 12.45:

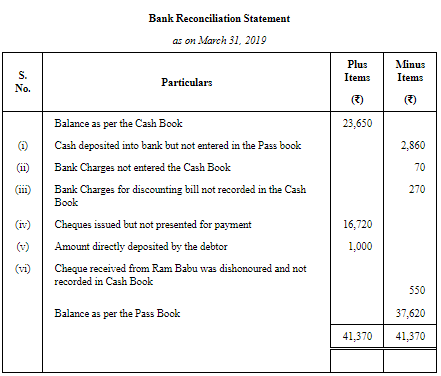

Question 7: On examining the Bank Statement of Green Ltd., it is found that the balance shown on 31st March, 2019, differs from the bank balance of ₹ 23,650 shown by the Cash Book on that date. From a detailed comparison of the entries it is found that:

(i) ₹ 2,860 is entered in the Cash Book as paid into the bank on 31st March, 2019 but not credited by the bank until the following day.

(ii) Bank charges of ₹ 70 on 31st March, 2019 are not entered in the Cash Book.

(iii) A bill for ₹ 5,500 discounted with the bank is entered in the Cash Book without recording the discount charges of ₹ 270.

(iv) Cheques totalling ₹ 16,720 were issued by the company and duly recorded in the Cash Book before 31st March, 2019 but had not been presented at the Bank for payment until after that date.

(v) On 25th March, 2019, a debtor paid ₹ 1,000 into the Company's Bank in settlement of his account but no entry was made in the Cash Book of the company in respect of this.

(vi) No entry has been made in the Cash Book to record the dishonour on 15th March, 2019, of a cheque for ₹ 550 received from Ram Babu.

Prepare a Bank Reconciliation Statement as on 31st March, 2019.

ANSWER:

Page No 12.45:

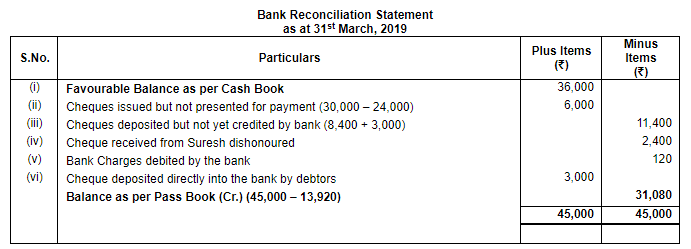

Question 8: Prepare a Bank Reconciliation Statement as on 31st March, 2019 from the following:

(i) On 31st March, 2019, Cash Book of a firm showed bank balance of ₹ 36,000 (Dr.).

(ii) Cheques had been issued for ₹ 30,000, out of which cheques of ₹ 24,000 were presented for payment.

(iii) Cheques of ₹ 8,400 were deposited in the bank on 28th March, 2019 but had not been credited by the bank. Also, a cheque of ₹ 3,000 entered in the Cash Book on 30th March, 2019 was banked on 3rd April.

(iv) A cheque from Suresh for ₹ 2,400 was deposited in the bank on 26th March, 2019 was dishonoured, advice was received on 2nd April.

(v) Pass Book showed bank charges of ₹ 120 debited by the bank.

(vi) One of the Debtors deposited ₹ 3,000 in the bank account of the firm on 26th March, 2019, but the intimation in this respect was received from the bank on 2nd April.

ANSWER:

Page No 12.45:

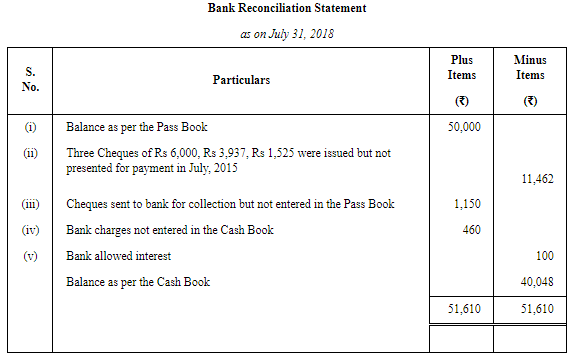

Question 9: Prepare Bank Reconciliation Statement from the following particulars on 31st July, 2018:

(i) Balance as per the Pass Book ₹ 50,000.

(ii) Three cheques for ₹ 6,000, ₹ 3,937 and ₹ 1,525 issued in last week of July, 2018 were presented for payment to the bank in August, 2018.

(iii) Two cheques of ₹ 500 and ₹ 650 sent to the bank for collection were not entered in the Pass Book by 31st July, 2018.

(iv) The bank charged ₹ 460 for its commission and allowed interest of ₹ 100 which were not mentioned in the Bank Column of the Cash Book.

ANSWER:

Page No 12.45:

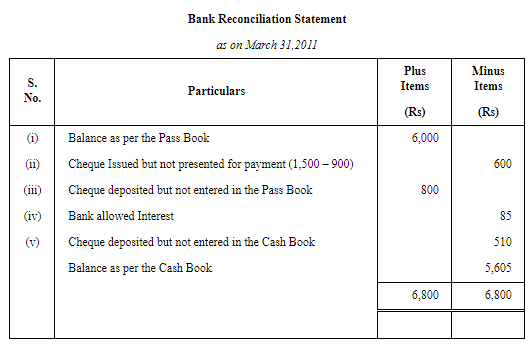

Question 10: Draw Bank Reconciliation Statement showing adjustment between your Cash Book and Pass Book as on 31st March, 2011.

(i) On 31st March, 2011 your pass book showed a balance of ₹ 6,000 to your credit.

(ii) Before that date, you had issued cheques amounting to ₹ 1,500 of which cheques of ₹ 900 have been presented for payment.

(iii) A cheque of ₹ 800 paid by you into the bank on 29th March, 2011 is not yet credited in pass book.

(iv) There was a credit of ₹ 85 for interest on Current Account in the pass book.

(v) On 31st March, 2011 a cheque for ₹ 510 received by you and was paid into bank but the same was omitted to be entered in cash book.

ANSWER:

|

61 videos|227 docs|39 tests

|

FAQs on Bank Reconciliation Statement ( Part - 2) - Accountancy Class 11 - Commerce

| 1. What is a bank reconciliation statement? |  |

| 2. Why is a bank reconciliation statement important? |  |

| 3. How often should bank reconciliation statements be prepared? |  |

| 4. What are the common reasons for differences between the bank balance and the company's accounting records? |  |

| 5. How can discrepancies in a bank reconciliation statement be resolved? |  |