Bank Reconciliation Statement (Part - 1) - Commerce PDF Download

Page No 15.27:

Question 1:

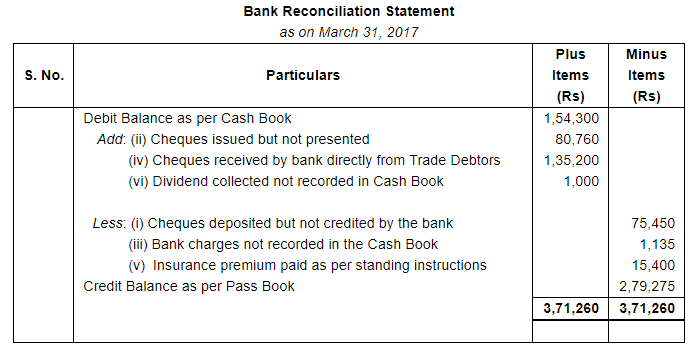

Rim Zim Ltd. maintains a current account with the State Bank of India. On 31st March, 2017, the bank column of its cash book showed a debit balance of ₹ 1,54,300. However, the bank statement showed a different balance as on that date. The following were the reasons for the difference:

| ₹ | ||

| (i) | Cheques deposited, but not yet credited by the bank | 75,450 |

| (ii) | Cheques issued, but not yet presented for payment | 80,760 |

| (iii) | Bank charges not yet recorded in the cash book | 1,135 |

| (iv) | Cheques received by the bank directly from trade debtors | 1,35,200 |

| (v) | Insurance premium paid by the bank as per standing instructions, but not yet recorded in the cash book | 15,400 |

| (vi) | Dividend collected by the bank, but not yet recorded in the cash book | 1,000 |

Find out the balance as per the bank statement as on 31st March, 2017.

ANSWER:

Page No 15.28:

Question 2:

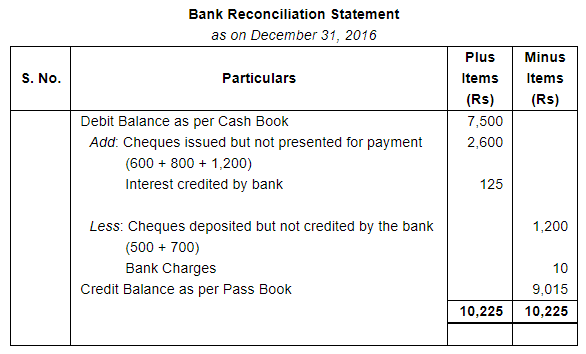

The balance of cash at bank as shown by the Cash Book of Pan & Co. on 31st December, 2016, was ₹ 7,500. On checking the entries in the Cash Book with the Pass Book, it was ascertained that cheques of ₹ 500 and ₹ 700 respectively paid in on 30th December, were not credited until the 2nd January following and three cheques of ₹ 600, ₹ 800 and ₹ 1,200 issued on the 28th December were not presented until the 3rd of January. There was a credit of ₹ 125 in the Pass Book in respect of interest under date 31st December, which was not entered in the Cash Book. There were also Bank Charges debited in the Pass Book amounting in all to ₹ 10 which were not entered in the Cash Book.

Prepare a Bank Reconciliation Statement as at 31st December, 2016.

ANSWER:

Question 3:

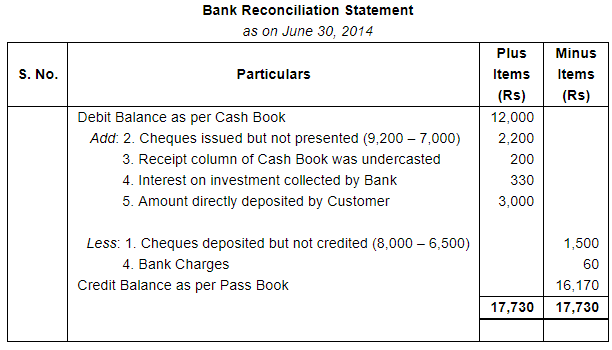

On 30th June, 2014, the bank column of Mohan Kapoor's Cash Book showed a debit balance of ₹ 12,000. On checking the Cash Book with bank statement you find that:-

1. Cheques paid into Bank ₹ 8,000, but out of these only cheques of ₹ 6,500 were cleared and credited by the Bankers upto 30th June.

2. Cheques of ₹ 9,200 were issued but out of these only cheques of ₹ 7,000 were presented for payment upto 30th June.

3. The receipt column of the Cash Book has been undercast by ₹ 200.

4. The Pass Book shows a credit of ₹ 330 as interest on investments collected by bankers and debit of ₹ 60 for bank charges.

5. On 29th June a Customer deposited ₹ 3,000 direct in the bank account but it was entered only in the Pass Book.

Prepare a Bank Reconciliation Statement.

ANSWER:

Question 4:

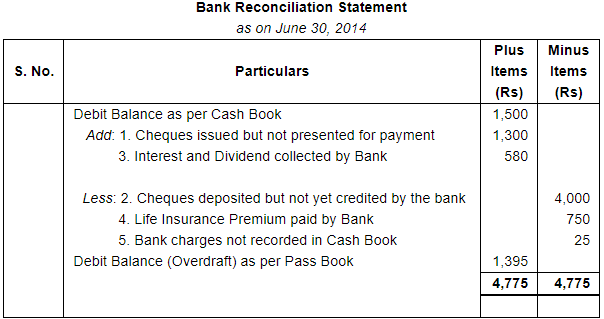

On 30th June 2014, the bank balance as per Sanjay Yadav's Cash Book was ₹ 1,500. On comparing with the Pass Book the following information was received:-

1. Cheques amounting to ₹ 7,290 were issued on 28th June, of which one cheque of ₹ 1,300 was presented in the bank for payment on 4th July.

2. Cheques deposited into bank for ₹ 10,000, but of these cheques for ₹ 4,000 were cleared and credited in July.

3. Interest and Dividend on investments ₹ 580 collected by bank and credited to his account but he did not have any information for this.

4. Life Insurance Premium ₹ 750 paid by bank according to his standing orders.

5. Bank Charges ₹ 25 not recorded in the Cash Book.

Prepare a Bank Reconciliation Statement.

ANSWER:

Page No 15.29:

Question 5:

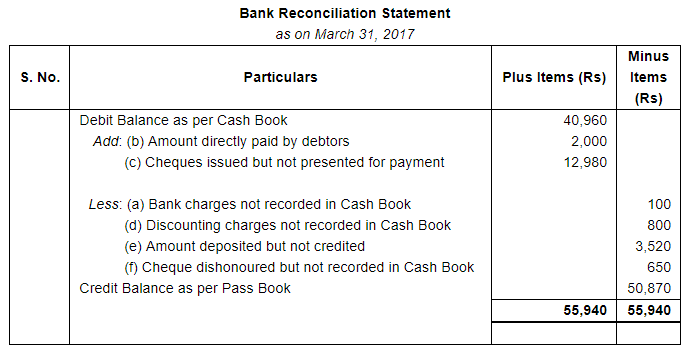

On comparing the Cash Book with Pass Book of Naman it is found that on March 31, 2017, bank balance of ₹ 40,960 showed by the Cash Book differs from the bank balance with regard to the following:

(a) Bank charges ₹ 100 on March, 31 2017, are not entered in the Cash Book.

(b) On March 21, 2017, a debtor paid ₹ 2,000 into the company's bank in settlement of his account, but no entry was made in the Cash Book of the company in respect of this.

(c) Cheques totalling ₹ 12,980 were issued by the company and duly recorded in the Cash Book before March 31, 2017, but had not been presented at the bank for payment until after that date.

(d) A bill for ₹ 6,900 discounted with the bank is entered in the Cash Book without recording the discount charge of ₹ 800.

(e) ₹ 3,520 is entered in the Cash Book as paid into bank on March 31st 2017, but not credited by the bank until the following day.

(f) No entry has been made in the Cash Book to record the dishonour on March 15, 2017 of a cheque for ₹ 650 received from Bhanu.

Prepare a reconciliation Statement as on March 31, 2017.

ANSWER:

Question 6:

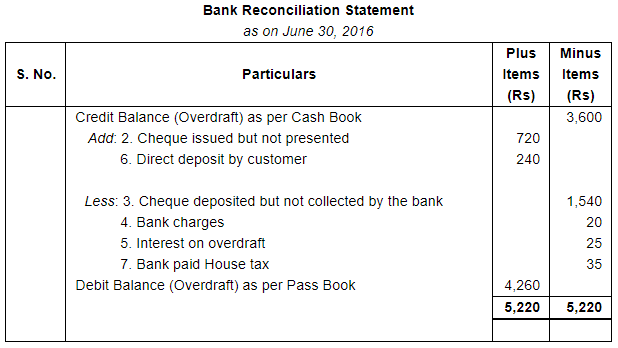

Prepare a Bank Reconciliation Statement from the following particulars as on 30th June, 2016:-

| (₹) | |

| 1. Credit balance as per Bank column of Cash Book | 3,600 |

| 2. Cheque issued to the creditor but not yet present for payment | 720 |

| 3. Cheques deposited into Bank for collection but not collected by the bank upto this time | 1,540 |

| 4. Bank charges charged by the bank | 20 |

| 5. Interest on overdraft charged by the bank | 25 |

| 6. A customer deposited into our bank account without informing us. | 240 |

| 7. Bank paid House Tax on our behalf, but no information was received from Bank. | 35 |

ANSWER:

Page No 15.30:

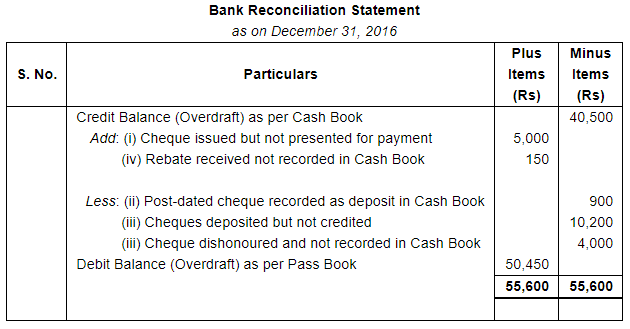

Question 7:

Tiwari and Sons find that the bank balance shown by their Cash Book on December 31, 2016 is ₹ 40,500 (Credit) but the Pass Book shows a difference due to the following reasons:

(i) A cheque for ₹ 5,000 drawn in favour of Manohar has not yet been presented for payment.

(ii) A post-dated cheque for ₹ 900 has been debited in the bank column of the Cash Book but it could not have been presented in any case.

(iii) Cheques totalling ₹ 10,200 deposited with the bank have not yet been collected and an another cheque for ₹ 4,000 deposited in the account has been dishonoured.

(iv) A Bill Payable for ₹ 10,000 was retired by the Bank under a rebate of ₹ 150 but the full amount of the bill was credited in the bank column of the cash book.

Prepare a Bank Reconciliation Statement and find out the balance as per Pass Book.

ANSWER:

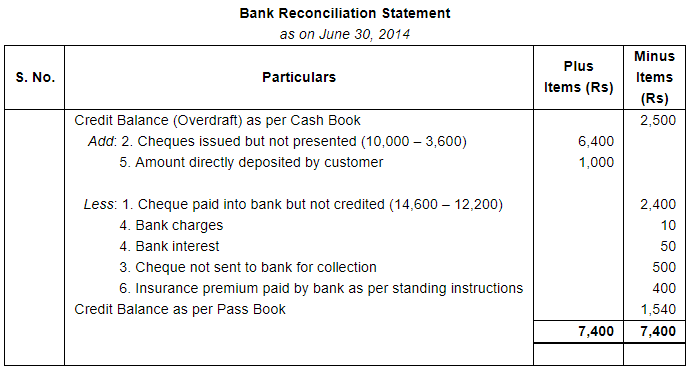

Question 8:

On 30th June 2014, the Cash Book of a trader shows a bank overdraft of ₹ 2,500. Following informations are available:-

1. Cheques amounting to ₹ 14,600 had been paid to the bank, but of these only ₹ 12,200 were credited in the Pass Book, up to 30th June, 2014.

2. He had also issued cheques amounting to ₹ 10,000, out of which only ₹ 3,600 had been presented for payment.

3. A cheque of ₹ 500 which he had debited to the bank account was not sent to bank for collection by mistake.

4. There is a debit in the Pass Book of ₹ 10 for Bank Charges and ₹ 50 for interest.

5. A customer directly paid into his bank ₹ 1,000, but it was not shown in the Cash Book.

6. Bank has paid insurance premium of ₹ 400 according to his instructions, but this is not recorded in the Cash Book.

Prepare a Bank Reconciliation Statement.

ANSWER:

FAQs on Bank Reconciliation Statement (Part - 1) - Commerce

| 1. What is a bank reconciliation statement? |  |

| 2. Why is a bank reconciliation statement important for businesses? |  |

| 3. How often should businesses perform bank reconciliations? |  |

| 4. What are the steps involved in preparing a bank reconciliation statement? |  |

| 5. Can bank reconciliation statements uncover fraudulent activities? |  |