Bank Reconciliation Statement (Part-3) | Accountancy Class 11 - Commerce PDF Download

Page No 12.46:

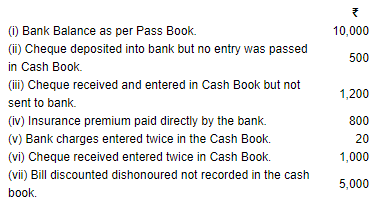

Question 11: Prepare Bank Reconciliation Statement as on 30th September, 2016 from the following particulars:

ANSWER:

Page No 12.46:

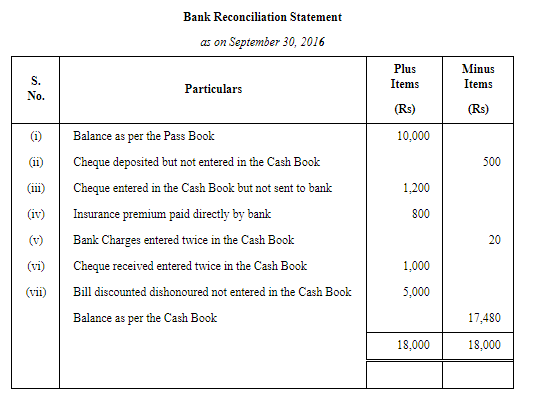

Question 12: Bank Statement of a customer shows bank balance of ₹ 62,000 on 31st March, 2019. On comparing it with the Cash Book the following discrepancies were noted:

(i) Cheques were paid into the bank in March but were credited in April:

P − ₹ 3,500; Q − ₹ 2,500; R − ₹ 2,000.

(ii) Cheques issued in March were presented in April:

X − ₹ 4,000; Q − ₹ 4,500.

(iii) Cheque for ₹ 1,000 received from a customer entered in the Cash Book but was not banked.

(iv) Pass Book shows a debit of ₹ 1,000 for bank charges and credit of ₹ 2,000

as interest.

(v) Interest on investment ₹ 2,500 collected by the bank appeared in the Pass Book.

Prepare Bank Reconciliation Statement showing the balance as per Cash Book on 31st March, 2019.

ANSWER:

Page No 12.46:

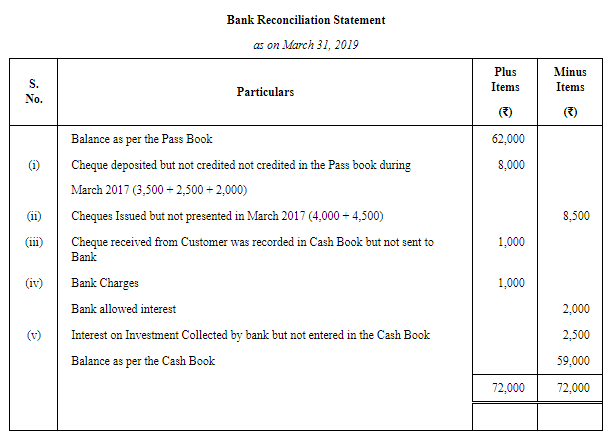

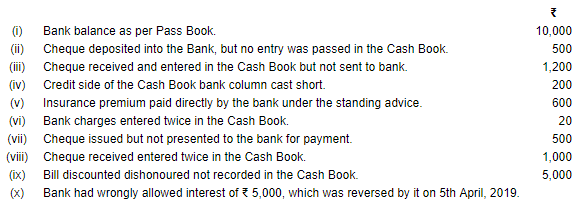

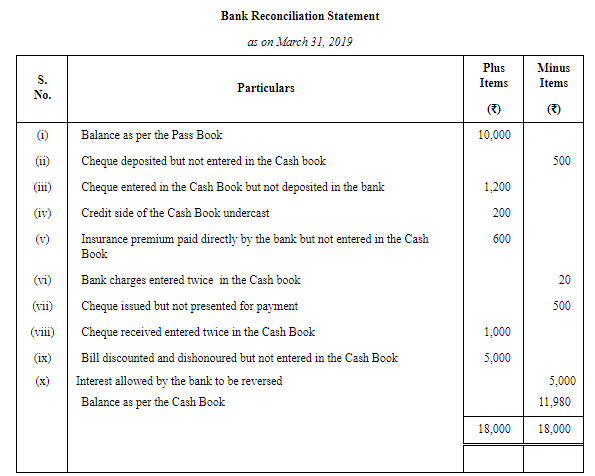

Question 13: Prepare Bank Reconciliation Statement as on 31st March, 2019 from the following particulars:

ANSWER:

Page No 12.47:

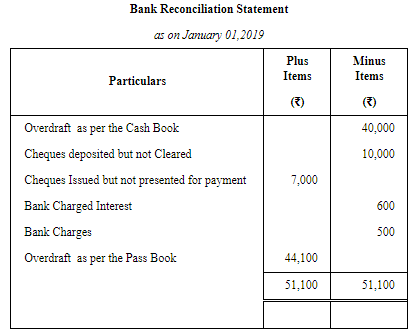

Question 14: On 1st January, 2019, Naresh had an overdraft of ₹ 40,000 as shown by his Cash Book in the bank column. Cheques amounting to ₹ 10,000 had been deposited by him but were not collected by the bank by 1st January, 2019. He issued cheques of ₹ 7,000 which were not presented to the bank for payment up to that day. There was also a debit in his Pass Book of ₹ 600 for interest and ₹ 500 for bank charges.

Prepare a Bank Reconciliation Statement.

ANSWER:

Page No 12.47:

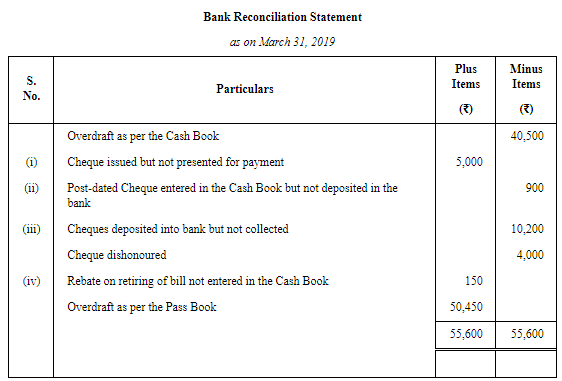

Question 15: Tiwari & Sons find that the bank balance shown by their Cash Book on 31st March, 2019 is ₹ 40,500 (credit) but the Pass Book shows a difference due to the following reasons:

(i) A cheque for ₹ 5,000 drawn in favour of Manohar has not yet been presented for payment.

(ii) A post-dated cheque for ₹ 900 has been debited in the bank column of the Cash Book but it could not have been presented in any case.

(iii) Cheques totalling ₹ 10,200 deposited with the bank have not yet been collected and a cheque for ₹ 4,000 has been dishonoured.

(iv) A bill for ₹ 10,000 was retired by the Bank under a rebate of ₹ 150 but the full amount of the bill was credited in the bank column of the Cash Book.

Prepare Bank Reconciliation Statement and find out the balance as per Pass Book.

ANSWER:

|

64 videos|152 docs|35 tests

|

FAQs on Bank Reconciliation Statement (Part-3) - Accountancy Class 11 - Commerce

| 1. What is a bank reconciliation statement? |  |

| 2. Why is a bank reconciliation statement important? |  |

| 3. What are the steps involved in preparing a bank reconciliation statement? |  |

| 4. What are the common reasons for differences between the bank statement and the company's records? |  |

| 5. How often should a company prepare a bank reconciliation statement? |  |