Bank Reconciliation Statement (Part - 6) | Accountancy Class 11 - Commerce PDF Download

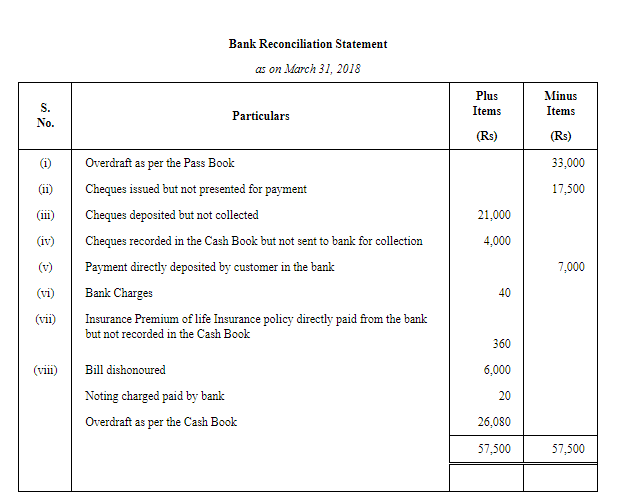

Page No 12.50:

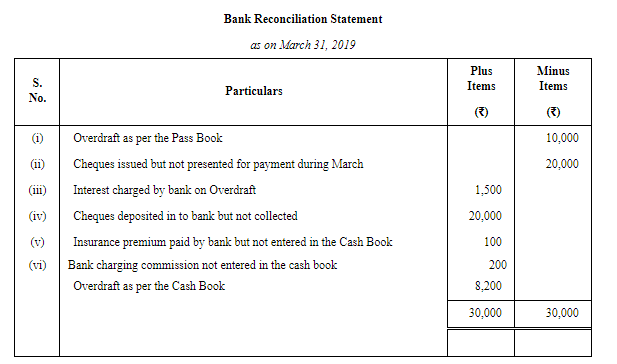

Question 27: Prepare Bank Reconciliation Statement from the following particulars and show balance as per Cash Book:

(i) Balance as per Pass Book on 31st March, 2019 overdrawn ₹ 10,000.

(ii) Cheques drawn in the last week of March, 2019 but not cleared till 3rd April, 2019 ₹ 20,000.

(iii) Interest on bank overdraft not entered in the Cash Book ₹ 1,500.

(iv) Cheques of ₹ 20,000 deposited in the bank in March, 2019 but not collected and credited till 3rd April, 2019.

(v) ₹ 100 Insurance Premium paid by the bank under a standing order has not been entered in the Cash Book.

(iv) A draft of ₹ 10,000 favouring Atul & Co. was issued by the bank charging commission of ₹ 200. However, in the Cash Book entry was passed by ₹ 10,000.

ANSWER:

Page No 12.50:

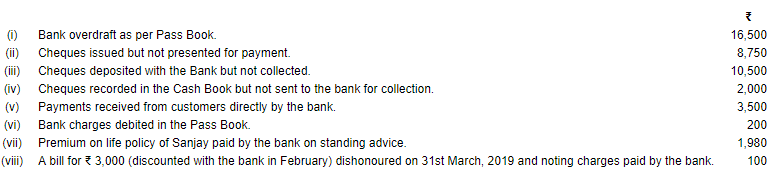

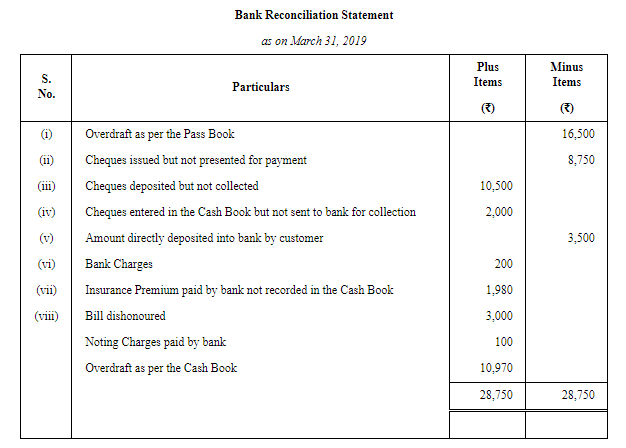

Question 28: From the following information supplied by Sanjay, prepare his Bank Reconciliation Statement as on 31st March, 2019: ANSWER:

ANSWER:

Page No 12.50:

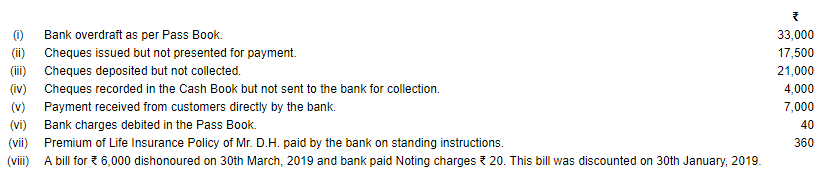

Question 29: From the following information supplied by Mr. D.H., prepare his Bank Reconciliation Statement as on 31st March, 2019:

ANSWER:

Page No 12.51:

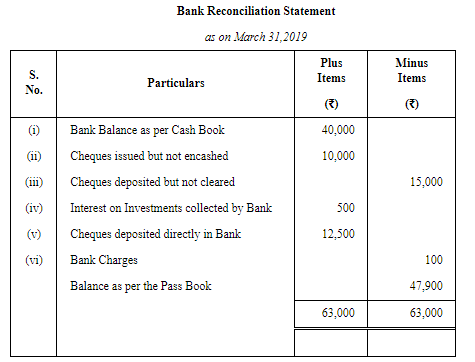

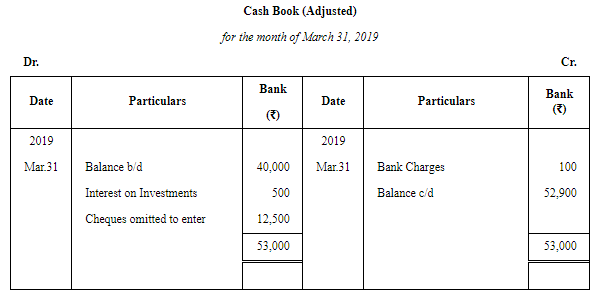

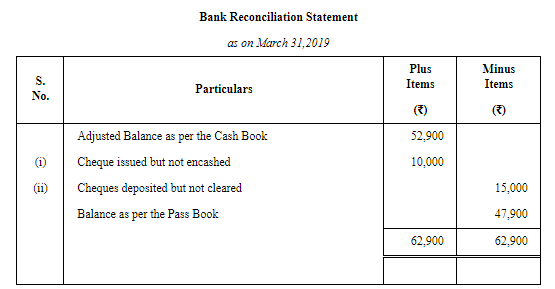

Question 30: From the following particulars, ascertain the bank balance as per Pass Book as on 31st March, 2019 (a) without correcting the Cash Book balance and (b) after correcting the Cash Book balance:

(i) The bank balance as per Cash Book on 31st March, 2019 ₹ 40,000.

(ii) Cheques issued but not encashed up to 31st March, 2019 amounted to ₹ 10,000.

(iii) Cheques paid into the bank, but not cleared up to 31st March, 2019 amounted to ₹ 15,000.

(iv) Interest on investments collected by the bank but not entered in the Cash Book ₹ 500.

(v) Cheques deposited in the bank but not entered in the Cash Book ₹ 12,500.

(vi) Bank charges debited in the Pass Book but not entered in the Cash Book ₹ 100.

ANSWER:

(a) Without correcting Cash Book Balance

(b) After correcting Cash Book Balance

Page No 12.51:

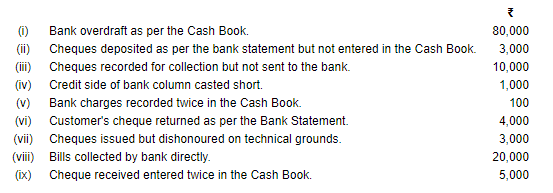

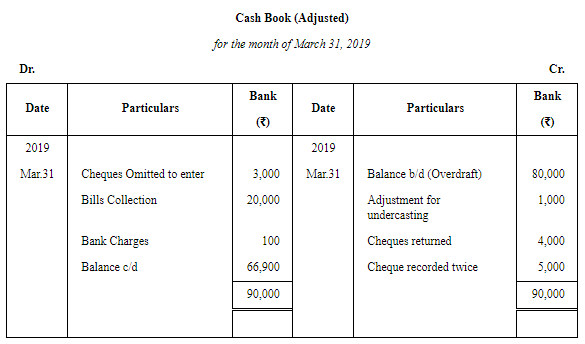

Question 31: From the following particulars, find out corrected bank balance as per Cash Book and thereafter prepare a Bank Reconciliation Statement as on 31st March, 2019 of a sole proprietor:

ANSWER:

Page No 12.52:

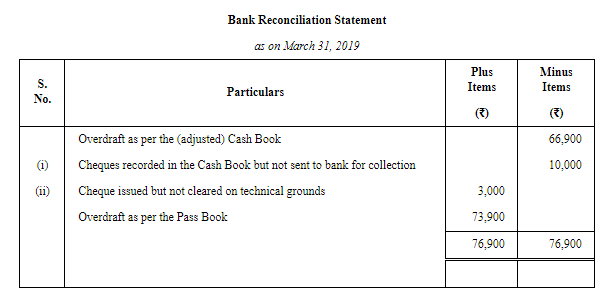

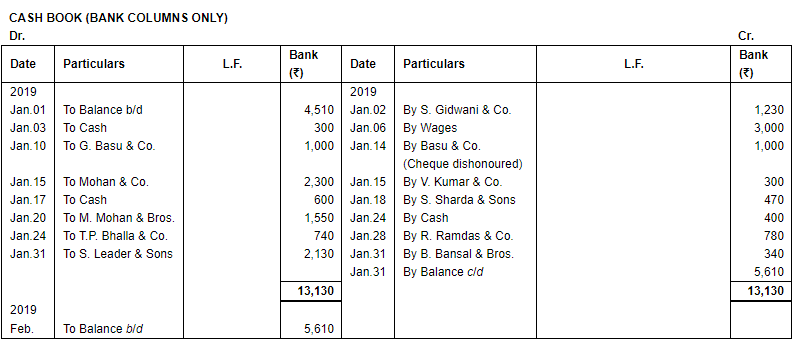

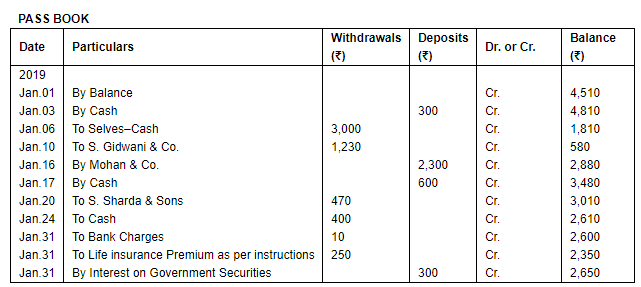

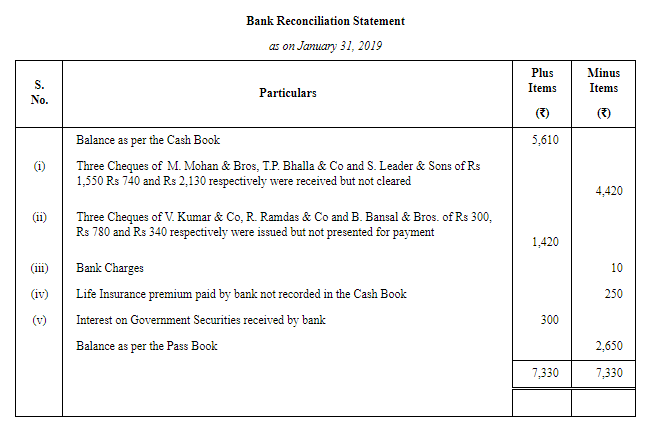

Question 32: From the following extracts from the Cash Book and the Pass Book for the month of January, 2019, prepare Bank Reconciliation Statement:

ANSWER:

Note: In Cash Book cheque received from G. Basu & Co is debited with Rs 1,000 and at the time of dishonour entry is reversed by crediting G. Basu & Co with Rs 1,000. Therefore its net effect is nil in Cash Book.

|

64 videos|152 docs|35 tests

|

FAQs on Bank Reconciliation Statement (Part - 6) - Accountancy Class 11 - Commerce

| 1. What is a bank reconciliation statement? |  |

| 2. Why is it important to reconcile bank statements? |  |

| 3. What are the common reasons for differences between the bank balance and company's records? |  |

| 4. How often should bank reconciliation be performed? |  |

| 5. What are the steps involved in preparing a bank reconciliation statement? |  |