Banking Industry Structure in India | IBPS PO Prelims & Mains Preparation - Bank Exams PDF Download

Scheduled Banks

Those banks which are included in 2nd Schedule of RBI Act 1934. These banks should fulfill two conditions:- Paid up capital and collected funds should not be less than Rs.5 lacs.

- Any activity of the Bank should not be detrimental or adversely affect the interests of the customers

Every Scheduled Bank enjoys two principal facilities

(i) It becomes eligible for a Loan from RBI at Bank Rate.

(ii) It automatically acquires the membership of Clearing House.

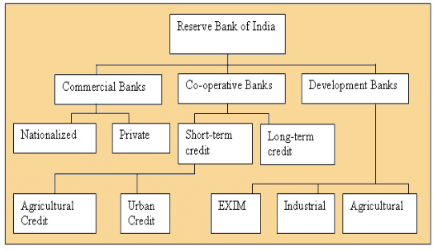

Scheduled Banks comprises of:

- Commercial Banks

- Cooperative Banks

Commercial Banks are both Scheduled and Non-scheduled commercial banks regulated Banking Regulaions Act 1949. Commercial Banks works on a ‘Profit Basis’ and are engaged in the business of accepting deposits for the purpose of advances/loans

4 Types of Scheduled Commercial Banks (SCBs)

I. Public Sector Banks

II. Private Sector Banks

III. Foreign Banks

IV. Regional Rural Banks

I. Public Sector Banks

are those banks where Govt. is the owner or having more than 51% stake in capital.SBI and all Nationalised Banks are Public Sector Banks.

For Example: SBI __________________1

SBI and its Associates (now all the 5 Associates merged wih SBI w.e.f. 01.04.2017).

- State Bank of Patiala

- State Bank of Bikaner & Jaipur

- State Bank of Mysore

- State Bank of Hydrabad

- State Bank of Travancore

- Earlier, State Bank of Indore and State Bank of Saurashtra already been merged with SBI.

Others

- Other Nationalised Banks____________19

- Other Public Sector Banks____________1

- IDBI and Bhartiya Mahila Bank____________1

- (BMB also now merged with SBI)

Total Public Sector Banks 21

After merger of 5 Associate Banks and BMB with SBI there will be 21 Public Sector Banks.

Total commercial Banks ___87 (before merger93)

Public Sector Banks (21):

1. SBI

2. Allahabad Bank

3. Bank of India

4. Bank of Baroda

5. Bank of Maharashtra

6. Canara Bank

7. Central Bank f India

8. Corporation Bank

9. Dena Bank

10. Indian Bank

11. Indian Overseas Bank

12. OBC

13. Punjab & Sind Bank

14. Punjab National Bank

15. Syndicate Bank

16. UCO Bank

17. Union Bank of India

18. United Bank of India

19. Vijaya Ban

Other Public Sector Bank

1. IDBI

2. BMB (merged with SBI)

II. Private Sector Banks

- Private Banks are owned by private individuals/institutions. These are registered under the Companies Act 1956 as Limited Companies. For example :

New Generation Private Banks

- HDFC Bank

- ICICI Bank

- AXIS Bank

- Yes Bank

Old Private Sector Banks

- Karur Vysaya Bank

- South Indian Bank etc.

III. Foreign Banks

Which are incorporated outside India and are operating branches in India also. For example:

- UK Banks : HSBC, Barclays Banks Standard Chartered Bank Royal Bank of Scotland

- US Banks: Bank of America Citi Bank American Express

Some foreign banks are also having their representative offices in India

IV. Regional Rural Banks:

- RRBs were established in 1975 under RRB Act 1976.

- Main focus : Rural Area Development and elimination of money lenders.

RRBs are jointly owned by:

- Govt. Of India 50%

- State Govt. 15%

- Sponsored Bank 35%

- Recommendations : Narsimham Committee

- First RRB : Pratham Gramin Bank by Syndicate Bank in Moradabad (UP).

- Regulated By : NABARD

- Minimum Capital : Rs. 5 crore

PS Lending Target of RRBs:

75% of total outstanding advances should be to Priority Sector :

- Agriculture incl. Small & Marginal - 18%

- Weaker Sector - 15%

- MSME - 7.5%

- Education

- Housing

- Social Infrastructure

- Renewable Energy

- Others

Cooperative Banks

Cooperative Banks are small sized banks operating in rural and urban areas. They also perform fundamental banking activities but they are different from commercial banks.- Coop. Banks are registered under Coop. Societies Act 1965 with RCS of the State.

- Coop. Banks are regulated by RBI under Banking Regulations Act 1949.

- Coop. Banks have limited products like – No ATM, Internet / Mobile Apps. Banking, RTGS/NEFT , Lesser Network of Branches etc.

Coop. Banking Structure is divided into 5 categories:

(i) Primary Coop. Credit Society – Association of borrowers and non-borrowers. Funds of society are derived from members.

(ii) District Central Coop. Bank – Functions at District level only

(iii) State Coop. Bank – Apex Body the State Govt.

(iv) Land Development Bank – Long term loans to farmers. No deposits from public.

(v) Urban Coop. Bank – general banking activities at State level.

Development Banks

- IFCI : To cater to the long term financial needs of the Industrial Sector/Big projects.

- IDBI : for Industrial Sector now merged with IDBI Bank.

- SIDBI : Loan assistance to MFIs (Micro Finance Institutions) for onward lending to individuals/ SHG, subject to Min.Rs.50 lacs.

- Finance by MFI per borrower should not be more than Rs.60000/- and per SHG Rs.100000.

EXIM Banks

Govt. owned institution to finance and support exports and import of goods. Planning, Promoting & Developing Exports and Imports.

Nabard

Promotion and development of agriculture, small scale industries, cottage and village industries, handicrafts and other allied economic activities.

|

647 videos|1019 docs|305 tests

|