Book of Original Entry - Cash Book (Part - 1) - Commerce PDF Download

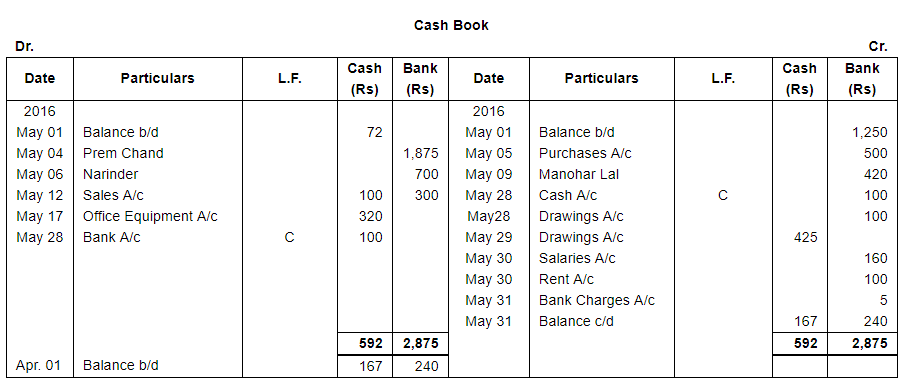

Page No 11.52:

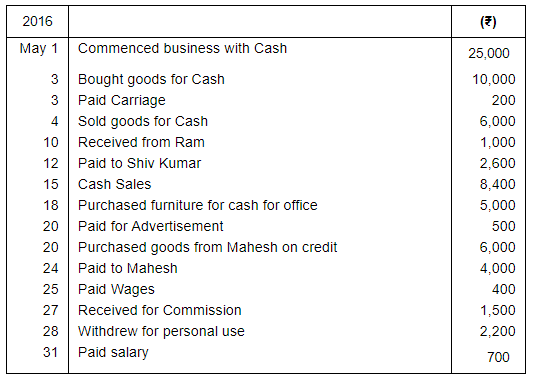

Ques 1:Enter the following transactions in a Single Column Cash Book∶−

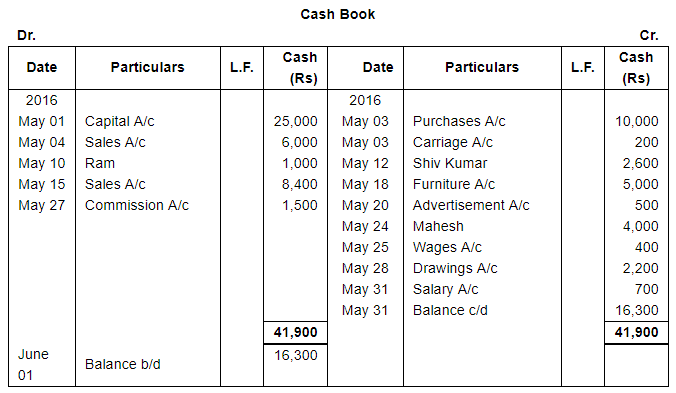

Ans:

Note: Transaction dated May 20, 2016, will not be recorded in Cash Book because credit transactions do not affect the cash balance.

Ques 2: Enter the following transactions in M/s Mukerjee & Bros. Single Column Cash Book:

Ans:

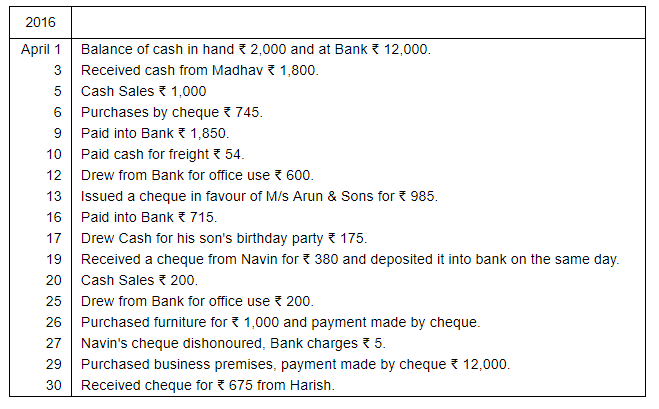

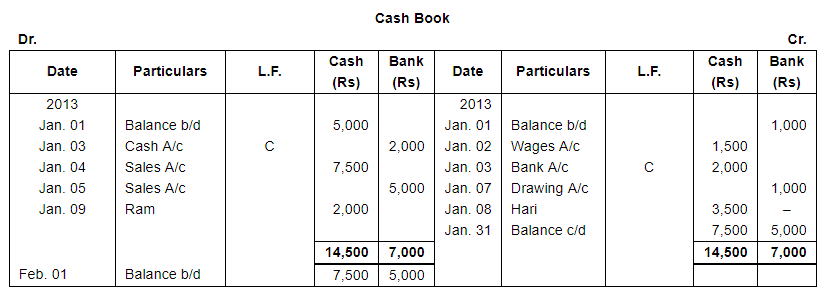

Page No 11.53:

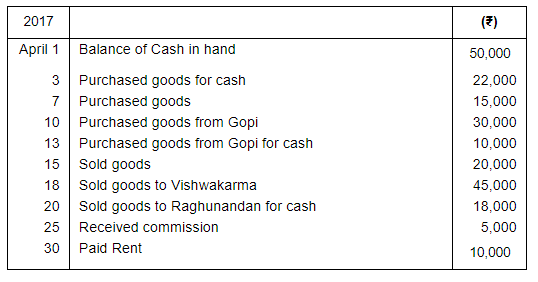

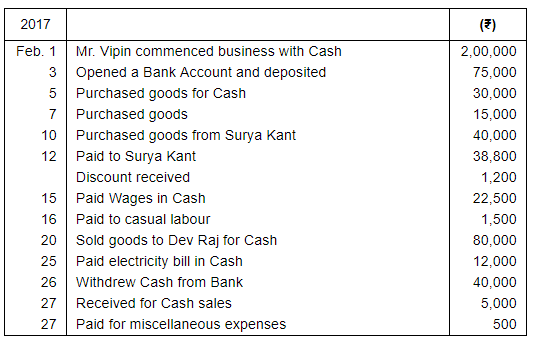

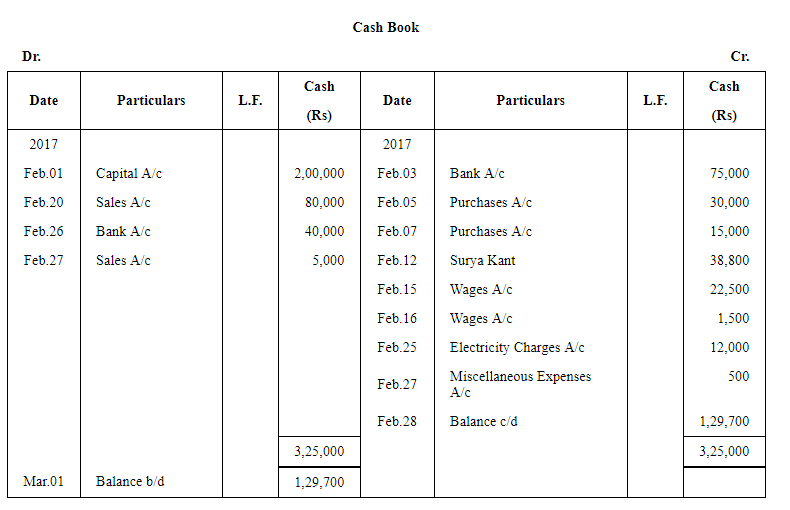

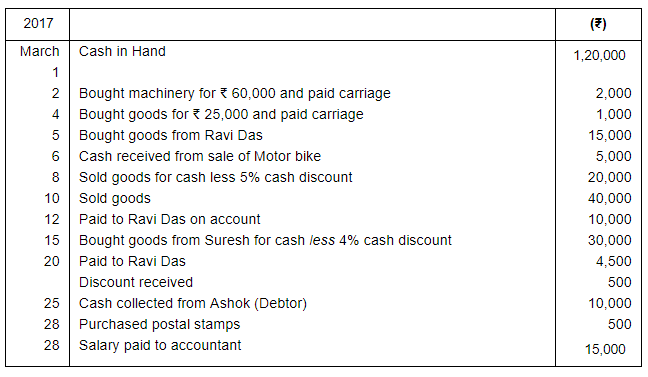

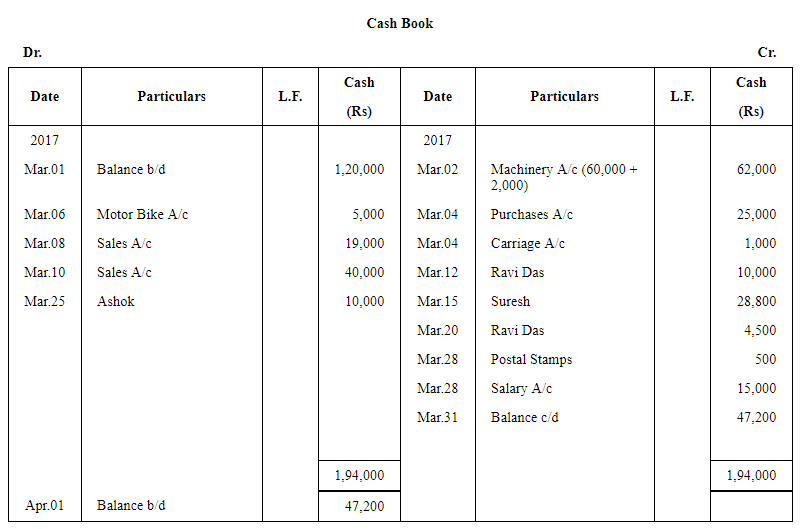

Ques 3: Enter the following transactions in a Single Column Cash Book∶

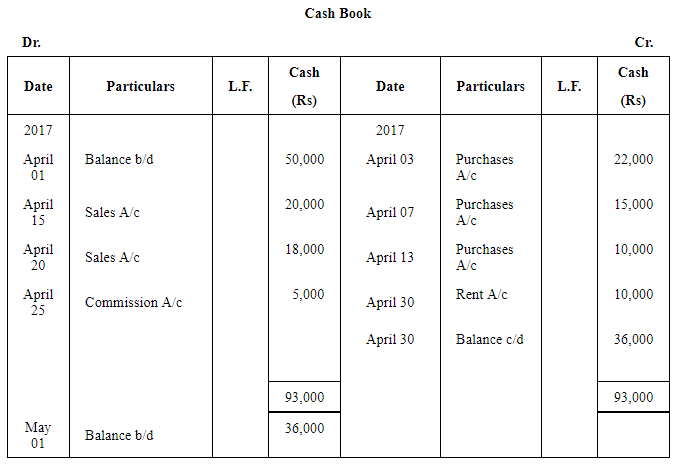

Ans:

Ques 4: Enter the following transactions in a Single Column Cash Book:-

Ans:

Page No 11.54:

Ques 5: Enter the following transactions in a Single Column Cash Book of M/s Suchitra Sen & Co. :

Ans:

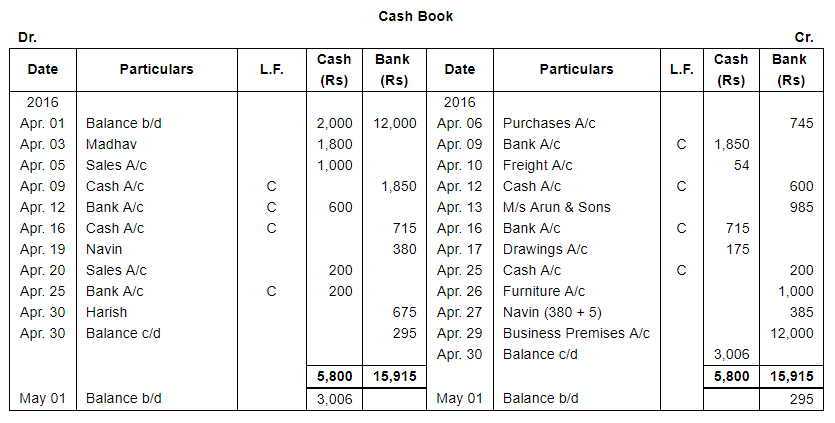

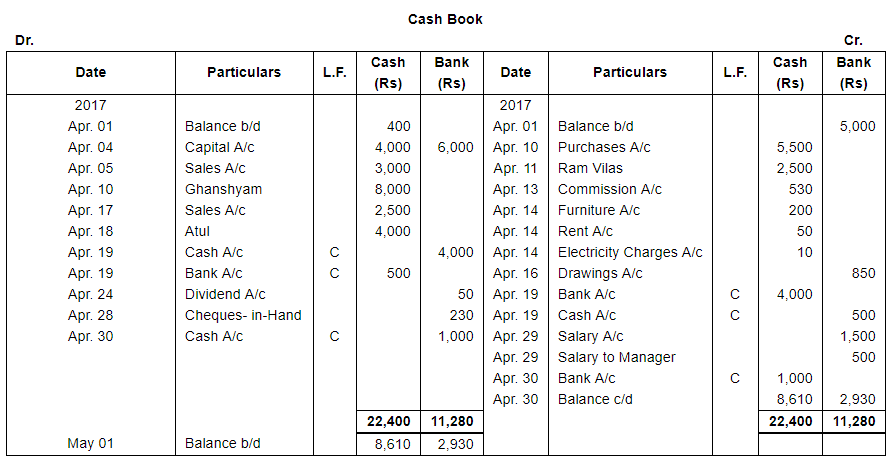

Ques 6: Write up Cash Book of Bhanu Partap with Cash and Bank Columns from the following transactions:−

Ans:

Page No 11.55:

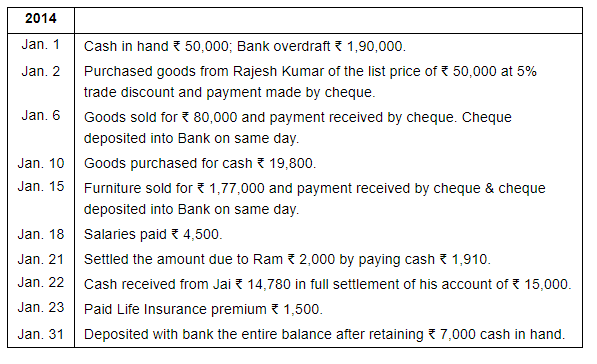

Ques 7: Prepare Two Column Cash Book from the following transactions and balance the book on 31st Jan., 2014:-

Ans:

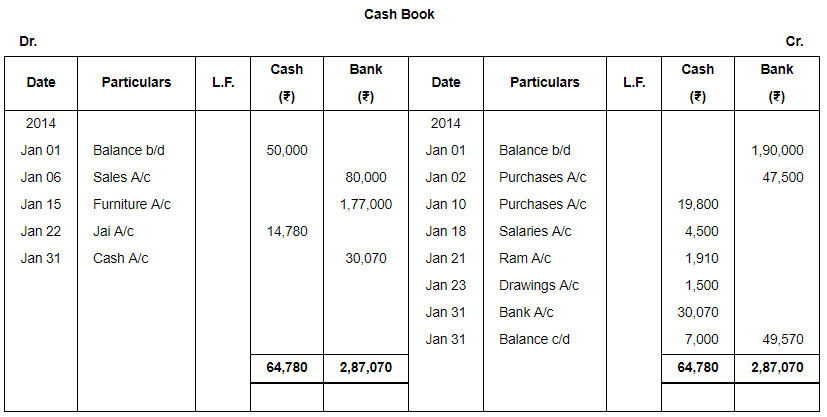

Ques 8(A): Enter the following particulars in the Cash Book with Cash and Bank columns:−

Ans:

Notes: Transaction dated April 30, 2016, does not contain any information regarding date of depositing the cheque, so it has been assumed that the cheque has been deposited on the same day.

Page No 11.56:

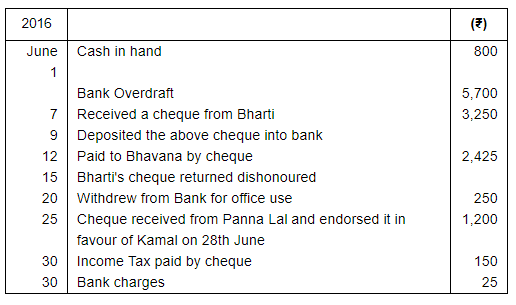

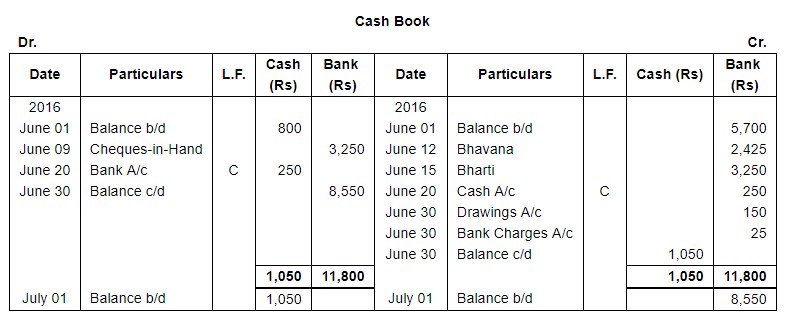

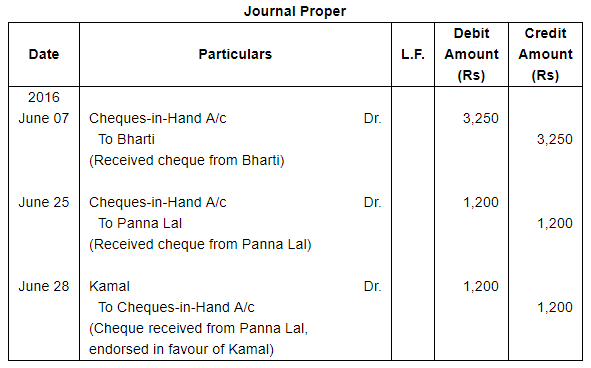

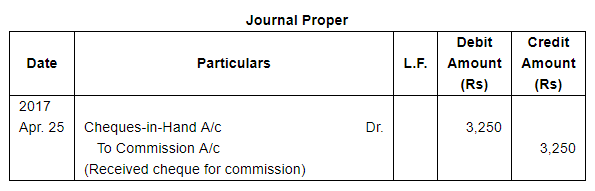

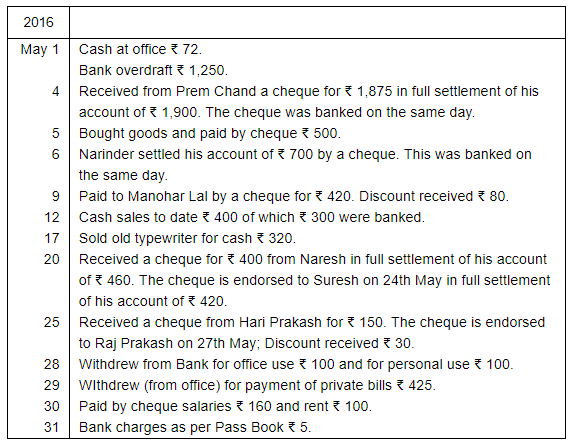

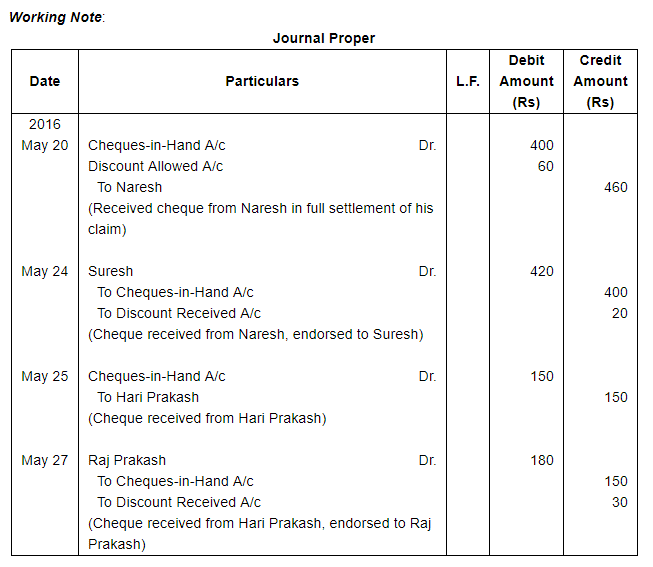

Ques 8(B): Enter the following transactions in the Cash Book with Cash and Bank Columns:−

Ans:

Working Note:

Page No 11.57:

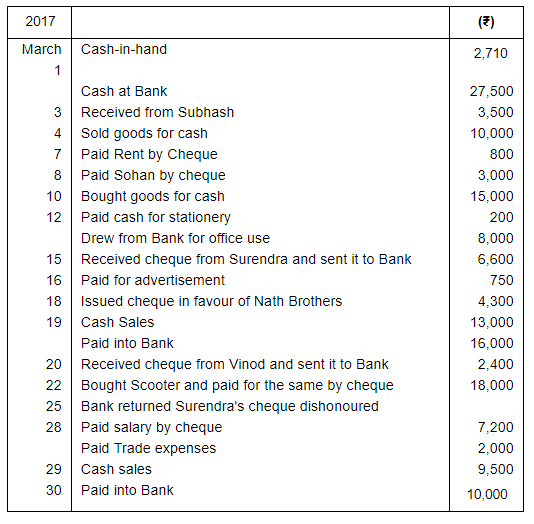

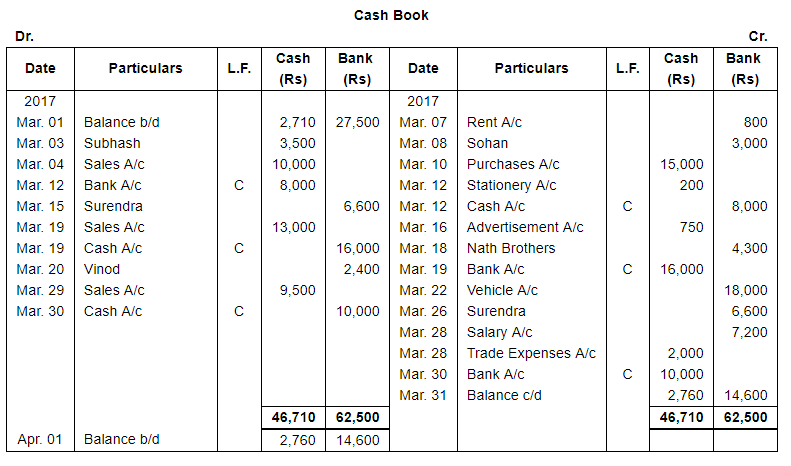

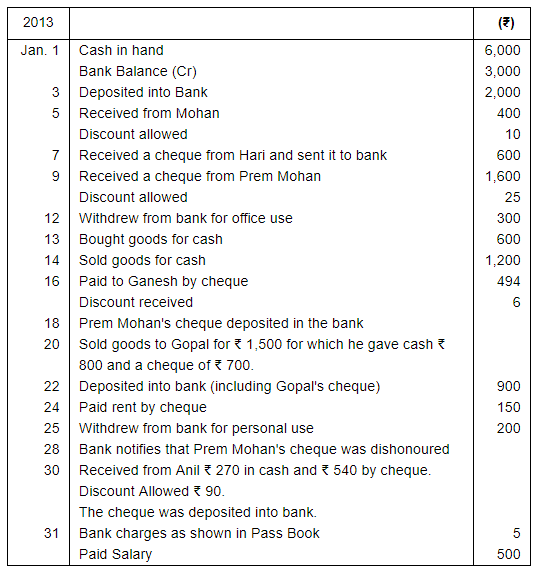

Ques 9: Enter the following transactions in the Cash Book with Cash and Bank Columns ∶−

Ans:

Working Notes:

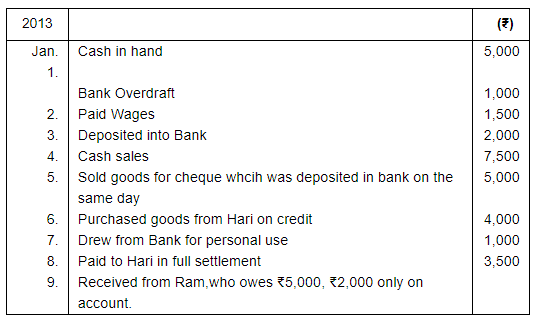

Ques 10(A): Enter the following transactions in a Two Column Cash Book :−

(i) Commenced business with cash ₹50,000

(ii) Deposited in Bank 40,000

(iii) Received c ash from Mohan ₹950 in full settlement of a debt of ₹1,000

(iv) Bought goods for cash ₹10,000

(v) Bought goods by cheque ₹15,000

(vi) Sold goods for cheque for ₹20,000 and deposited in Bank on the same day

(vii) Paid to Arun by cheque ₹1,900 in full settlement of his account of ₹2,000

(viii) Drew from Bank for office use ₹1,000

Ans:

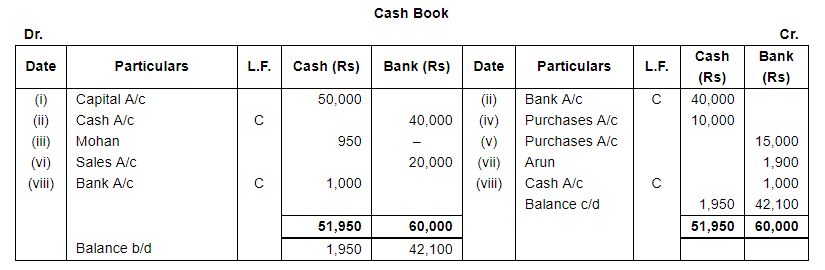

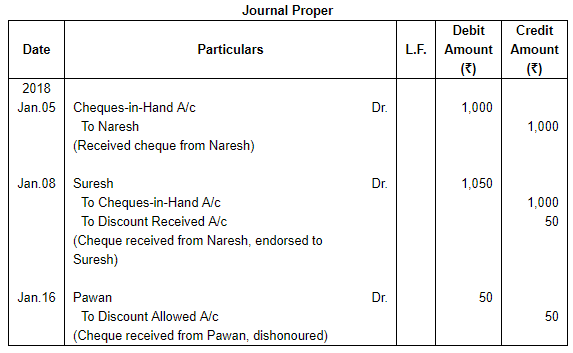

Ques 10(B): Prepare a Two Column Cash Book :−

Ans:

Note: Transaction dated January 06, 2013, will not be recorded in Cash Book because credit transactions will not affect the cash/bank balance.

Page No 11.58:

Ques 11(A): Write the following transactions in a Two Column Cash Book and balance the Cash Book:−

Ans:

Page No 11.59:

Ques 11(B): Prepare a Two Column Cash Book from the following transactions∶−

Ans:

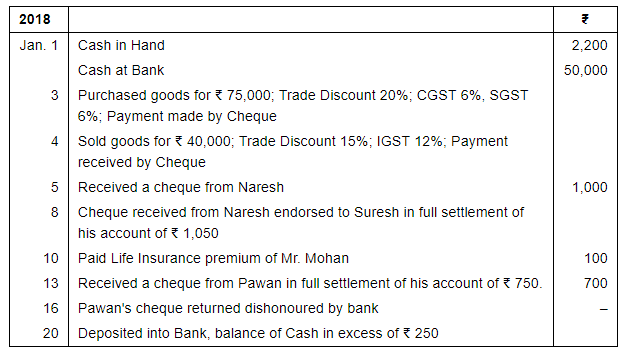

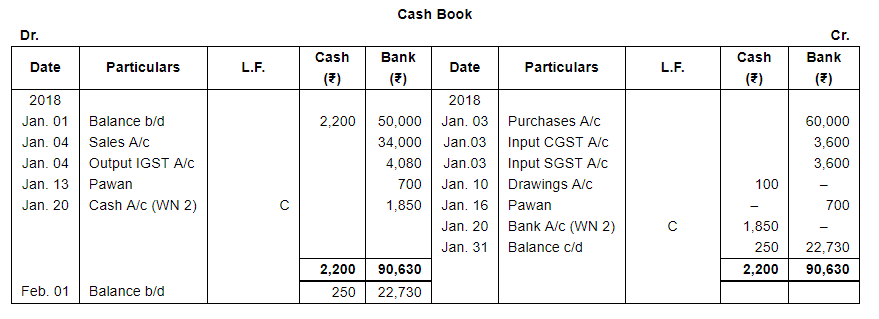

Ques 12(A): Enter the following transactions in the Two Column Cash Book of Mr. Mohan:-

Ans:

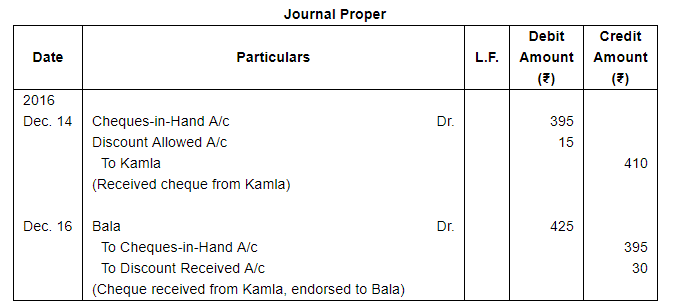

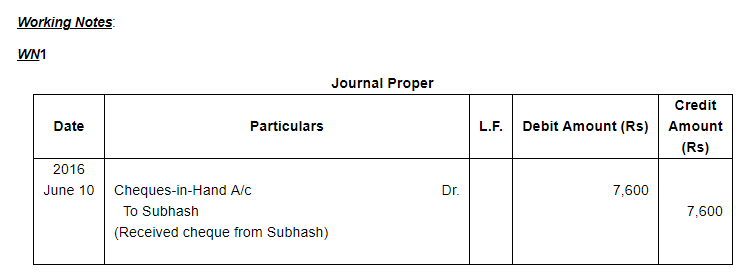

Working Notes

WN1

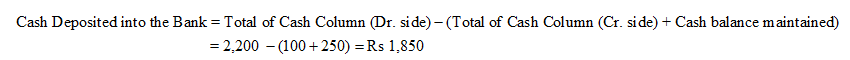

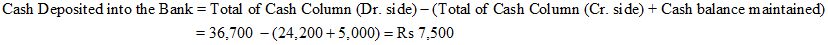

WN2 Cash Deposited into the Bank

Page No 11.60:

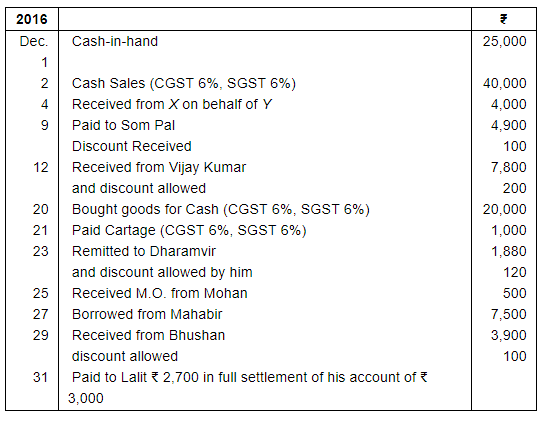

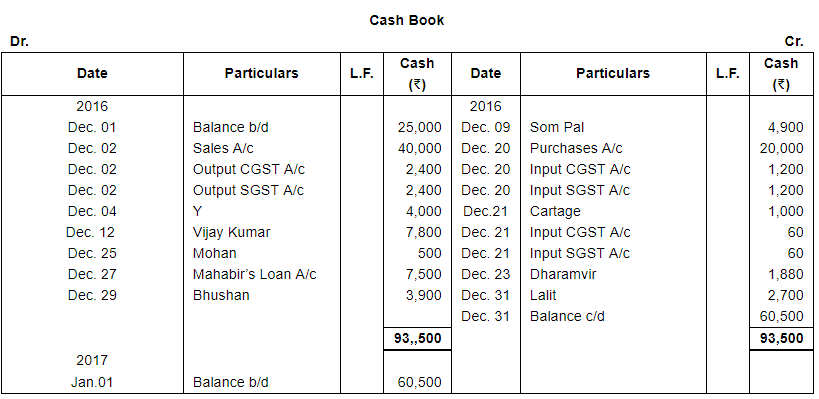

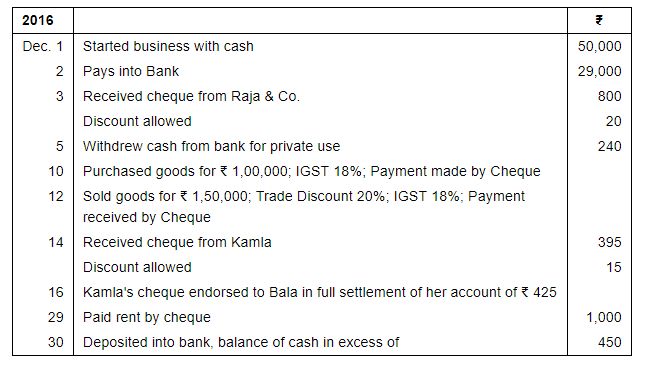

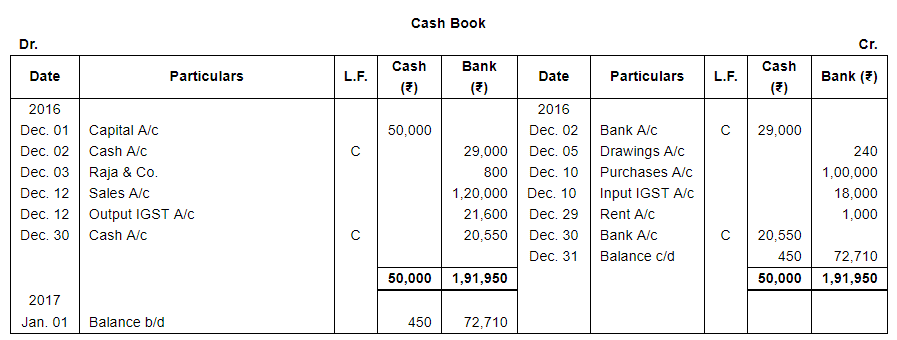

Ques 12(B): Enter the following transactions in a Two Column Cash Book:-

Ans:

Working Notes

WN1

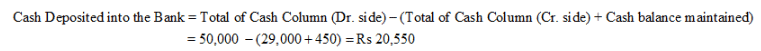

WN2 Cash Deposited into the Bank

Note: Transaction dated December 03, 2016, does not contain any information regarding date of depositing the cheque, so it has been assumed that the cheque has been deposited on the same day.

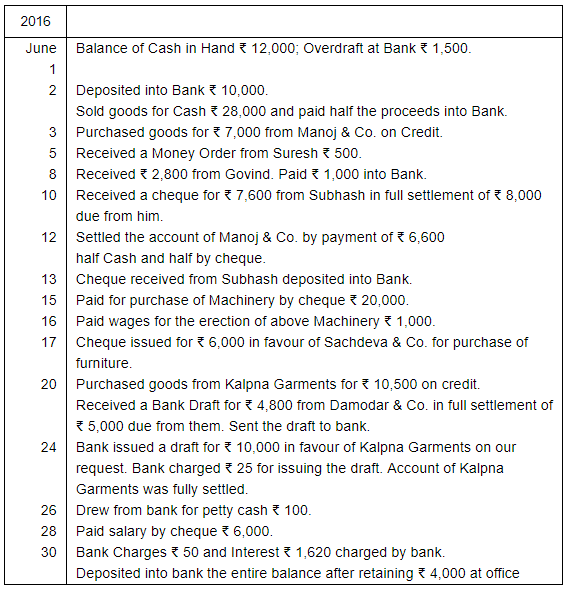

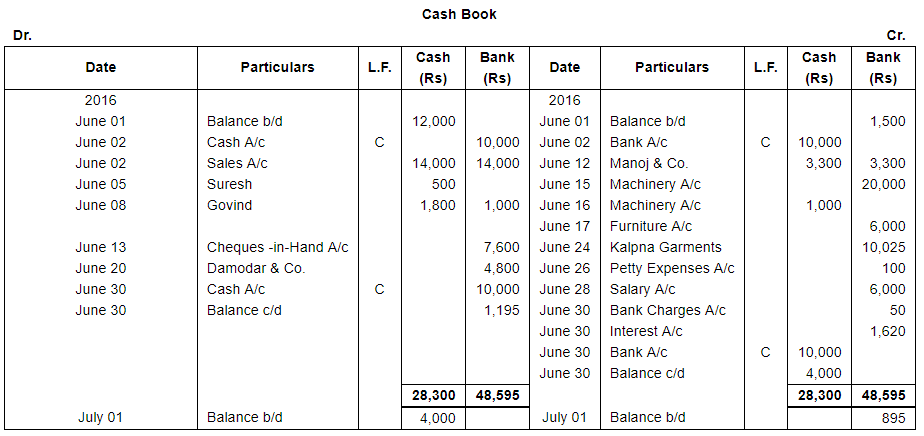

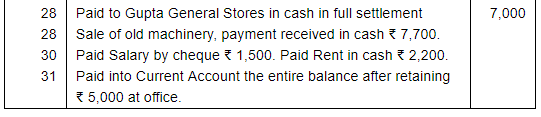

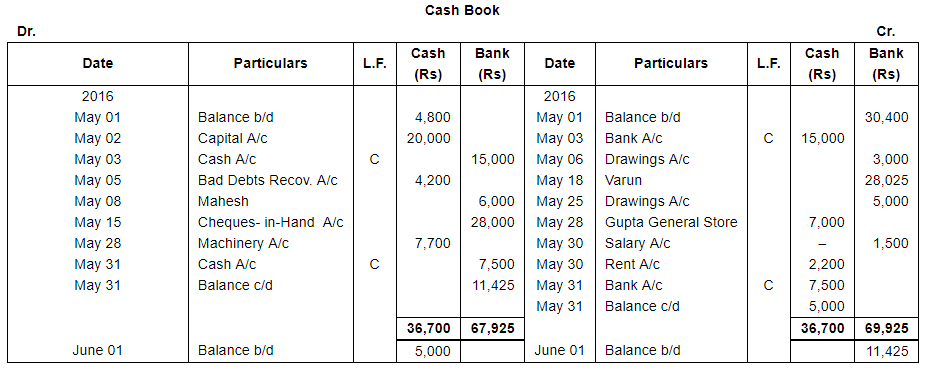

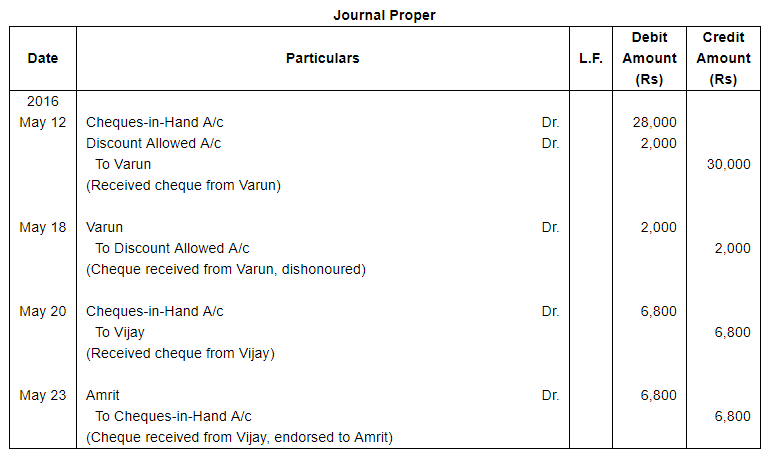

Ques 13: Enter the following transactions in the Cash Book with Cash and Bank Columns∶−

Ans:

WN2 Cash Deposited into the Bank

Cash Deposited into the Bank= Total of Cash Column (Dr. side)−(Total of Cash Column (Cr. side)+Cash Balance Maintained = 28,300−(14,300+4,000)=Rs 10,000

Note: Transaction dated June 03, 2011 and June 20, 2011 will not be recorded in Cash Book because credit transactions will not affect the cash/bank balance.

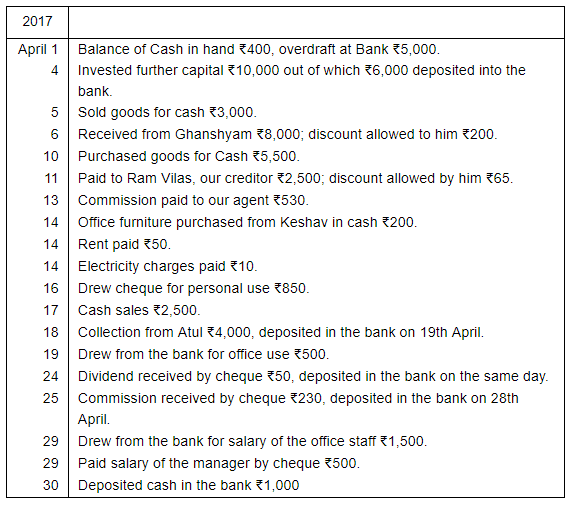

Ques 14(a): Prepare a Cash Book with Cash and Bank Columns from the following transactions:−

Ans:

Note: Transaction dated March 28, 2017, does not contain any information regarding date of depositing the cheque, so it has been assumed that the cheque has been deposited on the same day.

Page No 11.62:

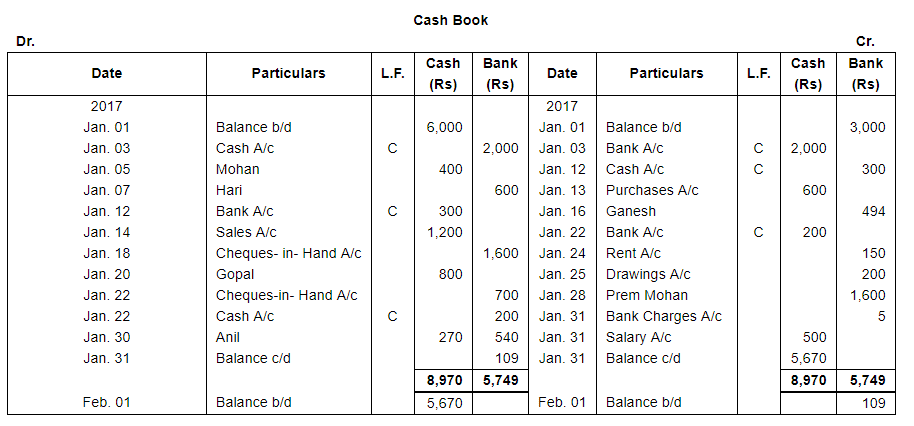

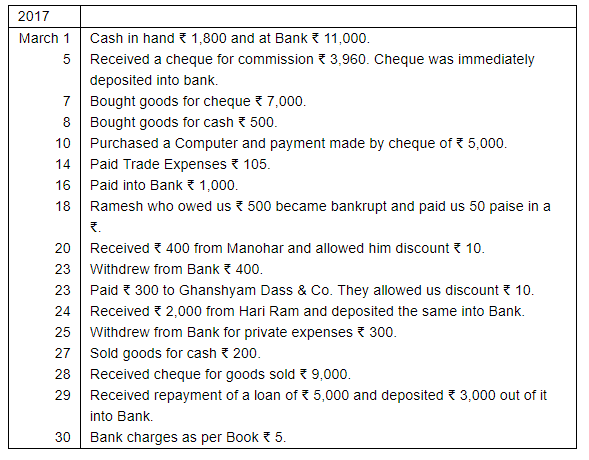

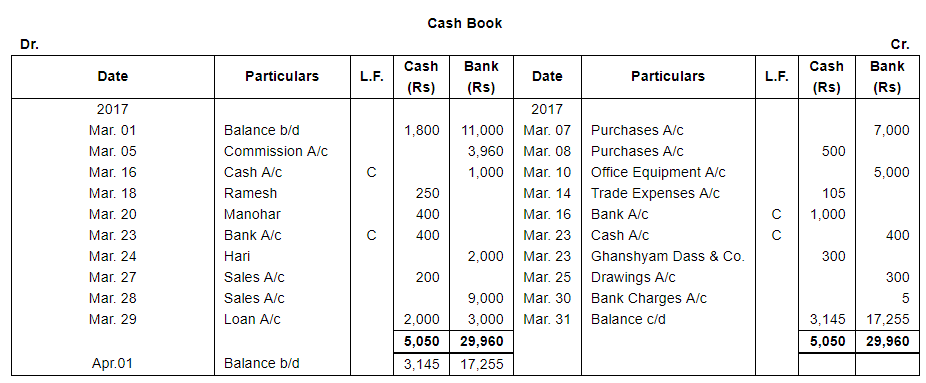

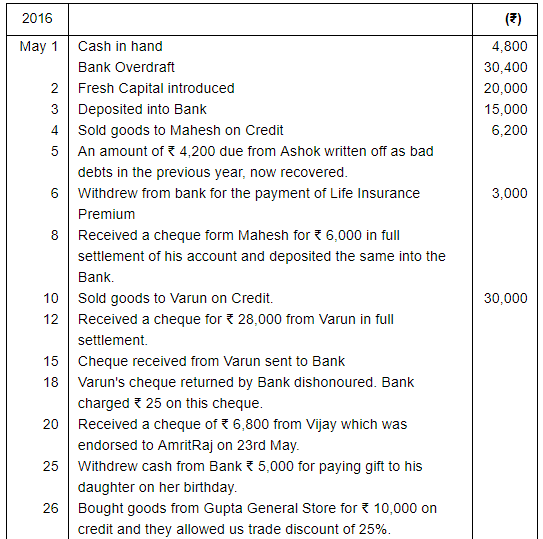

Ques 14(B): From the following transactions, prepare Cash Book with Cash and Bank Columns:−

Ans:

Working Notes:

WN1

WN2 Cash Deposited into the Bank

Note: Transaction dated May 04, 2016 and May 10, 2016 will not be recorded in Cash Book because credit transactions will not affect the cash/bank balance.

FAQs on Book of Original Entry - Cash Book (Part - 1) - Commerce

| 1. What is a cash book? |  |

| 2. What are the advantages of using a cash book? |  |

| 3. What are the different types of cash books? |  |

| 4. What is the difference between single column and double column cash book? |  |

| 5. What is the purpose of a cash book in accounting? |  |