Books of Original Entry- Journal (Part - 3) - Commerce PDF Download

Page No 9.67:

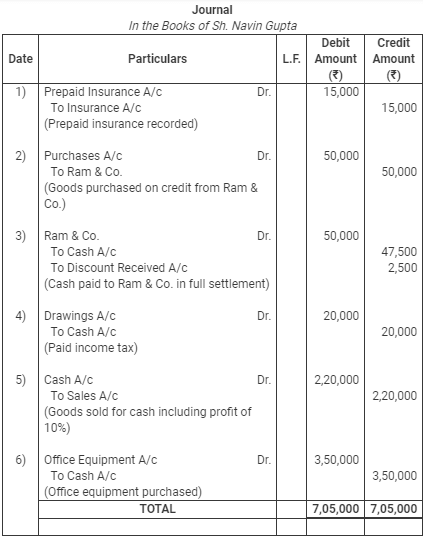

Ques 23: Journalise the following transactions in the Journal of Navin Gupta & Sons.:-

1. Out of Insurance premium paid this year, ₹ 15,000 is related to next year.

2. Credit purchases from Ram & Co. for ₹ 50,000. Cash discount will be received at 5% on payment of bill within 10 days.

3. Cash paid to Ram & Co. and discount availed of.

4. Paid Income Tax ₹ 20,000 by cheque.

5. Goods costing ₹ 2,00,000 sold for cash at a profit of 10%.

6. Purchased iron safe for ₹ 2,00,000 filing cabinet for ₹ 50,000 and Computer for ₹ 1,00,000.

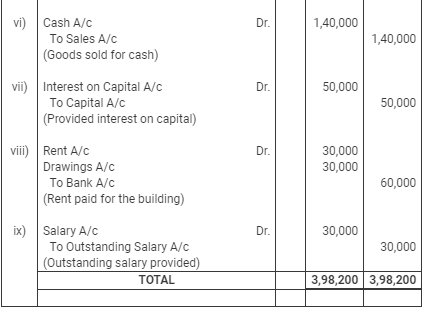

Ans:

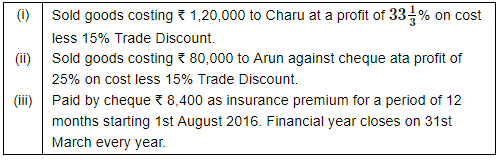

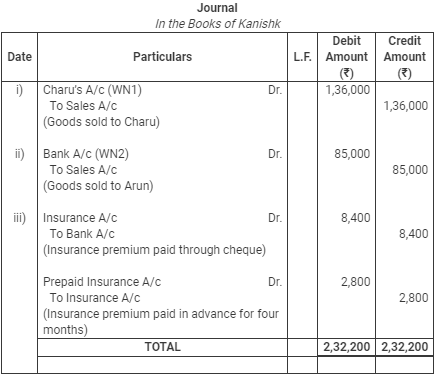

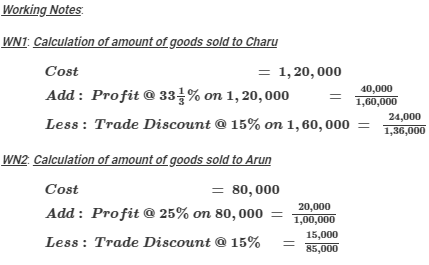

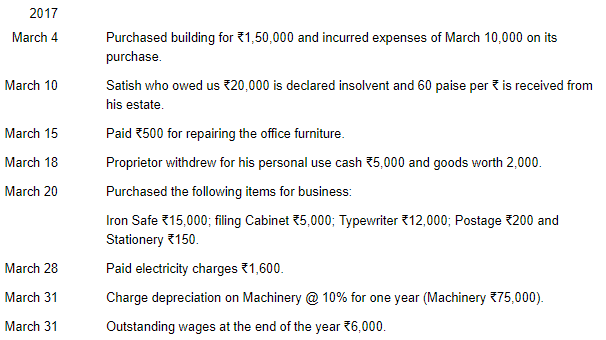

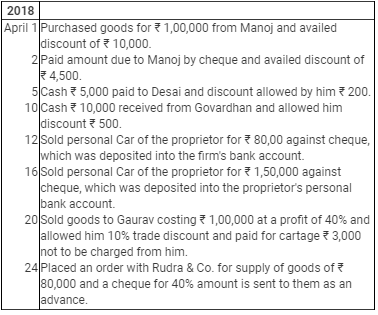

Ques 24: Journalise the following transactions in the books of Kanishk Traders:

Ans:

Ques 25: Journalise the following:− Ans:

Ans:

Page No 9.68:

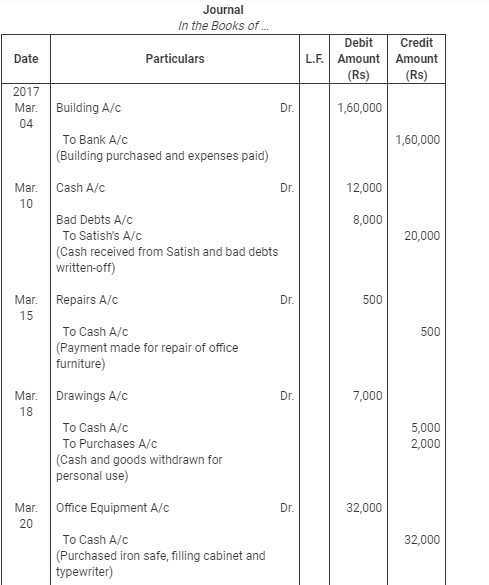

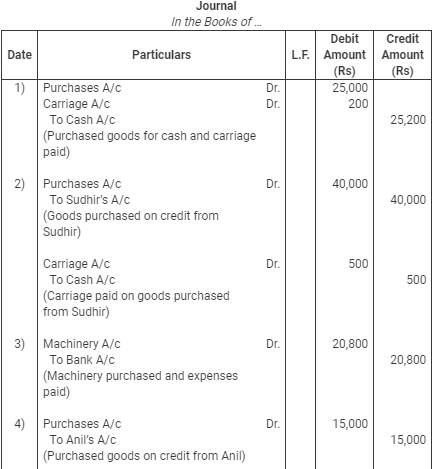

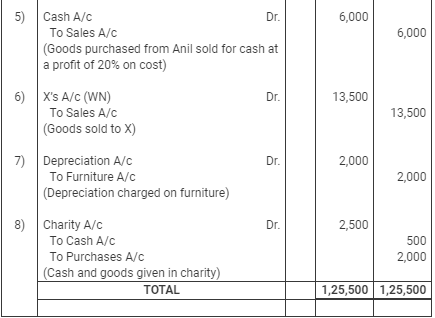

Ques 26: Journalise the following:

1. Purchased goods for ₹ 25,000 for Cash and paid ₹ 200 for carriage on these goods.

2. Purchased goods for ₹ 40,000 on Credit from Sudhir and paid ₹ 500 for carriage on these goods.

3. Purchased machinery for ₹ 20,000 and spent ₹ 500 on its carriage and ₹ 300 on its installation.

4. Purchased goods from Anil for ₹ 15,000.

5. Sold 1/3rd of the above goods at a profit of 20% on cost.

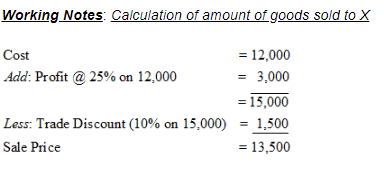

6. Goods costing ₹ 12,000 sold to Mr.X , issued invoice at 25% above cost less 10% trade discount.

7. Provide 20% depreciation on furniture costing ₹ 10,000. 8. Gave as charity − Cash ₹ 500 and Goods ₹ 2,000.

Ans:

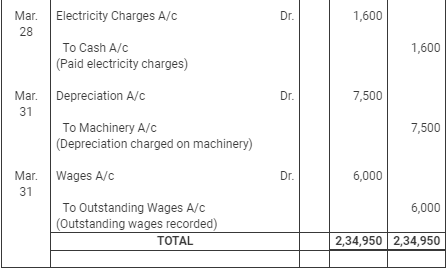

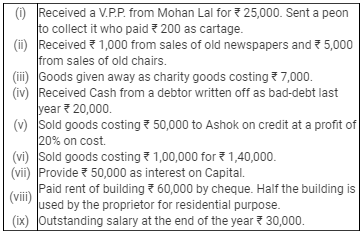

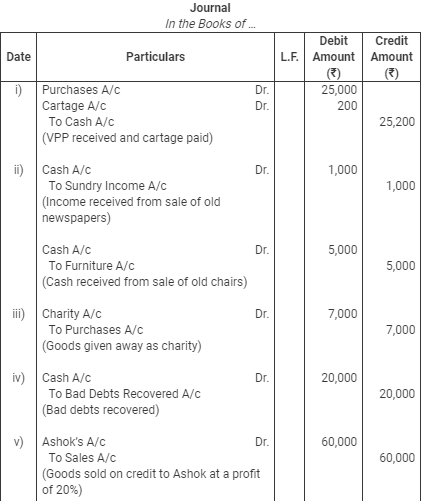

Ques 27: Journalise the following:

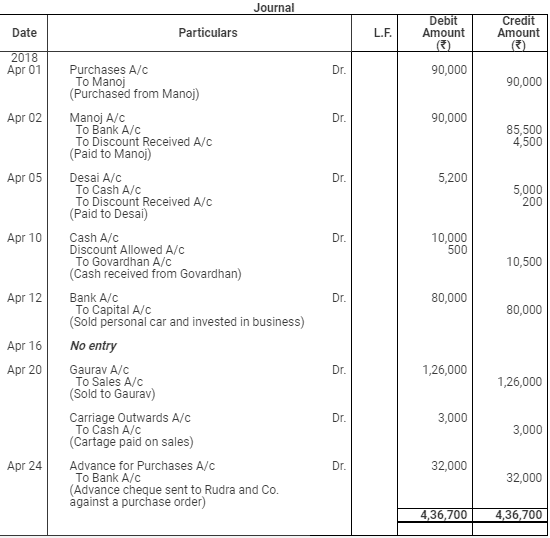

Ans:

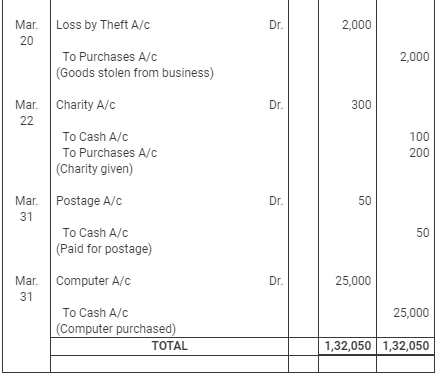

Page No 9.69:

Ques 28: Journalise the following transactions:

Ans:

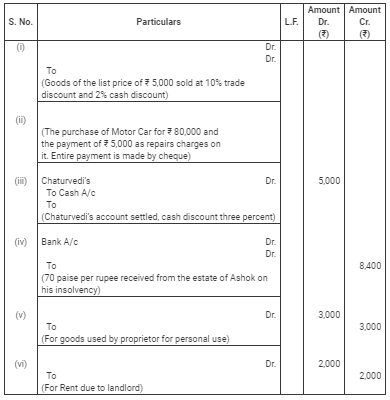

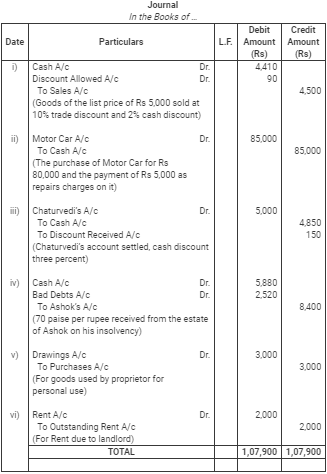

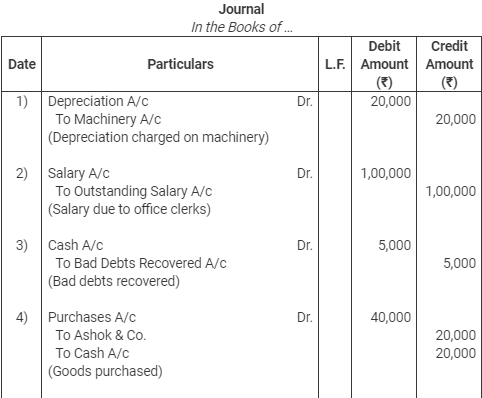

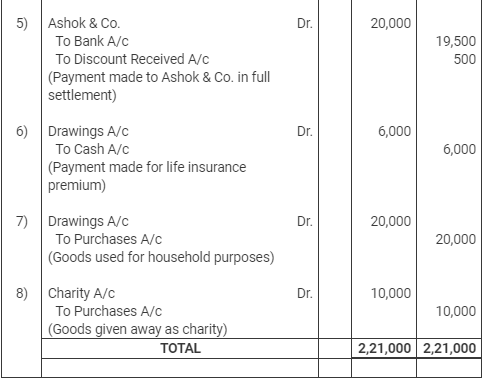

Ques 29: Give the journal entries corresponding to the narration given below:-

Ans:

Page No 9.70:

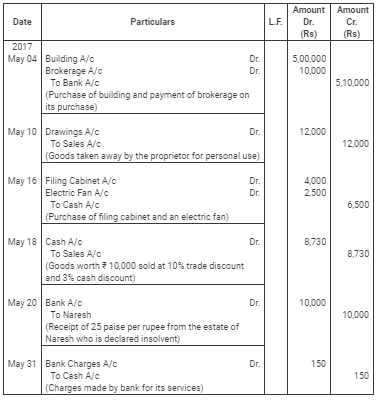

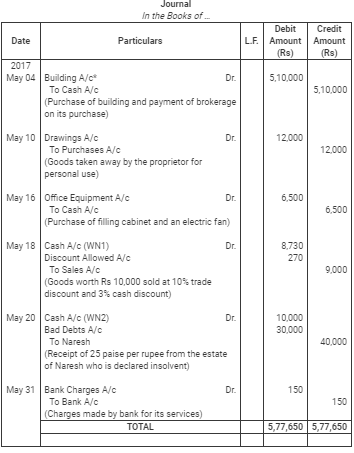

Ques 30: Rectify the following entries assuming that the narration in each case is correct:

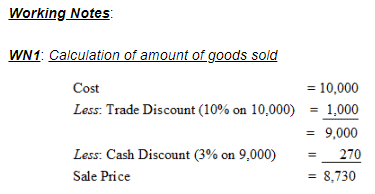

Ans:

* Payment of brokerage will be included in cost of the building as it is incurred at time of purchase of building.

Page No 9.71:

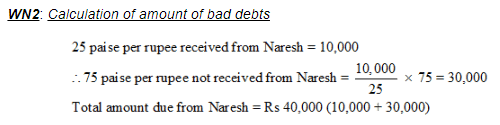

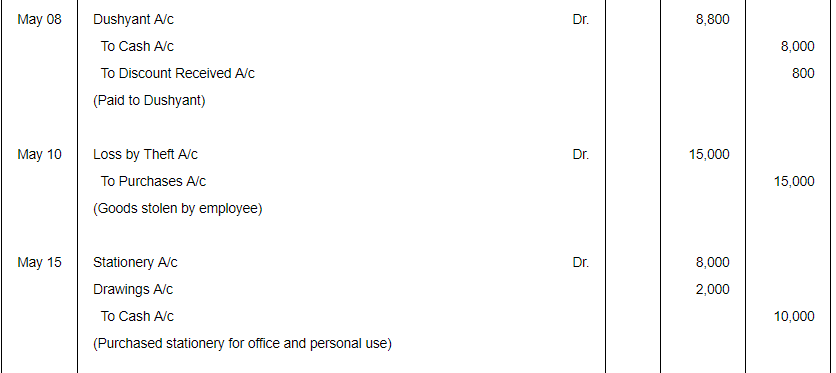

Ques 31: Journalise the following transactions:

(a) Goods destroyed by Fire for ₹ 5,000.

(b) Paid by cheque ₹ 25,000 as wages on installation of a Machinery.

(c) Issued a cheque in favour of M/s Parmatma Saran & Sons on account of purchase of goods ₹ 75,000.

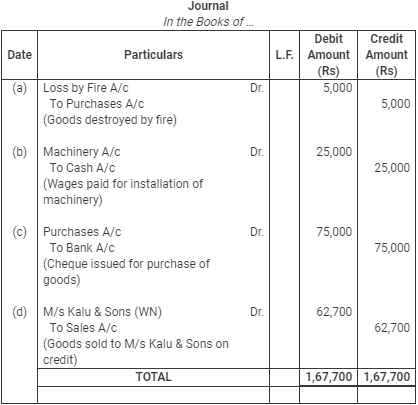

(d) Goods sold costing ₹ 60,000 to M/s Kalu Sons at an invoice price 10% above cost less 5% Trade discount.

Ans:

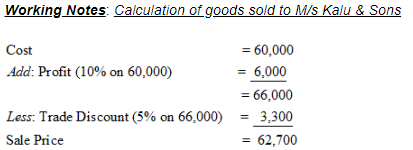

Ques 32: Journalise the following trasactions:−

Ans:

Page No 9.72:

Ques 33: Journalise the following transactions :

Ans:

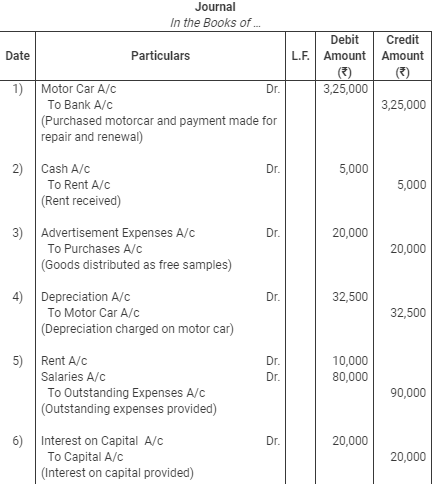

Ques 34: Journalise the following transactions:

1. Purchased a Motor Car for ₹ 3,00,000 and paid ₹ 25,000 for its repair and renewal. Entire payment is made by cheque.

2. Received Rent ₹ 5,000.

3. Goods worth ₹ 20,000 were distributed as free samples.

4. Charge depreciation on Motor Car ₹ 32,500.

5. Rent due to Landlord ₹ 10,000 and Salary due to Clerks ₹ 80,000.

6. Charge interest on Capital ₹ 20,000.

7. ₹ 5,000 due from Sanjay Gupta are bad-debts.

8. Goods worth ₹ 50,000 were destroyed by fire.

9. Cash ₹ 5,000 and goods worth ₹ 20,000 were stolen by an employee.

Ans:

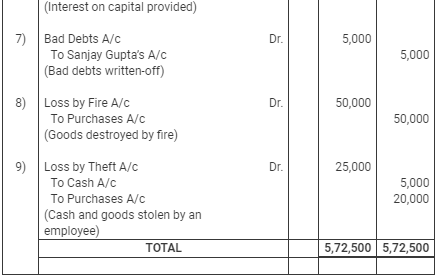

Ques 35: Journalise the following transactions:

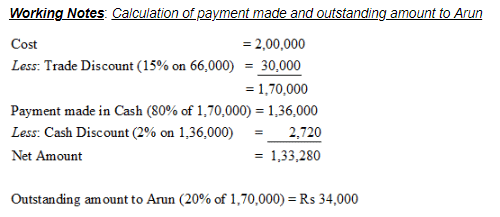

(i) Bought goods from Arun for ₹ 2,00,000 at a trade discount of 15% and cash discount of 2%. Paid 80% amount immediately.

(ii) Purchased foods for ₹ 20,000 from and supplied it to for ₹ 26,000.

(iii) Cash withdrawn from bank ₹ 5,000 for personal use and ₹ 25,000 for office use.

(iv) Goods destroyed by fire : Cost Price ₹ 40,000.

(v) Provide 20% depreciation on machinery costing ₹ 50,000.

(vi) Out of insurance paid this year, ₹ 3,000 is related to next year.

(vii) Allow ₹ 5,000 as interest on capital and charge ₹ 1,000 as interest on drawings.

(viii) Sohan who owed us ₹ 25,000 was declared insolvent and a cheque of 40 paise in a ₹ is received from him in full settlement.

(ix) Paid Income Tax ₹ 10,000 by cheque.

(x) Salary paid ₹ 80,000 and Salary Outstanding ₹ 20,000.

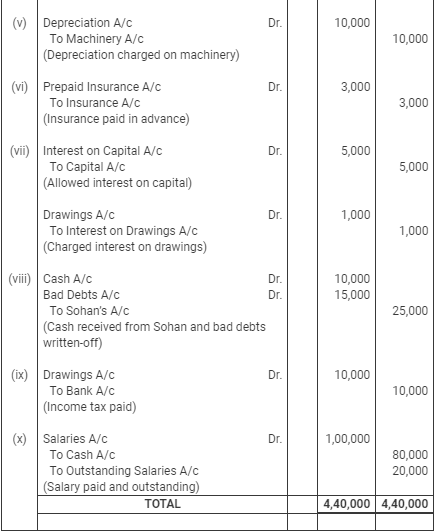

Ans:

Page No 9.73:

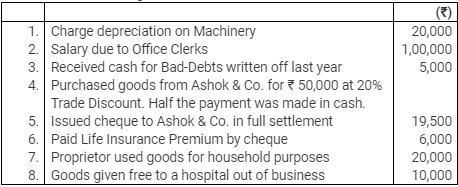

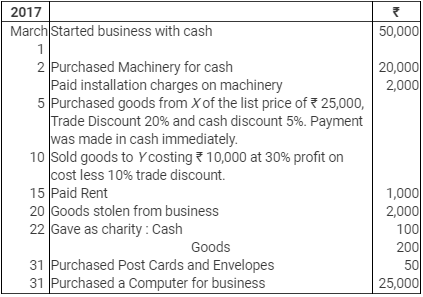

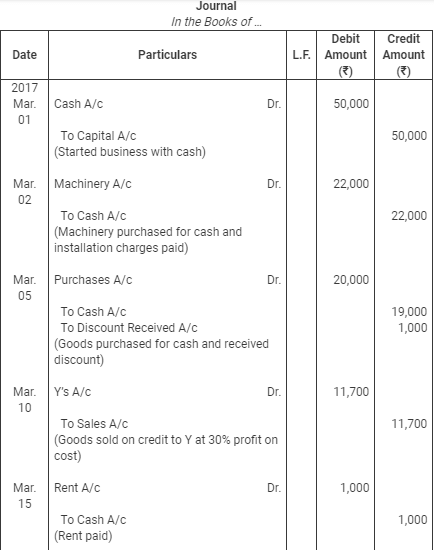

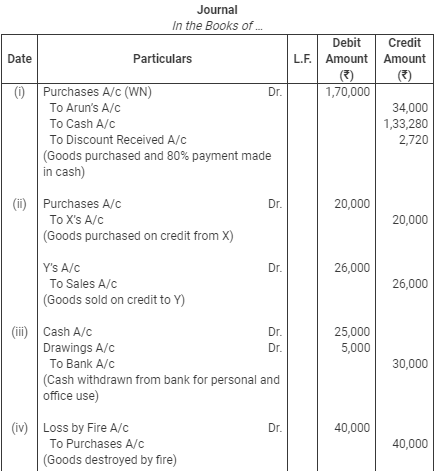

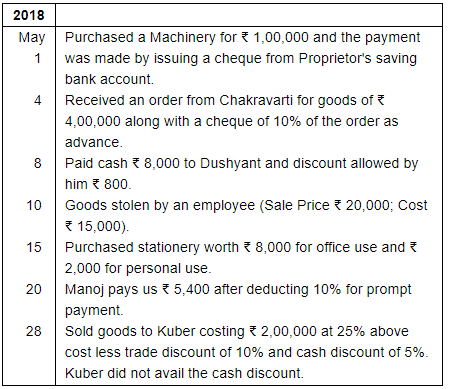

Question 36:

Journalise the following in the books of Som Nath & Sons:

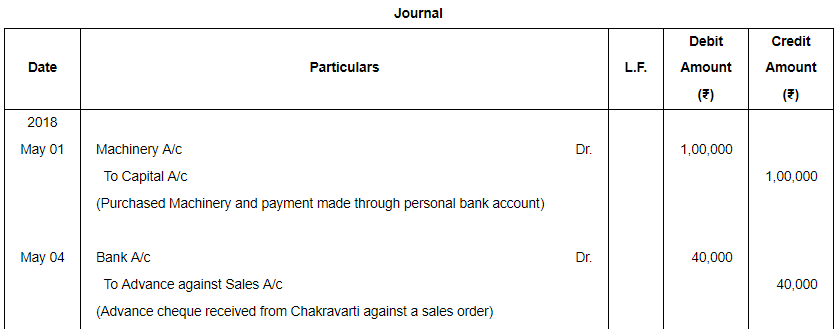

ANSWER:

Page No 9.73:

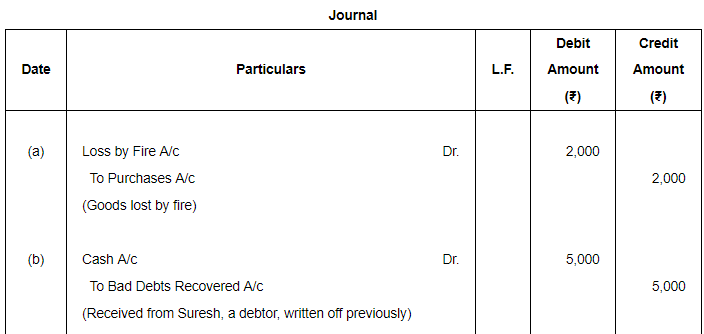

Question 37:

Journalise the following transactions :

(a) Goods worth ₹ 2,000 destroyed by fire.

(b) Received ₹ 5,000 from Suresh which were written off as bad debts.

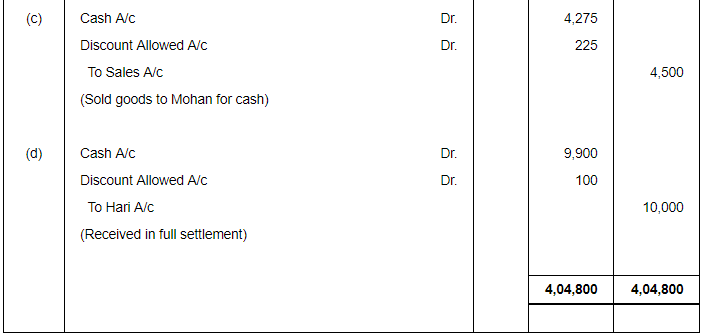

(c) Sold goods to Mohan of the list price of ₹ 5,000 subject to 10% trade discount and 5% cash discount. Mohan availed cash discount.

(d) Received ₹ 9,900 from Hari in full settlement of his account ₹ 10,000.

ANSWER:

FAQs on Books of Original Entry- Journal (Part - 3) - Commerce

| 1. What are the different types of books of original entry? |  |

| 2. What is the purpose of using a journal as a book of original entry? |  |

| 3. How is the journal different from other books of original entry? |  |

| 4. What is the significance of using books of original entry in accounting? |  |

| 5. How can errors be rectified in the journal as a book of original entry? |  |