Budget Highlights of Goa | Goa State PSC (GPSC) Preparation - GPSC (Goa) PDF Download

Goa Budget Analysis 2023-24

Dr. Pramod Sawant, the Chief Minister of Goa, presented the state budget for the financial year 2023-24 on March 29, 2023.

Budget Highlights

- Gross State Domestic Product (GSDP): For 2023-24, Goa’s GSDP at current prices is projected at ₹1 lakh crore, reflecting a 9.4% growth compared to 2022-23.

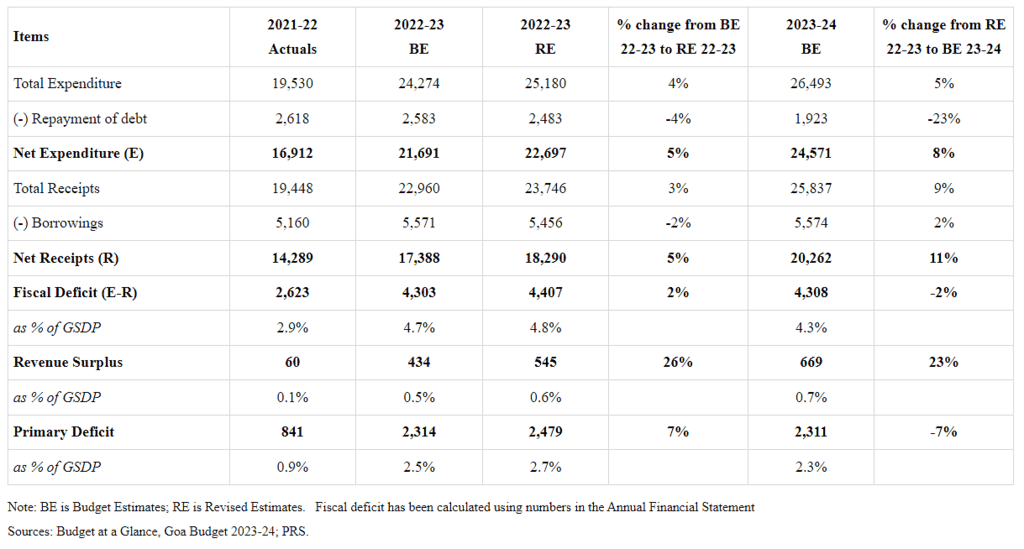

- Expenditure: Estimated at ₹24,571 crore for 2023-24 (excluding debt repayment), marking an 8% increase over revised estimates for 2022-23. Additionally, ₹1,923 crore in debt will be repaid.

- Receipts: Projected at ₹20,262 crore for 2023-24 (excluding borrowings), which is an 11% increase from revised estimates of 2022-23.

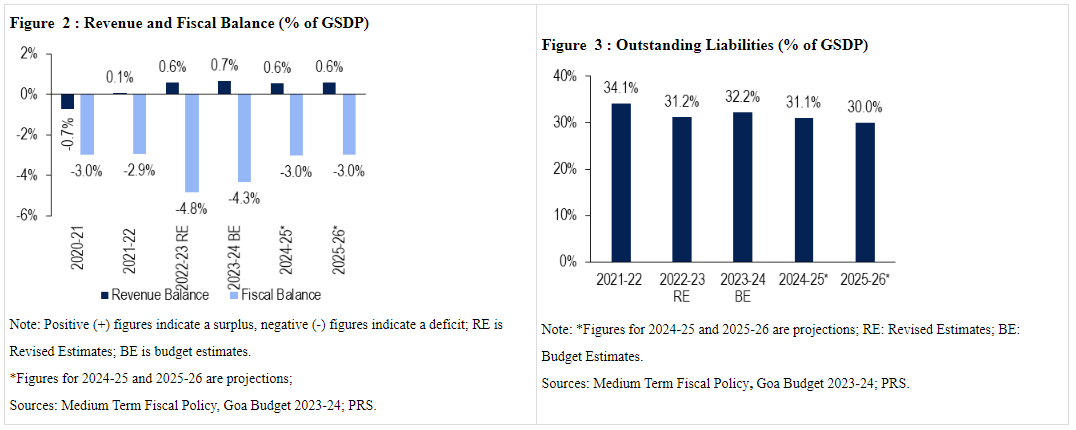

- Revenue Surplus: Expected to be 0.7% of GSDP (₹669 crore) in 2023-24, slightly above the revised estimate of 0.6% for 2022-23. The 2022-23 surplus is anticipated to be slightly higher than the initial budget estimate of 0.5% of GSDP.

- Fiscal Deficit: Targeted at 4.3% of GSDP (₹4,308 crore) for 2023-24. The revised fiscal deficit estimate for 2022-23 is 4.8% of GSDP, slightly higher than the budget estimate of 4.7% of GSDP.

Policy Highlights

- Digital Payment: All government departments and corporations will adopt digital payment methods to eliminate cash handling.

- Mukhyamantri Saral Pagar Yojana: This scheme will allow government employees to access wages proportionally to the days worked at any time during the month.

- Tax Changes: VAT on natural gas will be rationalized based on consumption. A 'green cess' will be introduced for non-Goan vehicles entering Goa. Excise duty on high-end liquor will be reduced, while it will be increased marginally on Indian Made Foreign Liquor (IMFL).

- Deen Dayal Upadhyay Grameen Kaushalya Yojana: This scheme will provide training in various professions and courses.

- New and Renewable Energy: The Green Goa Policy, 2023 will be introduced, which will focus on procuring incremental power from green sources without additional financial burden.

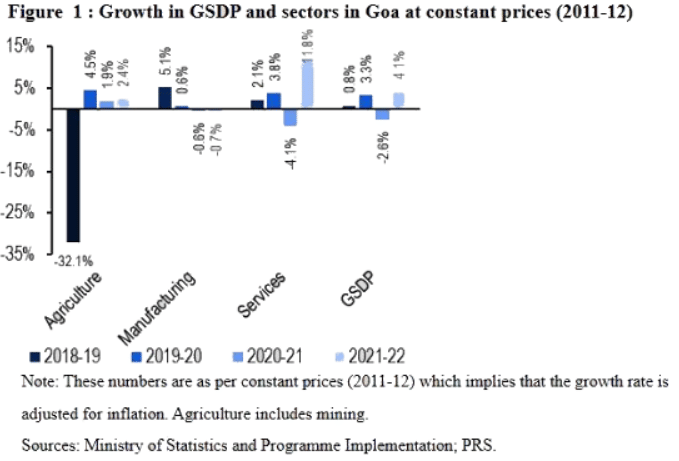

Goa’s Economy

- GSDP: For 2021-22, Goa’s GSDP (at constant prices) is projected to grow by 4.1% following a contraction of 2.6% in 2020-21. In comparison, the national GDP grew by 8.7% in 2021-22 after a 6.6% contraction in the previous year.

- Sectors: The services sector showed significant growth compared to the previous year. For 2021-22, the contributions of different sectors to the economy (at current prices) are estimated as follows: agriculture 8%, manufacturing 52%, and services 40%.

- Per Capita GSDP: In 2021-22, Goa’s per capita GSDP (at current prices) is estimated to be ₹5,27,146, reflecting an annualized increase of 4% from 2017-18.

Budget Estimates for 2023-24

- Total Expenditure: For 2023-24, the total expenditure (excluding debt repayment) is set at ₹24,571 crore, marking an 8% increase over the revised estimate for 2022-23. This expenditure is to be financed through receipts (excluding borrowings) amounting to ₹20,262 crore and net borrowings of ₹3,652 crore. Total receipts for 2023-24 (excluding borrowings) are anticipated to rise by 11% compared to the revised estimate for 2022-23.

- Revenue Surplus: The revenue surplus for 2023-24 is projected to be 0.7% of GSDP (₹669 crore), slightly higher than the revised estimates for 2022-23, which stood at 0.6% of GSDP.

- Fiscal Deficit: The fiscal deficit for 2023-24 is targeted at 4.3% of GSDP (₹4,308 crore), which is an improvement over the revised estimate for 2022-23 of 4.8% of GSDP. However, this is higher than the central government's permissible limit of 3.5% of GSDP, which includes 0.5% allocated for power sector reforms.

Table 1: Budget 2023-24 - Key figures (in Rs. crore)

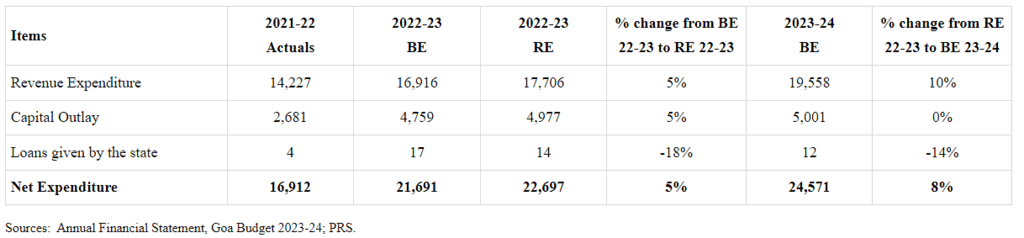

Expenditure in 2023-24

- Revenue Expenditure: For 2023-24, revenue expenditure is proposed at ₹19,558 crore, reflecting a 10% increase over the revised estimate for 2022-23. This expenditure encompasses salaries, pensions, interest, grants, and subsidies.

- Capital Outlay: The proposed capital outlay for 2023-24 is ₹5,001 crore, which is nearly the same as the revised estimate for 2022-23 (₹4,977 crore). Capital outlay represents spending on asset creation.

- Loans: Loans provided by the state in 2023-24 are projected to decrease by 14% (₹12 crore) compared to the revised estimate for 2022-23 (₹14 crore).

Spending on Capital Outlay

- Goa plans to spend ₹5,001 crore on capital outlay in 2023-24, which is broadly in line with the revised estimate for 2022-23 (₹4,977 crore). The revised estimates for 2022-23 are 5% higher than the initial budget estimates.

- Actual spending on capital outlay in 2021-22 was 55% lower than estimated. Between 2015 and 2020, Goa's actual capital outlay was 54% less than the budget estimates, the highest shortfall among all states. The average underspending on capital outlay by states during this period was 17%.

Table 2: Expenditure budget 2023-24 (in Rs. crore)

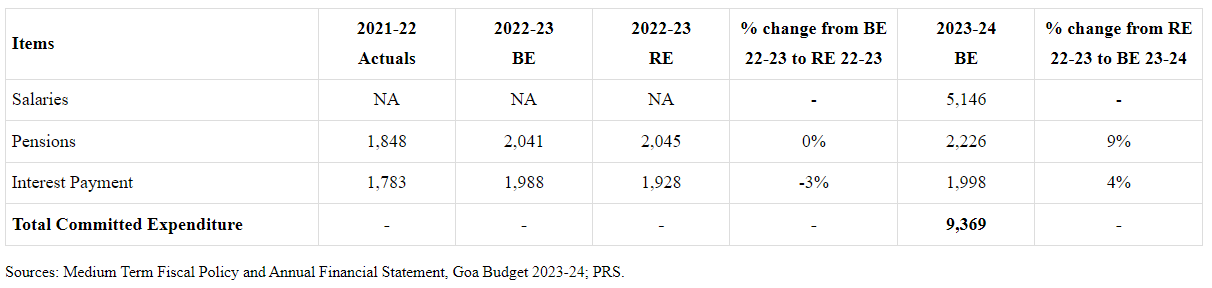

Committed Expenditure

- Definition: Committed expenditure refers to spending on fixed obligations such as salaries, pensions, and interest payments. High committed expenditure limits the flexibility of a state's budget for other priorities, including capital outlay.

- 2023-24 Estimates for Goa:

- Total Committed Expenditure: ₹9,369 crore, accounting for 46% of estimated revenue receipts.

- Breakdown:

- Salaries: 25% of revenue receipts

- Pensions: 11% of revenue receipts

- Interest Payments: 10% of revenue receipts

Table 3: Committed Expenditure in 2023-24 (in Rs. crore)

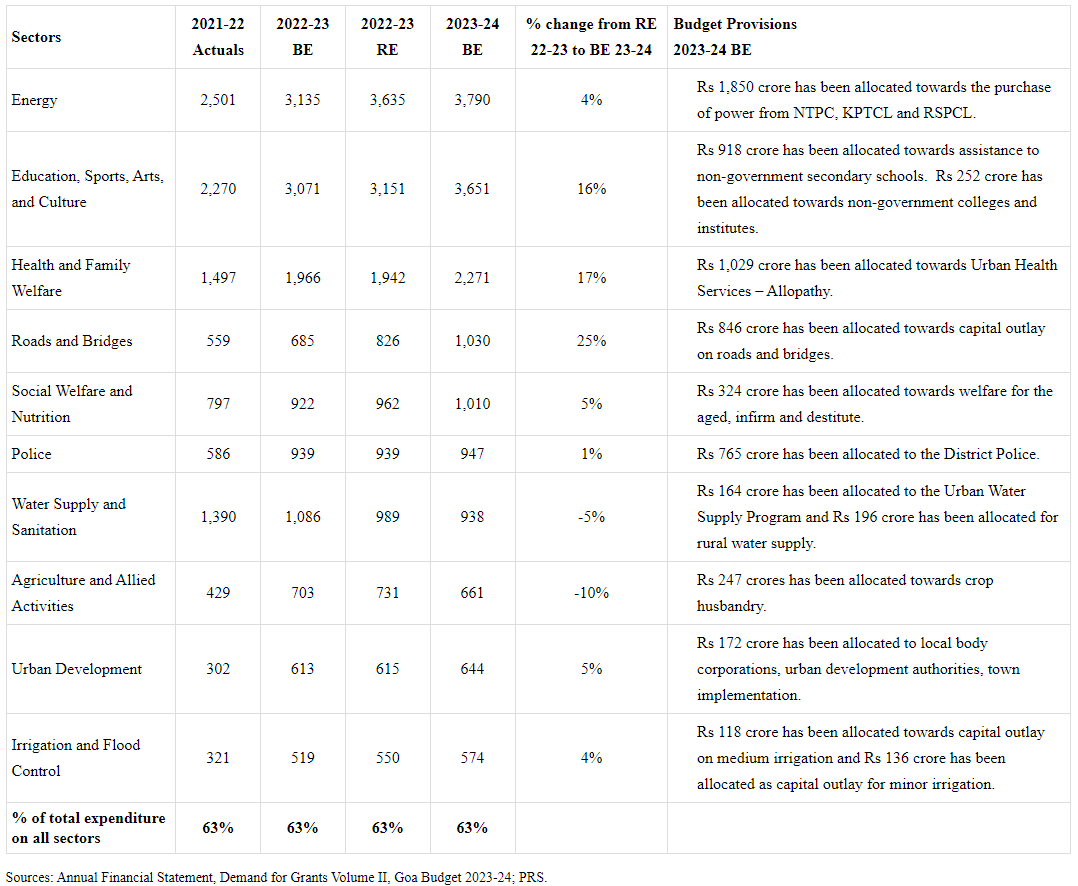

Sector-wise Expenditure:

- Overview: In 2023-24, the sectors detailed below represent 63% of the total expenditure allocated by the state.

- Comparison: For a detailed comparison of Goa's expenditure on key sectors relative to other states, refer to Annexure 1.

Table 4: Sector-wise expenditure under Goa Budget 2023-24 (in Rs. crore)

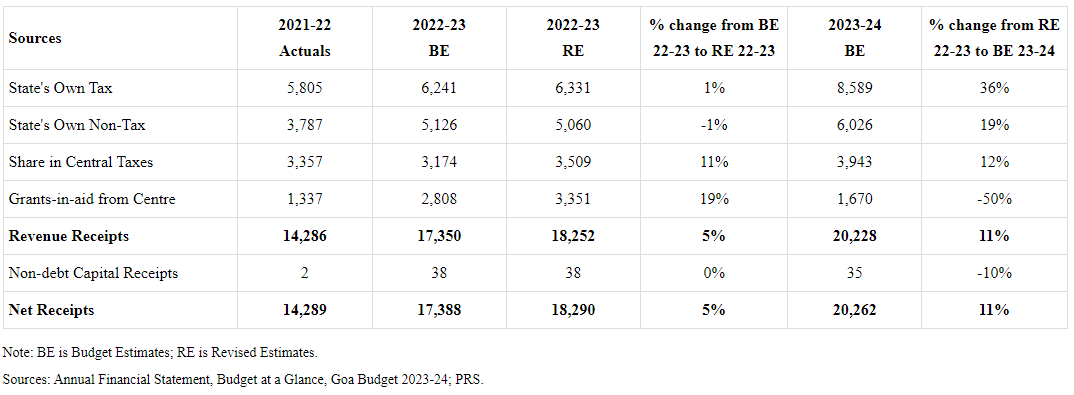

Receipts in 2023-24

- Total Revenue Receipts: For 2023-24, Goa’s revenue receipts are estimated to reach Rs 20,228 crore, reflecting an 11% increase from the revised estimate of 2022-23. Of this amount, Rs 14,615 crore (72%) will be generated through state resources, while Rs 5,613 crore (28%) will be sourced from the central government. Central resources include the state’s share in central taxes (19% of revenue receipts) and grants (8% of revenue receipts).

- Devolution: The state's share in central taxes for 2023-24 is projected to be Rs 3,943 crore, marking a 12% increase compared to the revised estimate for 2022-23.

- Grants from the Centre: The grants from the central government for 2023-24 are expected to be Rs 1,670 crore, which represents a 50% decrease from the revised estimates for 2022-23. This reduction is attributed to the decrease in GST compensation after June 2022.

- State’s Own Tax Revenue: Goa’s own tax revenue is estimated to be Rs 8,589 crore for 2023-24, a 36% increase over the revised estimate for 2022-23. This revenue is projected to be 8.6% of GSDP. In comparison, the ratio for 2022-23 was estimated at 6.8%, and the revised estimate slightly increased it to 6.9%.

Table 5: Break-up of the state government’s receipts (in Rs. crore)

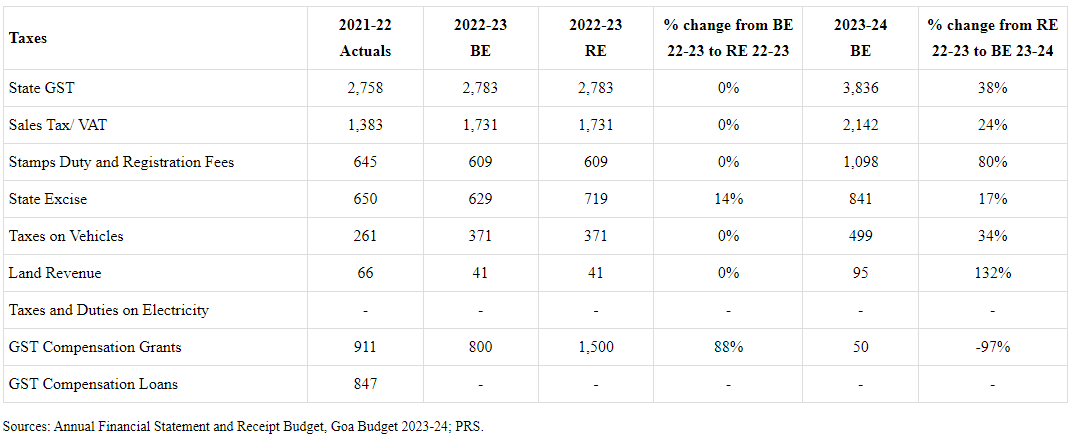

- State GST: For 2023-24, State GST is projected to be the largest component of Goa’s own tax revenue, accounting for 45% of the total. The revenue from State GST is expected to grow by 38% compared to the revised estimates for 2022-23.

- Stamp Duties and Registration Fees: Revenue from stamp duties and registration fees is anticipated to rise by 80% to Rs 1,098 crore in 2023-24, up from Rs 609 crore in the revised estimates for 2022-23.

- Sales Tax / VAT: Revenue from Sales Tax / VAT is estimated to increase by 24% to Rs 2,142 crore in 2023-24, compared to Rs 1,731 crore in the revised estimates for 2022-23.

Table 6: Major sources of state’s own-tax revenue (in Rs. crore)

Deficits, Debt, and FRBM Targets for 2023-24

- Revenue Balance: The revenue balance is the difference between revenue expenditure and revenue receipts. A revenue surplus indicates that the government can cover its non-capital expenses without borrowing. For 2023-24, a revenue surplus of Rs 669 crore (0.7% of GSDP) is projected, compared to Rs 545 crore (0.6% of GSDP) in 2022-23. The state aims for a revenue surplus of 0.6% of GSDP in both 2024-25 and 2025-26.

- Fiscal Deficit: Fiscal deficit represents the gap between total expenditure and total receipts, which is filled through borrowings. For 2023-24, the fiscal deficit is estimated at 4.3% of GSDP. The central government permits a fiscal deficit of up to 3.5% of GSDP, with an additional 0.5% available only if specific power sector reforms are implemented. The fiscal deficit for 2022-23 is expected to be 4.8% of GSDP, slightly higher than the budget estimate of 4.7%. The state plans to reduce the fiscal deficit to 3% of GSDP in 2024-25 and to 2.96% in 2025-26. A high fiscal deficit restricts the state’s borrowing capacity, impacting expenditure.

- Outstanding Liabilities: Outstanding liabilities are the total borrowings accumulated at the end of the financial year, including liabilities on the public account. By the end of 2023-24, outstanding liabilities are estimated to be 32.2% of GSDP, up from the revised estimate of 31.2% of GSDP for 2022-23. The state aims to reduce outstanding liabilities to 30% of GSDP by 2025-26.

- Outstanding Government Guarantees: Outstanding government guarantees refer to contingent liabilities that are not included in the state’s outstanding liabilities but may need to be honored if certain conditions arise. State governments often provide guarantees for the borrowings of State Public Sector Enterprises (SPSEs) from financial institutions. For the year 2022-23, Goa's outstanding guarantees are estimated to be Rs 1,193 crore, which is 1% of the GSDP.

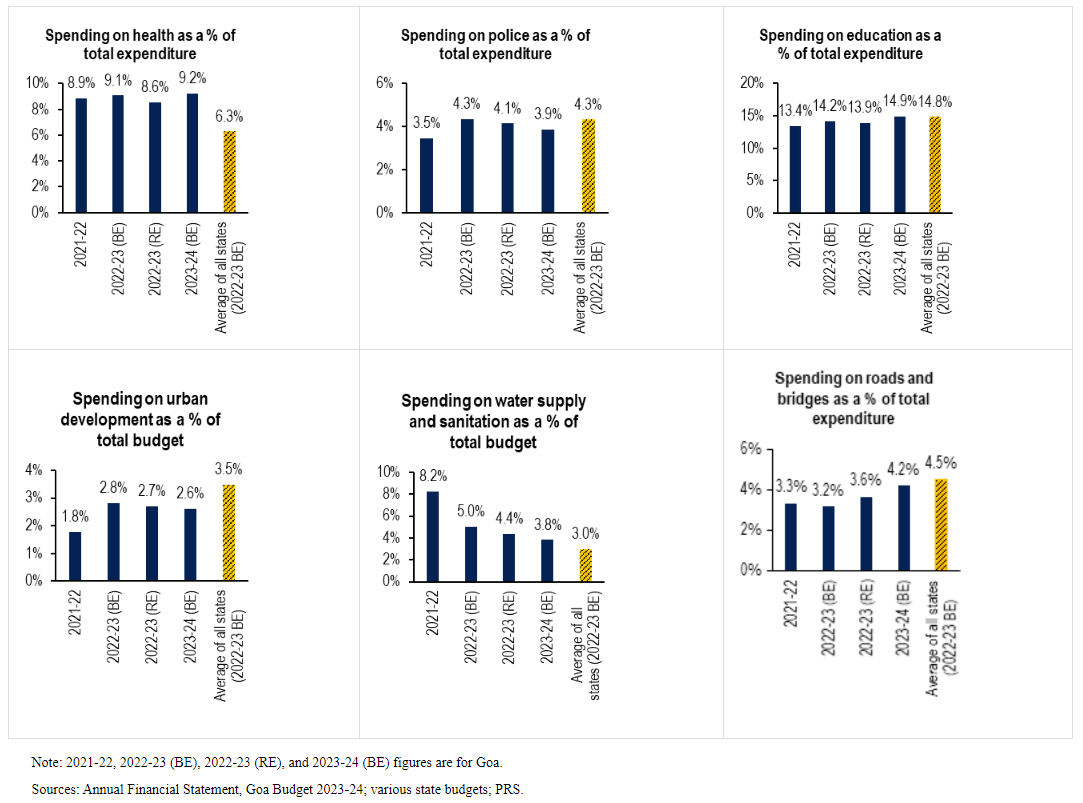

Annexure 1: Comparison of states’ expenditure on key sectors

Here’s a comparison of Goa’s expenditure in 2023-24 on six key sectors relative to its total expenditure, along with the average allocation for these sectors across 31 states (including Goa) as per their budget estimates for 2022-23:

- Health: Goa has allocated 9.2% of its expenditure to health, which is above the average allocation of 6.3% by states.

- Police: Goa's allocation for police is 3.9% of its total expenditure, which is below the average allocation of 4.3% by states.

- Education: Goa has allocated 14.9% of its expenditure to education, slightly above the average allocation of 14.8% by states.

- Urban Development: Goa’s allocation for urban development is 2.6%, lower than the average allocation of 3.5% by states.

- Water Supply and Sanitation: Goa has allocated 3.8% of its expenditure to water supply and sanitation, which is higher than the average allocation of 3% by states.

- Roads and Bridges: Goa's allocation for roads and bridges is 4.2%, which is below the average allocation of 4.5% by states.

[1] The 31 states include the Union Territories of Delhi, Jammu and Kashmir, and Puducherry.

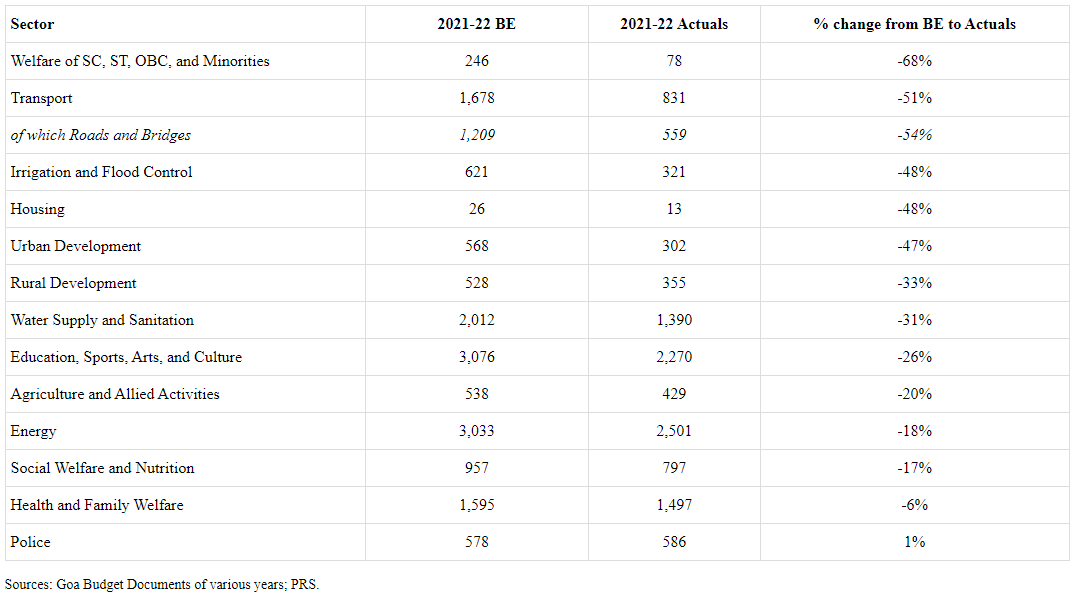

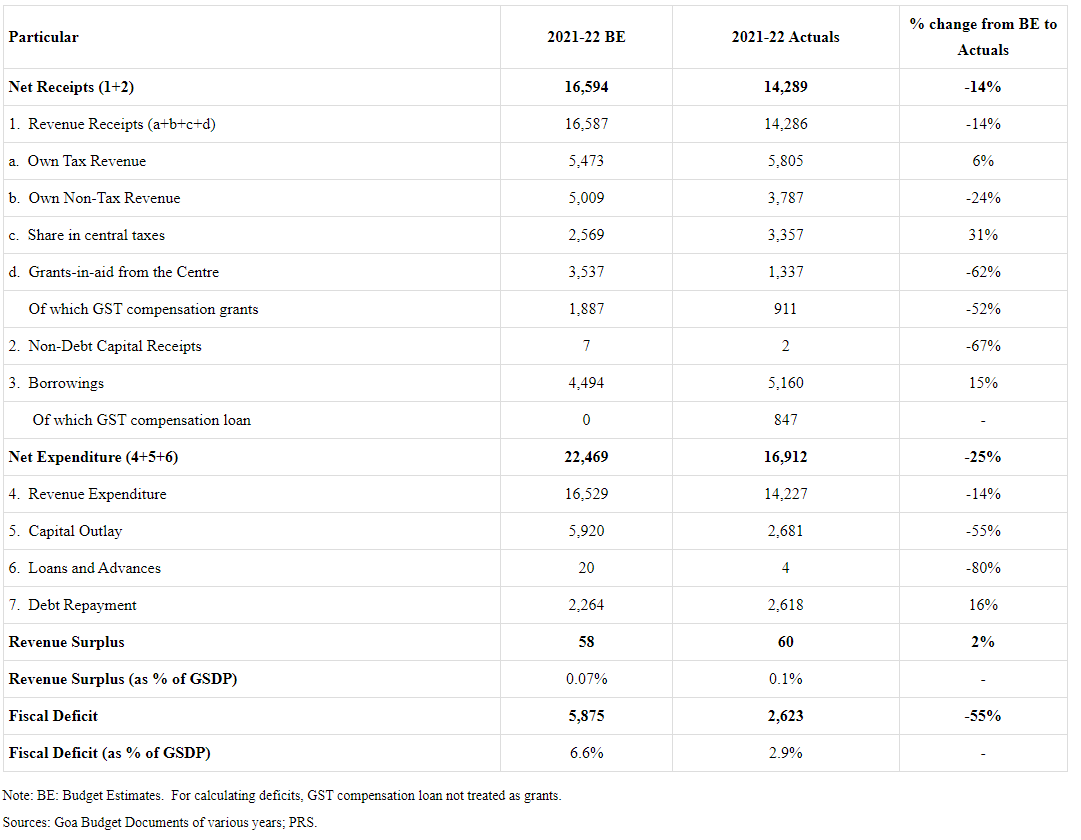

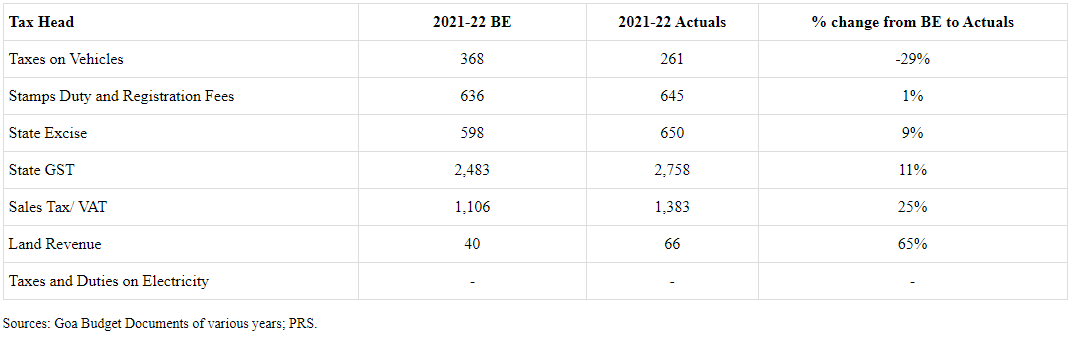

Annexure 2: Comparison of 2021-22 Budget Estimates and Actuals

The following tables compare the actuals of 2021-22 with budget estimates for that year.

Table 7: Overview of Receipts and Expenditure (in Rs. crore)

Table 8: Key Components of State's Own Tax Revenue (in Rs. crore)

Table 9: Allocation towards Key Sectors (in Rs. crore)