SSC CGL Exam > SSC CGL Notes > SSC CGL Tier 2 - Study Material, Online Tests, Previous Year > Capital Market

Capital Market | SSC CGL Tier 2 - Study Material, Online Tests, Previous Year PDF Download

What is a Capital Market?

- Capital markets serve as platforms where the flow of savings and investments occurs between providers of capital and those in need of capital.

- Entities with capital, such as retail and institutional investors, interact with those seeking capital, including businesses, governments, and individuals.

- An ideal capital market is characterized by the accessibility of finance at a reasonable cost.

- A well-functioning capital market is integral to the process of economic development, with the development of the financial system considered a prerequisite for economic growth.

- Adequate development of financial institutions and the promotion of free, fair, competitive, and transparent market operations are essential.

- The efficiency of the capital market extends to the provision of information, minimization of transaction costs, and the productive allocation of capital.

Types of Capital Market

The Capital Market is divided into two sections:

Primary Market

- The primary market is also known as the new issues market. It is concerned with new securities that are being issued for the first time.

- A primary market's primary function is to facilitate the transfer of investible funds from savers to entrepreneurs seeking to establish new businesses or expand existing ones by issuing securities for the first time.

- Banks, financial institutions, insurance companies, mutual funds, and individuals are among those who have invested in this market.

Secondary Market

- A secondary market is also referred to as a stock market or stock exchange.

- It is a market for buying and selling existing securities. It encourages existing investors to exit and new investors to enter the market.

- It also makes existing securities more liquid and marketable.

- It also contributes to economic growth by directing funds toward the most productive investments via the disinvestment and reinvestment process.

- SEBI's regulatory framework governs the trading, clearing, and settlement of securities.

- Trading through stock exchanges is now possible from anywhere in the country through trading terminals thanks to advances in information technology.

- Along with the expansion of the country's primary market, the secondary market has expanded significantly over the last ten years.

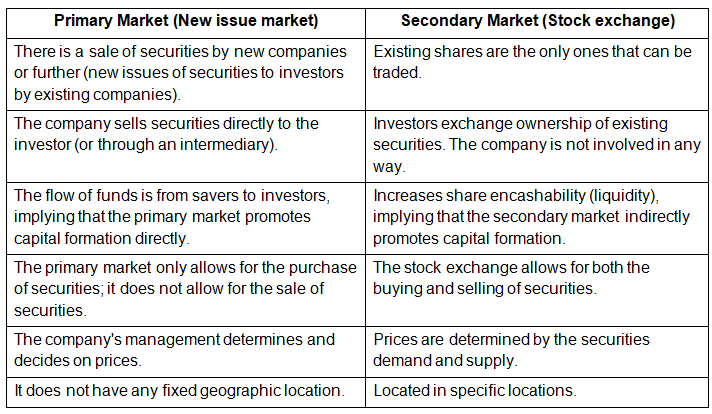

Primary Market vs Secondary Market

Capital Market – Instruments

There are three types of capital market instruments:

- Pure Instruments : They are pure and don't have anything in common. Shares, bonds, and debentures are examples of pure instruments.

- Hybrid instruments: They have a combination of characteristics, such as a bond and an equity investment.

- Derivatives: These instruments have no intrinsic value and are derived from one or more financial assets. Futures and options are two examples of derivatives.

Capital Market – Functions

- Capital markets connect those in need of capital with those who have excess capital.

- The goal of capital markets is to improve transaction efficiency.

- It promotes economic growth.

- It ensures that funds are available at all times.

- It contributes to increased national income by ensuring the movement and productive use of capital.

- Reduces transaction and information costs.

- Allows companies and investors to trade securities more easily.

- It provides protection against market risk.

Capital Market – Advantages

- Money flows between people who need capital and those who have it.

- The transactions are now more efficient.

- Securities such as shares aid in the generation of dividend income.

- The value of investments increases dramatically over time.

- Interest rates provided by securities such as Bonds are higher than interest rates provided by banks.

- Tax advantages can be obtained by investing in the stock market.

- Allow for a diverse range of investments.

- Capital market securities can be used as collateral to obtain bank loans.

Conclusion

Capital markets are continually working towards enhancing transactional efficiencies. They serve as a platform where individuals with capital and those seeking capital come together, providing a space for the exchange of securities among entities.

The document Capital Market | SSC CGL Tier 2 - Study Material, Online Tests, Previous Year is a part of the SSC CGL Course SSC CGL Tier 2 - Study Material, Online Tests, Previous Year.

All you need of SSC CGL at this link: SSC CGL

|

1597 videos|1641 docs|920 tests

|

Related Searches