Capital Structure | Crash Course for UGC NET Commerce PDF Download

An Introduction to Capital Structure

Capital is a crucial element when starting a business, serving as its foundation. It consists of two main sources: debt and equity. Capital structure is the combination of these two components that a company uses to finance its activities and drive its expansion.

Different Forms of Capital Structure

Capital structure involves distributing capital through various long-term funding sources, primarily comprising equity and debt. Companies raise funds through different means such as preference shares, equity shares, retained earnings, and long-term loans to ensure seamless business operations.

Equity Capital

Equity capital consists of funds contributed by the shareholders or owners of a company, which can be categorized into two types:

- Retained Earnings: These are profits that the company reinvests in its operations to enhance financial stability.

- Contributed Capital: This refers to the initial investment made by company owners or funds obtained from shareholders in exchange for ownership rights.

Debt Capital

Debt capital comprises borrowed funds utilized by a business, taking various forms such as:

- Long Term Bonds: Considered as secure debts with extended repayment periods, where regular interest payments are made while the principal amount is due at maturity.

- Short Term Commercial Paper: A short-term debt tool used by companies to raise capital for brief periods.

The Ideal Capital Structure

The ideal capital structure signifies the perfect blend of debt and equity financing that aims to maximize a company's market value while minimizing its cost of capital. Different industries have varying capital structures. For instance, companies in industries like mining or oil extraction might not prefer high debt ratios, while sectors like banking or insurance often rely significantly on debt.

Financial Leverage

Financial leverage, also known as capital gearing, represents the proportion of debt in a company's total capital. A firm with a high debt level is termed highly leveraged, while one with a lower debt ratio is considered low leveraged.

Significance of Capital Structure

The capital structure of a company plays a pivotal role in determining its overall stability. Here are the key reasons highlighting the importance of capital structure:

- A strong capital structure has the potential to boost the market price of a company's shares and securities, thereby increasing its market valuation.

- An effective capital structure ensures optimal utilization of funds, preventing situations of over-capitalization or under-capitalization.

- It assists the company in enhancing its profits by offering higher returns to stakeholders.

- An appropriate capital structure aids in maximizing shareholders' capital while minimizing the overall cost of capital.

- A well-thought-out capital structure provides the company with the flexibility to adjust debt capital based on the prevailing circumstances.

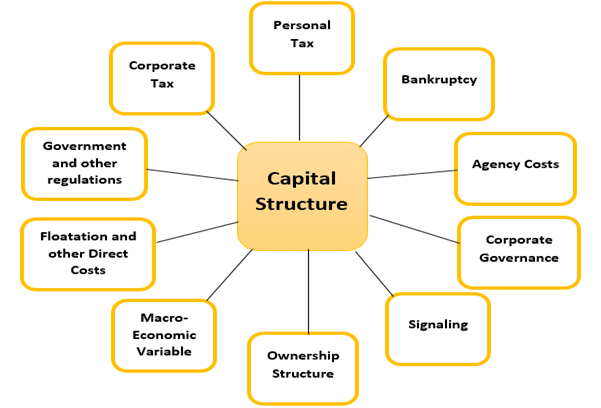

Factors Influencing Capital Structure

Here are the key factors that significantly influence the capital structure of a company:

- Costs of capital: This refers to the expenses associated with raising capital from various funding sources. A company needs to ensure that it generates enough revenue to cover these costs and support its growth.

- Degree of Control: Equity shareholders typically hold more authority in a company compared to preference shareholders or debenture holders. The type of shareholders and their voting rights play a crucial role in determining a firm's capital structure.

- Trading on Equity: When a company relies heavily on equity financing to borrow additional funds in order to amplify returns, it is said to be "trading on equity." This situation arises when the return on total capital surpasses the interest paid on debentures or the newly borrowed debt.

- Government Policies: Regulations and policies established by the government also exert an influence on capital structure decisions. Alterations in monetary and fiscal policies can significantly impact decisions related to capital structure.

|

157 videos|236 docs|166 tests

|

FAQs on Capital Structure - Crash Course for UGC NET Commerce

| 1. What is capital structure? |  |

| 2. What are the different forms of capital structure? |  |

| 3. How does capital structure affect a company's financial performance? |  |

| 4. What are the key factors to consider when determining the optimal capital structure for a company? |  |

| 5. How can a company optimize its capital structure to maximize shareholder value? |  |