Accounting Ratios Chapter Notes | Accountancy Class 12 - Commerce PDF Download

| Table of contents |

|

| Meaning of Accounting Ratios |

|

| Objectives of Ratio Analysis |

|

| Limitations of Ratio Analysis |

|

| Solvency Ratios |

|

| Profitability Ratios |

|

Meaning of Accounting Ratios

Accounting Ratios:

- Accounting ratios are a crucial tool for analyzing financial statements.

- A ratio is a mathematical comparison of two or more numbers, and it can be expressed in various forms such as a fraction, proportion, percentage, or a number of times.

- When this comparison is made using numbers from financial statements, it is called an accounting ratio.

- For instance, if a business has a gross profit of Rs. 10,000 and Revenue from Operations of Rs. 1,00,000, the gross profit ratio is 10% (10,000/100,000 x 100).

- This ratio indicates that gross profit is 10% of Revenue from Operations.

- Similarly, an inventory turnover ratio of 6 means that inventory is converted into Revenue from Operations six times a year.

- Accounting ratios show the relationship between numbers from financial statements.

- These ratios are derived numbers, and their usefulness depends on the accuracy of the basic numbers used to calculate them.

- If there are errors in the financial statements, the ratios will also be misleading.

- Furthermore, a ratio should be calculated using numbers that are meaningfully related.

- For example, calculating the ratio of purchases to furniture (3,00,000/1,00,000 = 3) is irrelevant because there is no relationship between these two figures.

Objectives of Ratio Analysis

- Ratio analysis is a crucial tool for interpreting the results presented in financial statements. It offers users vital financial insights and highlights areas that need further investigation.

- This technique involves reorganizing data using mathematical relationships, but its interpretation can be complex and requires a good understanding of the rules governing financial statement preparation.

- When done effectively, ratio analysis provides a wealth of information that aids analysts in various ways:

1. Identifying business areas that require more attention.

2. Recognizing potential areas for improvement with targeted efforts.

3. Conducting a deeper analysis of profitability, liquidity, solvency, and efficiency levels within the business.

4. Facilitating cross-sectional analysis by comparing performance with industry standards.

5. Generating information from financial statements that is useful for making future projections and estimates.

Advantages of Ratio Analysis

- The analysis of ratios, when done correctly, enhances the user's grasp of how well the business operates. The numerical connections reveal many hidden aspects of the business.

- If ratios are examined properly, they can highlight both challenges and strengths within the business. Knowing the issues allows management to address them in the future while understanding the areas that perform well can lead to further improvements.

- It is important to note that ratios are tools that guide decision-making rather than being the final goal. They serve as indicators and alert systems for the business.

- There are many benefits to conducting ratio analysis, which are summarized below:

1. Helps to understand decision effectiveness: Ratio analysis clarifies whether the business has made the right operating, investing, and financing choices. It shows how these decisions have impacted overall performance.

2. Simplifies complex data: Ratios make complicated accounting figures easier to understand by highlighting their relationships. They effectively summarize financial information and evaluate managerial efficiency, creditworthiness, earning capacity, and more.

3. Assists in comparative analysis: Ratios should not be calculated for just one year. When comparing figures from multiple years, they help identify trends within the business. This understanding of trends is valuable for making future projections.

4. Identifies problem areas: Ratios are useful for spotting both challenges and strengths in a business. Areas needing improvement require more focus, while successful areas can be further enhanced.

5. Enables SWOT analysis: Ratios provide insights into changes occurring within a business. This information is crucial for management to recognize current threats and opportunities and to conduct their own SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis.

6. Facilitates various comparisons:Ratios allow for comparisons with specific benchmarks to determine if the firm's performance is strong or weak. For this, profitability, liquidity, solvency, and other metrics can be compared in three ways:- With the company's own performance over different accounting periods (Intra-firm Comparison/Time Series Analysis).

- With other businesses (Inter-firm Comparison/Cross-sectional Analysis).

- With standards set for that firm or the industry (comparison with industry expectations).

Limitations of Ratio Analysis

- Limitations of Accounting Data: Ratio analysis relies on accounting data, which may not accurately reflect the true financial position of a business. Accounting figures are based on judgments and conventions and can vary depending on the competence and integrity of those preparing the statements. For example, profit figures are not exact and depend on accounting policies.

- Ignores Price-level Changes: Ratio analysis assumes stable price levels, but in reality, we often face inflation. Changes in price levels can make comparisons across different accounting periods meaningless, as financial records do not account for changes in the value of money.

- Ignores Qualitative Factors: Ratio analysis focuses solely on quantitative (monetary) aspects of a business, ignoring qualitative factors that may be crucial for understanding its performance.

- Variations in Accounting Practices: Different businesses may follow varying accounting practices for aspects like inventory valuation, depreciation, and treatment of intangible assets. These variations can hinder cross-sectional analysis and make comparisons difficult.

- Forecasting Limitations: Relying solely on historical data for forecasting future trends is not effective. Non-financial factors also play a significant role in accurate forecasting.

Types of Ratios

- Statement of Profit and Loss Ratios: Ratios derived from the statement of profit and loss, such as the gross profit ratio, which compares gross profit to revenue from operations.

- Balance Sheet Ratios: Ratios are calculated using figures from the balance sheet, like the current ratio, which compares current assets to current liabilities.

- Composite Ratios: Ratios that include one figure from the statement of profit and loss and another from the balance sheet, such as the trade receivables turnover ratio.

- Liquidity Ratios: Measure a business's ability to meet short-term commitments with liquid funds.

- Solvency Ratios: Assess a business's long-term ability to meet contractual obligations, especially to external stakeholders.

- Activity (or Turnover) Ratios: Evaluate the efficiency of a business's operations based on resource utilization, also known as Efficiency Ratios.

- Profitability Ratios: Analyze profits in relation to revenue, funds, or assets employed in the business.

Liquidity Ratios

- Definition: Liquidity ratios assess a business's short-term solvency, which means its ability to meet current obligations.

- Analysis Basis: These ratios are analyzed by comparing current assets and current liabilities as shown in the balance sheet.

- Types of Ratios: The two main ratios in this category are the current ratio and the liquidity ratio.

Current Ratio

The current ratio is the proportion of current assets to current liabilities. It is expressed as follows:

Current assets include current investments, inventories, trade receivables (debtors and bills receivables), cash and cash equivalents, short-term loans and advances and other current assets such as prepaid expenses, advance tax and accrued income, etc.

Current liabilities include short-term borrowings, trade payables (creditors and bills payables), other current liabilities and short-term provisions.

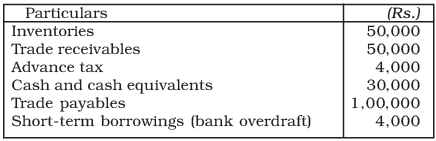

Example: Calulate Current Ratio from the following information:

Ans:

Ans:

Current Assets = Inventories + Trade receivables + Advance tax + Cash and cash equivalents

= Rs. 50,000 + Rs. 50,000 + Rs. 4,000 + Rs. 30,000

= Rs. 1,34,000

Current Liabilities = Trade payables + Short-term borrowings

= Rs. 1,00,000 + Rs. 4,000 = Rs. 1,04,000

Significance of Current Ratio:

- The current ratio measures how well current assets cover current liabilities. A higher current ratio indicates a larger safety margin against potential issues with realizing current assets and cash flow.

- However, the ratio should be reasonable, not too high or too low.

- A very high current ratio suggests excessive investment in current assets, indicating underutilization or mismanagement of resources.

- Conversely, a low current ratio poses a risk of failing to meet short-term debts on time, which can negatively impact the firm’s creditworthiness.

- Generally, a current ratio within the range of 2:1 is considered safe.

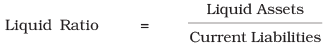

Quick or Liquid Ratio

The Quick Ratio, also known as the Acid-Test Ratio, measures a company's liquidity by comparing its quick assets to current liabilities.

- Quick assets are those that can be quickly converted into cash, such as cash, marketable securities, and accounts receivable.

- When calculating quick assets, we exclude inventories, prepaid expenses, advance tax, and other non-liquid current assets.

- This exclusion makes the Quick Ratio a more conservative and accurate measure of a company's liquidity position compared to the Current Ratio.

- The Quick Ratio is expressed as a simple formula:

- By focusing on liquid assets, the Quick Ratio provides a supplementary check on a business's ability to meet its short-term obligations.

Example: Calculate ‘Liquid Ratio’ from the following information:

Current liabilities = Rs. 50,000

Current assets = Rs. 80,000

Inventories = Rs. 20,000

Advance tax = Rs. 5,000

Prepaid expenses = Rs. 5,000

Ans: Liquid Assets = Current assets – (Inventories + Prepaid expenses + Advance tax)

Liquid Assets = Current assets – (Inventories + Prepaid expenses + Advance tax)

= Rs. 80,000 – (Rs. 20,000 + Rs. 5,000 + Rs. 5,000)

= Rs. 50,000

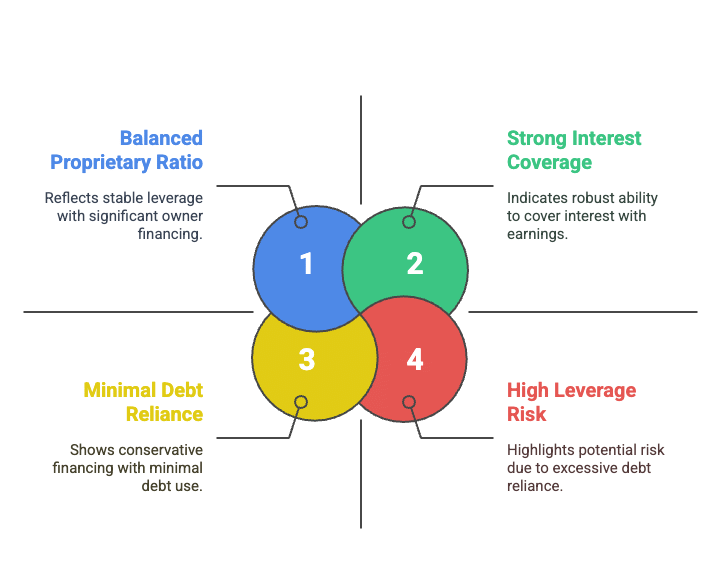

Solvency Ratios

- Debt-Equity Ratio: This ratio compares the total debt of a company to its equity. It helps in understanding the proportion of debt used to finance the business relative to the owners' equity. A lower ratio indicates a more financially stable company with less risk for creditors.

- Debt to Capital Employed Ratio: This ratio measures the proportion of debt in relation to the total capital employed in the business. It provides insights into how much of the company's capital is financed through debt. A lower ratio suggests a healthier financial position with lower risk.

- Proprietary Ratio: The proprietary ratio indicates the proportion of owners' equity in relation to the total assets of the company. It reflects the level of financial leverage and the extent to which assets are financed by owners' funds. A higher ratio signifies lower financial risk.

- Total Assets to Debt Ratio: This ratio assesses the relationship between total assets and total debt. It indicates the ability of the company to cover its debt obligations with its assets. A higher ratio implies better solvency and lower risk for creditors.

- Interest Coverage Ratio: The interest coverage ratio measures the ability of a company to pay interest on its outstanding debt. It is calculated by dividing earnings before interest and taxes (EBIT) by the interest expense. A higher ratio indicates a stronger capacity to meet interest payments, reducing the risk for lenders.

Debt-Equity Ratio

Debt-Equity Ratio measures the relationship between long-term debt and equity. If the debt component of the total long-term funds employed is small, outsiders feel more secure. From a security point of view, capital structure with less debt and more equity is considered favourable as it reduces the chances of bankruptcy. Normally, it is considered to be safe if the debt-equity ratio is 2 : 1. However, it may vary from industry to industry. It is computed as follows:

where:

Shareholders’ Funds (Equity) = Share capital + Reserves and Surplus + Money received against share warrants + Share application money pending allotment

Share Capital = Equity share capital + Preference share capital

or

Shareholders’ Funds (Equity) = Non-current assets + Working capital – Non-current liabilities

Working Capital = Current Assets – Current Liabilities

Significance of Debt-Equity Ratio:

- Measures Indebtedness: The debt-equity ratio assesses how much debt a company has in relation to its equity, indicating the level of indebtedness.

- Security for Lenders: A low debt-equity ratio is seen as more secure for long-term lenders, as it suggests a lower risk of default.

- Risk Assessment: A high debt-equity ratio is considered risky, as it may signal potential difficulties in meeting obligations to creditors.

- Owner Perspective: From the owners' viewpoint, using more debt (trading on equity) can lead to higher returns if the earnings on capital employed exceed the interest rates on debt.

- Balance of Risk and Reward: Finding the right balance in the debt-equity ratio is crucial, as too much debt can be risky, while too little may limit potential returns.

Example: From the following balance sheet of ABC Co. Ltd. as on March 31, 2015. Calculate debt equity ratio:

Ans:

Debt = Long-term borrowings + Other long-term liabilities + Long-term provisions

Debt = Long-term borrowings + Other long-term liabilities + Long-term provisions

= Rs. 4,00,000 + Rs. 40,000 + Rs. 60,000

= Rs. 5,00,000

Equity = Share capital + Reserves and surplus + Money received against share warrants

= Rs. 12,00,000 + Rs. 2,00,000 + Rs. 1,00,000

= Rs. 15,00,000

Alternatively, Equity = Non-curr ent assets + Working capital – Non-current liabilities

= Rs. 18,00,000 + Rs. 2,00,000 – Rs. 5,00,000

= Rs. 15,00,000

Working Capital = Current assets – Current liabilities

= Rs. 7,00,000 –Rs. 5,00,000

= Rs. 2,00,000

Debt to Capital Employed Ratio

- The Debt to Capital Employed Ratio measures the proportion of long-term debt in relation to the total capital employed in a business. Capital employed can be calculated as long-term debt plus shareholders' funds or as net assets, which is total assets minus current liabilities.

- Formula: Debt to Capital Employed Ratio = Long-term Debt / Capital Employed

- Example: Using data from Illustration 7, capital employed is Rs. 20,00,000, calculated as Rs. 5,00,000 (long-term debt) + Rs. 15,00,000 (shareholders' funds). Net assets are also Rs. 20,00,000, leading to a Debt to Capital Employed Ratio of 0.25:1 (Rs. 5,00,000 / Rs. 20,00,000).

- Significance: Similar to the debt-equity ratio, this metric indicates the proportion of long-term debt in the capital structure. A low ratio suggests security for lenders, while a high ratio indicates potential for trading on equity. In the example, a ratio of less than half indicates reasonable debt funding and adequate security for creditors.

- Alternative Calculation: The Debt to Capital Employed Ratio can also be computed using total assets, which involves calculating total debts (long-term debts plus current liabilities) as a proportion of total assets.

Proprietary Ratio

- The Proprietary Ratio measures the relationship between shareholders' funds and net assets. It is calculated using the formula:

- Proprietary Ratio = Shareholders' Funds / Capital Employed (or Net Assets)

- Based on the data from Illustration 7, the ratio is:

- Rs. 15,00,000 / Rs. 20,00,000 = 0.75 : 1

Significance:

- A higher proportion of shareholders' funds indicates a positive feature as it provides security to creditors.

- This ratio can also be calculated in relation to total assets instead of net assets.

- The sum of the Debt to Capital Employed Ratio and the Proprietary Ratio equals 1.

- For example, if the Debt to Capital Employed Ratio is 0.25 : 1 and the Proprietary Ratio is 0.75 : 1, the total is 1.

- This means 25% of Capital Employed is funded by debts and 75% by owners' funds.

Total Assets to Debt Ratio

- This ratio assesses the coverage of long-term debts by assets. It is calculated as:

- Total Assets to Debt Ratio = Total Assets / Long-term Debts

- Using data from Illustration 8, the ratio is:

- Rs. 14,00,000 / Rs. 1,50,000 = 9.33 : 1

Significance:

- A higher ratio indicates that assets are primarily financed by owners' funds and that long-term loans are adequately covered by assets.

- It is preferable to use net assets (capital employed) instead of total assets for this calculation, as the ratio then becomes the reciprocal of the Debt to Capital Employed Ratio.

- This ratio reflects the rate of external funds used in financing assets and the extent to which debts are covered by assets.

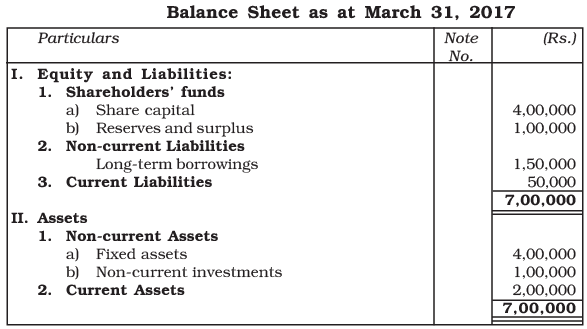

Example: From the following information, calculate Debt Equity Ratio, Total Assets to Debt Ratio, Proprietory Ratio, and Debt to Capital Employed Ratio:

Ans:

Ans:

Debt = Long-term borrowings = Rs. 1,50,000

Equity = Share capital + Reserves and surplus

= Rs. 4,00,000 + Rs. 1,00,000 = Rs. 5,00,000

Total Assets = Fixed assets + Non-current investments + Current assets = Rs. 4,00,000 + Rs. 1,00,000 + Rs. 2,00,000 = Rs. 7,00,000

Long-term Debt = Rs. 1,50,000

Capital Employed = Shareholders’ Funds + Long-term borrowings

= Rs. 5,00,000 + Rs. 1,50,000

= Rs. 6,50,000

Interest Coverage Ratio

- The Interest Coverage Ratio measures the ability to cover interest payments on long-term debts.

- It compares the profits available for paying interest to the amount of interest that needs to be paid.

- The formula for calculating the Interest Coverage Ratio is:

- A higher ratio indicates that profits are more than sufficient to cover interest payments, which is a positive sign for creditors.

- This ratio is important because it shows the security of interest payments on long-term debts.

- It reflects how many times the interest on these debts is covered by the available profits.

Example: From the following details, calculate interest coverage ratio: Net Profit after tax Rs. 60,000; 15% Long-term debt 10,00,000; and Tax rate 40%.

Ans:

Net Profit after Tax = Rs. 60,000 Tax Rate = 40% Net Profit before tax = Net profit after tax × 100/(100 – Tax rate) = Rs. 60,000 × 100/(100 – 40) = Rs. 1,00,000

Interest on Long-term Debt = 15% of Rs. 10,00,000 = Rs. 1,50,000

Net profit before interest and tax = Net profit before tax + Interest

= Rs. 1,00,000 + Rs. 1,50,000

= Rs. 2,50,000

Interest Coverage Ratio = Net Profit before Interest and Tax/Interest on long-term debt

= Rs. 2,50,000/Rs. 1,50,000

= 1.67 times.

Activity (or Turnover) Ratio

- Activity ratios measure how quickly a business is performing its activities, specifically how often assets are turned into sales during a given period.

- A higher turnover ratio indicates better asset utilization, improved efficiency, and higher profitability, which is why these ratios are also called efficiency ratios.

- Important activity ratios include:

1. Inventory Turnover

2. Trade Receivable Turnover

3. Trade Payable Turnover

4. Investment (Net Assets) Turnover

5. Fixed Assets Turnover

6. Working Capital Turnover

Inventory Turnover Ratio

- The Inventory Turnover Ratio measures how many times a company's inventory is converted into revenue from operations during a specific accounting period.

- It shows the relationship between the cost of revenue from operations and the average inventory held by the company.

- The formula for calculating the Inventory Turnover Ratio is:

Inventory Turnover Ratio = Cost of Revenue from Operations / Average Inventory:

- Average Inventory refers to the arithmetic average of opening and closing inventory, while Cost of Revenue from Operations is calculated by subtracting gross profit from revenue from operations.

Significance of Inventory Turnover Ratio:

- The Inventory Turnover Ratio is important because it indicates how frequently a company converts its finished goods inventory into revenue from operations.

- It is also a measure of liquidity, showing how many times inventory is purchased or replaced within a year.

- A low inventory turnover may signal issues such as poor purchasing decisions or obsolete inventory, which is a red flag for the business.

- Conversely, a high turnover is generally positive, but it should be interpreted with caution as it could result from buying in small quantities or selling quickly at low margins to generate cash.

- Overall, this ratio provides insights into the effectiveness of inventory utilization and management.

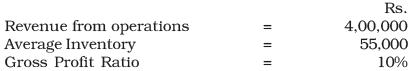

Example: From the following information, calculate inventory turnover ratio: Ans:

Ans:

Revenue from operations = Rs. 4,00,000

Gross Profit = 10% of Rs. 4,00,000 = Rs. 40,000

Cost of Revenue from operations = Revenue from operations – Gross Profit

= Rs. 4,00,000 – Rs. 40,000 = Rs. 3,60,000

Trade Receivables Turnover Ratio

- This ratio shows the relationship between credit revenue from operations and trade receivables.

- It is calculated using the formula: Trade Receivable Turnover Ratio = Net Credit Revenue from Operations / Average Trade Receivable

- Average Trade Receivable is determined by: (Opening Debtors and Bills Receivable + Closing Debtors and Bills Receivable) / 2

- When calculating, debtors should be considered before making any provision for doubtful debts.

Significance:

- The liquidity position of a firm depends on how quickly trade receivables are realized.

- This ratio indicates how many times receivables are converted into cash within an accounting period.

- A higher turnover means faster collection from trade receivables.

- The ratio also helps determine the average collection period by dividing the days or months in a year by the trade receivables turnover ratio.

Example: Calculate the Trade receivables turnover ratio from the following information:

Ans:

Credit Revenue from operations = Total revenue from operations – Cash revenue from operations

Cash Revenue from operations = 20% of Rs. 4,00,000

Credit Revenue from operations = Rs. 4,00,000 – Rs. 80,000 = Rs. 3,20,000

Trade Payable Turnover Ratio

The trade payables turnover ratio indicates the pattern of payment of trade payable. As trade payable arises on account of credit purchases, it expresses the relationship between credit purchases and trade payable. It is calculated as follows:

Significance of Trade Payable Turnover Ratio:

- Average Payment Period: The Trade Payable Turnover Ratio indicates the average time taken by a business to pay its suppliers. A lower ratio suggests that the business is taking longer to pay its suppliers, which could be due to extended credit terms or delayed payments.

- Supplier Relationships: Delayed payments to suppliers can harm a business's reputation and strain supplier relationships. It is generally not a good policy to consistently delay payments, as it may lead to suppliers being less willing to extend credit in the future.

- Calculation: The average payment period can be calculated by dividing the number of days or months in a year by the Trade Payable Turnover Ratio. This provides insight into how quickly a business is settling its debts with suppliers.

Example: Calculate the Trade payables turnover ratio from the following figures:

Ans:

Net Assets or Capital Employed Turnover Ratio

- This ratio shows the relationship between revenue from operations and net assets (capital employed) in a business.

- A higher turnover indicates better activity and profitability.

- It is calculated by dividing revenue from operations by net assets (capital employed).

The capital employed turnover ratio which studies the turnover of capital employed (or Net Assets) is analysed further by following two turnover ratios :

(a) Fixed Assets Turnover Ratio: It is computed as follows: (b) Working Capital Turnover Ratio: It is calculated as follows :

(b) Working Capital Turnover Ratio: It is calculated as follows :

Significance of Turnover Ratios:

- High turnover of capital employed, working capital, and fixed assets indicates efficient utilization of resources.

- Turnover ratios reveal how effectively capital is employed and how its components are being used.

- A higher turnover reflects efficient utilization, leading to increased liquidity and profitability for the business.

Example: From the following information, calculate

(i) Net assets turnover,

(ii) Fixed assets turnover, and

(iii) Working capital turnover ratios :

Revenue from operations for the year 2016-17 were Rs. 30,00,000

Ans:

Revenue from Operations = Rs. 30,00,000

Capital Employed = Share Capital + Reserves and Surplus + Long-term Debts (or Net Assets)

= (Rs.4,00,000 + Rs.6,00,000) + (Rs.1,00,000 + Rs.3,00,000) + (Rs.2,00,000 + Rs.2,00,000)

= Rs. 18,00,000

Fixed Assets = Rs.8,00,000 + Rs.5,00,000 + Rs.2,00,000 + Rs.1,00,000 = Rs. 16,00,000

Working Capital = Current Assets – Current Liabilities

= Rs.4,00,000 – Rs.2,00,000 = Rs. 2,00,000

Net Assets Turnover Ratio = Rs.30,00,000/Rs.18,00,000 = 1.67 times

Fixed Assets Turnover Ratio = Rs.30,00,000/Rs.16,00,000 = 1.88 times

Working Capital Turnover Ratio = Rs.30,00,000/Rs.2,00,000 = 15 times.

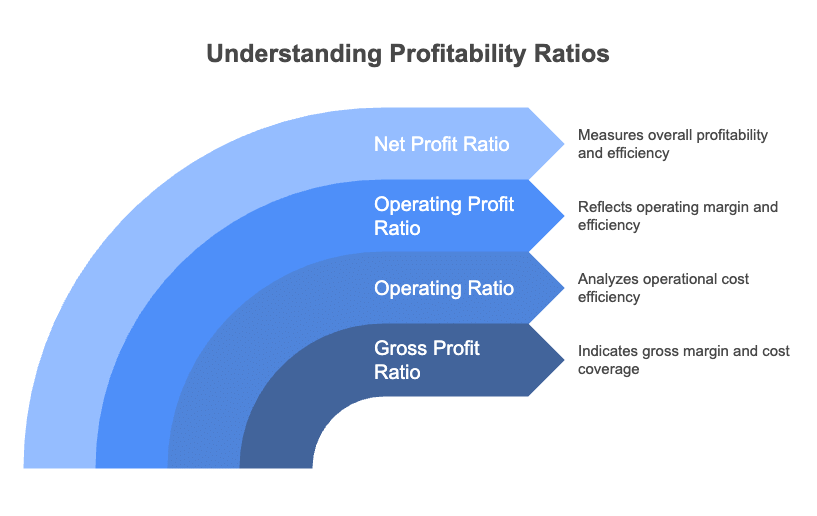

Profitability Ratios

- The profitability or financial performance of a business is primarily reflected in the statement of profit and loss.

- Profitability ratios are used to assess the earning capacity of a business, which depends on how well the resources employed are utilized.

- There is a close link between profit and the efficiency of resource utilization in the business.

- Common ratios used to analyze business profitability include:

Gross Profit Ratio

- The gross profit ratio, expressed as a percentage of revenue from operations, is calculated to understand the gross margin.

- It is computed using the formula: Gross Profit Ratio = (Gross Profit / Net Revenue of Operations) × 100

Significance:

- The gross profit ratio indicates the gross margin on products sold.

- It also shows the margin available to cover operating expenses, non-operating expenses, and other costs.

Interpretation:

- Changes in the gross profit ratio may result from variations in selling price, cost of revenue from operations, or a combination of both.

- A low gross profit ratio may suggest an unfavourable purchase and sales policy.

- Conversely, a higher gross profit ratio is always a positive sign.

Example: Following information is available for the year 2016-17, calculate gross profit ratio:

Ans:

Ans:

Revenue from Operations = Cash Revenue from Operations + Credit Revenue from Operation

= Rs.25,000 + Rs.75,000 = Rs. 1,00,000

Net Purchases = Cash Purchases + Credit Purchases – Return Outwards

= Rs.15,000 + Rs.60,000 – Rs.2,000 = Rs. 73,000

Cost of Revenue from operations= Purchases + (Opening Inventory – Closing Inventory) + Direct Expenses

= Purchases + Decrease in inventory + Direct Expenses

= Rs.73,000 + Rs.10,000 + (Rs.2,000 + Rs.5,000)

= Rs.90,000

Gross Profit = Revenue from Operations – Cost of Revenue from Operation

= Rs.1,00,000 – Rs.90,000

= Rs. 10,000

Gross Profit Ratio = Gross Profit/Net Revenue from Operations ×100

= Rs.10,000/Rs.1,00,000 × 100

= 10%.

Operating Ratio

- The operating ratio is a measure used to analyze the cost of operations in relation to the revenue generated from those operations.

- It is calculated using the formula: Operating Ratio = (Cost of Revenue from Operations + Operating Expenses) / Net Revenue from Operations × 100

Components of Operating Ratio:

- Operating Expenses: These include various costs such as office expenses, administrative expenses, selling expenses, distribution expenses, depreciation, and employee benefit expenses.

- Cost of Operation: This is determined by excluding non-operating incomes and expenses. Non-operating items include losses on asset sales, interest paid, dividends received, losses by fire, speculation gains, etc.

Operating Profit Ratio

- The operating profit ratio indicates the operating margin of a business. It can be calculated directly or as the complement of the operating ratio.

- Operating Profit Ratio = 100 - Operating Ratio

- Alternatively, it can be calculated using the formula: Operating Profit Ratio = Operating Profit / Revenue from Operations × 100

- Operating Profit = Revenue from Operations - Operating Cost

Importance of Operating Ratio:

- The operating ratio is used to express the cost of operations, excluding financial charges, in relation to the revenue generated from those operations.

- It is closely related to the operating profit ratio, which provides insights into the operational efficiency of a business.

- These ratios are valuable for comparing the performance of different firms (inter-firm comparison) as well as assessing the performance of the same firm over time (intra-firm comparison).

- A lower operating ratio is considered a positive sign, indicating better operational efficiency.

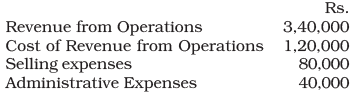

Example: Given the following information: Calculate Gross profit ratio and Operating ratio.

Calculate Gross profit ratio and Operating ratio.

Ans:

Gross Profit = Revenue from Operations – Cost of Revenue from Operations = Rs. 3,40,000 – Rs. 1,20,000 = Rs. 2,20,000

Operating Cost = Cost of Revenue from Operations + Selling Expenses + Administrative Expenses = Rs. 1,20,000 + 80,000 + 40,000 = Rs. 2,40,000

Net Profit Ratio

- The net profit ratio is calculated by dividing the net profit by the revenue from operations and multiplying by 100.

- It is a measure of net profit margin in relation to revenue from operations and reflects the overall efficiency of the business.

- The net profit generally refers to profit after tax (PAT).

- The net profit ratio is significant because it is the main variable in the computation of Return on Investment (ROI) and reveals profitability.

- The net profit ratio is important from the perspective of investors as it reflects the overall efficiency of the business.

Example: Gross profit ratio of a company was 25%. Its credit revenue from operations was Rs. 20,00,000 and its cash revenue from operations was 10% of the total revenue from operations. If the indirect expenses of the company were Rs. 50,000, calculate its net profit ratio.

Ans:

Cash Revenue from Operations = Rs.20,00,000 × 10/90 = Rs.2,22,222

Hence, total Revenue from Operations are = Rs.22,22,222

Gross profit = 0.25 × 22,22,222 = Rs. 5,55,555

Net profit = Rs.5,55,555 – 50,000 = Rs.5,05,555

Net profit ratio = Net profit/Revenue from Operations × 100

= Rs.5,05,555/Rs.22,22,222 × 100 = 22.75%.

Return on Capital Employed or Investment

- This ratio assesses how well a business is using its funds. Capital employed refers to the long-term money invested in the business, including shareholders' funds, debentures, and long-term loans. Alternatively, it can be seen as the total of non-current assets and working capital.

- For this ratio, profit means Profit Before Interest and Tax (PBIT). The formula is: Return on Investment (or Capital Employed) = (Profit before Interest and Tax / Capital Employed) × 100

- This ratio shows how efficiently a business uses the funds entrusted to it by shareholders, debenture-holders, and long-term lenders.

- A higher return on capital employed indicates better profitability and efficiency. It is useful for comparing different firms and assessing whether a company is earning more than the interest it pays on its debt.

Return on Shareholders' Funds

- This ratio is crucial for shareholders as it indicates whether their investment in the company is generating a reasonable return.

- It is expected to be higher than the return on investment; otherwise, it suggests that the company is not using its funds profitably.

A better measure of profitability from shareholders' point of view is obtained by determining the return on total shareholders’ funds, it is also termed as Return on Net Worth (RONW) and is calculated as under :

Earnings per Share (EPS)

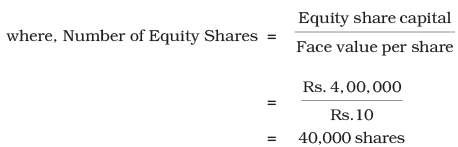

- EPS = Profit available for equity shareholders / Number of Equity Shares

- Profit available for equity shareholders = Profit after Tax - Dividend on Preference Shares

- EPS is crucial for equity shareholders and impacts share prices in the stock market

- It helps in comparing companies and assessing their ability to pay dividends

Book Value per Share

- Book Value per Share = Equity Shareholders’ Funds / Number of Equity Shares

- Equity Shareholders’ Funds = Shareholders’ Funds - Preference Share Capital

- This ratio is important for equity shareholders as it indicates the value of their holdings and influences market prices

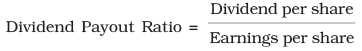

Dividend Payout Ratio

- This ratio shows the proportion of earnings distributed to shareholders as dividends

It is calculated as – This reflects the company’s dividend policy and growth in owner’s equity.

This reflects the company’s dividend policy and growth in owner’s equity.

Price / Earning Ratio

The ratio is computed as –

P/E Ratio = Market Price of a share/earnings per share

For example, if the EPS of X Ltd. is Rs. 10 and the market price is Rs. 100, the price-earning ratio will be 10 (100/10). It reflects investors' expectation about the growth in the firm’s earnings and the reasonableness of the market price of its shares. P/E ratios vary from industry to industry and company to company in the same industry depending upon investors' perception of their future.

Example: From the following details, calculate Return on Investment:

Also calculate Return on Shareholders’ Funds, EPS, Book value per share and P/E ratio if the market price of the share is Rs. 34 and the net profit after tax was Rs. 1,50,000, and the tax had amounted to Rs. 50,000.

Ans:

Profit before interest and tax = Rs. 1,50,000 + Debenture interest + Tax = Rs. 1,50,000 + Rs. 40,000 + Rs. 50,000 = Rs.2,40,000

Capital Employed = Equity Share Capital + Preference Share Capital + Reserves + Debentures = Rs. 4,00,000 + Rs. 1,00,000 + Rs. 1,84,000 + Rs. 4,00,000 = Rs. 10,84,000

Return on Investment = Profit before Interest and Tax/ Capital Employed × 100 = Rs. 2,40,000/Rs. 10,84,000 × 100 = 22.14%

Shareholders’ Fund = Equity Share Capital + Preference Share Capital + General Reserve = Rs. 4,00,000 + Rs. 1,00,000 + Rs. 1,84,000 = Rs. 6,84,000

Return on Shareholders’ Funds = Profit after tax/shareholders’ Funds × 100 = Rs. 1,50,000/Rs. 6,84,000 × 100 = 21.93%

EPS = Profit available for Equity Shareholders/ Number of Equity Shares = Rs. 1,38,000/ 40,000 = Rs. 3.45

Preference Share Dividend = Rate of Dividend × Prefence Share Capital = 12% of Rs. 1,00,000 = Rs. 12,000

Profit available to equity Shareholders = Profit after Tax – Preference dividend on preference shares

where, Dividend on Prefrence = Rate of Dividend × Preference Share Capital shares = 12% of Rs. 1,00,000

= Rs.12,000 = Rs. 1,50,000 – Rs. 12,000 = Rs. 1,38,000

P/E Ratio = Market price of a share/ Earnings per share

= 34/3.45

= 9.86

Times Book Value per share = Equity Shareholders’ fund/No. of equity shares Hence, Book value per share = Rs. 5,84,000/40,000 shares = Rs. 14.60

Hence, Book value per share = Rs. 5,84,000/40,000 shares = Rs. 14.60

It may be noted that various ratios are related to each other. Sometimes, the combined information regarding two or more ratios is given and missing figures may need to be calculated. In such a situation, the formula of the ratio will help in working out the missing figures.

|

42 videos|199 docs|43 tests

|

FAQs on Accounting Ratios Chapter Notes - Accountancy Class 12 - Commerce

| 1. What are accounting ratios and why are they important in commerce? |  |

| 2. How are accounting ratios calculated? |  |

| 3. What is the significance of liquidity ratios in accounting? |  |

| 4. How can accounting ratios be used to assess a company's profitability? |  |

| 5. Can accounting ratios be used to compare companies in different industries? |  |