Accounts from Incomplete Records Chapter Notes | Accounting for CA Foundation PDF Download

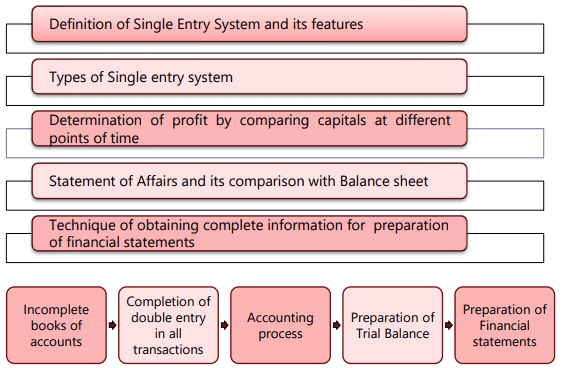

Chapter Overview

Introduction

In small sole proprietorships and partnership businesses, maintaining double-entry bookkeeping is not always feasible. This could be due to factors like a lack of accounting knowledge or the perception that the business is too small to warrant the effort. As a result, these businesses may only keep records of cash and credit transactions. However, at the end of the accounting period, they still want to assess their performance and financial position.

For instance, consider a grocery vendor selling vegetables from a street stall or a small shop. Is it realistic to expect him to learn accounting formally? No, he simply wants to keep track of a few key items, such as:

- The amount he owes for items purchased on credit from his supplier.

- The cash he has collected from selling those vegetables.

- If he runs a shop, the rent and electricity expenses he has paid.

- Any amounts he is owed from customers for credit sales.

There are other reasons for maintaining incomplete records, such as:

- Accidental destruction of accounting records, like in a fire.

- The need to calculate missing figures as balancing figures, for instance, due to damaged or destroyed inventory.

Every business owner wants to know their profit or loss. This chapter explores how to use available records to determine the profit or loss of a business and understand its financial position.

Single Entry System:

- The term "Single Entry System" might be a bit misleading because, in reality, accounts can only be prepared using the Double Entry System. The Single Entry System refers to a situation where records are incomplete or improper.

- In the Single Entry System, bookkeepers complete entries for some transactions while only recording one aspect of others. There are even transactions for which no entry is made at all. The accountant's job is to establish connections among the available information and finalize the accounts.

Typically, businesspeople keep records of cash receipts, cash payments, and personal accounts (such as receivables, payables, and capital). Information from bank statements, including withdrawals and deposits, is also readily available.

Features of Single Entry System

- It is an incorrect, unscientific, and disorganized way of recording business transactions.

- Typically, there is no record of real and nominal accounts, and often only cash transactions and personal accounts are recorded.

- The cash book combines business and personal transactions of the owners.

- There is no standard method for keeping records; each company may have different systems based on their own needs and convenience.

- The profit calculated under this system is merely an estimate based on the information available, meaning that the actual and accurate profits cannot be determined. The same applies to assessing the financial position without a proper balance sheet.

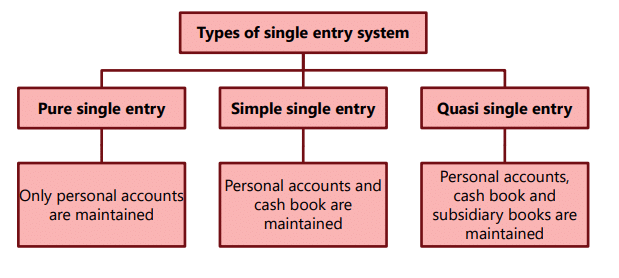

Types of Single Entry System

There are three types of single entry system.(i) Pure Single Entry:

- In this type, only personal accounts are maintained.

- As a result, there is no information available regarding cash and bank balances, sales, purchases, etc.

- This method fails to provide even basic information and exists only on paper, with no practical application.

(ii) Simple Single Entry:

- In this type, personal accounts and a cash book are maintained.

- Although these accounts are kept based on the double entry system, postings from the cash book are made only to personal accounts.

- No other accounts are found in the ledger.

- For example, a retail shop may keep a register of amounts receivable from customers without recording specific items sold.

(iii) Quasi Single Entry:

- In this type, personal accounts, a cash book, and some subsidiary books are maintained.

- The main subsidiary books include the Sales book, Purchases book, and Bills book.

- Discounts are entered into personal accounts, and scattered information about important expenses like wages, rent, and rates is also available.

- This method is often used as a substitute for the double entry system.

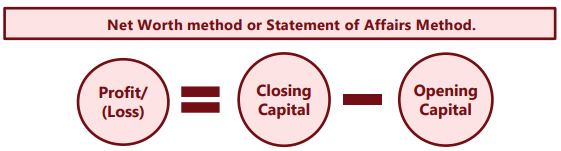

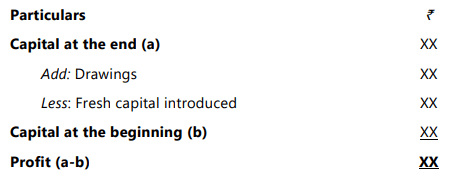

Ascertainment of Profit by Capital Comparison

This method is also referred to as the Net Worth method or Statement of Affairs Method.Profit/ (Loss) = Closing Capital – Opening Capital

When detailed information about revenue and expenses is lacking, preparing a profit and loss account becomes challenging. Instead, by gathering information about assets and liabilities, it is easier to create a balance sheet at two different points in time. Therefore, when preparing accounts from incomplete records and sufficient information is not available, it is preferable to use the capital comparison method to determine the profit or loss for the current year.

Methods of Capital Comparison

- The capital of a business increases when there is a profit made during the year.

- If the business incurs a loss, the capital will decrease.

- When the owner or partners invest more money into the business, the capital will rise.

- On the other hand, if they take out money from the business, the capital will fall.

The following points shall be considered while computing the profit/loss under capital comparison method-

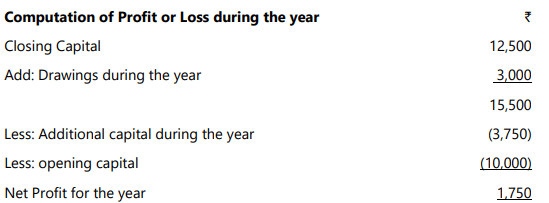

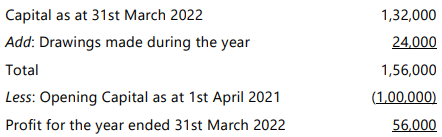

[Question: 0]

ILLUSTRATION 1

Raju does not maintain proper records of his business. However, he provides the following information:

- Starting Capital: 10,000

- Ending Capital: 12,500

- Withdrawals During the Year: 3,000

- Additional Capital Added During the Year: 3,750

You are required to calculate the profit or loss for the year.

SOLUTION

ALTERNATIVELY

Profit/Loss can also be ascertained as balancing figure by preparing capital account as follows:

Determining Opening and Closing Capital Using the Statement of Affairs

- To follow the capital comparison method, it's essential to know the opening and closing capital, which can be determined by preparing a statement of affairs at two different points in time.

- Capital is calculated by subtracting liabilities from assets: Capital = Assets - Liabilities.

- The statement of affairs requires a detailed listing of assets and liabilities along with their respective amounts.

Sources for Identifying Assets and Liabilities

- Cash Book: Used to find the cash balance.

- Bank Pass Book: Used to determine the bank balance.

- Personal Ledger: Helps identify debtors and creditors.

- Inventory: Assessed through actual counting and valuation.

- Fixed Assets:. list is prepared, with the help of the proprietor, who provides the original cost and date of purchase. After accounting for reasonable depreciation, the written-down value is included in the statement of affairs.

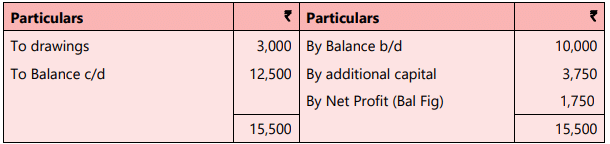

Preparing the Statement of Affairs

- Once all necessary information about assets and liabilities is gathered, the accountant can prepare the statement of affairs at two different points in time.

- This process involves listing all assets and liabilities to determine the opening and closing capital accurately.

The design of the statement of affairs is just like balance sheet as given below:

Now from the statement of affairs prepared at two different dates, the opening and closing capital balances can be obtained.

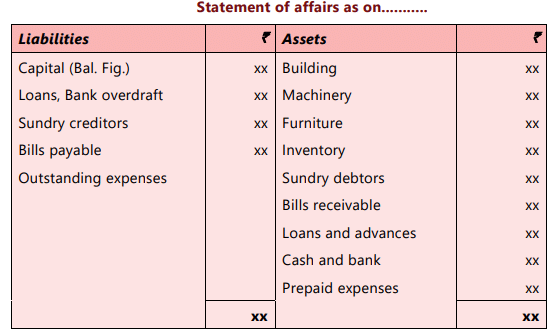

ILLUSTRATION 2

Rakesh started his business on 1st of April 2021. He invested a capital of Rs 1,00,000. On 31st March 2022, he has the following information available as per the Single-entry system maintained by him.

- Cash balance (counted): 3,200

- Inventory (physically verified): 34,800

- Receivable from Ajay for credit sales: 31,000

- Machine: 85,000

- Payable to Vinod for credit purchase: 12,000

- Loan taken from the bank: 10,000

- Drawings made during the year: 24,000

You are required to calculate the profit or loss earned by Rakesh for the year ended 31st March 2022.

SOLUTION

Statement of profit or loss for the year ended 31st March, 2022

Difference Between Statement of Affairs and Balance Sheet

- Basis:

- Statement of Affairs: This is created using transactions that are partly recorded using double-entry bookkeeping and partly with single-entry bookkeeping. Many assets are estimated based on assumptions and memories rather than accurate records.

- Balance Sheet: This is based on transactions recorded entirely through double-entry bookkeeping, meaning each item can be verified with relevant records and documents.

- Capital:

- In the statement of affairs, capital is simply a balancing figure.

- In the balance sheet, capital comes from the capital account in the ledger, ensuring that the total of assets equals the total of liabilities.

- Omission:

- The statement of affairs is based on incomplete records, making it hard to identify and record any omitted assets and liabilities.

- The balance sheet records all items properly, so there is no chance of missing assets and liabilities. If something is missing, it will be apparent since the balance sheet won’t match.

- Basis of Valuation:

- In the statement of affairs, asset valuation is often done arbitrarily, with no specific method disclosed.

- In the balance sheet, assets are valued systematically, with fixed assets shown at their original cost minus any depreciation. Any changes in valuation methods are clearly mentioned.

- Objective:

- The purpose of the statement of affairs is to find out the capital amounts at the beginning and end of the accounting period.

- The goal of the balance sheet is to determine the financial position at a specific date.

Preparation of Statement of Affairs and Determination of Profit

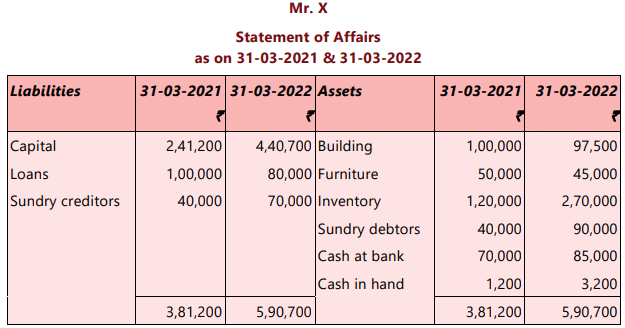

It has been discussed in Para 3.1 that figures of assets and liabilities should be collected for preparation of statement of affairs. Given below an example:ILLUSTRATION 3

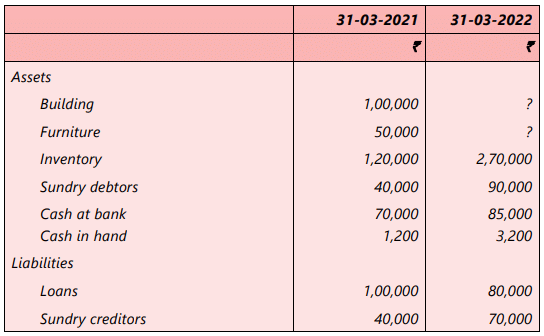

Assets and Liabilities of Mr. X as on 31-03-2021 and 31-03-2022 are as follows:

Decided to depreciate building by 2.5%p.a. and furniture by 10% p.a. One Life Insurance Policy of the Proprietor was matured during the period and the amount ` 40,000 is retained in the business. Proprietor took @ ` 2,000 p.m. for meeting family expenses.

Prepare Statement of Affairs as on 31-03-2021 and 31-03-2022.

SOLUTION

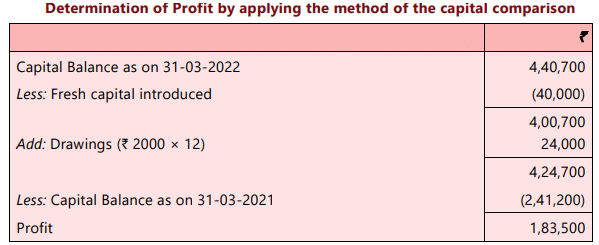

ILLUSTRATION 4

Take figures given in Illustration 4. Find out profit of Mr. X for the year ended 31-03-2022.

SOLUTION

Note:

- Closing capital is increased due to fresh capital introduction, so it is deducted.

- Closing capital was reduced due to withdrawal by proprietor; so it is added back.

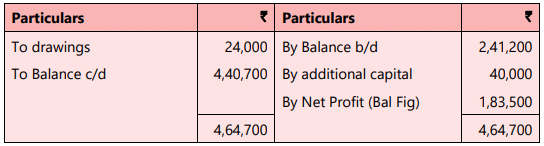

ALTERNATIVELY

Capital account can be prepared as follows:

ILLUSTRATION 5

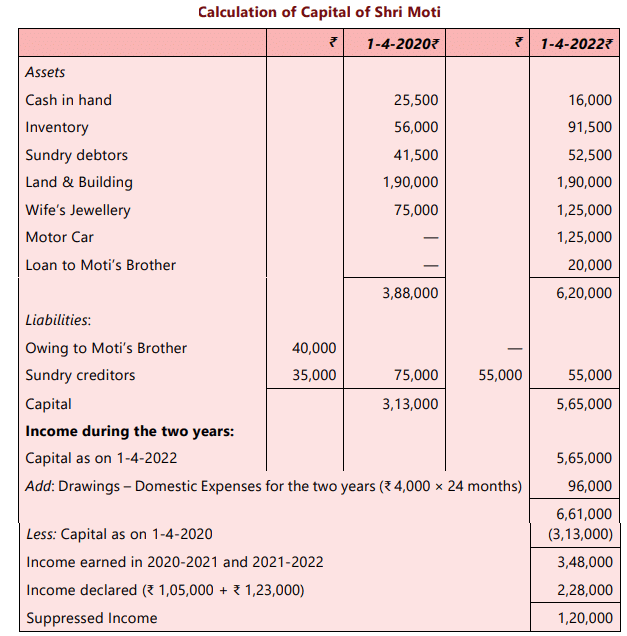

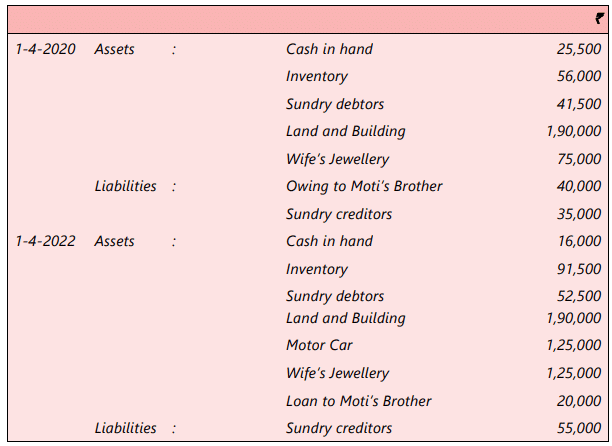

The Income Tax Officer, on assessing the income of Shri Moti for the financial years 2020-2021 and 2021-2022 feels that Shri Moti has not disclosed the full income. He gives you the following particulars of assets and liabilities of Shri Moti as on 1st April, 2020 and 1st April, 2022.

During the two years the domestic expenditure was ₹ 4,000 p.m. The declared incomes of the financial years were ₹ 1,05,000 for 2020-2021 and ₹ 1,23,000 for 2021-2022 respectively.

State whether the Income-tax Officer’s contention is correct. Explain by giving your workings.

SOLUTION

The Income-tax officer’s contention that Shri Moti has not declared his true income is correct. Shri Moti’s true income is in excess of the disclosed income by ₹ 1,20,000 based on the information available.

[Question: 0]

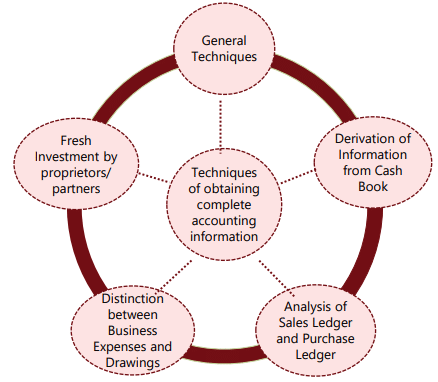

Techniques for Obtaining Complete Accounting Information

- When the books of accounts are incomplete, it is crucial to ensure that double entry is completed for all transactions.

- The entire accounting process should be followed meticulously, and a Trial Balance should be prepared at the end.

General Techniques

Preparation of Final Accounts from Incomplete Records- In case of incomplete records, it is advisable to first convert the accounts to the double-entry system and then prepare the Profit and Loss Account and Balance Sheet.

- Preparing a statement of affairs to determine profit or loss is not recommended due to the varying degrees of incompleteness in different firms' accounts.

Steps to Prepare Final Accounts from Incomplete Records

- Start Ledger Accounts: Begin with the opening balances of assets, liabilities, and capital.

- Post from Cash Book: If only personal accounts have been posted from the Cash Book, post debits and credits pertaining to nominal and real accounts that are not posted.

- Handle Discount Columns: Post totals of discounts paid and received to Discounts Allowed and Discounts Received Accounts, respectively, to complete the double entry.

- Total Subsidiary Books: Total up other subsidiary books like Purchases Day Book, Sales Day Book, Purchase Return Book, Sales Return Book, Bills Receivable, and Bills Payable, and post their totals to the ledger.

Dealing with Unposted Items:

- Personal Receipts and Payments: Credit the capital account for personal receipts and debit the capital account for personal payments.

- Business Receipts and Payments: Debit appropriate asset or expense accounts for business receipts and credit the source of funds for business payments.

- Cash Shortages: Debit the proprietor's capital account for cash shortages due to unidentified amounts.

- Shared Expenses: Allocate shared expenses, like rent, between the proprietor and the business on an equitable basis.

Trial Balance:

- Prepare a Trial Balance after making adjustments to identify any mistakes.

Derivation of Information from Cash Book

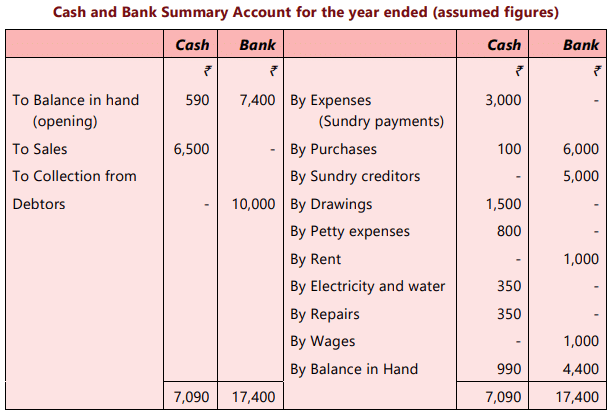

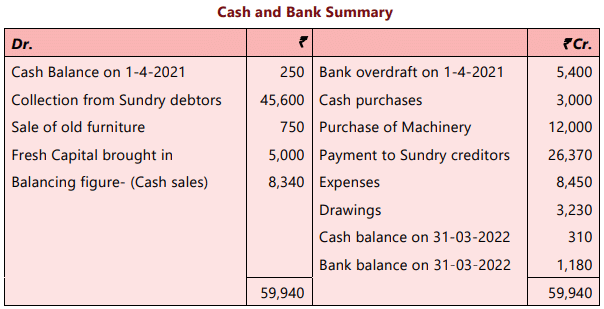

The analysis of cash as well as bank receipts and payments, should be extensive but under significant heads, so that various items of income and expenditure can be posted therefrom into the ledger. However before posting the information into the ledger the same should be collected in the form of an account, the specimen whereof is shown below:

The important point about incomplete records is that much of the information may not be readily available and that the relevant information has to be ascertained. A good point is to prepare Cash and Bank Summary (if not available in proper form with both sides tallied). The cash and bank balance at the end should be reconciled with the cash and bank books. Having done so, the various items detailed on the Summary Statements, should be posted into the ledger.

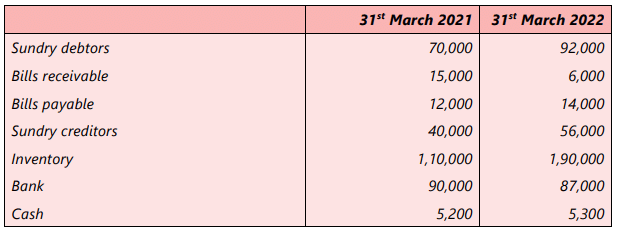

It is quite likely that some of the missing information will then be available. Consider the following about a firm relating to 31st March 2022.

Now prepare the cash and Bank Summary.

See that debit side is short by ` 8,340. What may be the possible source of cash inflow? It can be cash sales.

Analysis of Sales Ledger and Purchase Ledger

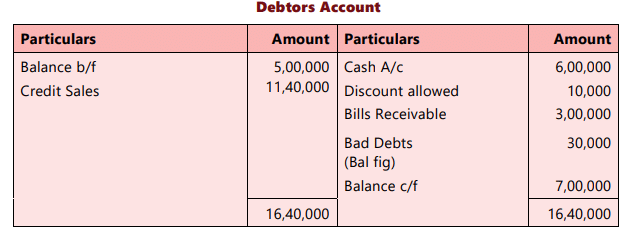

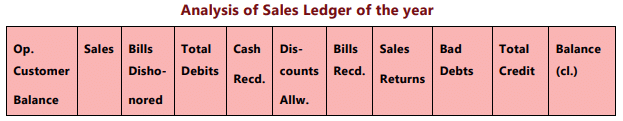

The Sales Ledger contains details about the opening balances of debtors, year-long transactions including credit sales, bills receivable, any dishonored bills, cash received, sales returns, discounts, rebates, and concessions granted. It also includes receipts of bills receivable, bad debts written off, and transfers. Journal entries are recorded by debiting or crediting the relevant impersonal accounts, with corresponding contra entries to the total debtors account.

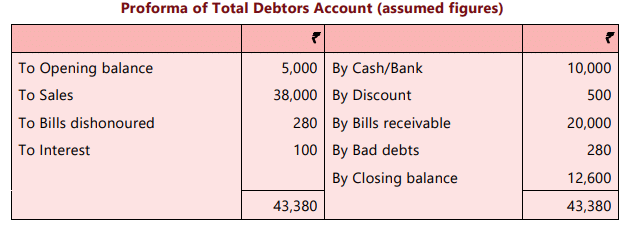

From the aforementioned, it will be possible to build up information about sales and other accounts which can then be posted in totals, if so desired. It would also be possible to prepare Total Debtors

Account in the following form:

The provided format indicates that any missing figure can be easily determined as a balancing figure, which may include the opening balance, credit sales, cash collected, or closing balance. For example, if information regarding credit sales is absent, it can be calculated as the balancing figure in the total Debtors Account, assuming all other figures are available.

[Question: 0]

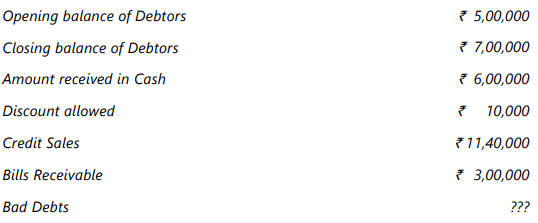

ILLUSTRATION 6

Calculate the bad debts from the below information:

SOLUTION

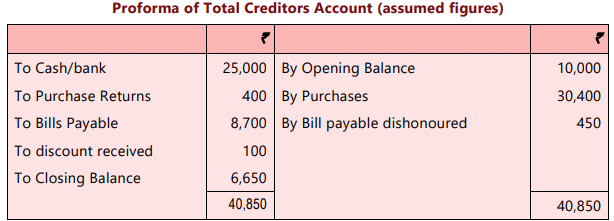

Purchases Ledger: Generally, a Purchases Ledger is less commonly maintained than a Debtors Ledger because it is often more convenient to record entries related to outstanding liabilities at the time of payment rather than when they are incurred. Information regarding opening balances of creditors and goods purchased on credit is still available.dit, bills payable accepted, bills payable dishonored; cash paid to the creditors during the year, discount and other concessions obtained, returns outwards and transfers. Here also, journal entries must be made by debiting or crediting the respective impersonal accounts. Contra credit or debit being given to total creditor’s account.

From the available information total creditors account can be prepared as follows:

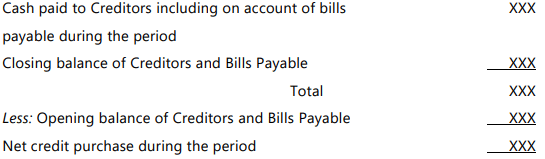

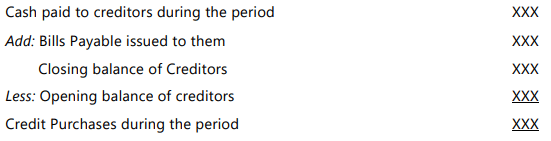

If a proper record of return to creditors, discount allowed by them etc., has not been kept, it may not be possible to write up the Total Creditors A/c. In such a case, net credit purchase can be ascertained as follows:

Alternatively

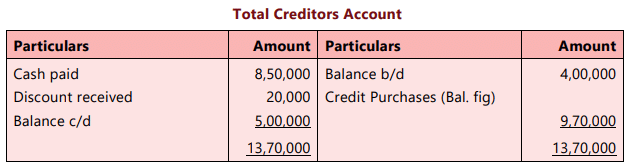

ILLUSTRATION 7

Calculate the credit purchases from the below information:

Opening balance of creditors - ₹ 4,00,000

Closing balance of creditors - ₹ 5,00,000

Payments made in Cash - ₹ 8,50,000

Discount received - ₹ 20,000

SOLUTION

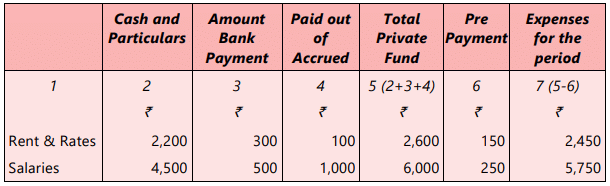

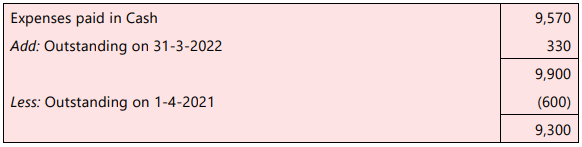

Nominal Accounts: It is quite likely that the total expenditure shown by balance of nominal account may contain items of expenditure which do not relate to the year for which accounts are being prepared and, also, there may exist certain items of expenditure incurred but not paid, which have not been included therein. On that account, each and every account should be adjusted in the manner shown below (figures assumed):

Only the amount entered as “expenses for the period” should be posted to the respective nominal accounts. A similar adjustment of nominal accounts in respect of revenue receipt should be made.

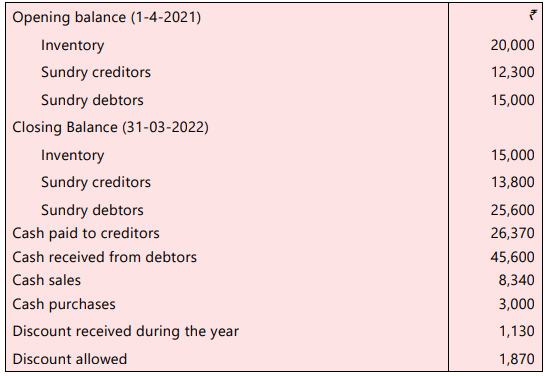

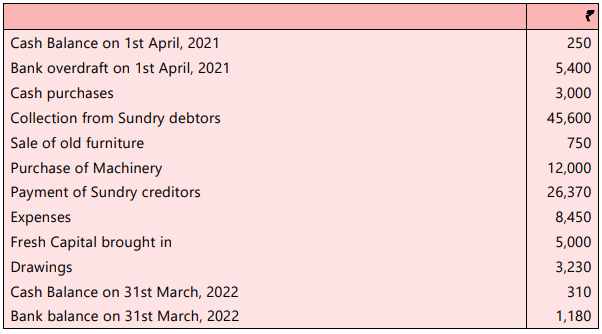

Let us continue with the example given in para 4.2. Given some other information, how to compute credit purchase and credit sale is discussed below:

What are the purchases for 2021-2022? Let us prepare the Sundry Creditors Account.

The credit purchases are ₹ 29,000; cash purchases are ₹3,000: hence total purchases are ₹ 32,000.

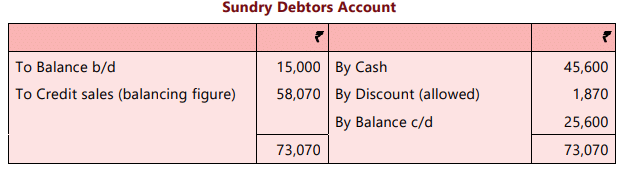

Likewise prepare the Sundry Debtors Account:

So total sales = credit sales + cash sales

= ₹ 58,070 + ₹ 8,340 = ₹ 66,410

Distinction between Business Expenses and Drawings

Drawings

- Drawings refer to the withdrawal of funds by the owner or partner from the business for personal use.

- Common items included in drawings are:

- Rent for premises used for both residential and business purposes.

- Shared electricity and telephone bills.

- Life insurance premiums of the proprietor or partners paid from business funds.

- Household expenses covered by business cash.

- Personal loans repaid to friends and relatives from business cash.

- Personal gifts made to friends and relatives using business funds.

- Goods or services taken from the business for personal use.

- Cash withdrawals for family expenses.

- Money collected from debtors used for personal expenses.

- To assess the nature and amount of drawings, it is crucial to examine the summary of cash transactions, business resources, and their utilization.

Fresh Investments by Proprietors/Partners

- Fresh investments made by proprietors or partners are sometimes not easily identifiable and require careful examination of business transactions.

- Fresh investments may include:

- Proceeds from the maturity of a Life Insurance Policy of the proprietors.

- Interest and dividends from personal investments of the proprietors.

- Income from non-business property.

- Payments made to creditors from personal funds.

- Proper identification and segregation of these items are essential to ensure accurate business income and prepare a correct statement of affairs.

[Question: 0]

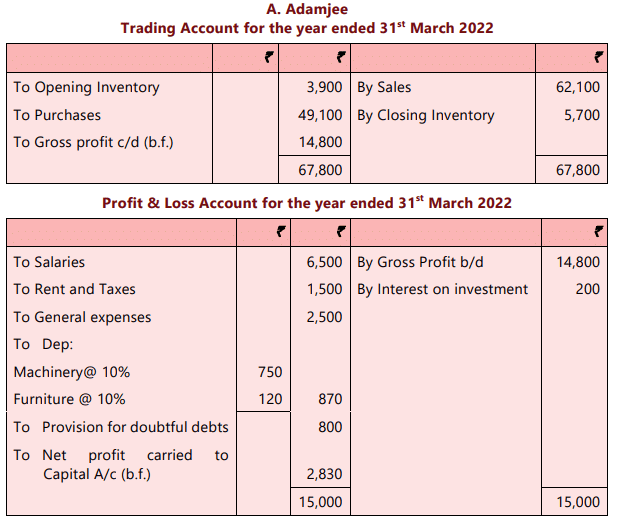

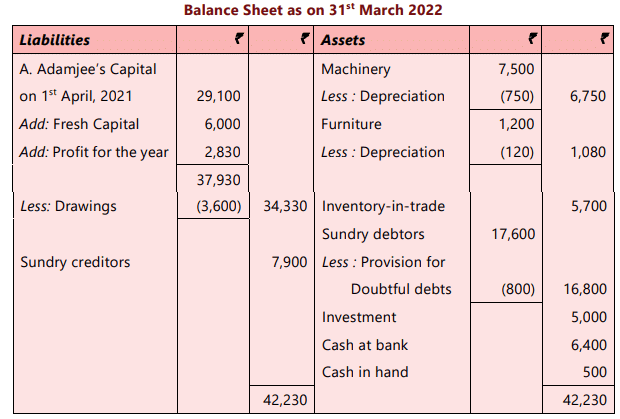

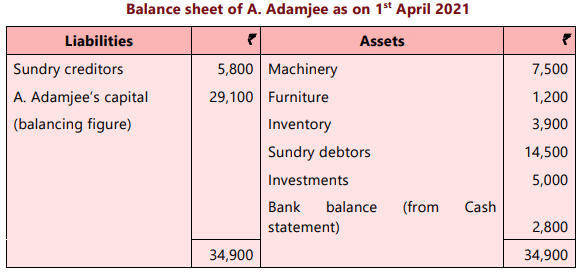

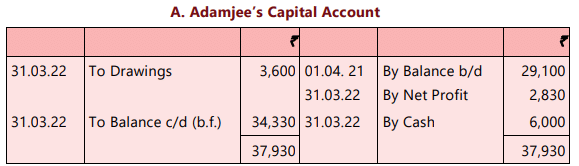

ILLUSTRATION 8

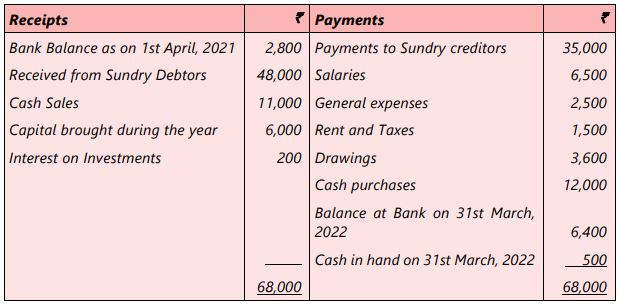

A. Adamjee keeps his books on single entry basis. The analysis of the cash book for the year ended on 31st March, 2022 is given below:

Particulars of other assets and liabilities are as follows:

Particulars of other assets and liabilities are as follows:

Prepare final accounts for the year ending 31st March, 2022 after providing depreciation at 10 per cent on machinery and furniture and ₹ 800 against doubtful debts.

SOLUTION

Working Notes:

1.

2. Ledger Accounts

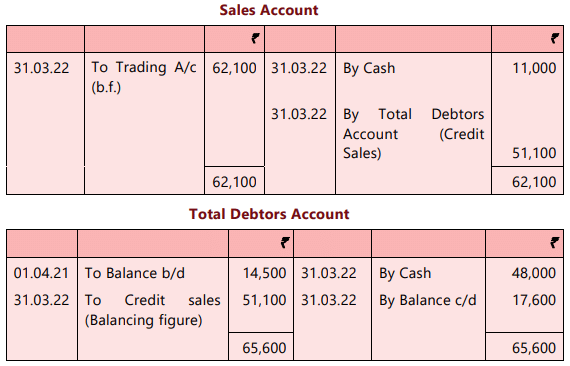

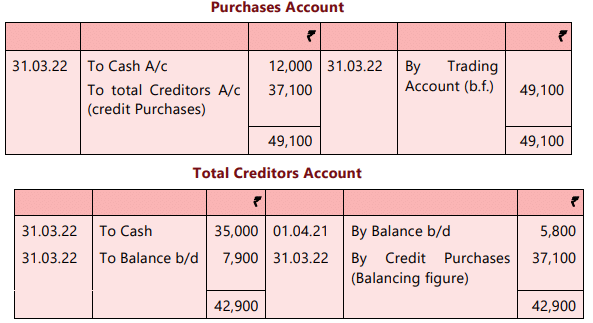

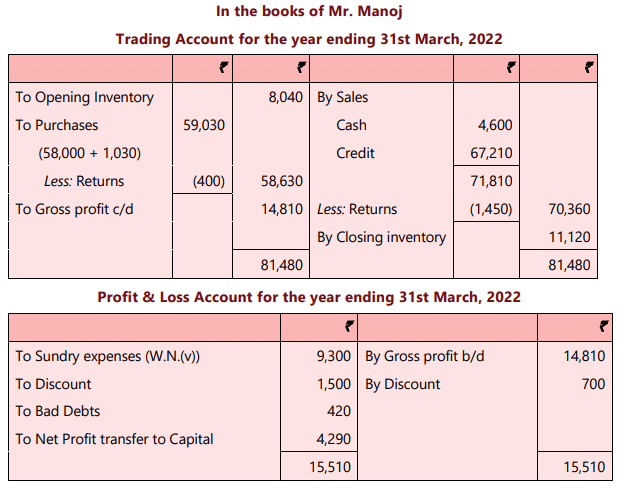

ILLUSTRATION 9

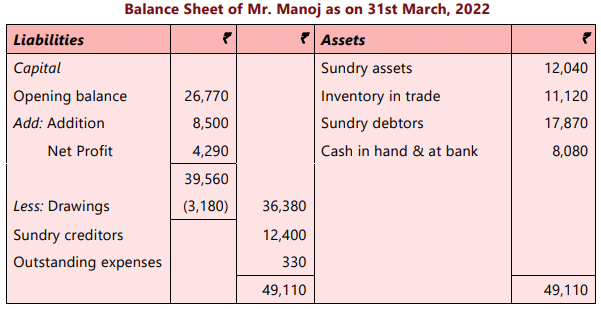

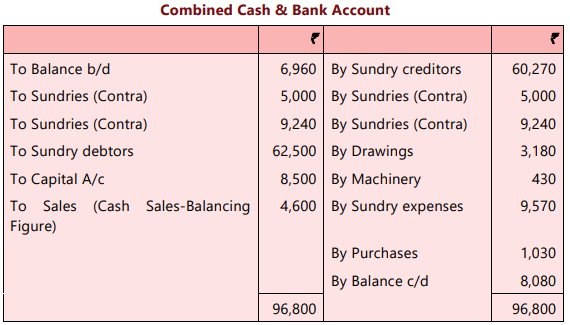

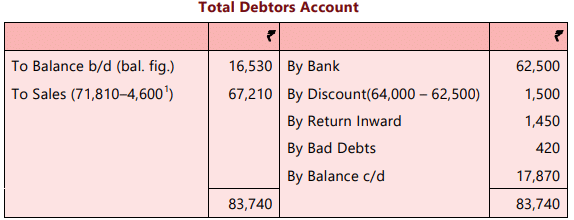

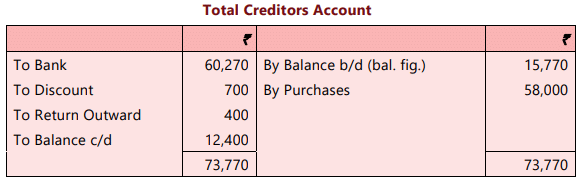

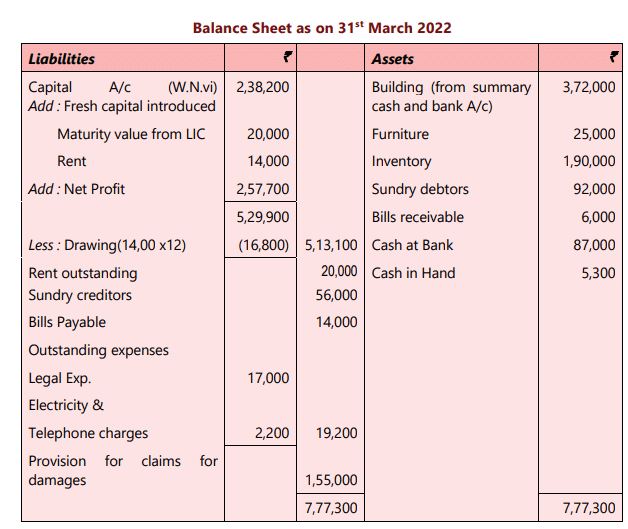

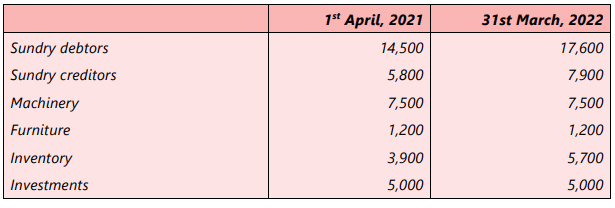

From the following data furnished by Mr. Manoj, you are required to prepare a Trading and Profit and Loss Account for the year ended 31st March, 2022 and Balance Sheet as at that date. All workings should form part of your answer.

SOLUTION

Working Notes:

(i) Cash sales

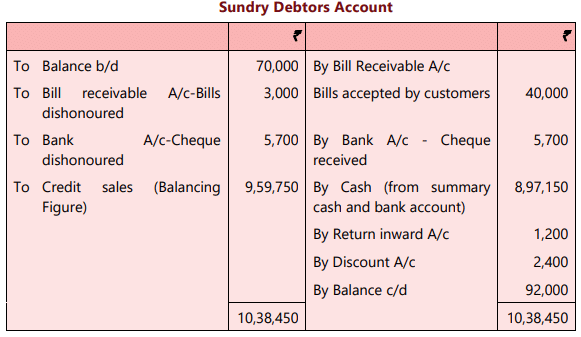

(ii) Total Debtors Account

(iii) Total Creditors Account

(iv)

(v)

(vi) Due to lack of information, depreciation has not been provided on fixed assets.

ILLUSTRATION 10

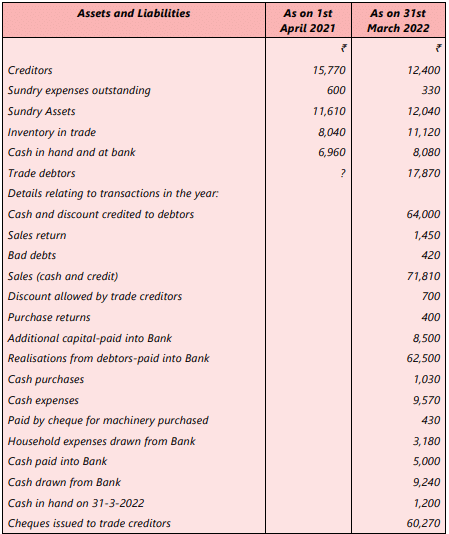

Mr. Anup runs a wholesale business where in all purchases and sales are made on credit. He furnishes the following closing balances:

Summary of cash transactions during the year 2021- 2022:

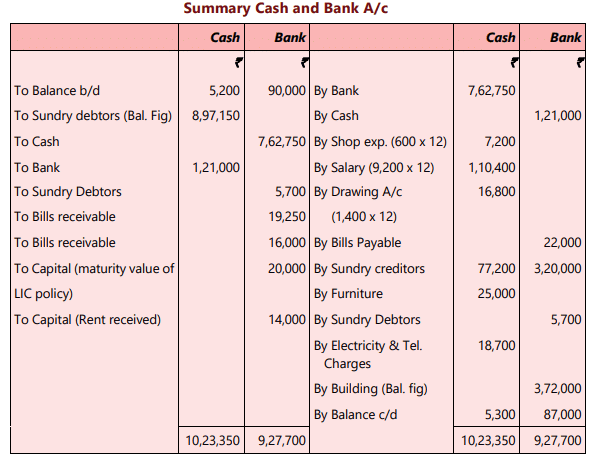

(i) Deposited to bank after payment of shop expenses @ ` 600 p.m., salary @ ` 9,200 p.m. and personal expenses @ ` 1,400 p.m. ` 7,62,750.

(ii) Cash Withdrawn from bank ` 1,21,000.

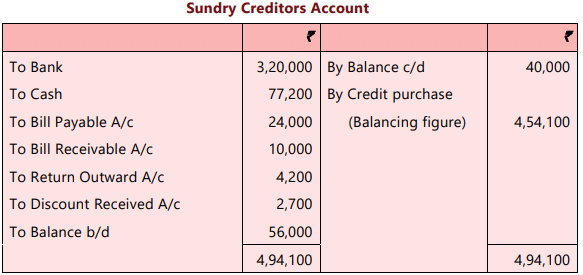

(iii) Cash payment to suppliers ` 77,200 for supplies and ` 25,000 for furniture.

(iv) Cheques collected from customers but dishonoured ` 5,700.

(v) Bills accepted by customers ` 40,000.

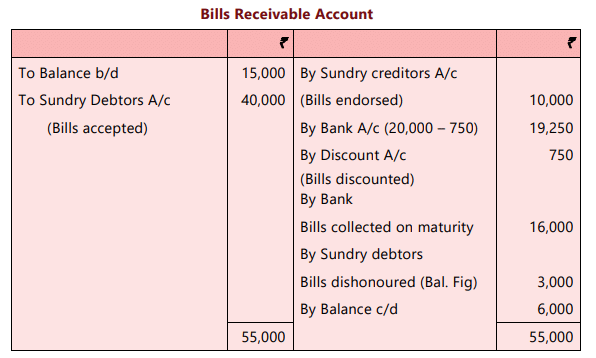

(vi) Bills endorsed ` 10,000.

(vii) Bills discounted ` 20,000, discount ` 750.

(viii) Bills matured and duly collected ` 16,000.

(ix) Bills accepted ` 24,000.

(x) Paid suppliers by cheque ` 3,20,000.

(xi) Received ` 20,000 on maturity of one LIC policy of the proprietor by cheque.

(xii) Rent received ` 14,000 by cheque for the premises owned by proprietor.

(xiii) A building was purchased on 30-11-2021 for opening a branch for ` 3,50,000 via cheque and some expenses were incurred on this building, details of which are not maintained.

(xiv) Electricity and telephone bills paid by cash ` 18,700, due ` 2,200.

Other transactions:

(i) Claim against the firm for damage ` 1,55,000 is under legal dispute. Legal expenses ` 17,000. The firm anticipates defeat in the suit.

(ii) Goods returned to suppliers ` 4,200.

(iii) Goods returned by customers ` 1,200.

(iv) Discount offered by suppliers ` 2,700.

(v) Discount offered to the customers ` 2,400.

(vi) The business is carried on at the rented premises for an annual rent of ` 20,000 which is outstanding at the year end.

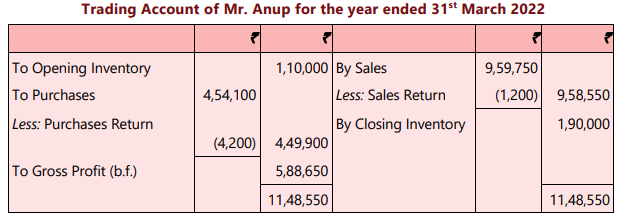

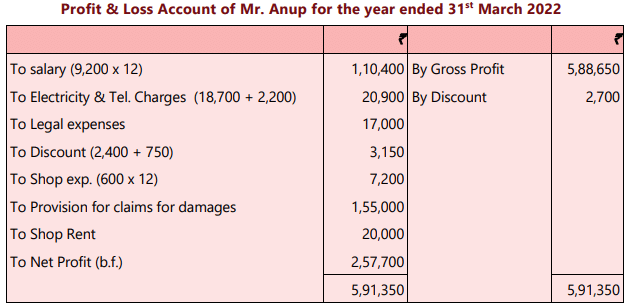

Prepare Trading and Profit & Loss Account of Mr. Anup for the year ended 31st March 2022 and Balance Sheet as on that date.

SOLUTION

Working Notes : (i)

(ii) Bills Receivable Account

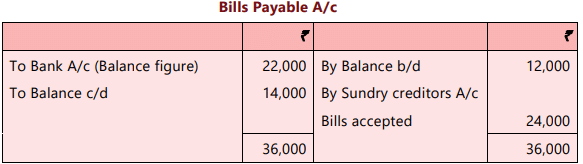

(iii) Sundry Creditors Account

(iv) Bills Payable A/c

(v) Summary Cash and Bank A/c

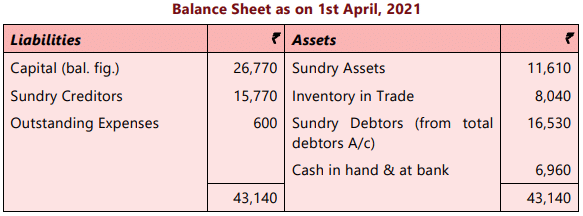

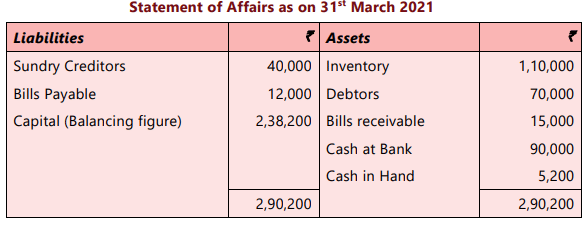

(vi) Statement of Affairs as on 31st March 2021

|

68 videos|265 docs|83 tests

|

FAQs on Accounts from Incomplete Records Chapter Notes - Accounting for CA Foundation

| 1. What is a single entry system in accounting? |  |

| 2. What are the different types of single entry systems? |  |

| 3. How can profit be ascertained using capital comparison in a single entry system? |  |

| 4. What is the difference between a statement of affairs and a balance sheet? |  |

| 5. What techniques can be used to obtain complete accounting information from incomplete records? |  |