Financial Statements - I Chapter Notes | Accountancy Class 11 - Commerce PDF Download

Stakeholders and their Information Requirements

The main goal of business is to share important information with different stakeholders so they can make smart choices.

- A stakeholder is anyone involved with the business.

- Stakeholders can have either monetary or non-monetary interests in the business.

- Stakeholder interests can vary:

1. Active or passive stake

2. Direct or indirect stake - For instance, the owner and individuals who lend money to the business have a monetary stake.

- On the other hand, the government, consumers, or researchers might have a non-monetary stake.

- Stakeholders are also referred to as users, and they can be classified based on their position:

1. Internal users: those who are part of the business

2. External users: those who are outside the business - Different users join the business for various reasons and therefore have unique information needs.

- In summary, the information requirements of users vary greatly based on their roles and interests in the business.

Analysis of various users of accounting information

Analysis of various users of accounting information

Accounting Process (up to Trial balance) :

- The process of recording transactions involves several key steps.

- First, only transactions that can be measured in monetary terms are recorded.

- This recording follows the double-entry system, where each transaction has two aspects: debit and credit.

- Repeated transactions of similar nature are documented in subsidiary books, also known as special journals, instead of the general journal.

- For instance, credit sales are recorded in a sales book, while credit purchases are noted in a purchases book.

- Other subsidiary books include the return inwards book and return outwards book, with cash and bank transactions recorded in a cash book.

- Transactions not captured in these specialized books are entered into a residual journal called the journal proper.

- Following this, the entries from these books are posted to the corresponding accounts in the ledger.

- The accounts are then balanced and compiled into a statement known as the trial balance.

- If the total debit and credit balances match, the accounts are deemed free from arithmetic errors.

- The trial balance serves as the foundation for preparing financial statements, including the trading and profit and loss account as well as the balance sheet.

Distinction between Capital and Revenue

- The difference between capital and revenue items is crucial in accounting.

- Revenue items are included in the trading and profit and loss accounts.

- Capital items are used to prepare the balance sheet.

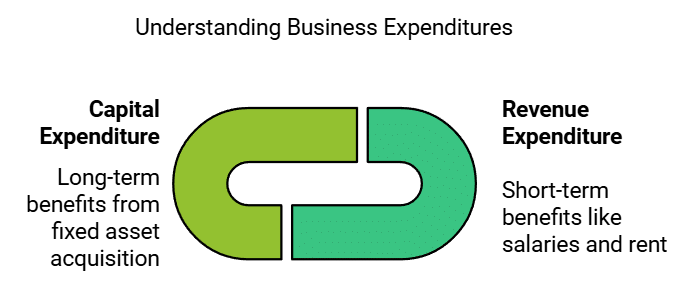

What is Expenditure?

- Expenditure refers to any payment made for purposes other than settling existing debts.

- Businesses incur expenditures expecting to gain benefits.

- Benefits from expenditures can last for one accounting year or more.

- If benefits last up to one accounting year, it is called revenue expenditure.

- Examples of revenue expenditure include payments for salaries and rent.

- For instance, salary payments in the current period do not benefit the next period.

- If benefits extend beyond one accounting period, it is termed capital expenditure.

- Buying furniture for business use is an example of capital expenditure.

- Capital expenditures typically involve acquiring or improving fixed assets.

Key Differences Between Capital and Revenue Expenditure

- Capital expenditure boosts the business's earning capacity, while revenue expenditure maintains it.

- Capital expenditure involves fixed assets, whereas revenue expenditure is for daily operations.

- Revenue expenditure is usually recurring, while capital expenditure is generally non-recurring.

- Capital expenditure benefits the business for more than one accounting year.

- Capital expenditure (after depreciation) appears on the balance sheet, while revenue expenditure appears in the profit and loss account.

Challenges in Classifying Expenditure

- Sometimes, it is hard to categorize expenditures as either revenue or capital.

- Advertising costs are often seen as revenue expenditure, but they can provide benefits over multiple years.

- Such advertising costs that benefit more than one period are known as deferred revenue expenditures.

Understanding Expenditure and Expenses

- Expenditure is a broad term that includes expenses.

- Expenditure refers to any money spent by the business.

- Expenses are parts of expenditures that are used up in the current year.

- Revenue expenditure is treated as an expense for the current year and shown in the profit and loss account.

- For example, salaries paid are considered expenses for that year.

- Capital expenditures are spread over multiple years, like furniture costing ₹50,000 used for 5 years.

- This will be recorded as an expense of ₹10,000 per year, known as depreciation.

- Deferred revenue expenditures are treated like capital expenditures and are written off over their benefit period.

Receipts in Accounting

- Receipts are treated similarly to expenditures.

- If a receipt creates an obligation to return money, it is classified as a capital receipt.

- Examples include additional capital from the owner or loans from banks.

- The sale of fixed assets, like old machinery, is also a capital receipt.

- If a receipt does not require returning money, it is a revenue receipt.

- Examples of revenue receipts include sales made and interest earned on investments.

Importance of Distinguishing Capital from Revenue

- The difference between capital and revenue affects how the trading and profit and loss account and balance sheet are prepared.

- All revenue items must be recorded in the trading and profit and loss account, while capital items belong in the balance sheet.

- If items are misclassified, it can lead to incorrect profit or loss figures.

- For instance, if revenue of ₹10,00,000 is reported with expenses of ₹8,00,000, profit appears to be ₹2,00,000.

- If a revenue item of ₹20,000 for repairs is mistakenly recorded as capital, expenses are actually ₹8,20,000, reducing profit to ₹1,80,000.

- This misclassification can lead to overstated profits.

- Conversely, if capital expenditure is wrongly recorded as revenue, it can lead to understated profits and asset values.

- Therefore, accurately identifying and categorizing items in accounts is essential for clear financial reporting.

- This accuracy is also important for tax purposes, as capital and revenueprofits are taxed differently.

Financial Statements

- It is important to recognize that different users have various needs for information.

- Instead of creating specific details for each user, the company prepares a collection of financial statements that generally meet the information needs of users.

- The main goals of creating financial statements are:

1. To provide a true and fair view of the business's financial performance.

2. To provide a true and fair view of the business's financial position. - To achieve these goals, the company typically prepares the following financial statements:

1. Trading and Profit and Loss Account

2. Balance Sheet - The Trading and Profit and Loss Account, also called the Income Statement, displays the financial performance in terms of profit made or loss incurred by the business.

- The Balance Sheet shows the financial position by listing assets, liabilities, and capital.

- These statements are prepared based on the trial balance and any additional information that may be available.

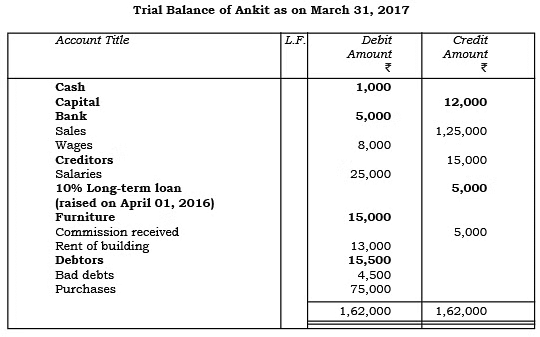

Example: Observe the following trial balance of Ankit and signify correctly the various elements of accounts and you will notice that the debit balances represent either assets or expenses/ losses and the credit balance represents either equity/liabilities or revenue/gains. [This trial balance of Ankit will be used throughout the chapter to understand the process of preparation of financial statements]

- The balance sheet and profit and loss account are now called position statement and statement of profit and loss in the company’s financial statements.

- Since Chapters 8 and 9 deal with the preparation of financial statements of sole proprietorship firm, the terms balance sheet and profit and loss account are retained.

Trading and Profit and Loss Account

- Purpose: The Trading and Profit and Loss account is created to find out the profit made or loss incurred by a business during a specific time period. It provides a summary of the business's earnings and expenses to determine the overall profit or loss.

- Calculation of Profit: Profit is calculated by subtracting total expenses from total revenue. If expenses exceed revenue, the result is considered a loss.

- Performance Summary: This account summarizes the business's performance over an accounting period by transferring revenue and expense balances from the trial balance.

- Structure: The Trading and Profit and Loss account consists of two sides: Debit and Credit.

1. The debit side includes expenses and losses.

2. The credit side includes revenues and gains.

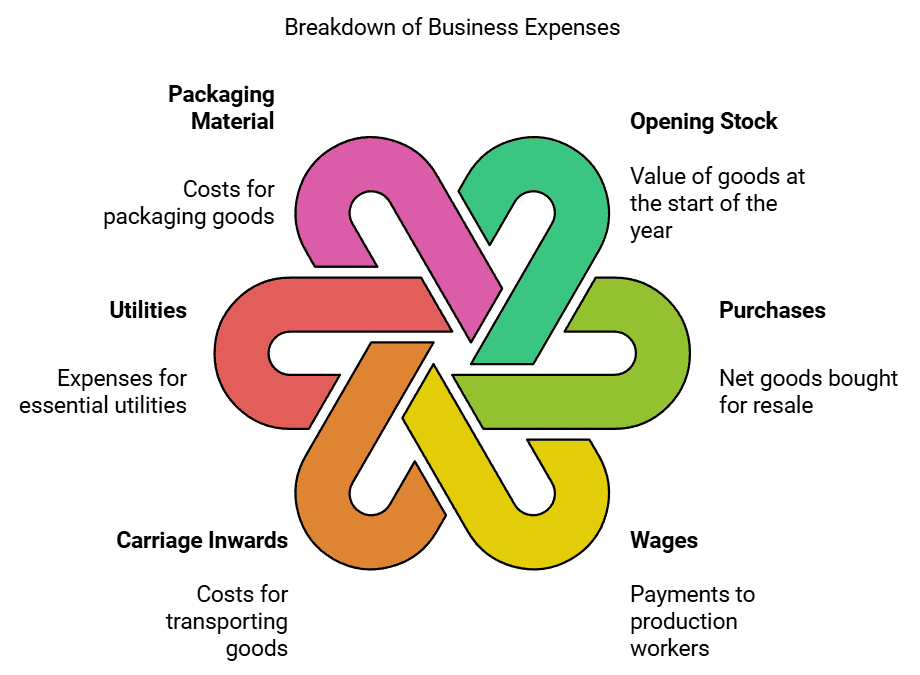

Items on the Debit Side

- Opening Stock: This is the value of goods available at the start of the accounting year, carried over from the previous year.

- Purchases (Less Returns): All goods bought for resale are recorded here, including cash and credit purchases. Goods returned to suppliers are deducted, resulting in Net Purchases.

- Wages: Payments made to workers involved in the production process are included here.

- Carriage Inwards: Costs for transporting purchased goods to the business location are recorded as expenses.

- Fuel/Water/Power/Gas: These utilities are necessary for production and are considered expenses.

- Packaging Material: Costs for small containers used in products are direct expenses, while larger containers used for transport are indirect expenses.

- Salaries: Payments to administrative and warehouse staff are recorded here, including any perks provided to employees.

- Rent Paid: Expenses for office, warehouse, and factory rent, along with any related taxes, are noted here.

- Interest Paid: This includes interest on loans and bank overdrafts, treated as expenses.

- Commission Paid: Commissions paid to agents for business transactions are recorded as expenses.

- Repairs: Costs for maintenance and small replacements of equipment and furniture are included here.

- Miscellaneous Expenses: Smaller expenses that don't fit into specific categories are grouped as miscellaneous or sundry expenses.

Items on the Credit Side

- Sales (Less Returns): The total sales amount (both cash and credit) is recorded here. Returns by customers are deducted to calculate Net Sales.

- Other Incomes: Any additional income, such as rent received, dividends, interest, discounts, or commissions, is recorded in the profit and loss account.

Closing Entries

- To prepare the trading and profit and loss account, you need to move the balances of all relevant accounts into it.

- The following accounts are closed by transferring their balances to the debit side of the trading and profit and loss account:

- Opening stock account

- Purchases account

- Wages account

- Carriage inwards account

- Direct expenses account

- This is done by recording the following entry:

- Trading A/c Dr.

- To Opening stock A/c

- To Purchases A/c

- To Wages A/c

- To Carriage inwards A/c

- To All other direct expenses A/c

- The purchase returns or returns outwards are closed by transferring their balance to the purchase account. This is recorded as:

- Purchases return A/c Dr.

- To Purchases A/c

- Similarly, the sales returns or returns inwards account is closed by transferring its balance to the sales account:

- Sales A/c Dr.

- To Sales return A/c

- The sales account is closed by moving its balance to the credit side of the trading and profit and loss account:

- Sales A/c Dr.

- To Trading A/c

- Expenses, losses, and similar items are closed with the following entries:

- Profit and Loss A/c Dr.

- To Expenses (individually) A/c

- To Losses (individually) A/c

- Items of income, gains, etc., are closed with this entry:

- Incomes (individually) A/c Dr.

- Gains (individually) A/c Dr.

- To Profit and Loss A/c

Concept of Gross Profit and Net Profit

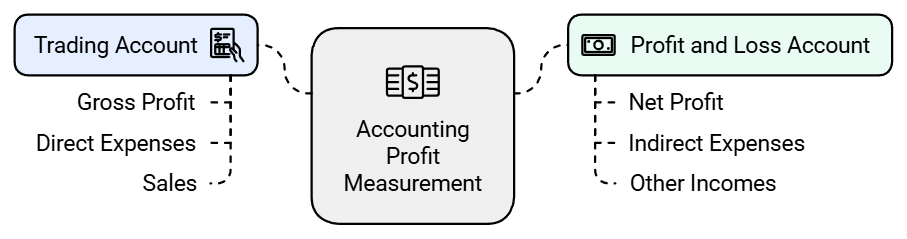

- The trading and profit and loss can be viewed as two accounts: Trading Account and Profit and Loss Account.

- The Trading Account measures the gross profit, while the Profit and Loss Account measures the net profit.

- The trading account determines the outcomes from the basic operations of a business, which include:

1. Manufacturing goods

2. Purchasing goods

3. Selling goods - It is created to check if selling goods or providing services is profitable for the business.

- Purchases are a major part of expenses in a business.

- Other expenses are categorized into:

- 1. Direct Expenses: Costs that are directly linked to manufacturing or purchasing goods, such as:

- Carriage inwards

- Freight inwards

- Wages

- Factory lighting

- Coal, water, and fuel

- Royalty on production

- 2. Indirect Expenses: Costs not directly tied to production, including:

- Salaries

- Rent of buildings

- Bad debts

- Sales are the primary source of revenue for the business.

- The difference between sales and the sum of purchases plus direct expenses is called Gross Profit.

- If purchases plus direct expenses exceed sales revenue, it results in Gross Loss.

- The formula for calculating gross profit is: Gross Profit = Sales – (Purchases + Direct Expenses)

- The gross profit or gross loss is then recorded in the profit and loss account.

- Indirect Expenses are recorded on the debit side of the profit and loss account.

- All other revenue/gains apart from sales are noted on the credit side of the profit and loss account.

- If the total on the credit side exceeds the debit side, the difference is the Net Profit for that period.

- Conversely, if the debit side totals higher than the credit side, the difference is the Net Loss.

- The formula for net profit is: Net Profit = Gross Profit + Other Incomes – Indirect Expenses

- The calculated net profit or net loss is then transferred to the capital account in the balance sheet through these entries:

- For transferring Net Profit:

- Profit and Loss A/c Dr.

- To Capital A/c

- For transferring Net Loss:

- Capital A/c Dr.

- To Profit and Loss A/c

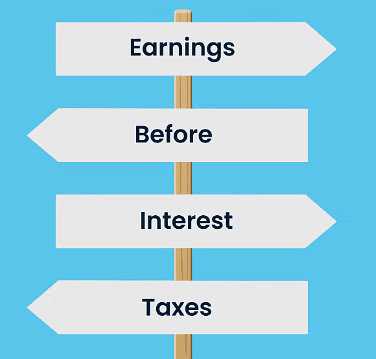

Operating Profit (EBIT)

Operating profit is the money a business earns from its regular activities.

- It is the difference between operating revenue and operating expenses.

- When calculating operating profit, we do not consider financial income and expenses.

- Therefore, operating profit is also known as earnings before interest and tax (EBIT).

- Abnormal items, like losses from events such as a fire, are excluded from this calculation.

- The formula for calculating operating profit is:

Operating profit = Net Profit - Non-Operating Expenses + Non-Operating Incomes - In the example from Ankit's trial balance, there is a line item for 10% interest on a long-term loan taken on April 1, 2017.

- The total interest amounts to ₹500 (calculated as ₹5,000 × 10/100).

- This interest has been recorded on the debit side of the trading and profit and loss account.

Showing the treatment of interest on profitThe operating profit will be :

Showing the treatment of interest on profitThe operating profit will be :

Operating profit = Net profit + Non-operating expenses – Non-operating incomes

Operating profit = ₹ 19,000+ 500 – nil = ₹ 19,500

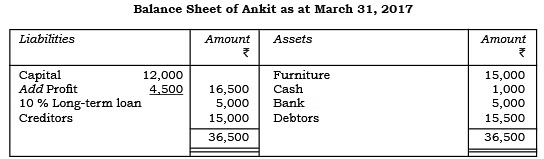

Balance Sheet

The balance sheet is a financial statement that shows the financial position of a business by summarizing its assets and liabilities at a specific date.

- Assets are recorded as debit balances, while liabilities, including capital, are shown as credit balances.

- This statement is prepared at the end of the accounting period after the trading and profit and loss accounts have been completed.

- The term balance sheet comes from the fact that it lists the balances of ledger accounts that are not included in the trading and profit and loss account and will be carried over to the next year.

- To carry forward these balances, an opening entry is made in the journal at the start of the next year.

- When preparing a balance sheet, all accounts related to assets, liabilities, and capital are included.

- The accounts for capital and liabilities are displayed on the left side, referred to as Liabilities.

- Assets and other debit balances are shown on the right side, known as Assets.

- There is no standard format for balance sheets in sole proprietorships and partnerships.

- However, for companies, the format and order of presenting assets and liabilities must follow the guidelines set out in Schedule III of the Companies Act 2013.

Format of Balance Sheet

Format of Balance Sheet

For example:

- You will observe that the trial balance of Ankit depicts 14 accounts, out of which 7 accounts have been transferred to the trading and profit and loss accounts.

- These are the accounts of revenues and expenses.

- The analysis shows that the business has incurred total expenses of ₹ 1,25,500 and revenues generated are ₹ 1,30,000 making a profit of ₹ 4,500.

- The remaining seven items in the trial balance reflect the capital, assets and liabilities.

- We are reproducing the trial balance to show how the accounts of assets and liabilities of Ankit would be presented in the balance sheet.

Showing the accounts of assets and liabilities in the trial balance of Ankit

Showing the accounts of assets and liabilities in the trial balance of Ankit

Showing the balance sheet of Ankit

Showing the balance sheet of Ankit

Relevant Items in the Balance Sheet

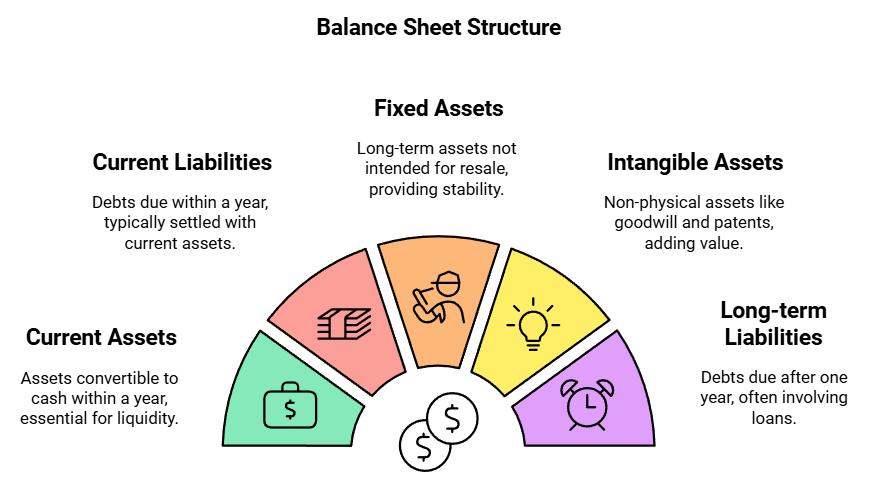

1. Current Assets

These are assets that are either cash or can be turned into cash within a year.

Examples include:

- Cash in hand or bank

- Bills receivable

- Stock of raw materials

- Semi-finished goods

- Finished goods

- Sundry debtors

- Short-term investments

- Prepaid expenses

2. Current Liabilities

These are debts that are expected to be paid within a year, typically using current assets.

Examples include:

- Bank Overdraft

- Bills payable

- Sundry creditors

- Short-term loans

- Outstanding expenses

3. Fixed Assets

These are long-term assets held by the business that are not meant for resale.

Examples include:

- Land

- Building

- Plant and machinery

- Furniture and fixtures

Sometimes referred to as Fixed Block or Block Capital.

4. Intangible Assets

These are assets that cannot be seen or touched. Examples include:

- Goodwill

- Patents

- Trademarks

5. Investments

This represents the money put into government securities, company shares, etc. They are listed at their cost price. If the market price of these investments is lower than the cost on the date of the balance sheet, a note may be added to explain this.

6. Long-term Liabilities

These are all debts that are not classified as current liabilities. They are usually due after one year. Important items include:

- Long-term loans from banks

- Loans from other financial institutions

- Capital: This is the difference between assets and liabilities owed to outsiders. It reflects the amount originally invested by the owner(s), plus profits and interest on capital, minus losses, drawings, and interest on drawings.

- Drawings: This refers to the money taken out by the owner, which reduces the capital account balance. The drawings account is closed by transferring its balance to the capital account, and it is shown as a deduction from capital in the balance sheet.

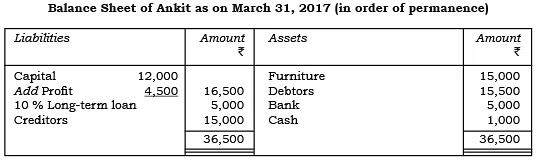

7. Marshalling and Grouping of Assets and Liabilities

- A key focus in accounting is the preparation and presentation of financial statements.

- The information in these statements should be useful for decision-making by users.

- It is important that items listed on the balance sheet are organized and shown in a specific order.

- Marshalling of Assets and Liabilities: In a balance sheet, assets and liabilities are arranged based on either liquidity or permanence.

- The process of organizing assets and liabilities in a specific order is referred to as Marshalling.

- For permanence, the most enduring asset or liability is placed at the top of the balance sheet.

- Following that, assets are arranged in a way that reflects their decreasing level of permanence.

In the balance sheet of Ankit, you will find that furniture is the most permanent of all the assets. Out of debtors, banks and cash, debtors will take maximum time to convert back into cash. Bank is less liquid than cash. Cash is the most liquid of all the assets. Similarly, on the liabilities side, the capital, being the most important source of finance will tend to remain in the business for a longer period than the long-term loan. Creditors being a liquid liability will be discharged in the near future.

In the case of liquidity, the order is reversed. The information presented in this manner would enable the user to have a good idea about the life of the various accounts. The assets account of the relatively permanent nature would continue in the business for a longer time whereas the less permanent or more liquid accounts will change their forms in the near future and are likely to become cash or cash equivalent.

The balance sheet of Ankit in the order of liquidity is:

- The items listed on the balance sheet can be organized into groups.

- Grouping means collecting similar items under one heading.

- For example, the balances of cash, bank accounts, and debtors can be combined and shown under the title 'current assets'.

- Similarly, the total values of fixed assets and long-term investments can be grouped together and labelled as 'non-current assets'.

|

64 videos|152 docs|35 tests

|

FAQs on Financial Statements - I Chapter Notes - Accountancy Class 11 - Commerce

| 1. What are the key stakeholders in a sole proprietorship and what information do they typically require? |  |

| 2. How do you differentiate between capital and revenue in financial statements? |  |

| 3. What is the purpose of a Trading and Profit and Loss Account? |  |

| 4. What is Operating Profit (EBIT) and why is it important? |  |

| 5. How does the Balance Sheet reflect the financial position of a sole proprietorship? |  |