Indian Economy Chapter Notes | Business Economics for CA Foundation PDF Download

Status of Indian Economy: Pre-Independence Period (1850-1947)

Economy in Ancient and Medieval India:

- India was once the largest economy in the world during the ancient and medieval periods, controlling about one-third to one-fourth of global wealth.

- The economy was prosperous and self-reliant, consisting of self-sufficient villages and bustling cities.

- Cities served as hubs for commerce, pilgrimage, and administration, offering more diverse economic opportunities compared to villages.

Division of Labour and Occupations:

- The division of labour in villages was simple yet intertwined with social factors like race, class, and gender, creating economic and social differentiation.

- While agriculture was the main source of livelihood for most people, India had a skilled workforce of artisans and craftsmen who produced high-quality manufactures, handicrafts, and textiles for international markets.

Ancient Economic Philosophy: Arthashastra:

- The Arthashastra, attributed to Kautilya (Chanakya), is the earliest known treatise on Indian economic philosophy. It serves as a handbook on statecraft and material well-being, focusing on wealth and land management.

- Kautilya emphasizes the importance of agriculture and fair taxation for maintaining the state’s treasury. His work covers various aspects of governance, including politics, economics, and military strategy.

- True kingship, according to Kautilya, involves prioritizing the welfare of the people over personal ambitions, with seven vital elements for governance: the King, Ministers, Farmlands, Fortresses, Treasury, Military, and Allies.

The arrival of Europeans, particularly the British, marked a significant turning point in India's economic history. British rule in India can be divided into two distinct periods:

- The rule of the East India Company from 1757 to 1858.

- Direct British government rule inIndia from 1858 to 1947.

Understanding the historical impact of British colonialism is crucial for explaining India's development trajectory. With the Industrial Revolution in the late 18th century, Britain's manufacturing capabilities expanded significantly. This increase created a demand for more raw materials and the need for new markets to sell finished goods. As a result, India's foreign trade shifted drastically from being an exporter of manufactured goods to an exporter of raw materials.

- During this period, Indian exports of finished products faced heavy tariffs, while imports were subjected to lower tariffs under British policy. This discriminatory tariff system made Indian finished goods more expensive to export and imported goods cheaper. Consequently, Indian products lost their competitiveness in both external and domestic markets. This decline led to a sharp decrease in demand for indigenous products, resulting in the destruction of Indian handicrafts and manufacturing.

- The decline of Indian manufacturing, driven by hostile imperial policies designed to benefit British interests and competition from machine-made goods, had severe and lasting impacts on the Indian manufacturing sector. The situation was worsened by a shift in domestic consumer preferences towards foreign goods, as many Indians began to adopt Western culture and lifestyles.

The damage inflicted on India's long-established production structure had profound economic and social consequences. It disrupted the traditional village economy, which had been characterized by a harmonious balance between agriculture and handicrafts. The consequences included:

- Widespread unemployment and a lack of alternative employment opportunities, forcing many individuals to rely on agriculture for their livelihoods.

- Increased pressure on land, leading to the subdivision and fragmentation of landholdings, subsistence farming, decreased agricultural productivity, and heightened poverty.

- The influx of cheap, machine-made goods from Britain, coupled with a shift in Indian tastes and fashion in favor of imported goods, further exacerbated the challenges faced by domestic industries.

During the colonial period, India underwent significant changes in its economy, particularly in agriculture and industry. However, these changes were marked by stagnation and exploitation, leading to a decline in productivity and a reliance on foreign powers.

Land Tenure and Zamindari System:

- The zamindari system, a land tenure system established by the British, created a class of zamindars (landlords) whose interests aligned with perpetuating British rule.

- Zamindars were given the authority to collect taxes from peasants and were responsible for paying a fixed amount to the British government. This system led to the exploitation of peasants and the enrichment of zamindars.

Impact on Agriculture:

- The zamindari system and excessive pressure on land increased the demand for land under tenancy.

- Zamindars exploited this demand by charging excessive rents and other payments from tenants.

- This practice contributed to the decline of Indian agriculture, as absentee landlordism, high indebtedness of agriculturists, and the rise of exploitative money lenders became prevalent.

- The focus on extracting maximum rent by zamindars led to a neglect of productivity-enhancing measures, further exacerbating the decline.

Industrialization During Colonial Era

Early Industrial Growth:

- Factory-based production in India was virtually non-existent before 1850. However, modern industrial enterprises began to emerge in the mid-19th century.

- The cotton milling industry grew steadily and became internationally competitive, with India ranking fifth globally in the number of spindles by the 1930s.

- Jute mills also expanded rapidly in response to global demand, with Indian jute occupying a significant share of the international market by the late 19th century.

Development of Various Industries:

- Other industries such as brewing, paper-milling, leather-making, matches, and rice-milling also developed during this period.

- Heavy industries, including the iron industry established by British capital as early as 1814, also contributed to industrial growth, with India ranking eighth globally in iron output by 1930.

- Despite the progress in modern industrial enterprises, many industries did not reach high levels of expansion due to pressure from English producers.

- The English producers influenced policy formulation to discourage the development of competing industries in India.

Limited Industrial Growth:

- India’s industrial growth was insufficient to transform its economic structure, with the manufacturing sector’s share in the net domestic product barely reaching 7% even in 1946.

- The share of factory employment in India was also small, indicating slow progress in industrialization.

Global Ranking and Competitiveness:

- Just before the Great Depression, India was ranked as the twelfth largest industrialized country in terms of the value of manufactured products.

- Some industries even reached global standards by the early 20th century, showcasing the potential of Indian industrial capabilities.

Conclusion

- The agricultural and industrial landscape in colonial India was marked by exploitation, stagnation, and a lack of productivity-enhancing measures.

- While there were pockets of industrial growth and competitiveness, the overall impact of colonial policies hindered significant progress and transformation in the Indian economy.

Indian Economy: Post-Independence (1947-1991)

Initial Conditions at Independence:

- India at the time of independence was predominantly rural, with a very low literacy rate of just over 18 percent and a life expectancy of around 32 years.

- The society was deeply stratified and heterogeneous, with extreme poverty not only in terms of income but also in human capital.

Nehruvian Economic Model:

- The Nehruvian model, which advocated for social and economic redistribution and state-directed industrialization, became the foundation of India’s economic policy post-independence.

- Centralized economic planning was central to this model, aiming for rapid economic growth along with equity and distributive justice.

Role of the Planning Commission:

- The Planning Commission was established to plan the economic development of the nation in line with socialist principles.

- Development was to be achieved through five-year plans, which were developed, implemented, and monitored by the Commission.

Industrialization Strategy:

- There was a strong emphasis on rapid industrialization, with the government playing a crucial role in designing economic strategy and coordinating investments with the private sector.

- The concept of “planned modernization” involved systematic planning to support industrialization, with a significant role envisioned for the state.

Industrial Policy Resolution (1948):

- This resolution envisioned a greater role for the public sector and regulated the private sector through licensing.

- It granted state monopoly in strategic areas like atomic energy, arms and ammunition, and railways, while new investments in basic industries were reserved for the state.

Economic Philosophies of the 1950s:

- The policies of the 1950s were influenced by Prime Minister Nehru’s vision of a socialist society focused on heavy industry and the Gandhian philosophy promoting small-scale and cottage industries and village republics.

Industrial Policy Resolution (1956):

- This resolution aimed to provide a comprehensive framework for industrial development but disproportionately favored the expansion of the public sector.

- The emphasis on the public sector stifled private initiative and enterprise, discouraging private investments and negatively impacting industrial growth in the long run.

India’s Economic Policies Post-Independence

1. Early Economic Policies (1950s)

- Initially, India had an open foreign investment and trade policy.

- However, in 1958, a balance of payments crisis raised concerns about foreign exchange, leading to stricter trade and investment controls.

- Comprehensive import controls were in place until 1966.

2. Growth Rate and Industrial Focus (1950–80)

- During the first three decades after independence, India’s GDP growth rate averaged a modest 3.5 percent annually, often referred to as the ‘Hindu growth rate.’

- The focus was on capital goods and heavy industrialization, with projects like dams and power plants, rather than on consumer goods.

3. Shift in Agricultural Policy (Mid-1960s)

- In the mid-1960s, there was a significant shift in economic strategy towards agriculture due to continuous monsoon failures and severe droughts in 1966 and 1967.

- Initially, agricultural development relied on institutional reforms like land reforms and farm cooperatives, but these had limited success.

- The focus shifted to enhancing agricultural productivity, particularly in wheat, leading to the Green Revolution.

4. The Green Revolution

- The Green Revolution involved the introduction of high-yielding seed varieties and increased use of water, fertilizers, and pesticides.

- This shift significantly boosted agricultural productivity and food grain production, helping India overcome its food crisis.

5. Increased Government Control and Nationalization

- Alongside changes in agricultural policy, the government imposed stricter controls on trade and industrial licensing and embarked on a wave of nationalization.

- Notably, 14 banks were nationalized in 1969, followed by another 6 in 1980.

- The interventionist policies established in the 1960s had long-lasting impacts on the economy.

This period marked a crucial transition in India’s economic policies, shifting from a focus on industrialization to enhancing agricultural productivity and increasing government control over the economy.

Economic Performance (1965-81)

- The period from 1965 to 1981 is considered the worst in independent India’s history in terms of economic performance.

- The decline in growth during this time is mainly attributed to a decrease in productivity.

- Several factors contributed to this decelerated growth, including:

- License Raj and Autarchic Policies: The strict regulatory framework and self-sufficient policies of the 1960s and 1970s hindered economic progress.

- External Shocks: India faced three wars (1962, 1965, and 1971), major droughts (notably in 1966 and 1967), and oil shocks in 1973 and 1979.

- Closed Economy: Being largely a closed economy, India missed out on the opportunities presented by a rapidly growing global economy.

- Government policies aimed at equitable distribution of income and wealth during this period inadvertently stifled the incentive to create wealth.

- Equity-driven policies were often anti-growth, such as the Monopolies and Restrictive Trade Practices (MRTP) Act of 1969, which regulated large firms with significant market power.

- MRTP Act: The Act imposed restrictions on licensing, capacity addition, mergers, and acquisitions for large firms, limiting their expansion and entry into most sectors except a few capital-intensive industries.

- In 1967, a policy was introduced reserving certain products for exclusive manufacture by the small-scale sector. This was intended to promote small-scale industries and encourage labour-intensive economic growth. However, it had negative consequences:

- Exclusion of Big Firms: The policy excluded large firms from labour-intensive industries, making it difficult for India to compete in the global market for these products.

- Stringent Labour Laws: Strict labour laws further discouraged the establishment of labour-intensive industries in the organized sector.

- Over time, there was a growing recognition among policymakers and industrialists that the prevailing strict regulatory regime was counterproductive.

- It became evident that controls and regulations needed to be accompanied by adequate incentives and openness to foster sustained rapid growth.

The Period of Reforms

The groundwork for early liberalization and reforms was laid in the 1980s, particularly after 1985. In the early 1980s, significant efforts were made to restore price stability through a combination of tight monetary policy, fiscal moderation, and some structural reforms. These initiatives, spanning from 1981 to 1989 and referred to as 'early liberalization,' aimed to shift the focus from 'inward-oriented' trade and investment practices. This period of liberalization is often called 'reforms by stealth' due to its ad hoc and not widely publicized nature. Early 1980s Efforts Growth Rates:

- Sixth Plan Period (1980–1985): Average annual GDP growth rate of 5.7%

- Seventh Plan Period (1985–1990): Average annual GDP growth rate of 5.8%

Areas of Early Reforms:

- Industry

- Trade

- Taxation

Industrial Policy Initiatives:

- Delicensing: In 1985, 25 broad categories of industries were delicensed, allowing for greater flexibility. This was later extended to more categories.

- Broad-Banding: This facility allowed industries to change their product mix without obtaining a new license. For instance, engineering firms could switch production between different vehicles, such as trucks and cars, within their existing capacity.

- MRTP Relaxation: To ease licensing and capacity constraints on larger MRTP (Monopolies and Restrictive Trade Practices) firms, the asset limit subject to MRTP regulations was raised from ₹20 crore to ₹100 crore in 1985–86.

- MODVAT Introduction: The shift from multipoint excise duties to a modified value-added tax (MODVAT) significantly reduced taxation on inputs and associated distortions.

- SEBI Establishment: The Securities and Exchange Board of India (SEBI) was established as a non-statutory body on April 12, 1988, through a resolution of the Government of India.

The open general licence (OGL) list was steadily expanded. The number of capital goods items included in the OGL list expanded steadily reaching1,329 in April 1990.

Several export incentives were introduced and expanded

- The exchange rate was set at a realistic level which helped expand exports and in turn reduced pressure on foreign exchange needed for imports

- Price and distribution controls on cement and aluminum were entirely abolished.

- Based on the real effective exchange rate (REER), the rupee was depreciated by about 30.0 per cent from 1985–86 to 1989–90. This reflects a considerable change in the official attitude towards exchange rate depreciation

- The budget for 1986 introduced policies of cutting taxes further, liberalising imports and reducing tariffs.

- However, the growth performance of the economy was thwarted due to structural inadequacies and distortions. The private sector investments were inhibited due to reasons such as convoluted licensing policies, public sector reservations and excessive government controls. Due to reservation of goods to small scale sector as well as excessive price and distribution controls, the private sector was virtually discouraged from making investments. The public sector which led the manufacturing and service sectors was plagued by inefficiency, government controls and bureaucratic procedures. Despite the fact that they were of massive in size and enjoyed monopoly in their respective areas, their performance was far from satisfactory and yielded very low returns on investment.

- The MRTP act had many restrictive conditions creating barriers for entry, diversification and expansion for large industrial houses. Import controls in the form of tariffs, quotas and quantitative restrictions ensured that foreign manufactures and components did not cross the borders and compete with the domestic industries. Foreign investments and foreign competition were not allowed on grounds of affording protection to domestic industries. Briefly put, the rules and regulations which were aimed at promoting and regulating the economic activities became major hindrances to growth and development.

Though the reforms in 1980’s were limited in scope and were without a clearly observable road map as compared to the New Economic Policy in 1990, they were instrumental in bringing confidence in the minds of politicians and policy makers regarding the efficacy of policy changes to produce sustained economic growth. The belief that well-regulated competitive markets can ensure economic growth and also increase total welfare got fostered in the minds of policy makers. In other words, the idea that government intervention in markets need not always be accepted as ‘the standard’ and that markets should be given priority over government in the conduct of a good number of economic activities gained a broad acceptance. Thus, the liberalization in the 1980s served as the necessary foundation for the more universal and organized reforms of the 1990s.

The Economic Reforms of 1991

In 1991, under the leadership of Prime Minister P. V. Narasimha Rao, India initiated a significant shift in its economic policy. This shift was necessary due to several pressing issues:

In the 1980s, despite efforts to boost economic growth, government spending consistently outpaced revenue. This led to large fiscal deficits, financed by both domestic and foreign debt. The high level of current expenditure was unsustainable, resulting in enormous fiscal deficits and a troubled balance of payments.

- The persistent large deficits increased public debt, forcing a significant portion of government revenue to be used for interest payments.

- The Gulf War in 1990 caused a spike in oil prices, further straining the balance of payments.

- Foreign exchange reserves plummeted to a critical low of $1.2 billion, barely enough for two weeks of imports. This dire situation was a key trigger for the economic reforms.

- To gather foreign exchange for essential imports, India tightened import restrictions, which in turn reduced industrial output.

- India had to rely on external borrowing from the International Monetary Fund (IMF), which imposed strict conditions for additional funds.

- The combination of a fragile political situation and economic crises led to a "crisis of confidence".

The year 1991 marked a significant turning point in Indian policy. Previously, India had followed a socialist model with heavy state intervention in the economy. However, the collapse of the Soviet Union and the success of China with outward-oriented policies influenced Indian policymakers. The reforms of 1991 aimed to steer the economy towards greater market orientation and openness to external trade.

These reforms, known as liberalization, privatization, and globalization, represented a major shift in economic philosophy and approach. The reforms had two main objectives:

- To reorient the economy from a centrally controlled system to a market-friendly one.

- To achieve macroeconomic stabilization by significantly reducing the fiscal deficit.

While a detailed description of the reform measures is beyond this overview, it is important to note that the measures taken in 1991 were crucial for setting India on a new economic path.

The momentum for reforms in the Indian economy was initially sparked by severe crises in the economic, fiscal, and balance of payments sectors. As a result, the reform package was carefully designed as a core set of mutually supportive reforms aimed at tackling the balance of payment crisis and addressing structural rigidities. The policy shift represented a fundamental change from central direction to market orientation.

The policies implemented during this period can be broadly categorized into two main types:

- Stabilization Measures: These were short-term interventions aimed at combating inflation and addressing the adverse balance of payments situation.

- Structural Reform Measures: These are long-term and ongoing initiatives designed to enhance productivity and competitiveness by eliminating structural rigidities across various sectors of the economy.

Fiscal Reforms

The rising levels of fiscal deficits complicated the stabilization efforts. Achieving fiscal discipline by reducing the fiscal deficit was crucial because the crisis was driven by excessive domestic demand, a surge in imports, and a widening current account deficit (CAD) that needed to be financed by depleting reserves. To address this, radical measures were implemented to increase revenues and reduce government expenditure. These measures included:- Introduction of a stable and transparent tax structure: Establishing a clear and consistent tax framework to enhance revenue generation.

- Ensuring better tax compliance: Improving compliance rates to boost tax revenues.

- Curbing government expenditure: Reducing unnecessary government spending.

- Reducing and abolishing unnecessary subsidies: Cutting back on subsidies that were not essential.

- Disinvestment of government equity holdings: Selling off portions of government stakes in select public sector undertakings to raise funds.

- Encouraging private sector participation: Inviting private sector involvement in various sectors to enhance efficiency and investment.

To establish fiscal discipline, it was important to avoid financing deficits through the easier route of money creation. Consequently, the government entered into a historic agreement with the Reserve Bank of India in September 1994 to gradually reduce the fiscal deficit to nil by 1997–98.

Monetary and Financial Sector Reforms

Significant monetary and financial sector reforms were introduced with the aim of making the financial system more efficient and transparent. The focus of these reforms was on reducing the burden of non-performing assets (NPAs) on government banks, fostering competition, and deregulating interest rates. Key measures included:- Interest rate liberalization: Relaxing controls on interest rates by the Reserve Bank of India, allowing banks more flexibility in setting interest rates on loans and deposits.

Reforms in the Banking Sector

Opening of New Private Sector Banks:- The introduction of new private sector banks was aimed at enhancing competition among public sector, private sector, and foreign banks.

- This move was accompanied by the removal of administrative constraints that had previously hindered efficiency in the banking sector.

Reduction in Reserve Requirements:

- The statutory liquidity ratio (SLR) and cash reserve ratio (CRR) were reduced in accordance with the recommendations of the Narasimham Committee Report, 1991.

- This reduction was intended to align reserve requirements with the evolving needs of the banking sector.

Liberalisation of Bank Branch Licensing Policy:

- The bank branch licensing policy was liberalised, granting banks greater freedom in opening, relocating, or closing branches.

Introduction of Prudential Norms:

- Prudential norms were introduced regarding the classification of assets, income disclosure, and provisions for bad debt.

- These norms were aligned with the Narasimham Committee recommendations to ensure that the financial statements of commercial banks accurately reflect their financial position.

Reforms in Capital Markets

- The Securities and Exchange Board of India (SEBI), originally established in 1988, gained statutory recognition in 1992.

- SEBI was empowered as an independent regulator of the capital market to promote transparency, facilitate resource mobilization, and ensure efficient allocation of resources.

The ‘New Industrial Policy’

- Announced on 24 July 1991, aimed to deregulate industry to foster a more efficient and competitive industrial economy.

- Ended the ‘License Raj’ by removing licensing restrictions for all industries except 18 related to security, strategic concerns, social reasons, safety, and environmental issues.

- Limited the public sector to eight sectors based on security and strategic grounds, later reduced to two: railway transport and atomic energy.

- Restructured the Monopolies and Restrictive Trade Practices (MRTP) Act, repealing provisions related to merger, amalgamation, and takeover, eliminating pre-entry scrutiny of investment decisions and prior approval for large companies for capacity expansion or diversification.

Changes in Industrial Policy:

- Small-Scale Industries: Many goods produced by small-scale industries were de-reserved, allowing large-scale industries to enter these sectors.

- Public Sector Monopoly: The policy ended the public sector monopoly in various sectors. The number of areas reserved for the public sector was reduced to encourage greater private sector participation. Only eight industries, crucial for strategic and security reasons, were reserved for the public sector. Currently, only parts of atomic energy generation and certain core railway transport activities remain reserved for the public sector.

- Foreign Investment: Foreign investment regulations were liberalised, introducing automatic approval for foreign direct investments (FDI) up to 51 percent, which was later extended to nearly all industries except reserved ones. FDI is prohibited only in four sectors: retail trade, atomic energy, lottery business, and betting and gambling.

- External Trade: External trade was further liberalised by shifting from the positive list approach to the negative list approach for license-free items. Import licensing was removed for all but a few intermediate and capital goods. Consumer goods that remained under licensing were made free a decade later. Today, most goods can be imported, except for a few restricted on health, environmental, and safety grounds, as well as specific items like edible oil, fertilizer, and petroleum products.

- Tariff Reduction: The highest tariff rate, which was 355% in 1990-91, was significantly reduced over the years, reaching 10% by 2007-08, with exceptions such as automobiles, which remained at 100%.

- Rupee Devaluation and Convertibility: The rupee was devalued by 18% against the dollar. From 1994 onwards, all current account transactions, including business, education, medical, and foreign travel, were permitted at market exchange rates, and the rupee became officially convertible on the current account.

- Disinvestment and Public Sector Autonomy: The disinvestment of government holdings in public sector enterprises was a significant step. Public sector units were given greater autonomy in decision-making and opportunities for professional management to ensure reasonable returns. Budgetary support for the public sector was progressively reduced.

Trade Policy Reforms

Economic reforms in India, which began in 1991, aimed to address various challenges such as high inflation, a massive fiscal deficit, and low foreign exchange reserves. The reforms included a shift from a closed economy to a more open and market-oriented one, with reduced government intervention and increased private sector participation.Key Changes Post-Reforms:

- Global Integration: India has become more integrated with the global economy, engaging in international trade and investment.

- Market Orientation: The economy has shifted towards a market-oriented model, with reduced government controls and interventions.

- Private Sector Growth: There has been significant growth in private sector investment and initiatives across various industries.

- Sectoral Competitiveness: Industries such as auto components, telecommunications, software, pharmaceuticals, biotechnology, and professional services have reached high levels of international competitiveness.

- Technology and Finance Access: Easing trade controls has facilitated easier access to foreign technology, inputs, know-how, and finance.

- Foreign Investment: India has seen stable foreign direct investment (FDI) inflows and substantial foreign portfolio investments.

- Foreign Exchange Reserves: The country maintains a solid cushion of foreign exchange reserves, covering nearly eight months of imports, and is among the largest holders of international reserves globally.

- Services Trade Surplus: Robust demand for information technology and financial services has kept the services trade surplus high at around 3.7 percent of GDP.

- Currency Stability: Pressure on the Indian rupee is relatively lower compared to other emerging market economies.

- Domestic Demand: Increased incomes, a large domestic market, and high levels of aggregate demand continue to sustain the economy.

- Poverty Reduction: There has been a substantial reduction in poverty levels across the country.

Overall, India is now better positioned than many other emerging market economies to handle global economic challenges, thanks to these reforms and changes.

- The economic reforms have spurred greater competition in sectors such as banking, insurance, and other financial services, resulting in enhanced customer choices and improved efficiency. These reforms have also paved the way for increased investment and the growth of private players within these sectors.

- The infrastructure sectors have experienced remarkable growth.

- However, the value-added share of agriculture and allied activities has been steadily declining over the past four decades.

- India’s financial sector has deepened significantly due to the enhanced liberalization of the financial sector.

Nevertheless, the country faces challenges such as high fiscal deficits, inflation, and a substantial debt level, which stood at 86 percent of GDP in FY21/22. This debt level is notably higher than the average of 64.5% for emerging market and developing economies (EMDEs) in 2022, as reported by the International Monetary Fund (IMF).

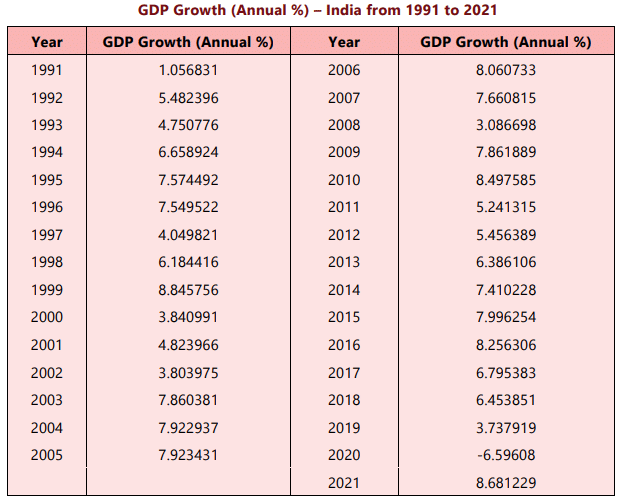

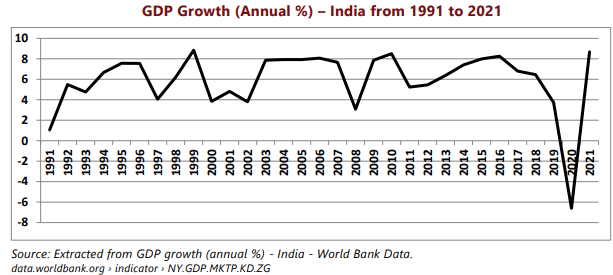

GDP Growth Rates After 1991 Reforms

The GDP growth rate is widely considered the most dependable measure of economic growth. The following table and graph illustrate the GDP growth rate in India following the 1991 reforms.

Niti Aayog: a Bold Step for Transforming India

The Planning Commission of India, which had been a key institution in the central government for nearly sixty-four years, advocated for public investment-led development. However, with the emergence of neoliberal ideologies emphasizing market orientation and a reduced role for government, along with the planning system's decline, there was a need to change the nature, composition, and scope of governance institutions.

On January 1, 2015, the Planning Commission was replaced by the National Institution for Transforming India (NITI) Aayog. The primary aim of this transition was to stimulate innovative thinking by objective experts and promote cooperative federalism by enhancing the voice and influence of states. NITI Aayog is expected to function as the government’s think tank and a policy dynamo.

Objectives of NITI Aayog:

- Evolving a Shared Vision: NITI Aayog aims to create a common vision for national development priorities, sectors, and strategies with active involvement from states.

- Fostering Cooperative Federalism: The organization seeks to strengthen cooperative federalism by providing structured support initiatives and mechanisms to states, recognizing that strong states contribute to a strong nation.

- Developing Mechanisms for Village-Level Planning: NITI Aayog intends to establish mechanisms for formulating credible plans at the village level and progressively aggregating them at higher levels of government.

- Incorporating National Security Interests: The organization will ensure that national security interests are integrated into economic strategy and policy in areas specifically referred to it.

- Addressing Vulnerable Sections: NITI Aayog will pay special attention to sections of society that may not benefit adequately from economic progress.

- Designing Strategic and Long-Term Policies: The organization will design and monitor the progress and efficacy of strategic and long-term policy and program frameworks and initiatives.

- Encouraging Partnerships: NITI Aayog will provide advice and encourage partnerships between key stakeholders, national and international think tanks, educational institutions, and policy research organizations.

- Creating a Knowledge and Innovation Support System: The organization aims to establish a support system for knowledge, innovation, and entrepreneurship through a collaborative community of experts and practitioners.

- Resolving Inter-Sectoral and Inter-Departmental Issues: NITI Aayog will offer a platform for resolving inter-sectoral and inter-departmental issues to expedite the implementation of the development agenda.

- Maintaining a Resource Centre: The organization will operate a resource centre, serving as a repository of research on good governance and best practices in sustainable and equitable development, and disseminating this information to stakeholders.

Key Initiatives of NITI Aayog:

- ‘Life’. This initiative aims to replace the current 'use-and-dispose' economy with a more sustainable model.

- National Data and Analytics Platform (NDAP). NDAP enhances access to Indian government data, facilitating better data utilization and decision-making.

- Shoonya Campaign. This campaign focuses on improving air quality in India by accelerating the deployment of electric vehicles (EVs).

- E-Amrit. E-Amrit serves as a comprehensive information hub for electric vehicles, providing essential details to consumers and stakeholders.

- India Policy Insights (IPI). IPI offers insights and analysis on various policy matters to inform and guide decision-making processes.

- Methanol Economy Programme. This programme aims to reduce India's oil import bill and greenhouse gas emissions by converting coal reserves and municipal solid waste into methanol.

- Transforming India’s Gold Market. This initiative recommends measures to tap into the potential of India’s gold market, stimulating exports and economic growth.

Criticisms and Limitations of NITI Aayog:

- Limited Role: Critics argue that NITI Aayog has a limited role in national planning and policy formulation. Unlike its predecessor, the Planning Commission, NITI does not produce national plans, control expenditures, or review state plans.

- Exclusion from Budgeting Process: One of the major shortcomings of NITI Aayog is its exclusion from the budgeting process. This limits its influence and ability to impact fiscal policy and resource allocation effectively.

- Lack of Autonomy: NITI Aayog is criticized for lacking autonomy and a balanced power structure within the policy-making apparatus of the central government. This diminishes its capacity to act independently and advocate for long-term developmental goals.

- Strengthening of Finance Ministry: The termination of the Planning Commission has reportedly strengthened the hand of the Ministry of Finance, which focuses on near-term macroeconomic stability and limiting expenditure. NITI Aayog, in contrast, lacks the power to act as a counterweight or advocate for developmental concerns.

- Weakness as a Counterweight: Experts argue that NITI Aayog does not have the necessary independence or power to function as a "voice of development." It is seen as unable to address inequities and long-term developmental challenges effectively.

Overview of the Indian Economy by Sector

The Indian economy can be broadly divided into three sectors: the primary sector, which includes agriculture and related activities; the secondary sector, encompassing manufacturing and industrial activities; and the tertiary sector, which involves services and allied sectors.

The Primary Sector

- Agriculture, along with its allied sectors, is the largest source of livelihood in India.

- Initially, India was food deficient and relied on imports. However, it has now become a major producer of various agricultural products.

- India is the world’s largest producer of milk, pulses, jute, and spices. It has the largest area planted with wheat, rice, and cotton and is the second-largest producer of fruits, vegetables, tea, farmed fish, cotton, sugarcane, and other staples.

- The Indian food and grocery market is the sixth largest globally, with retail contributing significantly to sales. India also has the world’s largest cattle herd, particularly buffaloes.

- The livestock sector has seen significant growth, becoming a major producer of milk, eggs, and meat. Cash crops like cotton, jute, and sugarcane are also prominent.

- Although agriculture’s share in the overall Gross Value Added (GVA) is declining, it continues to grow in absolute terms.

- Approximately 47% of India’s population relies on agriculture for their livelihood, and it contributes significantly to the Gross Domestic Product (GDP), with a GVA of 18.8% in 2021-22.

- The index of agricultural production for various categories shows a sustained increase in output, with significant production of food grains and other crops. Private investment in agriculture has also seen an increase.

- In 2022-23, agriculture recorded a growth of 3.5%, driven by strong rabi sowing and government measures to support the sector.

Government Initiatives in Agriculture:

- Augmenting Crop and Livestock Productivity: The government is focused on increasing the productivity of crops and livestock to ensure higher yields and better quality produce.

- Price Support and MSP: To provide certainty of returns to farmers, the Minimum Support Price (MSP) for all 23 mandated crops is set at 1.5 times the All India weighted average cost of production. This ensures that farmers receive a fair price for their produce.

- Promoting Crop Diversification: The government is encouraging farmers to diversify their crops to enhance income and reduce risk. This involves shifting from traditional crops to those that are more profitable or in demand.

- Improving Market Infrastructure: There is a push for setting up Farmer-Producer Organisations (FPOs) which help in better marketing of produce and improving bargaining power of farmers.

- Agriculture Infrastructure Fund: The government is promoting investment in infrastructure facilities through the Agriculture Infrastructure Fund, which supports the development of post-harvest management infrastructure and community farming assets.

Transformation from Food Deficit to Food Exporter:

- India has successfully transitioned from being food deficient and import-dependent in the early 1960s to becoming one of the top ten exporters of agricultural products globally.

- Export Growth: The export of agricultural and allied products has significantly increased, reaching an all-time high of Rs 374611 crore. In the first half of the financial year 2022-23, exports of agricultural and processed food products rose by 25% compared to the same period in the previous year.

- Role of APEDA: The Agricultural and Processed Food Export Development Authority (APEDA) is responsible for promoting the export of agricultural products.

Liberalization Measures and Government Interventions:

- The Government of India has implemented liberalization measures such as allowing 100% Foreign Direct Investment (FDI) in the marketing of food products and food product e-commerce under the automatic route.

- Various interventions have been undertaken to support the agricultural sector, including:

- Income Support: PM KISAN scheme provides income support to farmers.

- Minimum Support Price: MSP is fixed at one-and-a-half times the cost of production.

- Institutional Credit: Concessional institutional credit for the agriculture sector.

- National Mission for Edible Oils: Launched to boost edible oil production.

- Pradhan Mantri Fasal Bima Yojana:. crop insurance scheme for farmers.

- Mission for Integrated Development of Horticulture: Aimed at holistic growth of the horticulture sector.

- Soil Health Cards: Provision of cards to monitor and improve soil health.

- Paramparagat Krishi Vikas Yojana: Supports organic farming and soil health improvement.

- Agri Infrastructure Fund:. financing facility for post-harvest management infrastructure and community farming assets.

The Secondary Sector

The industrial sector in India is diverse, encompassing manufacturing, heavy industries, fertilizers, pharmaceuticals, chemicals and petrochemicals, oil and natural gas, food processing, mining, defense products, textiles, retail, micro, small & medium enterprises, cottage industries, and tourism. The informal sector contributes over 50% of gross value added (GVA) in the economy. Rapid industrial growth and diversification are crucial for sustainable economic development, with a focus on building a robust manufacturing sector being a key priority for the Indian government.

The industrial production in India measures the output of businesses within the industrial sector of the economy, with manufacturing being the most significant component, accounting for 78 percent of total production. The manufacturing Gross Value Added (GVA) at current prices was estimated at US$ 77.47 billion in the third quarter of financial year 2021-22, contributing around 16.3% to the nominal GVA over the past decade.

Industrial Growth Figures:

- Industrial Production. Measures the output of businesses in the industrial sector, with manufacturing being the most critical, accounting for 78% of total production.

- Manufacturing GVA. Estimated at US$ 77.47 billion in Q3 of FY 2021-22, contributing around 16.3% to nominal GVA over the past decade.

- Core Industries Index. In 2022-23 (up to September 2022), the combined index of eight core industries stood at 142.8, driven by production in coal, refinery products, fertilizers, steel, electricity, and cement industries.

- Manufacturing PMI. As of January 31, 2023, India’s Manufacturing Purchasing Managers’ Index was 55.4, indicating expansion in the manufacturing sector.

- Global Innovation Index (GII). India improved its rank to 40th in 2022, up from 81st in 2015, reflecting enhanced innovation capabilities.

Core Industries Explained

Role of DPIIT:

- The Department for Promotion of Industry and Internal Trade (DPIIT) is responsible for formulating and implementing industrial policies and strategies for industrial development in line with national objectives.

- Since independence, various governments have introduced innovative schemes to boost industrial performance.

Industrial Policies and Initiatives:

- Goods and Services Tax (GST). Implemented on July 1, 2017, as a single domestic indirect tax law, replacing multiple indirect taxes like excise duty, VAT, and service tax.

- Corporate Tax Reduction. Offering domestic companies the option to pay income tax at 22% without availing exemptions or incentives.

- Make in India Initiative. Launched in 2014 to promote investment, innovation, and infrastructure, making India a hub for manufacturing, design, and innovation. The updated focus, ‘Make in India 2.0’, targets 27 sectors, including 15 manufacturing and 12 service sectors.

- Ease of Doing Business. Focused on simplifying procedures, rationalizing legal provisions, digitizing government processes, and decriminalizing minor defaults. India improved its rank in the World Bank’s Doing Business Report from 77th in 2019 to 63rd in 2020.

National Single Window System is designed to streamline investor-related approvals and services in India, offering continuous support and facilitation to investors.

PM Gati Shakti National Master Plan aims to enable data-driven decisions for integrated planning of multimodal infrastructure, which helps in reducing logistics costs.

National Logistics Policy (NLP), launched in September 2022, focuses on lowering logistics costs to align with those of developed countries.

Production Linked Incentive (PLI) Scheme was introduced in March 2020 to boost India's manufacturing capabilities and export competitiveness in 14 key sectors. The scheme has now been extended to include white goods such as air conditioners and LED lights.

Industrial Corridor Development Programme aims to create Greenfield Industrial regions with sustainable infrastructure and 'plug and play' facilities at the plot level.

FAME-India Scheme (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) promotes the manufacturing of electric and hybrid vehicle technology for sustainable growth.

'Udyami Bharat' focuses on empowering Micro, Small, and Medium Enterprises (MSMEs).

PM Mega Integrated Textile Region and Apparel (PM MITRA) initiative aims to develop world-class industrial infrastructure in the textiles sector to attract cutting-edge technology, Foreign Direct Investment (FDI), and local investment.

Opening up for global investments involves implementing significant Foreign Direct Investment (FDI) reforms in sectors like defence, pension, and e-commerce to make India a more attractive investment destination.

100 per cent FDI under the automatic route is now permitted for coal mining activities, associated processing infrastructure, and insurance intermediaries.

Foreign Investment Promotion Board (FIPB) was abolished in May 2017, and the Foreign Investment Facilitation Portal (FIF) was introduced to simplify the FDI approval process. Since the implementation of FIF, FDI proposals have increased by 39%.

Remission of Duties and Taxes on Export Products (RoDTEP) was established in 2021 to replace the Merchandise Exports from India Scheme (MEIS) to boost exports by providing rebates on hidden central, state, and local duties/taxes/levies on exported goods.

Initiatives to Foster Innovation:

- Incubation and Handholding: Support for new ideas and startups through incubation programs and hands-on guidance.

- Funding: Financial assistance to promote innovative projects and startups.

- Industry-Academia Partnership: Collaboration between industries and academic institutions to drive research and innovation.

- Mentorship: Providing expert guidance to startups and innovators.

- Strengthening IPR Regime: Enhancing the Intellectual Property Rights framework to protect innovations.

National Logistics Policy (NLP)

- A comprehensive policy framework aimed at improving the logistics sector in India.

Start-up India Programme

- Facilitates ideas and innovation in the country, contributing to India’s improved rank in the Global Innovation Index (GII) from 81st in 2015 to 40th in 2022.

Public Procurement (Preference to Make in India) Order, 2017

- Gives preference to locally manufactured goods, works, and services in public procurement, boosting industrial growth.

Emergency Credit Line Guarantee Scheme (ECLGS)

- A fully guaranteed emergency credit line to support lending institutions.

Industry 4.0 and National Manufacturing Policy

- Preparing for the fourth industrial revolution by integrating new technologies such as cloud computing, IoT, machine learning, and artificial intelligence (AI) in manufacturing. The National Manufacturing Policy aims to increase the share of manufacturing in GDP to 25 percent by 2025.

Foreign Direct Investment (FDI) in Manufacturing

- India as an attractive hub for foreign investments in the manufacturing sector, with rising FDI equity inflows and efforts to open up sectors to global investors. In 2021-22, India received a total foreign direct investment (FDI) inflow of US$ 58.77 billion.

Challenges in the Industrial Sector:

- Infrastructure and Manpower: Shortage of efficient infrastructure and skilled manpower, leading to reduced factor productivity.

- Import Reliance and Exchange Rate Volatility: Dependence on imports, exchange rate fluctuations, and associated time and cost overruns.

- MSME Credit Availability: The Micro, Small, and Medium Enterprises (MSME) sector facing challenges in credit availability.

- Industrial Location Cost Structure: Industrial locations established without consideration of cost-effective factors experience unsustainable cost structures.

- Public Sector Industries: Heavy losses, inefficiencies, lower productivity, and unsustainable returns affecting public sector industries.

- Labor-Management Relations: Strained labor-management relations leading to loss of man hours.

- Export Competitiveness: Lower export competitiveness, slowing external demand, and imposition of non-tariff barriers by other countries.

Global Challenges:

- Supply Chain Disruptions: Ongoing global supply chain issues and uncertainties are posing significant challenges.

- Inflation: Rising inflation and related macroeconomic factors are leading to increased input costs and decreased demand.

- Global Slowdown:. global economic slowdown is negatively impacting investment sentiments.

- Monetary Policy: Aggressive tightening of monetary policy and rising credit costs are adding to economic pressures.

- Fuel Prices: High and escalating fuel prices are further straining economic conditions.

- Informal Sector: The growing presence of the informal sector is also a contributing factor.

The Tertiary Sector

- The services sector plays a crucial role in driving income and employment growth in the post-reform Indian economy.

- India’s unique growth trajectory involved a shift from agriculture directly to the services sector, bypassing the traditional industrial phase seen in other nations.

The services sector in India encompasses a wide range of activities, including:

- Wholesale and retail trade

- Transportation and storage

- Accommodation and food services

- Information and communication

- Financial and insurance activities

- Real estate activities

- Professional, scientific, and technical services

- Administrative and support services

- Public administration, defense, and social security

- Education

- Human health and social work

- Arts, entertainment, and recreation

- Other service activities

- Households as employers

- Activities of extra-territorial organizations and bodies

The services sector is the largest in India, accounting for 53.89% of the total Gross Value Added (GVA). In 2020-21, the GVA for the services sector at current prices was estimated at ₹ 96.54 lakh crore.

- This sector is also the fastest growing and has the highest labor productivity.

- Growth in the services sector is influenced by both domestic and global factors, with a significant contribution from knowledge-based services such as professional and technical services.

- The rise of information-intensive services, facilitated by advanced information technology, has greatly boosted the sector.

- Additionally, the growth of the services sector can complement manufacturing growth, and many successful start-ups in recent years belong to this sector.

Export of Services:

- India ranks among the top 10 members of the World Trade Organization (WTO) for both service exports and imports. In November 2022, India’s services exports reached US$ 27.0 billion, showing strong growth driven by demand for software, business, and travel services. Unlike other sectors that faced challenges, India’s services exports remained robust during the Covid-19 pandemic due to increased demand for digital support and the need to upgrade digital infrastructure.

- The services sector in India is the largest recipient of Foreign Direct Investment (FDI) inflows, accounting for over 60 per cent of total FDI equity inflows into the country. According to the World Investment Report 2022 by UNCTAD, India was the seventh largest recipient of FDI among the top 20 host countries in 2021. India achieved record FDI inflows of US$ 84.8 billion in 2021-22, including US$ 7.1 billion in the services sector.

- To promote investment liberalization in various industries, the Indian government has allowed 100 per cent foreign participation in telecommunication services through the Automatic Route, covering all services and infrastructure providers. The FDI cap in insurance companies was also increased from 49 to 74 per cent. Government initiatives like the National Single-Window system and raising the FDI ceiling through the automatic route have significantly facilitated investment in the country.

Conclusion

The India Development Update (IDU) published by the World Bank in November 2022, highlights the challenges India faced due to the Russia-Ukraine war, rising crude oil and commodity prices, ongoing global supply disruptions, stricter financial conditions, and high domestic inflation. Despite these difficulties, India’s real GDP grew by 6.3 percent in the July-September period of 2022-23, driven by strong private consumption and investment.The report also notes that India’s economy is more insulated from global issues than other emerging markets because it relies on its large domestic market rather than international trade. This makes India more resilient to global challenges compared to other emerging economies.

|

86 videos|200 docs|58 tests

|

FAQs on Indian Economy Chapter Notes - Business Economics for CA Foundation

| 1. What was the state of the Indian economy during the pre-independence period (1850-1947)? |  |

| 2. What were the key features of India's economy from 1947 to 1991? |  |

| 3. What were the major economic reforms introduced in 1991? |  |

| 4. How did GDP growth rates change after the 1991 reforms? |  |

| 5. What is the role of Niti Aayog in transforming the Indian economy? |  |