Recording of Transactions-I Chapter Notes | Accountancy Class 11 - Commerce PDF Download

| Table of contents |

|

| Introduction |

|

| Business Transactions and Source Document |

|

| Accounting Equation |

|

| Books of Original Entry |

|

| The Ledger |

|

| Posting from Journal |

|

Introduction

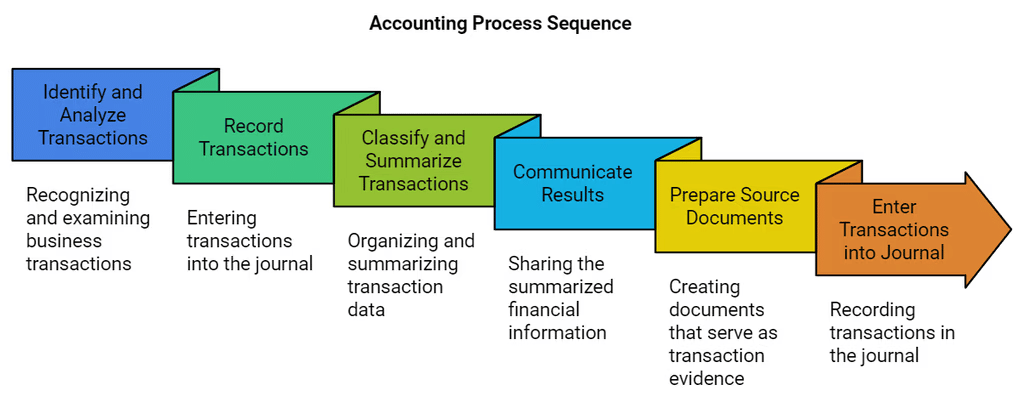

Accounting is a process that involves several steps to manage financial information. The first step is to identify and analyse business transactions. After identifying transactions, the next step is to record them properly. Transactions are then classified and summarised to understand their impact. Finally, the results are communicated to those who need the accounting information.

To prove and record these transactions, documents like cash memos, invoices, and cheques are used. These are called source documents, and they form the basis of preparing vouchers. These transactions are entered into a primary book known as the journal. After recording in the journal, the information is then posted to individual accounts in a main book called the ledger.

Business Transactions and Source Document

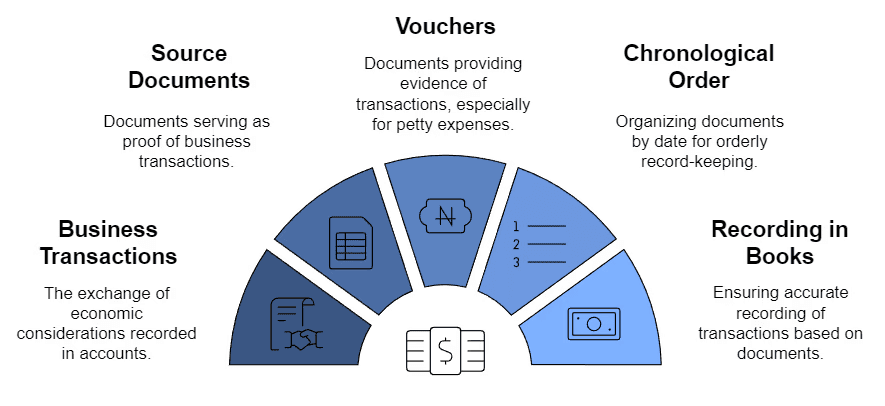

- Business Transactions: These involve the exchange of economic considerations between parties and have a two-fold effect, meaning they are recorded in at least two accounts. For example, when you buy a computer for cash, it involves giving cash and taking a computer.

- Source Documents: Business transactions are usually evidenced by documents like cash memos, invoices, sales bills, pay-in-slips, cheques, and salary slips. These documents serve as proof of the transaction.

- Vouchers: A voucher is a document that provides evidence of a transaction. In cases where there is no documentary evidence, such as with petty expenses, a voucher can be prepared with the necessary details and approved by the appropriate authority within the firm.

- Chronological Order: All vouchers and source documents are arranged in chronological order, meaning they are organised by date. They are also serially numbered and kept in a separate file for record-keeping purposes.

- Recording in Books of Account: All recordings in the books of account are done based on the vouchers and source documents. This ensures that there is a proper record of all business transactions.

Preparation of Accounting Vouchers

- Cash Vouchers: Used for cash transactions.

- Debit Vouchers: Indicate amounts to be debited.

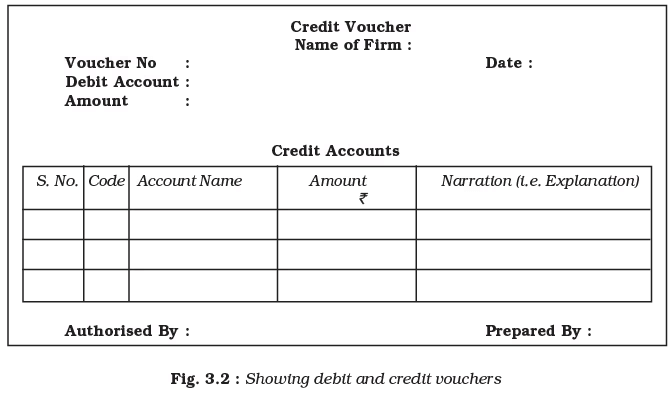

- Credit Vouchers: Indicate amounts to be credited.

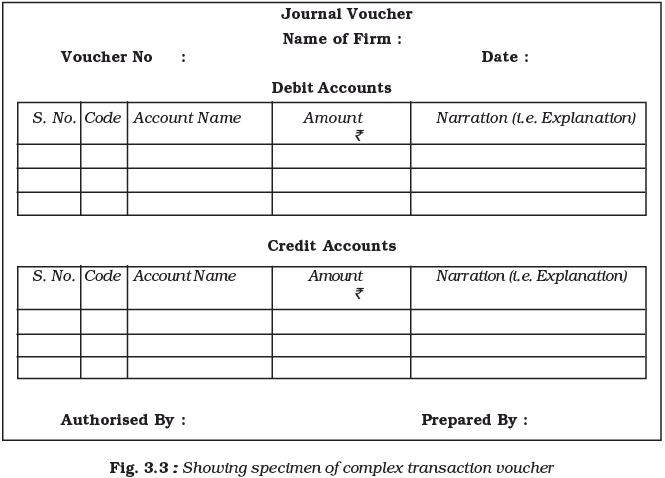

- Journal Vouchers: For adjustments and non-cash transactions.

- Compound Vouchers: For transactions with multiple debits or credits.

Features of Accounting Vouchers:

- No Fixed Format: There is no strict format for accounting vouchers.

- Computerised Accounting: In modern accounting, vouchers are prepared using software, showing the code number and name of the accounts to be debited and credited.

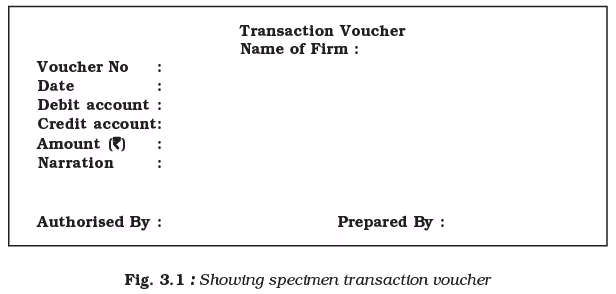

- Transaction Voucher: Used for simple transactions with one debit and one credit.

- Compound Voucher: Used for transactions with multiple debits or credits.

Types of Compound Vouchers:

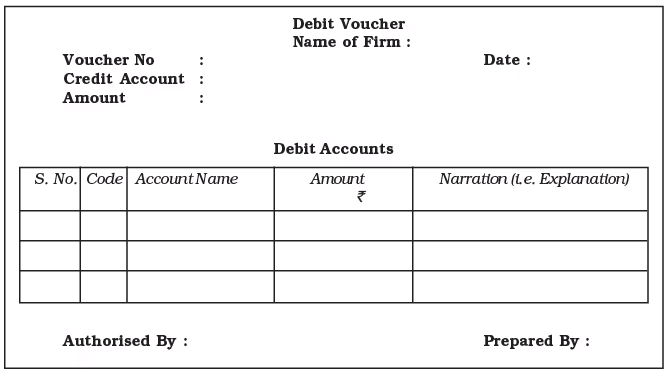

- Debit Voucher: This type of compound voucher records multiple debits and one credit.

- Credit Voucher: This type of compound voucher records multiple credits and one debit.

Transactions with multiple debits and multiple credits are called complex transactions and the accounting voucher prepared for such transaction is known as Complex Voucher/ Journal Voucher. The format of a complex transaction voucher is shown in the figure.

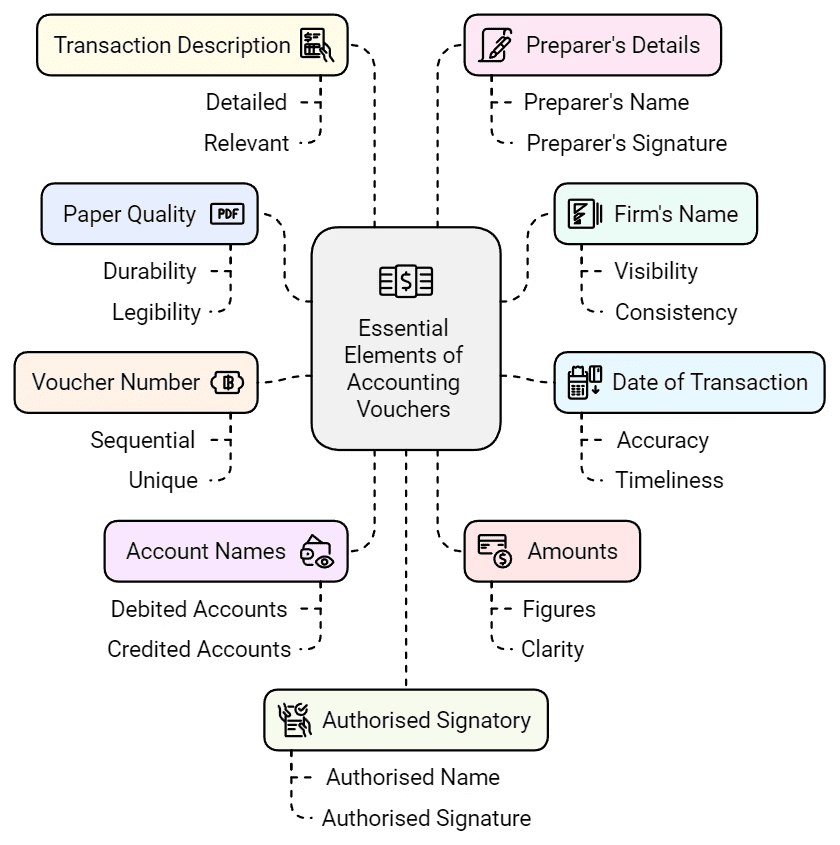

Accounting Vouchers: Essential Elements

- Paper Quality: Vouchers should be written on good-quality paper.

- Firm's Name: The name of the firm must be printed at the top of the voucher.

- Date of Transaction: Fill in the date of the transaction, not the date of recording.

- Voucher Number: The voucher number should be in serial order.

- Account Names: Clearly mention the names of accounts to be debited or credited.

- Amounts: Write debit and credit amounts in figures.

- Transaction Description: Provide a description of the transaction for each account.

- Preparer's Details: The person preparing the voucher should mention their name and signature.

- Authorised Signatory: Include the name and signature of the authorised person.

Design and Distinction

- The design of accounting vouchers varies based on the nature, requirements, and convenience of the business.

- There is no fixed format for accounting vouchers.

- Different colours and fonts are used to distinguish various vouchers.

Accounting Equation

- The accounting equation shows that a business's assets are always equal to the sum of its liabilities and capital (owner’s equity).

- The equation is represented as: A = L + C,

where:

A. Assets

L. Liabilities

C. Capital - This equation can be rearranged to find missing figures:

(i) A – L = C

(ii) A – C = L. - Because it shows the basic relationship between balance sheet components, the accounting equation is also called the Balance Sheet Equation.

- The balance sheet lists a business's assets, liabilities, and capital at a specific time.

- Assets are owned resources, while liabilities are claims from owners (capital) and outsiders (liabilities).

- The equality of assets and liabilities sides of the balance sheet is a fundamental principle that justifies the equation's name.

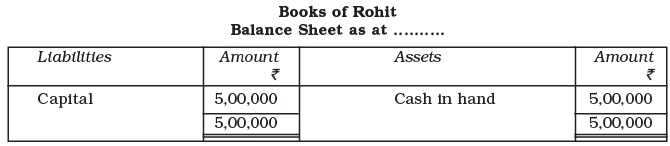

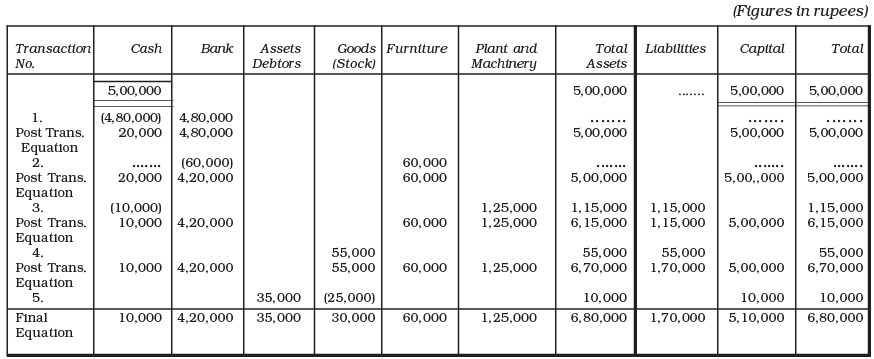

- For example, if Rohit starts a business with ₹ 5,00,000 in cash, the accounting view shows ₹ 5,00,000 in assets and ₹ 5,00,000 in capital from Rohit as the proprietor.

If we put this information in the form of equality of resources and sources, the picture would emerge somewhat as follows:

In the above balance sheet, the total assets are equal to the liabilities of the business. Since the business has not yet started its activities and has not earned any profits, the amount invested in the business is still ₹ 5,00,000. In case any profits are earned, it will increase the invested amount in the business. On the other hand, if the business suffers any losses, it will decrease the invested amount in the business.

Using Debit and Credit

In double-entry accounting, every transaction has a give-and-take aspect and affects at least two accounts. When recording a transaction, the total amount debited must equal the total amount credited.

- The terms "debit" and "credit" indicate whether a transaction is recorded on the left or right side of an account.

- An account in its simplest form looks like the letter "T," which is why it is called a T-account.

- The left side of a T-account is called debit (Dr.), and the right side is called credit (Cr.).

- The left side records an increase, while the right side records a decrease in the item.

- For example, in a customer account, all goods sold appear on the left side, and all payments received appear on the right side.

- The difference between the two sides, called the balance, reflects the amount due to the customer.

Accounting Equation

Enter the amount on the left side of an account to debit the account. To enter the amount on the right side to credit the account.

Rules of Debit and Credit

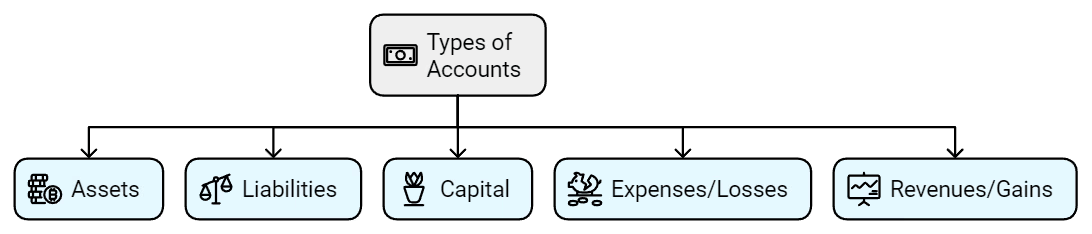

Accounts are categorised into five types:

(a) Asset

(b) Liability

(c) Capital

(d) Expenses/Losses

(e) Revenues/Gains

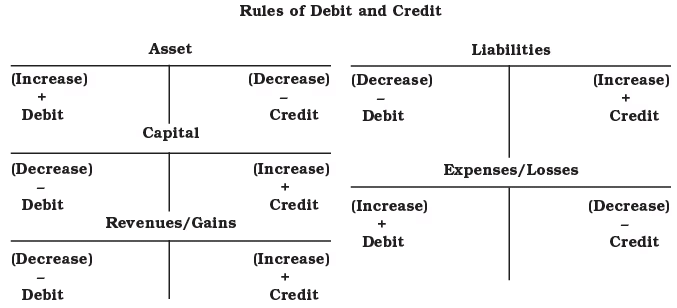

(1) Changes in Assets/Expenses:

(i) Increase in asset: Debit. Decrease in asset: Credit

(ii) Increase in expenses/losses: Debit. Decrease in expenses/losses: Credit

(2) Changes in Liabilities and Capital/Revenues:

(i) Increase in liabilities: Credit. Decrease in liabilities: Debit

(ii) Increase in capital: Credit. Decrease in capital: Debit

(iii) Increase in revenue/gain: Credit. Decrease in revenue/gain: Debit

The rules applicable to the different kinds of accounts have been summarised in the following chart:

Observe the analysis table given on page 48 carefully to be sure that you understand before you go on to the next one. To illustrate different kinds of events, three more transactions have been added (transactions 7 to 9).

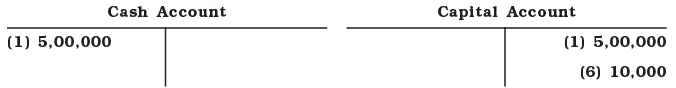

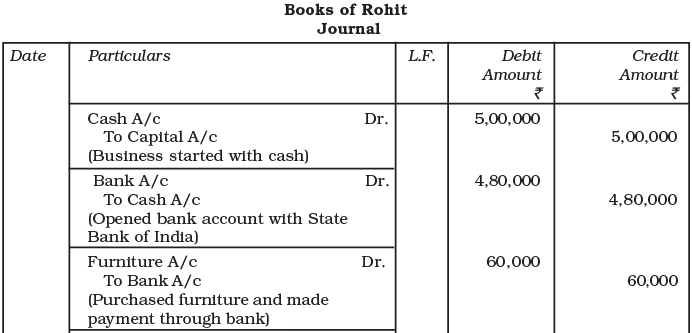

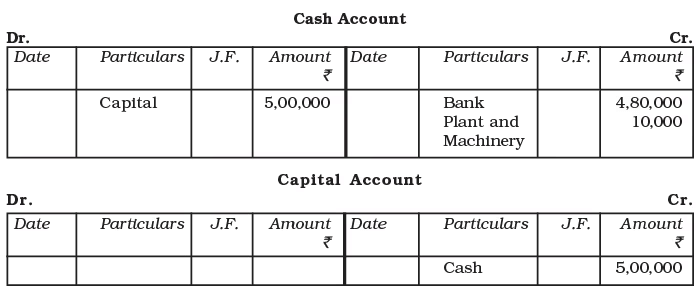

1. Rohit started a business with cash ₹ 5,00,000. Analysis of Transaction: The transaction increases cash on one hand and increases capital on the other hand. Increases in assets are debited and increases in capital are credited. Therefore, record the transaction with a debit to Cash and a credit to Rohit’s Capital.

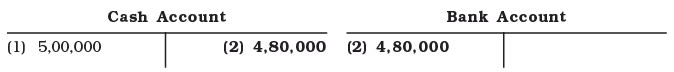

2. Opened a bank account with an amount of ₹ 4,80,000. Analysis of Transaction: The transaction increases the cash at the bank on one hand and decreases cash in hand on the other hand. Increases in assets are debited and decreases in assets are credited. Therefore, record the transactions with a debit to the Bank account and a credit to the Cash account.

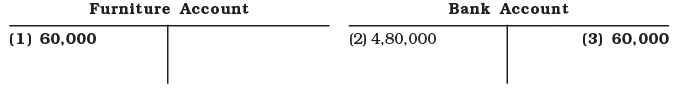

3. Bought furniture for ₹ 60,000 and issued a cheque for the same. Analysis of Transaction: This transaction increases furniture (assets) on one hand and decreases bank (assets) on the other hand by ₹ 60,000. Increases in assets are debited and decreases are credited. Therefore, record the transactions with a debit to the Furniture account and a credit to the Bank account.

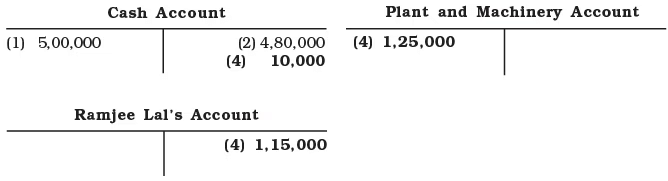

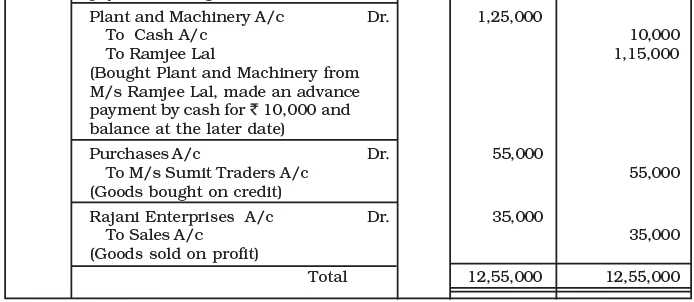

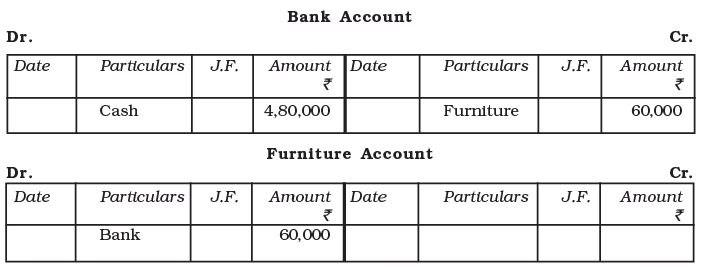

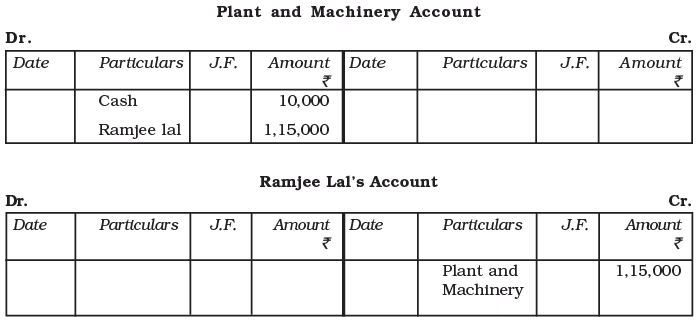

4. Bought Plant and Machinery from Ramjee lal for the business for - ₹ 1,25,000 and an advance of ₹₹₹₹₹ 10,000 in cash is given.

Analysis of Transaction: This transaction increases plant and machinery (assets) by ₹ 1,25,000, decreases cash by ₹ 10,000 and increases liabilities (M/s Ramjee Lal as creditor) by ₹ 1,15,000. Increases in assets are debited, whereas decreases in assets are credited. On the other hand increases in liabilities are credited. Therefore, record the transaction with a debit to the Furniture account and with a credit to Cash and Ramjee Lal’s account.

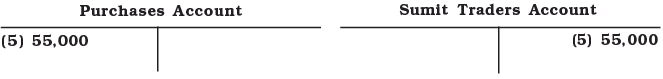

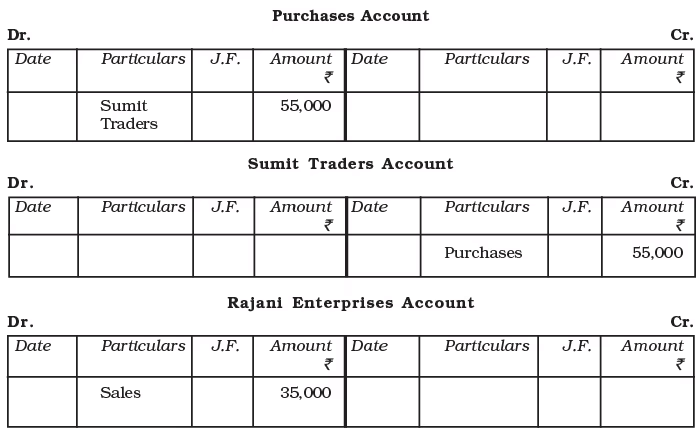

5. Goods purchased from Sumit Traders for ₹ 55,000. Analysis of transaction: This transaction increases purchases (expenses) and increases liabilities (M/s Sumit Traders as creditors) by ₹ 55,000. Increases in expenses are debited and increases in liabilities are credited. Therefore, record the transaction with a debit to the Purchases account and credit to the Sumit Traders account.

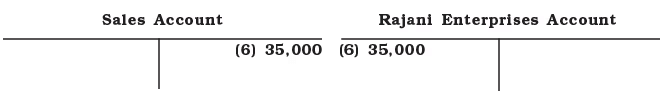

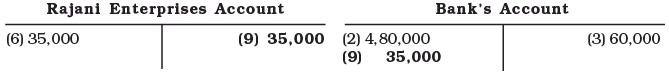

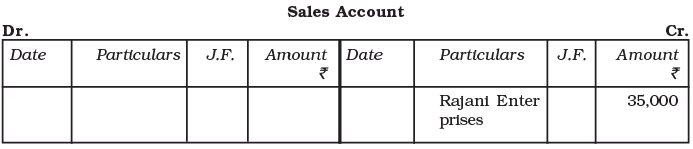

6. Goods costing ₹ 25,000 sold to Rajani Enterprises for ₹ 35,000. Analysis of transaction: This transaction increases sales (Revenue) and increases assets (Rajani Enterprises as debtors). Increases in assets are debited and revenue increases are credited. Therefor,e record the entry with credit to Sales account and debit to Rajani Enterprises account.

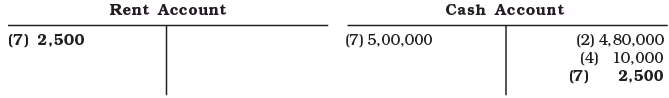

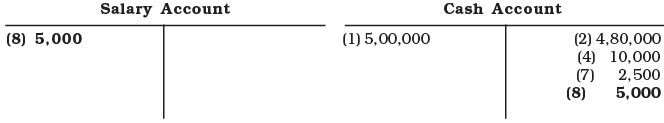

7. Paid the monthly store rent ₹ 2,500 in cash. Analysis of transaction: The payment of rent is an expense that decreases capital thus, is recorded as debits. Credit cash to record decrease in assets.

8. Paid ₹ 5,000 as salary to the office employees. Analysis of transaction: The payment of salary is an expense that decreases capital thus, is recorded as debits. Credit Cash to record decrease in assets.

9. Received cheque as full payment from Rajani Enterprises and deposited same day into bank. Analysis of transaction: This transaction increases assets (Bank) on the one hand and decreases assets (Rajani Enterprises as debtors) on the other hand. An increase in assets is debited whereas a decrease in assets is credited. Therefore record the entry with debit to the Bank account and credit to the Rajani Enterprises account.

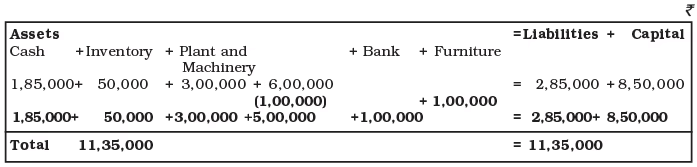

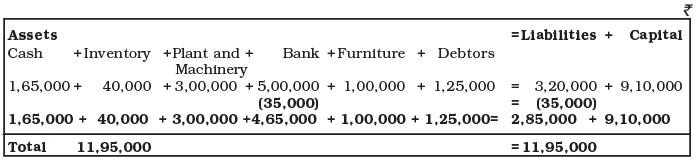

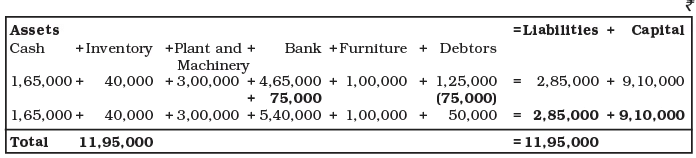

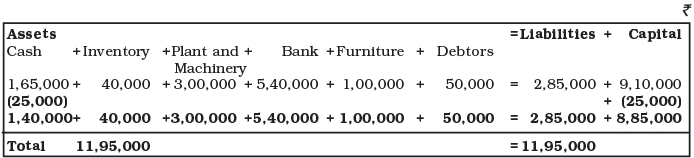

Example: Analyse the effect of each transaction on assets and liabilities and show that the both sides of Accounting Equation (A = L + C) remains equal:

(i) Introduced ₹ 8,00,000 as cash and ₹ 50,000 by stock.

(ii) Purchased plant for ₹ 3,00,000 by paying ₹ 15,000 in cash and balance at a later date.

(iii) Deposited ₹ 6,00,000 into the bank.

(iv) Purchased office furniture for ₹ 1,00,000 and made payment by cheque.

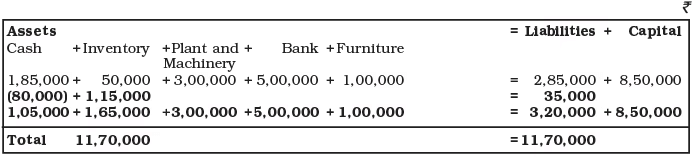

(v) Purchased goods worth ₹ 80,000 for cash and for ₹ 35,000 in credit.

(vi) Goods amounting to ₹ 45,000 was sold for ₹ 60,000 on cash basis.

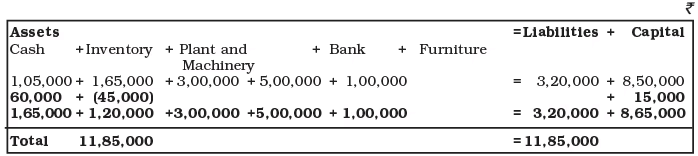

(vii) Goods costing to ₹ 80,000 was sold for ₹ 1,25,000 on credit.

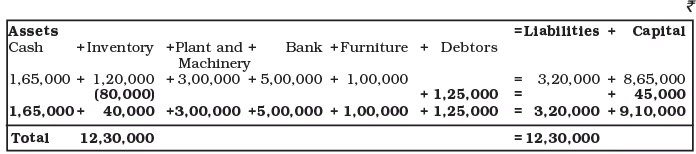

(viii) Cheque issued to the supplier of goods worth ₹ 35,000.

(ix) Cheque received from customer amounting to ₹ 75,000.

(x) Withdrawn by owner for personal use ₹ 25,000.

Ans:

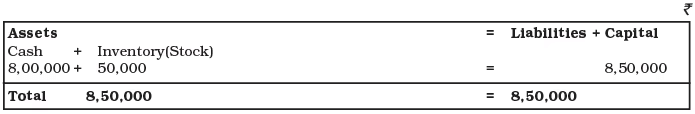

Transaction (i) It affects Cash and Inventory on the assets side and Capital on the other hand. There is an increase in cash by ₹ 8, 00,000 and an Inventory of goods by ₹ 50,000 on the assets side of the equation. Capital is increased by ₹ 8, 50,000.

Transaction (ii) It affects Cash and Plant and Machinery on the assets side and liabilities on the other side of the equation. There is an increase in plant and machinery by ₹ 3, 00,000 and a decrease in cash by ₹ 15,000. Liability to pay to the supplier of plant and machinery increases by ₹ 2,85,000.

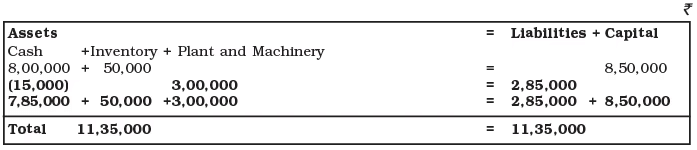

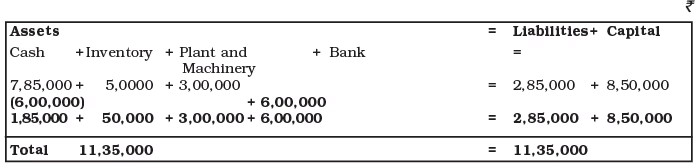

Transaction (iii) It affects the assets side only. The composition of the asset side changes. Cash decreases by ₹ 6,00,000 and by the same amount bank increases.

Transaction (iv) It affects the assets side only. The composition of the asset side changes. Furniture increases by ₹ 1,00,000 and by the same amount bank decreases.

Transaction (v) It affects Cash and Inventory on the assets side and liability on the other side. There is a decrease in cash by ₹ 80,000 and an increase in inventory of goods by ₹ 1,15,000 on the assets side of the equation. Liabilities increase by ₹ 35,000.

Transaction (vi) It affects Cash and Inventory on the assets side and capital on the other side. There is an increase in cash by ₹ 60,000 and a decrease in inventory of goods by ₹ 45,000 on the assets side of the equation. Capital increases by ₹ 15,000.

Transaction (vii) It affects Debtors and Inventory on the assets side and capital on the other side. There is an increase in debtors by ₹ 1, 25,000 and a decrease in Inventory of goods by ₹ 80,000 on the assets side of the equation. Capital increases by Rs.45, 000.

Transaction (viii) It affects the Bank on the assets side on one side and liability on the other side. There is a decrease in bank by ₹ 35,000 on the assets side and liability also decreases by ₹ 35,000.

Transaction (ix) It affects the assets side only. The composition of the assets side changes. Bank increases by ₹ 75,000 and by the same amount Debtors decreases.

Transaction (x) It affects Cash on the asset side and Capital on the other hand. There is a decrease in Cash by ₹ 25,000 on the assets side whereas capital decreases by ₹ 25,000.

Books of Original Entry

- The process of analysing transactions and recording their effects directly in the accounts is helpful as a learning exercise, but real accounting systems do not record transactions this way.

- Instead, transactions are first recorded in a book called the journal or book of original entry.

- The journal provides a complete record of each transaction in one place and links the debits and credits for each transaction.

- After the journal entries are made, they are transferred to individual accounts in a process called posting.

- The journal is called the book of original entry because it is where transactions are first recorded. The ledger account is considered the principal book of entry.

- The journal is subdivided into several books of original entry due to the number and commonality of most transactions.

- These subdivisions include:

(a) Journal Proper

(b) Cash Book

(c) Other Day Books:

(i) Purchases (Journal) Book

(ii) Sales (Journal) Book

(iii) Purchase Returns (Journal) Book

(iv) Sale Returns (Journal) Book

(v) Bills Receivable (Journal) Book

(vi) Bills Payable (Journal) Book

Let us learn about the process of journalising and their posting into the ledger.

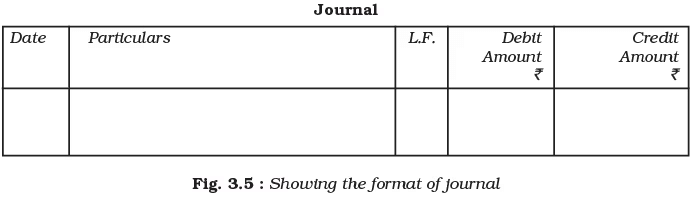

Journal

- The journal is the primary book for recording transactions. It captures transactions in the order they occur, chronologically.

- Each transaction is recorded separately after identifying which account needs to be debited or credited.

- This book serves as the initial point of entry for transactions before they are posted to the respective accounts.

- The format of the journal includes columns for the date, accounts involved, debit and credit amounts, and a brief description of the transaction.

Date: The date when the transaction occurred is recorded in the first column.

Particulars: This column includes the accounts involved in the transaction.

1. Debit Account: The account to be debited is written on the first line, starting from the left corner, with "Dr." at the end of the column.

2. Credit Account: The account to be credited is written on the second line, preceded by "To."Narration: A brief description of the transaction is provided below the account titles. After writing the narration, a line is drawn in the particulars column to indicate the end of the journal entry.

Ledger Folio: This column records the page number of the ledger book where the relevant account appears. It is filled in at the time of posting, not during the journal entry.

Debit and Credit Amounts: The amounts to be debited and credited are recorded in their respective columns.

Page Totals: Since there are many transactions, the amount columns are totalled at the end of each page and carried forward (c/f) to the next page, where they are recorded as brought forward (b/f) balances.

Simple Journal Entry: When only two accounts are involved in recording a transaction, it is called a simple journal entry.

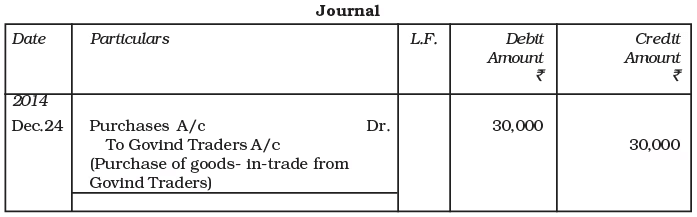

For Example, Goods Purchased on credit for Rs.30,000 from M/s Govind Traders on December 24, 2017, involves only two accounts:

(a) Purchases A/c (Goods),

(b) Govind Traders A/c (Creditors).

This transaction is recorded in the journal as follows:

- It is important to note that when a transaction occurs, the account that is debited is the purchases account rather than the goods account, even though the stock of goods increases.

- The goods account is separated into five different accounts:

1. Purchases account

2. Sales account

3. Purchases returns account

4. Sales returns account

5. Stock account - When there are multiple accounts to debit or credit in a transaction, this type of entry is known as a compound journal entry.

- A compound journal entry includes more than one account involved in the transaction.

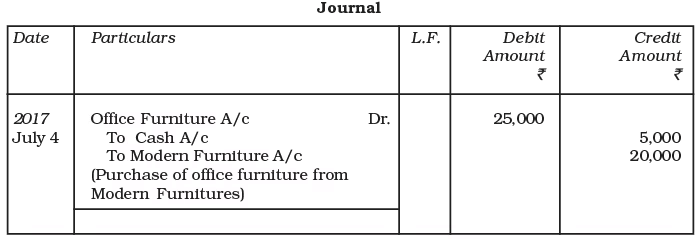

- For instance, on July 4, 2017, office furniture was purchased from Modern Furniture for ₹ 25,000.

- An immediate cash payment of ₹ 5,000 was made, leaving a remaining balance of ₹ 20,000 to be paid later.

- This transaction affects the accounts as follows:

1. The furniture account (an asset) increases by ₹ 25,000.

2. The cash account (an asset) decreases by ₹ 5,000.

3. The liability account increases by ₹ 20,000, reflecting the amount still owed.

The entry made in the journal on July 4, 2017 is:

Have a look at the following transactions to be listed:

1. Opened a bank account at the State Bank of India with an amount of ₹ 4,80,000.

Analysis of transaction: This action increases the cash in the bank (an asset) and reduces cash (another asset) by ₹ 4,80,000.

2. Purchased furniture for ₹ 60,000, and a cheque was issued on the same day.

Analysis of transaction: This purchase increases furniture (an asset) and decreases bank balance (an asset) by ₹ 60,000.

3. Acquired plant and machinery for the business costing ₹ 1,25,000, with an advance of ₹ 10,000 paid in cash to M/s Ramjee Lal.

Analysis of transaction: This transaction increases plant and machinery (an asset) by ₹ 1,25,000, decreases cash by ₹ 10,000, and increases liabilities (as M/s Ramjee Lal is a creditor) by ₹ 1,15,000.

4. Goods were purchased from M/s Sumit Traders for ₹ 55,000.

Analysis of transaction: This transaction increases goods (assets) and liabilities (as M/s Sumit Traders are creditors) by ₹ 55,000.

5. Sold goods costing ₹ 25,000 to Rajani Enterprises for ₹ 35,000.

Analysis of transaction: This sale decreases the stock of goods (an asset) by ₹ 25,000, increases assets (as Rajani Enterprises is a debtor) by ₹ 35,000, and increases capital due to the profit of ₹ 10,000.

Now observe how the transactions listed are recorded in the journal:

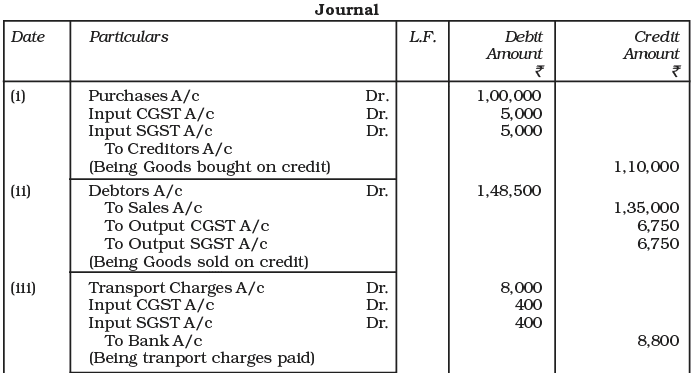

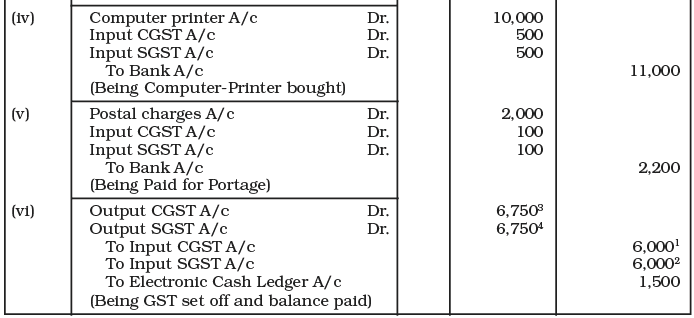

Accounting Entries under Goods and Services Tax:

Example: Record necessary Journal entries assuming CGST @ 5% and SGST @ 5% and all transactions are occurred within Delhi) i. Shobit bought goods ₹ 1,00,000 on credit ii. He sold them for ₹ 1,35,000 in the same state on credit iii. He paid for Railway transport ₹ 8,000 iv. He bought computer printer for ₹ 10,000 v. Paid postal charges ₹ 2000

Ans:

Working Notes:-

Total Input CGST = ₹ 5,000 + ₹ 400 + ₹500 + ₹100 = ₹6,0001

Total Input SGST = ₹ 5,000 + ₹ 400 + ₹500 + ₹100 = ₹6,0002

Total Output CGST = ₹ 6,7503

Total Output SGST = ₹ 6,7504

Net CGST

Payable = ₹ 6,750 - ₹6,000 = ₹750

Net SGST Payable = ₹ 6,750 - ₹6,000 = ₹750

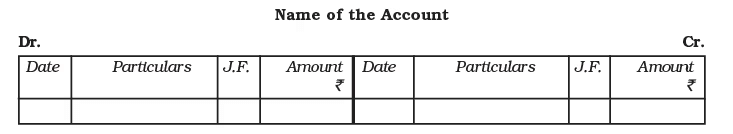

The Ledger

- The ledger is the main book in an accounting system where different accounts are kept.

- It records transactions related to each account.

- Think of the ledger as a collection of all the accounts that have been debited or credited from the journal proper and various special journals.

- Ledgers can be in different forms, like a bound register, cards, or separate sheets in a binder.

- Ideally, each account should have its own page or card in the ledger.

Utility:

- The ledger is extremely useful and important for organizations. It shows the net result of all transactions for a specific account on a given date.

- For instance, if management wants to know how much a customer owes or how much the firm owes a supplier on a certain date, they can find this information in the ledger.

- This information is hard to get from the journal because transactions in the journal are recorded in order and are not classified.

- To make posting and finding accounts easier, they are opened in a specific order in the ledger, often in the same order as in the profit and loss account and balance sheet.

- An index is usually provided at the beginning for easy reference. In larger organizations, each account may also have a code number for quick identification.

The format of the account is shown in the figure:

Format of Ledger Account:

- Title of the Account: The name of the item is written at the top of the format, ending with the suffix "Account."

- Dr./Cr.: "Dr." stands for the debit side of the account (left side), while "Cr." indicates the credit side (right side).

- Date: Transactions are recorded in chronological order, including the year, month, and date.

- Particulars: The name of the item, referencing the original book of entry, is written on the debit or credit side of the account.

- Journal Folio: This column records the page number of the original book of entry where the relevant transaction is documented. It is filled in at the time of posting.

- Amount: The amount is recorded in numerical figures, corresponding to what is entered in the amount column of the original book of entry.

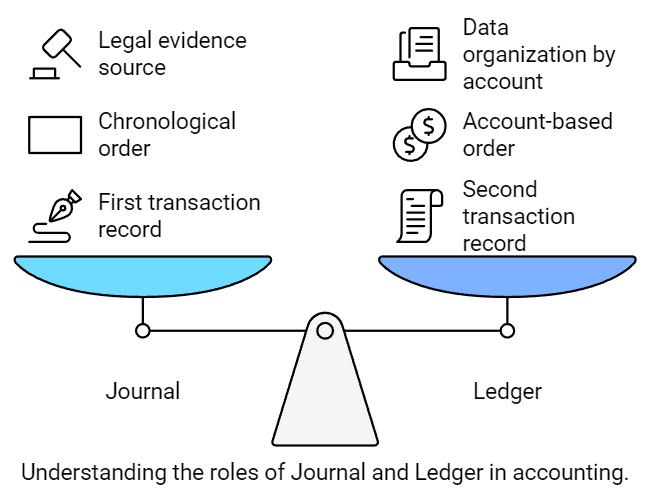

Distinction between Journal and Ledger:

- The Journal is where transactions are recorded first, while the Ledger is where they are recorded second.

- The Journal records transactions in the order they occur, while the Ledger organizes them by account.

- The Journal is considered more important for legal evidence because it is the original source of entry.

- Transactions are the basis for organizing data in the Journal, while accounts are the basis for organizing data in the Ledger.

- The process of recording in the Journal is called Journalising, while in the Ledger, it is called Posting.

Classification of Ledger Accounts:

- Ledger accounts are classified into five categories: assets, liabilities, capital, revenues/gains, and expenses/losses.

- These accounts are further divided into permanent and temporary accounts.

- Permanent accounts are balanced and carried forward to the next accounting period. Temporary accounts are closed at the end of the period by transferring their balances to the trading and profit and loss accounts.

- Permanent accounts appear in the balance sheet. Assets, liabilities, and capital accounts are permanent, while revenue and expense accounts are temporary.

- This classification is important for preparing financial statements.

Posting from Journal

- Posting is the process of transferring entries from the journal to the ledger.

- It involves grouping all transactions related to a specific account in one place for better understanding and to continue the accounting process.

- Posting from the journal to the ledger can be done periodically, such as weekly, fortnightly, or monthly, depending on the needs and convenience of the business.

Steps for Posting from Journal to Ledger:

Step 1: Locate the Account

- Find the account to be debited in the ledger as per the journal entry.

Step 2: Enter the Date

- Write the date of the transaction in the date column on the debit side of the ledger.

Step 3: Write the Particulars

- In the "Particulars" column, write the name of the account through which the amount has been debited in the journal.

- For example, if furniture is sold for cash ₹ 34,000, write "Furniture" in the cash account on the debit side.

- In the Furniture account, write "Cash" in the particulars column on the credit side.

Step 4: Enter Page Numbers

- Enter the page number of the journal in the folio column of the ledger.

- Write the page number of the ledger in the journal for the specific account.

Step 5: Enter the Amount

- Write the relevant amount in the amount column on the debit side.

- The same procedure is followed for making entries on the credit side of the account to be credited.

- An account is opened only once in the ledger, and all related entries are posted on the debit or credit side as applicable.

We will now see how the transactions listed in the example above under Rules of Debit and Credit are posted to different accounts from the journal:

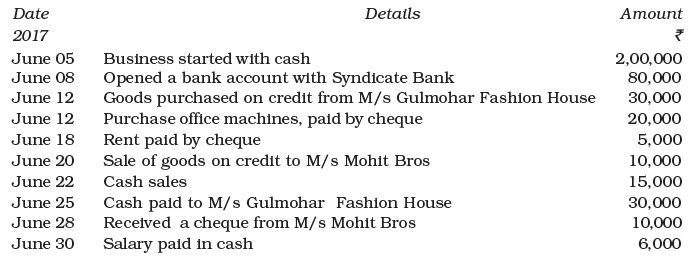

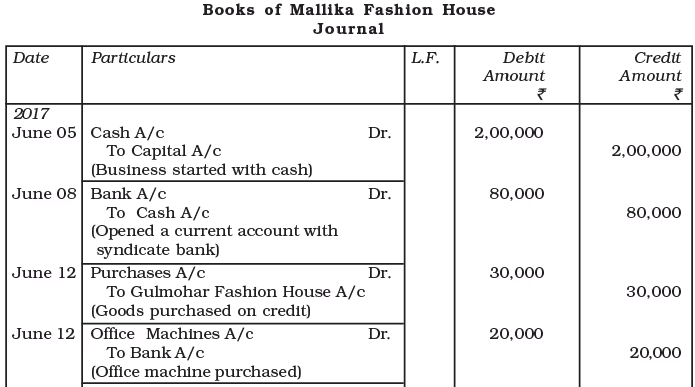

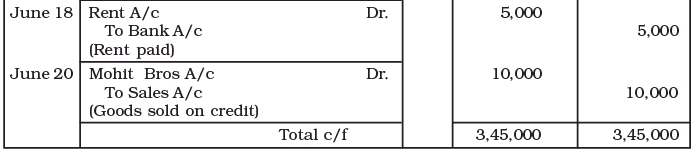

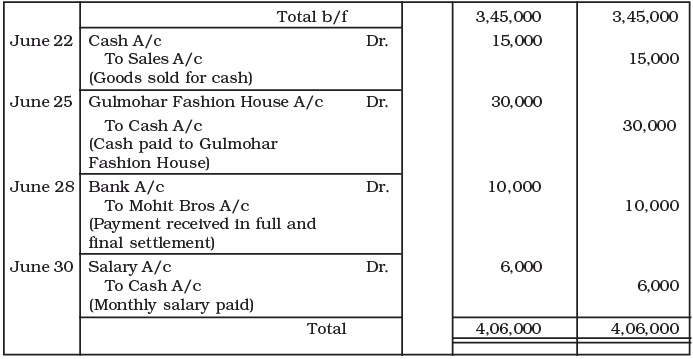

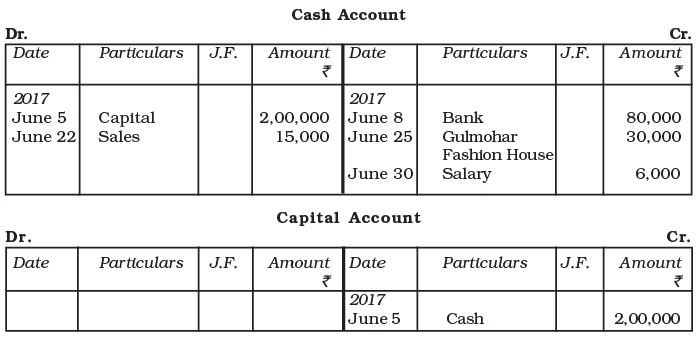

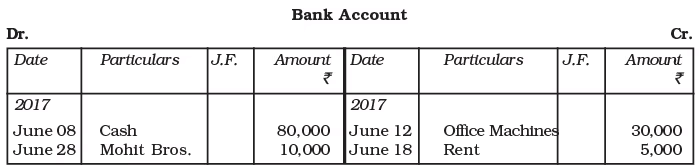

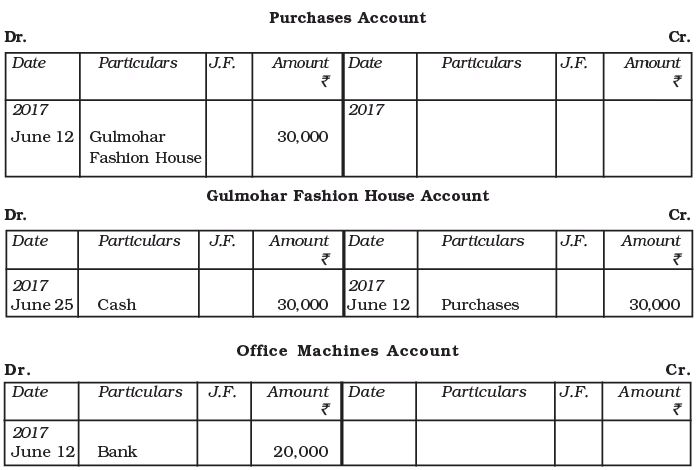

Example: Journalise the following transactions of M/s Mallika Fashion House and post the entries to the Ledger:

Ans:

Ans:

(i) Recording the transactions

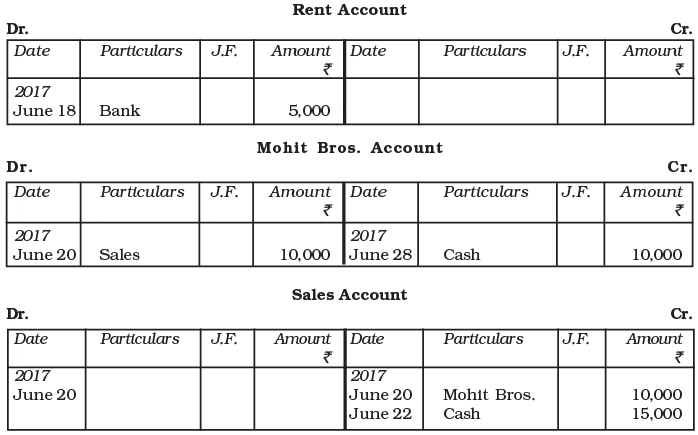

(ii) Posting in the Ledger Book

|

61 videos|154 docs|35 tests

|

FAQs on Recording of Transactions-I Chapter Notes - Accountancy Class 11 - Commerce

| 1. What are business transactions and why are source documents important? |  |

| 2. How does the accounting equation relate to recording transactions? |  |

| 3. What are books of original entry and what is their purpose? |  |

| 4. What is the ledger and how is it different from the journal? |  |

| 5. What is posting from the journal to the ledger and why is it important? |  |