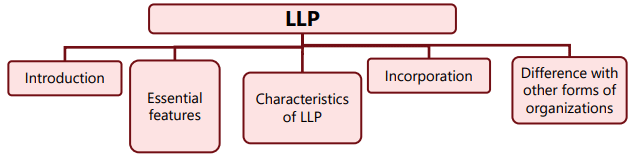

The Limited Liability Partnership, 2008 Chapter Notes | Business Laws for CA Foundation PDF Download

| Table of contents |

|

| Overview |

|

| Introduction |

|

| Limited Liability Partnership (LLP) |

|

| Characteristics of LLP |

|

| Incorporation of LLP |

|

| Differences With Other Forms of Organisation |

|

Overview

Introduction

- The Ministry of Law and Justice announced the Limited Liability Partnership Act on 9th January 2007.

- The Limited Liability Partnership Bill was passed by Parliament on 12th December 2008.

- The President of India approved the Bill on 7th January 2009, officially naming it the Limited Liability Partnership Act, 2008.

- This Act applies to all of India.

- The LLP Act, 2008 was created to establish rules for the creation and management of Limited Liability Partnerships and related matters.

- The Act consists of 81 sections and 4 schedules.

- The First Schedule outlines the mutual rights and responsibilities of partners, including details about limited liability partnerships and their partners when there is no formal agreement.

- The Second Schedule focuses on how to convert a traditional firm into an LLP.

- The Third Schedule explains how to change a private company into an LLP.

- The Fourth Schedule deals with converting an unlisted public company into an LLP.

- The Ministry of Corporate Affairs and the Registrar of Companies (ROC) are responsible for overseeing the LLP Act, 2008.

- The Central Government can create rules related to the LLP Act, 2008 and modify them through official notifications.

- It is important to note that the Indian Partnership Act of 1932 does not apply to LLPs.

- The LLP Act, 2008 was updated by the Limited Liability Partnership (Amendment) Act, 2021, which was enacted on 13th August 2021.

Need for a New Form of Business Organization

The Limited Liability Partnership (LLP) Act, 2008 was introduced to address the need for a modern corporate structure that reflects the changing dynamics of the Indian economy. Here are the key points highlighting the necessity for this new form of business organization:- Alternative to Traditional Partnerships: Traditional partnerships come with the drawback of unlimited personal liability for partners. This poses a significant risk, especially in today’s complex business environment. The LLP model provides a solution by offering limited liability protection to its members, safeguarding their personal assets.

- Governance Structure: LLPs combine the benefits of limited liability with a governance structure similar to that of limited liability companies. This ensures a clear framework for decision-making and management, which is crucial for the smooth operation of any business.

- Flexibility and Innovation: The LLP structure allows for greater flexibility in organizing and operating a business. This is particularly important for professional expertise and entrepreneurial initiatives that require innovative and efficient ways of working together. The ability to customize the internal structure of an LLP based on mutual agreement adds to its appeal.

- Suitability for Various Sectors: LLPs are designed to cater to a wide range of sectors, including professional services, scientific research, and technical disciplines. The flexibility in operation makes LLPs an ideal choice for small enterprises and ventures seeking investment from venture capital.

In summary, the LLP Act, 2008 was enacted to provide a contemporary and suitable business structure that meets the needs of modern entrepreneurs and professionals, offering them the benefits of limited liability and operational flexibility.

Limited Liability Partnership (LLP)

Meaning of LLP: An LLP is a legal business entity that offers limited liability to its partners. It is an alternative corporate structure that combines the benefits of limited liability with the flexibility of a traditional partnership. In an LLP, the internal structure can be organized similarly to a partnership, while the LLP itself is responsible for its assets. This means that while the LLP is liable for its debts and obligations, the liability of individual partners is limited. LLPs are distinct from both corporate and partnership structures, as they incorporate elements of both. They provide the limited liability protection characteristic of companies while allowing the operational flexibility of a partnership. This makes LLPs a suitable option for professionals, entrepreneurs, and businesses seeking a balance between liability protection and organizational flexibility.

LLPs are distinct from both corporate and partnership structures, as they incorporate elements of both. They provide the limited liability protection characteristic of companies while allowing the operational flexibility of a partnership. This makes LLPs a suitable option for professionals, entrepreneurs, and businesses seeking a balance between liability protection and organizational flexibility.

Important Definitions

Body Corporate [Section 2(1)(d)]: This refers to a company as outlined in clause (20) of section 2 of the Companies Act, 2013. It includes:- A limited liability partnership (LLP) registered under this Act.

- An LLP incorporated outside India.

- A company incorporated outside India.

However, it does not include:

- A corporation sole.

- A co-operative society registered under any current law.

- Any other body corporate specified by the Central Government through a notification in the Official Gazette.

Business [Section 2(1)(e)]: Business encompasses all trades, professions, services, and occupations, except for activities that the Central Government may exclude through a notification.

Designated Partner [Section 2(1)(j)]: A designated partner is a partner appointed as such according to section 7 of the relevant Act.

Entity [Section 2(1)(k)]: An entity refers to any body corporate and includes a firm established under the Indian Partnership Act, 1932, for specific sections of the Act.

Financial Year [Section 2(1)(l)]: In the context of a Limited Liability Partnership (LLP), a financial year is defined as the period from April 1st of one year to March 31st of the following year. However, for an LLP incorporated after September 30th of a year, the financial year may end on March 31st of the following year.

Example 1: if an LLP is incorporated on October 15th, 2019, its financial year would run from October 15th, 2019, to March 31st, 2020.

The Income Tax department has established a standard financial year from April 1st to March 31st of the next year. In alignment with Income Tax law, the financial year for an LLP should always be from April 1st to March 31st each year.

Foreign LLP [Section 2(1)(m)]: A Foreign LLP is an LLP that is formed, incorporated, or registered outside of India but establishes a place of business within India.

Limited Liability Partnership [Section 2(1)(n)]: A Limited Liability Partnership (LLP) refers to a partnership that is formed and registered under the relevant Act.

Limited Liability Partnership Agreement [Section 2(1)(o)]: This refers to any written agreement between the partners of an LLP or between the LLP and its partners that outlines their mutual rights and duties, as well as their rights and duties in relation to the LLP.

Key Definitions under the LLP Act:

- Partner: A partner in a Limited Liability Partnership (LLP) is an individual who joins the LLP as per the terms set out in the LLP agreement.

- Small Limited Liability Partnership: This refers to an LLP that meets specific criteria regarding its contribution and turnover, which are defined by the government.

- Non-applicability of the Indian Partnership Act: The provisions of the Indian Partnership Act, 1932 do not apply to LLPs unless stated otherwise.

- Partners: Any individual or body corporate can be a partner in an LLP. However, certain individuals, such as those declared of unsound mind by a court, undischarged insolvents, or individuals pending insolvency adjudication, are disqualified from becoming partners.

- Minimum Number of Partners: An LLP must have at least two partners. If the number of partners falls below two, the remaining partner becomes personally liable for the obligations of the LLP after six months of operating under this condition.

- Designated Partners: Every LLP is required to have at least two designated partners who are individuals, with at least one being a resident of India. If all partners are bodies corporate, at least two individuals from these bodies must act as designated partners.

- Resident in India: A person is considered a resident in India if they have stayed in the country for a minimum of 120 days during the financial year.

Example 2: There is an LLP by the name Indian Helicopters LLP having 5 partners namely Mr. A (Non resident), Mr. B (Non Resident) Ms. C (resident), Ms. D (resident) and Ms. E (resident). In this case, at least 2 should be named as Designated Partner out of which 1 should be resident. Hence, if Mr. A and Mr. B are designated then it will not serve the purpose. One of the designated partners should be there out of Ms. C, Ms. D and Ms. E.

|

Download the notes

Chapter Notes: The Limited Liability Partnership, 2008

|

Download as PDF |

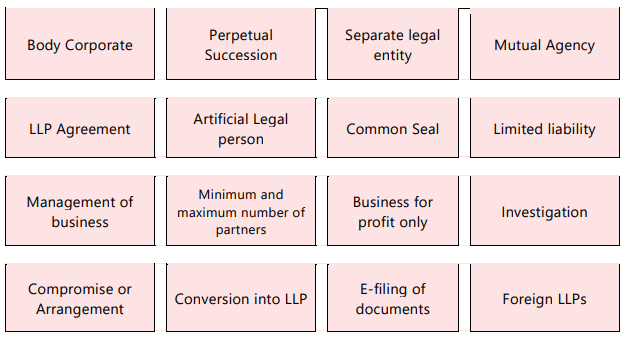

Characteristics of LLP

LLP is a body corporate:According to Section 2(1)(d) of the LLP Act, 2008, a Limited Liability Partnership (LLP) is classified as a body corporate, which means it is established and registered under this Act. It functions as a distinct legal entity separate from its partners and possesses perpetual succession. Consequently, any alterations in the partners of an LLP do not influence the LLP's existence, rights, or obligations. Additionally, Section 3 reiterates that an LLP is a body corporate formed and recognized under this legislation, emphasizing its separate legal status from its partners.

- Perpetual Succession: An LLP can continue to exist regardless of changes in its partners. Events such as the death, mental incapacity, retirement, or insolvency of partners do not affect the LLP's existence. It has the capacity to enter into contracts and hold property in its own name.

- Separate Legal Entity: An LLP is a distinct legal entity from its partners. This means it is liable for its debts and obligations to the extent of its assets. However, the liability of the partners is limited to their agreed contributions to the LLP. Creditors can only claim against the LLP and not against individual partners.

- Mutual Agency: In an LLP, no partner is responsible for the actions of other partners that are independent or unauthorized. This protects individual partners from being jointly liable for the wrongful decisions or misconduct of another partner. Each partner acts as an agent of the LLP, and no single partner can bind the others by their actions.

- LLP Agreement: The rights and duties of partners within an LLP are governed by an agreement among the partners. The LLP Act, 2008 allows partners the flexibility to create this agreement according to their preferences. If no agreement is in place, the mutual rights and duties are determined by the provisions of the LLP Act, 2008.

- LLP is a Body Corporate: According to Section 2(1)(d) of the LLP Act, 2008, an LLP is a body corporate formed and incorporated under this Act. It is a legal entity separate from its partners and has perpetual succession. This means that changes in partners do not affect the existence, rights, or liabilities of the LLP.

- Common Seal: An LLP may have a common seal, which is used to affix the seal on documents. The common seal can be used for various purposes, such as executing deeds and documents.

- Management of Business: The management of the business of the LLP is vested in the partners, and they have the authority to manage the business as per the LLP Agreement.

- Minimum and Maximum Number of Partners: There is no restriction on the minimum and maximum number of partners in an LLP. However, the LLP Act, 2008 specifies that the number of partners should not exceed 200 in the case of a firm.

- Business for Profit Only: An LLP can only carry on business for profit. The business objective should be to make a profit, and the partners should share the profits among themselves.

- Investigation: The Central Government has the power to appoint an inspector to investigate the affairs of an LLP if there is a suspicion of misconduct or fraud. The inspector has the authority to access the records and documents of the LLP.

- Compromise or Arrangement: An LLP can enter into a compromise or arrangement with its creditors or members. This is a legal process to restructure the debts or obligations of the LLP.

- Conversion into LLP: A partnership firm can be converted into an LLP by complying with the provisions of the LLP Act, 2008. The partners should agree to the conversion and comply with the necessary formalities.

- E-filing of Documents: LLPs are required to file certain documents electronically with the Registrar. This includes filing of annual returns, financial statements, and other documents as specified under the LLP Act, 2008.

- Foreign LLPs: Foreign LLPs can operate in India by registering under the LLP Act, 2008. They should comply with the provisions of the Act and file the necessary documents with the Registrar.

Advantages of LLP Structure

Incorporation of LLP

1. Incorporation Document (Section 11):The incorporation document is the most crucial document required for the registration of a Limited Liability Partnership (LLP).

For an LLP to be incorporated:

(a) Two or more persons must associate themselves for carrying on a lawful business with the intention of making a profit and subscribe their names to the incorporation document.

(b) The incorporation document must be filed in the prescribed manner and with the prescribed fees to the Registrar of the State where the registered office of the LLP is situated.

(c). Statement, in the prescribed form, must be filed along with the incorporation document. This statement should be made by either an advocate, a Company Secretary, a Chartered Accountant, or a Cost Accountant engaged in the formation of the LLP, and by anyone who subscribed their name to the incorporation document. The statement certifies that all the requirements of the Act and the rules have been complied with regarding the incorporation and related matters.

2. Contents of the Incorporation Document:

The incorporation document shall:

(a) Be in a prescribed form;

(b) State the name of the LLP;

(c) State the proposed business of the LLP;

(d) State the address of the registered office of the LLP;

(e) State the name and address of each person who will be a partner of the LLP at the time of incorporation;

(f) State the name and address of the persons who will be designated partners of the LLP at the time of incorporation;

(g) Contain any other information concerning the proposed LLP as may be prescribed.

3. Penalty for False Statement:

If a person makes a statement in the incorporation document that they know to be false or do not believe to be true, they shall be punishable with:

(a) Imprisonment for a term that may extend to 2 years; and

(b). fine that shall not be less than ₹10,000 and may extend to ₹5 Lakhs.

Incorporation by Registration

- When the conditions specified in clauses (b) and (c) of sub-section (1) of section 11 are met, the Registrar will keep the incorporation document. If clause (a) of that sub-section is also complied with, the Registrar will, within 14 days:

(a) Register the incorporation document; and

(b) Issue a certificate confirming the LLP's incorporation under the specified name. - The Registrar may consider the statement provided under clause (c) of sub-section (1) of section 11 as adequate proof of compliance with clause (a).

(a) The certificate mentioned in clause (b) of sub-section (1) will be signed by the Registrar and authenticated with his official seal.

(b) This certificate serves as definitive proof that the LLP is incorporated under the specified name.

Registered Office of LLP

- Every LLP is required to have a registered office where all communications and notices can be addressed and received.

- Document can be served to an LLP or its partners by sending it by post under a certificate of posting, registered post, or any other prescribed manner, at the registered office and any other address specifically declared by the LLP for this purpose.

- An LLP may change the location of its registered office by filing a notice of such change with the Registrar, following the prescribed form, manner, and conditions. The change will take effect only upon such filing.

- f an LLP violates any provisions of this section, the LLP and each of its partners will be liable to a penalty of ₹ 500 for each day of default, subject to a maximum of ₹ 50,000 for the LLP and each partner.

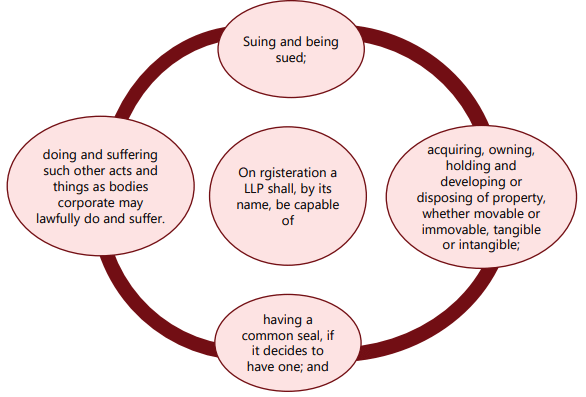

Effect of registration (Section 14):

Name of LLP

Every LLP must have "limited liability partnership" or "LLP" at the end of its name.

- The Central Government can deny a name if it is undesirable or too similar to another LLP, company, or registered trademark.

Reservation of Name

Individuals can apply to the Registrar to reserve a name for a proposed LLP or for changing an existing LLP name.

- The Registrar may reserve the name for 3 months if it meets the necessary criteria.

Changing an LLP Name

If an LLP is registered with a name that is too similar to another LLP, company, or registered trademark, it may be directed to change its name within 3 months.

- The trademark owner can apply for this change within 3 years of the LLP's incorporation or name change.

- When an LLP changes its name, it must inform the Registrar within 15 days and update its LLP agreement within 30 days.

- If the LLP fails to comply, the Central Government can assign a new name, and the Registrar will issue a new certificate of incorporation.

Differences With Other Forms of Organisation

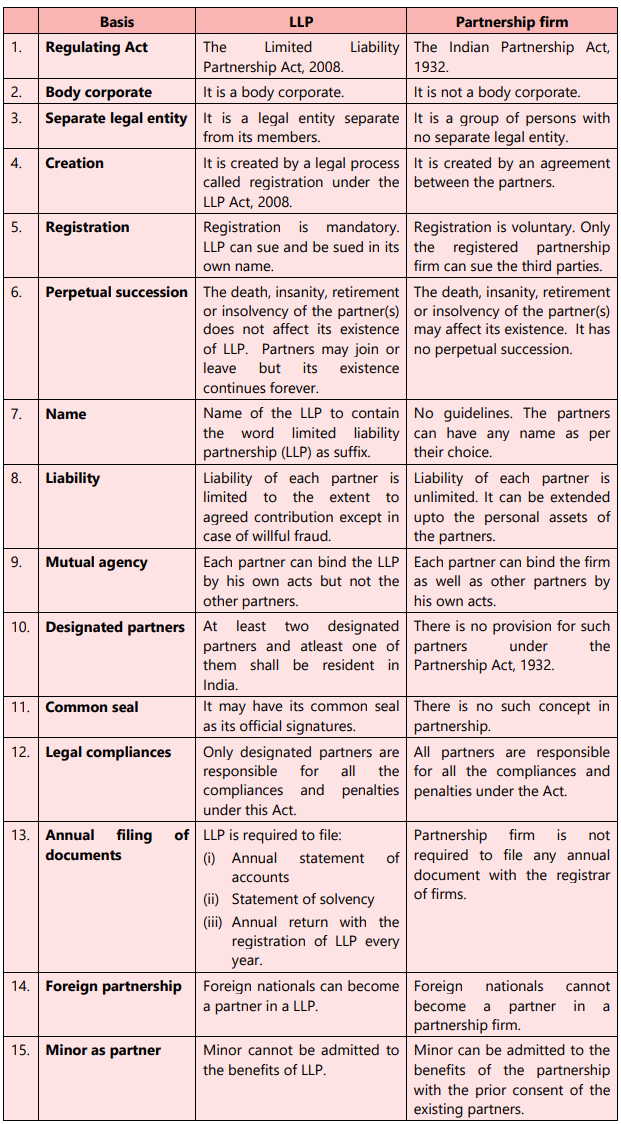

Distinction between LLP and Partnership Firm: The points of distinction between a limited liability partnership and partnership firm are tabulated as follows:

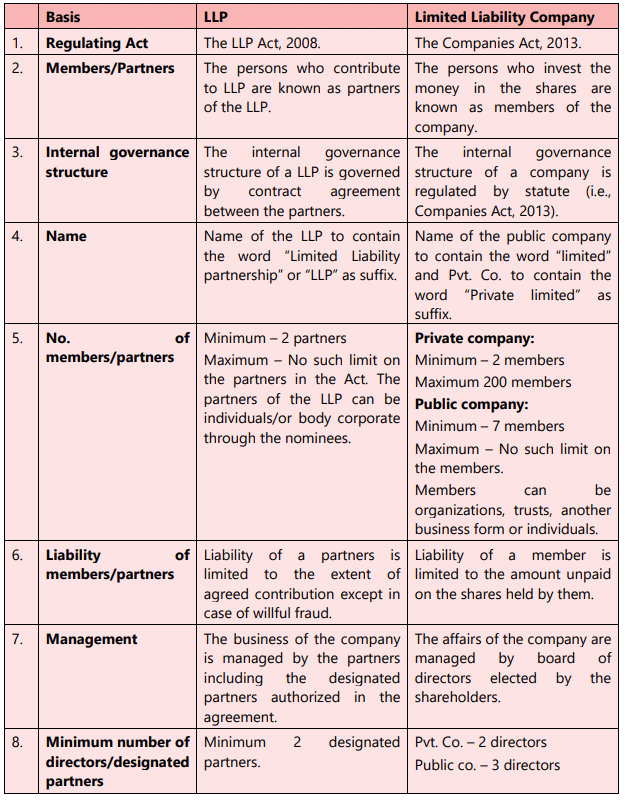

Difference between LLP and Limited Liability Company

|

51 videos|110 docs|57 tests

|

FAQs on The Limited Liability Partnership, 2008 Chapter Notes - Business Laws for CA Foundation

| 1. What is a Limited Liability Partnership (LLP) and how does it function? |  |

| 2. What are the key characteristics of an LLP? |  |

| 3. How can one incorporate an LLP? |  |

| 4. What are the differences between an LLP and a traditional partnership? |  |

| 5. What are the advantages of choosing an LLP over other business structures? |  |