Unit 1: Basic Accounting Procedures- Journal Entries - 1 Chapter Notes | Accounting for CA Foundation PDF Download

| Table of contents |

|

| Overview |

|

| Double Entry System |

|

| Advantages pf Double Entry System |

|

| Account |

|

| Debit and Credit |

|

| Transactions |

|

| Accounting Equation Approach |

|

| Traditional Approach |

|

Overview

Double Entry System

The double-entry system of accounting has a history spanning over 500 years. “Luca Pacioli,” an Italian friar and mathematician, published Summa de Arithmetica, Geometria, Proportioni, et Proportionalita (“Everything about Arithmetic, Geometry, and Proportions”), which is the first book to describe a double-entry accounting system. This method of bookkeeping has evolved through various accounting techniques. It is the only scientific approach to accounting. According to this system, every transaction has two aspects: debit and credit, both of which must be recorded in the accounts. Consequently, at least two accounts are affected in every transaction. For instance, when furniture is purchased, either the cash balance decreases or a liability to the supplier is created, while a new asset, the furniture, is acquired. This illustrates that the double-entry system captures both sides of a transaction. It can be defined as the system that recognizes and records both aspects of transactions. This system has proven to be systematic and is extremely useful for recording financial transactions for all types of entities that utilize money.Advantages pf Double Entry System

This system offers the following benefits:- The accuracy of accounting work can be verified using the trial balance.

- The profit or loss for a specific period can be determined along with detailed information.

- The financial status of the entity or institution can be assessed at the end of each period through the preparation of financial statements.

- This system allows for detailed account keeping, providing essential information for control and reporting purposes.

- Results from one year can be compared with those from previous years to identify reasons for any changes.

Given the above advantages, the double entry system is widely utilized across various countries.

Account

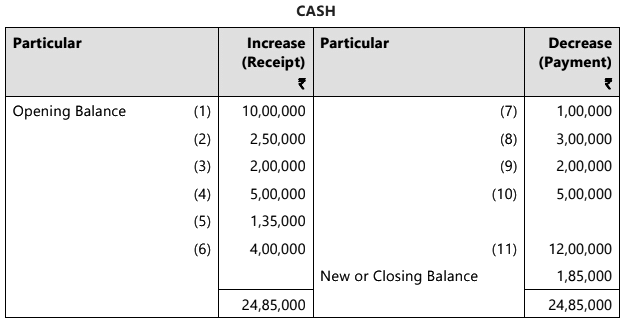

The accounting equation remains valid in all situations. For instance, if a person starts a business with ₹ 10,00,000 as capital, the cash balance will also be ₹ 10,00,000. Various transactions will affect the cash balance in two ways: some will increase the cash balance while others will decrease it. For example, cash payments for purchased goods, salaries, and rent will lower the cash balance, whereas cash sales and collections from customers will raise it.Maintaining the cash balance with each transaction could be tedious. A more efficient method would be to record all transactions that increase cash in one column and those that reduce it in another. By adding all increases to the opening cash balance and subtracting the total decreases, the closing balance can be determined. This approach provides valuable insights regarding cash flow.

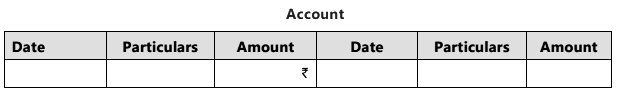

The two columns which we referred above are put usually in the form of an account, called the ‘T’ form. This is illustrated below by taking imaginary figures:

Since, each T-account shows only amounts and not transaction descriptions, we record each transaction in some way, such as by numbering used in this illustration. However, one can use date also for this purpose.

we have done is to record the increase of cash on the left hand side and the decrease on the right hand side; the closing balance has been ascertained by deducting the total of payments, ₹ 23,00,000 from the total of the left - hand side. Such a treatment of receipts and payments of cash is very convenient. Here we talked about only one account namely cash, now let us see how to make T-accounts when assets as well as liabilities are effected from a particular transaction. Now, let us take some more examples:-

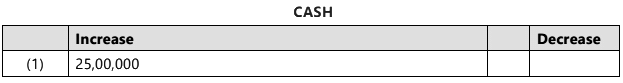

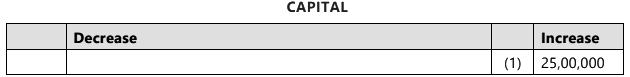

Transaction 1:

Initial investment by owners ₹ 25,00,000 in cash. This will effect two accounts namely cash and capital. The asset cash increases and the stock holders’ equity paid up capital also increases.

Transaction 2:

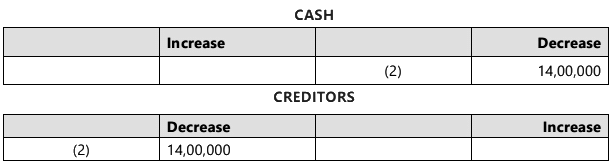

Paid cash to the creditors ₹ 14,00,000

This will effect cash account which will decrease and creditors account which is a liability will also decrease. The proper form of an account is as follows:

The proper form of an account is as follows: The columns are self-explanatory.

The columns are self-explanatory.

Debit and Credit

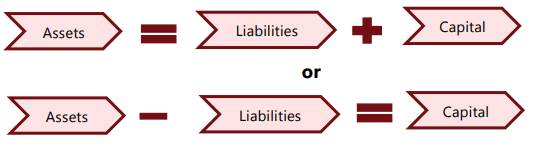

In T-accounts, increases and decreases are recorded on the left and right sides of accounts for assets, respectively, while the opposite is true for liabilities. Accountants use the terms Debit (Dr.) for entries on the left side and Credit (Cr.) for entries on the right side. By subtracting the total liabilities from the total assets, the capital amount is determined, as shown by the accounting equation.

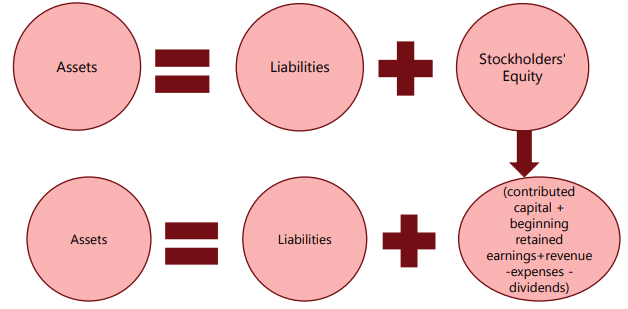

To understand the equation better, let us expand it:-

Contributed capital = the initial funds provided by the owner.

Beginning retained earnings = prior profits that have not been paid out to shareholders.

Revenue = income generated from the company's ongoing operations.

Expenses = costs associated with the company's operational activities.

Dividends = profits distributed to the company's shareholders.

We have also seen that if there is any change on one side of the equation, it is bound to be similar change on the other side of the equation or amongst items covered by it or an opposite change on the same side of the equation. This is illustrated below:

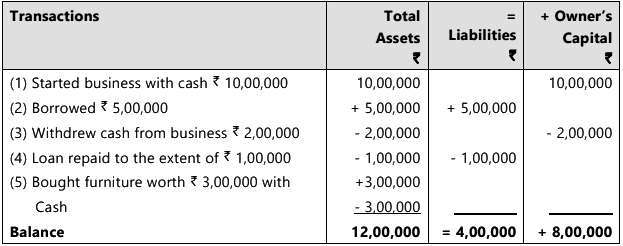

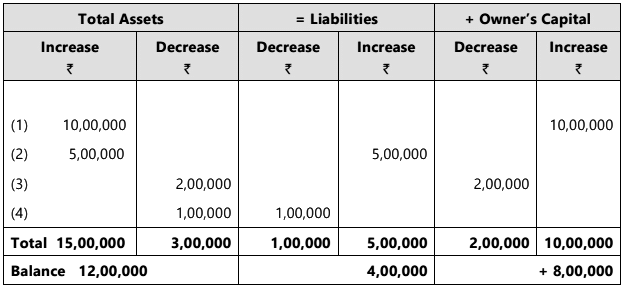

As previously noted, the method described is only effective for a limited number of transactions. For a larger volume, an alternative approach that organizes increases and decreases into separate columns will be more beneficial and provide valuable insights. The transactions mentioned earlier are presented below using this method.

It is a tradition that:

The following principles apply to accounting:

(i) Increases in assets are recorded on the left-hand side, while decreases are on the right-hand side.

(ii) For liabilities and capital, increases are recorded on the right-hand side, and decreases on the left-hand side.

When organized in a T format, the left-hand side is known as the 'debit side' and the right-hand side as the 'credit side'. Recording on the debit or left-hand side means the account is debited, whereas recording on the credit or right-hand side indicates the account has been credited.

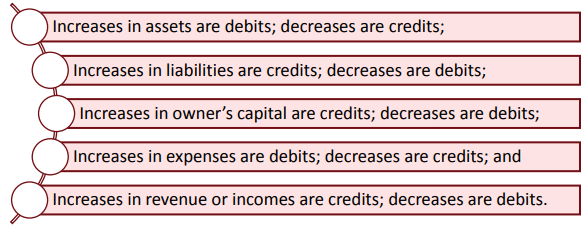

From the above, the following rules can be deduced:

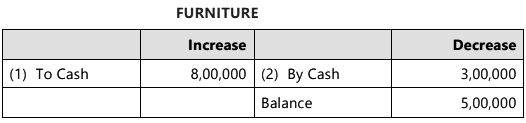

(i) An increase in an asset results in debiting its account; a decrease will lead to crediting the account. For example, if a firm buys furniture for ₹ 8,00,000, the furniture account will be debited by ₹ 8,00,000 due to the asset's increase. Conversely, if the firm later sells furniture worth ₹ 3,00,000, the reduction will be recorded by crediting the furniture account by ₹ 3,00,000.

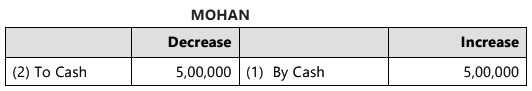

(ii) When a liability amount increases, it is recorded on the credit side of the liability account, meaning the account will be credited. Conversely, if there is a decrease in the liability amount, the liability account will be debited. For example, if a firm borrows ₹ 5,00,000 from Mohan, Mohan's account will be credited because ₹ 5,00,000 is now owed to him. Later, when the loan is repaid, Mohan's account will be debited as the liability is no longer present.

(iii) An increase in the owner's capital is noted by crediting the capital account: If the proprietor adds more capital, the capital account will be credited. Conversely, if the owner withdraws funds, referred to as making a drawing, the capital account will be debited.

(iv) Profit results in an increase in capital, while a loss causes a decrease: Following the rule outlined in (iii), profits and incomes can be directly credited to the capital account, while losses and expenses can be debited. However, it is more beneficial to record all incomes, gains, expenses, and losses separately. This practice provides valuable insights into the elements contributing to the year's profits and losses. Eventually, the net outcome of all these is calculated and adjusted in the capital account.

(v) Expenses are debited, and incomes are credited: Since incomes and gains enhance capital, the principle is to credit all gains and incomes in the respective accounts. Conversely, since expenses and losses diminish capital, the rule is to debit all expenses and losses. If there is a decrease in any income or gain, the relevant account will be debited; similarly, any decrease in an expense or loss will result in a credit to the respective account.

The rules given above are summarised below:

The terms debit and credit should not be taken to mean, respectively, favourable and unfavourable things. They merely describe the two sides of accounts.

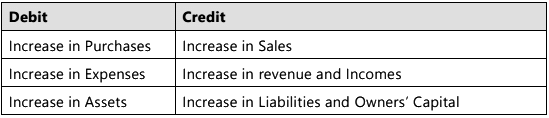

Whether an entry is to the debit or credit side of an asset depends on the type of account and the transactions

In the same way, decrease in purchases, expenses and assets are credits and decrease in sales, income, liabilities and owners’ capital are debit.

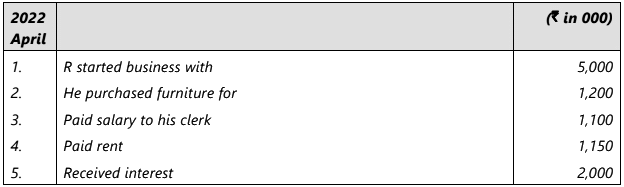

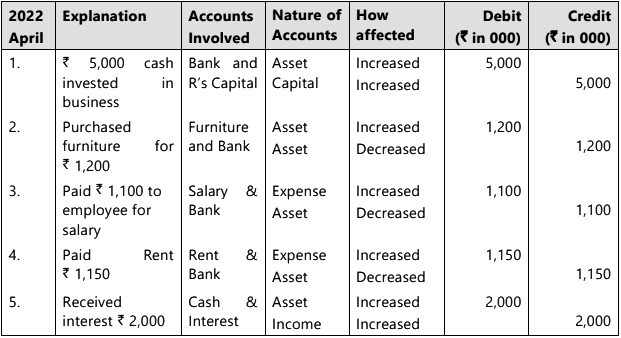

Illustration 1: Following are the transactions entered into by R after he started his business. Show how various accounts will be affected by these transactions: Sol:

Sol:

Transactions

In the bookkeeping system, students can observe that transactions are documented in the accounts. A transaction is an event, typically external, quantifiable in monetary terms. Throughout an accounting period, businesses engage in numerous transactions that are analyzed financially and recorded individually, followed by classification and summarization to assess their effect on financial statements. A transaction entails a two-way process where value is exchanged between parties. One party may receive value in the form of goods and provide value as money, or vice versa. Thus, it is evident that in a transaction, each party both receives and gives value to the other.For transaction recording, it is essential that they are backed by relevant documents such as purchase invoices, bills, payslips, cash memos, and passbooks.

Transactions evaluated in monetary terms and substantiated by appropriate documents are recorded in the books of accounts using the double entry system. To examine the dual nature of each transaction, two methodologies can be utilized:

- Accounting Equation Approach.

- Traditional Approach.

Accounting Equation Approach

The relationship between assets, liabilities, and owners' equity in equation form is referred to as the ‘Accounting Equation’. The basic accounting equation emerges when the total of capital and liabilities equals assets; assets represent what the business owns, while capital and liabilities represent what the business owes. In a double-entry system, every transaction has a dual effect on the business, influencing changes in assets, liabilities, or capital in a manner that maintains the accounting equation. This equation remains valid at all times and for any number of transactions, unless there are errors in the accounting process.For example, an individual starts a business by contributing ₹ 50,00,000 and taking a loan of ₹ 10,00,000 from a bank, repayable after 5 years. He purchases furniture for ₹ 10,00,000 and merchandise worth ₹ 50,00,000. For the merchandise, he pays ₹ 40,00,000 to the suppliers and agrees to pay the balance after 3 months.

The owner’s contribution is referred to as capital, while loans are classified as liabilities. If a loan is repayable within one year, it is deemed a short-term loan or liability. Conversely, if it is repayable after at least one year, it is classified as a long-term loan or liability.

Short-term liabilities related to credit purchases of merchandise are commonly known as trade payables, while other purchases and services received on credit are referred to as expense payables. Short-term liabilities are termed current liabilities, whereas long-term liabilities are referred to as non-current liabilities.

Additionally, the funds raised are invested in two categories of assets: fixed assets and current assets. Furniture is a fixed asset if it lasts more than one year and provides utility to the business, while inventory and cash balances are current assets, as they do not remain fixed for long once the business operations commence.

The owner's claim or fund in the business is termed equity, which implies the capital invested plus any profits earned minus any losses incurred.

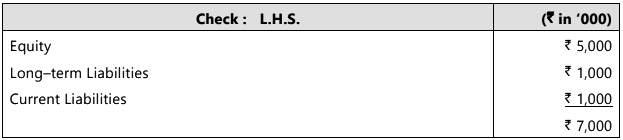

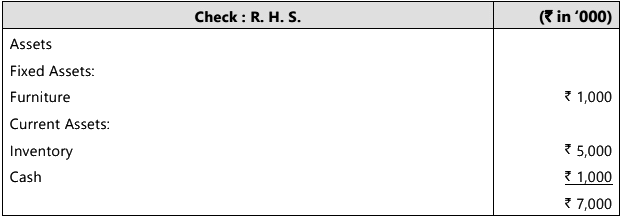

Now we have an equation:

Equity + Liabilities = Assets or, Equity + Long-Term Liabilities = Fixed Assets + Current Assets - Current Liabilities

Cash = Capital + Loan - Furniture - Payment to Trade payables (₹’ 000 )

= ₹ 5,000 + ₹ 1,000 - ₹ 1,000 - ₹ 4,000 = ₹ 1,000

Let us use E0, L0 and A0 to mean Equity, Liabilities and Assets respectively at t0. Thus the basic accounting equation becomes

E0 + L0 = A0

or E0 = A0 - L0 ...(Eq. 1)

(₹’ 000 )

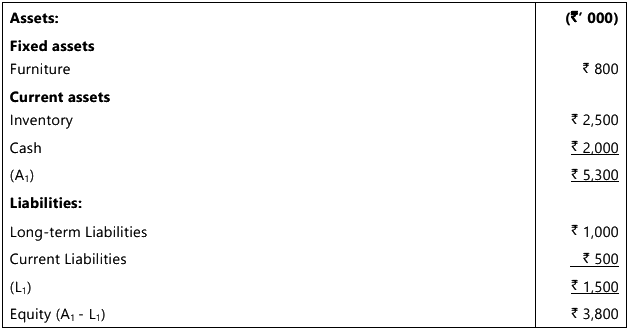

Now, let us suppose that at the end of period inventory valuing ₹ 2,500 is in hand, cash ₹ 2,000; trade payables ₹ 500; bank loan ₹ 1,000 (interest was properly paid); furniture ₹ 800 {₹ 200 is taken as loss of value due to use (also known as depreciation)}. So at t1 -

Equity = Assets - Liabilities

i.e., E1 = A1 - L1

or E1 + L1 = A1 ...(Eq. 2)

Let us compare E1 with E0. Equity is reduced by ₹ 12,00,000 (50,00,000 - 38,00,000). Reduction in equity is termed as loss incurred.

Since the business has incurred loss during the period, E1 becomes less than E0.

E1< E0 implies loss during t01

Similarly, E2 < E1 implies loss during t12 and so on.

On the other hand, E1 > E0 implies profit earned by business during t01, E2 > E1 implies profit earned during t2&1 and so on.

So if En> En-1, in general terms, equity has increased, while En< En-1 implies that equity has decreased. Increase in equity is termed as profit while decrease in equity is termed as loss.

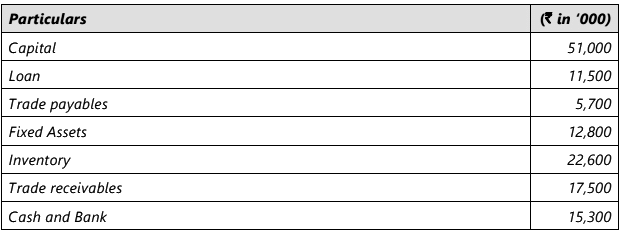

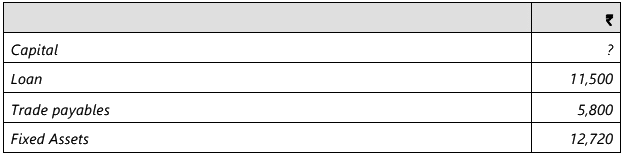

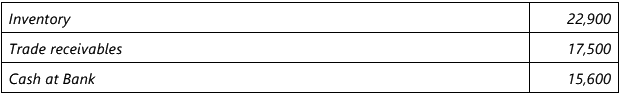

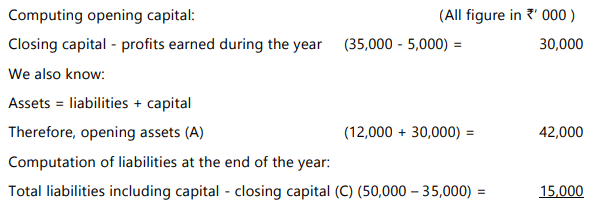

Illustration 2: Develop the accounting equation from following information available at the beginning of accounting period: At the end of the accounting period the balances appear as follows:

At the end of the accounting period the balances appear as follows:

(a) Reset the equation and find out profit.

(a) Reset the equation and find out profit.

(b) Prepare Balance Sheet at the end of the accounting period.

Sol: (All the figures in solution are in ‘000)

(a) Accounting equation is given by Equity + Liabilities = Assets

Let us use E0, L0 and A0 to mean equity, liabilities and assets respectively at the beginning of the accounting period. E0 = ₹ 51,000

L0 = Loan + Trade payables = ₹ 11,500 + ₹ 5,700 = ₹ 17,200

A0 = Fixed Assets + Inventories + Trade receivables + Cash at Bank

= ₹ 12,800 + ₹ 22,600 + ₹ 17,500 + ₹ 15,300 = ₹ 68,200

So, at the beginning of accounting period

E0 + L0 = A0

i.e., ₹ 51,000 + ₹ 17,200 = ₹ 68,200

Let us use E1, L1, A1 to mean equity, liabilities and assets respectively at the end of the accounting period.

L1 = Loan + Trade payables

= ₹ 11,500 + ₹ 5,800 = ₹ 17,300

A1 = Fixed Assets + Inventories + Trade receivables + Cash at Bank

= ₹ 12,720 + ₹ 22,900 + ₹ 17,500 + ₹ 15,600 = ₹ 68,720

E1 = A1 - L1 = ₹ 68,720 - ₹ 17,300 = ₹ 51,420

Profit = E1 - E0 = ₹ 51,420 - ₹ 51,000 = ₹ 420

(b)

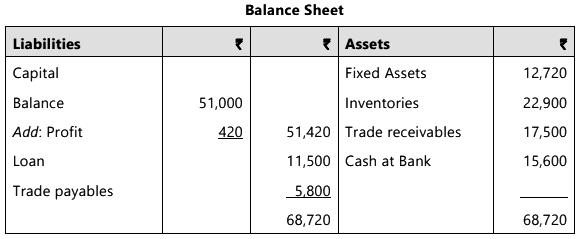

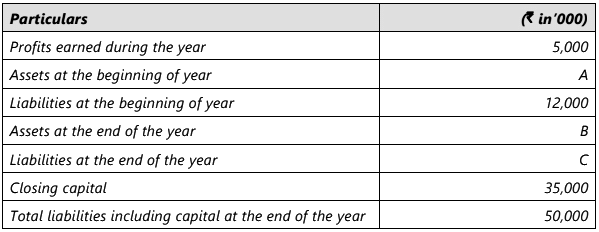

Illustration 3: Mr. Dravid. has provided following details related to his financials. Find out the missing figures: Sol:

Sol:

Also assets at the end of the year (B) = closing capital + liabilities at the end of the year

= 35,000 + 15,000 = 50,000

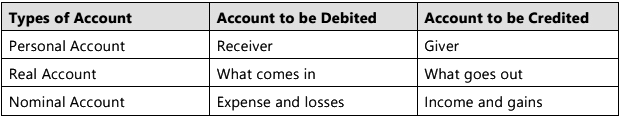

Traditional Approach

In the traditional method of recording transactions, it's essential to grasp the concepts of debit and credit along with their rules.Transactions in the journal are recorded following the rules of debit and credit. For recording purposes, these transactions are categorized into three groups:

(i) Personal transactions.

(ii) Transactions concerning assets and properties.

(iii) Transactions associated with expenses, losses, income, and gains.

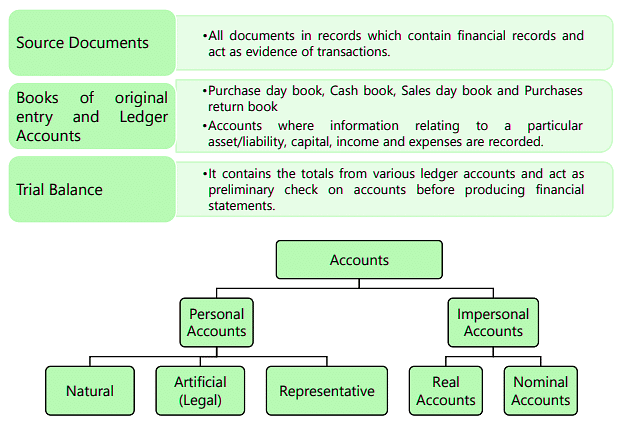

Classification of Accounts

(i) Personal Accounts: Personal accounts pertain to individuals, trade receivables, or trade payables. An example includes the account of Ram & Co., a credit customer, or the account of Jhaveri & Co., a supplier of goods. The capital account, which belongs to the proprietor, is also classified as personal, with adjustments for profits and losses made within it. This account is further divided into three categories:

- Natural personal accounts: These accounts involve transactions of individuals such as Ram, Rita, etc.

- Artificial (legal) personal accounts: For business purposes, entities are recognized as separate entities under the law for dealings with others. Examples include the Government, companies (private or limited), clubs, and cooperative societies.

- Representative personal accounts: These do not bear the name of a person or organization but are treated as personal accounts. Examples include outstanding liability accounts, prepaid accounts, capital accounts, and drawings accounts.

(ii) Impersonal Accounts: These accounts are not personal, such as machinery accounts, cash accounts, rent accounts, etc. They can be further classified as follows:

- Real Accounts: Accounts related to the firm’s assets, excluding debts. Examples include land, building, investments, and fixed deposits. Cash in hand and cash at bank accounts are also real accounts.

- Nominal Accounts: Accounts related to expenses, losses, gains, revenues, etc., such as salary accounts, interest paid accounts, and commission received accounts. The net result of all nominal accounts reflects profit or loss, which is transferred to the capital account. Nominal accounts are thus temporary.

Golden Rules of Accounting

All the above classified accounts have two rules each, one related to Debit and one related to Credit for recording the transactions which are termed as golden rules of accounting, as transactions are recorded on the basis of double entry system.

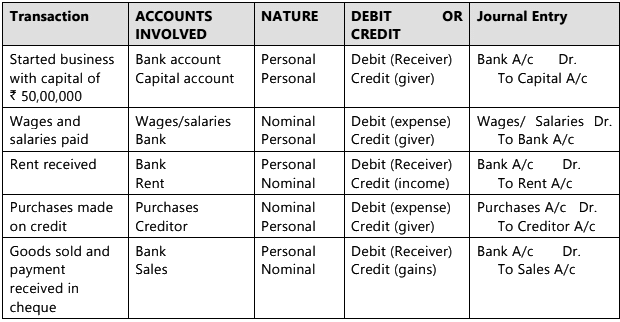

Example: From the following information, state the nature of account and state which account will be debited and which will be credited.

- Started business with a capital of ₹ 50,00,000.

- Wages and salaries paid ₹ 50,000

- Rent received ₹ 2,00,000

- Purchased goods on credit ₹ 9,00,000

- Sold goods for ₹ 8,16,000 and received payment in cheque.

Sol:

|

68 videos|265 docs|83 tests

|

FAQs on Unit 1: Basic Accounting Procedures- Journal Entries - 1 Chapter Notes - Accounting for CA Foundation

| 1. What is the Double Entry System in accounting? |  |

| 2. What are the advantages of using the Double Entry System? |  |

| 3. What is the significance of debit and credit in accounting? |  |

| 4. How does the Accounting Equation approach work in accounting? |  |

| 5. What are journal entries and why are they important in accounting? |  |