Unit 1: Introduction to Company Accounts Chapter Notes | Accounting for CA Foundation PDF Download

| Table of contents |

|

| Unit Overview |

|

| Introduction |

|

| Meaning of Company |

|

| Salient Features of a Company |

|

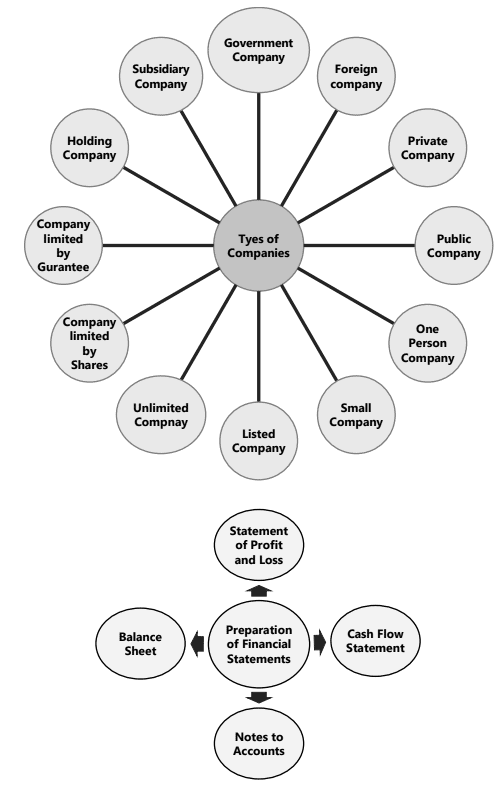

| Types of Companies |

|

| Maintenance of Books of Account |

|

| Preparation of Financial Statements |

|

Unit Overview

Introduction

- The constant human desire for growth has led to the expansion of business activities, requiring a larger scale of operations to meet the increasing demands of a growing population.

- This expansion necessitates substantial resources such as money, modern technology, and a large workforce, which are difficult to manage under partnership or proprietorship models.

- To address these challenges, the concept of a 'Company' or 'Corporation' emerged.

- The advent of steam power inspired the creation of large machines for mass production, while the need to separate management from ownership gave rise to the modern company structure.

- The company form of organisation is a remarkable innovation that allows businesses to optimise resource use and continue wealth creation activities.

- Over time, the company structure has become a crucial institutional form for business enterprises, playing a vital role in both business operations and societal wealth generation.

Meaning of Company

- The term "company" comes from the Latin words "com" (together) and "panis" (bread), originally referring to a group of people sharing food and discussing matters.

- In everyday use, a company signifies a group of individuals united for a social purpose, companionship, or fellowship.

- However, in a legal context, a company is defined as an entity formed and registered under the Companies Act, 2013, or previous company laws.

Legal Definition and Characteristics

- A company is a separate legal entity with perpetual succession, a distinct name, and a common seal. Its existence is not affected by changes in membership.

- Shareholders, who hold transferable shares, have limited liabilities and elect a board of directors to manage the company.

Corporate Jurisprudence

- Justice Marshall described a corporation as an artificial being existing only in the eyes of the law.

- Lord Justice Hanay defined a company as an artificial person created by law with perpetual succession and a common seal.

Core Concept

- A company is an association of individuals created by law for a specific purpose, with unique characteristics that allow people to invest in its capital by purchasing shares and appointing representatives to manage its affairs.

Salient Features of a Company

1. Incorporated Association:. company comes into being through the law, specifically by being incorporated under the Companies Act. Without this registration, a company cannot exist. Since it is created by law, a company is considered an artificial legal person.

2. Separate Legal Entity:. company is a separate legal entity, which means it is not affected by changes in its membership. As a distinct business entity, a company can enter into contracts, sue, and be sued in its own name and capacity.

3. Perpetual Existence:. company has an existence that is independent of its members. This means it continues to exist even if members die, become insolvent, or change.

4. Common Seal: Since a company is not a natural person, it cannot sign documents like an individual. To facilitate this, a company uses a Common Seal, which is affixed to documents by an authorized person who signs on behalf of the company. Although the Companies Act, 2013 originally required the common seal for certain documents, it is now optional. Such documents can be signed by two directors or one director and a company secretary instead. Companies in India are also required to obtain a unique Corporate Identification Number (CIN) from the Registrar of Companies.

5. Limited Liability: The liability of each shareholder in a company is limited to the amount they have agreed to pay for the shares allotted to them. If the shares are fully paid-up, the shareholder has no further liability.

6. Distinction between Ownership and Management: Due to the large number of shareholders, who may be spread across different locations, it is challenging for them to manage the company’s operations on a daily basis. This necessity leads to the separation of management and ownership in a company.

7. Not a Citizen:. company, while created by law, is not a citizen in the same way a natural person is. It has a legal existence but does not enjoy the same citizenship rights and duties as natural citizens.

8. Transferability of Shares: The capital of a company is contributed by shareholders through the purchase of shares, which are generally transferable. However, private limited companies may impose certain restrictions on the transferability of shares.

9. Maintenance of Books: By law, a limited company is required to maintain a specific set of account books. Failing to do so can result in penalties.

10. Periodic Audit: Companies must have their accounts audited regularly by chartered accountants appointed by the shareholders on the board of directors' recommendation.

11. Right of Access to Information: Shareholders have the right to inspect a company’s books of accounts, as governed by the Articles of Association. They can also seek information from directors by participating in company meetings and through periodic reports.

Types of Companies

Companies are classified into various types based on their ownership, liability, and other factors. Here are the different types of companies as per the Companies Act, 2013:- Government Company. A government company is one where at least 51% of the paid-up share capital is held by the Central Government, State Governments, or a combination of both. This includes subsidiary companies of such government entities.

- Foreign Company. A foreign company is defined as a company incorporated outside India that has a place of business in India, either physically or through electronic means, and conducts business activities in India.

- Private Company. A private company restricts the transfer of its shares, limits the number of its members to 200 (with certain exceptions), and prohibits public invitations to subscribe for its securities. Shares of a private company are not listed on stock exchanges.

- Public Company. A public company is one that is not a private company and meets the prescribed minimum paid-up share capital requirements. Public companies can be listed or unlisted, and the minimum paid-up capital requirements have been removed under the Companies Act, 2013.

- One Person Company. A one-person company is defined as a company with only one member.

- Small Company. A small company, other than a public company, has a paid-up share capital not exceeding four crores rupees (or a higher prescribed amount) and a turnover not exceeding forty crores rupees (or a higher prescribed amount). Certain companies, such as holding companies and companies registered under specific acts, are excluded from this definition.

- Listed Company. A listed company is one whose securities are listed on a recognized stock exchange. An unlisted company, on the other hand, may be a public or private company whose shares are not listed on any stock exchange.

- Unlimited Company. An unlimited company is one without any limit on the liability of its members.

- Company limited by Shares. A company limited by shares has the liability of its members limited to the amount unpaid on the shares held by them.

- Company limited by Guarantee. A company limited by guarantee has the liability of its members limited to the amount they undertake to contribute to the company's assets in the event of winding up.

- Holding Company. A holding company is one that controls one or more subsidiary companies.

- Subsidiary Company. A subsidiary company is controlled by a holding company, either through the composition of its Board of Directors or by exercising control over more than half of its share capital. Indirect control through subsidiary companies is also considered.

Maintenance of Books of Account

- According to Section 128 of the Companies Act, 2013, every company is required to maintain books of account and other relevant documents at its registered office. These records must provide an accurate and fair representation of the company's financial situation for each financial year, including details from any branch offices. The accounting records should follow the accrual basis and the double entry system.

- Additionally, the company is permitted to maintain these books and relevant documents in electronic format as specified by the applicable regulations.

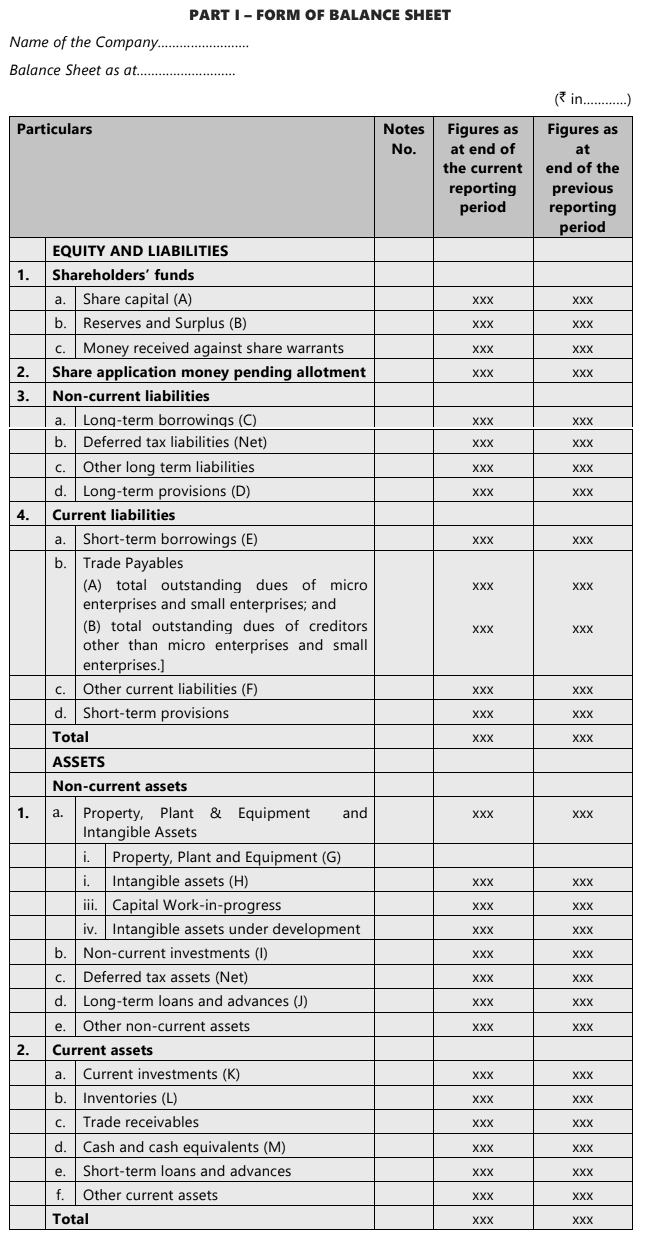

Preparation of Financial Statements

According to Section 129 of the Companies Act, 2013, financial statements must present a true and fair view of the company's situation, comply with accounting standards, and follow the prescribed formats in Schedule III. The Board of Directors is responsible for presenting these statements at the annual general meeting.

Financial statements include:

- Balance sheet

- Profit and loss account or income and expenditure account

- Cash flow statement

- Statement of changes in equity (if applicable)

- Explanatory notes

One Person Companies, small companies, and dormant companies may omit the cash flow statement.

Requisites of Financial Statements

- Financial statements must provide a true and fair view of the company's state of affairs at the end of the financial year.

Provisions Applicable

- Specific Act is applicable: Certain companies, such as insurance companies, banking companies, electricity generation or supply companies, and other classes of companies with prescribed forms under their governing acts, must follow specific regulations for their financial statements.

- Schedule III to the Companies Act, 2013: This schedule outlines the format for financial statements and is applicable to all corporate entities.

Divisions of Schedule III:

- Division I: Applicable to companies required to apply Accounting Standards notified under the Companies Act, 2013.

- Division II: Applicable to companies required to apply Indian Accounting Standards notified under the Companies Act, 2013.

- Division III: Applicable to Non-Banking Finance Companies (NBFCs) required to apply Indian Accounting Standards notified under the Companies Act, 2013.

Financial Statements and their Components

1. Balance Sheet:. snapshot of the company's financial position at the end of the financial year, showing assets, liabilities, and equity.

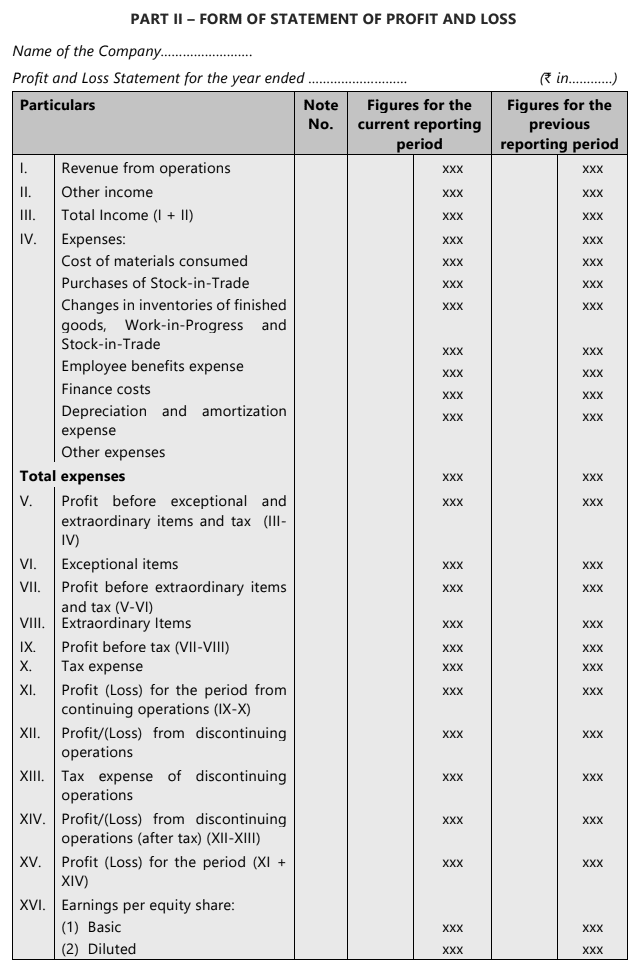

2. Profit and Loss Account:. statement summarizing the company's revenues, expenses, and profits or losses for the financial year. Non-profit companies would use an income and expenditure account instead.

3. Cash Flow Statement: This statement provides details about the cash inflows and outflows during the financial year. However, it is not mandatory for One Person Companies, small companies, and dormant companies.

4. Statement of Changes in Equity: This statement outlines the changes in the company's equity during the financial year, if applicable.

5. Explanatory Notes: These are notes that provide additional information and context to any of the documents mentioned above.

- Division I: Companies applying Accounting Standards.

- Division II: Companies applying Indian Accounting Standards.

- Division III: Non-Banking Finance Companies (NBFCs) applying Indian Accounting Standards.

The paper of accounting at Foundation level incorporates fundamentals of accounting and accounting of non-corporate entities and corporate entities. At foundation level, students are expected to understand the format of financial statements of corporate entities prepared as per Accounting Standards. Therefore, the format of financial statements as per Division I of Schedule III to the Companies Act, 2013 has been given below:

Certain items are to be explained as follows (list not exhaustive):

The balance sheet is a crucial financial statement that provides a snapshot of a company's financial position at a specific point in time. It lists the company's assets, liabilities, and shareholders' equity, following the accounting equation: Assets = Liabilities + Shareholders' Equity.

The balance sheet is typically organized into two main sections: Assets and Liabilities & Shareholders' Equity. Assets are further classified into non-current and current assets, while liabilities are divided into non-current and current liabilities. Shareholders' equity includes share capital, reserves and surplus, and other equity items.

The balance sheet is prepared in accordance with the relevant accounting standards and regulations, ensuring that it presents a true and fair view of the company's financial position. It is an essential tool for investors, creditors, and other stakeholders to assess the company's financial health and make informed decisions.

1. Share Capital

a. Authorized Share Capital. This refers to the total number of shares that a company is authorized to issue as per its constitutional documents. It includes the following details:

- Number of shares authorized

- Amount of share capital authorized

b. Issued, Subscribed, and Paid-up Shares. This section provides information on the shares that have been issued, subscribed, and paid-up, including:

- Number of shares issued, subscribed, and fully paid

- Number of shares issued, subscribed but not fully paid

c. Par Value per Share. The par value, also known as the face value, is the nominal value of each share as stated in the company’s articles of association.

d. Reconciliation of Shares Outstanding. This involves reconciling the number of shares outstanding at the beginning and end of the reporting period, providing a clear picture of changes in share capital during the period.

e. Calls Unpaid. This refers to any amounts due on shares that have been called but not yet paid by shareholders.

f. Forfeited Shares. This section includes details of shares that have been forfeited due to non-payment of calls or other reasons, along with the reasons for forfeiture.

2. Reserves and Surplus

Reserves and surplus can be distributed among the following sub-heads:

- Capital reserves

- Capital redemption reserves

- Securities Premium

- Debenture Redemption reserve

- Revaluation reserve

- Surplus. the balance as per profit and loss statement

- Other reserves (specify the nature and purpose)

3. Long-Term Borrowings

Long-term borrowings can be classified under the following sub-heads:

- Bonds/Debentures

- Term loans

- Deferred payment liabilities

- Deposits

- Long-term maturities of finance lease obligations

- Loans and advances from related parties

- Other loans and advances (specify nature)

4. Long-Term Provisions

This can be classified as follows:

- Employee benefits provision like gratuity, provident fund, etc.

- Other provisions (specify the nature)

5. Short-Term Borrowings

Short-term borrowings can be classified among the following sub-heads:

- Loans repayable on demand

- Loans and advances from related parties

- Deposits

- Other loans and advances (specify the nature)

- Current maturities of long-term borrowings shall be disclosed separately.

6. Other Current Liabilities

Some of the other current liabilities can be grouped as under:

- Current maturities of finance lease obligations

- Interest accrued but not/and due on borrowings

- Income received in advance

- Unpaid dividends

- Application money received for allotment of securities and due for refund and interest accrued thereon

- Other current liabilities (specify the nature)

7. Property, Plant and Equipment

Property, Plant and Equipment can be classified as follows:

- Land

- Buildings

- Plant and Equipment

- Furniture and Fixtures

- Vehicles

- Office equipment

- Others (specify the nature)

A detailed report showing additions, disposals, acquisitions through business combinations, and other adjustments, along with amounts related to depreciation, impairment losses, revaluation, etc., should be provided for each class of asset.

8. Intangible Assets

Intangible assets can be classified as follows:

- Goodwill

- Brands/trademarks

- Computer software

- Mining rights

- Mastheads and Publishing titles

- Copyrights, patents, and other intellectual property rights, services, and operating rights.

- Licence and franchise

- Recipes, models, designs, formulae, and prototypes

- Others (specify the nature)

A detailed report showing additions, disposals, acquisitions through business combinations, and other adjustments, along with amounts related to depreciation, impairment losses, revaluation, etc., should be provided for each class of asset.

9. Non-Current Investments

Investments can be classified as under:

- Investments in property

- Investments in Equity instruments

- Investments in Preference shares

- Investments in Governments or trust securities

- Investments in debentures or bonds

- Investments in Mutual funds

- Investments in partnership firms

- Other non-current investments (specify the nature)

10. Long-Term Loans and Advances

It can be classified under the following sub-groups:

- Capital advances

- Loans and advances to related parties

- Other loans and advances (specify nature)

The above shall also be sub-classified as follows:

- Secured, considered good

- Unsecured, considered good

- Doubtful

11. Current Investments

It can be classified as follows:

- Investments in equity instruments

- Investments in preference shares

- Investments in Government or trust securities

- Investments in bonds or debentures

- Investments in Mutual funds

- Investments in partnership firms

- Other investments (specify the nature)

12. Inventories

Inventories can be classified as:

- Raw materials

- Work-in-progress

- Stores and spares

- Finished goods

- Loose tools

- Stock in trade

- Goods in transit

- Others (specify the nature)

13. Cash and Cash Equivalents

The following head can be classified as follows:

- Balances with banks

- Cheques, drafts in hand

- Cash in hand

- Others (specify the nature)

|

68 videos|265 docs|83 tests

|