Unit 2: Accounting Concepts, Principles and Conventions - 1 Chapter Notes | Accounting for CA Foundation PDF Download

| Table of contents |

|

| Introduction |

|

| Accounting Concepts |

|

| Accounting Principles |

|

| Accounting Conventions |

|

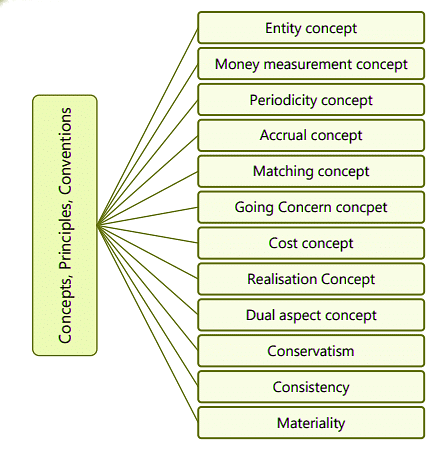

| Concepts, Principles And Conventions - An Overview |

|

Introduction

- Imagine a scenario where you, as a business owner, provide your accounting records to five different accountants, asking them to prepare financial statements and calculate the business's profit for the year. After a few days, each accountant presents a different profit figure, with significant discrepancies among them. In such a situation, you would likely have a negative impression of the accounting profession. To prevent this issue, a set of generally accepted rules has been established. These rules create a unified understanding and approach in accounting practices, leading to improved preparation and presentation of financial statements.

- Accounting serves as the language of business. The financial statements prepared by accountants convey important financial information to various stakeholders for decision-making purposes. Therefore, it is essential that financial statements from different organizations are prepared uniformly and that consistency is maintained over time. If each accountant were to apply their own norms and interpretations to different items, it would lead to significant confusion.

- To avoid this confusion and to achieve uniformity, the accounting process operates within the conceptual framework of 'Generally Accepted Accounting Principles' (GAAPs). GAAPs refer to the rules developed for preparing financial statements, encompassing concepts, conventions, postulates, and principles. These GAAPs form the foundation of the accounting information system, which would be unstable without them. Accounting principles are the fundamental norms and assumptions that underpin the entire accounting framework. Accountants also follow various accounting standards issued by regulatory authorities to standardize the accounting policies applicable in specific situations. This conceptual framework, along with GAAPs and accounting standards, constitutes the theoretical basis of accounting. On a global scale, countries adopt the framework of International Financial Reporting Standards (IFRS) to achieve standardization. However, countries may also implement their respective GAAPs and associated conceptual frameworks. For instance, in India, companies must adhere to Accounting Standards (AS) or Indian Accounting Standards (Ind-AS) as relevant.

Accounting Concepts

Accounting concepts outline the assumptions upon which a business entity's financial statements are created. These concepts are recognized, assumed, and accepted in accounting to provide a cohesive framework and internal logic for the accounting process. The term concept refers to an idea or notion that has universal relevance. Financial transactions are analyzed through the lens of the concepts that guide accounting methods. Concepts represent fundamental assumptions and conditions that establish the foundation of accountancy. Unlike physical sciences, accounting concepts arise from a broad consensus. These accounting concepts serve as the groundwork for the formulation of accounting principles.Accounting Principles

Accounting principles are a body of doctrines commonly associated with the theory and procedures of accounting serving as an explanation of current practices and as a guide for selection of conventions or procedures where alternatives exist.”Accounting principles must satisfy the following conditions:

- They should be based on real assumptions;

- They must be simple, understandable and explanatory;

- They must be followedconsistently;

- They should be able to reflect future predictions;

- They should be informational for the users

Accounting Conventions

Accounting conventions arise from accounting practices, often referred to as accounting principles, that various organizations adopt over time. These conventions develop through usage and practice. Accounting bodies globally may modify any convention to enhance the quality of accounting information. It is important to note that accounting conventions do not require universal application.In the study material, the terms ‘accounting concepts’, ‘accounting principles’, and ‘accounting conventions’ are used interchangeably to denote the fundamental agreements that underpin financial accounting theory and practice.

Concepts, Principles And Conventions - An Overview

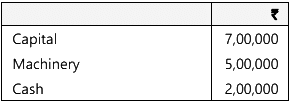

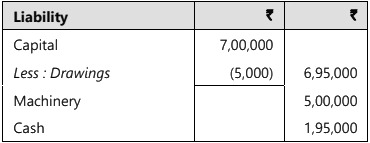

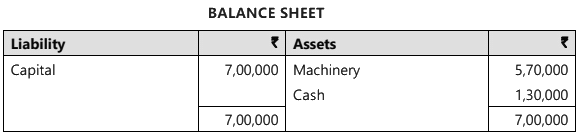

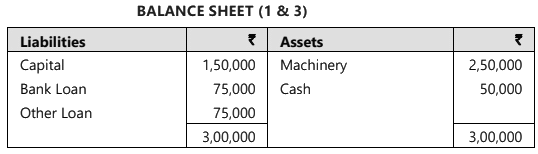

Entity Concept: The entity concept asserts that a business enterprise operates as a distinct identity separate from its owner. Accountants must treat the business independently from the owner. Business transactions are recorded in the business's accounting records, while the owner's personal transactions are documented separately. This practice of differentiating business affairs from personal affairs began in the early stages of double-entry bookkeeping. The concept allows for a clear separation of business operations from the owner's personal matters, applicable to all types of organizations, whether sole proprietorships, partnerships, or corporations. It aids in determining the amount owed to the owner in terms of capital and share of profits earned, and it facilitates accounting from the business's perspective rather than the owner's. For instance, if an individual who runs a business pays his son's school fees from personal funds, this transaction is not recorded in the business's books. Conversely, if the individual withdraws funds from the business to pay for the school fees, it is recorded as an amount withdrawn by the owner. The entity concept also means that the enterprise owes the owner for the capital investment made, often referred to as risk capital, granting the owner a claim on the enterprise's profits. Any portion of profits allocated to the owner that becomes immediately payable is classified as a current liability in corporate entities.Example 1: Mr. X started business investing ₹ 7,00,000 with which he purchased machinery for ₹ 5,00,000 and maintained the balance in hand. The financial position of the will be as follows: This means that the enterprise owes to Mr. X ₹ 7,00,000. Now if Mr. X spends ₹ 5,000 to meet his family expenses from the business fund, then it should not be taken as business expenses and would be charged to his capital account (i.e., his investment would be reduced by ₹ 5,000). Following the entity concept the revised financial position would be

This means that the enterprise owes to Mr. X ₹ 7,00,000. Now if Mr. X spends ₹ 5,000 to meet his family expenses from the business fund, then it should not be taken as business expenses and would be charged to his capital account (i.e., his investment would be reduced by ₹ 5,000). Following the entity concept the revised financial position would be

(b) Money Measurement Concept: According to this concept, only those transactions that can be quantified in monetary terms are recorded. Money serves as the medium of exchange and the standard for economic value, thus necessitating that only transactions measurable in money be recorded in accounting books. Events that materially impact business results but cannot be expressed in monetary terms are excluded from the records.

For instance, if a business owns a factory on an acre of land, an office building with 2 floors, 20 computers, and 10 machines, these items must be represented in monetary terms. The factory might be valued at ₹50 Cr, the land at ₹30 Cr, the building at ₹15 Cr, computers at ₹10 lac, and machines at ₹10 Cr, all of which must be recorded.

However, this concept has limitations. Transactions and events that cannot be expressed in monetary terms are excluded from business records. For example, while employees are assets of the organization, their value cannot be quantified in monetary terms, hence they are not recorded in the books. The currency of the ruling country serves as the measurement unit for money, providing a common basis for valuing material objects.

When transactions occur across country borders, multiple currencies may be involved. For example, if a businessman sells goods worth ₹50 lakhs domestically and goods worth 1 lakh Euro in the United States, the sales total is ₹50 lakhs plus 1 lakh Euro. Since these cannot be directly combined arithmetically, uniformity in monetary units is necessary. Assuming EURO 1 = ₹71, the total sales would amount to ₹50 lakhs plus ₹71 lakhs, resulting in ₹121 lakhs. The Money Measurement Concept allows for flexibility in the measurement and interpretation of accounting data.

This concept overlooks the fact that money is an inelastic measure, based on the assumption that the purchasing power of money does not require adjustment. For instance, a unit of land bought 10 years ago for ₹40 Cr and a similar unit bought now for ₹90 Cr would still be recorded at their respective values, totaling ₹130 Cr, whereas their true combined value might be ₹180 Cr (90 + 90). Thus, accounting does not always reflect a true and fair view of business affairs.

As previously noted, many significant transactions and events are not recorded simply because they cannot be expressed in monetary terms. Nevertheless, this concept is utilized in accounting as no better measurement scale exists. Both entity and money measurement are fundamental concepts upon which other procedural concepts are based.

(c) Periodicity Concept: Also known as the definite accounting period concept, this asserts that an indefinite lifespan of an entity is assumed under the going concern principle. For a business, it is impractical to measure performance solely at the end of its life.

For example, if a textile mill operates for 100 years, measuring its performance only at the end would be inefficient. Therefore, a manageable time fraction is selected for performance measurement and financial assessment. Typically, a one-year period is used, although it can also be 6, 9, or 15 months.

This concept dictates that accounts should be prepared periodically rather than only at the end of an entity's life. Generally, this period spans from April 1 to March 31 of the following year. Consequently, it is unnecessary to analyze revenue and expenses over an excessively long timeframe. This concept enhances the accounting system's functionality and makes the term ‘accrual’ relevant. Without a defined time frame, accruals would not exist; expenses cannot be unpaid nor revenues unreceived.

Thus, the periodicity concept aids in:

(i) Comparing financial statements across different periods.

(ii) Ensuring uniform and consistent accounting treatment for determining business profit and assets.

(iii) Matching periodic revenues with expenses to derive accurate results of business operations.

(d) Accrual Concept: Under the accrual concept, the effects of transactions and other events are recognized on a mercantile basis, meaning they are recorded when they occur, rather than when cash or cash equivalents are received or paid. These transactions are documented in accounting records and reflected in the financial statements of the relevant periods.

Financial statements prepared on an accrual basis inform users not only of past cash transactions but also of future cash obligations and resources representing cash to be received later.

To understand accrual assumption knowledge of revenues and expenses is required. Revenue is the gross inflow of cash, receivables and other consideration arising in the course of the ordinary activities of an enterprise from sale of goods, from rendering services and from the use by others of enterprise’s resources yielding interest, royalties and dividends.

For example, (1) Mr. X started a cloth merchandising. He invested ₹ 50,000, bought merchandise worth ₹ 50,000. He sold such merchandise for ₹ 60,000. Customers paid him ₹ 50,000 cash and assure him to pay ₹ 10,000 shortly. His revenue is ₹ 60,000. It arose in the ordinary course of cloth business; Mr. X received ₹ 50,000 in cash and ₹ 10,000 by way of receivables.

Take another example; (2) an electricity supply undertaking supplies electricity spending ₹ 16,00,000 for fuel and wages and collects electricity bill in one month ₹ 20,00,000 by way of electricity charges. This is also revenue which arose from rendering services.

Lastly, (3) Mr. A invested ₹ 1,00,000 in a business. He purchased a machine paying ₹ 1,00,000. He rented it for ₹ 20,000 annually to Mr. B. ₹ 20,000 is the revenue of Mr. A; it arose from the use PG the enterprise’s resources.

Expense is a cost relating to the operations of an accounting period or to the revenue earned during the period or the benefits of which do not extend beyond that period. In the first example, Mr. X spent ₹ 50,000 to buy the merchandise; it is the expense of generating revenue of ₹ 60,000.

In the second instance ₹ 16,00,000 are the expenses. Also whenever any asset is used it has a finite life to generate benefit. Suppose, the machine purchased by Mr. A in the third example will last for 10 years only. Then ₹ 10,000 is the expense every year relating to the cost of machinery.

Accrual means recognition of revenue and costs as they are earned or incurred and not as money is received or paid. The accrual conceptrelates to measurement of income, identifying assets and liabilities.

Example: Mr. J D buys clothing of ₹ 50,000 paying cash ₹ 20,000 and sells at ₹ 60,000 of which customers paid only ₹ 50,000.

His revenue is ₹ 60,000, not ₹ 50,000 cash received. Expense (i.e., cost incurred for the revenue) is ₹ 50,000, not ₹ 20,000 cash paid. So the accrual concept based profit is ₹ 10,000 (Revenue – Expenses).

As per Accrual Concept: Revenue – Expenses = Profit

Accrual Concept provides the foundation on which the structure of present-day accounting has been developed.

Alternative as per Cash basis Cash received in ordinary course of business – Cash paid in ordinary course of business = profit.

Timing of revenue and expense booking could be different from cash receipt or paid.

(i) when cash received before revenue is booked - a liability is created when cash is received in advance

(ii) when cash received after revenue is booked - an asset called Trade receivables is created

(iii) when cash paid before expense is booked - creates an asset called Trade Advance when cash is paid in advance

(iv) when cash paid after expense is booked - creates a liability called payables or Trade payables or outstanding liabilities

(e) Matching concept:

- The concept states that all expenses associated with the revenue of a specific period should be considered. In the financial statements of an organization, if any revenue is recognized, the expenses incurred to earn that revenue should also be recognized.

- This concept is rooted in the accrual principle, which emphasizes the recognition of expenses and income regardless of the actual cash flow. This necessitates adjustments for items such as prepaid and outstanding expenses, as well as unearned or accrued income.

- Not all expenses correspond to every income. Some expenses are directly tied to revenue, while others are based on time. For instance, selling expenses are directly related to sales, whereas rent and salaries are recorded on an accrual basis for a specific accounting period. In essence, the periodicity concept is also applied alongside the matching concept.

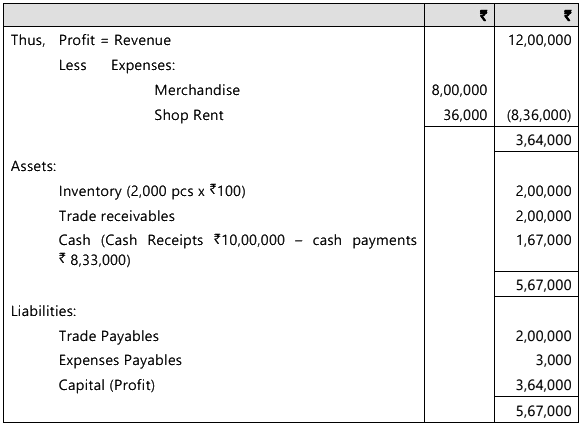

Mr. P K started cloth business. He purchased 10,000 pcs. garments @ ₹ 100 per piece and sold 8,000 pcs. @ ₹ 150 per piece during the accounting period of 12 months 1st January to 31st December, 2022. He paid shop rent @ ₹ 3,000 per month for 11 months and paid ₹ 8,00,000 to the suppliers of garments and received ₹ 10,00,000 from the customers.

Let us see how the accrual and periodicity concepts operate.

Periodicity Concept fixes up the time-frame for which the performance is to be measured and financial position is to be appraised. Here, it is January 2022 - December, 2022. Therefore, revenues and expenses are to be measured for the year 2022 and assets and liabilities are to be ascertained as on 31st December, 2022.

Accrual Concept operates to measure revenue of ₹ 12,00,000 (arising out of sale of garments 8,000 Pcs × ₹ 150) which accrued during 2022, not the cash received ₹ 10,00,000 and also the expenses correctly. Shop rent for 12 months is an expense item amounting to ₹ 36,000, not ₹ 33,000 the cash paid.

Should the accountant treat ₹ 10,00,000 as expenses for purchase of merchandise? And should he treat ₹ 1,64,000 as profit? (Revenue ₹ 12,00,000-Merchandise ₹ 10,00,000. Shop Rent ₹ 36,000). Obviously, the answer is No. Matching links revenue with expenses.

Revenue – Expenses = Profit

But this unqualified equation may create misconception.

It should be defined as: Periodic Profit = Periodic Revenue – Matched Expenses

From the revenue of an accounting period such expenses are deducted which are expended to generate the revenue to determine profit of that period.

In the given example revenue relates to only sale of 8,000 pcs. of garments. Therefore, the cost of 8,000 pcs of garments should be treated as expenses.

Thus, accrual, matching and periodicity concepts work together for income measurement and recognition of assets and liabilities.

(f) Going Concern concept:

- The financial statements are normally prepared on the assumption that an enterprise is a going concern and will continue in operation for the foreseeable future.

- Hence, it is assumed that the enterprise has neither the intent nor the need to liquidate or curtail materially the scale of its operations;

- If such an intention or need exists, the financial statements may have to be prepared on a different basis and, if so, the basis used needs to be disclosed.

- The valuation of assets of a business entity is dependent on this assumption.

- Traditionally, accountants follow historical cost in the majority of the cases.

Suppose Mr. X purchased a machine for his business paying ₹ 5,00,000 out of ₹ 7,00,000 invested by him. He also paid transportation expenses and installation charges amounting to ₹ 70,000. If he is still willing to continue the business, his financial position will be as follows:

If he chooses to withdraw and wants to sell the machine, it could be valued at either more or less than ₹ 5,70,000. Therefore, his financial situation might differ. According to the going concern concept, any short-term increase or decrease in asset value is disregarded. This principle suggests that assets are held for future benefits, not for immediate sale; thus, current fluctuations in asset value are not realizable and should not be considered.

This can be illustrated with examples from real life. For instance, during the pandemic, numerous businesses faced shutdowns due to significant losses. If the financial statements of these companies do not disclose the risk of winding up due to losses, it could mislead stakeholders. A sudden announcement of a business closure could be detrimental to those stakeholders.

Consequently, companies must evaluate their ability to continue operations when preparing financial statements. If there are doubts about the going concern assumption, this information should be clearly communicated to stakeholders.

(g) Cost concept: The value of an asset is determined based on historical cost, or acquisition cost. Although there are various measurement bases, accountants traditionally favor this concept for the sake of objectivity. For instance, if a machine is acquired for ₹ 5,00,000, the value of the machine, according to the cost concept, is recorded as ₹ 5,00,000. This approach is highly objective and free from bias. Other measurement bases lack this level of objectivity. Determining the current cost of an asset can be challenging; for example, if the asset was purchased on 1.1.1995 and the model is no longer available in the market, identifying an equivalent model becomes difficult. Similarly, unless the machine is sold, realizable value provides only a hypothetical figure. Lastly, the present value base is very subjective, as assessing an asset's value requires predicting uncertain future outcomes.

However, the cost concept creates a lot of distortion too as outlined below:

- In an inflationary situation when prices of all commodities go up on an average, acquisition cost loses its relevance. For example, a piece of land purchased on 1.1.1995 for ₹ 2,000 may cost ₹ 1,00,000 as on 1.1.2022. So if the accountant makes valuation of asset at historical cost, the accounts will not reflect the true position.

- Historical cost-based accounts may lose comparability. Mr. X invested ₹ 1,00,000 in a machine on 1.1.1995 which produces ₹ 50,000 cash inflow during the year 2022, while Mr. Y invested ₹ 5,00,000 in a machine on 1.1.2005 which produced ₹ 50,000 cash inflows during the year. Mr. X earned at the rate 50% while Mr. Y earned at the rate 10%. Who is more efficient? Since the assets are recorded at the historical cost, the results are not comparable. Obviously, it is a corollary to (a).

- Many assets do not have acquisition costs. Human assets of an enterprise are an example. The cost concept fails to recognise such asset although it is a very important asset of any organization. Many other controversial issues have arisen in financial accounting that revolves around the cost concept which will be discussed at the advanced stage. However, later on we shall see that in many circumstances, the cost convention is not followed. See conservatism concept for an example, which will be discussed later on in this unit.

(h) Realisation concept:

The cost concept is closely adhered to, stating that any asset value change should be recorded only upon realization. For instance, if an asset is recorded at its historical cost of ₹ 5,00,000, its current cost of ₹ 15,00,000 is not recognized until there is certainty of realization.

Accountants tend to adopt a conservative approach, accounting for all probable losses but disregarding any potential gains. In other words, anticipated decreases in value are recorded, while increases in value are ignored until they are realized. Economists criticize the realization concept, arguing that it leads to value distortion and renders accounting ineffective.

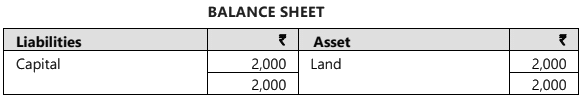

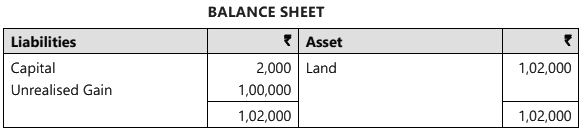

Example: Mr. X purchased a piece of land on 1.1.1995 paying ₹ 2,000. Its current market value is ₹ 1,02,000 on 31.12.2022. Should the accountant show the land at ₹ 2,000 following cost concept and ignoring ₹1,00,000 value increase since it is not realised? If he does so, the financial position would be: Is it not proper to show it in the following manner?

Is it not proper to show it in the following manner?

Now-a-days the revaluation of assets has become a widely accepted practice when the change in value is of permanent nature. Accountants adjust such value change through creation of revaluation (capital) reserve. Thus, the going concern, cost concept and realization concept gives the valuation criteria.

(i) Dual aspect concept:

This concept is fundamental to double entry bookkeeping. Each transaction or event has two sides:

- It raises one Asset and lowers another Asset;

- It raises an Asset while simultaneously increasing Liability;

- It lowers one Asset and raises another Asset;

- It lowers one Asset and reduces a Liability. Alternatively:

- It raises one Liability and decreases another Liability;

- It raises a Liability and increases an Asset;

- It decreases Liability while raising another Liability;

- It reduces Liability and decreases an Asset.

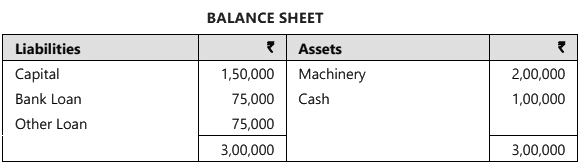

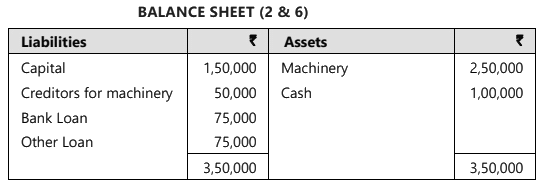

Example:

Transactions:

(a) A new machine is purchased paying ₹ 50,000 in cash.

(b) A new machine is purchased for ₹ 50,000 on credit, cash is to be paid later on.

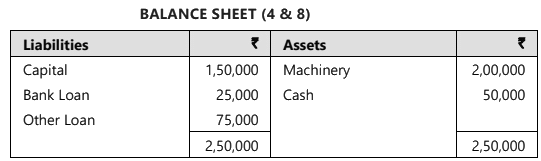

(c) Cash paid to repay bank loan to the extent of ₹ 50,000.

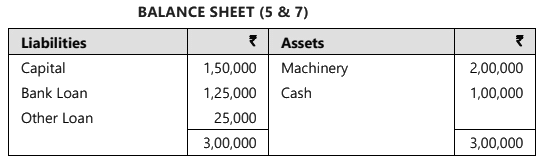

(d) Raised bank loan of ₹ 50,000 to pay off other loan.

Effect of the Transactions:

(a) Increase in machine value and decrease in cash balance by ₹ 50,000.

(b) Increase in machine value and increase in Creditors by ₹ 50,000.

(c) Decrease in bank loan and decrease in cash by ₹ 50,000.

(d) Increase in bank loan and decrease in other loan by ₹ 50,000.

We may conclude that every transaction and event has two aspects. This gives basic accounting equation :

Equity (E) + Liabilities (L) = Assets (A)

or

Equity (E)= Assets (A) – Liabilities(L)

Or, Equity + Long Term Liabilities + Current Liabilities = Fixed Assets + Current Assets

Or, Equity + Long Term Liabilities = Fixed Assets + (Current Assets – Current Liabilities)

Or, Equity = Fixed Assets + Working Capital – Long Term Liabilities

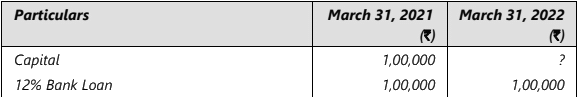

Illustration 1

Develop the accounting equation from the following information: -

Required

Required

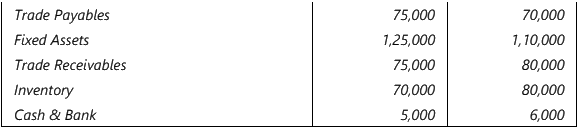

Find the profit for the year & the Balance sheet as on 31/3/2022.

Sol:

For the year ended March 31, 2021:

Equity = Capital ₹ 1,00,000

Liabilities = Bank Loan + Trade Payables

₹ 1,00,000 + ₹ 75,000 = ₹ 1,75,000

Assets = Fixed Assets + Trade Receivables + Inventory + Cash & Bank

₹ 1,25,000 + ₹ 75,000 + ₹ 70,000 + ₹ 5,000 = ₹ 2,75,000

Equity + Liabilities = Assets

₹ 1,00,000 + ₹ 1,75,000 = 2,75,000

For the year ended March 31, 2022:

Assets = ₹ 1,10,000 + ₹ 80,000 + ₹ 80,000 + ₹ 6,000 = ₹ 2,76,000

Liabilities = ₹ 1,00,000 + ₹ 70,000 = ₹ 1,70,000

Equity = Assets – Liabilities = ₹ 2,76,000 – ₹ 1,70,000 = ₹ 1,06,000 Profits = New Equity – Old Equity = ₹ 1,06,000 – ₹1,00,000 = ₹ 6,000

Conservatism

- Conservatism dictates that accountants should not anticipate future income but must account for all potential losses. When faced with multiple potential asset values, the accountant should select the method that results in the lowest value. This principle is foundational for the valuation of current assets, encapsulated in the rule: ‘cost or market price whichever is lower.’

- The Realisation Concept states that changes should only be recorded when they materialize, while the Conservatism Concept further emphasizes caution. It is imprudent to recognize unrealized gains, but it is wise to prepare for possible losses.

For this principle, three qualitative characteristics of financial statements are essential:

- Prudence: Judgement regarding potential future losses and uncertain gains.

- Neutrality: An unbiased perspective is necessary to identify and record potential losses while excluding uncertain gains.

- Faithful representation: Accurate portrayal of alternative values.

This principle is particularly important for investors who need to make informed decisions about their investments. Recording future profits that have not yet been realized may mislead investors into believing the business is thriving, potentially resulting in poor investment choices. Conversely, if a loss is anticipated, it should be recorded in the present to protect investors' interests.

For example, Mr. X runs a computer business. He buys 10 computers at ₹20,000 each, expecting to sell them for ₹25,000 each. However, under conservatism, he cannot recognize the profit until the sale occurs. If the market price drops to ₹17,000, he must acknowledge a loss of ₹3,000 per computer, even without a sale. Some accounting experts argue that this principle may lead to an understatement of income and wealth, suggesting it should not solely guide financial statement preparation.

Consistency

- The consistency principle ensures comparability of an enterprise's financial statements over time by consistently applying accounting policies from one period to another. Changes in accounting policies are only made under exceptional circumstances.

- Consistency is particularly relevant when various equally acceptable accounting methods exist. For instance, a company may choose from different depreciation methods, such as the written-down-value or straight-line method. It is advisable for the company to consistently use the same method for depreciation or inventory valuation over the years.

- However, apparent inconsistencies may arise without being actual inconsistencies. For instance, if a company uses the ‘cost or market price whichever is lower’ principle, resulting in one year’s inventory being valued at cost and another at market price, this does not constitute inconsistency; it’s merely an application of the principle.

Moreover, the consistency principle does not preclude flexibility in adopting improved accounting methods. Changes to accounting policies should occur only:

- To align with issued Accounting Standards.

- To comply with legal requirements.

- When new methods better reflect a true and fair view of the financial statements under changed circumstances.

Materiality

- The materiality principle allows for the disregard of other concepts if their effects are not deemed material. This principle serves as an exception to the full disclosure principle. According to materiality, all items with a significant economic effect on the enterprise must be disclosed in financial statements, while insignificant items that do not add value for users can be omitted.

- Materiality is subjective, relying on the accountant's judgment, common sense, and discretion to determine what is material. For instance, stationery purchases that are not fully utilized in the year can still be recorded as expenses due to materiality. Similarly, depreciation on small items like books or calculators may be fully expensed in the year of purchase, even if they have a useful life extending beyond that year, because their individual amounts are too small to warrant separate balance sheet recognition.

- Materiality is influenced not only by the item's amount but also by the size and nature of the business, the level of information, and the decision-maker's perspective. An item that is material to one individual may not be to another. The key is ensuring that the omission of information does not hinder the decision-making process for various users.

|

68 videos|265 docs|83 tests

|

FAQs on Unit 2: Accounting Concepts, Principles and Conventions - 1 Chapter Notes - Accounting for CA Foundation

| 1. What are the fundamental accounting concepts that every student should know? |  |

| 2. How do accounting principles differ from accounting concepts? |  |

| 3. What are accounting conventions, and why are they important? |  |

| 4. Can you explain the relationship between accounting concepts, principles, and conventions? |  |

| 5. What role does the Institute of Chartered Accountants of India (ICAI) play in accounting education? |  |