Unit 2: Final Accounts of Manufacturing Entities Chapter Notes | Accounting for CA Foundation PDF Download

| Table of contents |

|

| Unit Overview |

|

| Introduction to Manufacturing Account |

|

| Purpose of Manufacturing Account |

|

| Manufacturing Cost |

|

| Format of a Manufacturing Account |

|

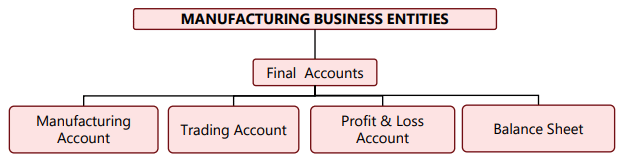

Unit Overview

Introduction to Manufacturing Account

- Manufacturing entities prepare a separate Manufacturing Account as part of their final accounts, alongside the Trading Account, Profit and Loss Account, and Balance Sheet.

- The purpose of the Manufacturing Account is to determine the manufacturing costs of finished goods, which helps assess the cost-effectiveness of manufacturing activities.

- The manufacturing costs of finished goods calculated in the Manufacturing Account are then transferred to the Trading Account.

(a) Trading Account vs. Manufacturing Account

- The Trading Account shows Gross Profit, while the Manufacturing Account shows the cost of goods sold, which includes direct expenses.

(b) Raw Materials and Work in Progress

- The Manufacturing Account deals with raw materials and work in progress, whereas the Trading Account deals only with finished goods.

[Intext Question]

Purpose of Manufacturing Account

- Total Cost of Manufacturing: The account details the entire cost involved in manufacturing finished products, breaking down the costs into various components such as materials, wages, and expenses.

- Factory Cost and Reconciliation: It provides a clear picture of factory costs and helps in reconciling financial records with cost accounts. This also allows for comparison of manufacturing efficiency over different periods.

- Profit or Loss on Manufacture: The account can indicate the profit or loss on manufacture if the output is recorded in the Trading Account at market prices.

- Production Linked Bonus: It can be used to determine the amount of production-linked bonus in schemes where such bonuses are applicable.

Manufacturing Cost

Manufacturing costs are classified into:

Raw Material consumed is arrived at after adjustment of opening and closing Inventory of raw materials:

If there remain unfinished goods at the beginning and at the end of the accounting period, cost of such unfinished goods (also termed as Work-In-Process) is shown in the Manufacturing Account.

Opening inventory of Work-in-Process is posted to the debit of the Manufacturing Account and closing inventory of Work-in-Process is posted to the credit of the Manufacturing Account.

Direct Manufacturing Expenses

Direct manufacturing expenses refer to costs incurred for a specific product or service, excluding material and labor costs. These expenses are directly tied to the production of goods or services and can vary with the level of production.

Examples of direct manufacturing expenses include:

- Royalties for using a license or technology based on the number of units produced.

- Hire charges for plant and machinery used on a rental basis, also based on the number of units produced.

When royalty or hire charges are calculated based on units produced, these expenses fluctuate directly with production levels.

ILLUSTRATION 1

1,00,000 units were produced in a factory. Per unit material cost was ₹ 10 and per unit labour cost was ₹ 5. That apart it was agreed to pay royalty @ ₹ 3 per unit to the Japanese collaborator who supplied technology.

Required

Calculate Manufacturing Cost.

SOLUTION

In this case Manufacturing Cost comprises of –

Indirect Manufacturing Expenses or Overhead Expenses

- Indirect manufacturing expenses are also known as manufacturing overhead, production overhead, or works overhead. These expenses include the total cost of indirect materials, indirect wages, and indirect expenses.

- Overhead = Indirect Material + Indirect Wages + Indirect Expenses

- Indirect Material refers to materials that cannot be directly linked to the units produced. Examples include stores consumed for repair and maintenance work, small tools, fuel, and lubricating oil.

- Indirect Wages are wages that cannot be directly attributed to the units produced, such as wages for maintenance work and holding pay.

- Indirect Expenses are costs that cannot be directly linked to the units produced, including training expenses, depreciation of plant and machinery, depreciation of the factory shed, and insurance premiums for plant and machinery and the factory shed.

- Indirect manufacturing expenses consist of indirect material, indirect wages, and indirect expenses related to the manufacturing division.

By-Products in Manufacturing

In many manufacturing processes, producing the main product also leads to the creation of a secondary product that has some value when sold. For instance, when hydrogenated vegetable oil is produced, oxygen gas is also generated as a by-product. Similarly, the production of steel results in scrap metal. By-Product DefinitionA by-product is a secondary product that comes from the same raw materials used to produce the main product, without incurring any additional costs. By-products are not the primary focus of production; they are simply a result of the process.

Examples of By-Products

- Molasses is a by-product in sugar manufacturing.

- Buttermilk is a by-product of dairies producing butter and cheese.

Valuation and Treatment

- By-products typically have a negligible value compared to the main product.

- They are often valued at their net realizable value if their costs cannot be identified separately.

- While by-product sales are sometimes treated as Other Operating Income, the correct accounting practice is to credit the sale value of the by-product to the Manufacturing Account. This approach reduces the overall cost of manufacturing the main product.

[Intext Question]

Format of a Manufacturing Account

A Manufacturing Account does not have a fixed design for presentation. However, the following format includes various elements that can be considered:

A sole proprietorship is a type of business that is owned and operated by a single individual. This form of business is the simplest and most common way for an individual to start a business. In a sole proprietorship, the owner has complete control over the business and is entitled to all the profits. However, the owner is also personally liable for any debts and obligations of the business.

Sole proprietorships are often used by freelancers, consultants, and small business owners who want to keep things simple and have full control over their operations. This type of business is easy to set up and requires minimal regulatory paperwork, making it an attractive option for many entrepreneurs.

Meaning of Final Accounts

- Final accounts refer to the financial statements prepared at the end of an accounting period to summarize the financial performance and position of a business. These accounts provide a comprehensive overview of the income, expenses, assets, liabilities, and equity of the business, helping stakeholders assess its profitability and financial health.

- Final accounts typically include the following components:

- Trading Account: This account calculates the gross profit or loss of the business by comparing the sales revenue with the cost of goods sold. It provides insights into the core trading activities and profitability before considering other operating expenses.

- Profit and Loss Account: Also known as the income statement, this account details all the income and expenses of the business during the accounting period. It shows the net profit or loss by subtracting total expenses from total income, reflecting the overall financial performance.

- Balance Sheet: This statement presents the financial position of the business at a specific date. It lists all the assets, liabilities, and equity, ensuring that the accounting equation (Assets = Liabilities + Equity) is balanced. The balance sheet provides insights into the liquidity and solvency of the business.

Need for Preparation of Final Accounts

- Preparation of final accounts is essential for businesses to assess their financial performance, comply with legal requirements, and provide transparency to stakeholders. These accounts offer valuable insights into profitability, financial position, and operational efficiency, aiding in decision-making and strategic planning.

- Final accounts are also crucial for tax purposes, securing loans, attracting investors, and maintaining trust with suppliers and customers. Regular preparation of final accounts ensures accurate financial reporting and helps businesses monitor their financial health over time.

Features of Final Accounts

- Accuracy: Final accounts must be prepared with precision to ensure that all financial information is correctly represented. Any errors can lead to misleading conclusions about the business's financial health.

- Completeness: All relevant financial transactions and events must be included in the final accounts to provide a comprehensive view of the business's performance and position.

- Compliance: Final accounts should comply with applicable accounting standards, legal requirements, and regulatory frameworks to ensure validity and acceptance.

- Timeliness: Final accounts should be prepared and presented within a reasonable timeframe after the end of the accounting period to provide timely information for decision-making.

- Transparency: The final accounts should be clear and transparent, allowing stakeholders to understand the basis of preparation and the financial position and performance of the business easily.

- Comparison: Final accounts are often compared with previous periods or industry benchmarks to assess performance trends and identify areas for improvement.

Types of Final Accounts

- Trading Account: This account is prepared to determine the gross profit or loss of a business. It includes all the direct costs associated with the production of goods sold during a specific period. The trading account provides insights into the core operational efficiency and profitability of the business before considering other expenses.

- Profit and Loss Account: Also known as the income statement, this account summarizes all the income and expenses of a business during a specific period. It calculates the net profit or loss by subtracting total expenses from total income. The profit and loss account reflects the overall financial performance and operational efficiency of the business, considering all revenue and expenditure aspects.

- Balance Sheet: The balance sheet presents the financial position of a business at a specific point in time. It lists all the assets, liabilities, and equity, ensuring that the accounting equation (Assets = Liabilities + Equity) is balanced. The balance sheet provides insights into the liquidity, solvency, and overall financial health of the business, showing how resources are financed and what obligations exist.

ILLUSTRATION 2

Mr. Vimal runs a factory which produces soaps. Following details were available in respect of his manufacturing activities for the year ended on 31.3.2022:

Required

Prepare a Manufacturing Account of Mr. Vimal for the year ended 31.3.2022.

SOLUTION

Working Notes:

ILLUSTRATION 3

On 31st March, 2022 the Trial Balance of Mr. White were as follows:

The following additional information is available:

Stocks on 31st March, 2022 were:

Raw Materials ₹ 16,200

Finished goods ₹18,100

Semi-finished goods ₹ 7,800

Salaries and wages unpaid for March 2022 were respectively, ₹900 and ₹ 2,000

Machinery is to be depreciated by 10% and office furniture by 71/2 %

Provision for doubtful debts is to be maintained @ 1% of sales

Office premises occupy 1/4 of total area.

Lighting is to be charged as to 2/3 to factory and 1/3 to office.

Prepare the Manufacturing Account Trading Account, Profit and Loss Account and the Balance Sheet relating to 31st March 2022.

SOLUTION

NOTE: The ICAI has, through guidance note (August, 2023 edition) provided guidance on the formats of financial statements for non-corporate entities. This would enable these entities to communicate their financial performance and financial position in standardised formats thereby enhancing their consistency and comparability. The said format of financial statements has been given as Annexure – I at the end of the chapter for awareness of students. It may be noted that this format does not form part of syllabus and has been given here for the knowledge of students only.

[Intext Question]

|

68 videos|160 docs|83 tests

|

FAQs on Unit 2: Final Accounts of Manufacturing Entities Chapter Notes - Accounting for CA Foundation

| 1. What is the purpose of a Manufacturing Account? |  |

| 2. What are the key components of manufacturing costs? |  |

| 3. How is a Manufacturing Account structured or formatted? |  |

| 4. Why is it important for non-manufacturing entities to understand manufacturing accounts? |  |

| 5. What are the differences between a Manufacturing Account and a Trading Account? |  |

|

Explore Courses for CA Foundation exam

|

|