Unit 2: Issue, Forfeiture and Re-Issue of Shares Chapter Notes | Accounting for CA Foundation PDF Download

Unit Overview

Note:

According to Section 53 of the Companies Act, 2013, a company is prohibited from issuing shares at a discount, except for sweat equity shares. Any discount share issuance by a company is deemed void and may result in penalties. Sweat equity shares refer to equity shares issued to directors or employees at a discount or in exchange for non-cash considerations, such as know-how, intellectual property rights, or value additions.

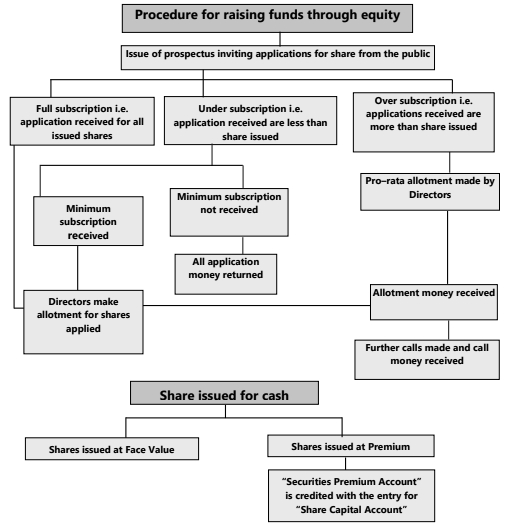

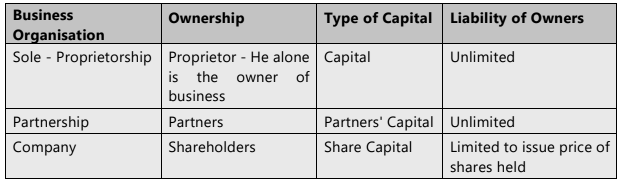

Introduction

Funds contributed by the owner(s) to a business are classified as capital, which varies depending on the business structure. In a sole proprietorship, the sole proprietor supplies the capital, while in a partnership, multiple owners, known as partners, contribute capital. Since the number of partners in a partnership is limited, the capital that can be raised is also restricted. Additionally, in non-corporate business forms such as sole proprietorships and partnerships, the owners bear unlimited liability.Capital funding process for different types of business forms can be summarised as follows:

With the onset of the Industrial Revolution, the demand for capital investment surged, accompanied by heightened risks of failure due to rapid technological advancements. Non-corporate entities struggled to manage the increased capital requirements and associated risks, which resulted in the rise of the corporate form of organization.

Share Capital

- Share Capital refers to the total capital of a company divided into small units called shares. Each share has a fixed value known as the nominal, par, or face value, which is printed on the share certificate. However, shares can be issued at a price different from this face value. Shareholders' liability is limited to the issue price of the shares they acquire.

- The issue price of shares is not always the same as the market price. Nowadays, shares are often priced using the book building process, where the company determines a price band and fixes the issue price based on bids from potential investors within that band.

- Share Capital is categorized into various types:

(i) Authorised Share Capital or Nominal Capital. This represents the maximum capital a company estimates it might need, as specified in the 'Capital Clause' of the 'Memorandum of Association' registered with the Registrar of Companies. It puts a limit on the capital a company can raise during its lifetime and is shown in financial statements at face value.

(ii) Issued Share Capital. This is the portion of share capital that a company actually issues, which can include shares issued for cash or consideration other than cash, such as to promoters and others. It is also presented in the balance sheet at nominal value. The portion of authorised capital that is not issued is called Un-issued Capital, which is not shown in the balance sheet.

(iii) Subscribed Share Capital. This is the part of issued share capital that is subscribed by the public, meaning it is applied for by the public and allotted by the company. It also includes the face value of shares issued for consideration other than cash.

(iv) Called-up Share Capital. This refers to the portion of the issue price of shares that a company has called for from shareholders. The remaining balance that the company has decided to call in the future is known as Uncalled Capital.

(v) Paid-up Share Capital. This is the portion of called-up capital that has been paid by the shareholders. If a shareholder fails to pay the called amount fully or partially, it is referred to as unpaid calls or calls in arrears. Calls in advance refer to the portion of capital that has been paid by the shareholder before it is called by the company. In financial statements, called-up and paid-up capital are shown together.

(vi) Reserve Share Capital. According to Section 65 of the Companies Act, 2013, a company can decide to reserve a portion of its subscribed uncalled capital to be called up only in the event of winding up the company. This portion is known as Reserve Capital. It is different from Capital Reserve, which is part of 'Reserves and Surplus' and refers to reserves not available for declaration of dividend.

Important Formulas and Concepts:

- Authorised Capital. Issued Capital. Unissued Capital

- Subscribed Capital can be equal to, greater than, or less than Issued Capital, resulting in Fully Subscribed, Over Subscribed, or Under Subscribed situations, respectively.

- Called up Capital. Paid up Capital. Calls in arrears (if any) - Calls in advance (if any)

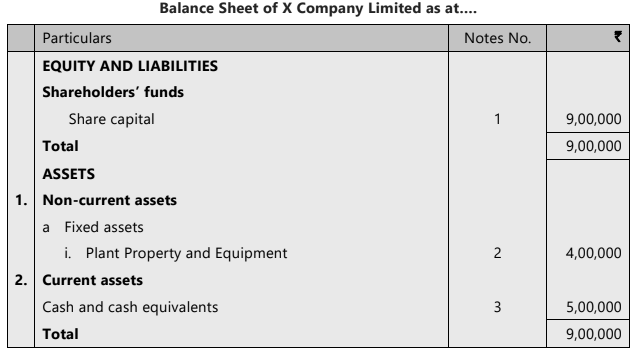

ILLUSTRATION 1

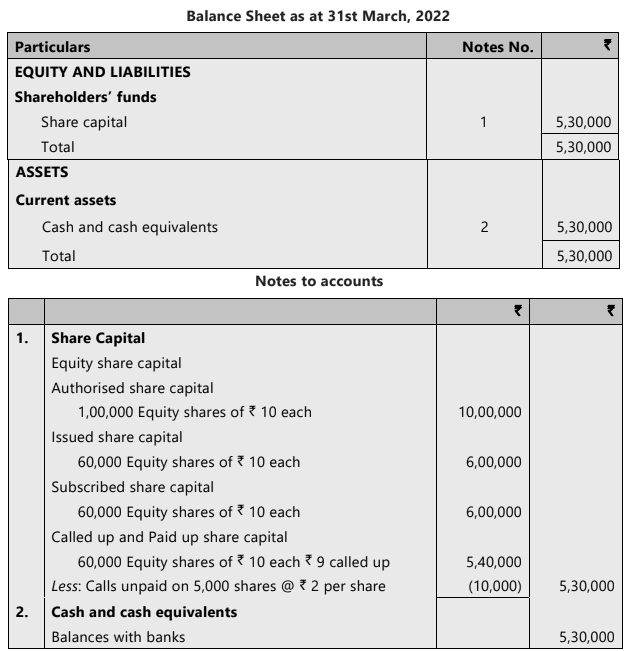

A company had an authorised capital of ₹ 10,00,000 divided into 1,00,000 equity shares of ₹ 10 each. It decided to issue 60,000 shares for subscription and received applications for 70,000 shares. It allotted 60,000 shares and rejected remaining applications. Upto 31-3 -2022, it has demanded or called ₹ 9 per share. All shareholders have duly paid the amount called, except one shareholder, holding 5,000 shares who has paid only ₹ 7 per share.

Prepare a balance sheet assuming there are no other details.

SOLUTION

The details of authorized, issued, and subscribed capital are provided in the Notes to Accounts but are not included in the total. Only the paid-up capital, which represents the portion of the issued capital subscribed by shareholders, is considered when calculating the liabilities side of the balance sheet.

Types of Shares

Shares issued by a company can be broadly categorized into two types:(i) Preference Shares and

(ii) Equity Shares.

(i) Preference Shares

- Preference shares, as defined in Section 43 of the Companies Act, 2013, are held by preference shareholders who are guaranteed a fixed-rate preferential dividend during the company's existence.

- These shareholders also have the preferential right to be paid before other shareholders in case of the company's winding up.

- Preference shareholders enjoy priority in:

- Payment of dividends

- Repayment of capital

- Typically, holders of preference shares do not have voting rights.

- Companies prefer this mode of financing as it is less expensive than raising debt.

- Dividends on preference shares are usually cumulative, meaning they can be paid from future profits if not paid in the current year.

- The Companies Act, 2013 prohibits the issuance of irredeemable preference shares.

- Unless stated otherwise, preference shares are cumulative and non-participating.

Types of Preference Shares

- Cumulative Preference Shares: These shares entitle holders to a fixed dividend that can be paid from future profits if current profits are insufficient. Dividends accumulate and must be paid in full, leading to their designation as Cumulative Preference Shares. Companies must disclose any arrears of fixed cumulative dividends in financial statements. If dividends are in arrears for two years, holders gain the right to vote on resolutions in shareholder meetings.

- Non-cumulative Preference Shares: These shares guarantee a fixed dividend, but if no dividend is declared in a year, the right to that dividend expires. Holders do not have a claim to missed dividends in the future.

- Participating Preference Shares: In addition to a fixed dividend, these shares allow holders to participate in surplus profits after equity shareholders receive their stipulated dividend. In the event of winding up, holders also receive a predetermined portion of surplus after equity shareholders are paid.

- Non-participating Preference Shares: These shares only receive a fixed rate of dividend annually, without additional rights to profits or surplus in winding up. Unless specified otherwise, preference shares are generally non-participating.

- Redeemable Preference Shares: These shares are issued with the condition that the company will repay them after a fixed period or earlier at its discretion. Redemption is governed by Section 55 of the Companies Act, 2013.

- Non-redeemable Preference Shares: These shares do not have a redemption arrangement. According to Section 55, companies limited by shares cannot issue irredeemable preference shares or those redeemable after 20 years from the date of issue. However, companies may issue preference shares redeemable after 20 years for specified infrastructure projects under the Companies Act, 2013.

- Convertible Preference Shares: These shares grant holders the right to convert them into equity shares at their option, according to the terms of issuance.

- Non-convertible Preference Shares: These shares do not grant holders the right to convert their holdings into equity shares. Preference shares are non-convertible unless stated otherwise.

(ii) Equity Shares

- Equity shares are those that do not fall under the category of preference shares.

- This means that equity shares do not have any preferential rights when it comes to the payment of dividends or the repayment of capital.

- The rate of dividend on equity shares is determined by the Board of Directors and can vary from year to year.

- The dividend rate depends on the company's dividend policy and the availability of profits after satisfying the rights of preference shareholders.

- Equity shares come with voting rights, allowing shareholders to participate in the decision-making process of the company.

- The Companies Act, 2013 allows the issuance of equity share capital with differential rights regarding dividend, voting, or other matters, in accordance with prescribed rules.

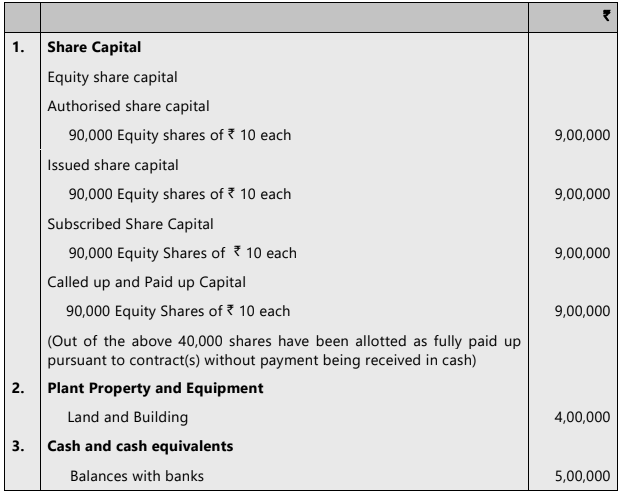

Shares can be issued by a company either: (1) for cash or (2) for consideration other than cash.

Issue of Shares for Cash

- Private Companies: Rely on 'Private Placement' to issue shares.

- Public Companies: Issue a 'Prospectus' to invite the general public to subscribe for shares.

- Accounting Treatment: Focus on public companies for accounting treatment, but similar treatment applies to private placements. For journal entries involving preference shares, replace 'Equity' with 'Preference.'

- Prospectus and Applications:. public company issues a prospectus inviting the public to subscribe for shares. Interested parties deposit applications in a scheduled bank along with the application money, which is at least 5% of the nominal value of shares.

- Allotment of Shares: After the closing date of the issue, the company decides on the allotment of shares in consultation with SEBI and the stock exchange. Shares cannot be allotted unless the minimum subscription is received.

- Minimum Subscription: Defined as the minimum amount that must be subscribed for shares before allotment. The Board of Directors determines this amount, considering preliminary expenses, commission, fixed asset costs, working capital needs, and other operational expenses.

- SEBI Guidelines: Minimum subscription should be at least 90% of the offer. In case of an initial public offer, it is subject to allotment of a minimum number of specified securities.

- Refunds: If the minimum subscription of 90% is not met, all application moneys must be refunded within specified timeframes, either fifteen days for non-underwritten issues or seventy days for underwritten issues.

- Application Acceptance: The company has the right to accept or reject applications, either fully or partially. Successful applicants become shareholders and are required to pay the allotment money. Unsuccessful applicants receive their money back, and the company may be liable to pay interest on delayed refunds. Subsequent payments, known as calls, may be requested by the company.

- Application Money: According to Section 39 of the Companies Act, 2013, application money must be at least 5% of the face value of shares. However, SEBI Regulations stipulate that the minimum application money should not be less than 25% of the issue price.

- Regulatory Authority: Matters related to the issue and transfer of securities are governed by SEBI, as per Section 24 of the Companies Act, 2013.

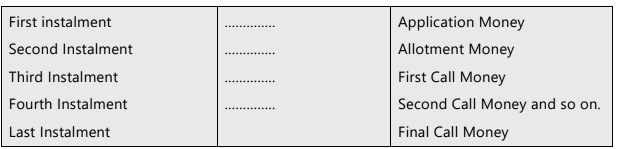

The issue price of shares is generally received by the company in instalments and these instalments are known as under :

Journal Entries for Issue of Shares for Cash

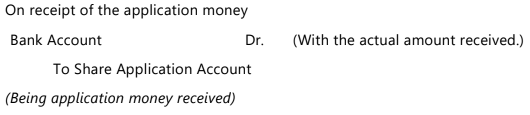

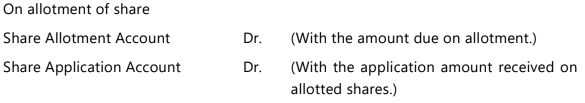

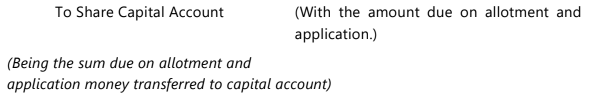

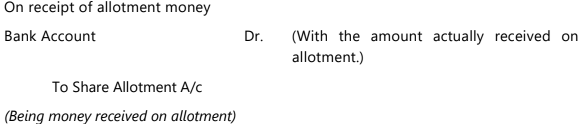

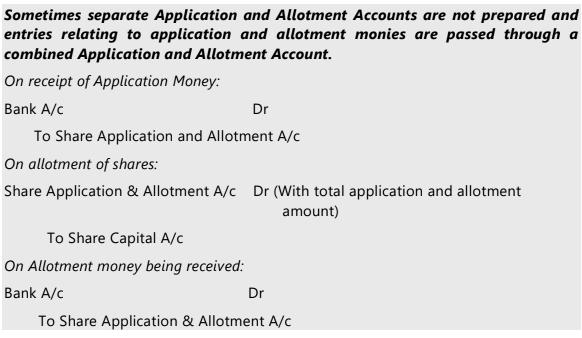

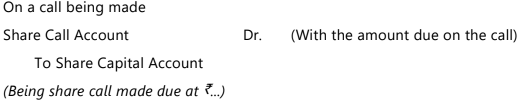

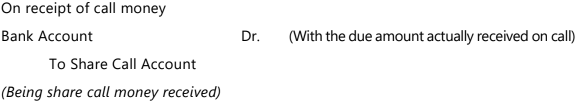

Upon the issue of share capital by a company, the undermentioned entries are made in the financial books:

(1)

(2)

(3)

(4)

(5)

Subscription of Shares

Full SubscriptionFull Subscription: When a company issues shares to the public, it invites applications for subscription through a prospectus. The accounting treatment for the issue of shares depends on the type of subscription received. Let's discuss the three possibilities:

Fully Subscribed: This occurs when the number of shares offered for subscription matches the number of shares actually subscribed by the public.

ILLUSTRATION 2

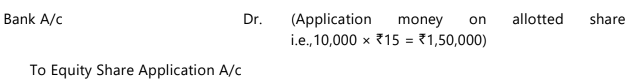

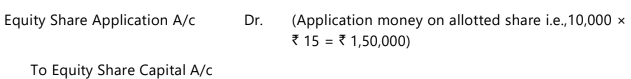

A company invited applications for 10,000 equity shares of ₹ 50 each payable on application ₹ 15, on Allotment ₹ 20, on first and final call ₹15. Applications are received for 10,000 shares and all the applicants are allotted the number of shares they have applied for and instalment money was duly received by the company. Show Journal entries in the books of the company.

SOLUTION

Journal entries in the books of a company

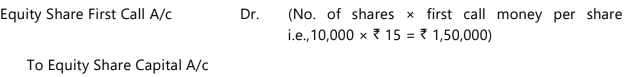

For application money received: Amount received along with application is accounted as follows:At the time of allotment: Application money received from successful applicants become part of share capital and is transferred to share capital as under:

To record amount due on allotment: When the decision is taken to allot shares, allotment money on allotted shares falls due and is recorded as follows:

For allotment money received: Allotment money received from shareholders is recorded as follows:

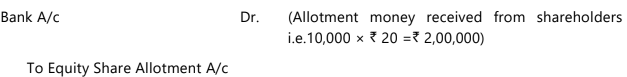

When decision to demand first call is made: After allotment of share, when the Board of Directors decide to demand the next instalment from shareholders, first call money falls due and is accounted for, as under:

On receiving first and final call money: The journal entry passed to record the money received on account of first call is as under:

Under Subscription

The situation occurs when the shares available for subscription exceed the shares that the public subscribes to. In such cases, the journal entries are recorded with one modification: the calculations for application, allotment, and call money are based solely on the number of shares that have been actually applied for and allotted. It is important to note that shares can only be allotted if the minimum subscription requirement is met.ILLUSTRATION 3

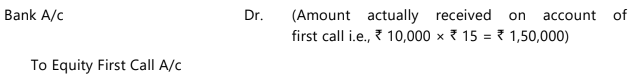

On 1st April, 2021, A Ltd. issued 43,000 shares of ₹ 100 each payable as follows:

₹ 20 on application;

₹ 30 on allotment;

₹ 25 on 1st October, 2021; and

₹ 25 on 1st February, 2022.

By 20th May, 40,000 shares were applied for and all applications were accepted. Allotment was made on 1st June. All sums due on allotment were received on 15th July; those on 1st call were received on 20th October. Journalise the transactions when accounts were closed on 31st March, 2022.

SOLUTION

Over Subscription

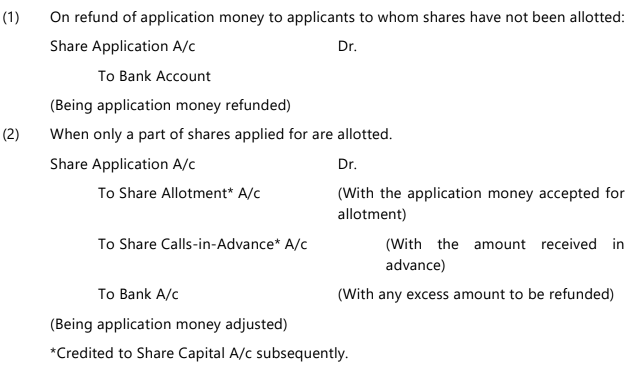

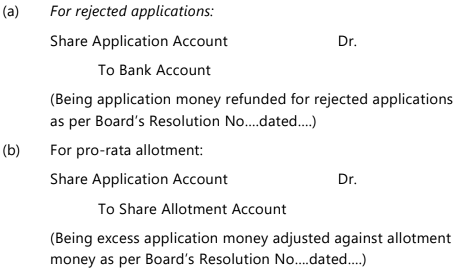

When shares are issued, they can be either oversubscribed or undersubscribed. In cases of oversubscription, some applications may be rejected, leading to refunds of application money. For others, only a portion of the requested shares may be allotted, with any excess funds potentially applied towards future allotment or call money payments that are due or imminent.

(Note: This type of share allotment is termed as Pro-rata allotment and has been discussed in detail in para 2.8)

ILLUSTRATION 4

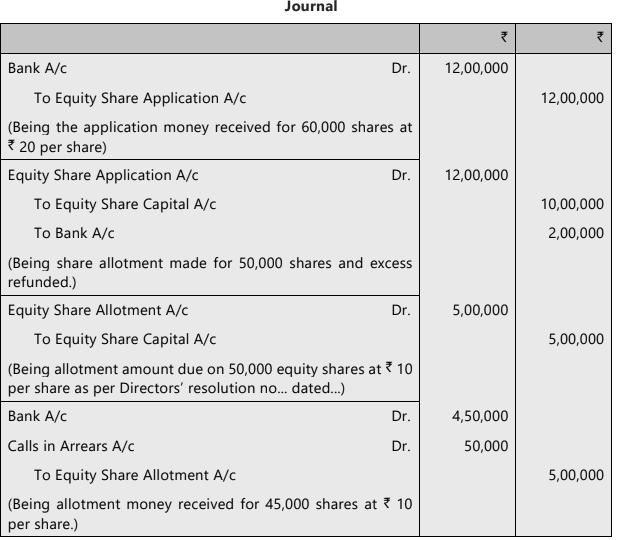

Pant Ltd. invited applications for 50,000 equity shares at ₹ 50 each, which are payable as on application ₹ 20, on allotment ₹ 10 and on first and final call ₹ 20. The company received applications for 60,000 shares. The directors accepted application for 50,000 shares and rejected the rest. Show Journal entries if company refunded the application money to rejected applicants and allotment money was received for 45,000 shares.

SOLUTION

ILLUSTRATION 5

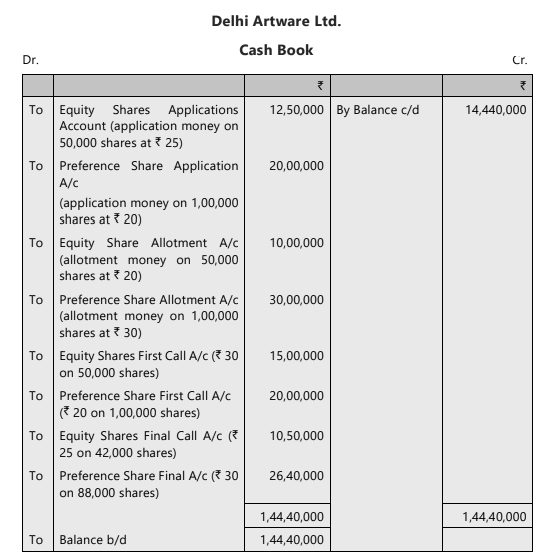

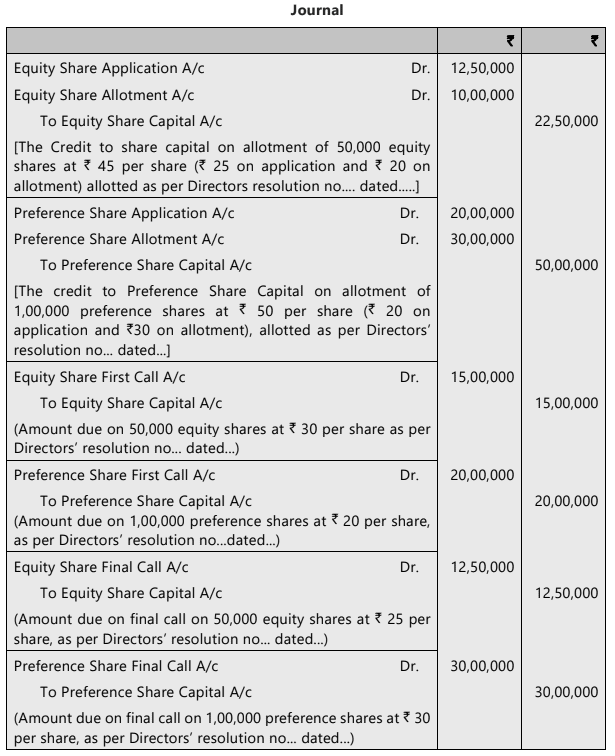

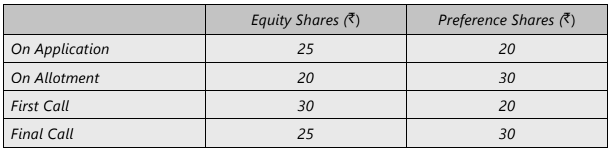

The Delhi Artware Ltd. issued 50,000 equity shares of ₹ 100 each and 1,00,000 preference shares of ₹ 100 each. The Share Capital was to be collected as under:

All these shares were subscribed. Final call was received on 42,000 equity shares and 88,000 preference shares. Prepare the cash book and journalise the remaining transactions in the books of the company.

SOLUTION

Note: Students may note that cash transactions have not been journalised as these have been entered in the Cash Book.

Share Issues at Discount

Shares are considered issued at a discount if they are sold for less than their nominal or par value, with the difference representing the discount. For example, a share with a nominal value of ₹100 issued at ₹98 is at a 2% discount. Under Section 53 of the Companies Act, 2013, companies are prohibited from issuing shares at a discount, except for sweat equity shares given to employees and directors; thus, any such discounted share issuance is deemed invalid.Share Issues at Premium

When a company offers its securities at a price higher than their face value, it is referred to as an issue at a premium. The premium represents the difference between the issue price and the face value of the security. It is common for financially strong and well-managed companies to issue their shares at a premium, meaning at a price above the nominal or par value of the shares. For instance, if a share with a nominal value of ₹100 is issued at ₹105, it is said to be issued at a premium of 5 percent. When shares are issued at a premium, the amount of premium can be technically called at any stage of share capital transactions. However, it is generally called along with the amount due on allotment, sometimes with the application money, and rarely with the call money.Accounting Treatment

When shares are issued at a premium, the premium amount is credited to a separate account called “ Securities Premium Account. because it is not a part of share capital. Rather, it represents a gain of a capital nature to the company.

- Being a credit balance, Securities premium Account is shown under the heading, “ Reserves and Surplus ”. However, ‘Reserves and Surplus’ is shown as ‘shareholders’ funds in the Balance Sheet as per Schedule III.

- According to Section 52 of the Companies Act, 2013, Securities Premium Account may be used by the company.

- Towards issue of un-issued shares of the company to be issued to members of the company as fully paid bonus securities.

- To write off preliminary expenses of the company.

- To write off the expenses of, or commission paid, or discount allowed on any of the securities or debentures of the company.

- To provide for premium on the redemption of redeemable preference shares or debentures of the company.

- For the purchase of own shares or other securities.

- It may be noted that certain class of Companies as prescribed under Section 133 of the Companies Act, 2013, whose financial statements comply with the accounting standards prescribed for them (i.e. those companies to whom Indian Accounting Standards are applicable), can’t apply the securities premium account for the purposes (b) and (d) mentioned above.

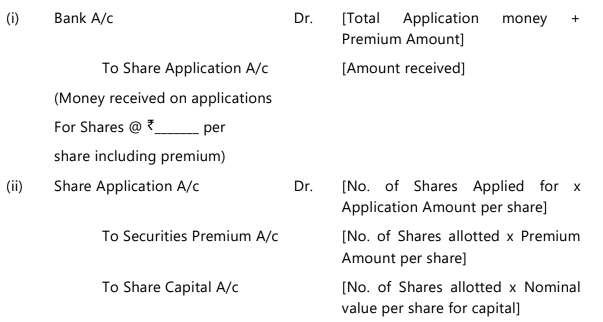

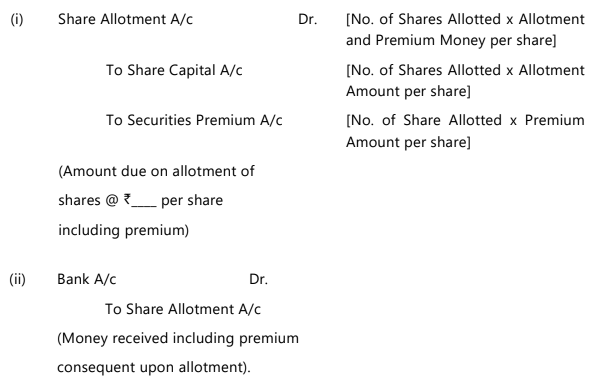

When shares are issued at a premium, the journal entries are as follows:

Premium amount called with Application money

Premium Amount called with Allotment Money

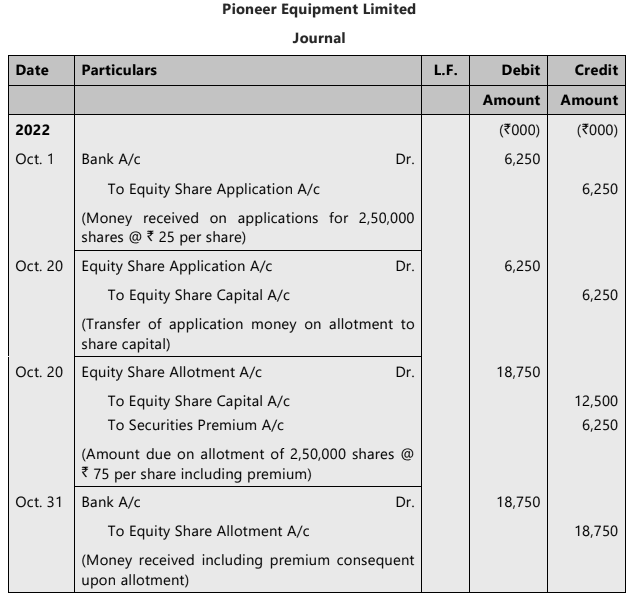

ILLUSTRATION 6

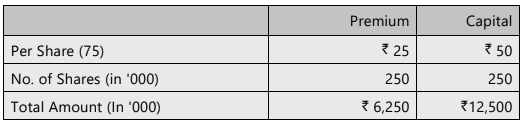

On 1st October, 2022 Pioneer Equipment Limited received applications for 2,50,000 Equity Shares of ₹ 100 each to be issued at a premium of 25 per cent payable as :

On Application ₹ 25

On Allotment ₹ 75 (including premium)

Balance Amount on Shares - As and when required

The shares were allotted by the Company on October 20, 2022 and the allotment money was duly received on October 31, 2022.

Record journal entries in the books of the company to record the transactions in connection with the issue of shares.

SOLUTION

Note: Bifurcation of Allotment amount

Security premium per share = 25% x ₹100 = ₹ 25

Money received on allotment per share = ₹ 75

Over Subscription and Pro-Rata Allotment

Over Subscription refers to the situation when a company receives application money for more shares than it has offered to the public. This phenomenon typically occurs with attractive issues and is influenced by factors such as investor confidence in the company, overall economic conditions, and the pricing of the issue.

When a share issue is oversubscribed, the company faces the challenge of deciding how to allocate the limited number of shares among the applicants. The company has several options for allotment:

- Rejecting Some Applicants: The company may choose to reject some applicants entirely, refunding their application money.

- Full Allotment: Allotment may be given to some applicants in full, meaning they receive all the shares they applied for.

- Pro-Rata Allotment: This method involves allocating shares to applicants in proportion to the number of shares they applied for.

Example of Pro-Rata Allotment

- Suppose a company offers 10,000 shares to the public and receives applications for 12,000 shares. Under pro-rata allotment, the shares would be allocated in a 12,000:10,000 ratio, or 6:5. This means that for every 6 shares an applicant applied for, they would be allotted 5 shares.

Adjustment of Excess Application Money

- Under pro-rata allotment, the excess application money received is adjusted against the amount due on allotment or future calls. Any surplus money, after making this adjustment, is returned to the applicants.

Communication of Allotment Procedure

- Applicants are informed about the allotment procedure through advertisements in leading newspapers.

Treatment of Excess Application Money

- When pro-rata allotment occurs, the total application money paid by an applicant is often more than the amount due on application. The excess amount is treated as an advance against allotment or future calls.

- The net amount due on allotment or future calls is the difference between the amount due and the excess amount received in the application.

Accounting Entries

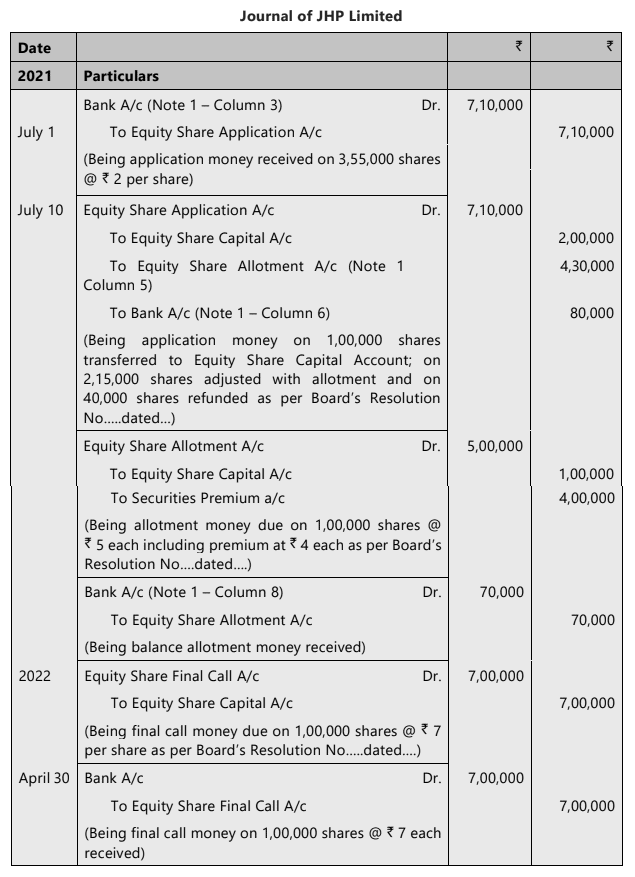

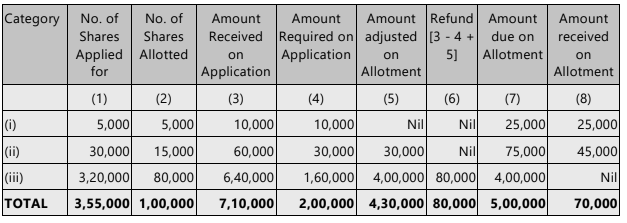

Illustration 7

JHP Limited is a company with an authorised share capital of 10,00,000 in equity shares of ₹ 10 each, of which 6,00,000 shares had been issued and fully paid on 30th June, 2021. The company proposed to make a further issue of 1,00,000 of these ₹ 10 shares at a price of ₹ 14 each, the arrangements for payment being:

(a) ₹ 2 per share payable on application, to be received by 1st July, 2021;

(b) Allotment to be made on 10th July, 2021 and a further ` 5 per share (including the premium) to be payable;

(c) The final call for the balance to be made, and the money received by 30th April, 2022.

Applications were received for 3,55,000 shares and were dealt with as follows:

(i) Applicants for 5,000 shares received allotment in full;

(ii) Applicants for 30,000 shares received an allotment of one share for every two applied for; no money was returned to these applicants, the surplus on application being used to reduce the amount due on allotment;

(iii) Applicants for 3,20,000 shares received an allotment of one share for every four applied for; the money due on allotment was retained by the company, the excess being returned to the applicants; and

(iv) the money due on final call was received on the due date.

You are required to record these transactions (including cash items) in the Journal of JHP Limited.

SOLUTION

Working Notes:

Calculation for Adjustment and Refund

Also,

(i) Amount Received on Application (3) = No. of shares applied for (1) x ₹ 2

(ii) Amount Required on Application (4) = No. of shares allotted (2) x ₹ 2

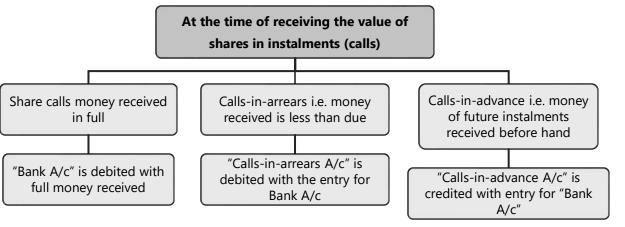

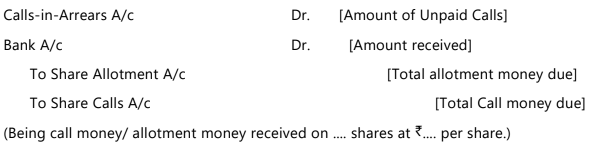

Calls-in-arrears and Calls-in-advance

Calls-in-Arrears

Calls-in-Arrears or Unpaid Calls refer to the total unpaid amount by shareholders on their allotted shares or calls. This amount represents capital that has not been collected from shareholders and is deducted from the called-up capital to determine the paid-up value of the share capital.

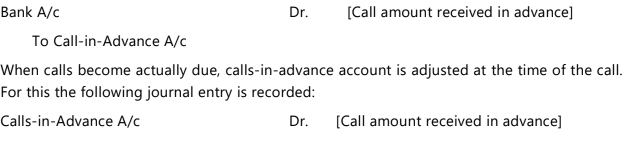

Calls-in-Advance

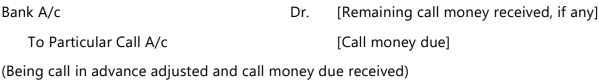

Some shareholders may sometimes pay a part, or whole, of the amount not yet called up, such amount is known as Calls-in-advance. According to Table F, interest at a rate not exceeding 12 per cent p.a. is to be paid on such advance call money. This amount is credited in Calls-in-Advance Account. The following entry is recorded:

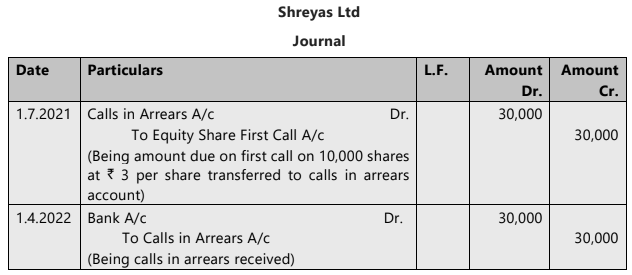

ILLUSTRATION 8

Shreyas Ltd. did not receive the first call on 10,000 equity shares @ ₹3 per share which was due on 1.7.2021. This amount was received on 1.4.2022.

Open Calls in arrears account and journalise the entries in the books of the company on 1.7.2021 and 1.4.2022.

SOLUTION

Interest on Calls-in-arrears and Callsin-advance

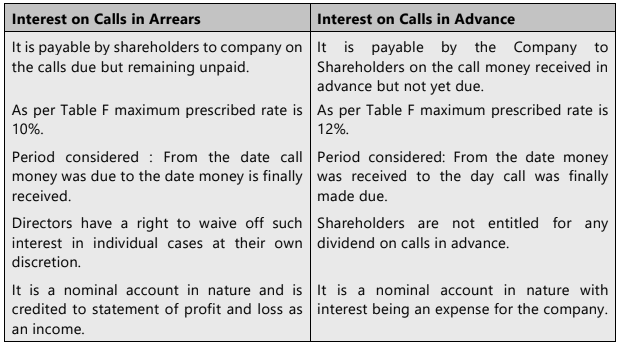

Interest on calls in arrears can be recovered, while interest on calls in advance must be paid, as specified in the company's articles. The rates for these interests can either be outlined in the articles or determined by the directors, adhering to the limits set forth. According to Table F, the maximum rates are 10% per annum for calls in arrears and 12% per annum for calls in advance.

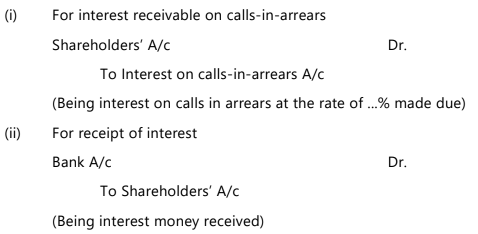

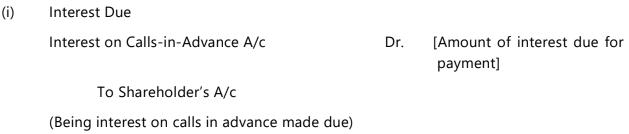

The accounting entries for adjusting interest on calls in arrears or received in advance are similar to those for temporary loans. The key difference is that debits are recorded, and credits are made to the Sundry Members Account instead of individual shareholders' accounts. This pertains to interest recoverable on calls in arrears or payable on calls received in advance, with corresponding entries made in Interest Receivable on Calls in Arrears and Interest Payable on Calls in Advance.

The journal entries for calls-in-arrears are as follows :

The accounting treatment of interest on Calls-in-Advance is as follows:

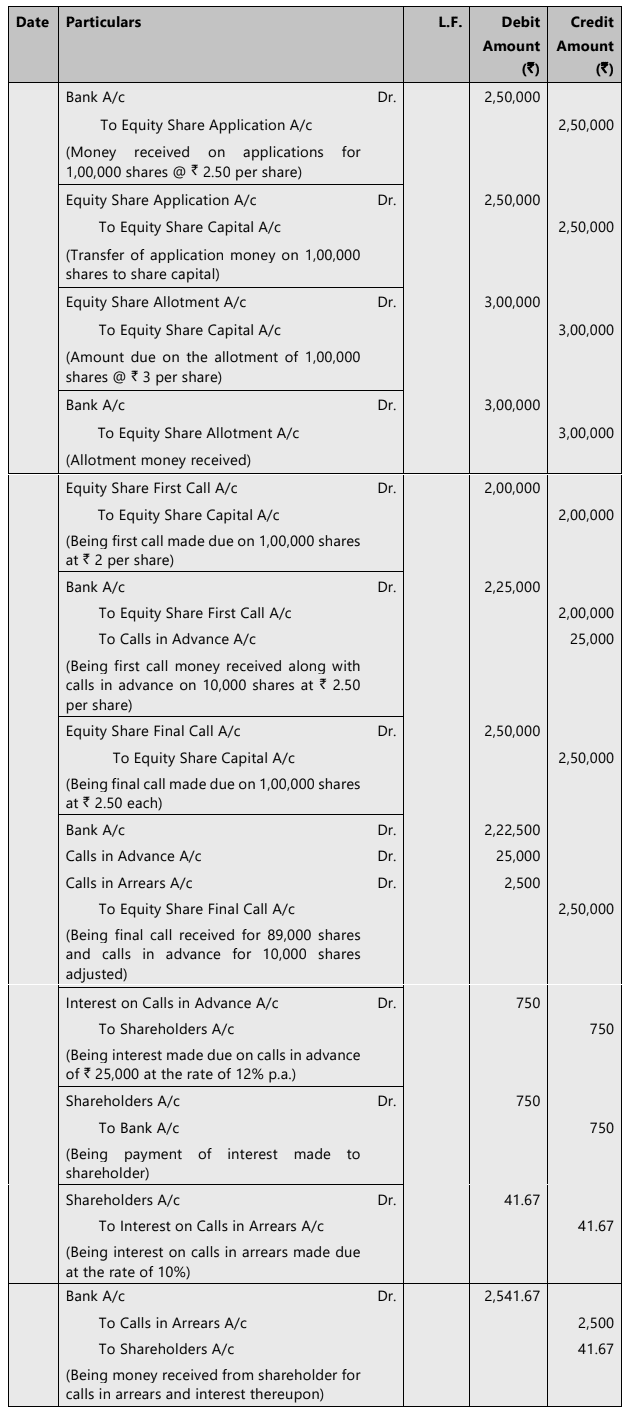

ILLUSTRATION 9

Rashmi Limited issued at par 1,00,000 Equity shares of ₹10 each payable ₹2.50 on application; ₹3 on allotment; ₹ 2 on first call and balance on the final call. All the shares were fully subscribed. Mr. Nair who held 10,000 shares paid full remaining amount on first call itself. The final call which was made after 3 months from first call was fully paid except a shareholder having 1000 shares who paid his due amount after 2 months along with interest on calls in arrears. Company also paid interest on calls in advance to Mr. Nair. Give journal entries to record these transactions.

SOLUTION

Forfeiture of Shares

Forfeiture of shares refers to the cancellation of shares by a company due to a shareholder's failure to pay the allotted shares and/or calls by the due date. The term "forfeit" means taking away property due to a breach of condition. When a shareholder fails to pay the call money, the company has the right to forfeit the shares.

- Empowerment of Directors: The Articles of Association typically empower the directors to forfeit shares in case of non-payment by serving proper notice to the defaulting shareholders.

- Extinguishing Title: When shares are forfeited, the title of the defaulting shareholder is extinguished, meaning they lose all rights to the shares. However, any amount paid up to that point is not refunded.

- No Further Claims: Once shares are forfeited, the shareholder has no further claims on the company.

- Strict Adherence: The power of forfeiture must be exercised strictly in accordance with the rules and regulations laid down in the Articles of Association and should be in good faith for the interests of the company.

- Directors' Authority: The Articles usually authorize the Directors to forfeit shares in case of non-payment of a call or interest thereon after giving prior notice as prescribed.

- Cancellation of Forfeiture: Directors also have the right to cancel the forfeiture before the forfeited shares are re-allotted.

Accounting Entries

At the time of passing entry for forfeiture of shares, students must be careful about the following matters:

- Amount called-up (i.e., amount credited to capital) in respect of forfeited shares.

- Amount already received in respect of those shares.

- Amount due but has not been received in respect of those shares.

- We know that shares can be issued at par or at a premium.

- Accounting entries for forfeiture will vary according to situations.

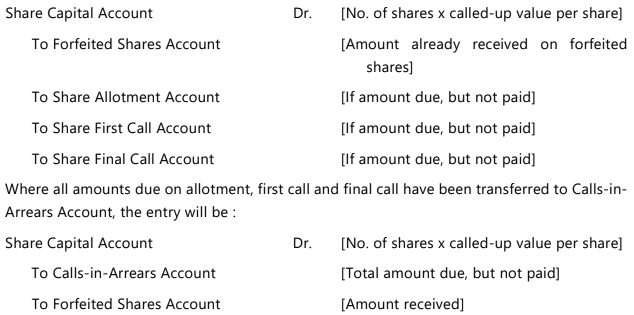

Forfeiture of Shares which were issued at Par

In this case, Share Capital Account will be debited with the called-up value of shares forfeited. Allotment or Calls Account will be credited with the amount due but not paid by the shareholder(s). (Alternatively, Calls-in-Arrears Account can be credited for all amount due, if it was transferred to Calls-in-Arrears Account). Forfeited Shares Account or Shares Forfeiture Account will be credited with the amount already received in respect of those shares.

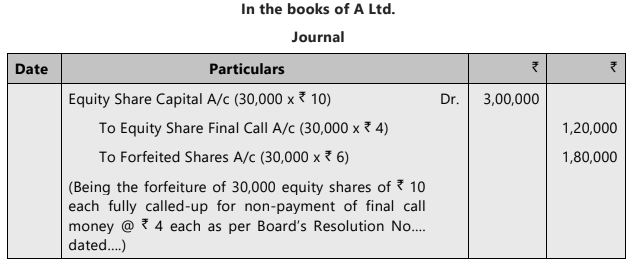

ILLUSTRATION 10

A Ltd forfeited 30,000 equity shares of ₹ 10 fully called-up, held by Mr. X for non-payment of final call @ ₹ 4 each. However, he paid application money @ ₹ 2 per share and allotment money @ ₹ 4 per share. These shares were originally issued at par. Give Journal Entry for the forfeiture.

SOLUTION

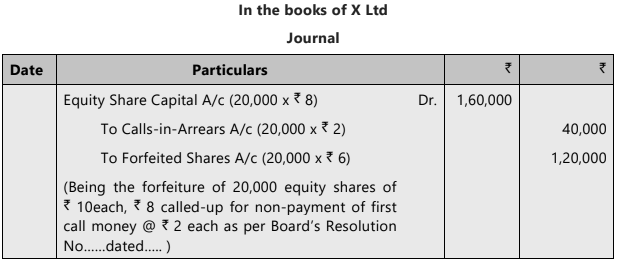

ILLUSTRATION 11

X Ltd forfeited 20,000 equity shares of ₹ 10 each, ₹ 8 called-up, for non-payment of first call money @ ₹ 2 each. Application money @ ₹ 2 per share and allotment money @ ₹ 4 per share have already been received by the company. Give Journal Entry for the forfeiture (assume that all money due is transferred to Calls-in-Arrears Account).

SOLUTION

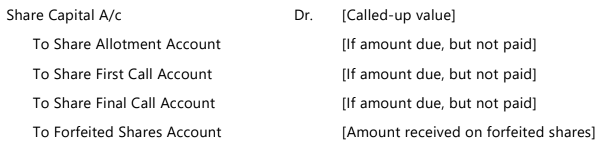

Forfeiture of Shares which were issued at a Premium

In this case, Share Capital Account will be debited with the called-up value of shares forfeited. If the premium on such shares has not been paid by the shareholder, the Securities Premium Account will be debited to cancel it (if it was credited earlier). Allotment, Calls and Forfeited Accounts will be credited in the usual manner.If the premium has already received by the company, it cannot be cancelled even if the shares are forfeited in the future.

If premium not received

If premium received

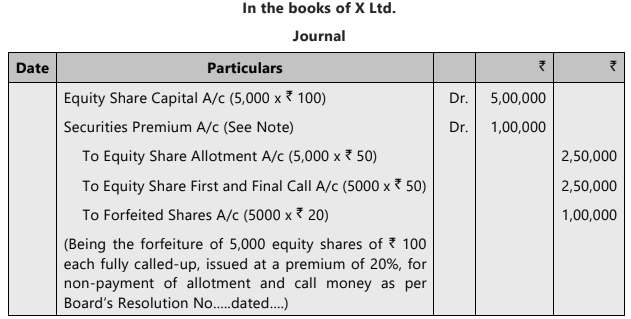

ILLUSTRATION 12

X Ltd. forfeited 5,000 equity shares of ₹100 each fully called-up which were issued at a premium of 20%. Amount payable on shares were: on application ₹ 20; on allotment ₹ 50 (including premium); on First and Final call ₹ 50. Only application money was paid by the shareholders in respect of these shares. Pass Journal Entries for the forfeiture.

SOLUTION

Tutorial Note: Share premium @ ₹ 20 on 5,000 shares has not been received by the company. Therefore, at the time of forfeiture, Securities Premium Account will be debited to cancel it (because Securities Premium Account was credited at the time of allotment).

Also, in case of pro-rata allotment where shares are issued at premium, the excess money received on application will be first adjusted to capital account and then for securities premium.

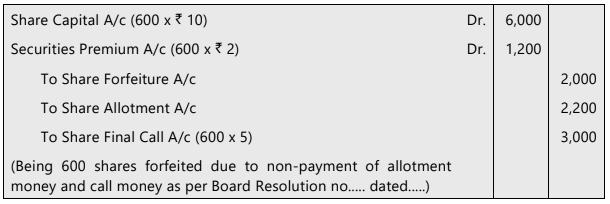

ILLUSTRATION 13

Mr. Shami has applied for 1,000 shares of Company XYZ Ltd. paying application money @ ₹ 2 per share but has been allotted only 600 shares. The shares have a face value of ₹ 10 and a premium of ₹ 2 per share, which are payable as: on Allotment- ₹ 5 (including premium) and on final call ₹ 5. Now in case Mr. Shami doesn't pay allotment money and final call and his shares are forfeited, then following entry will be passed on forfeiture:

SOLUTION

Note:

Forfeiture of Fully Paid-Up Shares

Shares may be forfeited for various reasons, including non-payment of calls, premiums, or any unpaid portion of their face value. Additionally, fully paid-up shares can be forfeited to recover debts owed by the shareholder, provided that the Articles of Association explicitly allow for this action.

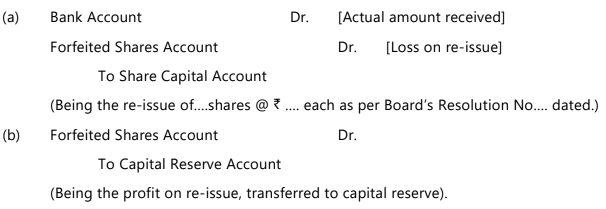

Re-issue of Forfeited Shares

- A forfeited share is a share that the company can sell, and it is still owned by the company just for this purpose.

- The process of reissuing forfeited shares is not the same as allotting new shares; it is simply a sale of these shares.

- Once a share is forfeited, the company is required to sell it.

- In practice, forfeited shares are usually sold through auction.

- These shares can be sold again at any price, as long as the total money received from both the original owner and the new buyer is at least equal to the face value of the shares.

Accounting Entries :

Points for Consideration

- Loss on re-issue should not be greater than the amount that was forfeited.

- If the loss on re-issue is less than the forfeited amount, the extra money should be moved to Capital Reserve.

- The amount that was forfeited on shares (the amount that was originally paid) and has not yet been reissued should be listed under share capital.

- When only some of the forfeited shares are re-issued, then any profit from reissuing those shares should go to Capital Reserve.

- If shares are re-issued at a loss, that loss must be recorded in the Forfeited Shares Account.

- If shares are re-issued for more than their face value, the extra amount will be added to the Securities Premium Account.

- If the total amount from the re-issue and the forfeited amount exceeds the face value of the re-issued shares, you do not need to transfer that extra amount to the Securities Premium Account.

Calculation of Profit on Re-Issue of Forfeited Shares

- Students should understand that the credit balance in the forfeited shares account cannot be considered a surplus until the forfeited shares are re-issued. This is because, when the company re-issues these shares, it might give a discount to the new buyer that matches the amount held in the forfeited shares account.

- For example, if 120 shares with a nominal value of ₹10 are forfeited, and ₹5 per share was paid, this amount is transferred to the Forfeited Share Account.

- Later, if 50 shares are re-issued and ₹6per share is collected to make them fully paid, the following transactions occur:

- ₹200 (calculated as 50 shares x ₹10 - 50 shares x ₹6) will be credited to the Share Capital Account to cover the shortfall on the re-issued shares.

- An additional ₹50 (calculated as 50 shares x ₹5 - ₹200) will be moved to the Capital Reserve Account as the surplus from the re-issue of the 50 shares.

- The balance in the Forfeited Shares Account will reflect the amount collected from the remaining 70 forfeited shares, which equals ₹350. This amount will be carried forward until those shares are re-issued.

- In this scenario, it is assumed that the amount paid up on all 120 forfeited shares was ₹5 each. However, in reality, shares may be forfeited with different amounts outstanding.

- For instance, if 70 shares had ₹5 paid up and 50 shares had ₹7.50 paid up, the balance in the Share Forfeited Accountwould be calculated as:

- Share Forfeited Account Balance = (70 x 5) + (50 x 7.50) = ₹725

- If the 50 shares with ₹7.50 paid up are re-issued for ₹6 each, the balance in the Capital Reservewould be computed as follows:

- ₹(7.50 + 6 - 10) x 50 shares = ₹175

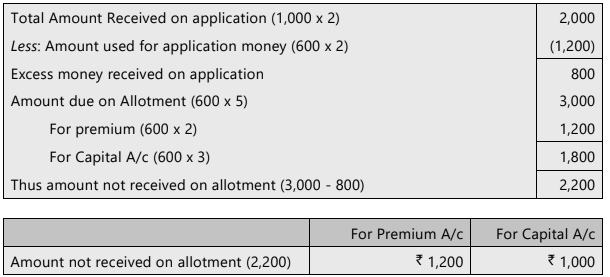

ILLUSTRATION 14

Mr. Long who was the holder of 2,000 preference shares of ₹ 100 each, on which ₹ 75 per share has been called up could not pay his dues on Allotment and First call each at ₹ 25 per share. The Directors forfeited the above shares and reissued 1500 of such shares to Mr. Short at ₹ 65 per share paid-up as ₹ 75 per share.

Give Journal Entries to record the above forfeiture and re-issue in the books of the company.

SOLUTION

Working Note:

Calculation of amount to be transferred to Capital Reserve

Forfeited amount per share = ₹ 50,000/2000 = ₹ 25

Loss on re-issue = ₹ 75 – ₹ 65 = ₹ 10

Surplus per share re-issued = ₹15

Transferred to capital Reserve ₹ 15 x 1500 = ₹ 22,500

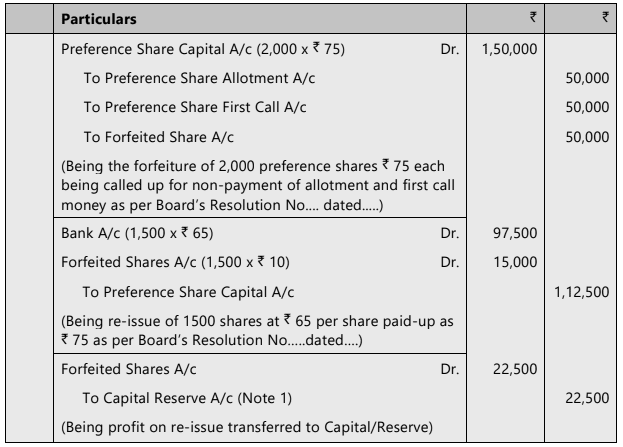

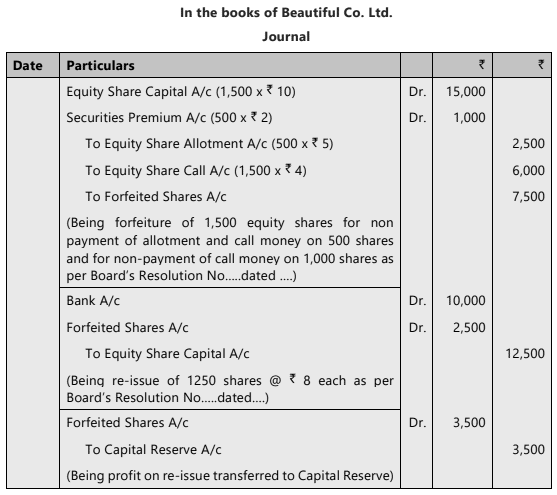

ILLUSTRATION 15

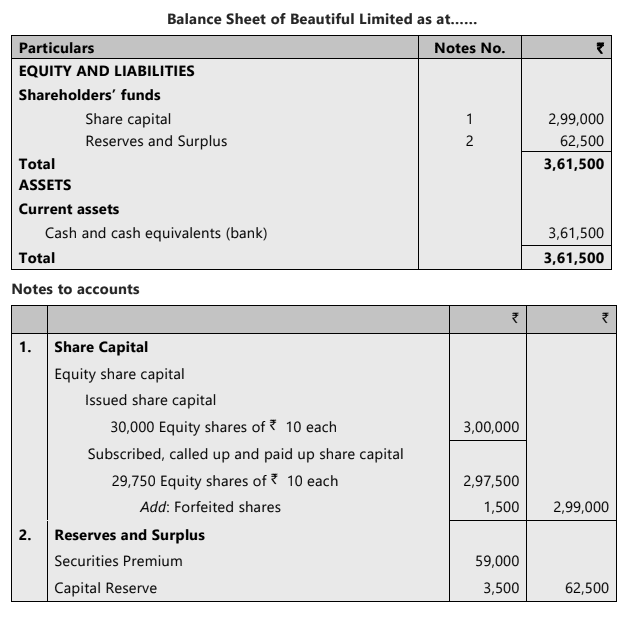

Beautiful Co. Ltd issued 30,000 equity shares of ₹ 10 each payable as ₹ 3 per share on application, ₹ 5 per share (including ₹ 2 as premium) on allotment and ₹ 4 per share on call. All the shares were subscribed. Money due on all shares was fully received except from Ram, holding 500 shares, who failed to pay the Allotment and Call money and Shyam, holding 1,000 shares, who failed to pay the Call Money. All those 1,500 shares were forfeited. Of the shares forfeited, 1,250 shares (including whole of Ram’s shares) were subsequently re-issued to Jadu as fully paid up at a discount of ₹ 2 per share.

Pass the necessary entries in the Journal of the company to record the forfeiture and re-issue of the share. Also prepare the Balance Sheet of the company.

SOLUTION

Working Note :

(1) Calculation of Amount to be Transferred to Capital Reserve

(2) Balance of Security Premium

Total Premium amount receivable on allotment = 60,000

Less: Amount reversed on forfeiture = (1,000)

Balance remaining = 59,000

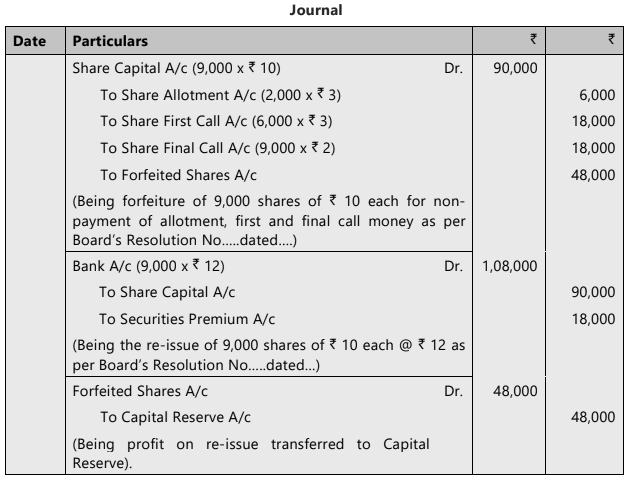

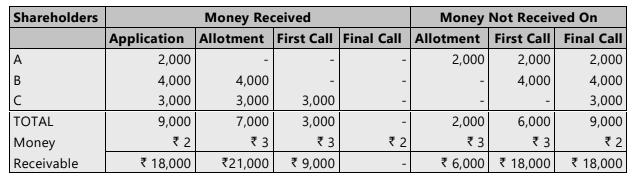

ILLUSTRATION 16

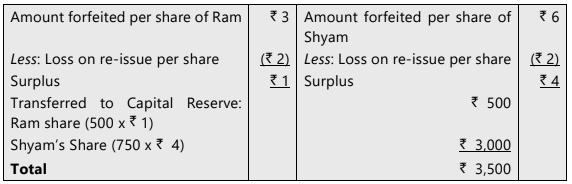

A holds 2,000 shares of ₹ 10 each on which he has paid ₹ 2 as application money. B holds 4,000 shares of ₹ 10 each on which he has paid ₹ 2 per share as application money and ₹ 3 per share as allotment money. C holds 3,000 shares of ₹ 10 each and has paid ₹ 2 on application, ₹ 3 on allotment and ₹ 3 for the first call. They all fail to pay their arrears on the second and final call and the directors, therefore, forfeited their shares. The shares are reissued subsequently for ₹ 12 per share fully paid-up. Journalise the transactions relating to the forfeiture and re-issue.

SOLUTION

Working Note:

ILLUSTRATION 17

X Limited invited applications for issuing 75,000 equity shares of ₹ 10 each at a premium of ₹ 5 per share. The total amount was payable as follows:

- ₹ 9 per share (including premium) on application and allotment

- Balance on the First and Final Call

Applications for 3,00,000 equity shares were received. Applications for 2,00,000 equity shares were rejected and money refunded. Shares were allotted on pro-rata basis to the remaining applicants. The first and final call was made. The amount was duly received except on 1,500 shares applied by Mr. Raj. His shares were forfeited. The forfeited shares were re-issued at a discount of ₹ 4/- per share.

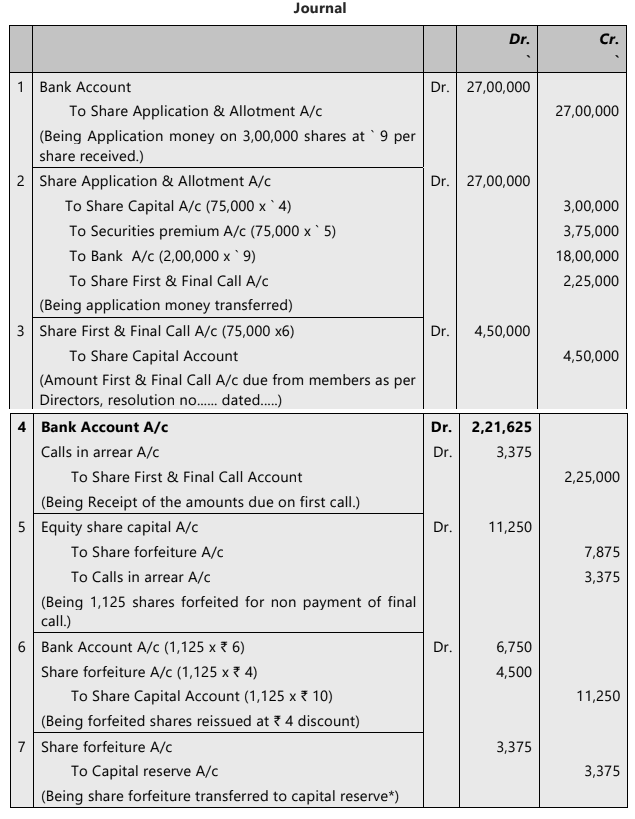

Pass necessary journal entries· for the above transactions in the books of X Limited.

SOLUTION

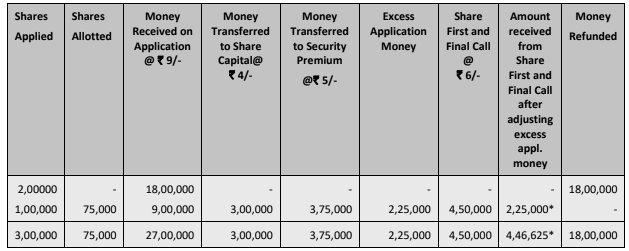

Working notes:

1.

*4,50,000 less 2,25,000

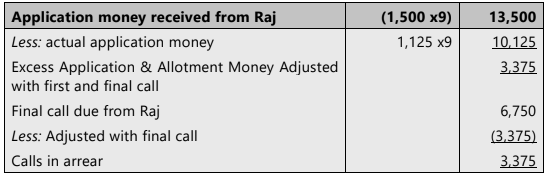

** ₹ 4,50,000 less ₹ 3,375.2. Number of shares allotted to Mr. Raj = 1,500 x 75,000 / 1,00,000 = 1,125 shares

3. Calculation of calls in arrear

Issue of Shares for Consideration Other Than Cash

- Public limited companies typically issue shares in exchange for cash, which is then used to acquire various assets necessary for the business. However, there are instances where a company may issue shares in direct exchange for assets such as land, buildings, or other tangible goods.

- Shares can also be issued as payment for services rendered by individuals such as promoters or lawyers during the formation of the company. When this occurs, these shares should be listed separately under the heading 'Share Capital.'

- Within a specified period after the allotment of shares, the company is required to present a written contract of sale or service to the Registrar regarding the shares that have been allotted.

- According to accounting standards, when an asset is acquired, either wholly or partially, through the issuance of shares or other securities, the cost of acquisition is determined by the fair value of the securities issued. This fair value may be indicated by the issue price set by statutory authorities and does not necessarily equate to the nominal or par value of the securities.

Accounting Entries:

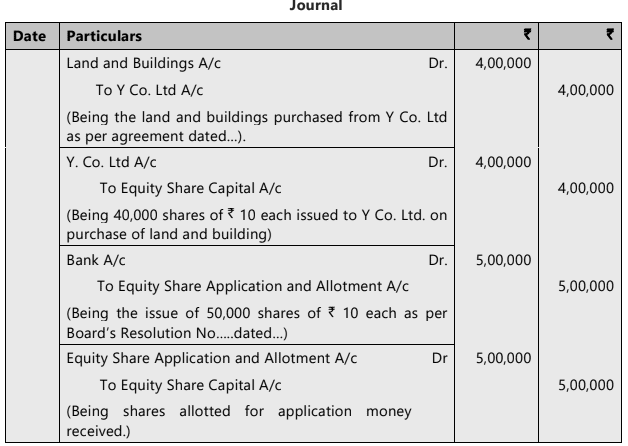

ILLUSTRATION 18

X Co. Ltd. was incorporated with an authorized share capital of 90,000 equity shares of ₹ 10 each. The company purchased land and buildings from Y Co. Ltd for ₹ 4,00,000 payable in fully paid-up shares of the company. The balance of the shares were issued to the public, which were fully subscribed and paid for.

You are required to pass Journal Entries and to prepare the Balance Sheet.

SOLUTION

Notes to accounts

|

68 videos|265 docs|83 tests

|

FAQs on Unit 2: Issue, Forfeiture and Re-Issue of Shares Chapter Notes - Accounting for CA Foundation

| 1. What is share capital and why is it important for a company? |  |

| 2. What are the different types of shares that a company can issue? |  |

| 3. How does a company issue shares for cash and what are the steps involved? |  |

| 4. What is the difference between issuing shares at a discount and at a premium? |  |

| 5. What are calls-in-arrears and calls-in-advance in share capital management? |  |