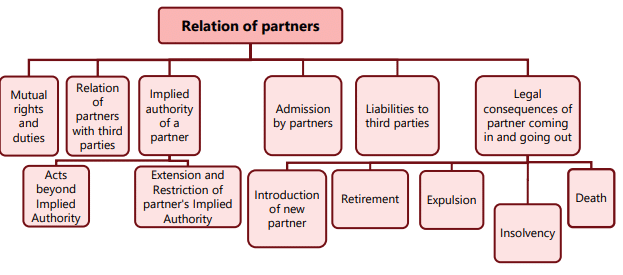

Unit 2: Relations of Partners Chapter Notes | Business Laws for CA Foundation PDF Download

Overview

Relationship of Partners to One Another

The Partnership Act outlines various provisions that regulate the relationship between partners.

1. General Duties of Partners (Section 9) :

- Partners are required to conduct the business of the firm for the mutual benefit of all partners and must provide full information about matters affecting the firm to any partner or their legal representatives.

- A partner must act with the utmost good faith in their dealings with other partners.

- All partners are obligated to render accounts to each other. If some accounts are maintained by one partner, they are expected to explain and provide full information about those accounts.

Example 1: If one partner is selling their share of the business to another partner, and one partner is more familiar with the accounts, it is their responsibility to disclose all relevant information.

2. Duty to Indemnify for Loss Caused by Fraud (Section 10) :

- A partner who engages in fraudulent activities in the course of the firm’s business must compensate for any losses incurred by the firm. The amount brought into the partnership should be distributed among the partners.

- If a partner’s actions constitute fraud against their co-partners, the co-partners have the right to hold the partner responsible for the consequences.

3. Determination of Rights and Duties of Partners by Contract (Section 11) :

- The mutual rights and duties of partners can be determined by a contract between them, which can be express or implied by a course of dealing.

- Such a contract can be varied by the consent of all partners, which can be express or implied.

- Contracts may specify that a partner cannot engage in any business other than that of the firm while they remain a partner, despite Section 27 of the Indian Contract Act, 1872.

- Partnership is based on the consent of the parties, not only for its existence but also for the terms of the agreement. An agreement to become partners or to change the terms does not need to be in any specific form.

4. The Conduct of the Business (Section 12):

(a) Right to Take Part in the Business: Every partner has the right to participate in the business of the firm. This is because the partnership business belongs to all the partners, and their management powers are generally equal.

Example 2: If a partner is unfairly excluded from participating in the business, the court can intervene and restrain the other partners from doing so. The excluded partner also has other remedies available, such as suing for dissolution or seeking accounts without dissolution.

(b) Right to Attend Diligently: Every partner is obligated to attend diligently to their duties in the conduct of the business.

(c) Decision-Making in Ordinary Matters: Any differences arising in ordinary matters related to the business can be decided by a majority of the partners. However, every partner has the right to express their opinion before a decision is made. No change in the nature of the business can be made without the consent of all partners.

(d) Right to Access Books: Every partner has the right to access, inspect, and copy any of the firm’s books.

(e) Rights of Heirs after Death of Partner: In the event of a partner’s death, their heirs or legal representatives have the right to access and inspect copies of the firm’s books.

(f) Contractual Variations: The rights mentioned above apply only if there is no contract stating otherwise between the partners. It is common to find terms in partnership agreements that limit the management power of certain partners or assign management to specific partners, excluding others. In such cases, the court is usually reluctant to interfere unless there is clear evidence of illegal actions or breaches of trust by the managing partners.

(g) Right to be Consulted (Section 12(c)): When differences arise among partners regarding the firm’s business, the majority opinion will prevail. However, all partners should be consulted as much as possible, and no change in the nature of the business can occur without the consent of all partners.

5. Mutual Rights and Liabilities (Section 13):

(i) Right to Share Profits (Section 13(b)): Partners have the right to share profits equally and bear losses equally. If there is no agreement on profit sharing, it is assumed to be equal, and the burden of proof lies with the party claiming otherwise.There is no link between profit-sharing ratios and capital contributions.

(ii) Interest on Capital (Section 13(c)): A partner is entitled to interest on capital only if there is an express agreement, a customary practice, a trade custom, or a statutory provision allowing it.

(iii) Interest on Advances (Section 13(d)): If a partner makes an advance to the firm beyond their capital contribution, they are entitled to interest at 6% per annum. Interest on advances continues after dissolution until payment, while interest on capital ceases at dissolution.

(iv) Right to be Indemnified (Section 13(e)): Partners have the right to be indemnified by the firm for expenses and liabilities incurred in the ordinary course of business, as well as for emergency actions taken to protect the firm, provided these actions are reasonable.

(v) Right to Indemnify the Firm (Section 13(f)): A partner must indemnify the firm for any losses caused by willful neglect in the conduct of the firm’s business.

Partnership Property (Section 14)

The Property of the Firm (Section 14): Partnership property includes all property, rights, and interests to which the firm, collectively, is entitled. In the absence of an agreement to the contrary, the following items are considered property of the firm:Property of the Firm: The property of the firm consists of:

All property, rights, and interests contributed by partners to the common business;

Property, rights, and interests acquired or purchased by the firm for its business purposes;

Goodwill of the business.

Goodwill of the Firm: Goodwill is considered part of the firm's property. It can be sold either separately or along with other properties of the firm.

Sale of Goodwill: When a partnership firm is dissolved, partners have the right to sell the goodwill for the benefit of all partners unless there is an agreement stating otherwise.

Restriction on Competing: A partner selling the firm's goodwill may agree with the buyer not to engage in a similar business within certain time or geographical limits. This agreement is valid as long as the restrictions are reasonable, despite Section 27 of the Indian Contract Act, 1872.

Property of a Partner: Property that exclusively belongs to a partner does not become partnership property simply because it is used for the partnership's business. It becomes partnership property only if there is an agreement to that effect.

Determining Partnership Property: Whether a particular property is considered partnership property depends on the real intention or agreement of the partners. Using a partner's property for the firm's purposes does not automatically make it partnership property unless intended as such.

Conversion of Property: Partners can agree to convert the property of any partner or the separate property of a partner into partnership property. This conversion, if made in good faith, is effective between partners and against the firm's creditors.

Goodwill as Property: Section 14 states that goodwill is subject to the partners' agreement and is considered property of the firm. However, the term "goodwill" is not defined in this section.

Definition of Goodwill: Goodwill represents the value of a business's reputation and the expected future profits exceeding the normal profit level of similar businesses.

Property of the Firm (Section 15):

- Exclusive Use: The property of the firm must be held and used solely for the firm's purposes.

- Shared Interest: All partners have a shared interest in the firm's property, but no individual partner has a proprietary interest in the assets during the partnership.

- Rights of Partners: Each partner is entitled to their share of profits as long as the firm exists and has the right to ensure that all partnership assets are used for partnership business.

Personal Profit Earned by Partners (Section 16)

- Profits from Firm Transactions: If a partner makes a profit from a firm transaction, using the firm's property, business connections, or name, they must account for and pay that profit to the firm.

- Competing Business Profits: If a partner runs a competing business, they must account for and pay all profits from that business to the firm.

Example 3: In a partnership for refining sugar, A, a wholesale grocer, sold sugar from his personal stock to the firm without disclosing it. A was required to account for the profit made from this sale to the firm.

Example 4: In a partnership for importing and selling salt, A conducted similar transactions on his own account and was held liable to account for the profits to the firm.

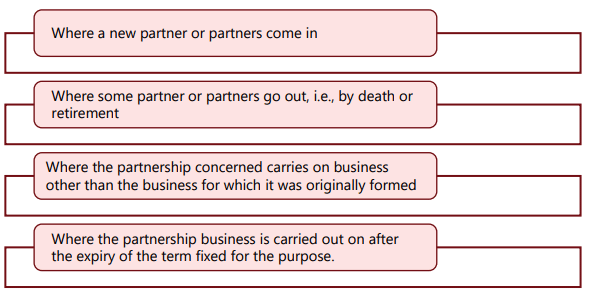

Rights and Duties of Partners After a Change in the Firm (Section 17)

- Understanding Changes: Before discussing rights and duties, it's important to understand how a change in the firm's constitution can occur. There are four ways in which this can happen.

- Change in the firm: When a firm's structure changes, the rights and responsibilities of the partners in the new firm stay the same as they were just before the change, as much as possible.

- After the fixed term ends: If a firm that was set up for a specific period continues to operate after that time, the partners' rights and duties remain the same as they were before the term ended, as long as they align with the rules of a partnership that can be ended at any time.

- When new partners join: If new partners come into the firm, it does not change the existing agreements among the original partners.

- When partners leave: If one or more partners leave the firm due to reasons like death or retirement, the remaining partners' rights and obligations stay intact.

- Business outside original purpose: If the partnership starts conducting business that is different from what it was originally formed to do, the mutual rights and duties of the partners still apply as they did before.

- Continuing after term expiration: If the partnership continues to operate after the agreed-upon time has passed, the partners' rights and duties remain unchanged, provided they comply with the principles of a partnership that can be ended at will.

- Additional undertakings: If a firm that was created to handle one or more specific projects takes on new projects, the rights and responsibilities related to the new projects are the same as those for the original projects.

Relation of Partners to Third Parties

1. Partner to be an Agent of the Firm (Section 18)- A partnership is defined as the relationship between partners who agree to share the profits of a business carried out by any or all of them acting for all (Section 4). This implies that any partner can act as an agent for the others.

- Section 18 clarifies this by stating that, subject to the provisions of the Act, a partner is an agent of the firm for its business purposes. A partner essentially acts as both a principal and an agent:

- As a principal, when acting in their own interest within the common concern of the partnership.

- As an agent, when acting for the benefit of the other partners.

- The key difference between a partner and a mere agent is that a partner has a community of interest in the entire property, business, and liabilities of the partnership, whereas an agent does not have such an interest.

- The rule that a partner is an agent of the firm applies only to acts done by partners for the purpose of the firm's business, not to all transactions and dealings between partners themselves.

2. Implied Authority of a Partner as Agent of the Firm (Section 19)

- A partner has the implied authority to bind the firm when they act to carry on business of the kind usually conducted by the firm.

- This implied authority is subject to certain restrictions and does not empower a partner to take certain actions without specific consent.

The act of a partner that is done to carry on the business of the kind usually conducted by the firm binds the firm. The authority of a partner to bind the firm conferred by this section is called his “implied authority”.

Restrictions on Implied Authority

- Submit a dispute to arbitration: A partner cannot agree to arbitrate a dispute on behalf of the firm.

- Open a bank account in their name: A partner cannot open a bank account for the firm in their own name.

- Compromise or relinquish claims: A partner cannot settle or give up any part of a claim on behalf of the firm.

- Withdraw legal proceedings: A partner cannot withdraw a lawsuit or legal action filed on behalf of the firm.

- Admit liability in legal proceedings: A partner cannot admit fault in a lawsuit or legal action against the firm.

- Acquire immovable property: A partner cannot purchase real estate on behalf of the firm.

- Transfer immovable property: A partner cannot sell or transfer real estate belonging to the firm.

- Enter into partnership agreements: A partner cannot enter into partnership agreements on behalf of the firm without consent.

Mode of Doing Act to Bind Firm (Section 22)

- An act or instrument done or executed by a partner or other person on behalf of the firm shall bind the firm if it is done or executed in the firm name, or in any other manner expressing or implying an intention to bind the firm.

- For example, if a partner signs a contract in the firm’s name, it binds the firm.

Understanding Implied Authority

- Implied authority refers to the power a partner has to act on behalf of the firm in matters related to the partnership business.

- Each partner acts as an agent for every other partner in all matters related to the partnership business, binding the firm to their actions.

Key Points on Implied Authority (Sections 19(1) and 22)

- The act of a partner binds the firm if it is done to carry on business of the kind usually conducted by the firm.

- The act must be done in the firm name or in a manner expressing or implying an intention to bind the firm.

- This authority is subject to certain restrictions, ensuring that partners act within their limits.

- The act must relate to the firm's usual business and fall within the partner's authority.

- The act should be for the normal conduct of the firm's business, which varies based on the nature and circumstances of each case.

Implied Authority of Partners:

- According to Section 22 of the Indian Partnership Act, a partner has the implied authority to bind the firm by acts done in the usual course of business and within the scope of the partnership. This authority can vary depending on the nature of the business.

Examples 5:

- In a firm of solicitors, if a partner borrows money and signs a promissory note without authority, the other partners are not liable because such acts are outside the ordinary scope of their business.

- However, in a firm of bankers, it may be usual for a partner to draw, accept, or endorse a bill of exchange on behalf of the firm.

Acts within Implied Authority in General Commercial Partnerships

- Pledge or sell partnership property

- Buy goods on behalf of the partnership

- Borrow money, contract debts, and pay debts on behalf of the partnership

- Draw, make, sign, endorse, transfer, negotiate, and procure to be discounted promissory notes, bills of exchange, cheques, and other negotiable instruments in the name and on behalf of the partnership

3. Extension and Restriction of Implied Authority

The implied authority of a partner can be extended or restricted by contract between the partners. Restrictions on implied authority are effective against third parties under the following conditions:

- The third party is aware of the restrictions, or

- The third party is unaware that they are dealing with a partner in a firm.

Example 6:

- If a partner borrows money in the name of the firm beyond their authority, and the other partners have restricted this authority, the firm may still be liable to repay the lender if the lender is unaware of the restriction.

- Conversely, if the lender is aware of the restriction, the firm may not be liable to repay the amount.

4. Partner's Authority in an Emergency (Section 21)

- In accordance with Section 21 of the Indian Partnership Act, a partner possesses the authority to take necessary actions in an emergency to safeguard the firm from potential losses. These actions should align with what an ordinary prudent person would do in similar circumstances, and such actions will be binding on the firm.

Effect of Admissions by a Partner (Section 23)

Partners, acting as agents for one another, have the ability to make binding admissions regarding partnership transactions, provided these admissions occur in the ordinary course of business. However, if a partner's authority is limited on a particular matter and the other party is aware of this limitation, the admission or representation will not bind the firm. It's important to note that the section addresses admissions and representations that impact the firm when presented by third parties; their effect may differ in disputes among the partners themselves.Example 7: Consider partners X and Y who run a business selling spare parts for various brands of motorcycle bikes. If Z, a customer, buys a spare part for his Yamaha motorcycle based on X's assurance that the part is suitable, and Y is unaware of this transaction, both X and Y could be held responsible to Z for any damages caused by the unsuitable part. Their liability may vary depending on the specifics of their partnership agreement and the circumstances surrounding the transaction.

Effect of Notice to Acting Partner (Section 24)

According to Section 24, a notice given to a partner who regularly engages in the firm's business activities regarding the firm's affairs is considered a notice to the entire firm. This holds true unless there is a fraud committed by that partner against the firm, with or without the partner's consent. Essentially, just as a notice to an agent is a notice to their principal, a notice to one acting partner is akin to a notice to all partners. However, the notice must be actual, not constructive, and should be received by a working partner, not a sleeping partner. Additionally, it must pertain to the firm's business for it to qualify as a notice to the firm.Example 8: In a partnership involving P, Q, and R engaged in the purchase and sale of second-hand goods, if R acquires a second-hand car from S on behalf of the firm and discovers during the transaction that the car is stolen and rightfully belongs to X, while P and Q remain unaware of this information, all partners would be liable to X, the legitimate owner of the car.

Example 9: A, a partner who actively participates in the management of the business of the firm, bought for his firm, certain goods, while he knew of a particular defect in the goods. His knowledge as regards the defect, ordinarily, would be construed as the knowledge of the firm, though the other partners in fact were not aware of the defect. But because A had, in league with his seller, conspired to conceal the defect from the other partners, the rule would be inoperative and the other partners would be entitled to reject the goods, upon detection by them of the defect.

Liability to Third Parties

(a) Liability of a Partner for Acts of the Firm (Section 25)- Partners are jointly and severally responsible to third parties for all acts within their express or implied authority.

- These acts are considered as being done towards the business of the firm.

- An "act of the firm" refers to any act or omission by all partners, any partner, or an agent of the firm that creates a right enforceable by or against the firm.

- For liability under Section 25, the act must have occurred while the individual was a partner.

- Example 10 : Partners were held liable for trademark infringement damages even if the damages arose after the firm's dissolution, as they were partners when the infringing acts took place.

(b) Liability of the Firm for Wrongful Acts of a Partner (Section 26)

- The firm is liable to the same extent as the partner for any loss or injury caused to a third party by a partner's wrongful acts if they are done while acting:

- In the ordinary course of the business of the firm.

- With the authority of the partners.

- Even if the method employed by the partner was unauthorized or wrongful, the act can still be considered authorized if it falls within the categories mentioned in Section 26.

- All partners in a firm are liable to a third party for loss or injury caused by a partner's negligent act acting in the ordinary course of business.

- Example 11: One of the two partners in coal mine acted as a manager was guilty of personal negligence in omitting to have the shaft of the mine properly fenced. As a result thereof, an injury was caused to a workman. The other partner was also held responsible for the same.

Liability of the Firm for Misapplication by Partners (Section 27)

In a coal mine partnership, one partner's negligence in failing to properly fence the mine shaft led to an injury to a workman. Both partners were held equally responsible for the incident.

Clause (a) of Section 27 addresses situations where a partner, acting within their authority, receives money or property belonging to a third party and misapplies it. It is not necessary for the money to have physically come into the firm's custody for this clause to apply.

Clause (b) applies when money or property has come into the firm's custody and is misapplied by any partner. The firm is liable in both cases.

If a partner receives money outside the scope of their authority, it is not considered a receipt by the firm. Other partners are not liable unless the money comes into their possession or control.

Example 12: In a car parking partnership, if one partner sells a car parked by a customer without authority, the firm is still liable for that partner's actions.

Rights of Transferee of a Partner’s Interest (Section 29)

A partner’s share in a partnership is transferable like any other property. However, since the partnership is based on mutual trust, the rights of the transferee (the person receiving the partner’s share) are limited.

Rights of the Transferee:

During the Partnership: The transferee is not allowed to interfere with the business, demand accounts, or inspect the firm’s books. They are only entitled to receive the share of profits belonging to the transferring partner, and they must accept the profits as agreed by the partners without disputing the accounts.

Upon Dissolution or Retirement: When the firm is dissolved or the transferring partner retires, the transferee is entitled to claim their share from the remaining partners.

Section 30: Minors Admitted to the Benefits of Partnership

- A minor cannot be bound by a contract because a minor's contract is voidable at the minor's discretion, not automatically void.

- Therefore, a minor cannot become a partner in a firm because partnership is founded on a contract.

- However, a minor can be admitted to the benefits of partnership under Section 30 of the Act.

- This means that a minor can be validly given a share in the partnership profits with the consent of all partners.

- When a minor is admitted to the benefits of partnership, their rights and liabilities are governed by Section 30 of the Act.

- This section outlines the rights and liabilities of a minor who is admitted to the benefits of partnership.

- It is important to note that a minor who is admitted to the benefits of partnership does not have the same rights and liabilities as a partner.

- For example, a minor cannot be held liable for the debts of the partnership.

(1) Rights of a Minor Partner:

- Profit Share: A minor partner is entitled to his agreed share of the firm's profits.

- Access to Accounts: He has the right to access, inspect, and copy the firm's accounts.

- Legal Action: He can sue the partners for account settlement or payment of his share, but this is only possible when he severs his connection with the firm.

- Election on Majority: Upon reaching majority, he has 6 months to decide whether to become a partner. If he chooses to become a partner, he is entitled to the share he would have received as a minor. If he decides not to become a partner, the firm must serve public notice, and his share will not be liable for any acts.

(2) Liabilities :

(i) Before attaining majority:

- The liability of a minor in a partnership is limited to their share in the profits and the property of the firm.

- A minor is not personally liable for the debts of the firm incurred during their minority.

- While a minor cannot be declared insolvent, if the firm is declared insolvent, their share in the firm passes to the Official Receiver or Assignee. This means that the minor can recover their share in the firm on a proportional basis from the Official Receiver or Assignee.

(i) After Attaining Majority:

- When a minor partner attains majority or gains knowledge of being admitted to the benefits of partnership, he has a window of 6 months to decide whether to remain a partner or leave the firm.

If he chooses not to become a partner:

- He must give public notice of his decision.

- His rights and liabilities remain those of a minor until the notice is given.

- His share will not be liable for any acts of the firm occurring after the notice.

- He may have the right to sue the partners for his share of the property and profits, usually upon dissolution of the partnership or his exit from it.

If he becomes a partner:

- He becomes personally liable to third parties for all acts of the firm from the date of his admission.

- His share in the property and profits remains the same as it was when he was a minor.

Legal Consequences of Partner Coming In and Going Out (Sections 31 – 35)

Any change in the relationship of partners leads to the reconstitution of the partnership firm. Instances that trigger reconstitution include:- Admission of a new partner

- Retirement of an existing partner

- Expulsion of a partner

- Insolvency of a partner

(i) Introduction of a Partner (Section 31)

- Consent of Existing Partners: New partners can only join a firm with the consent of all existing partners, as per the contract between partners and the provisions regarding minors in a firm.

- Rights and Liabilities of a New Partner: The liabilities of a new partner typically begin from the date of their admission. However, they can agree to be liable for obligations incurred before their admission. The new firm, including the new partner, can agree to take on the existing debts of the old firm. Creditors may also agree to accept the new firm as their debtor and release the old partners, but this requires the creditor's consent.

- Novation: Novation refers to the substituted liability in a contract, and it is not limited to partnership cases. A mere agreement among partners does not constitute novation. For example, an agreement between the partners and the incoming partner that makes them liable for existing debts does not automatically give creditors the right to claim against the incoming partner.

- Partnership of Two Partners: Section 31 does not apply to a partnership of two partners, which is automatically dissolved upon the death of one partner. However, specific conditions or jurisdictional laws may provide exceptions.

(ii) Retirement of a Partner ( Section 32 )

A partner can retire from a partnership under the following conditions:

- With Consent: If all the other partners agree to the retirement.

- According to Agreement: If there is an explicit agreement among the partners that allows for retirement.

- Notice in Partnership at Will: If the partnership is a partnership at will, by giving written notice to all partners of the intention to retire.

Discharge from Liability:

A retiring partner can be discharged from liability to third parties for acts of the firm done before retirement through an agreement with the third party and the partners of the reconstituted firm. This agreement can also be implied by the course of dealing between the third party and the reconstituted firm after the third party became aware of the retirement.

Continuing Liability:

- Acts Before Public Notice: Even after a partner retires, he and the remaining partners are liable to third parties for acts that would have constituted acts of the firm before retirement until public notice of the retirement is given.

- Protection for Retired Partners: A retired partner is not liable to any third party who deals with the firm without knowledge of his retirement.

Giving Notice:

- Notices regarding retirement under subsection (3) can be given by the retired partner or by any partner of the reconstituted firm.

Supreme Court Ruling:

- In the case of Vishnu Chandra Vs. Chandrika Prasad, the Supreme Court interpreted a clause in a partnership deed concerning a partner's dissociation from the partnership business. The court clarified that this clause includes a situation where a partner wishes to retire from the partnership.

- The expression used in the clause indicated that the partnership business would not cease to exist in the event of a partner's retirement.

Example 13:

- When a partner who was the tenant of the premises where the partnership business was conducted retires, it does not automatically result in the assignment of tenancy rights to the remaining partners.

- Even though the retiring partner loses any right, title, or interest in the business, the tenancy rights do not transfer to the remaining partners solely due to the retirement of the partner.

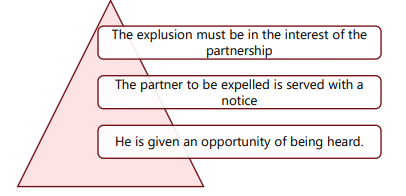

(iii) Expulsion of a Partner (Section 33)

- Conditions for Valid Expulsion: For the expulsion of a partner to be valid under Section 33, the following conditions must be met:

- Existence of Power in Contract: The power of expulsion must be explicitly stated in the contract between the partners.

- Majority Decision in Good Faith: The power must be exercised by a majority of partners and in good faith.

- Good Faith: The expulsion must be in good faith and in the best interest of the partnership.

- Test of Good Faith: The test of good faith includes the following:

- Interest of the Partnership: The expulsion must be in the interest of the partnership.

- Notice and Opportunity to be Heard: The partner being expelled must be given notice and an opportunity to be heard.

- Invalid Expulsion: If a partner is expelled without meeting these conditions, the expulsion is null and void.

- Continuation of Partnership: The invalid expulsion does not dissolve the partnership, and it continues as before.

Example14:

- Scenario: Partners A, B, and C were running a successful business together. After a personal incident involving spouses A and B, A and C decided to expel B from the partnership without notice.

- Legal Perspective: According to the Indian Partnership Act, 1932, a partner can only be expelled in good faith and with the power conferred by the partnership contract. Since these conditions were not met, B's expulsion was invalid.

- Expulsion Validity: The expulsion of Partner B was not valid as it did not meet the conditions of good faith and proper procedure outlined in Section 33(1).

- Rights of Expelled Partner: The provisions applicable to a retired partner also apply to an expelled partner, treating them as if they had retired from the partnership.

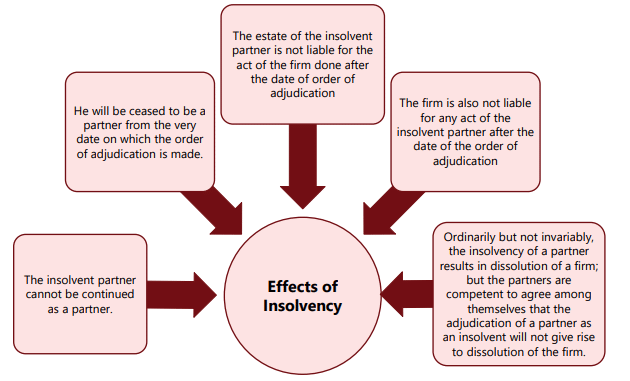

(iv) Insolvency of a Partner (Section 34)

When a partner in a firm is declared insolvent by a court, he ceases to be a partner from the date of the court's order, regardless of whether the firm is dissolved or not.

If the partnership agreement allows the firm to continue despite a partner's insolvency, the following rules apply:

- The estate of the adjudicated partner is not responsible for any actions of the firm after the adjudication date.

- The firm is not liable for any actions of the insolvent partner occurring after the adjudication order.

(v) Liability of Estate of Deceased Partner (Section 35)

- Normally, when a partner dies, the partnership is dissolved. However, this rule can be changed if the partners have a contract that states otherwise. The partners can agree that the death of one partner will not dissolve the partnership, except when there are only two partners in the firm.

- To release the estate of the deceased partner from future obligations of the partnership, it is not required to inform the public or those dealing with the firm.

Example 15:

- Suppose X was a partner in a firm that ordered goods while X was alive, but the delivery occurred after X’s death. In this situation, X’s estate would not be responsible for the debt. Creditors could only pursue the surviving partners personally and seek a claim against the partnership assets in the hands of those partners. A lawsuit for goods sold and delivered would not be valid against the representatives of the deceased partner, although exceptions might exist based on local laws or specific partnership terms. This is because there was no debt owed for the goods during X’s lifetime.

Rights of Outgoing Partner to Carry on Competing Business (Section 36)

An outgoing partner has the right to engage in a business that competes with the firm they are leaving. They can also promote this competing business. However, unless there is a specific agreement stating otherwise, the outgoing partner cannot:- Use the name of the firm.

- Claim to be running the business of the firm.

- Solicit customers who were dealing with the firm before the partner left.

Agreement in Restraint of Trade

A partner can agree with their partners that upon leaving the partnership, they will not engage in any similar business within a certain period or specific geographical area. This type of agreement is valid even with section 27 of the Indian Contract Act, 1872, as long as the restrictions are reasonable.Right of Outgoing Partner to Share Subsequent Profits (Section 37)

- According to section 37, when a partner in a firm passes away or otherwise leaves the partnership, and the remaining partners continue the business using the firm’s assets without settling accounts with the outgoing partner or their estate, the outgoing partner or their representatives have the right to claim a share of the profits made after their departure. This share is based on the use of their portion of the firm’s assets or interest at six per cent per annum on the value of their share in the firm’s assets, unless there is a different agreement in place.

- When a contract between partners gives the surviving or continuing partners the option to buy the interest of a deceased or outgoing partner, and this option is properly exercised, the estate of the deceased or outgoing partner is not entitled to any further share of profits. However, if the partner exercising the option does not comply with its terms in all material respects, they are liable to account under the previous provisions of this section.

Example 16: A, B, and C are partners in a machinery manufacturing business. A is entitled to three-eighths of the partnership property and profits. When A becomes bankrupt, B and C continue the business without settling accounts with A's estate. A's estate is entitled to three-eighths of the profits made in the business from the date of his bankruptcy until the final liquidation of the partnership affairs, subject to local bankruptcy laws and partnership agreements.

Example 17: A, B, and C are partners. When C retires after selling his share in the partnership firm, A and B fail to pay the agreed value of C's share. According to the agreement, the value of C's share at the time of his retirement becomes a debt from the date he ceased to be a partner. C is entitled to recover this debt with interest.

Revocation of Continuing Guarantee by Change in Firm (Section 38)

Section 38 states that a continuing guarantee given to a firm or a third party regarding the transactions of a firm is revoked for future transactions from the date of any change in the firm's constitution, unless there is an agreement to the contrary.|

32 videos|185 docs|57 tests

|

FAQs on Unit 2: Relations of Partners Chapter Notes - Business Laws for CA Foundation

| 1. What are the rights and duties of partners after a change in the firm as per Section 17? |  |

| 2. How does Section 23 relate to the admissions made by a partner? |  |

| 3. What is the liability of partners to third parties under partnership law? |  |

| 4. What are the rights of a transferee of a partner’s interest as per Section 29? |  |

| 5. Can minors be admitted to the benefits of partnership and what does Section 30 state about this? |  |