Unit 2: The Concept of Money Supply Chapter Notes | Business Economics for CA Foundation PDF Download

Unit Overview

Introduction

- In the previous unit, we talked about the different theories about the demand for money.

- Money serves as a means of payment and acts as a lubricant that makes exchanges easier.

- Regardless of its type, money has three main roles in any economy:

- It acts as a medium of exchange, allowing people to buy and sell goods and services.

- It serves as a unit of account, which means it helps to measure and express the value of goods and services in monetary terms.

- It functions as a store of value, enabling people to save money for future use.

- In practice, money provides not just monetary services but also tangible benefits.

- This is why money must be connected to the activities that economic entities engage in.

- For policy purposes, money can be defined as a collection of liquid financial assets. Changes in the amount of these assets can affect overall economic activity.

- To ensure economic stability, the money supply should be kept at an ideal level at all times.

- A key requirement for maintaining this is to regularly and accurately assess the money supply and adjust it according to the country's monetary needs.

- This unit will explore various aspects related to the supply of money.

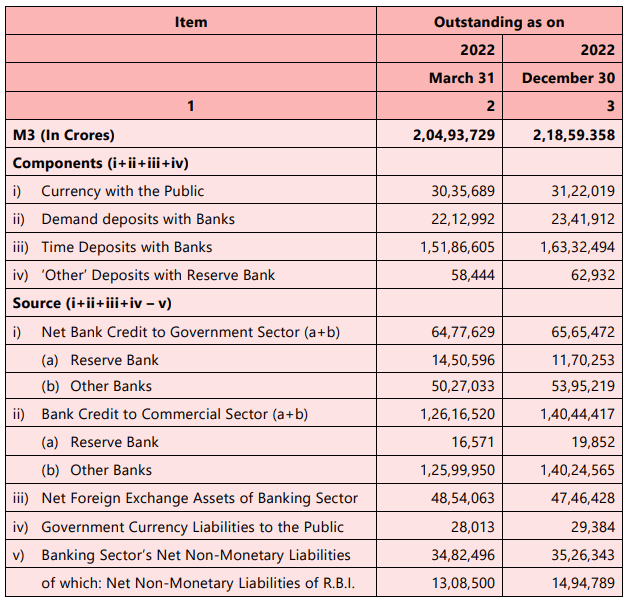

Money Supply on December 30th, 2022

- M3 is known as broad money.

- The formula for M3 is: M3 = M1 + Time deposits with the banking system.

- M2 is defined as: M2 = M1 + Savings deposits from post office savings banks.

- M1consists of:

- Currency in public hands.

- Demand deposits with the banking system, which includes savings accounts and current accounts.

- Broad money (M3)includes:

- Currency.

- Deposits with a maturity of up to two years.

- Deposits that can be withdrawn on notice of up to three months.

- Repurchase agreements.

- Money market fund shares/units.

- Debt securities with a maturity of up to two years.

- The term ‘public’refers to all economic units, such as:

- Households.

- Firms.

- Institutions.

- Exceptions to the publicdefinition include:

- Producers of money like the government and the banking system.

- The government includes central, state, and local governments.

- The banking system includes the Reserve Bank of India and all banks that accept demand deposits.

- The publicalso includes:

- Local authorities.

- Non-banking financial institutions.

- Non-departmental public-sector undertakings.

- Foreign central banks and governments.

- The International Monetary Fund (IMF), which holds some Indian money in deposits with the RBI.

- When discussing the money supply, it is important to note that:

- Interbank deposits are not included.

- Money held by the government and the banking system is excluded.

Rationale of Measuring Money Supply

1. Understanding Money Growth: By analyzing the money supply, we can gain insights into the factors driving money growth in the economy. This helps in understanding the underlying monetary developments and their causes.

2. Monetary Policy Framework: Measuring money supply is crucial for evaluating whether the amount of money in the economy aligns with the goals of price stability. It helps central banks understand deviations from these standards and adjust their policies accordingly.

Central banks worldwide use monetary policy to stabilize price levels and promote GDP growth by controlling the supply of money, primarily through managing the monetary base. The effectiveness of such policies relies on the ability to control both the monetary base and the money supply.

Sources of Money Supply

- Recent advancements in technology-driven payment solutions have prompted central banks worldwide to examine the potential advantages and risks associated with issuing a Central Bank Digital Currency (CBDC). This exploration is essential to keep pace with the ongoing trends in innovation. The Reserve Bank of India (RBI) has also been assessing the benefits and drawbacks of introducing CBDCs for some time.

- Currently, the RBI is working towards a phased implementation strategy, progressing through various stages of pilot programs before the final launch. Simultaneously, the RBI is evaluating potential use cases for its own CBDC, known as the Digital Rupee (e₹), aiming for minimal disruption to the financial system. We are at the brink of a significant transformation in the evolution of currency, which will fundamentally alter the nature and functions of money.

- The Reserve Bank defines CBDC as legal tender issued by a central bank in digital form. While similar to sovereign paper currency, CBDCs differ in form and are exchangeable at par with existing currency. They will be accepted as a medium of payment, legal tender, and a safe store of value. CBDCs will appear as liabilities on a central bank’s balance sheet.

In India, cryptocurrencies face considerable legislative uncertainties and are not legally recognized as currency by the Reserve Bank. As a result, they are not classified as money. In a significant development for crypto traders in India, the RBI has clarified that banks and other financial entities cannot invoke the RBI’s 2018 order, which prohibited them from dealing with virtual cryptocurrencies.

(a) Central Bank

- The supply of money in the economy is primarily determined by the central bank, which has the authority to issue currency and regulate the money supply.

- The central bank issues high-powered money, also known as base money or reserve money, which forms the foundation for the entire money supply in the economy.

- High-powered money includes currency in circulation and reserves held by commercial banks with the central bank.

- The currency issued by the central bank is known as fiat money, as it is not backed by a physical commodity like gold but is accepted as legal tender by law.

(b) Commercial Banks

- Commercial banks play a crucial role in the money supply by creating credit money through their lending activities.

- When banks provide loans to individuals and businesses, they do not physically hand over existing money; instead, they create new deposits in the borrowers' accounts, effectively creating new money.

- This process of fractional reserve banking allows banks to lend out a portion of the deposits they receive while keeping a fraction as reserves, thus expanding the money supply.

- The combination of high-powered money and credit money constitutes the total money supply in the economy.

Evolution of Money

- The concept of money has evolved significantly over time, from commodity-based money to metallic currency, paper currency, and now to digital currency.

- With advancements in technology and the digitalization of financial systems, new forms of money, such as Central Bank Digital Currencies (CBDCs), are emerging, representing a new milestone in the history of money.

Measurement of Money Supply in India

Measuring the money supply is a challenging task due to the variety of money types, especially credit money. Different countries have their own practices for measuring money supply, and these measures can vary from country to country, over time, and for different purposes.The Reserve Bank of India (RBI) compiles and publishes a range of monetary and liquidity measures. Money supply changes when the amount of any of its components changes. Since July 1935, the RBI has been compiling and disseminating monetary statistics.

Historical Measures of Money Supply:

1. Narrow Measure (M1)

- Until 1967-68, the RBI published only a narrow measure of money supply known as M1.

- M1 was defined as the sum of currency and demand deposits held by the public.

2. Introduction of Aggregate Monetary Resources (AMR)

- In 1967-68, the RBI introduced a broader measure called Aggregate Monetary Resources (AMR) alongside the narrow measure.

3. Four Alternative Measures

- From April 1977, based on the recommendations of the Second Working Group on Money Supply, the RBI started publishing data on four alternative measures of money supply: M1, M2, M3, and M4, along with reserve money.

Definitions of Money Supply Measures:

1. M1: Includes currency notes and coins with the public, demand deposits with the banking system (current and savings accounts), and other deposits with the RBI.

2. M2: M1 plus savings deposits with post office savings banks.

3. M3: M1 plus time deposits with the banking system.

4. M4: M3 plus total deposits with the Post Office Savings Organization, excluding National Savings Certificates.

Determinants of Money Supply

There are two main theories regarding the determination of money supply:

- Exogenous Determination: Some believe that the central bank determines the money supply from outside the system.

- Endogenous Determination: Others argue that the money supply is influenced by changes in economic activity, such as people's preference for holding currency versus deposits, interest rates, and so on.

Currently, the money supply is explained using the money multiplier approach. This approach looks at the relationship between the money stock and money supply in terms of the monetary base or high-powered money. The monetary base includes the total currency in circulation and bank reserves.

According to this approach, the total supply of nominal money in the economy is determined by the combined actions of the central bank, commercial banks, and the public. Before diving into the determinants of money supply, it is essential to understand the concept of the money multiplier.

Understanding the Money Multiplier

The Reserve Bank of India (RBI) generates what is known as the monetary base or high-powered money. Banks, on the other hand, create money by issuing loans. When a bank lends or invests its excess reserves, it does so to earn additional interest. This process leads to a situation where a one-rupee increase in the monetary base results in a more than one-rupee increase in the money supply. This phenomenon is referred to as the money multiplier.

Definition of Money Supply

- Money can be classified as either currency held by the public or bank deposits, expressed as: M = C + D.

Relationship Between Money Supply, Multiplier, and Monetary Base

- The equation M = m X MB represents the money supply (M) as the product of the money multiplier (m) and the monetary base (MB). From this equation, the money multiplier (m) can be derived as: Money Multiplier (m) = Money Supply / Monetary base...

Understanding the Money Multiplier

- The money multiplier (m) is a ratio that connects changes in the money supply to changes in the monetary base. It represents the ratio of the total money stock to the stock of high-powered money.

- For example, if a central bank injects Rs. 100 crore into the economy through open market operations and this leads to an increase of Rs. 500 crore in the final money supply, the money multiplier is 5. This indicates how much the monetary base is transformed into money supply.

Relationship Between Money and High-Powered Money:

- Money and high-powered money are linked through the money multiplier. To simplify the concept, two assumptions are made:

(a) Banks do not hold excess reserves.

(b) Individuals and non-bank corporations do not hold currency.

Factors Influencing the Size of the Money Multiplier

- The money multiplier is inversely related to the reserve ratio. Banks hold only a fraction of high-powered money in reserves and lend out the rest, leading to money creation. If R represents the reserve ratio, each unit of money reserves generates 1/R money.

- For instance, if R = 10%, the money multiplier is 10. If the reserve ratio is 5%, the money multiplier is 20. Therefore, a higher reserve ratio means banks lend out a smaller portion of each deposit, resulting in a smaller money multiplier.

Impact of Currency Holdings on the Money Multiplier

- When a portion of high-powered money is held as currency, it does not undergo multiple deposit expansion, reducing the size of the money multiplier. An increase in the monetary base that goes into currency is not multiplied, whereas an increase that supports deposits is multiplied.

The Money Multiplier Approach to the Supply of Money

The money multiplier approach to the supply of money, introduced by Milton Friedman and Anna Schwartz in 1963, identifies three key factors as immediate determinants of the money supply:

Stock of High-Powered Money (H). This refers to the base level of money that the central bank controls, which includes currency in circulation and reserves held by commercial banks.

Reserve Ratio (r). This is the ratio of reserves to deposits, indicating the fraction of deposits that banks are required to hold as reserves. It is calculated as Reserves/Deposits (R/D).

Currency-Deposit Ratio (c). This ratio reflects the behaviour of the public regarding how much currency they hold relative to deposits. It is calculated as Currency/Deposits (C/D).

These factors represent the behaviour of the central bank, commercial banks, and the general public, respectively. Let's explore how each of these contributes to the determination of the aggregate money supply in an economy.

(a) The Behaviour of the Central Bank

- The central bank controls the issuance of currency, which is reflected in the supply of nominal high-powered money.

- The money stock is determined by the money multiplier, and the monetary base (H) is regulated by the monetary authority.

- If the behaviour of the public and commercial banks remains constant, the total supply of nominal money in the economy will increase in direct proportion to the supply of nominal high-powered money issued by the central bank.

(b) The Behaviour of Commercial Banks

- Commercial banks play a crucial role in determining the total amount of nominal demand deposits by creating credit.

- The behaviour of commercial banks is reflected in their reserve ratio, which is the ratio of cash reserves to deposits.

- If the required reserve ratio on demand deposits increases, banks need to hold more reserves, leading to a contraction in loans, a decline in deposits, and a decrease in the money supply.

- Conversely, if the required reserve ratio decreases, banks can support more deposits with the same level of reserves, leading to an increase in the money supply.

- In essence, a smaller reserve ratio results in a larger money multiplier.

- In practice, commercial banks often hold more reserves than the required minimum, maintaining a higher actual reserves ratio as a buffer against unexpected cash needs.

(c) Public Behaviour

- Demand deposits in banks can undergo multiple expansions, while currency held by the public does not. When bank deposits are converted into currency, the capacity for credit money creation decreases. This leads to a decline in the overall level of multiple expansion, causing the money multiplier to fall.

- Therefore, there is a negative relationship between the money multiplier and the currency ratio (c). As the currency ratio increases, both the money multiplier and the money supply decrease.

Factors Affecting Money Multiplier

- Currency-Deposit Ratio (c). Indicates how much currency people hold relative to deposits. A smaller ratio means more deposits are available for banks to lend, increasing the money multiplier. This ratio reflects people's banking habits, influenced by economic activity, financial access, and innovations.

- Time Deposit-Demand Deposit Ratio (TD/DD). Shows the proportion of money held in time deposits versus demand deposits. A higher TD/DD ratio means more free reserves for banks, leading to greater deposit expansion and monetary growth.

- Required Reserve Ratio (r). The minimum reserves banks must hold, set by the central bank. Lowering this ratio increases the money multiplier.

- Excess Reserve Ratio (e). The proportion of excess reserves banks hold. A higher excess reserve ratio can increase the money multiplier.

Money Supply Determinants

- High Powered Money (H). The base money supply, including currency and reserves.

- Money Multiplier (m). The factor by which high powered money is multiplied to determine the total money supply.

- Proximate Determinants. The currency ratio, reserve ratio, and excess reserve ratio are key factors in analyzing changes in the nominal money supply.

Revised Equations

- Money Supply (M). M = (c+1) D

- High Powered Money (H). H = (c+ r) D

- Money Multiplier (m). m = 1 + c / r + e + c

When Excess Reserves are Present:

- The money multiplier (m) can be adjusted to reflect the presence of excess reserves, further influencing the money supply.

Money Multiplier

Money Multiplier refers to the maximum amount of money that a bank can create with each unit of reserves. It is determined by the reserve ratio, which is the percentage of deposits that banks are required to hold as reserves.

The formula for calculating the money multiplier is:

- Money Multiplier = 1 / Reserve Ratio

For example, if the reserve ratio is 10%, the money multiplier would be 10 (1 / 0.10). This means that for every $1 of reserves, banks can create $10 of new money through the lending process.

The money multiplier can be affected by various factors, including changes in the reserve ratio, changes in public demand for cash, and changes in the willingness of banks to lend. A higher reserve ratio will lead to a lower money multiplier, while a lower reserve ratio will lead to a higher money multiplier.

In summary, the money multiplier is a crucial concept in understanding how banks create money and the impact of monetary policy on the money supply.

Money Multiplier Formula

The formula for the money multiplier is given by:

- m = 1 + c / r + e + c

Where:

- m = Money Multiplier

- c = Currency Ratio (the proportion of currency held by the public)

- r = Required Reserve Ratio (the proportion of deposits that banks must hold as reserves)

- e = Excess Reserves Ratio (the proportion of deposits that banks hold as excess reserves)

Components of the Money Multiplier

- Currency Ratio (c): This ratio is determined by the behavior of the public and reflects the proportion of their money that they choose to hold in the form of currency rather than deposits. For example, if the public holds 50% of their money as currency and 50% as deposits, the currency ratio would be 0.5.

- Excess Reserves Ratio (e): This ratio is set by banks and indicates the proportion of deposits that banks hold as excess reserves beyond the required reserves. For instance, if a bank holds 0.1% of its deposits as excess reserves, the excess reserves ratio would be 0.001.

- Required Reserve Ratio (r): This ratio is set by the central bank and represents the minimum proportion of deposits that banks must hold as reserves. The required reserve ratio is influenced by factors such as the Cash Reserve Ratio (CRR) and the reserves needed to meet settlement obligations. For example, if the required reserve ratio is 10%, it means banks must hold 10% of their deposits as reserves.

Example of Money Multiplier Calculation

Let’s consider a hypothetical scenario in Gladys Land to illustrate the concept of the money multiplier:

- Currency (C): 400 billion

- Deposits (D): 800 billion

- Excess Reserves (e): 0.8 billion (or 800 million)

- Money Supply (M): C + D = 1200 billion

- Currency Ratio (c): C/D = 400 billion / 800 billion = 0.5

- Excess Reserves Ratio (e): e = 0.8 billion / 800 billion = 0.001

- Required Reserve Ratio (r): 10% (or 0.1)

Calculation of the Money Multiplier

Now, let’s calculate the money multiplier (m) using the formula:

- m = 1 + c / r + e + c

Substituting the values:

- m = 1 + 0.5 / 0.1 + 0.001 + 0.5

Simplifying further:

- m = 1 + 5 + 0.001 + 0.5

- m = 6.501

Impact of Changes in Reserve Ratio

If the required reserve ratio increases to 15%, the money multiplier would be recalculated as follows:

- m = 1 + 0.5 / 0.15 + 0.001 + 0.5

- m = 1 + 3.333 + 0.001 + 0.5

- m = 4.834

This demonstrates that an increase in the required reserve ratio (r) leads to a decrease in the money multiplier (m). Conversely, a decrease in the required reserve ratio would result in an increase in the money multiplier.

Difference between Money Multiplier and Simple Deposit Multiplier

- Money Multiplier: The money multiplier takes into account the currency held by the public and excess reserves held by banks in addition to the required reserves. It reflects the maximum potential increase in the money supply resulting from an increase in bank reserves.

- Simple Deposit Multiplier: The simple deposit multiplier, on the other hand, only considers the required reserve ratio and does not account for currency or excess reserves. It represents a more basic calculation of the potential increase in the money supply based solely on the required reserves.

In the example provided, the money multiplier was calculated to be 6.501, while the simple deposit multiplier would be 10 (1 / 0.1). The difference arises because the money multiplier includes additional factors that affect the money supply, making it a more comprehensive measure.

Relationship between Reserve Ratio and Money Multiplier

- Inverse Relationship: The reserve ratio (r) and the money multiplier (m) have an inverse relationship. When the reserve ratio increases, the money multiplier decreases, and vice versa.

- Explanation: This relationship exists because a higher reserve ratio means that banks are required to hold a larger portion of their deposits as reserves, leaving less room for additional deposit creation. Conversely, a lower reserve ratio allows for more deposit creation, leading to a higher money multiplier.

Monetary Policy and Money Supply

Introduction: Monetary policy plays a crucial role in regulating economic activity by controlling the money supply in the economy. When a central bank aims to stimulate economic activity, it injects liquidity into the system, which can be done through various mechanisms, including open market operations (OMO).

Open Market Operations (OMO):

a. Purchase of Government Securities: When the central bank purchases government securities from the market, it injects high-powered money (monetary base) into the banking system. This increase in reserves allows banks to create more credit, leading to an expansion of the money supply. The formula for calculating the change in money supply is:

- ∆Money Supply = 1/R x ∆Reserves

where R is the reserve requirement ratio, and ∆Reserves is the change in reserves.

b. Sale of Government Securities: Conversely, when the central bank sells government securities, it withdraws reserves from the banking system. This reduction in reserves leads to a decrease in the money supply. The impact of an open market sale is similar to that of a purchase but in the opposite direction.

Money Multiplier: The money multiplier represents the maximum amount of money that can be created in the banking system for each unit of reserves. It is influenced by factors such as the reserve requirement ratio and the currency-to-deposit ratio. However, there are situations where the money multiplier can be effectively zero. This can occur when interest rates are extremely low, prompting banks to hold excess reserves without taking risks. In such cases, the newly injected reserves do not translate into increased lending and money creation.

Impact of Government Spending on Money Supply

When the cash balances of the central and state governments fall below the necessary minimum, they can utilize a facility known as Ways and Means Advances (WMA) or an overdraft (OD) facility. When the Reserve Bank of India (RBI) lends to the governments under WMA or OD, it leads to the creation of excess reserves.

Understanding Excess Reserves

- Excess reserves refer to the surplus balances that commercial banks hold with the Reserve Bank, beyond the required minimum.

- When the government spends money, it debits its account with the RBI and credits the account of the recipient (e.g., a government employee’s salary account) with a commercial bank.

- This process generates excess reserves, as the banks’ balances with the RBI increase.

Impact on Money Supply

- The creation of excess reserves has the potential to increase the money supply through the money multiplier process.

- The money multiplier effect occurs when banks lend out a portion of their excess reserves, creating new deposits and effectively increasing the overall money supply in the economy.

The Credit Multiplier

- The Credit Multiplier, also known as the deposit multiplier or deposit expansion multiplier, measures the additional money that commercial banks can create through lending, based on their excess reserves above the central bank's reserve requirements.

- It is closely linked to the bank's reserve requirement and indicates how much new money the banking system can generate for a given increase in high-powered money.

- The credit multiplier is calculated as the reciprocal of the required reserve ratio. For example, if the reserve ratio is 20%, the credit multiplier would be 5 (1/0.20).

Fractional Reserve Banking and Money Creation

- The credit multiplier arises from fractional reserve banking, where banks use depositors' funds to make loans, creating new claims on deposited money.

- When a bank lends a portion of its deposits, it generates another claim on the deposited funds. For instance, if A deposits ₹1000 in Bank X with a 10% reserve requirement, the bank can lend ₹900 to B.

- By doing so, the bank creates a deposit of ₹900 for B, giving him the right to use that money, while A still has a claim on ₹1000.

- This means the bank has ₹1000 in cash against claims of ₹1900, effectively creating ₹900 out of "thin air," as this amount is not backed by actual cash.

- Fractional reserve commercial banks consistently have more cash liabilities than actual cash in their vaults, enabling them to expand the money supply through lending.

Money and Credit

In our discussion about the money supply in India, we noted that the Reserve Bank of India (RBI) plays a crucial role in controlling the money supply. However, there are instances when the RBI's efforts to increase the money supply are not met with a corresponding increase in credit. This situation can arise when banks are unwilling to lend or when there is a lack of demand for loans.

To illustrate this point, let's consider the period following the COVID-19 pandemic. During this time, the RBI took various measures to encourage lending and boost the economy. Despite these efforts, banks remained risk-averse and preferred to park their excess funds in the reverse repo window. The reverse repo rate during this period was relatively low, at 3.35 percent.

Reverse Repo Window

- The reverse repo window is a monetary policy tool used by the RBI to manage liquidity in the banking system. It involves the RBI borrowing funds from commercial banks by offering them government securities as collateral.

- By parking their funds in the reverse repo window, banks effectively lend money to the RBI for short periods, earning interest on their excess reserves. This practice helps the RBI control the money supply and stabilize interest rates in the economy.

Increase in Funds Parked Under Reverse Repo

- During the March quarter following the pandemic, the average deposit of funds by banks in the reverse repo window was around Rs 2.4 lakh crore.

- By the June quarter, this figure more than tripled, reaching an average of Rs 7 lakh crore.

- In May, banks parked nearly Rs 8 lakh crore under reverse repo on a daily average basis.

Implications for Money Supply

- The significant increase in funds parked under the reverse repo window indicated that banks were more comfortable holding their excess liquidity with the RBI rather than extending loans to businesses and individuals.

- This behavior reflected a cautious approach by banks in the aftermath of the pandemic, where they prioritized safety and stability over aggressive lending.

Conclusion

- The period following the COVID-19 pandemic highlighted the complexities of monetary policy and credit expansion in India.

- While the RBI aimed to increase the money supply and stimulate economic activity, the actual outcome was influenced by the risk appetite of banks and the demand for loans.

- The example of increased funds parked under the reverse repo window illustrates how monetary policy measures can have varying degrees of effectiveness based on the prevailing economic conditions and the behavior of financial institutions.

|

86 videos|255 docs|58 tests

|

FAQs on Unit 2: The Concept of Money Supply Chapter Notes - Business Economics for CA Foundation

| 1. What is the rationale behind measuring the money supply in an economy? |  |

| 2. What are the main sources of money supply in India? |  |

| 3. How does the money multiplier affect the money supply? |  |

| 4. What role does monetary policy play in controlling money supply? |  |

| 5. How does government spending impact the money supply? |  |