Unit 3: Registration and Dissolution of a Firm Chapter Notes | Business Laws for CA Foundation PDF Download

| Table of contents |

|

| Overview |

|

| Registration of Firms |

|

| Consequences of Non-Registration (Section 69) |

|

| Dissolution of Firm |

|

| Consequences of Dissolution (Sections 45-55) |

|

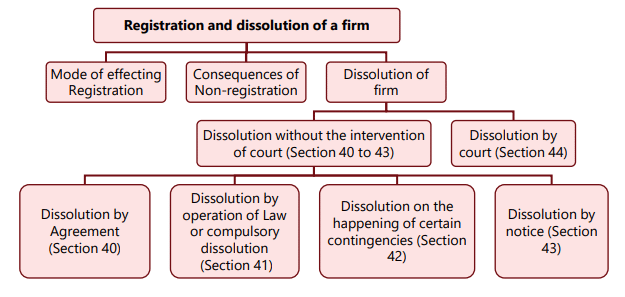

Overview

Registration of Firms

Application for Registration (Section 58):- Registration of a firm can happen at any time by sending or delivering a statement in the prescribed form to the Registrar, along with the prescribed fee.

- The statement must include:

- (a) The firm’s name

- (b) The place or principal place of business

- (c) Names of other places where the firm operates

- (d) Dates when each partner joined

- (e) Full names and permanent addresses of partners

- (f) Duration of the firm

- The statement must be signed by all partners or their authorized agents and verified as prescribed.

Restrictions on Firm Name

- A firm name cannot include certain words, such as:

- Crown, Emperor, Empress, Empire, Imperial, King, Queen, Royal

- Government approval for such words is required, except with State Government consent.

Registration Process (Section 59):

- The Registrar will record the statement in the Register of Firms and issue a Certificate of Registration if Section 58 is complied with.

- Registration is considered complete upon delivery of the application, fee, and partnership details to the Registrar.

- The Registrar’s recording is a routine duty.

- A firm can register even after filing a suit, but must withdraw the suit before proceeding with registration and can file a new suit afterward.

Late Registration with Penalty (Section 59A-1)

- If the statement is not submitted to the Registrar within the specified time, the firm can be registered by paying a penalty of one hundred rupees for each year or part of delay.

Consequences of Non-Registration (Section 69)

- A partnership firm that is not registered cannot:

(a) File a suit to enforce a contract against any partner.

(b) Claim a set-off or counter-claim in a suit against a partner related to a contract. - The following actions are allowed even if the firm is unregistered:

(a) Filing a suit for the dissolution of the firm.

(b) Suing for the realization of a partner’s share in the firm after dissolution.

(c) Suing for the realization of a partner’s share in the firm in case of the death of a partner. - Partners of an unregistered firm cannot file a suit against third parties to enforce a contract.

- The non-registration of a firm does not affect the validity of the contract or the rights of the partners in the firm.

In English law, registering firms is mandatory, and failure to do so incurs a penalty. However, the Indian Partnership Act does not make registration compulsory nor does it impose penalties for non-registration. Despite this, non-registration brings about various disabilities as outlined in Section 69 of the Act. These disabilities create a strong incentive for firms to register, even though it is not legally required.

Disabilities of Non-Registration:

- No Legal Action Against Third Parties: A firm or its partners cannot sue a third party for breach of contract unless the firm is registered and the suing partners are listed in the register.

- No Set-Off Claims in Certain Cases: If a third party sues an unregistered firm for more than ₹100, neither the firm nor its partners can claim a set-off or pursue other proceedings to enforce contract rights.

- Limited Legal Actions for Aggrieved Partners: Partners of unregistered firms cannot sue the firm or alleged partners, except for dissolution, accounts, and realization of their share in a dissolved firm's property.

- Third Party Lawsuits: Unregistered firms can be sued by third parties.

Example 1: A & Co. is registered as a partnership firm in 2017 with A, B and C partners. In 2018, A dies. In 2019, B and C sue X in the name and on behalf of A & Co. without fresh registration. Now the first question for our consideration is whether the suit is maintainable.

Exceptions to Non-Registration: Non-registration does not affect the following rights:

- Third parties' right to sue the firm or any partner.

- Partners' right to sue for dissolution, settlement of accounts, or realization of a dissolved firm's property.

- Official Assignees or Receivers' power to release an insolvent partner's property and bring actions.

- Right to sue or claim a set-off if the suit's value does not exceed ₹100.

Dissolution of Firm

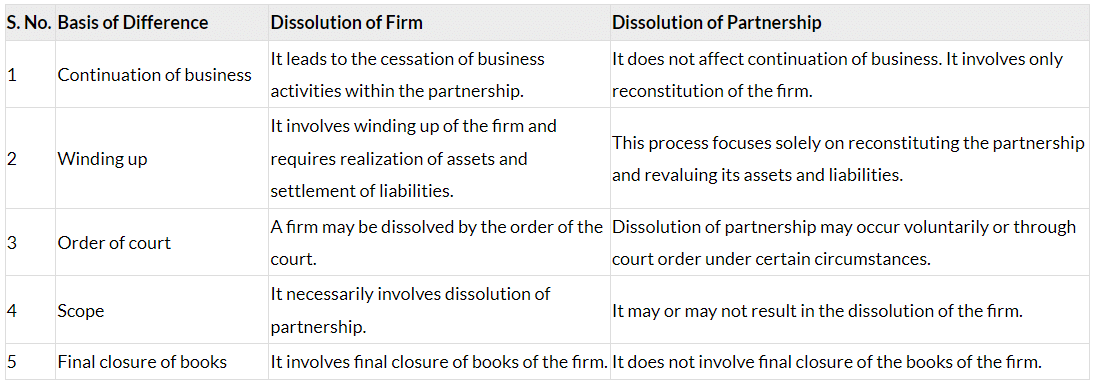

Dissolution of Firm means the discontinuation of the legal relationship existing between all the partners of the firm.The dissolution of partnership between all partners of a firm is called the ‘dissolution of the firm’.

Section 39: Partnership Act, 1932

"Dissolution of partnership between all partners of a firm is called the ‘dissolution of the firm’."

Dissolution of Firm Vs. Dissolution of Partnership

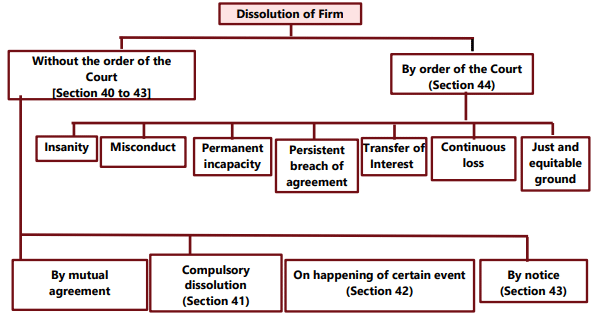

Modes of Dissolution of a Firm (Sections 40-44)

The dissolution of a partnership firm may be in any of the following ways:

1. Dissolution Without the Order of the Court or Voluntary Dissolution:

It consists of the following four types:

(i) Dissolution by Agreement (Section 40):

Section 40 gives the right to the partners to dissolve the partnership by agreement with the consent of all the partners or in accordance with a contract between the partners. ‘Contract between the partners’ means a contract already made.

(ii) Compulsory dissolution (Section 41):

A firm is compulsorily dissolved by the happening of any event which makes it unlawful for the business of the firm to be carried on or for the partners to carry it on in partnership.

However, when more than one separate adventure or undertaking is carried on by the firm, the illegality of one or more does not, by itself, cause the dissolution of the firm regarding its lawful adventures and undertakings.

Example 2: A firm is carrying on the business of trading a particular chemical, and a law is passed which bans the trading of that chemical. The business of the firm becomes unlawful, and so the firm must cease operations as soon as the law takes effect.

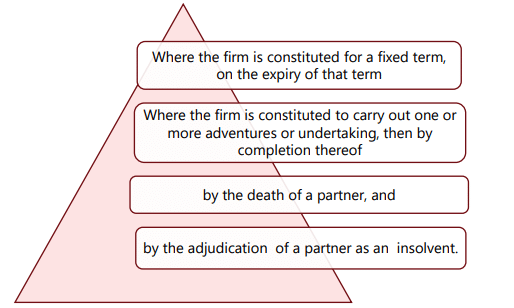

(iii) Dissolution on the Happening of Certain Contingencies (Section 42):

Subject to the contract between the partners, a firm can be dissolved on the happening of any of the following contingencies:

(iv) Dissolution by Notice of Partnership at Will (Section 43):

Where the partnership is at will, a partner may dissolve the firm by giving written notice of their intention to all other partners.

In case a date is mentioned in the notice:

The firm is dissolved as from the date mentioned in the notice as the date of dissolution, or in case no date is so mentioned, as from the date of the communication of the notice.

(2) Dissolution by the Court (Section 44)

- A court can dissolve a partnership firm at the request of a partner under certain circumstances.

- Insanity or Unsound Mind: If a partner (who is not a sleeping partner) becomes of unsound mind, the court may dissolve the firm. This can be done at the request of the other partners or by the next friend of the insane partner. It's important to note that temporary illness is not a valid reason for dissolution.

- Example 3: If A, B, and C are partners in a firm and A suffers from a serious illness like typhoid, which temporarily prevents him from conducting business, this does not typically justify the dissolution of the partnership.

- Permanent Incapacity: The court may dissolve the firm if a partner, other than the one suing, becomes permanently incapable of fulfilling their duties due to physical disability or illness.

- Misconduct: If a partner, other than the one suing, engages in conduct that is likely to adversely affect the business, the court may order the dissolution of the firm. The misconduct does not have to be related to the business itself; what matters is its negative impact on the business. The nature of the business will determine whether an act constitutes misconduct.

- Persistent Breach of Agreement: If a partner, other than the one suing, willfully or persistently breaches agreements related to the management of the firm or conducts themselves in a way that makes it impractical for the other partners to continue the partnership, the court may dissolve the firm. Examples of breach of contract include embezzlement, keeping inaccurate accounts, holding excess cash, and refusing to show accounts upon request.

- Example 4: If a partner maintains incorrect accounts by omitting receipts or if there are ongoing disputes among partners that erode mutual trust, the court may order the dissolution of the firm.

- Transfer of Interest: If a partner, other than the one suing, transfers their entire interest in the firm to a third party or allows their share to be charged or sold by the court due to unpaid land revenue, the court may dissolve the firm at the request of another partner.

- Continuous/Perpetual losses: Where the business of the firm cannot be carried on except at a loss in future also, the court may order for its dissolution.

- Just and Equitable Grounds for Dissolution

(i) Deadlock in Management: Inability to make decisions due to a stalemate.

(ii) Partners Not on Speaking Terms: Breakdown of communication among partners.

(iii) Loss of Substratum: The fundamental basis of the partnership is lost.

(iv) Gambling by a Partner: A partner engages in gambling activities affecting the partnership.

Consequences of Dissolution (Sections 45-55)

Upon dissolution of a partnership firm, partners have specific rights and liabilities.(a) Liability for Acts of Partners After Dissolution (Section 45)

- Partners remain liable for acts done by any of them that would have been acts of the firm before dissolution, until public notice of dissolution is given.

- The estate of a partner who dies, is declared insolvent, or retires without being known as a partner is not liable for acts done after their exit.

- Any partner can give notice of dissolution under this section.

Objectives of Section 45:

To protect third parties dealing with the firm who were unaware of the dissolution.

To protect partners of a dissolved firm from liability towards third parties.

Example 5:

- If X and Y dissolve their partnership on December 1 but fail to give public notice, and X borrows money in the firm’s name from R on December 20 without R knowing of the dissolution, Y would still be liable for the debt.

Exceptions to Liability:

- If notice of dissolution has not been given, there will be no liability for subsequent acts in cases such as:

(b) Right of Partners to Wound Up Business After Dissolution (Section 46): When a firm is dissolved, every partner or their representative has the right to demand that the firm’s property be used to pay off its debts and liabilities. Any surplus should be distributed among the partners or their representatives according to their rights.

(c) Ongoing Authority of Partners for Winding Up (Section 47): After a firm is dissolved, each partner still has the authority to bind the firm for the purpose of winding up its affairs and completing unfinished transactions. However, this authority is limited to what is necessary for these purposes.

Important Note: The firm is not bound by the actions of a partner who has been declared insolvent. However, this does not affect the liability of anyone who has represented themselves or allowed themselves to be represented as a partner of the insolvent after the declaration.

(d) Method of Settling Partnership Accounts (Section 48): The following rules should be observed when settling the accounts of a firm after dissolution, unless the partners agree otherwise:

a. Payment of Losses: Losses, including capital deficiencies, should be paid in the following order:

1. First from profits;

2. Then from capital;

3. Lastly, if necessary, by the partners individually in the proportions they were entitled to share profits.

b. Application of Assets: The firm’s assets, including any amounts contributed by partners to cover capital deficiencies, should be applied in the following order:

1. To pay debts to third parties;

2. To pay each partner rateably what is due to them from capital;

3. To pay each partner rateably what is due to them on account of capital;

4. Any remaining assets should be distributed among partners in proportion to their profit shares.

Example 6: Consider a situation where X and Y are partners sharing profits and losses equally. When X passes away, it is discovered that he contributed ₹6,60,000 to the firm’s capital, while Y only contributed ₹40,000. The total assets of the firm amount to ₹2,00,000. In this case, there is a deficiency of ₹5,00,000 (calculated as ₹6,60,000 + ₹40,000 - ₹2,00,000). This deficiency would need to be shared equally between Y and X’s estate.

In the previous example, if the agreement stipulated that upon dissolution, the surplus assets would be distributed among the partners according to their respective capital interests, and a capital deficiency was discovered at the time of dissolution, then the assets would be divided in proportion to the partners' capital contributions. This would result in X's estate bearing the brunt of the loss.

(e) Payment of Firm Debts and Separate Debts (Section 49): When there are joint debts owed by the firm and also separate debts owed by individual partners, the following process is followed:

- Payment from Firm Property: The property of the firm is used first to pay off the firm's debts. Any surplus remaining after settling the firm's debts is then allocated to cover each partner's separate debts.

- Payment from Partner's Separate Property: A partner's separate property is used to pay their personal debts first. Any remaining funds from their separate property are then directed towards paying the firm's debts.

|

32 videos|185 docs|57 tests

|

FAQs on Unit 3: Registration and Dissolution of a Firm Chapter Notes - Business Laws for CA Foundation

| 1. What is the process for registering a firm under the Indian Partnership Act? |  |

| 2. What are the consequences of non-registration of a firm? |  |

| 3. How can a partnership firm be dissolved? |  |

| 4. What are the consequences of dissolution of a firm as per Sections 45-55 of the Indian Partnership Act? |  |

| 5. What steps should be taken after the dissolution of a firm? |  |